Compare Mobile Web Application Development Services for Hedge Funds

Introduction

The landscape of mobile web application development is evolving rapidly, particularly for hedge funds that require innovative solutions to maintain their competitive edge.

As these investment firms navigate the complexities of compliance and operational efficiency, it becomes essential to understand the nuances of mobile web applications.

Hedge funds face significant challenges in selecting the right development service; they must ensure that their chosen solution not only meets regulatory demands but also enhances user engagement.

This article explores the critical factors that hedge funds must consider when comparing mobile web application development services, offering insights that can shape their future strategies.

Understand Mobile Web Application Development

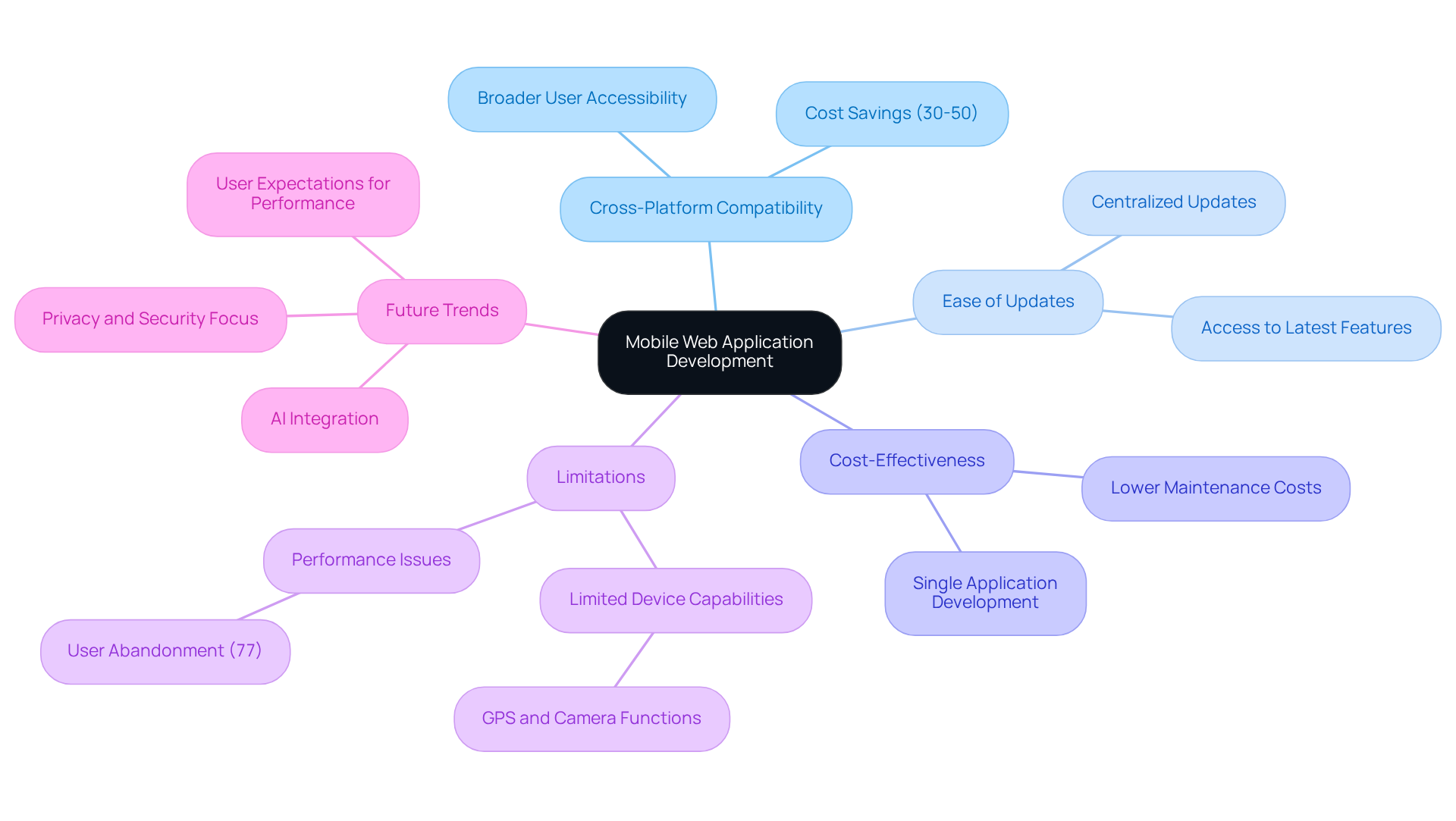

Mobile web application development services entail the creation of applications accessible through web browsers on portable devices. Unlike native applications, which are installed directly on devices, web applications are hosted on servers and can be accessed from any device equipped with a browser. This flexibility allows investment groups to reach a broader audience without the need for multiple app versions tailored to different operating systems.

Key characteristics of mobile web applications include:

- Cross-Platform Compatibility: These applications function on any device with a web browser, broadening user accessibility. Cross-platform development can reduce costs by 30-50%, making it a financially viable option for hedge funds.

- Ease of Updates: Since they are hosted on a server, updates can be implemented centrally, eliminating the need for users to download new versions. This ensures that all users have access to the latest features and security enhancements.

- Cost-Effectiveness: Developing a single web application can be more economical than creating separate native applications for iOS and Android, significantly lowering overall development and maintenance costs.

However, mobile web application development services may not fully leverage device capabilities such as GPS or camera functions, which can restrict their functionality compared to native applications. Additionally, performance issues can lead to user abandonment; studies indicate that 77% of individuals stop using an app within three days if they encounter performance problems. As investment groups assess their application strategies, understanding these distinctions and the evolving landscape of app development-particularly the shift towards AI integration and user expectations for immediate performance-is crucial for enhancing user engagement and operational efficiency.

Identify Hedge Fund Requirements for Mobile Applications

Hedge pools operate within a strictly regulated environment, necessitating applications that enhance operational efficiency while ensuring compliance with stringent regulations. The key requirements for hedge fund mobile applications are as follows:

- Security Features: Due to the sensitive nature of financial data, applications must integrate robust security measures, including encryption, two-factor authentication, and secure data storage. Research indicates that 88% of financial applications fail cryptographic assessments, underscoring the critical need for stringent security protocols to protect against vulnerabilities and uphold user trust.

- Real-Time Data Access: Hedge groups demand immediate access to market data and analytics to inform investment decisions. Mobile applications should facilitate real-time updates and notifications, with acceptable response times of approximately five seconds, as hedge investors require timely data delivery. Case studies reveal that firms utilizing integrated mobile solutions, which allow fund managers to access data at any time, significantly improve decision-making efficiency.

- Accessible Interface: A seamless user experience is vital for portfolio managers and traders who must navigate complex data swiftly. The incorporation of intuitive design elements can streamline workflows, minimizing the time spent on data retrieval and analysis.

- Compliance with Regulations: Applications must comply with financial regulations, including data protection laws and trading compliance standards. Even applications that are not regulated should be designed with compliance readiness in mind, ensuring user consent for data collection and secure handling of personally identifiable information.

- Integration Capabilities: The capacity to integrate with existing systems and platforms is crucial for maintaining operational continuity and data integrity. Effective mobile solutions must address the specific needs of investment firms, facilitating the seamless transfer of information across various applications.

By understanding these requirements, investment firms can more effectively assess which mobile web application development services align with their operational needs, thereby ensuring competitiveness in a rapidly evolving financial landscape.

Compare Leading Mobile App Development Providers

When assessing mobile app development providers for hedge funds, several key players emerge, each offering distinct solutions:

-

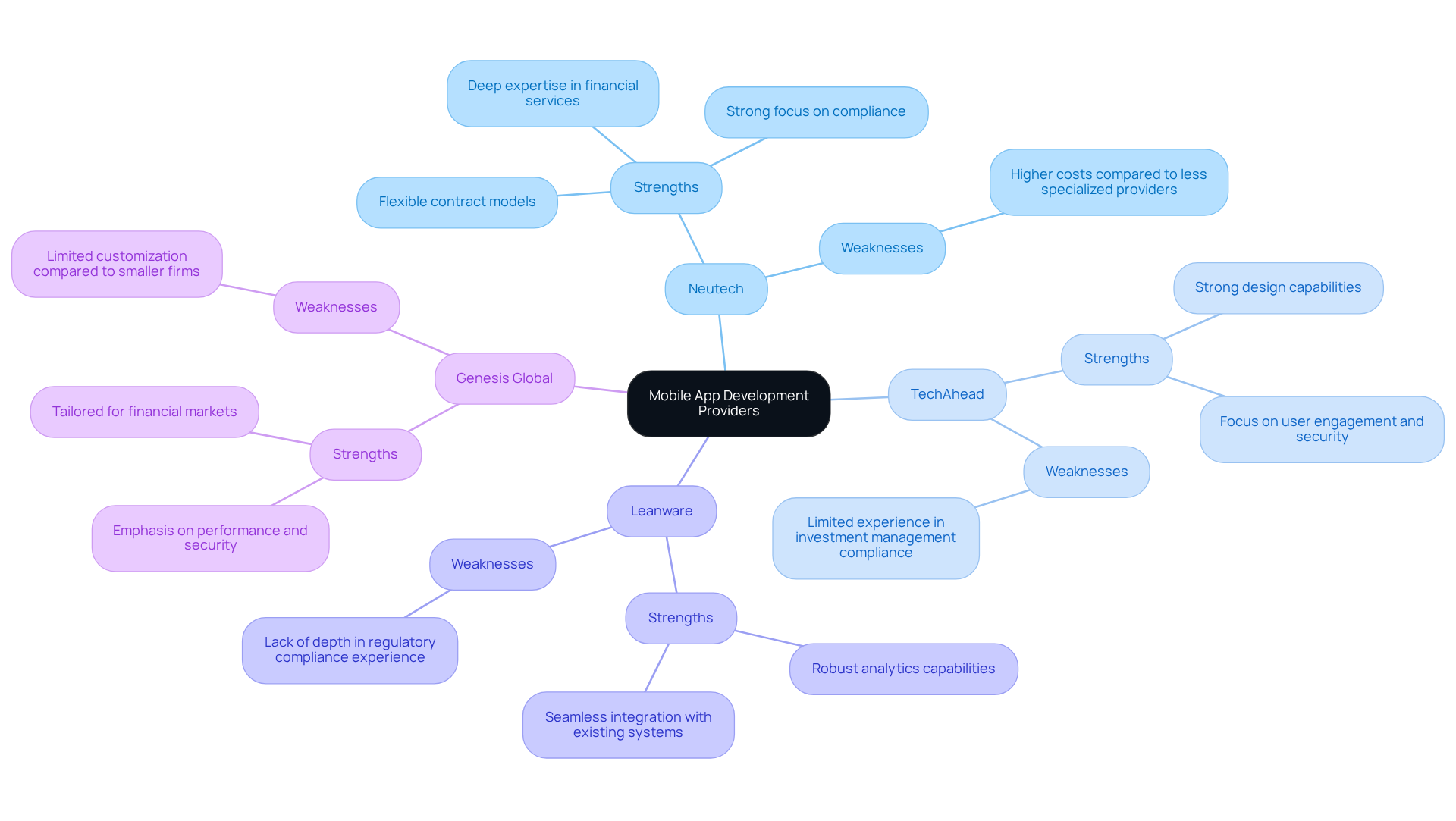

Neutech specializes in regulated industries, delivering tailored solutions for hedge funds. Their engineers participate in a rigorous residency program, ensuring high-quality development. The company’s zero-bench philosophy guarantees that all engineers are actively engaged, providing both flexibility and reliability.

- Strengths: Neutech possesses deep expertise in financial services, a strong focus on compliance, and flexible contract models that allow for month-to-month adjustments.

- Weaknesses: Their costs may be higher compared to less specialized providers, reflecting their commitment to quality and compliance.

-

TechAhead is renowned for its innovative mobile solutions, offering mobile web application development services, including app development for financial institutions. They prioritize client experience and security, which are vital for maintaining customer trust.

- Strengths: TechAhead showcases strong design capabilities and a focus on user engagement, critical for retaining users in a competitive market.

- Weaknesses: Their limited experience specifically in investment management compliance may present challenges in meeting strict regulatory requirements.

-

Leanware provides a comprehensive range of mobile web application development services, focusing on data analysis and real-time reporting, essential for investment firms aiming to enhance decision-making.

- Strengths: Leanware offers robust analytics capabilities and seamless integration with existing systems, facilitating improved operational efficiency.

- Weaknesses: They may lack the depth of experience in regulatory compliance compared to Neutech, potentially impacting risk management.

-

Genesis Global delivers a platform tailored for financial markets, concentrating on high-performance applications that meet the requirements of investment firms.

- Strengths: This provider is tailored for financial services, emphasizing performance and security to ensure reliability in critical operations.

- Weaknesses: Genesis Global may not provide the same level of customization as smaller firms, which could limit flexibility in addressing unique client needs.

By comparing these providers, investment firms can identify which company aligns best with their specific needs and compliance requirements, ensuring they select a partner capable of delivering secure and effective solutions.

Summarize Key Insights for Hedge Funds

Hedge investments must prioritize their specific needs when choosing mobile web application development services. Key considerations include the following:

-

Prioritize Security and Compliance: Given the evolving regulatory landscape, partnering with providers that emphasize robust security measures and compliance protocols is essential. This focus not only safeguards sensitive data but also aligns with regulatory expectations, thereby reducing the risk of costly penalties.

-

Evaluate Provider Expertise: Engaging with specialized providers, such as Neutech, which possess extensive knowledge in financial services, can provide a significant competitive edge. Their expertise ensures that the development process adheres to industry standards and best practices.

-

Consider Flexibility and Scalability: The ability to modify development resources in response to market changes is crucial for investment firms. A flexible approach allows for efficient scaling, ensuring that resources align with operational demands without compromising quality.

-

Focus on User Experience: A user-friendly interface is vital for enhancing operational efficiency and facilitating informed decision-making. An intuitive design can significantly impact user engagement and satisfaction.

-

Integration Capabilities: It is imperative that the chosen solution integrates seamlessly with existing systems. This capability is essential for maintaining data integrity and ensuring operational continuity, particularly in a complex regulatory environment.

By synthesizing these insights, hedge funds can make informed decisions that align with their operational goals and regulatory requirements, ultimately enhancing their competitive positioning in the market.

Conclusion

Investment firms navigating the mobile web application landscape must prioritize their unique needs and regulatory requirements to remain competitive. Understanding the distinctions between mobile web applications and native apps allows hedge funds to leverage cross-platform compatibility, ease of updates, and cost-effectiveness. This approach ensures they reach a wider audience without compromising functionality.

Key insights emphasize the importance of robust security features, real-time data access, user-friendly interfaces, and seamless integration capabilities when selecting a mobile application development provider. As firms evaluate their options, they should consider specialized providers that align with their operational goals and compliance standards. This alignment ultimately enhances decision-making efficiency and user engagement.

In a rapidly evolving financial environment, the significance of choosing the right mobile web application development service cannot be overstated. By focusing on security, user experience, and adaptability, hedge funds can harness technology to improve their operations and maintain a competitive edge in the market. Embracing these insights will not only facilitate compliance with regulatory standards but also foster innovation and growth in an increasingly digital landscape.

Frequently Asked Questions

What are mobile web applications?

Mobile web applications are applications that can be accessed through web browsers on portable devices. They are hosted on servers rather than being installed directly on devices.

How do mobile web applications differ from native applications?

Unlike native applications, which are installed on devices and tailored to specific operating systems, mobile web applications are accessible from any device with a web browser, allowing for broader audience reach without the need for multiple versions.

What are the key characteristics of mobile web applications?

Key characteristics include cross-platform compatibility, ease of updates, and cost-effectiveness. They function on any device with a web browser, allow for centralized updates, and are generally more economical to develop than separate native applications for different operating systems.

How does cross-platform compatibility benefit mobile web applications?

Cross-platform compatibility broadens user accessibility, allowing applications to function on any device with a web browser. This can reduce development costs by 30-50%, making it a financially viable option for investment groups.

What advantages do mobile web applications have regarding updates?

Mobile web applications allow for centralized updates since they are hosted on a server. This means users do not need to download new versions, ensuring everyone has access to the latest features and security enhancements.

Why are mobile web applications considered cost-effective?

Developing a single mobile web application is often more economical than creating separate native applications for iOS and Android, which significantly lowers overall development and maintenance costs.

What are some limitations of mobile web applications?

Mobile web applications may not fully utilize device capabilities such as GPS or camera functions, which can restrict their functionality compared to native applications.

What impact can performance issues have on mobile web applications?

Performance issues can lead to user abandonment; studies show that 77% of individuals stop using an app within three days if they experience performance problems.

Why is it important for investment groups to understand mobile web application development?

Understanding the distinctions between mobile web and native applications, as well as the evolving landscape of app development, is crucial for investment groups to enhance user engagement and operational efficiency, especially with the shift towards AI integration and user expectations for immediate performance.