Introduction

In the complex realm of financial services, software development transcends mere innovation; it requires a careful navigation of compliance. As regulations evolve and become more stringent, developers must grasp the intricacies of financial compliance to create robust, market-ready applications. This article explores best practices that not only ensure adherence to regulatory standards but also elevate the quality and reliability of software products. The challenge persists: how can development teams seamlessly integrate compliance without hindering creativity and efficiency?

Understand Regulatory Compliance Requirements in Financial Software Development

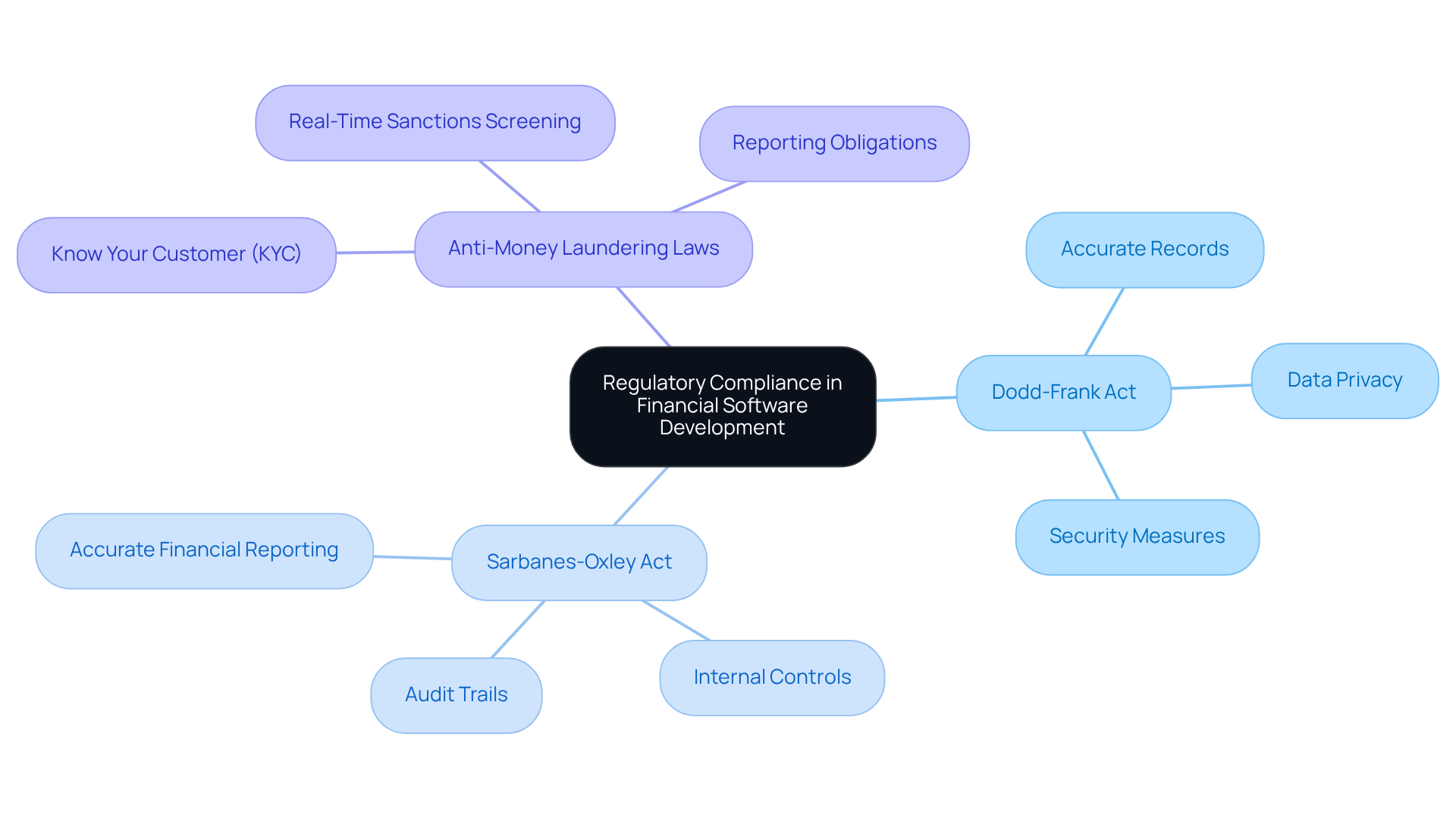

To create applications efficiently for the financial services sector, a thorough understanding of the regulatory standards governing this industry is essential. Key regulations include:

- The Dodd-Frank Act

- The Sarbanes-Oxley Act

- Various Anti-Money Laundering (AML) laws

Each regulation imposes specific obligations on financial institutions, such as maintaining accurate records, ensuring data privacy, and implementing robust security measures.

Developers must familiarize themselves with these regulations and consider their impact on system architecture, data handling, and user interactions. For instance, applications must be designed to comply with Know Your Customer (KYC) requirements, which necessitate the collection and verification of customer identities. Additionally, understanding the implications of the General Data Protection Regulation (GDPR) is crucial for applications managing personal information, ensuring that user consent and data protection measures are integrated from the outset.

By prioritizing regulatory compliance during the initial phases of application development, teams can avoid costly revisions and ensure that their products are market-ready and aligned with industry standards from the start.

Implement Best Practices for Compliance Throughout the Development Lifecycle

To effectively embed compliance within the software development lifecycle (SDLC), teams should adopt several best practices:

-

Incorporate Regulatory Checks Early: Begin by integrating regulatory requirements into the initial planning and design phases. This involves defining adherence objectives and identifying relevant regulations that will shape the software’s architecture.

-

Utilize Agile Methodologies: Agile development enables iterative testing and feedback, allowing teams to continuously evaluate adherence. Regular sprints should include oversight reviews to ensure that any modifications adhere to regulatory standards. Experts note that integrating adherence early can significantly reduce the risk of regulatory breaches.

-

Automate Adherence Testing: Utilize automated testing tools to verify conformity with regulations such as GDPR and AML. Automation not only saves time but also minimizes the risk of human error, enhancing overall accuracy. AI-driven regulatory solutions have been demonstrated to accelerate verification processes by as much as 7X, making them an essential element of contemporary practices.

-

Documentation and Audit Trails: Maintain thorough records of regulatory processes and decisions throughout the creation lifecycle. This documentation acts as a vital audit trail, invaluable during regulatory audits and reviews. Regular updates to this documentation ensure that it reflects the latest regulatory changes.

-

Training and Awareness: Conduct regular training sessions for development groups on regulatory requirements and best practices. This guarantees that all group members comprehend their responsibilities and the essential role adherence plays in their work. Effective training can streamline regulatory management and enable groups to concentrate on growth while reducing risks.

-

Avoid Common Pitfalls: Be aware of frequent traps in regulatory integration, such as neglecting to involve legal teams early in the process or failing to keep documentation current. Tackling these issues in advance can avert expensive errors and guarantee a more seamless regulatory process.

By incorporating these practices into the SDLC, organizations can promote a culture of adherence that reduces risks and enhances the quality of their software products.

Establish Continuous Monitoring and Adaptation Mechanisms for Compliance

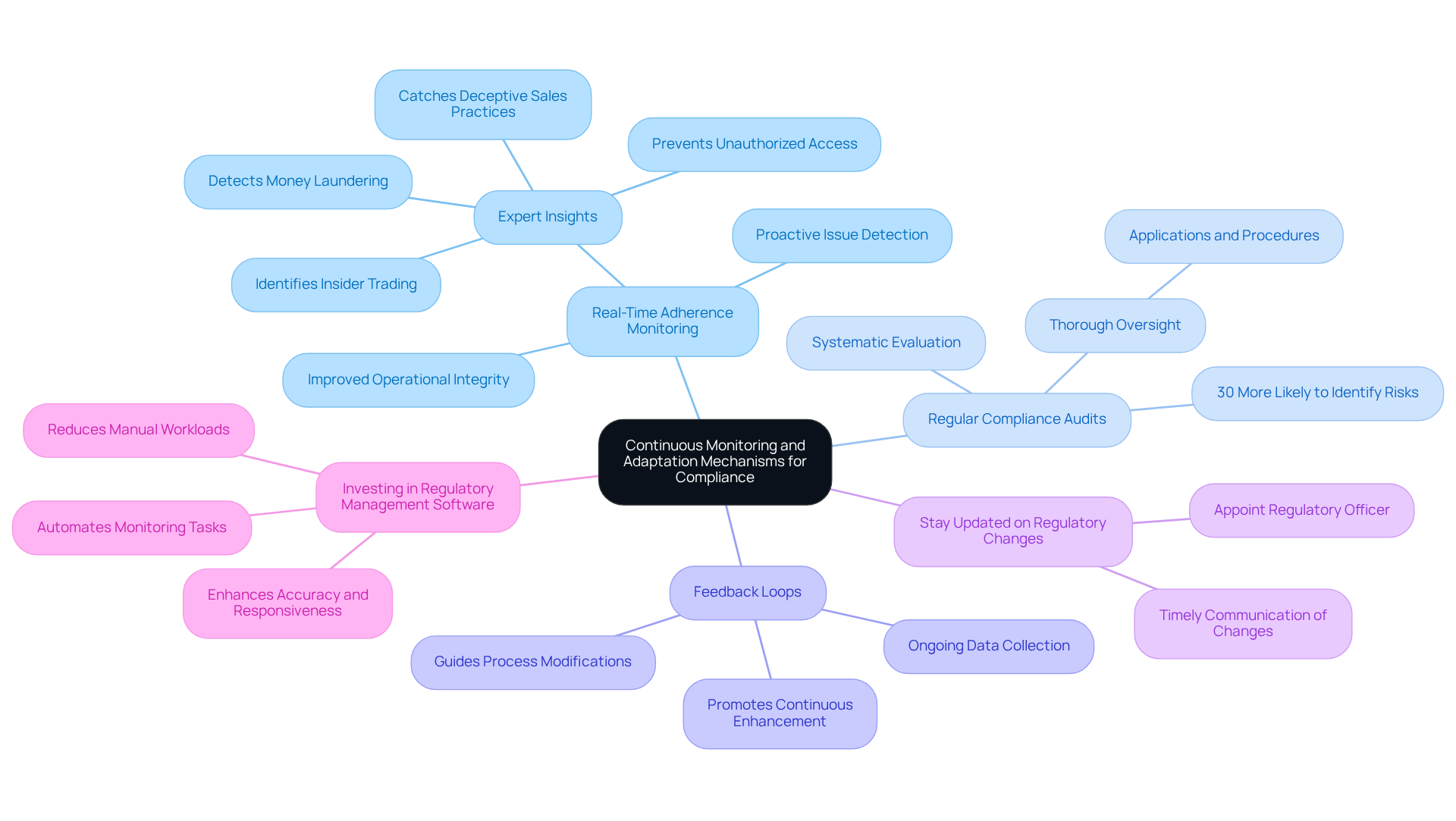

In the financial services sector, where regulations are in constant flux, establishing robust mechanisms for continuous monitoring and adaptation is essential. Key strategies to implement include the following:

-

Real-Time Adherence Monitoring: Organizations should utilize tools that enable real-time tracking of adherence metrics. This proactive method allows for the quick recognition and correction of regulatory issues as they arise, thereby improving overall operational integrity. As expert Joshua Wood emphasizes, “Effective regulatory programs detect money laundering attempts, identify insider trading, prevent unauthorized access to accounts, and catch deceptive sales practices before they harm consumers.”

-

Regular Compliance Audits: Systematic audits are crucial for evaluating adherence to existing regulations. Industry statistics indicate that organizations conducting regular audits are 30% more likely to identify and effectively reduce regulatory risks. These audits must encompass both the applications and the procedures involved in their creation and implementation, ensuring thorough regulatory oversight.

-

Feedback Loops: Establishing feedback mechanisms facilitates the ongoing collection of data related to adherence performance. This data-driven approach guides essential modifications to processes and system features, promoting a culture of continuous enhancement.

-

Stay Updated on Regulatory Changes: Appointing a regulatory officer or group responsible for tracking regulatory updates is vital. This team should promptly communicate any changes to the software development financial team, ensuring that the software can be adapted in a timely manner.

-

Investing in regulatory management software is essential for software development financial solutions that automate monitoring tasks and provide alerts for potential breaches. Such technology not only reduces manual workloads but also enhances accuracy and responsiveness. Regulatory leaders assert, “Adherence is your primary defense against financial crime, fraud, and mis-selling.”

By employing these ongoing monitoring strategies, organizations can uphold standards and swiftly adjust to regulatory changes, ultimately protecting their operations and reputation.

Foster Collaboration Between Development Teams and Compliance Experts

Successful cooperation between software creators and regulatory specialists is essential for ensuring that programs comply with legal standards. To foster this collaboration, consider the following strategies:

-

Cross-Functional Teams: Establish cross-functional teams that include both developers and regulatory specialists. This approach ensures that regulatory considerations are integrated into the development process from the very beginning.

-

Regular Meetings and Workshops: Organize regular meetings and workshops where developers and compliance experts can discuss ongoing projects, share insights, and collaboratively address compliance challenges. This consistent interaction promotes a culture of teamwork and mutual understanding.

-

Common Goals and Objectives: Define common goals that align the interests of both groups. For instance, setting a shared objective to minimize compliance-related errors can enhance motivation for collaboration and accountability.

-

Utilize Collaboration Tools: Implement collaboration tools that facilitate communication and document sharing between teams. Platforms such as Slack, Microsoft Teams, or project management software can improve transparency and streamline workflows, making it easier to monitor compliance-related tasks.

-

Promote Transparent Dialogue: Foster an environment where team members feel comfortable discussing regulatory matters and asking questions. Open communication can lead to the swift identification of potential compliance risks and the development of effective solutions.

-

Address Challenges: Recognize that challenges, such as a lack of trust among team members who may not be familiar with one another, can hinder progress. Building trust through team bonding activities and emphasizing common goals can enhance collaboration.

By promoting collaboration between development and compliance teams, organizations can create a more cohesive approach to software development financial processes, ultimately resulting in higher-quality software that meets regulatory standards.

Conclusion

In the realm of financial software development, achieving compliance with regulatory standards is not merely a checkbox exercise; it is a fundamental aspect that shapes the entire development process. Understanding the intricate web of regulations, such as the Dodd-Frank Act and GDPR, enables developers to create applications that not only meet legal requirements but also foster trust and security within the financial sector.

This article outlines several best practices crucial for embedding compliance throughout the software development lifecycle. Key strategies include:

- The early integration of regulatory checks

- The adoption of agile methodologies for iterative testing

- Automation of adherence testing

- Maintaining thorough documentation

Furthermore, fostering collaboration between development teams and compliance experts ensures that all stakeholders are aligned and informed, ultimately leading to higher-quality software that adheres to the necessary standards.

As the landscape of financial regulations continues to evolve, organizations must prioritize continuous monitoring and adaptation to remain compliant. By investing in regulatory management software and establishing feedback loops, teams can proactively address compliance issues and enhance their operational integrity. A commitment to best practices in software development not only safeguards against potential legal pitfalls but also positions organizations for sustainable success in the competitive financial industry. Embracing these practices is essential for any organization aiming to thrive in a landscape where compliance is paramount.

Frequently Asked Questions

Why is understanding regulatory compliance important in financial software development?

Understanding regulatory compliance is essential because it ensures that applications meet the specific legal standards governing the financial services sector, which helps avoid costly revisions and ensures products are market-ready.

What are some key regulations that financial software developers need to be aware of?

Key regulations include the Dodd-Frank Act, the Sarbanes-Oxley Act, and various Anti-Money Laundering (AML) laws.

What specific obligations do these regulations impose on financial institutions?

These regulations impose obligations such as maintaining accurate records, ensuring data privacy, and implementing robust security measures.

What is the significance of Know Your Customer (KYC) requirements in application development?

KYC requirements necessitate the collection and verification of customer identities, which must be integrated into the application design to ensure compliance.

How does the General Data Protection Regulation (GDPR) impact financial software applications?

GDPR impacts applications managing personal information by requiring that user consent and data protection measures are integrated from the outset.

How can prioritizing regulatory compliance during application development benefit teams?

Prioritizing regulatory compliance can help teams avoid costly revisions and ensure that their products are aligned with industry standards from the start.