4 Best Practices for Secure Mobile Banking Software Development

Introduction

In an era dominated by digital transactions, the security of mobile banking software is of paramount importance. Developers encounter the dual challenge of protecting sensitive customer data while adhering to a complex array of regulatory requirements. This article explores four essential practices that not only bolster security but also ensure compliance and foster user trust.

How can developers effectively balance innovation with the necessity for robust security in a swiftly evolving digital landscape?

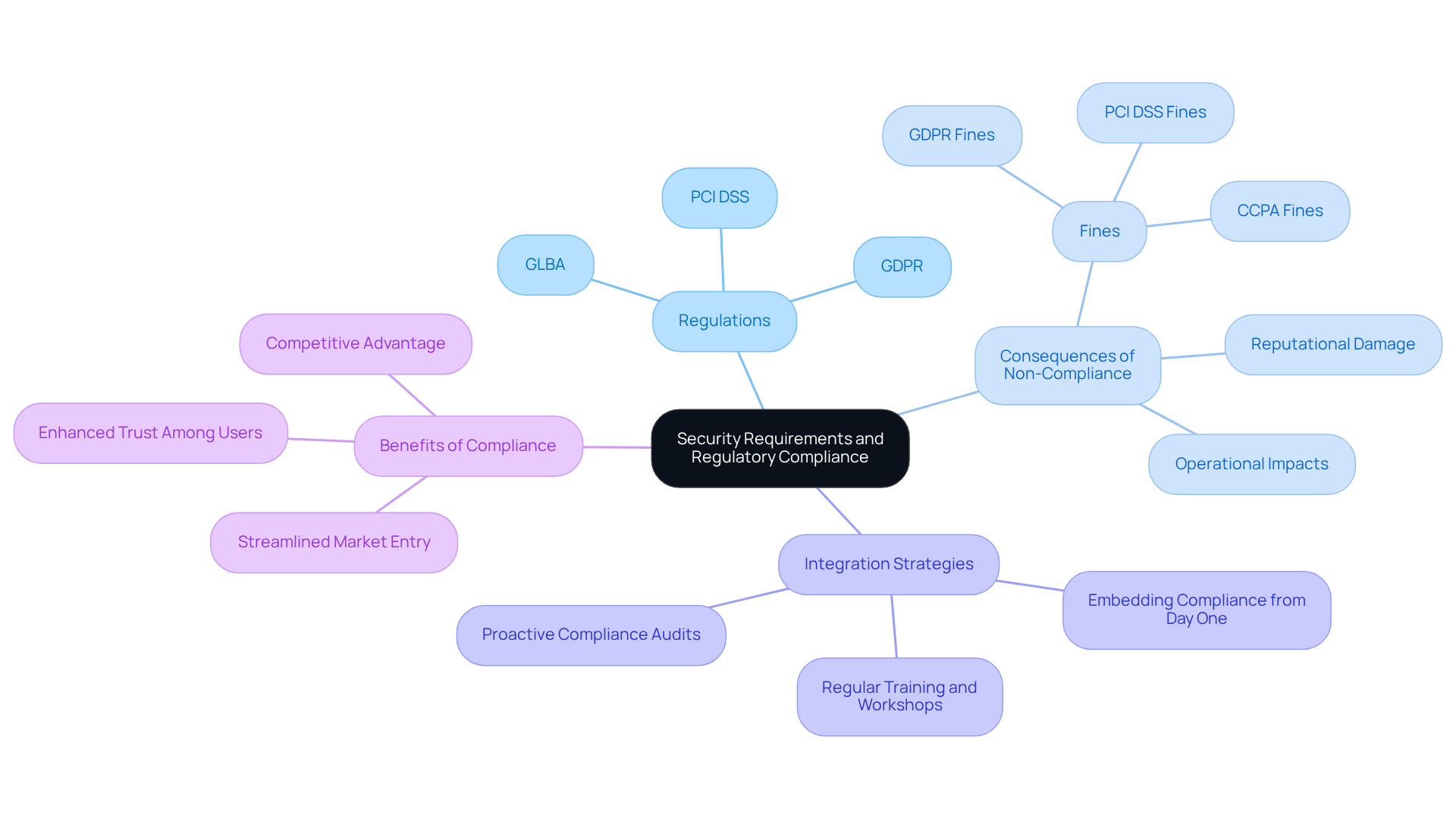

Understand Security Requirements and Regulatory Compliance

In mobile banking software development, understanding protection requirements and regulatory compliance is essential. Developers must be well-versed in regulations such as the General Data Protection Regulation (GDPR) and the Payment Card Industry Data Security Standard (PCI DSS), which govern the handling, storage, and transmission of sensitive customer data. For instance, GDPR mandates that personal data be processed lawfully, transparently, and for specific purposes. Non-compliance can lead to fines of up to €20 million or 4% of annual revenue, in addition to significant reputational damage. Moreover, non-compliance can jeopardize partnerships with banks and payment providers, delaying app launches and impacting operational efficiency.

Integrating compliance checks into the development process is not merely advisable; it is essential. Financial institutions face average breach costs of $5.97 million, influenced by overlapping regulations such as GLBA and PCI DSS, making adherence to these standards a competitive advantage. Furthermore, staying updated on regional regulations is crucial, as they can vary significantly across jurisdictions. Regular training and workshops can equip development teams with the knowledge necessary to navigate the evolving regulatory landscape effectively.

Industry leaders emphasize that treating compliance as a design principle rather than an afterthought can prevent costly missteps. As stated by OpenForge, “Rather than fixing issues later on, include compliance into your app from day one.” By embedding compliance features directly into the app’s architecture, developers can enhance trust among users and streamline market entry, ultimately fostering a more secure and reliable financial environment.

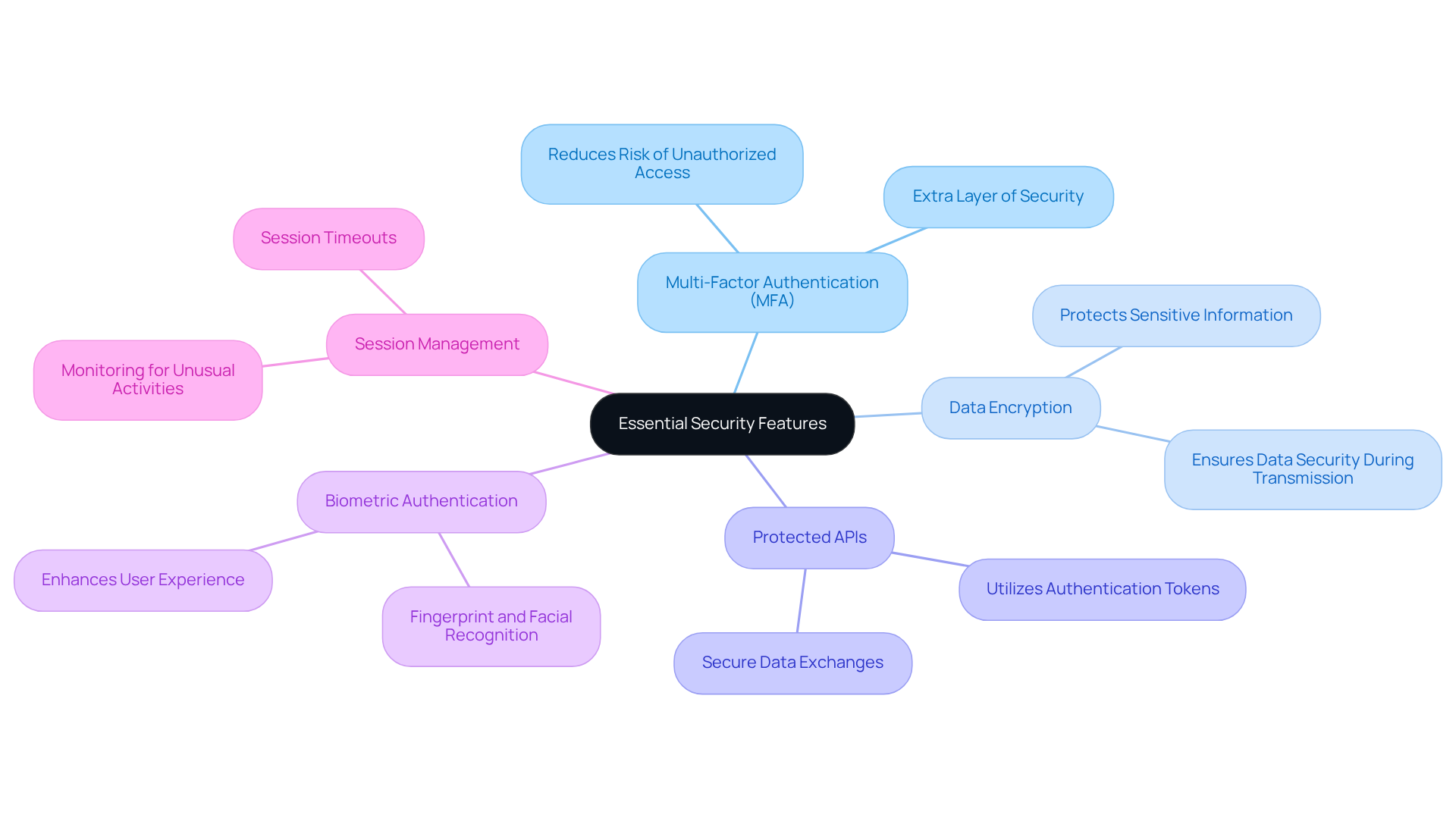

Implement Essential Security Features

To safeguard client data and enhance the security of mobile banking software, developers must integrate essential protective features. These features include:

- Multi-Factor Authentication (MFA): This mechanism introduces an extra layer of security by requiring users to present two or more verification factors to access their accounts.

- Data Encryption: Protecting sensitive information both at rest and during transmission ensures that even if data is intercepted, it remains inaccessible to unauthorized parties.

- Protected APIs: APIs should be developed with security as a priority, employing authentication tokens and ensuring that data exchanges are secure.

- Biometric Authentication: The use of fingerprint or facial recognition can bolster security while providing a seamless user experience.

- Session Management: Implementing session timeouts and monitoring for unusual activities can effectively prevent unauthorized access.

By integrating these features, developers can significantly reduce the risk of data breaches and enhance user confidence in their mobile banking software and financial applications.

Conduct Rigorous Testing and Quality Assurance

Rigorous testing and quality assurance (QA) are essential components in the development of mobile banking software. Developers must adopt a multi-faceted testing approach that encompasses several critical areas:

-

Security Testing: Identifying vulnerabilities through penetration testing and vulnerability assessments is crucial to ensure that the application can withstand cyber threats. Notably, Kaspersky Lab reports that 40% of companies lack sufficient cybersecurity measures, underscoring the importance of robust security testing.

-

Functional Testing: It is vital to ensure that all features operate as intended to enhance customer satisfaction and operational efficiency. This includes testing for common bugs that can obstruct user experience, such as registration issues and product rating functionalities.

-

Performance Testing: Applications must be evaluated under various load conditions to confirm they can handle peak usage without crashing. With mobile shoppers accounting for nearly 50% of leading retailers’ clientele, the necessity for performance enhancement to retain customers is paramount.

-

Compliance Testing: Regular audits are essential to ensure that the software meets all regulatory requirements, particularly in the financial sector where compliance is critical.

-

User Acceptance Testing (UAT): Engaging actual users to evaluate the software can provide valuable insights and reveal usability problems, ensuring that the final product aligns with user expectations.

By implementing a comprehensive testing strategy, developers can guarantee that their mobile banking software platforms are secure, reliable, and compliant with industry standards. The penetration testing sector is projected to reach a value of $4.5 billion by 2025, highlighting the increasing demand for thorough testing in mobile financial services.

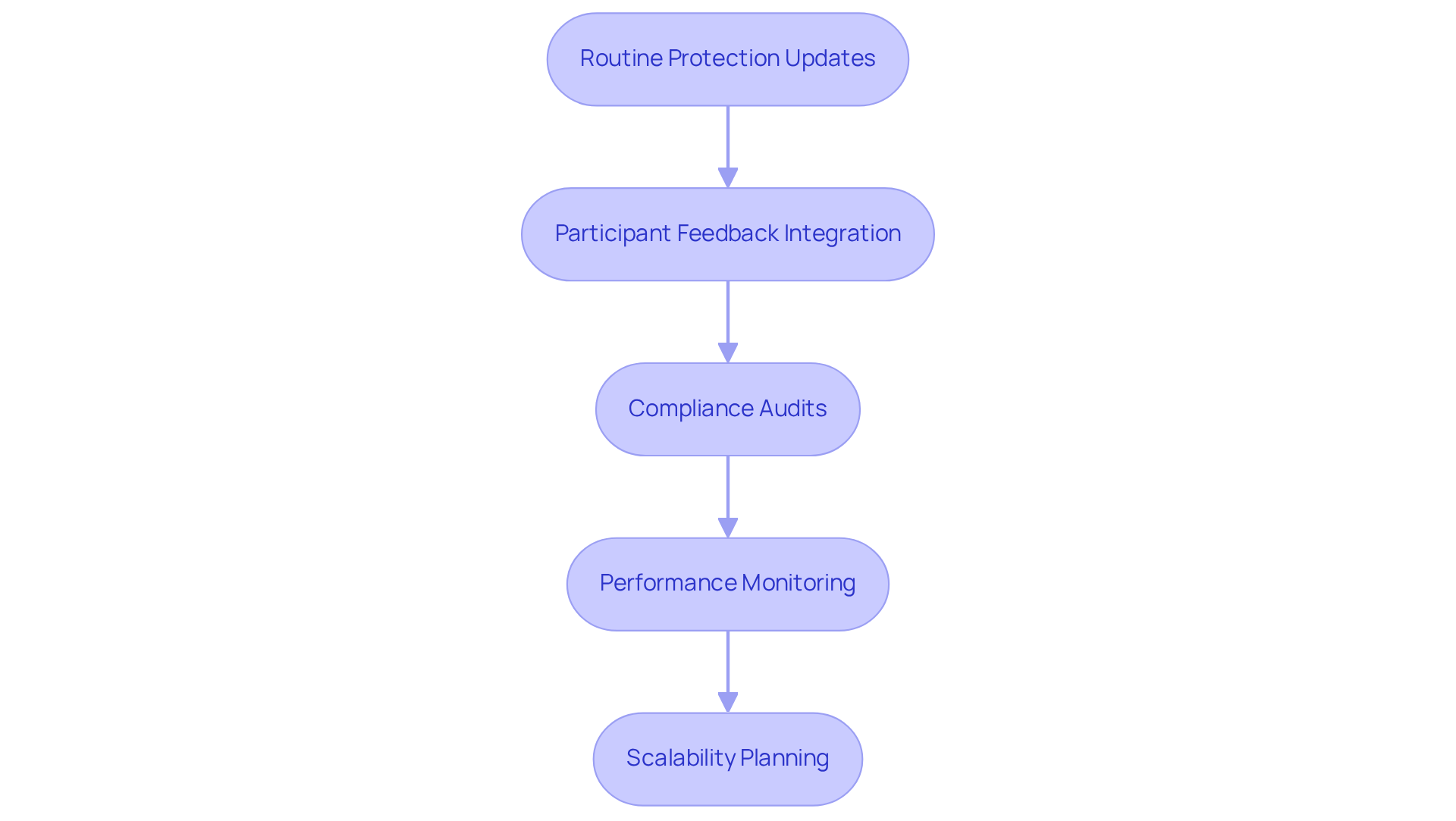

Ensure Ongoing Maintenance and Updates

Continuous upkeep and enhancements are essential for ensuring the safety and performance of mobile banking software. Developers should establish a routine that incorporates the following key practices:

-

Routine Protection Updates: Timely application of patches is vital to address vulnerabilities and safeguard against emerging threats. With 60% of data breaches linked to unpatched vulnerabilities, a proactive approach to security updates is non-negotiable. As Benjamin Harris, CEO of watchTowr, states, “Attackers are moving faster than ever. The time from disclosure to in-the-wild exploitation has never been shorter, making timely updates critical.”

-

Participant Feedback Integration: Continuously gathering and assessing participant feedback is crucial for identifying areas requiring enhancement. This practice not only improves client experience but also drives app improvements that align with user expectations, fostering loyalty and trust. Research indicates that tools that actively incorporate user feedback see a 30% increase in user satisfaction and retention.

-

Compliance Audits: Regular assessments of the system against current regulations are necessary to ensure ongoing compliance. This reduces legal risks and strengthens the system’s credibility in a highly regulated environment, particularly in financial services. Darren Guccione, CEO of Keeper Security, emphasizes, “Public-private collaboration is essential for strengthening our digital borders and protecting systems that power our society.”

-

Performance Monitoring: Utilizing analytical tools to track system performance enables developers to detect and address issues before they impact users. This proactive monitoring is essential for maintaining a seamless experience, especially as user expectations evolve.

-

Scalability Planning: As demand rises, developers must prepare for scalability to ensure the software can manage increased traffic without sacrificing performance. This foresight is critical in maintaining service quality and user satisfaction.

By prioritizing these ongoing maintenance practices, developers can ensure that their mobile banking software applications remain secure, compliant, and user-friendly over time, ultimately enhancing customer trust and satisfaction.

Conclusion

In mobile banking software development, prioritizing security is essential. Understanding security requirements and regulatory compliance, integrating key security features, conducting thorough testing, and ensuring ongoing maintenance are critical steps for developers. These practices help create robust applications that protect sensitive customer data and foster user trust, which are fundamental for navigating the complex landscape of mobile banking successfully.

Key arguments highlight the necessity of embedding compliance from the outset, implementing multi-factor authentication, and conducting rigorous testing to identify vulnerabilities. Additionally, regular updates and the integration of user feedback are vital for maintaining a secure and user-friendly experience. Collectively, these strategies not only mitigate risks but also enhance the overall reliability and performance of mobile banking software.

As the mobile banking landscape evolves, adopting these best practices becomes crucial for developers who aim to stay ahead of security threats and regulatory challenges. A proactive approach to security and compliance not only safeguards customer data but also strengthens the credibility and competitiveness of financial institutions in an increasingly digital world. By prioritizing these practices, developers can ensure a secure future for mobile banking applications and build lasting trust with users.

Frequently Asked Questions

Why is understanding security requirements and regulatory compliance important in mobile banking software development?

Understanding security requirements and regulatory compliance is essential in mobile banking software development to ensure the lawful and secure handling of sensitive customer data, as well as to avoid fines and reputational damage associated with non-compliance.

What are some key regulations developers need to be familiar with?

Developers need to be familiar with regulations such as the General Data Protection Regulation (GDPR) and the Payment Card Industry Data Security Standard (PCI DSS), which govern the handling, storage, and transmission of sensitive customer data.

What are the consequences of non-compliance with regulations like GDPR?

Non-compliance with regulations like GDPR can lead to fines of up to €20 million or 4% of annual revenue, as well as significant reputational damage and jeopardized partnerships with banks and payment providers.

How can integrating compliance checks into the development process benefit financial institutions?

Integrating compliance checks into the development process can prevent costly missteps and provide a competitive advantage, as financial institutions face average breach costs of $5.97 million due to overlapping regulations.

Why is it important to stay updated on regional regulations?

It is important to stay updated on regional regulations because they can vary significantly across jurisdictions, affecting how developers must approach compliance in different markets.

What do industry leaders recommend regarding compliance in app development?

Industry leaders recommend treating compliance as a design principle from the outset of app development, rather than as an afterthought, to enhance user trust and streamline market entry.

How can embedding compliance features into an app’s architecture impact its success?

Embedding compliance features directly into an app’s architecture can enhance trust among users and contribute to a more secure and reliable financial environment, ultimately facilitating smoother market entry.