4 Best Practices for Effective UI UX Solutions in Finance

Introduction

In an industry where trust and clarity are paramount, the design of financial applications plays a crucial role in shaping user engagement and satisfaction. Financial service providers can leverage best practices in UI/UX design to create intuitive and secure experiences that resonate with users. However, a significant challenge persists: how can designers effectively balance the presentation of complex data with user-friendly interfaces to cater to diverse client needs? By exploring the core principles and innovative strategies for UI/UX in finance, we uncover pathways to enhance usability and foster lasting customer loyalty.

Understand Core Principles of UI UX Design

To create effective UI/UX solutions in finance, it is essential to understand the core principles that guide design decisions. These principles include:

-

Client-Centric Design: Prioritizing client needs and preferences enhances satisfaction and usability. This approach is crucial in finance, where trust is paramount. Engaging individuals through customized experiences can significantly enhance retention rates. Good fintech UX keeps individuals involved for weeks and months. Moreover, statistics indicate that only 60% of individuals are accomplishing key actions in fintech products, emphasizing the significance of customer-focused design in promoting engagement.

-

Clarity and Simplicity: Financial applications often handle complex data. Simplifying interfaces and ensuring clarity in navigation enable individuals to make informed decisions without feeling overwhelmed. Successful fintech apps like Revolut utilize minimalistic designs that focus on essential tasks, allowing users to complete key actions efficiently.

-

Consistency: Maintaining uniformity in visual elements across the application fosters familiarity and ease of use. A consistent layout assists individuals in navigating instinctively, minimizing cognitive burden and improving overall contentment. This principle is demonstrated by platforms like Google Workspace, where a cohesive visual language across tools aids navigation. Furthermore, effective hierarchy in information design can significantly improve user navigation, as seen in various successful applications.

-

Accessibility: Ensuring usability for all individuals, including those with disabilities, is critical. This involves using appropriate color contrasts, scalable text sizes, and alternative text for images. Accessibility not only meets legal standards but also expands the audience, enhancing overall engagement.

-

Security Signals: Given the sensitive nature of financial data, incorporating visible security features-such as SSL certificates and two-factor authentication-builds trust and confidence in the application. Clear communication of security measures can alleviate individual anxiety, making them feel more secure in their transactions.

By following these principles, designers can create UI/UX solutions that not only meet regulatory standards but also significantly enhance user experience and engagement.

Conduct Comprehensive User Research and Testing

To design effective UI/UX solutions for finance, conducting thorough user research and testing is imperative. Here are key strategies:

-

User Interviews: Engage with potential users to gather qualitative insights about their needs, pain points, and preferences. This direct feedback is invaluable for shaping the design process. For instance, Rob Vanasco, a User Researcher at Region’s Bank, emphasizes that understanding user frustrations is crucial for improving financial applications.

-

Surveys and Questionnaires: Utilize surveys to collect quantitative data from a larger audience. This assists in recognizing trends and shared obstacles encountered by individuals in financial programs. Statistics indicate that companies investing in UX can decrease development cycles by 33-50%, emphasizing the significance of comprehending client needs early on.

-

Usability Testing: Conduct usability tests with prototypes to observe how individuals interact with the application. This allows designers to identify friction points and areas for improvement before the final launch. For example, TBC Bank’s kiosk design validation demonstrated how usability testing led to a user-friendly interface and a seamless cash-in experience.

-

A/B Testing: Implement A/B testing to compare various design variations and determine which performs better in terms of engagement and satisfaction. This iterative approach fosters continuous improvement, as evidenced by Virgin America’s redesign, which resulted in a 14% increase in conversion rates.

-

Analytics and Heatmaps: Utilize analytics tools and heatmaps to monitor behavior within the application. This data can reveal how users navigate the interface and where they encounter difficulties. Businesses that emphasize customer experience can demand a premium of up to 16% for their products and services, highlighting the economic advantages of a thoughtfully crafted experience.

By employing these research methods, designers can create financial applications that utilize UI/UX solutions, ensuring they are not only functional but also connect with individuals, ultimately leading to higher satisfaction and retention rates. Moreover, steering clear of typical mistakes like disregarding user input or not revising concepts can greatly improve the effectiveness of these strategies.

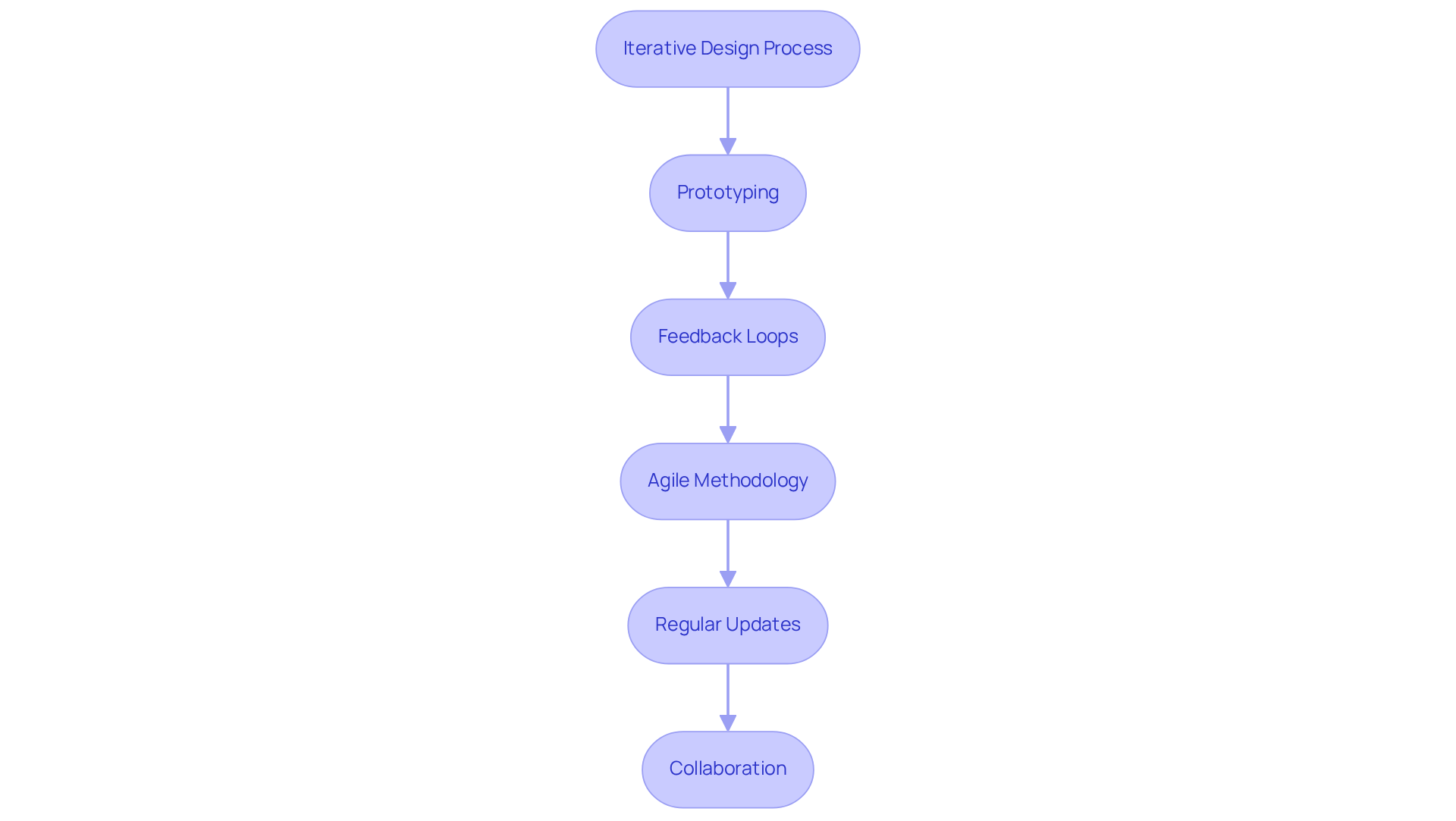

Implement Iterative Design and Feedback Loops

An iterative development process is crucial for crafting effective UI/UX solutions in finance. The following key practices should be implemented:

- Prototyping: Initiate the design process with low-fidelity prototypes to visualize concepts and gather early feedback. This approach facilitates quick adjustments before committing to high-fidelity designs.

- Feedback Loops: Establish systems for continuous participant feedback throughout the development process. This includes regular check-ins with users and actively seeking their opinions on design iterations.

- Agile Methodology: Embrace an agile approach to design, where teams operate in short sprints to develop and test features. This methodology promotes flexibility and responsiveness to client needs.

- Regular Updates: Consistently update the application based on user feedback and analytics. This practice ensures that the product evolves in alignment with consumer expectations and industry trends.

- Collaboration: Encourage collaboration among designers, developers, and stakeholders to ensure that all perspectives are integrated into the iterative process.

By adopting iterative design and feedback loops, financial applications can be refined to better address user needs, ultimately enhancing user experiences and satisfaction with effective UI/UX solutions.

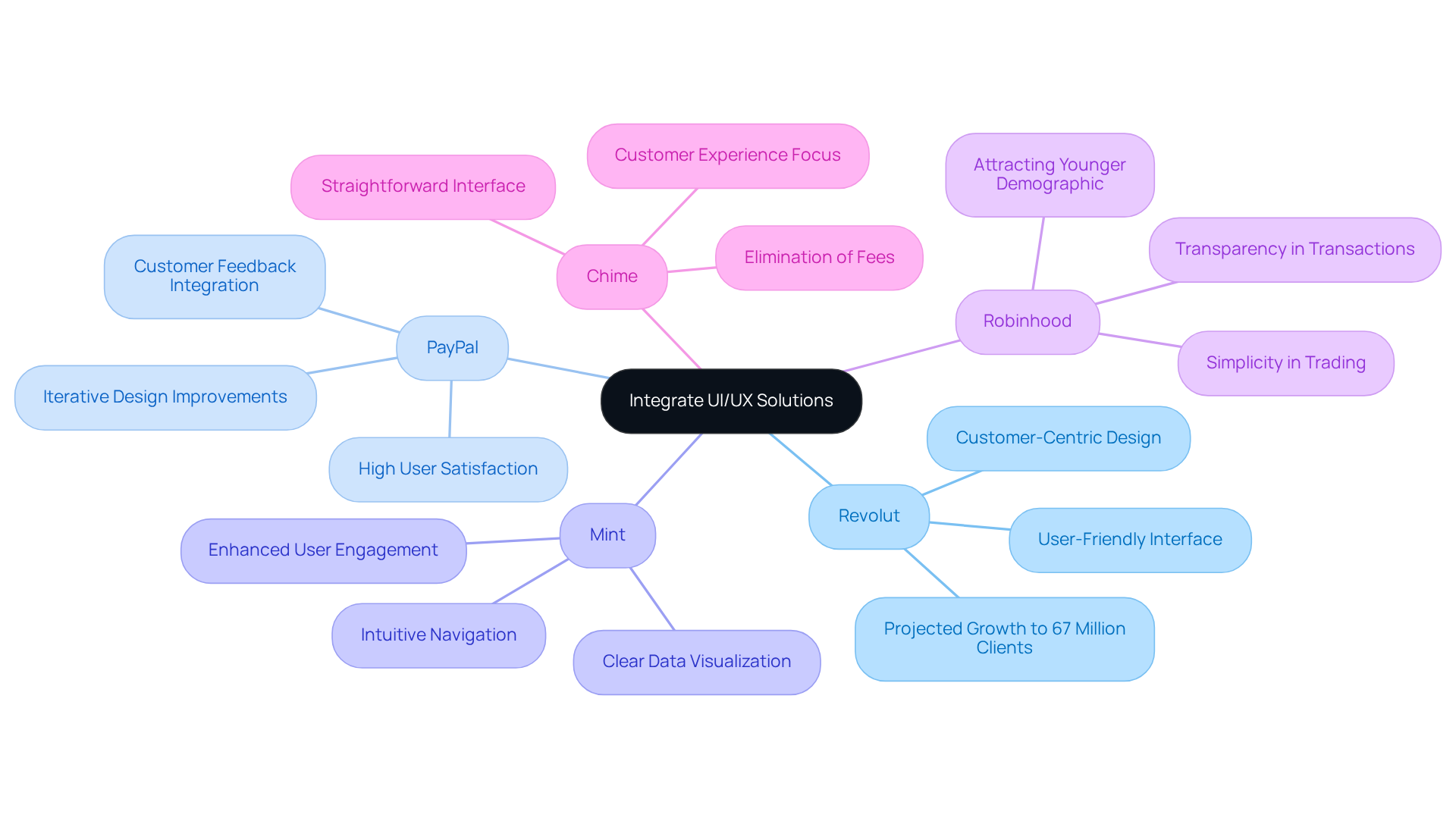

Integrate UI UX Solutions with Real-World Case Studies

Integrating UI/UX solutions with real-world case studies yields valuable insights into effective design practices. Notable examples illustrate this:

-

Revolut: This fintech app has transformed banking by providing a user-friendly interface that simplifies complex financial tasks. Their focus on clarity and security has led to rapid adoption and trust, with projections indicating an increase to 67 million clients by the end of 2025. As stated by Revolut, ‘Our dedication to customer-focused creation has led to high customer satisfaction and retention.’

-

PayPal: By continually refining their layout based on customer feedback, PayPal has maintained a leading position in the digital payment sector. Their commitment to user-centric design has resulted in high user satisfaction and retention rates, demonstrating the impact of iterative design improvements.

-

Mint: This personal finance application utilizes intuitive concepts to help individuals manage their finances effortlessly. Their clear data visualization and intuitive navigation have made financial management accessible to a broad audience, enhancing user engagement.

-

Robinhood: By prioritizing simplicity and transparency, Robinhood has attracted a younger demographic to investing. Their approach clarifies stock trading, making it accessible for beginner investors and facilitating greater adoption.

-

Chime: This neobank emphasizes customer experience by eliminating fees and providing a straightforward interface. Their focus on user-centric design has cultivated a loyal customer base, illustrating the effectiveness of prioritizing user needs.

These case studies exemplify how effective UI/UX solutions can lead to successful financial applications, emphasizing the importance of applying best practices in real-world contexts. However, it is essential to avoid common pitfalls in UI/UX design, such as neglecting user feedback or overcomplicating interfaces, as these can hinder user engagement and satisfaction.

Conclusion

Effective UI/UX solutions in the finance sector depend on a profound understanding of core design principles and a steadfast commitment to user-centric approaches. By prioritizing client needs, embracing clarity and simplicity, ensuring consistency, and promoting accessibility, designers can create applications that not only comply with regulatory standards but also cultivate trust and satisfaction among users. Furthermore, incorporating visible security features enhances confidence in managing sensitive financial data.

The article delineates essential practices for achieving these objectives, including:

- Comprehensive user research and testing

- Iterative design processes

- Real-world case studies

Engaging users through interviews, surveys, and usability testing is vital for identifying pain points and preferences. Meanwhile, iterative design facilitates continuous refinement based on user feedback. Case studies from successful fintech companies such as Revolut and PayPal exemplify the tangible benefits of applying these principles, demonstrating how thoughtful design can lead to heightened user engagement and loyalty.

In conclusion, the significance of effective UI/UX design in finance is paramount. As the industry evolves, embracing these best practices will be crucial for developing applications that resonate with users and drive success. Designers are urged to adopt a proactive approach, integrating user feedback and iterative processes to remain ahead of trends and enhance the overall user experience. By doing so, financial services can not only meet the demands of today’s users but also foster enduring relationships grounded in trust and satisfaction.

Frequently Asked Questions

What are the core principles of UI/UX design in finance?

The core principles include client-centric design, clarity and simplicity, consistency, accessibility, and security signals.

How does client-centric design impact user satisfaction in finance?

Client-centric design prioritizes client needs and preferences, enhancing satisfaction and usability. It is crucial in finance for building trust and can significantly improve retention rates.

Why is clarity and simplicity important in financial applications?

Clarity and simplicity help users navigate complex data without feeling overwhelmed, allowing them to make informed decisions efficiently. Successful fintech apps utilize minimalistic designs to focus on essential tasks.

What role does consistency play in UI/UX design?

Consistency in visual elements fosters familiarity and ease of use, allowing users to navigate instinctively. A cohesive layout minimizes cognitive burden and improves overall contentment.

How does accessibility factor into UI/UX design?

Accessibility ensures usability for all individuals, including those with disabilities. It involves using appropriate color contrasts, scalable text sizes, and alternative text for images, which expands the audience and enhances engagement.

Why are security signals important in financial applications?

Security signals, such as SSL certificates and two-factor authentication, build trust and confidence in the application. Clear communication of these security measures alleviates user anxiety regarding their transactions.

What is the overall benefit of following these UI/UX design principles?

Following these principles helps create UI/UX solutions that meet regulatory standards while significantly enhancing user experience and engagement.