Introduction

Navigating the intricate landscape of PCI compliance presents a significant challenge for hedge funds, particularly as the financial sector encounters heightened scrutiny regarding data security. With an estimated 70% of investment pools anticipated to comply with PCI DSS by 2026, it is imperative to grasp the essential requirements and select suitable compliance software. This is not merely a regulatory obligation; it is a strategic necessity. Therefore, how can hedge funds effectively assess their specific compliance needs and identify software solutions that not only fulfill regulatory standards but also bolster their security posture against emerging threats?

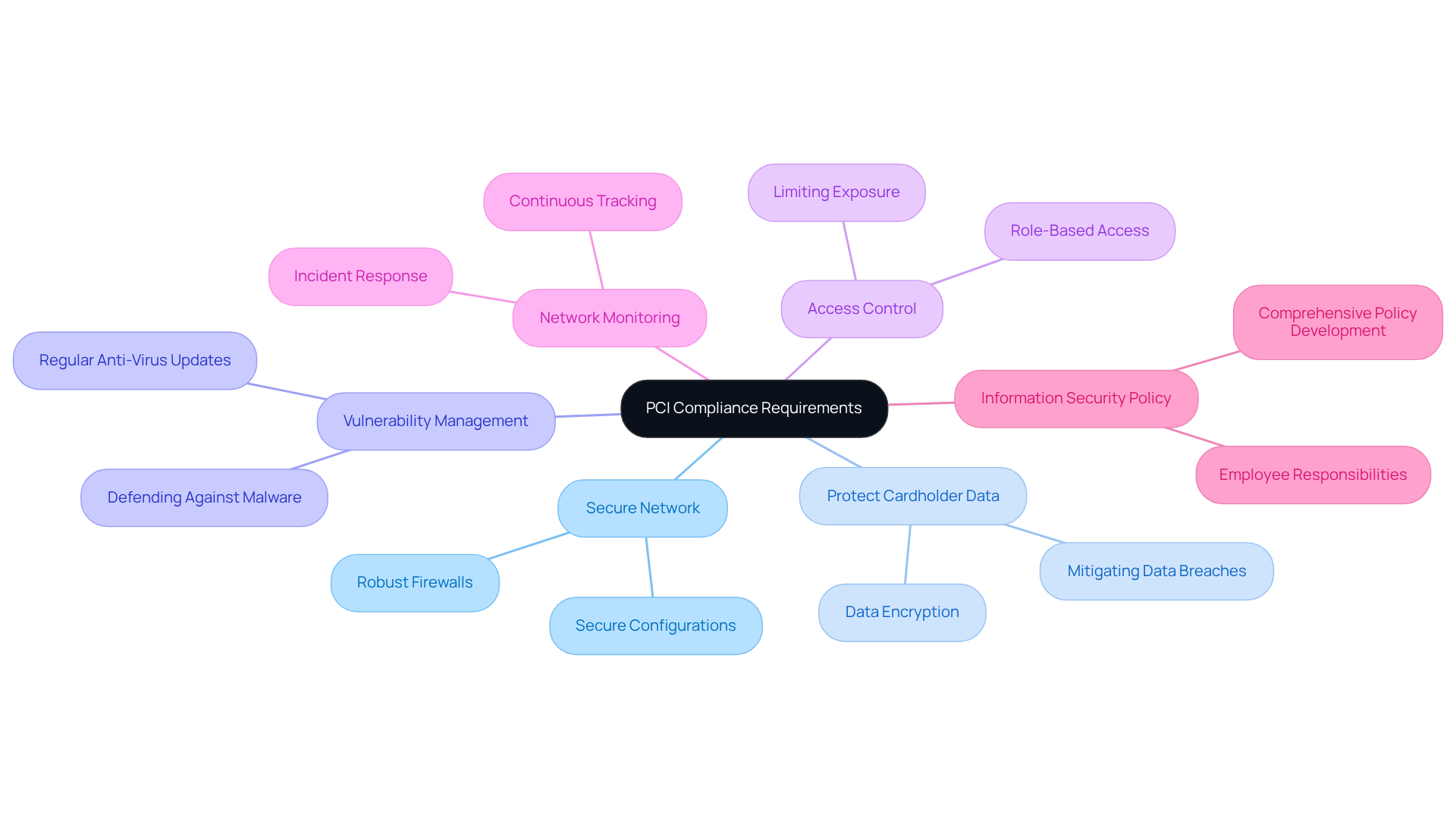

Understand PCI Compliance Requirements

To effectively select PCI compliance tools, investment firms must first understand the requirements of the PCI DSS (Payment Card Industry Data Security Standard), which are crucial for safeguarding sensitive financial information. The key requirements include:

- Build and Maintain a Secure Network: Establish robust firewalls and secure configurations to protect cardholder data from unauthorized access.

- Protect Cardholder Data: Ensure that cardholder data is encrypted during transmission across open and public networks, thereby mitigating the risk of data breaches.

- Maintain a Vulnerability Management Program: Regularly utilize and update anti-virus software to defend against malware and other vulnerabilities.

- Implement Strong Access Control Measures: Limit access to cardholder data strictly to individuals who require it for their roles, thus reducing potential exposure.

- Regularly Monitor and Test Networks: Continuously track and monitor all access to network resources and cardholder data to promptly identify and respond to security incidents.

- Maintain an Information Security Policy: Develop a comprehensive policy that addresses information security protocols for employees and contractors, ensuring that everyone understands their responsibilities.

By 2026, approximately 70% of investment pools are expected to comply with PCI DSS, reflecting a growing commitment to data security within the financial sector. As regulatory standards evolve, financial institutions are increasingly investing in secure network infrastructures to meet these requirements. Cybersecurity specialists emphasize that adhering to PCI standards not only fulfills regulatory obligations but also enhances overall security posture, making it a strategic priority for investment firms. According to Coalfire, “77% of security and IT leaders indicated they plan to transition to updated frameworks, such as PCI DSS 4.0, within the next 18 months.” By understanding these criteria, hedge investment groups can select software solutions that ensure compliance while bolstering their defenses against emerging threats. Furthermore, the financial repercussions of non-compliance are significant; violations related to non-adherence cost organizations an average of $4.61 million in 2025, underscoring the necessity for robust adherence programs.

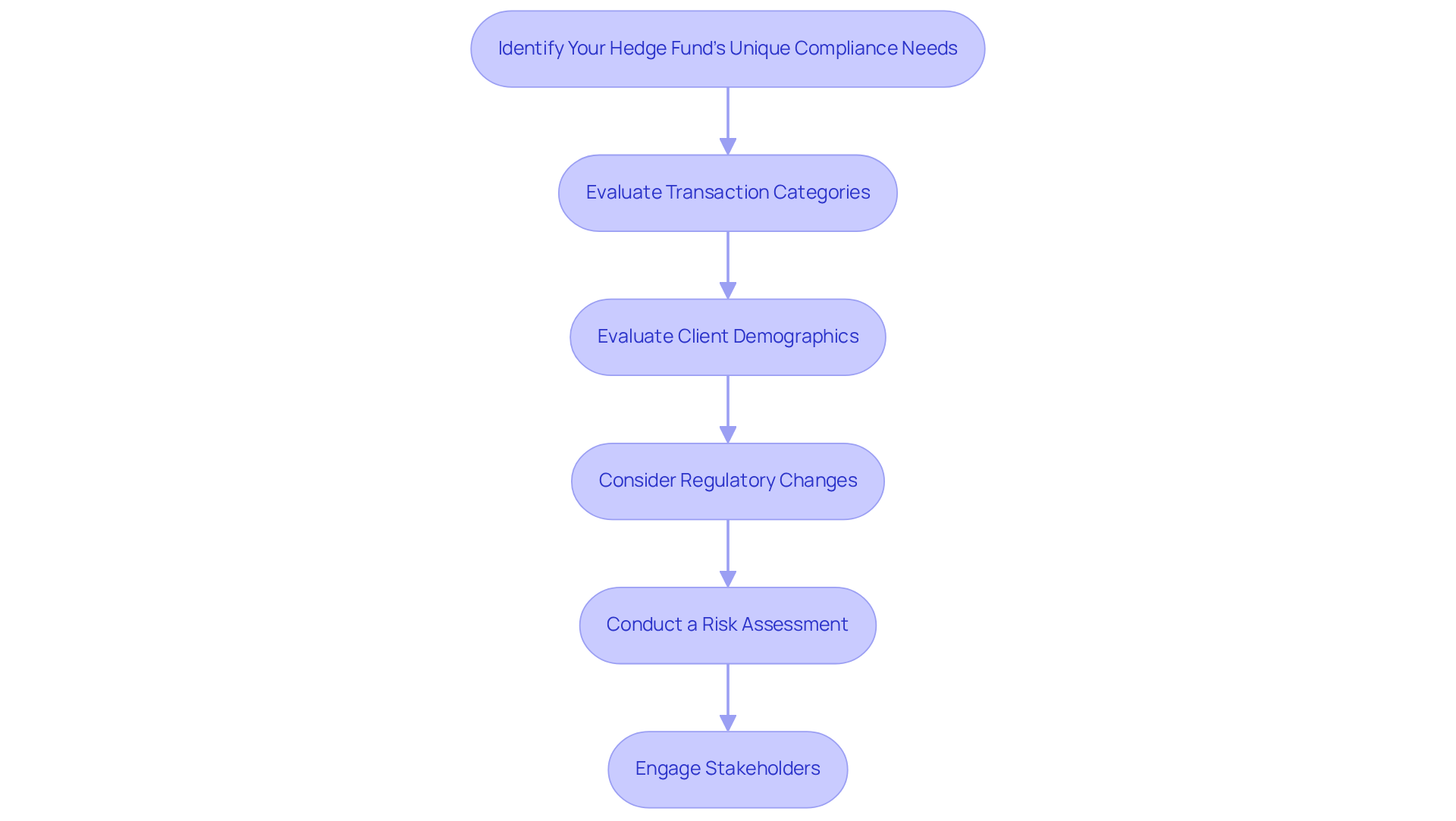

Identify Your Hedge Fund’s Unique Compliance Needs

Hedge pools face specific regulatory obligations shaped by their operational structures, client profiles, and the prevailing legal environment. To effectively identify these needs, consider the following steps:

-

Evaluate Transaction Categories: Assess the nature of transactions managed by your investment group, as different transaction categories carry distinct regulatory implications. For instance, hedge funds dealing with cryptocurrencies may encounter a range of regulatory challenges compared to those focused on traditional equities.

-

Evaluate Client Demographics: Recognize the regulatory expectations of your clients, especially if they include institutional investors or high-net-worth individuals, who may have particular requirements. Regulatory officers often emphasize the importance of tailoring compliance strategies to meet these expectations.

-

Consider Regulatory Changes: Stay informed about evolving regulations that may impact your compliance responsibilities, such as the SEC’s recent postponement of new investment disclosure requirements until October 1, 2026. This change is significant as it allows investment groups additional time to adapt their practices to the latest regulatory standards.

-

Conduct a Risk Assessment: Identify potential risks related to data handling and assess how these align with PCI compliance software standards, ensuring that your practices effectively mitigate vulnerabilities. Engaging with regulatory officers can provide valuable insights into common risks faced by investment funds.

-

Engage Stakeholders: Involve key stakeholders, including compliance officers and IT personnel, to gather insights on specific regulatory needs and ensure a comprehensive understanding of the regulatory landscape.

By thoroughly evaluating these elements, investment groups can select technological solutions that align with their unique regulatory requirements, ultimately enhancing their operational integrity and fostering client confidence.

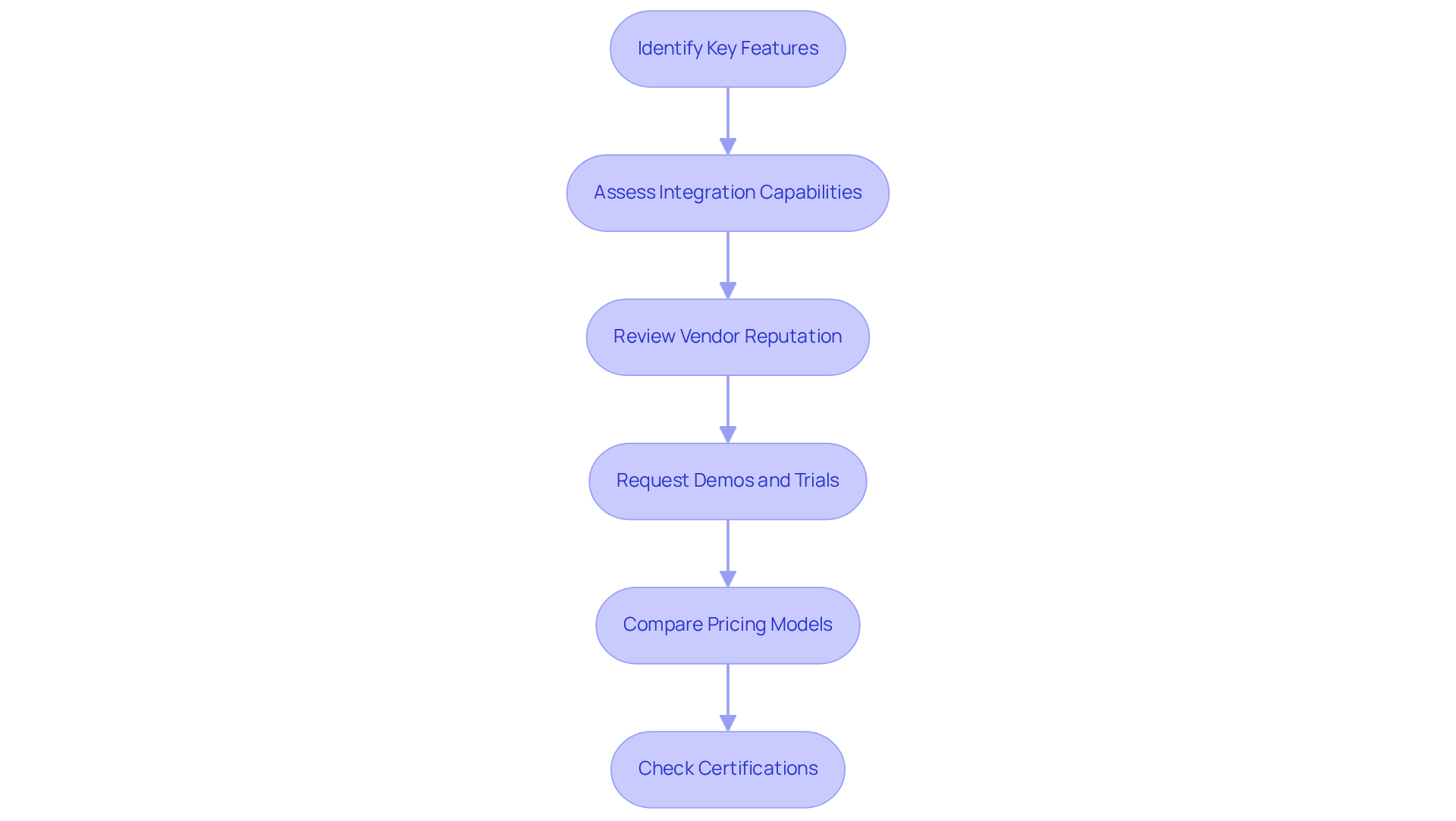

Evaluate and Compare PCI Compliance Software Options

When evaluating PCI compliance software, hedge funds should adhere to several essential steps:

-

Identify Key Features: It is crucial to prioritize applications that offer automated regulatory reporting, real-time monitoring, and robust data encryption capabilities. These features are vital for safeguarding sensitive information.

-

Assess Integration Capabilities: Ensure that the application can seamlessly connect with existing systems and workflows. This minimizes operational disruptions during implementation, which is critical for maintaining efficiency.

-

Review Vendor Reputation: Conduct thorough research on vendors, such as Trustwave and VikingCloud, which are recognized for their PCI adherence services. Examine customer reviews and case studies to evaluate their reliability and support services.

-

Request Demos and Trials: Utilize free trials or demos to assess the application’s usability and functionality in real-world situations. This step is essential to ensure that the software meets specific needs.

-

Compare Pricing Models: Analyze various pricing structures, including subscription versus one-time fees. Consider the variability in pricing among vendors to identify a solution that aligns with budget constraints.

-

Check Certifications: Confirm that the application is certified for PCI standards and that it utilizes pci compliance software to adhere to the latest guidelines. Understanding the importance of these certifications is essential for maintaining compliance.

By systematically following these steps, hedge funds can make informed choices and select the most appropriate tools to meet their regulatory requirements. The PCI adherence technology market is anticipated to expand considerably, approaching around USD 5.90 billion by 2033, underscoring the significance of selecting the right solution.

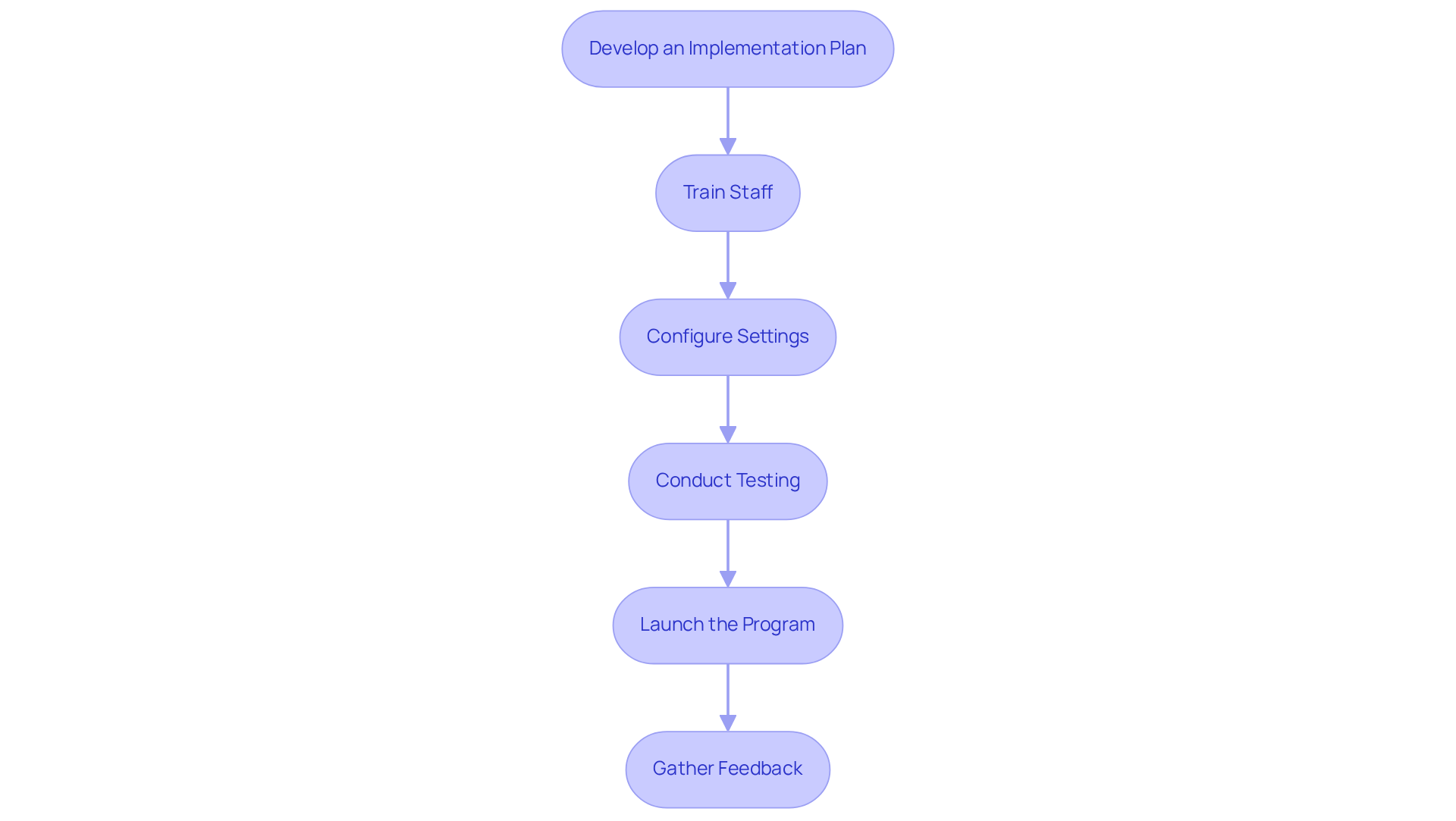

Implement and Integrate Your Chosen Software

To effectively implement your PCI compliance software, follow these structured steps:

- Develop an Implementation Plan: Create a comprehensive plan that outlines timelines, responsibilities, and milestones for the system rollout.

- Train Staff: Organize training sessions for all relevant personnel to ensure they understand how to effectively utilize the application and comply with PCI standards.

- Configure Settings: Tailor the application settings to meet your hedge fund’s specific compliance needs and operational workflows.

- Conduct Testing: Prior to going live, execute thorough testing to identify any potential issues and confirm that the program functions as intended.

- Launch the Program: Implement the application organization-wide, ensuring that all users have access and support throughout the transition.

- Gather Feedback: After implementation, collect feedback from users to pinpoint areas for improvement and address any challenges encountered.

By following these steps, investment groups can ensure a successful execution of PCI compliance software that enhances their regulatory efforts.

Manage and Monitor Compliance Continuously

To maintain PCI compliance effectively, hedge funds should utilize PCI compliance software along with a continuous management and monitoring strategy.

-

Regular Audits: Periodic audits are essential for assessing adherence to PCI standards and identifying areas for improvement. These audits play a crucial role in helping investment groups stay ahead of regulatory changes and mitigate risks associated with non-compliance. According to the SEC, yearly audits and quarterly reports will cost hedge funds nearly $1 billion, underscoring the financial implications of maintaining regulatory standards.

-

Update Policies and Procedures: It is vital to regularly review and revise adherence policies to align with evolving regulations and operational practices. This proactive approach ensures that organizations remain compliant within a dynamic regulatory environment.

-

Utilize Monitoring Tools: Implementing oversight monitoring tools allows for continuous tracking of adherence status and the detection of potential issues in real-time. Such tools can significantly reduce manual labor and the risk of costly penalties by proactively addressing regulatory gaps. Ongoing adherence monitoring is crucial for hedge funds to prevent fines and security risks.

-

Conduct Staff Training: Ongoing training for staff is necessary to keep them informed about regulatory requirements and best practices. Consistent training fosters a culture of adherence and ensures that all team members understand their roles in upholding PCI standards.

-

Engage with Regulatory Specialists: Consulting with regulatory specialists provides insights into industry trends and regulatory changes. Their expertise can help hedge funds navigate complex regulatory environments and implement effective strategies. Regulatory auditors emphasize that regular audits are vital for ensuring compliance with evolving regulations.

-

Document Everything: Maintaining comprehensive documentation of compliance efforts, audits, and incidents is essential. This documentation is crucial for demonstrating adherence to PCI standards and can be invaluable during audits when utilizing PCI compliance software.

By implementing these strategies, hedge funds can ensure compliance and effectively manage their PCI obligations with PCI compliance software, ultimately safeguarding their reputation and operational integrity.

Conclusion

Selecting the appropriate PCI compliance software is crucial for hedge funds aiming to safeguard sensitive financial data and fulfill regulatory requirements. A comprehensive understanding of PCI compliance nuances is vital, as it serves as the basis for identifying software that not only adheres to these standards but also bolsters overall security. By emphasizing a meticulous evaluation process, hedge funds can ensure they select solutions that align with their specific compliance needs.

The article outlines essential steps, including:

- Grasping PCI requirements

- Assessing individual compliance needs

- Comparing software alternatives

- Effectively implementing chosen solutions

- Sustaining ongoing compliance management

Each of these steps is integral to establishing a robust compliance framework that protects against potential security breaches and regulatory penalties. The financial repercussions of non-compliance highlight the necessity of making well-informed decisions when choosing compliance software.

The importance of PCI compliance within the financial sector is paramount. As regulations evolve, hedge funds must adopt a proactive stance in their compliance initiatives. Collaborating with regulatory experts, investing in continuous training, and employing advanced monitoring tools are critical strategies for ensuring compliance. By prioritizing these practices, hedge funds can not only safeguard their operational integrity but also cultivate trust with clients and stakeholders in an increasingly intricate regulatory environment.

Frequently Asked Questions

What is PCI compliance and why is it important for investment firms?

PCI compliance refers to adherence to the Payment Card Industry Data Security Standard (PCI DSS), which is crucial for safeguarding sensitive financial information. It is important for investment firms to protect cardholder data and avoid the significant financial repercussions of non-compliance.

What are the key requirements of PCI DSS?

The key requirements of PCI DSS include: – Building and maintaining a secure network with robust firewalls. – Protecting cardholder data through encryption during transmission. – Maintaining a vulnerability management program with updated anti-virus software. – Implementing strong access control measures to limit data access. – Regularly monitoring and testing networks to identify security incidents. – Maintaining an information security policy for all employees and contractors.

What is the expected trend in PCI compliance among investment pools by 2026?

By 2026, approximately 70% of investment pools are expected to comply with PCI DSS, indicating a growing commitment to data security within the financial sector.

How do cybersecurity specialists view PCI compliance?

Cybersecurity specialists emphasize that adhering to PCI standards not only fulfills regulatory obligations but also enhances the overall security posture of investment firms, making it a strategic priority.

What financial impact can non-compliance have on organizations?

Violations related to non-adherence to PCI compliance can cost organizations an average of $4.61 million in 2025, highlighting the necessity for robust adherence programs.

How can hedge funds identify their unique compliance needs?

Hedge funds can identify their unique compliance needs by: – Evaluating transaction categories and their regulatory implications. – Assessing client demographics and their specific regulatory expectations. – Staying informed about regulatory changes that may impact compliance responsibilities. – Conducting risk assessments related to data handling. – Engaging stakeholders, including compliance officers and IT personnel, for insights.

What recent regulatory changes should hedge funds be aware of?

Hedge funds should be aware of the SEC’s recent postponement of new investment disclosure requirements until October 1, 2026, allowing additional time to adapt to the latest regulatory standards.