Comparing Finance Software Solutions for Hedge Funds’ Needs

Introduction

The hedge fund industry is characterized by its complexity and rapid evolution, where the right finance software can significantly impact success. As investment firms navigate a landscape filled with stringent regulations and intense competition, the need for customized software solutions that improve risk management, compliance, and data analytics has reached unprecedented levels. Yet, with a multitude of options available, how can hedge funds identify the software that best aligns with their specific strategies and operational requirements? This article explores the essential features, benefits, and comparative analysis of leading finance software solutions, offering insights that empower investment groups to make informed decisions in a dynamic financial environment.

Essential Features of Finance Software for Hedge Funds

Hedge investments operate within a highly regulated and competitive environment, necessitating the use of finance software solutions that encompass a variety of critical features.

-

Risk Management Tools are essential for evaluating and mitigating risks linked to investment strategies. They provide real-time insights into market volatility and potential losses. The integration of AI-powered analytics enhances predictive accuracy, allowing investment groups to manage risks more effectively. Notably, 90% of investment vehicles are leveraging AI to manage assets and optimize portfolios, underscoring the significance of advanced technology in risk management.

-

Compliance Tracking is crucial given the stringent regulatory landscape. Finance software solutions must incorporate robust compliance features, including automated reporting and audit trails, to ensure adherence to financial regulations. This functionality is vital for maintaining transparency and avoiding penalties, especially as investment firms face increasing pressure to demonstrate compliance with evolving standards.

-

Portfolio Management capabilities are vital for investment groups to monitor performance, manage assets, and refine investment strategies. Advanced tools facilitate the analysis of market trends, improving decision-making processes and enabling firms to adapt to fluctuating market conditions.

-

Data Analytics tools empower investment groups to process large datasets, identify emerging trends, and make informed, data-driven decisions. The ability to harness AI and machine learning in this area significantly boosts operational efficiency, particularly as investment groups increasingly rely on quantitative analysis to enhance returns.

-

Integration Capabilities are essential for seamless connectivity with existing systems and data sources, enhancing functionality and ensuring smooth operations. This adaptability allows investment groups to respond swiftly to economic shifts and maintain a competitive edge, particularly in a landscape where competition for specialized roles in AI and quantitative analysis is intensifying.

Collectively, these features enable investment pools to operate efficiently and effectively, positioning them strongly for success in a dynamic financial environment with the help of finance software solutions. As the sector evolves, technological solutions must also adapt to address challenges such as data quality issues in AI implementation and the changing fee structures that reflect industry pressures and investor expectations.

Key Benefits of Leading Finance Software Solutions

Leading finance software solutions provide a variety of benefits that significantly enhance hedge fund operations.

-

Increased Efficiency: Automating routine tasks minimizes manual errors, allowing analysts and fund managers to focus more on strategic decision-making. This shift is crucial, as 57% of investment managers are already leveraging technology to improve operational efficiency in response to market disruptions, with 40% planning to invest in automating manual processes.

-

Enhanced Compliance: Robust compliance features are vital for investment vehicle applications, ensuring adherence to regulatory requirements. This reduces the risk of penalties and fosters greater investor trust, which is essential in today’s regulatory landscape.

-

Improved Data Management: Centralized data management systems enhance the organization and accessibility of information, facilitating quicker and more informed decision-making. This capability is critical for investment groups navigating complex strategies and regulatory demands.

-

Scalability: Many finance software solutions are designed to adapt as investment firms grow, allowing for seamless modifications in functionality to meet evolving needs. This flexibility is particularly advantageous for firms aiming to scale efficiently without sacrificing performance.

-

Real-Time Insights: Access to real-time information and analytics enables investment groups to respond swiftly to market fluctuations, optimizing strategies and enhancing overall performance. The integration of AI and machine learning capabilities further supports this by providing predictive insights that can identify anomalies and inform strategic positioning, as AI aids in forecasting potential future movements.

These combined advantages empower investment groups to operate efficiently within a dynamic financial environment, ensuring they remain competitive and compliant while maximizing their operational capacity.

Comparative Analysis of Top Finance Software Solutions

In evaluating the leading finance software solutions for hedge funds, several key players stand out, each with distinct strengths:

-

Bloomberg Terminal: Esteemed for its extensive data analytics and real-time market information, it serves hedge funds that require thorough financial analysis and trading capabilities. Industry insights indicate that hedge funds necessitate robust and reliable software to manage high-frequency trading, risk management, and regulatory compliance. However, its high cost may pose a challenge for smaller investments.

-

SS&C Technologies: This platform offers strong finance software solutions for portfolio management and compliance capabilities, making it well-suited for investment groups focused on regulatory adherence. Its scalability represents a significant advantage, although the user interface may be less intuitive compared to competitors. The investment management software market is projected to grow substantially, with a predicted CAGR of 12.87%, underscoring the importance of compliance solutions in this evolving landscape.

-

Eze Software: Known for its user-friendly interface and robust integration features, Eze Software is favored by investment groups seeking simplicity in finance software solutions. Nonetheless, it may lack some advanced analytics features available in other solutions. As investment groups increasingly adopt cloud-based solutions, Eze Software’s integration capabilities become even more critical.

-

FactSet: This platform offers comprehensive finance software solutions and analytics tools, making it a strong option for investment groups that prioritize research and data-informed decision-making. Its pricing structure can be complex, which may deter some users. The demand for advanced analytical tools is emphasized by the anticipated growth of the hedge investment technology market, expected to reach USD 5349.03 million by 2035.

-

Dynamo Software: A cloud-based finance software solution that excels in investor relations and reporting, making it ideal for organizations that prioritize communication with stakeholders. However, it may not provide the same depth of analytics as other platforms. The rapid growth of cloud-based applications is attributed to the advantages they offer over traditional on-premise systems, allowing for scalability and flexibility.

This comparative analysis aids investment groups in identifying which applications align with their operational needs and strategic goals.

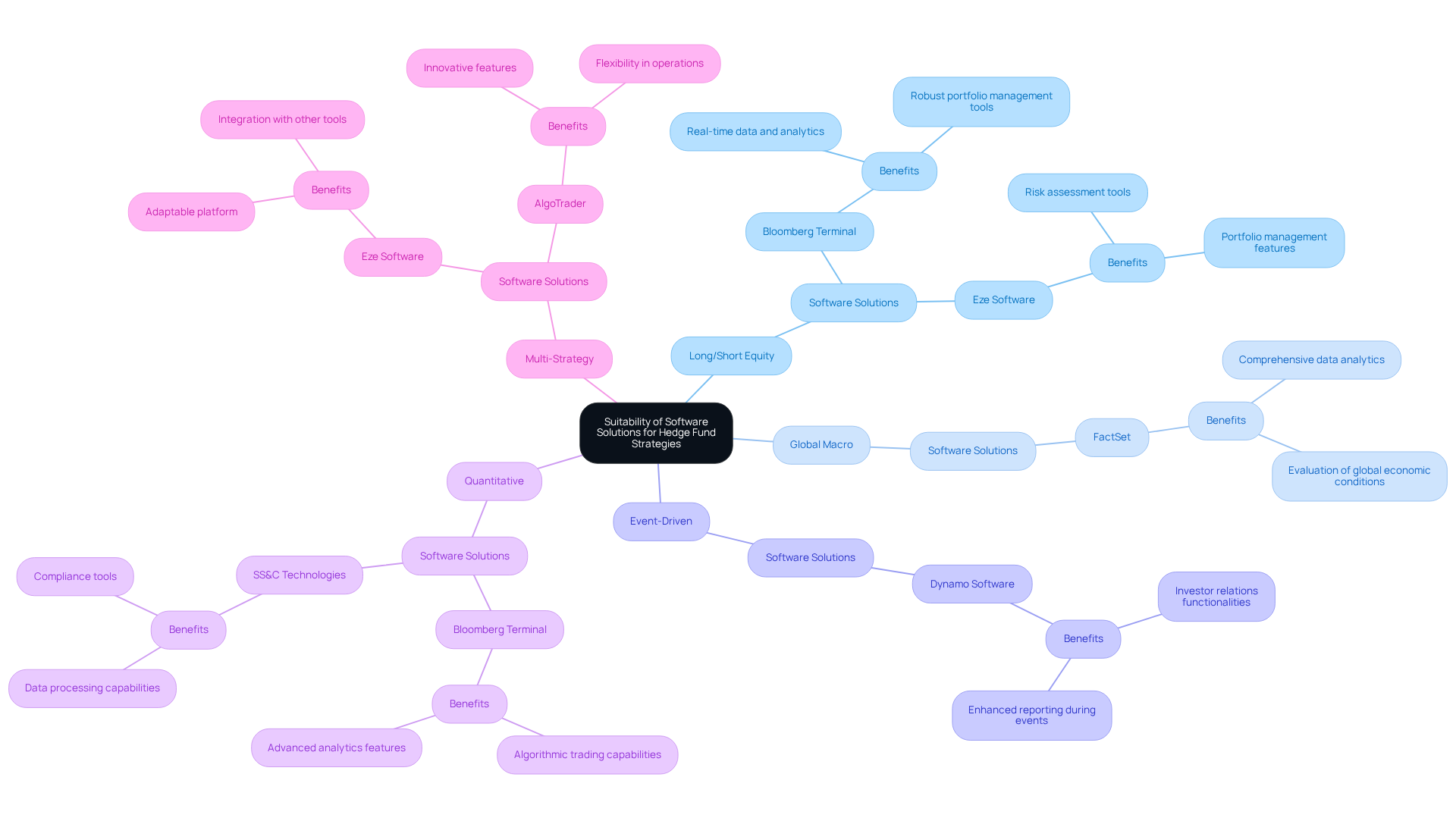

Suitability of Software Solutions for Different Hedge Fund Strategies

Various investment strategies require tailored finance software solutions to effectively meet their unique operational demands. Below is an overview of how different software options correspond with specific strategies:

-

Long/Short Equity: Funds utilizing this strategy gain significant advantages from software equipped with robust portfolio management and risk assessment tools. Notable examples include Bloomberg Terminal and Eze Software, which offer real-time data and analytics. The hedge investment software sector is projected to reach an estimated value of USD 2.2 billion by 2025, reflecting the growing demand for such solutions.

-

Global Macro: For investments focused on macroeconomic trends, platforms like FactSet deliver comprehensive data analytics capabilities, empowering managers to evaluate global economic conditions effectively. According to BlackRock, these strategies have consistently demonstrated their efficacy in navigating complex markets, often outperforming other strategies during challenging times.

-

Event-Driven: Hedge funds that leverage corporate events may find Dynamo Software particularly beneficial due to its investor relations and reporting functionalities, which enhance communication during critical occurrences. The incorporation of advanced analytics can significantly improve decision-making during these pivotal moments.

-

Quantitative: Quantitative strategies demand robust data processing and algorithmic trading capabilities. Bloomberg Terminal and SS&C Technologies emerge as suitable options, given their advanced analytics and execution features. The evolving regulatory landscape necessitates that these platforms ensure compliance while offering sophisticated analytical tools.

-

Multi-Strategy: Funds employing multiple strategies benefit from adaptable platforms like Eze Software, which can cater to diverse operational requirements and integrate seamlessly with other tools. This flexibility is essential in a competitive environment, where firms such as AlgoTrader and Eze Software are at the forefront of innovation.

By aligning finance software solutions with specific hedge fund strategies, funds can significantly enhance their operational efficiency and investment performance. Insights from case studies, such as those on Portable Alpha Strategies, further illustrate the effectiveness of these software solutions in achieving strategic objectives.

Conclusion

Hedge funds navigate a complex financial landscape that necessitates sophisticated finance software solutions tailored to their specific requirements. The integration of essential features – such as risk management tools, compliance tracking, portfolio management, data analytics, and robust integration capabilities – is crucial for enhancing operational efficiency and ensuring adherence to regulatory standards. Collectively, these attributes empower investment groups to effectively manage market volatility and sustain a competitive advantage.

This article underscores the key benefits of leading finance software solutions. These include:

- Increased efficiency through automation

- Enhanced compliance that fosters investor trust

- Improved data management for informed decision-making

- Scalability to accommodate growth

- Real-time insights that facilitate swift responses to market fluctuations

Each of these factors is vital in positioning hedge funds for success within a rapidly evolving financial environment.

As the hedge fund industry continues to evolve, the selection of appropriate finance software becomes increasingly critical. Investment groups must align their operational strategies with the capabilities of various software solutions to maximize efficiency and performance. By embracing advanced technology, firms not only address current challenges but also prepare to thrive in the future, making it imperative to remain informed about the latest developments in finance software solutions.

Frequently Asked Questions

What are the essential features of finance software for hedge funds?

The essential features include risk management tools, compliance tracking, portfolio management capabilities, data analytics tools, and integration capabilities.

Why are risk management tools important for hedge funds?

Risk management tools are crucial for evaluating and mitigating risks associated with investment strategies, providing real-time insights into market volatility and potential losses, and enhancing predictive accuracy through AI-powered analytics.

How does compliance tracking benefit hedge funds?

Compliance tracking ensures adherence to financial regulations through robust features like automated reporting and audit trails, helping maintain transparency and avoid penalties.

What role does portfolio management play in hedge fund operations?

Portfolio management capabilities allow investment groups to monitor performance, manage assets, and refine investment strategies, facilitating better decision-making in response to market trends.

How do data analytics tools enhance the performance of hedge funds?

Data analytics tools empower investment groups to process large datasets and identify emerging trends, enabling informed, data-driven decisions and improving operational efficiency through AI and machine learning.

Why are integration capabilities important for finance software?

Integration capabilities ensure seamless connectivity with existing systems and data sources, enhancing functionality and allowing investment groups to respond quickly to economic shifts.

What challenges do hedge funds face regarding technology and finance software?

Hedge funds face challenges such as data quality issues in AI implementation and changing fee structures that reflect industry pressures and investor expectations.