4 Key Insights on Investment Manager Software for Hedge Funds

Introduction

Investment manager software has emerged as an essential tool for hedge funds, fundamentally transforming how financial experts manage portfolio assets in a market characterized by increasing complexity. These software solutions streamline critical functions, including:

- Trade execution

- Risk management

- Compliance reporting

By enhancing operational efficiency, they empower managers to make informed decisions that can significantly influence financial performance.

However, as technology advances rapidly and market dynamics shift, hedge fund managers face the challenge of selecting the right software that aligns with their unique needs. This selection process must also consider the complexities of regulatory compliance and data integration.

Define Investment Management Software

Investment manager software is part of the asset management applications that encompass a range of digital tools designed to assist financial experts in effectively managing portfolio assets. Investment manager software streamlines essential functions such as trade execution, portfolio tracking, risk management, and compliance reporting, all of which are critical in the highly regulated environment of hedge funds. Key components typically include:

- Portfolio Management Systems (PMS)

- Order Management Systems (OMS)

- Advanced analytics tools that provide valuable insights into market trends and performance metrics.

Recent advancements in investment manager software have concentrated on enhancing user experience and integrating AI-driven analytics, which are increasingly vital for optimizing decision-making processes. For instance, companies leveraging advanced analytics tools can improve their financial performance by as much as 15%. As the market evolves, there is a growing emphasis on automation and compliance, with technological solutions developed to address the complexities of regulatory requirements. The Investment Management Software Market is projected to reach USD 49.6 billion by 2032, expanding at a CAGR of 10.2% from 2024 to 2032, driven by technological innovations and a rising demand for data analytics.

Financial experts recognize the importance of these tools, with industry leaders such as Warren Buffett noting that a market decline can present opportunities for strategic investments. This underscores the necessity for robust programs that support informed decision-making. As the investment manager software market continues to grow, investment firms must remain vigilant in tracking trends to sustain a competitive edge.

Identify Key Features of Top Solutions

Top investment manager software solutions for hedge funds are characterized by several critical features that enhance operational efficiency and decision-making.

-

Portfolio Management: These tools empower fund managers to track and manage a diverse array of asset classes, including equities, fixed income, and derivatives. This ensures comprehensive oversight of investment portfolios.

-

Risk Analytics: Advanced analytics capabilities are essential for assessing market risks. They allow managers to make informed financial decisions based on real-time data and predictive modeling.

-

Compliance Management: Robust compliance features are crucial for adhering to regulatory requirements. They incorporate automated reporting and audit trails, streamlining processes and mitigating risks.

-

Integration Capabilities: The ability to seamlessly integrate with other financial systems and data sources is vital. This enhances operational efficiency and ensures that all relevant information is readily accessible.

-

User-Friendly Interface: An intuitive design is essential for enhancing ease of use among asset managers and their teams. This enables quicker adoption and effective utilization of the program.

As asset management firms increasingly adopt advanced technological solutions, these features not only address operational requirements but also align with the evolving needs of the financial landscape. By 2026, it is forecasted that 5% of investment groups will capture 90% of net flows within the sector, underscoring the necessity for robust investment manager software to maintain competitiveness. As Ilya Gaysinskiy, CTO of Point72, remarked, “The incorporation of advanced technology and AI is crucial for investment firms to improve their operational capabilities and decision-making processes.

Explore Benefits for Hedge Fund Managers

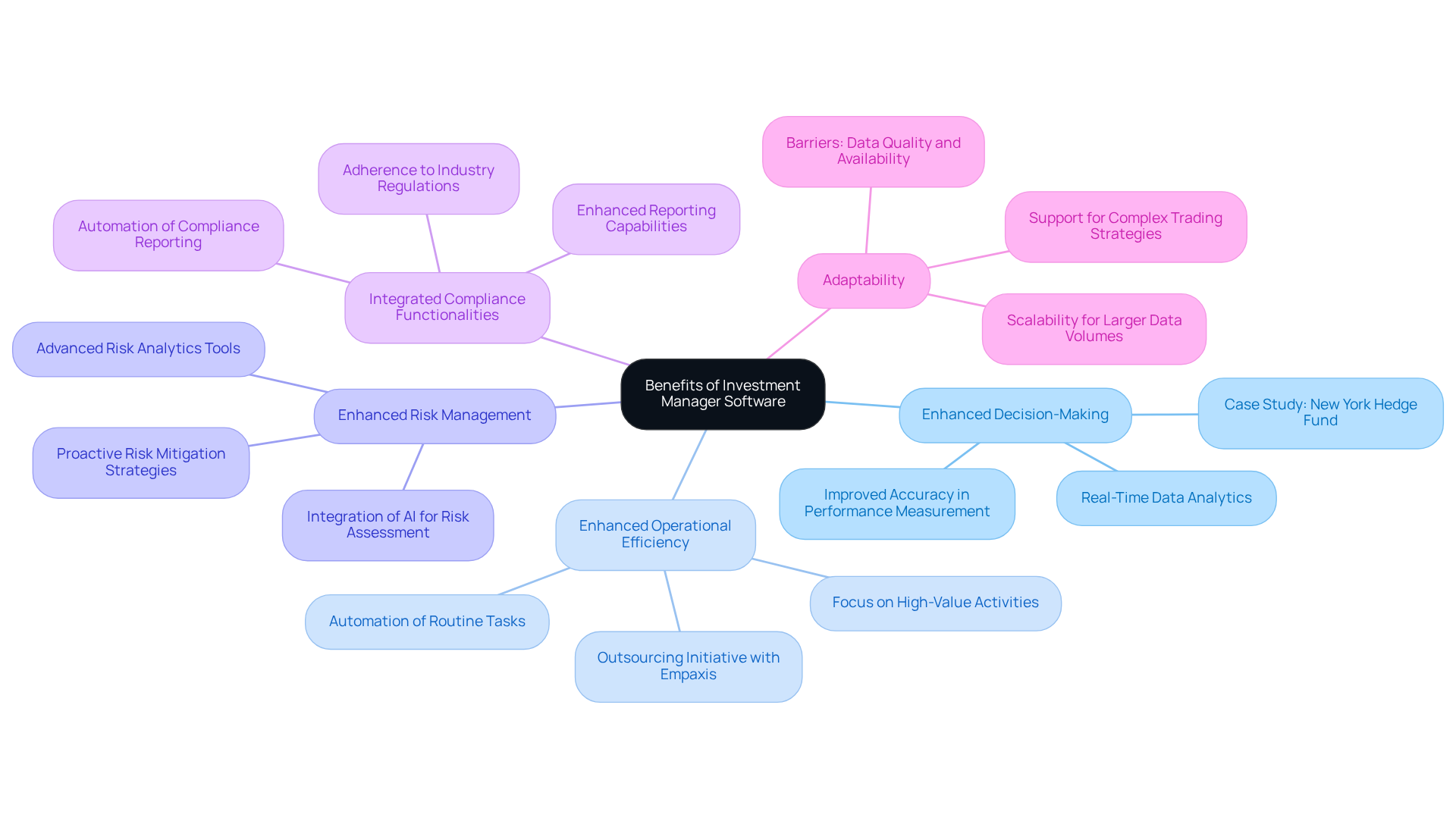

Investment manager software provides asset managers with significant advantages that enhance decision-making processes. The key benefits include:

-

Enhanced Decision-Making: Real-time data analytics and reporting empower managers to make swift, informed decisions, allowing them to adapt effectively to market fluctuations. For example, firms that utilize investment manager software with automated workflows have reported improved accuracy in performance measurement, which directly influences their investment strategies. A New York-based investment management company faced challenges with manual processes that delayed financial reporting; by automating these tasks, they significantly improved their decision-making capabilities.

-

Enhanced Operational Efficiency: Investment manager software enhances operational efficiency by automating routine tasks such as trade execution and compliance reporting, enabling hedge funds to minimize manual errors and dedicate more time to strategic planning. This transition allows teams to focus on high-value activities, ultimately leading to enhanced financial results. The outsourcing initiative with Empaxis illustrates this point, as it resulted in substantial cost savings and permitted the firm to reinvest in core business functions.

-

Enhanced Risk Management: Enhanced risk management can be achieved using investment manager software, as advanced risk analytics tools are crucial for identifying potential risks early in the funding process. This proactive approach allows managers to implement mitigation strategies before issues escalate, thereby enhancing overall portfolio stability. Managers have observed that integrating AI can assist in identifying new business opportunities and improving risk assessment.

-

Integrated Compliance Functionalities: Investment manager software includes integrated compliance functionalities that ensure adherence to industry regulations, significantly reducing the risk of penalties. Enhanced reporting capabilities provided by investment manager software also promote greater transparency, thereby boosting investor confidence. The automation of compliance reporting has been shown to improve regulatory adherence and lessen the burden on staff.

-

Adaptability: As alternative asset managers expand, investment manager software can seamlessly adjust to accommodate larger data volumes and more complex trading strategies without compromising performance. This adaptability is essential for maintaining operational integrity as firms grow. However, managers have identified data quality and availability as barriers to fully leveraging AI’s potential, underscoring the necessity for robust systems that can scale effectively.

Considerations for Selecting Software

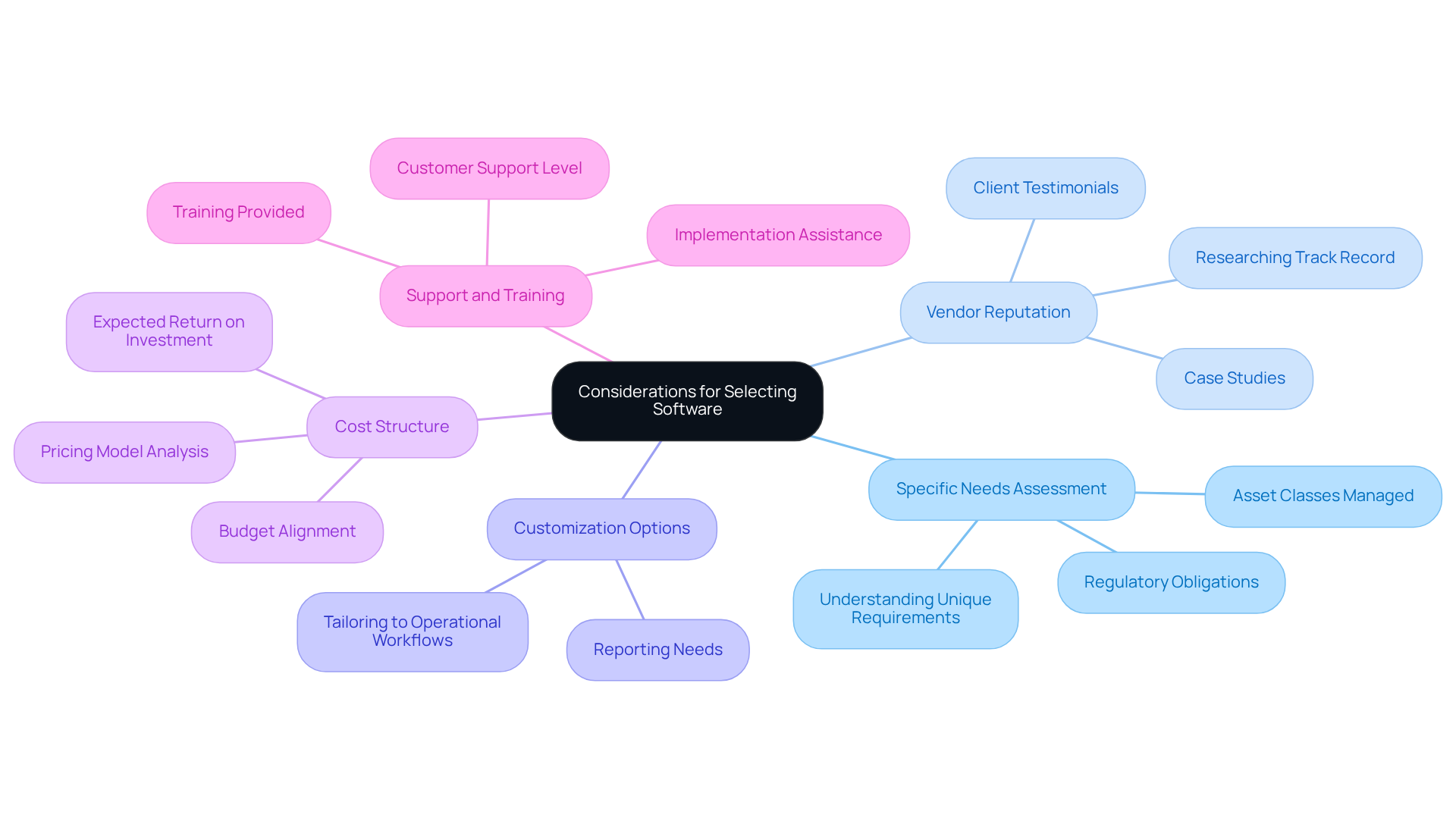

When selecting investment manager software, hedge fund managers should consider several critical factors.

-

Specific Needs Assessment: It is essential to understand the unique requirements of the fund, which includes the asset classes managed and the regulatory obligations that must be met.

-

Vendor Reputation: Researching the vendor’s track record in the financial services industry is crucial. This includes examining client testimonials and case studies to gauge their reliability and effectiveness.

-

Customization Options: Evaluating whether the software can be tailored to meet specific operational workflows and reporting needs is vital for ensuring it aligns with the fund’s processes.

-

Cost Structure: Analyzing the pricing model is necessary to ensure it aligns with the fund’s budget and expected return on investment, allowing for informed financial planning.

-

Support and Training: Finally, assessing the level of customer support and training provided by the vendor is important to ensure smooth implementation and ongoing usage of the software.

Conclusion

In conclusion, investment manager software stands as a crucial asset for hedge funds, offering a comprehensive suite of features designed to streamline operations and enhance decision-making capabilities. As the financial landscape evolves, the integration of advanced analytics and automation within these software solutions becomes essential for maintaining a competitive edge. The significance of selecting the appropriate investment manager software cannot be overstated, as it directly influences a firm’s ability to navigate the complexities of the market and regulatory environment.

This article has highlighted several key insights, including:

- The definition and critical components of investment manager software

- The essential features that top solutions provide

- The substantial benefits they offer to hedge fund managers

From enhanced decision-making through real-time analytics to improved compliance management and operational efficiency, these tools empower firms to adapt swiftly to market changes while minimizing risks. Additionally, considerations for selecting the right software, such as vendor reputation and customization options, are vital for ensuring alignment with specific fund needs.

In a rapidly changing financial landscape, embracing the capabilities of investment manager software is not merely advantageous but necessary for hedge funds aiming to thrive. As the market for these solutions expands, firms must remain proactive in adopting technologies that enhance their operational efficiency and strategic decision-making. By doing so, hedge fund managers can safeguard their investments while seizing new opportunities for growth and innovation in an increasingly competitive environment.

Frequently Asked Questions

What is investment management software?

Investment management software is a type of asset management application that includes digital tools to help financial experts manage portfolio assets effectively. It streamlines functions such as trade execution, portfolio tracking, risk management, and compliance reporting.

What are the key components of investment management software?

The key components typically include Portfolio Management Systems (PMS), Order Management Systems (OMS), and advanced analytics tools that offer insights into market trends and performance metrics.

How has investment management software evolved recently?

Recent advancements have focused on enhancing user experience and integrating AI-driven analytics, which are crucial for optimizing decision-making processes. Companies using these advanced analytics tools can improve their financial performance by as much as 15%.

What is the projected growth of the investment management software market?

The Investment Management Software Market is projected to reach USD 49.6 billion by 2032, expanding at a compound annual growth rate (CAGR) of 10.2% from 2024 to 2032, driven by technological innovations and increasing demand for data analytics.

Why do financial experts consider investment management software important?

Financial experts recognize these tools as essential for informed decision-making, especially during market declines, which can present strategic investment opportunities. Robust software programs support the ability to track trends and maintain a competitive edge in the investment sector.