Master Staff Augmentation Services for Hedge Funds Today

Introduction

In an increasingly competitive financial landscape, hedge funds must adapt swiftly to market demands while ensuring operational efficiency. Staff augmentation services present a strategic solution, enabling investment firms to access specialized expertise without the long-term commitment associated with permanent hires. However, the challenge lies in accurately identifying specific needs and selecting the right partner to enhance team capabilities.

How can hedge funds effectively navigate this complex terrain to leverage staff augmentation for maximum impact?

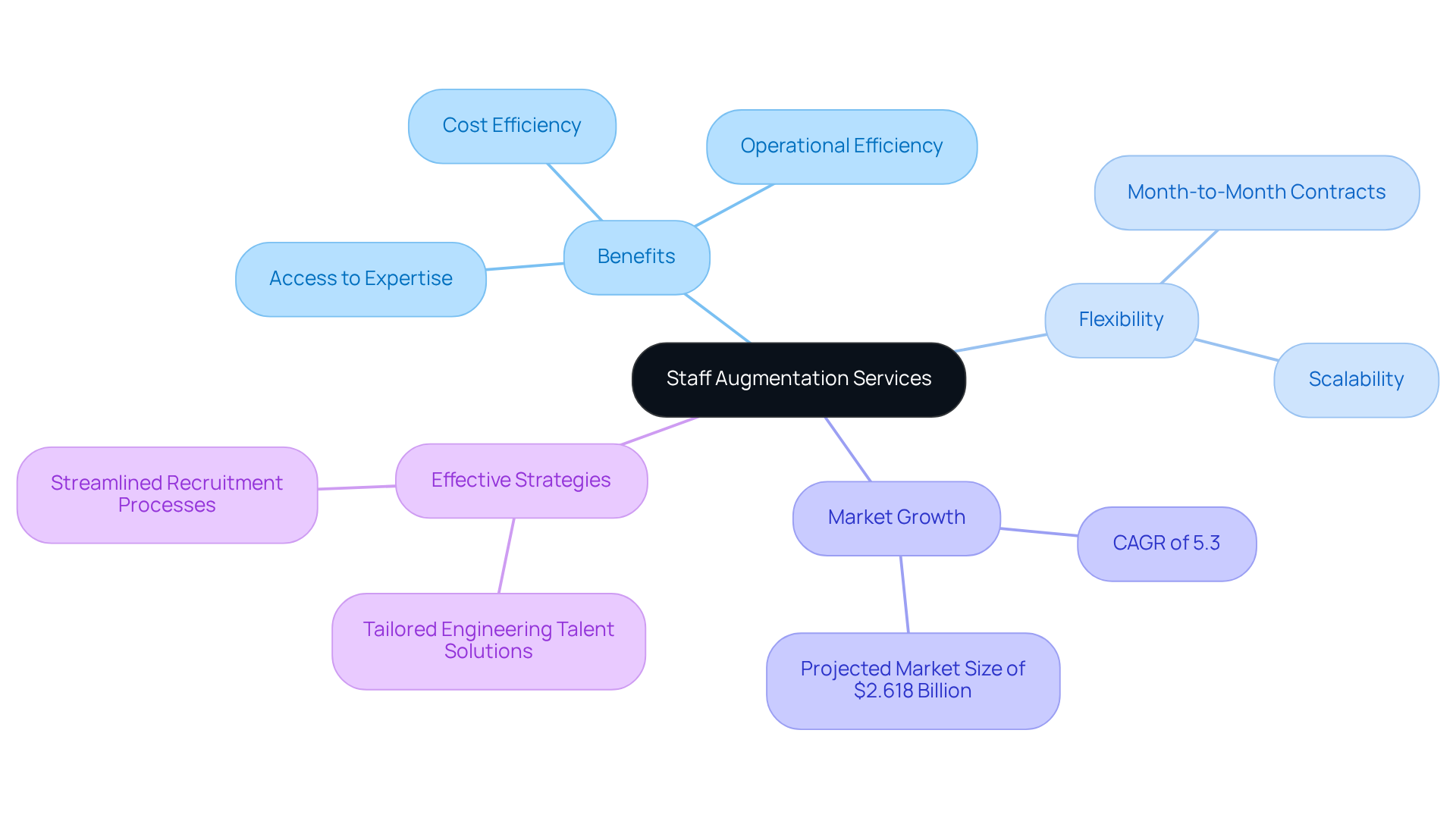

Define Staff Augmentation Services

A staff augmentation services company provides a strategic solution for organizations, enabling them to enhance their workforce with external professionals on a temporary basis. This approach is particularly advantageous for investment groups, which often encounter diverse requirements for specialized skills. Investment firms can swiftly access expertise in critical areas such as financial modeling, compliance, and risk management by utilizing a staff augmentation services company, all without the long-term commitments associated with full-time hires.

Neutech’s adaptable engineering talent model, characterized by month-to-month contracts, empowers investment groups to scale their teams efficiently. This flexibility ensures that they can respond to market fluctuations and project demands promptly. With the ability to integrate development resources seamlessly, Neutech provides tailored engineering talent solutions that align with the specific needs of investment firms, facilitating rapid scaling in regulated sectors.

Moreover, Neutech has established a streamlined ongoing pipeline for identifying and training skilled software engineers, guaranteeing that hedge funds have access to the necessary expertise when required. The benefits of personnel augmentation in financial services are significant, with the market projected to grow at a compound annual growth rate (CAGR) of 5.3%, nearing approximately $2.618 billion. This growth highlights the increasing dependence on a staff augmentation services company to provide external expertise for navigating the complexities of the financial landscape, especially in regulated environments where compliance and risk management are critical.

Effective workforce augmentation strategies in financial services can be achieved by partnering with a staff augmentation services company to leverage specialized skills that enhance operational efficiency and mitigate risks associated with compliance errors. Ultimately, this leads to improved performance and a competitive advantage.

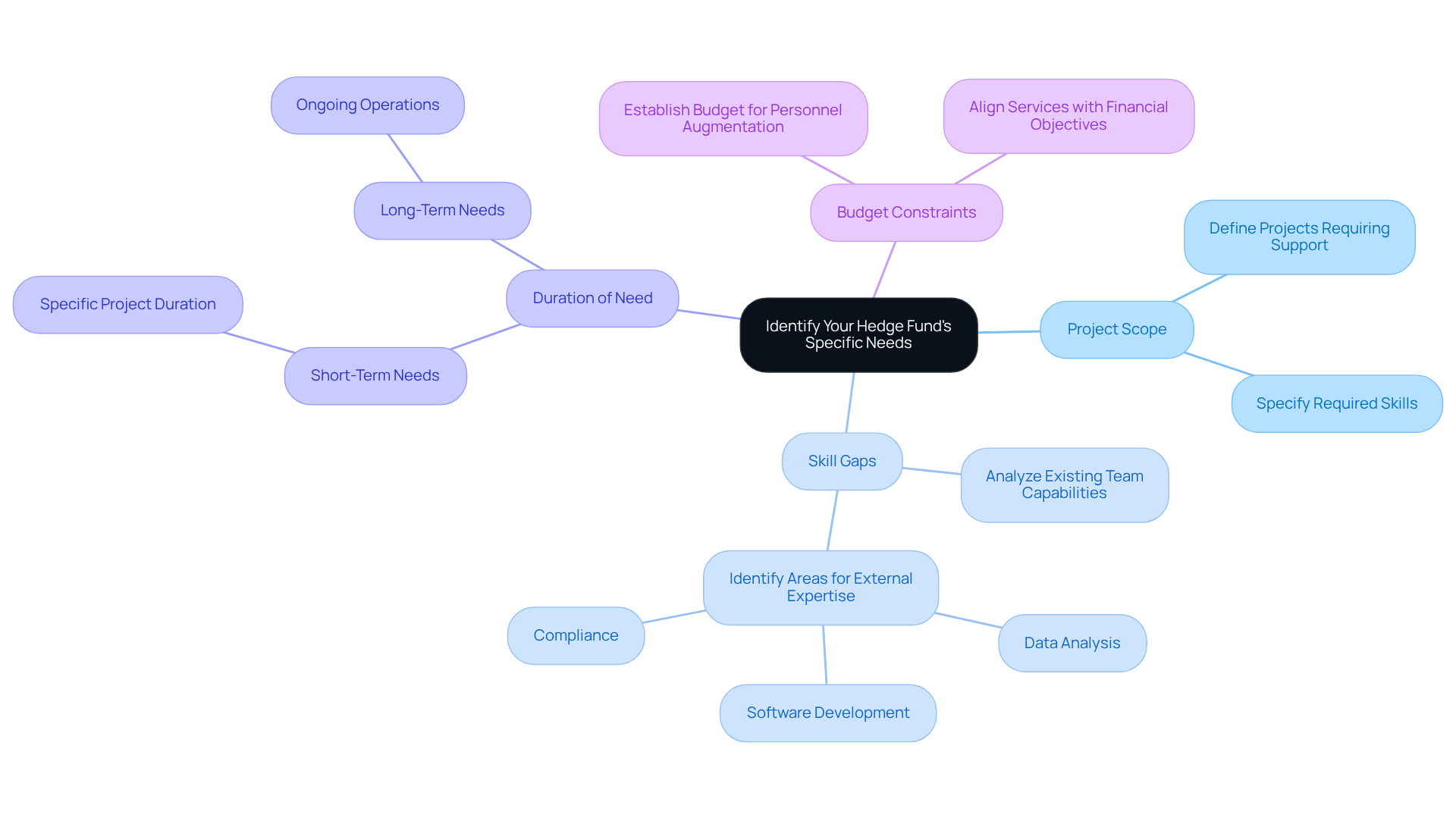

Identify Your Hedge Fund’s Specific Needs

To effectively leverage a staff augmentation services company, hedge funds must first identify their specific requirements. This involves a thorough evaluation of current projects, pinpointing skill gaps, and understanding the duration for which additional resources are necessary. Neutech plays a crucial role in this process by supplying tailored engineering talent. Once needs are mutually identified, Neutech will present a selection of candidate designers and developers to seamlessly integrate into your team.

Key areas to assess include:

- Project Scope: Clearly define the projects that require additional support and specify the skills needed.

- Skill Gaps: Conduct a comprehensive analysis of the existing team’s capabilities to identify areas where external expertise is essential, such as data analysis, software development, or compliance.

- Duration of Need: Determine whether the requirement for additional personnel is short-term (for a specific project) or long-term (for ongoing operations).

- Budget Constraints: Establish a budget for personnel augmentation to ensure that the selected services align with financial objectives.

By carefully outlining these requirements and utilizing Neutech’s customized approach, investment groups can streamline the process of selecting the appropriate staff augmentation services company.

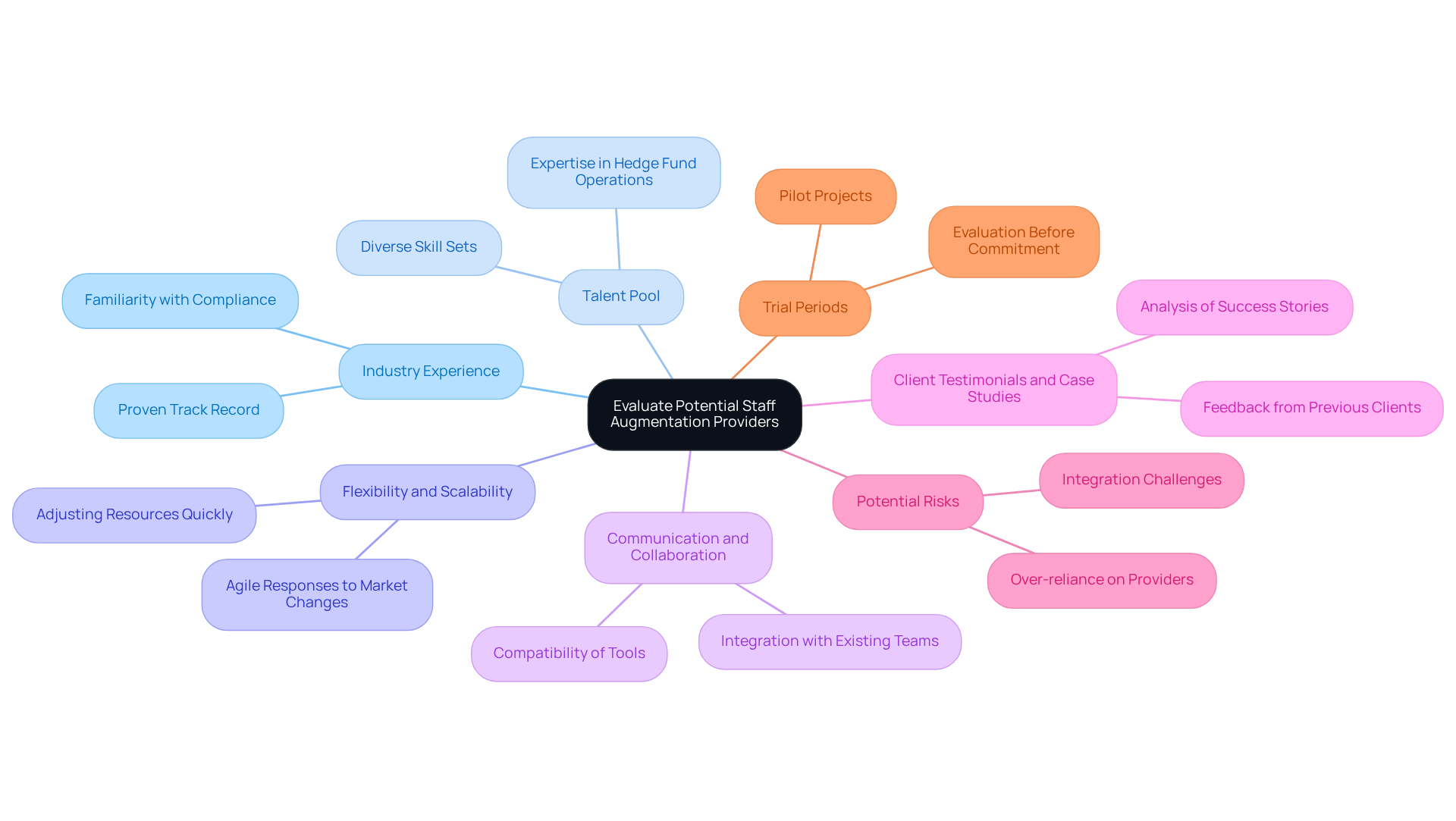

Evaluate Potential Staff Augmentation Providers

When selecting a staff augmentation provider, hedge funds must evaluate several critical factors to ensure alignment with their operational needs:

-

Industry Experience: It is essential to prioritize providers with a proven track record in the financial services sector. Their familiarity with the unique challenges and compliance requirements of investment vehicles is invaluable.

-

Talent Pool: Assess the provider’s access to a diverse talent pool equipped with the necessary skills and expertise for hedge fund operations, particularly in areas such as portfolio management and regulatory compliance.

-

Flexibility and Scalability: Choose a provider capable of swiftly adjusting resources in response to project demands. This flexibility enables agile responses to market fluctuations and operational shifts.

-

Communication and Collaboration: Evaluate how the provider fosters communication and integrates with your existing team. Effective collaboration is crucial for achieving project success and maintaining workflow continuity. Additionally, consider the communication and collaboration tools employed by the provider to ensure compatibility with your internal systems.

-

Client Testimonials and Case Studies: Review feedback from previous clients and analyze case studies to gauge the provider’s reliability and service quality. Positive testimonials can indicate a provider’s ability to deliver results that meet or exceed expectations.

-

Potential Risks: Be cognizant of the risks associated with over-reliance on an external provider, which can lead to inefficiencies or delays during critical periods. Integration challenges may arise if additional personnel do not seamlessly align with in-house teams.

-

Trial Periods: Consider whether the provider offers a trial period or pilot project to evaluate service quality before making a long-term commitment.

By rigorously evaluating potential suppliers against these criteria, investment firms can select a staff augmentation services company that not only aligns with their operational objectives but also enhances their team’s capabilities, ultimately fostering greater efficiency and success.

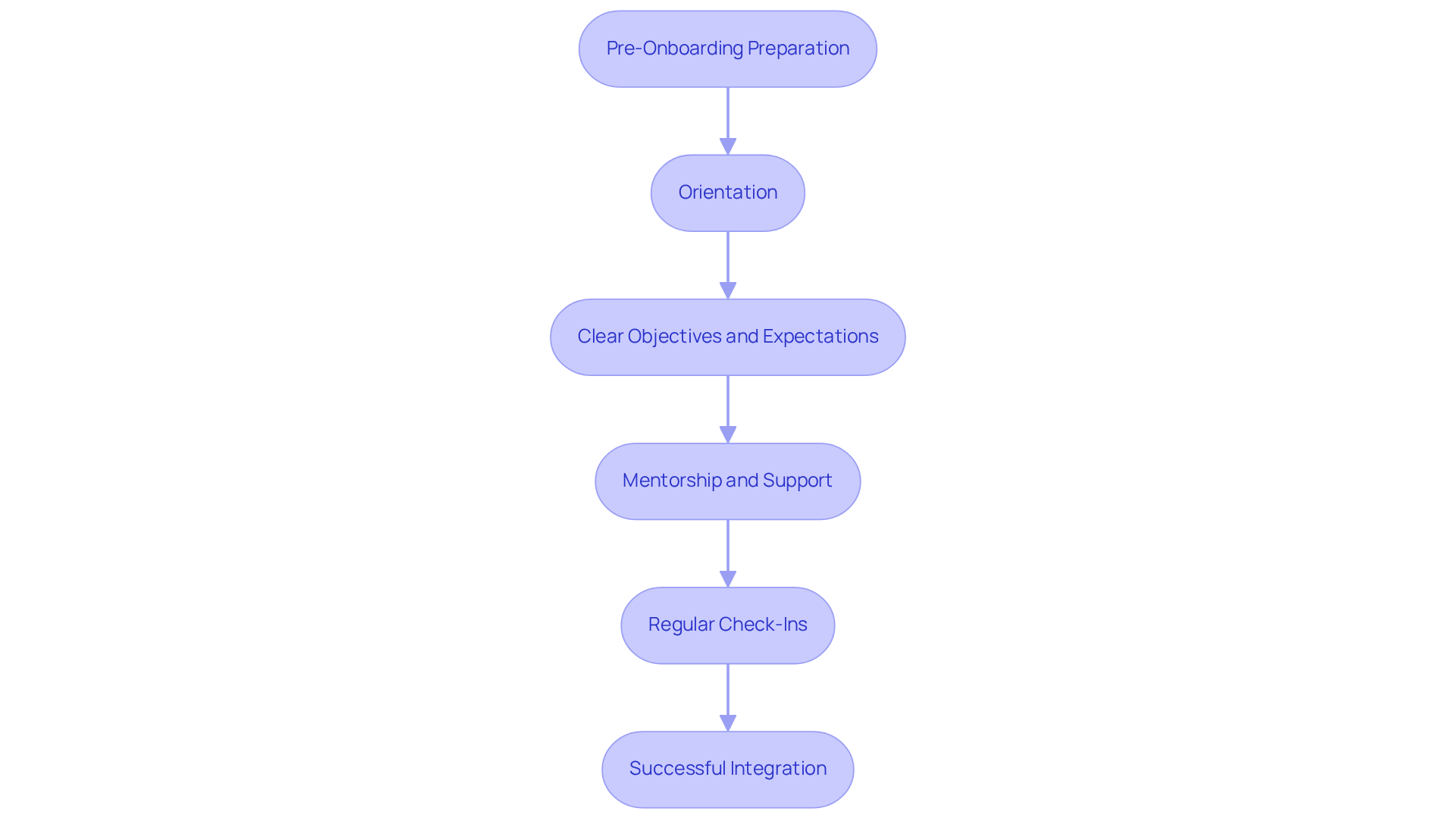

Implement an Effective Onboarding Process

To maximize the effectiveness of augmented staff, hedge funds should implement a structured onboarding process that encompasses several key steps:

-

Pre-Onboarding Preparation: Prior to the arrival of additional personnel, it is essential to ensure that all necessary tools, system access, and relevant documentation are in place. This preparation enables new hires to commence their roles without delays, significantly enhancing their initial productivity.

-

Orientation: A comprehensive orientation session should be conducted to familiarize augmented personnel with the company culture, values, and operational processes. This introduction is crucial for helping them understand the context of their work and aligning them with the organization’s mission.

-

Clear Objectives and Expectations: It is vital to clearly define performance expectations and objectives for the augmented staff. This clarity ensures that they comprehend their roles and responsibilities from the outset, which is essential for their success and integration into the group.

-

Mentorship and Support: Assigning a mentor or buddy from the current group to provide guidance and assistance during the initial integration period is recommended. This mentorship fosters collaboration and helps build essential relationships, which are critical for long-term retention and satisfaction.

-

Regular Check-Ins: Consistent check-ins should be scheduled to assess progress, address challenges, and provide constructive feedback. Ongoing communication is essential for maintaining alignment and productivity, as it allows for timely adjustments in response to any issues that arise.

By adhering to these organized onboarding procedures, investment groups can ensure that additional personnel from a staff augmentation services company are successfully incorporated into their units, resulting in improved performance and enhanced project outcomes. Statistics indicate that organizations that partner with a staff augmentation services company for a robust onboarding process can experience a 50% increase in new hire productivity, underscoring the importance of investing in effective onboarding strategies. Furthermore, 22% of workers reported leaving a job within the first 90 days, highlighting the critical nature of effective onboarding in reducing early turnover. Additionally, most HR directors estimate that a failed new hire can cost up to $25,000, emphasizing the financial implications of poor onboarding practices. Organizations with a strong onboarding process improve new hire retention by 82%, reinforcing the need for structured onboarding processes. Lastly, the 4 C’s of employee onboarding – Compliance, Clarification, Culture, and Connection – provide a framework for understanding the components of effective onboarding. New hires are also 3.4 times more likely to describe their onboarding experience as exceptional when managers are involved, stressing the importance of manager participation in the onboarding process.

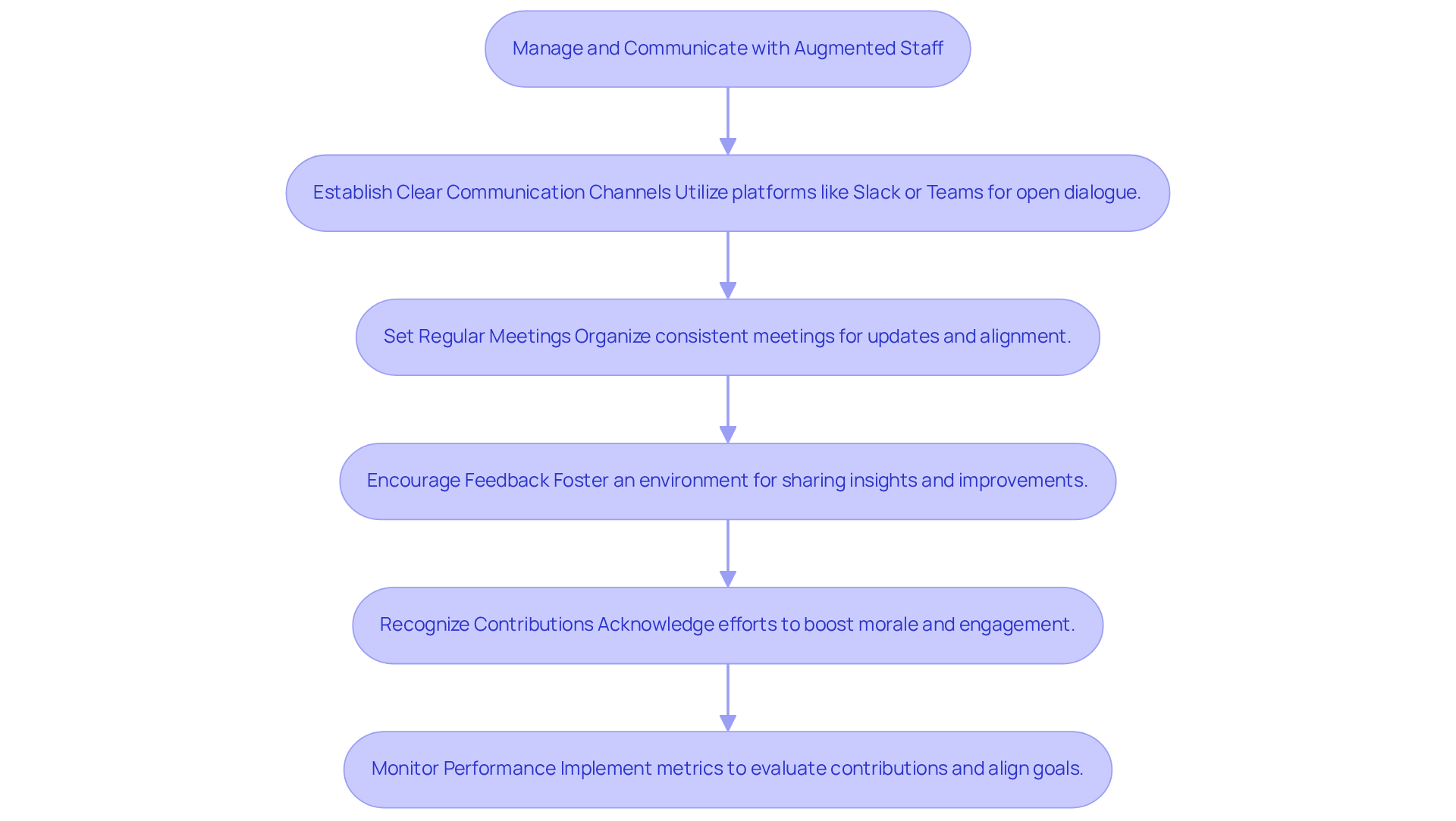

Manage and Communicate with Augmented Staff

Effective management and communication with enhanced personnel from a staff augmentation services company are crucial for maximizing their contributions to a hedge fund’s objectives. To achieve this, several essential strategies should be implemented:

-

Establish Clear Communication Channels: Utilize platforms such as Slack or Microsoft Teams to foster open dialogue between augmented personnel and existing teams. This approach not only promotes collaboration but also enables swift issue resolution. A McKinsey survey indicates that effective communication can lead to a productivity boost of 20-25%, highlighting the significance of these channels.

-

Set Regular Meetings: Organize consistent group meetings to review project updates, address challenges, and celebrate successes. This practice ensures alignment among team members and nurtures a sense of belonging. As Patrick Lencioni states, “Teamwork begins by building trust. And the only way to do that is to overcome our need for invulnerability.”

-

Encourage Feedback: Foster an environment where enhanced team members feel empowered to share feedback on processes and workflows. Such insights can lead to substantial improvements and enhance operational efficiency. Research shows that 86% of executives and employees cite ineffective communication as a significant cause of workplace failures, underscoring the necessity for open feedback channels.

-

Recognize Contributions: Acknowledge the efforts and achievements of augmented personnel to elevate morale and motivation. Recognition is vital in enhancing their engagement and commitment to the team. As Tony Robbins notes, “The way we communicate with others and with ourselves ultimately determines the quality of our lives.”

-

Monitor Performance: Implement performance metrics to evaluate the contributions of augmented personnel. Regular evaluations help identify areas for improvement and ensure alignment with project goals. A case study of an investment manager that outsourced investment operations to Empaxis illustrates how effective communication and performance monitoring led to increased efficiency and enhanced accuracy in financial data.

By adopting these management strategies, hedge funds can seamlessly integrate augmented staff from a staff augmentation services company into their teams, thereby boosting overall productivity and ensuring project success.

Conclusion

The strategic integration of staff augmentation services into hedge fund operations represents a pivotal approach to enhancing workforce capabilities. By leveraging external expertise, investment firms can effectively address specific skill gaps, respond to market demands, and sustain operational efficiency without the constraints of long-term commitments. This strategy not only grants immediate access to specialized skills but also cultivates a flexible workforce capable of adapting to the ever-evolving financial landscape.

Key insights discussed throughout the article include:

- The necessity of identifying precise staffing needs

- Evaluating potential providers

- Implementing effective onboarding processes

- Managing augmented staff efficiently

Each of these components is vital in ensuring that the incorporation of external talent aligns with the firm’s objectives, ultimately resulting in enhanced performance and a competitive advantage. The projected growth of the staff augmentation market, anticipated to reach approximately $2.618 billion, underscores the increasing dependence on these services within the financial sector.

In summary, the strategic application of staff augmentation services can significantly bolster a hedge fund’s operational capabilities. Firms are urged to adopt best practices in assessing their needs, selecting appropriate providers, and implementing robust onboarding and management strategies. As the financial landscape continues to evolve, embracing these practices will not only streamline operations but also position hedge funds to excel in an increasingly complex environment. Investing in staff augmentation transcends a mere tactical decision; it serves as a pathway to sustained growth and success in the competitive realm of finance.

Frequently Asked Questions

What are staff augmentation services?

Staff augmentation services provide organizations with a strategic solution to enhance their workforce by temporarily adding external professionals, allowing for quick access to specialized skills without the long-term commitments of full-time hires.

Who benefits from staff augmentation services?

Staff augmentation services are particularly advantageous for investment groups that require specialized expertise in areas such as financial modeling, compliance, and risk management.

How does Neutech support investment groups with staff augmentation?

Neutech offers an adaptable engineering talent model with month-to-month contracts, allowing investment groups to efficiently scale their teams in response to market fluctuations and project demands.

What is the projected market growth for personnel augmentation in financial services?

The market for personnel augmentation in financial services is projected to grow at a compound annual growth rate (CAGR) of 5.3%, nearing approximately $2.618 billion.

What steps should hedge funds take to leverage staff augmentation services effectively?

Hedge funds should first identify their specific needs by evaluating current projects, pinpointing skill gaps, understanding the duration of resource needs, and establishing budget constraints.

What key areas should hedge funds assess when identifying their needs?

Hedge funds should assess project scope, skill gaps within their existing team, duration of need for additional personnel, and budget constraints for personnel augmentation.

How does Neutech assist in the selection of candidates for staff augmentation?

Once the specific needs are identified, Neutech presents a selection of candidate designers and developers to seamlessly integrate into the hedge fund’s team.