Master MVP Minimum Viable Product Strategies for Hedge Fund Success

Introduction

In the high-stakes realm of hedge funds, the equilibrium between innovation and regulatory compliance has become increasingly critical. As financial services encounter heightened scrutiny, the concept of a Minimum Viable Product (MVP) emerges as an essential strategy for firms navigating this intricate landscape. By concentrating on the fundamental features that satisfy market demands while adhering to rigorous regulations, hedge funds can mitigate risks and position themselves for success.

However, how can these firms ensure that their MVP effectively addresses customer pain points and distinguishes itself in a competitive market?

Define the Minimum Viable Product and Its Importance in Regulated Industries

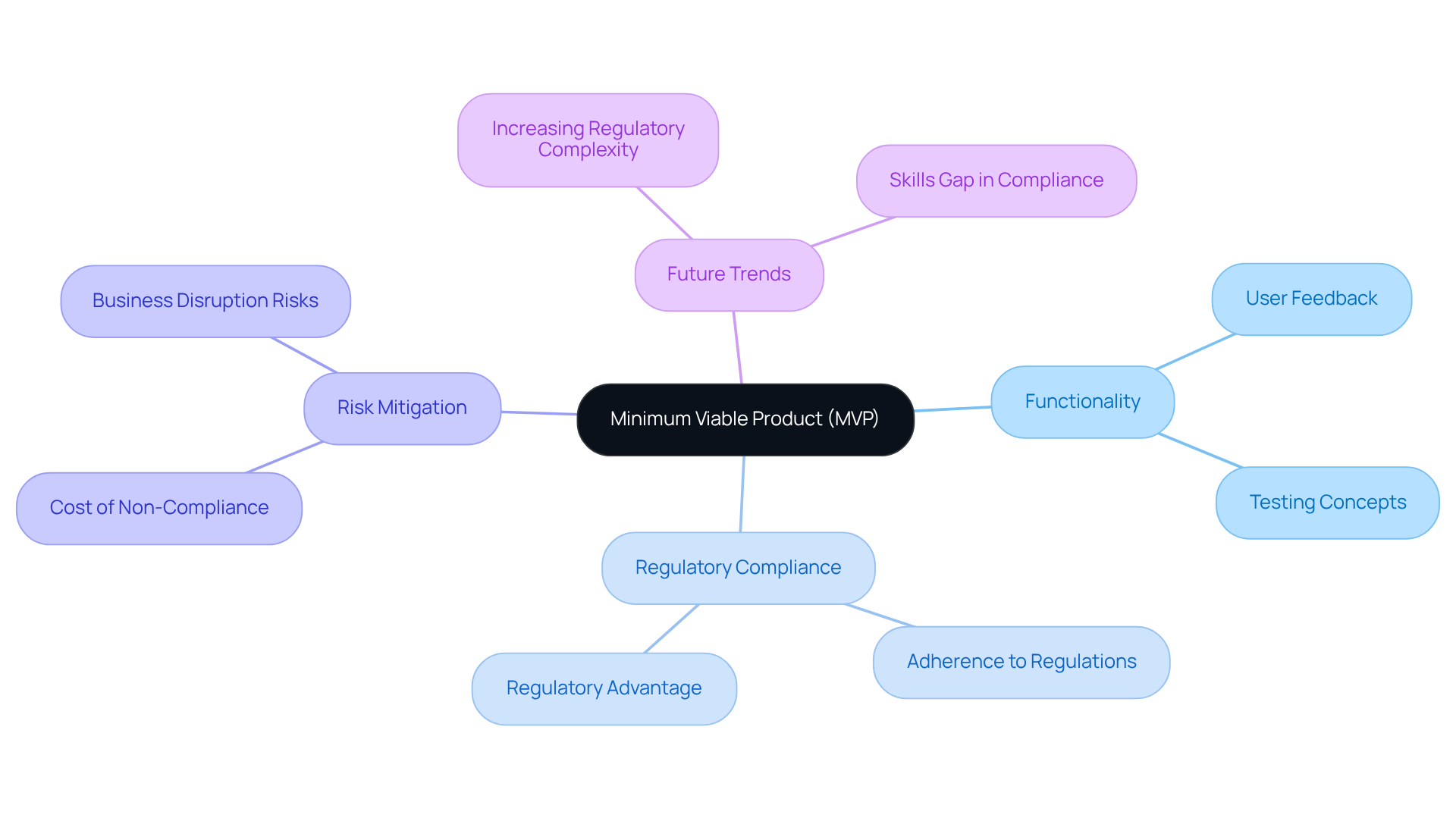

An MVP minimum viable product represents the most basic version of a product that enables teams to validate their business hypotheses using minimal resources. In regulated industries, particularly within financial services, the MVP must not only satisfy market demands but also adhere to stringent regulatory requirements. This dual focus on functionality and compliance is crucial for investment funds, where the stakes are high and the margin for error is minimal.

By initiating with an MVP minimum viable product, hedge funds can effectively test their concepts, gather user feedback, and refine their offerings while ensuring compliance with necessary regulations. This approach minimizes risk and maximizes the potential for success. As we approach 2026, the increasing complexity of regulations will favor firms that can demonstrate adherence and deliver fair outcomes. Regulators are tightening the feedback loop between product promises and customer experiences, making compliance more critical than ever.

Furthermore, business disruptions stemming from non-compliance can incur costs averaging over $5 million, highlighting the significance of the MVP minimum viable product in risk mitigation. As Alex Tsepaev notes, “In 2026, the regulatory advantage will belong to firms that can demonstrate their efforts.” This underscores the necessity for investment funds to adopt MVP minimum viable product strategies that fulfill industry demands while navigating the intricate landscape of regulatory requirements.

Identify Customer Pain Points and Analyze the Competitive Landscape

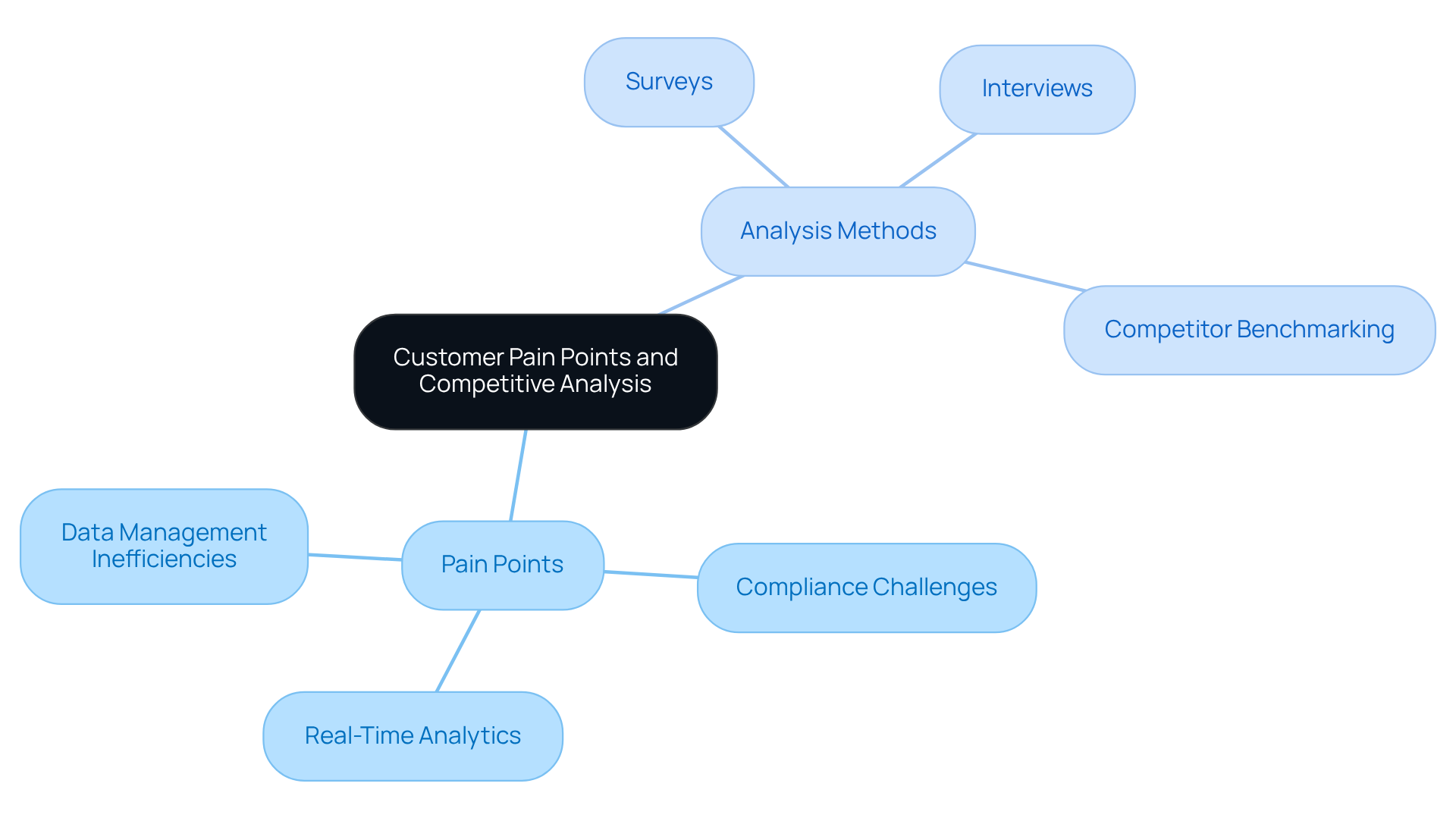

To create an effective MVP (minimum viable product), it is essential to first identify the specific pain points of potential customers. In the context of investment funds, these pain points may encompass issues such as:

- Data management inefficiencies

- Compliance challenges

- The necessity for real-time analytics

Conducting thorough industry research and competitive analysis is crucial for understanding these pain points and examining how competitors are addressing them. Utilizing tools such as:

- Surveys

- Interviews

- Competitor benchmarking

can yield valuable insights. By aligning the features of the MVP (minimum viable product) with the identified pain points, hedge funds can ensure that their product not only meets market demand but also provides a competitive advantage.

Test the MVP for Validity and Compliance with Regulatory Standards

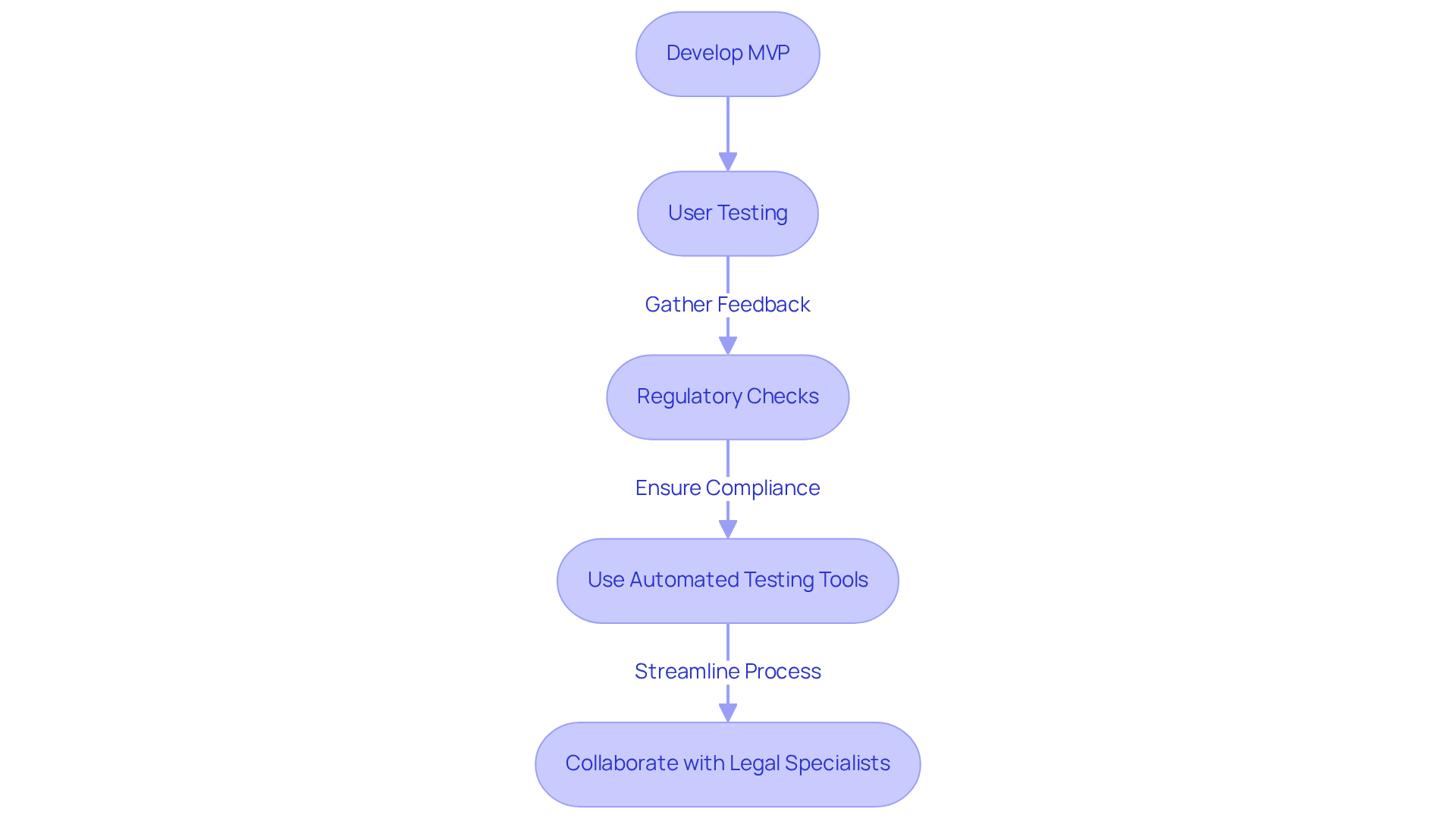

Once the MVP minimum viable product is developed, thorough testing is essential to validate its functionality and ensure compliance with regulatory standards. This process encompasses:

- User testing to gather feedback on usability and performance

- Rigorous checks against industry regulations, such as the Investment Advisers Act and the Securities Act

Employing automated testing tools and verification checklists can streamline this process. Furthermore, collaborating with legal and compliance specialists during this phase significantly reduces risks, ensuring that the MVP minimum viable product is ready for launch without encountering regulatory obstacles.

Prepare for a Successful MVP Launch with Strategic Planning

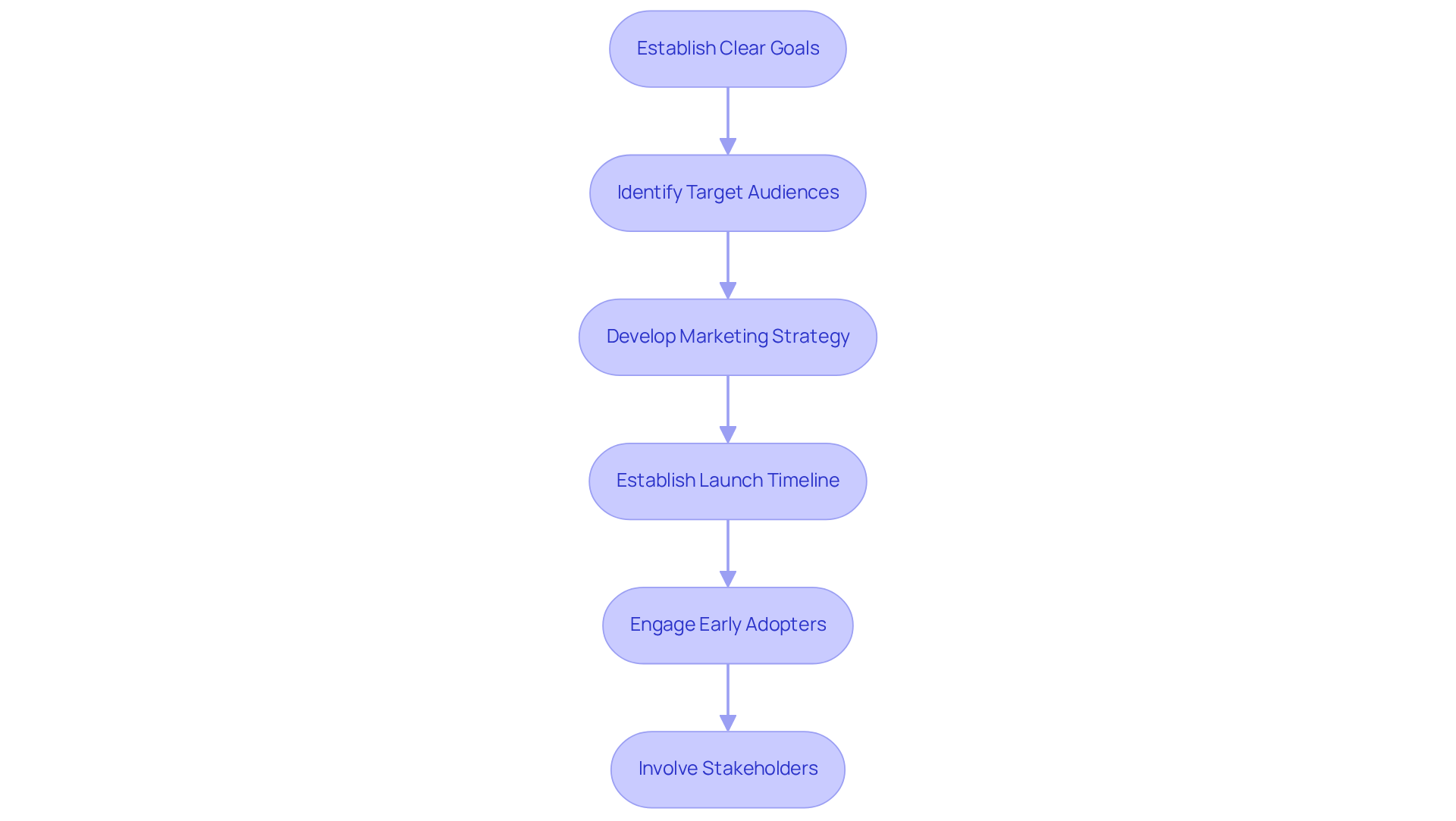

A successful MVP (Minimum Viable Product) launch relies on meticulous strategic planning. This process begins with establishing clear goals that align with industry demands, followed by identifying target audiences to ensure the product resonates with potential users. Developing a robust marketing strategy is essential for effectively communicating the MVP’s value proposition, especially in the competitive financial services sector.

Establishing a launch timeline with key milestones helps keep the team focused and accountable, with typical MVP development timelines ranging from 2 to 12 weeks. Engaging with early adopters during the launch phase facilitates the collection of invaluable feedback, which can inform subsequent iterations and enhancements. Furthermore, involving stakeholders and potential investors early on not only enhances credibility but also lays the groundwork for future funding and growth opportunities.

Statistics indicate that startups employing the MVP can reach the market approximately 35% faster than those using traditional methods, providing a significant advantage for hedge funds aiming to maintain a competitive edge. Additionally, with 53% of companies not achieving expected ROI from software investments, a well-structured launch strategy becomes crucial to avoid this pitfall. As Mike Cecconello noted, “53% of companies don’t see expected ROI from software investments,” highlighting the importance of strategic planning in achieving successful outcomes.

Conclusion

The journey toward hedge fund success relies heavily on the effective implementation of Minimum Viable Product (MVP) strategies. By concentrating on the creation of a foundational product that meets market demands and adheres to regulatory standards, hedge funds can navigate the complexities of the financial landscape with increased agility and confidence. This dual focus on functionality and compliance not only mitigates risks but also positions firms to excel in an increasingly regulated environment.

Key insights from the article underscore the significance of:

- Identifying customer pain points

- Conducting thorough competitive analyses to inform MVP development

Engaging in user testing and collaborating with compliance experts ensures that the product meets user expectations while aligning with industry regulations. Moreover, strategic planning for a successful MVP launch is crucial, as it can significantly enhance a hedge fund’s competitive edge and return on investment (ROI).

In conclusion, adopting MVP strategies is not merely a tactical choice but a fundamental necessity for hedge funds aiming for long-term success. As the regulatory landscape continues to evolve, firms must prioritize compliance and customer-centricity in their product development processes. Embracing these principles will not only help hedge funds distinguish themselves in a crowded market but also pave the way for sustainable growth and innovation in the financial services sector.

Frequently Asked Questions

What is a Minimum Viable Product (MVP)?

A Minimum Viable Product (MVP) is the most basic version of a product that allows teams to validate their business hypotheses using minimal resources.

Why is an MVP important in regulated industries?

In regulated industries, particularly in financial services, an MVP must meet market demands while also adhering to strict regulatory requirements. This dual focus on functionality and compliance is crucial for minimizing risk and maximizing success.

How do hedge funds benefit from starting with an MVP?

Hedge funds can test their concepts, gather user feedback, and refine their offerings while ensuring compliance with necessary regulations, which helps minimize risk and enhance potential for success.

What impact will increasing regulatory complexity have by 2026?

As regulations become more complex by 2026, firms that can demonstrate adherence to these regulations and deliver fair outcomes will have a competitive advantage.

What are the risks associated with non-compliance in regulated industries?

Non-compliance can lead to significant business disruptions and costs that average over $5 million, highlighting the importance of an MVP in risk mitigation.

What does Alex Tsepaev suggest about the future of regulatory advantages?

Alex Tsepaev notes that in 2026, the regulatory advantage will belong to firms that can demonstrate their compliance efforts, emphasizing the need for investment funds to adopt MVP strategies that meet industry demands and navigate regulatory requirements.