Introduction

Hedge funds operate within a complex and ever-evolving financial landscape characterized by high stakes and an increasingly stringent regulatory environment. As these investment firms pursue operational excellence and compliance, the demand for specialized software solutions becomes essential. This raises a critical question: how can hedge funds effectively navigate the challenges of regulatory adherence and technological advancement while maintaining a competitive edge?

This article explores the pivotal role that specialized website application development companies play in addressing these unique challenges, enhancing operational efficiency, and fostering innovation within the hedge fund industry.

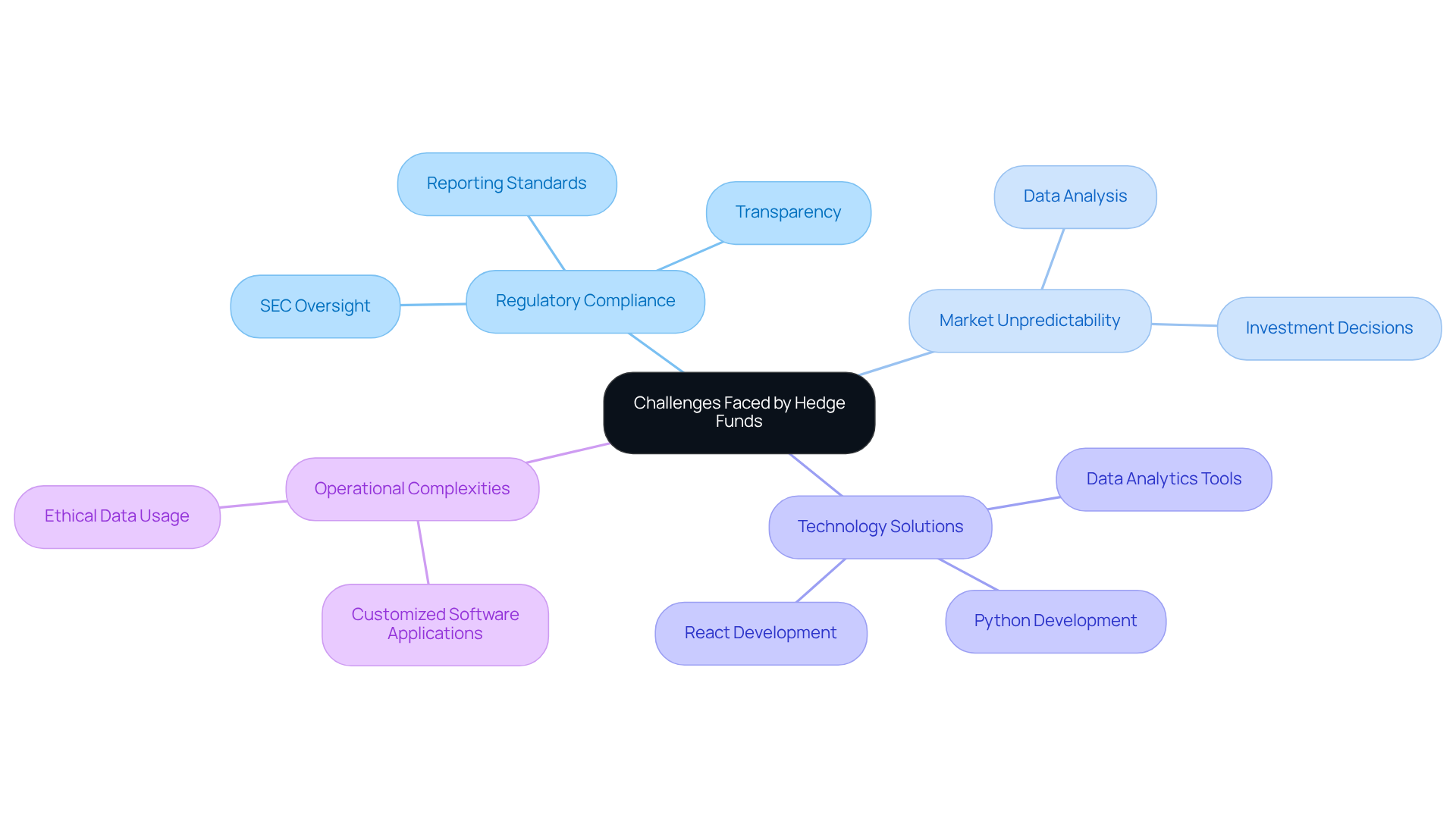

Understand the Unique Challenges Faced by Hedge Funds

Hedge pools operate within a highly competitive and regulated environment, facing unique challenges that necessitate specialized software solutions. Regulatory compliance is critical, as governing bodies impose strict guidelines that demand transparency and adherence to complex reporting standards. By 2026, investment pools are expected to confront even more intricate compliance issues, with the SEC and other regulators intensifying oversight on reporting practices. The investment sector, which reached a record $5 trillion in assets under management in 2025, must also navigate the unpredictable nature of financial markets, necessitating the ability to analyze extensive datasets swiftly and accurately for informed investment decisions.

Additionally, the incorporation of alternative data sources introduces further complexity, compelling hedge funds to derive unique insights while ensuring ethical usage. Companies leveraging advanced data analytics tools, including expertise in React Development and Python Development, have successfully enhanced their investment strategies, underscoring the vital role of technology in addressing compliance challenges. Financial analysts stress that maintaining trust and credibility is paramount in this sector, and the appropriate software solutions from Neutech can significantly reduce risks associated with regulatory non-compliance. These operational complexities underscore the urgent need for a website application development company that specializes in creating customized software applications to streamline processes, strengthen compliance, and support strategic decision-making.

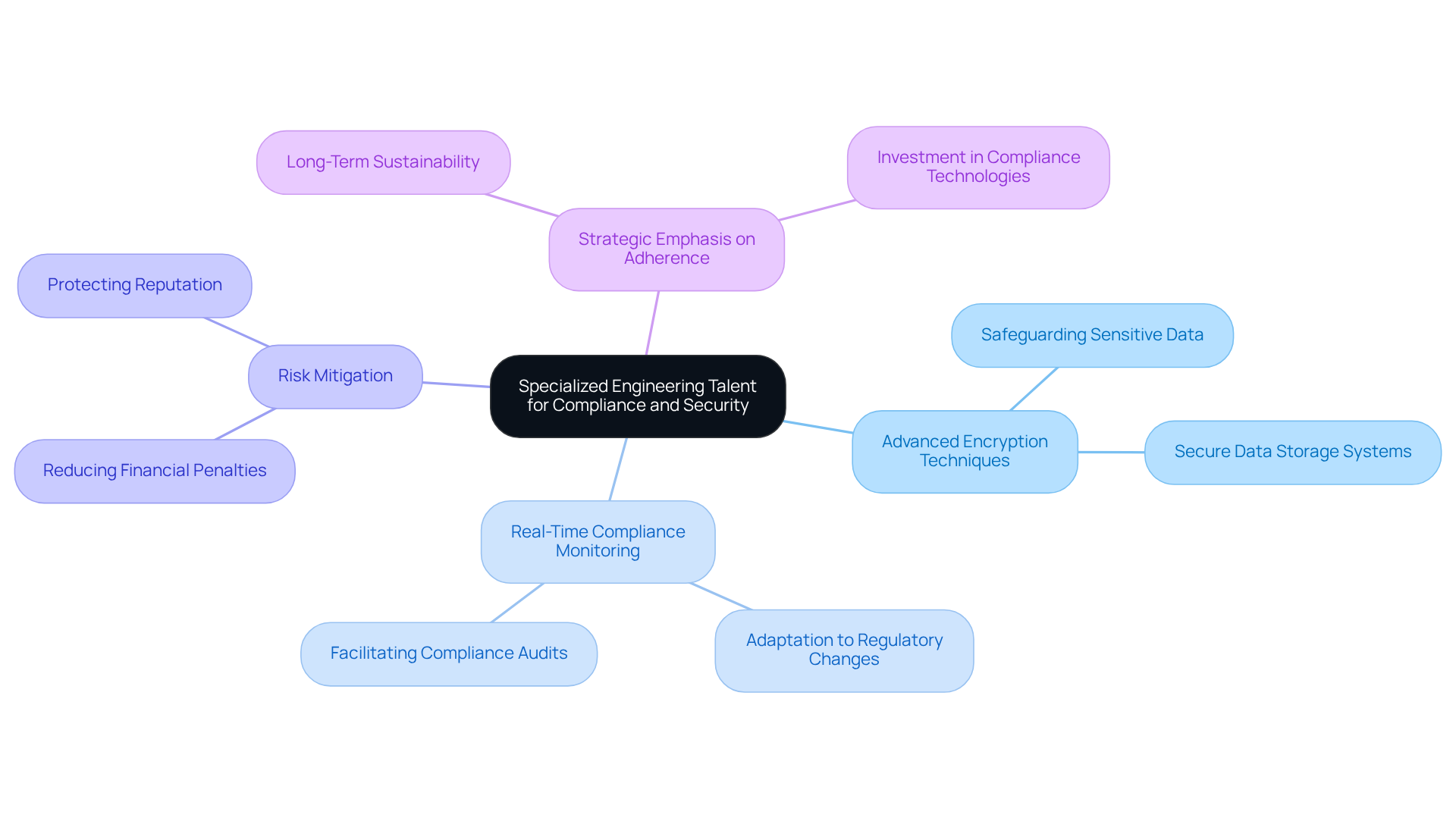

Leverage Specialized Engineering Talent for Compliance and Security

Hedge pools operate within a complex regulatory environment, making adherence a paramount concern. The incorporation of expert engineering talent is essential for creating software solutions that comply with stringent regulations while enhancing security measures.

- Advanced encryption techniques and secure data storage systems are crucial for safeguarding sensitive investor data and proprietary trading algorithms.

- Furthermore, expert engineers excel in developing systems that facilitate real-time compliance monitoring, enabling investment firms to swiftly adapt to regulatory changes.

- By leveraging this expertise, investment groups can effectively mitigate the risks associated with non-compliance, which can result in significant financial penalties and reputational damage.

- This strategic emphasis on adherence and safety through expert personnel is vital for the long-term sustainability and success of investment groups.

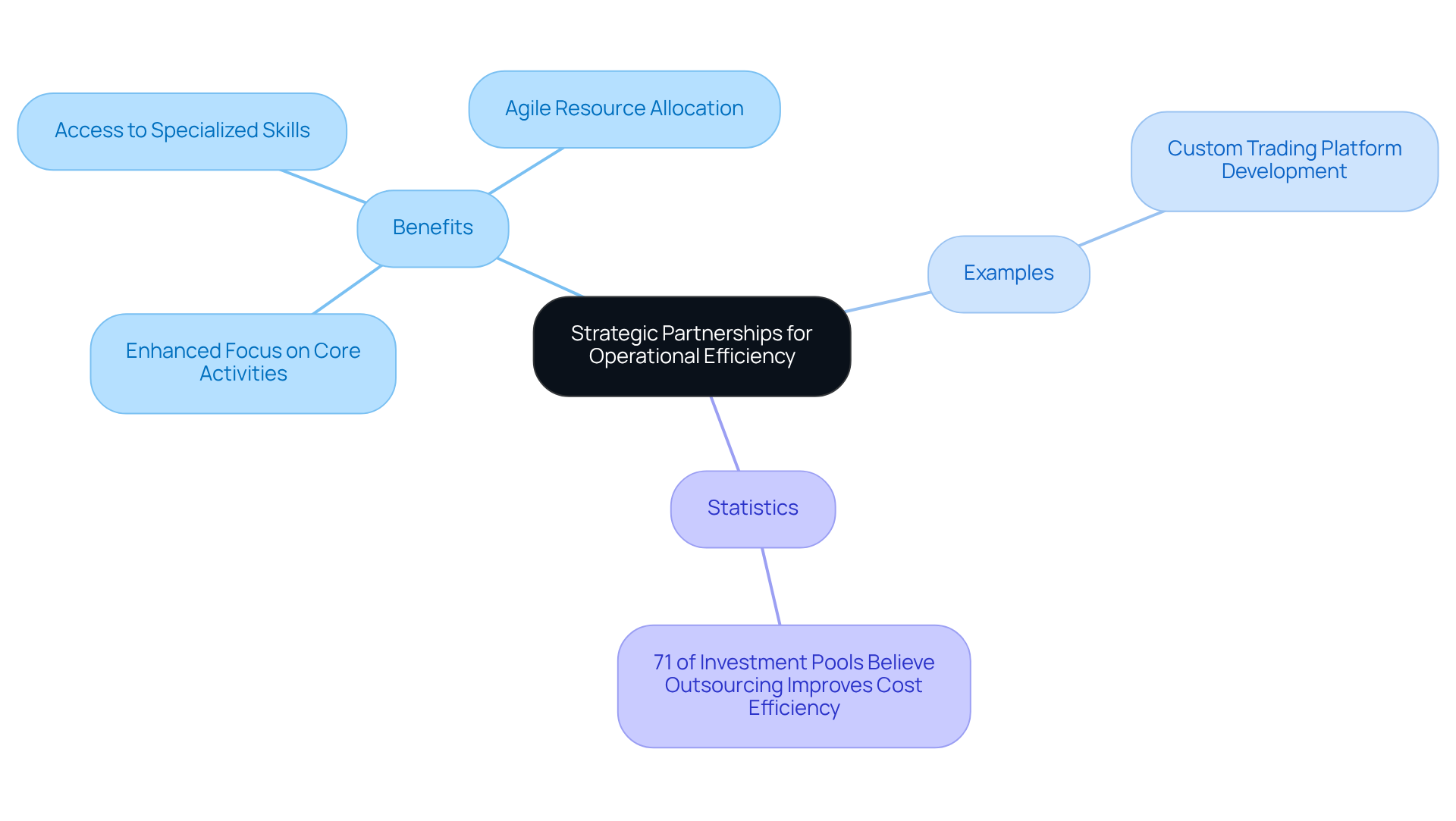

Enhance Operational Efficiency and Scalability Through Strategic Partnerships

Strategic alliances with specialized software development firms are essential for enhancing the operational effectiveness and scalability of investment firms. By outsourcing software development, these firms can concentrate on their core activities while leveraging external expertise to address complex technological needs. Neutech emphasizes intangibles such as work ethic, communication, and leadership, ensuring that the developers and designers provided are not only skilled but also reliable and committed to the project’s success. This collaboration enables investment groups to swiftly adapt to evolving market conditions and client demands without the burden of maintaining a large internal development team.

For example, a hedge fund may require a custom trading platform that integrates various data sources and advanced analytics tools. Partnering with another company provides access to the necessary skills and technology to develop this platform effectively. Neutech’s tailored engineering talent provision process begins with a thorough assessment of client needs, facilitating the supply of specialized developers and designers who seamlessly integrate into the project. This flexible engineering talent framework allows investment groups to hire developers on a monthly basis, fostering agile resource allocation that aligns with project requirements. Such partnerships not only enable the rapid implementation of innovative solutions but also empower investment groups to expand their operations in response to market fluctuations, ensuring they remain adaptable and competitive in a dynamic environment.

Data indicates that 71% of investment pools believe outsourcing specific operations can lead to improved cost efficiency, underscoring the strategic advantage of these collaborations. Moreover, as the investment sector continues to grow, with an expected market size of USD 126.9 billion by 2026, the demand for specialized software solutions will only increase, making these partnerships vital for sustained success. Jeff Boyd, head of investment services at Northern Trust, highlights this trend, stating, “We work with a number of larger managers and, as with certain smaller investment firms, they’re also looking to have us do as much as we can and outsource work to us.

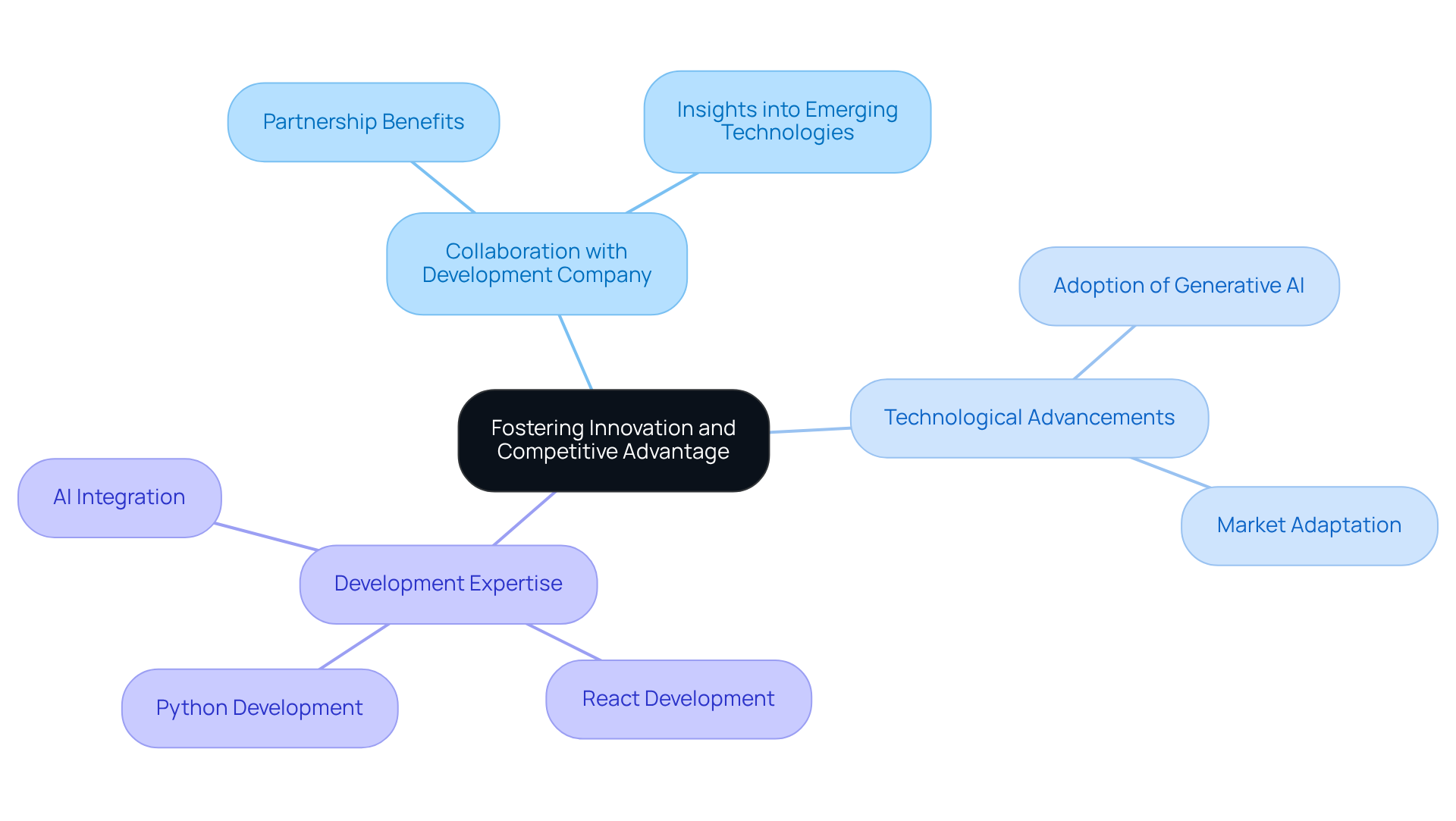

Foster Innovation and Competitive Advantage Through Ongoing Collaboration

In the dynamic landscape of investment portfolios, fostering innovation is essential for maintaining a competitive edge. Continuous collaboration with a website application development company enables investment groups to effectively leverage technological advancements and adapt to market trends. The company offers a range of development expertise, including:

- React Development

- Python Development

- AI integration

These are vital as the investment sector increasingly embraces artificial intelligence and machine learning to refine investment strategies.

Partnering with a website application development company such as Neutech ensures the smooth incorporation of these technologies into everyday operations. This collaboration not only promotes innovation but also empowers investment groups to enhance their processes, ensuring agility in responding to market fluctuations. By partnering with a website application development company, investment funds gain valuable insights into emerging technologies and industry best practices, significantly boosting their operational capabilities.

This strategic focus on innovation positions investment firms to capitalize on new opportunities and adeptly navigate challenges, ultimately fostering long-term success in a shifting market. As Michael Serota from EY observes, “The pace at which the hedge fund industry is being disrupted continues to accelerate, as advances in technology bring new threats, but also opportunity,” underscoring the significance of collaboration with firms like Neutech in managing these transitions.

Conclusion

The necessity for hedge funds to engage a specialized website application development company is paramount. As the investment landscape grows increasingly complex and regulated, tailored software solutions become essential tools for navigating compliance, security, and operational efficiency. By leveraging the expertise of specialized developers, hedge funds can effectively address their unique challenges, ensuring adherence to stringent regulations while enhancing their competitive edge.

This article underscores several critical aspects that highlight this need. It emphasizes the importance of:

- Regulatory compliance

- The role of advanced data analytics

- The benefits of strategic partnerships and ongoing innovation

Clearly, investment firms must leverage specialized engineering talent to thrive. The integration of cutting-edge technologies, such as AI and machine learning, further illustrates how collaboration with expert software development firms like Neutech can lead to improved operational capabilities and cost efficiency.

Ultimately, embracing specialized website applications transcends merely keeping pace with industry demands; it positions hedge funds for long-term success in a rapidly evolving market. By prioritizing tailored solutions and fostering partnerships, investment groups can navigate challenges, capitalize on new opportunities, and maintain a robust online presence. The journey toward innovation and operational excellence begins with the right technological foundation, making it imperative for hedge funds to invest in specialized development strategies today.

Frequently Asked Questions

What unique challenges do hedge funds face?

Hedge funds operate in a highly competitive and regulated environment, facing challenges such as regulatory compliance, the need for transparency, and complex reporting standards.

How is regulatory compliance evolving for hedge funds?

By 2026, hedge funds are expected to encounter more intricate compliance issues as the SEC and other regulators intensify oversight on reporting practices.

What is the significance of the investment sector’s growth?

The investment sector reached a record $5 trillion in assets under management in 2025, highlighting the need for hedge funds to navigate the unpredictable nature of financial markets.

Why is data analysis important for hedge funds?

Hedge funds need to analyze extensive datasets swiftly and accurately to make informed investment decisions in a volatile market.

What role does alternative data play in hedge fund operations?

The incorporation of alternative data sources adds complexity, requiring hedge funds to derive unique insights while ensuring ethical usage.

How can technology assist hedge funds in overcoming compliance challenges?

Companies using advanced data analytics tools, such as React Development and Python Development, can enhance their investment strategies and address compliance challenges effectively.

Why is maintaining trust and credibility important for hedge funds?

Trust and credibility are paramount in the hedge fund sector, as they are crucial for long-term success and regulatory compliance.

What solutions does Neutech provide for hedge funds?

Neutech offers software solutions that can significantly reduce risks associated with regulatory non-compliance and streamline operational processes.

What is the need for specialized software applications in hedge funds?

There is an urgent need for a website application development company specializing in creating customized software to strengthen compliance and support strategic decision-making for hedge funds.