Introduction

Navigating the journey from concept to a successful Minimum Viable Product (MVP) presents numerous challenges, especially within the dynamic landscape of financial services. Mastering the MVP development process enables startups to validate their ideas with minimal investment while ensuring compliance with essential regulations that protect user trust. However, entrepreneurs often face the dilemma of balancing the necessity for core features and compliance without succumbing to overengineering their product. This article delineates the eight critical steps to effectively navigate the MVP development process, offering insights that empower innovators to create products that resonate with their target audience while adhering to industry standards.

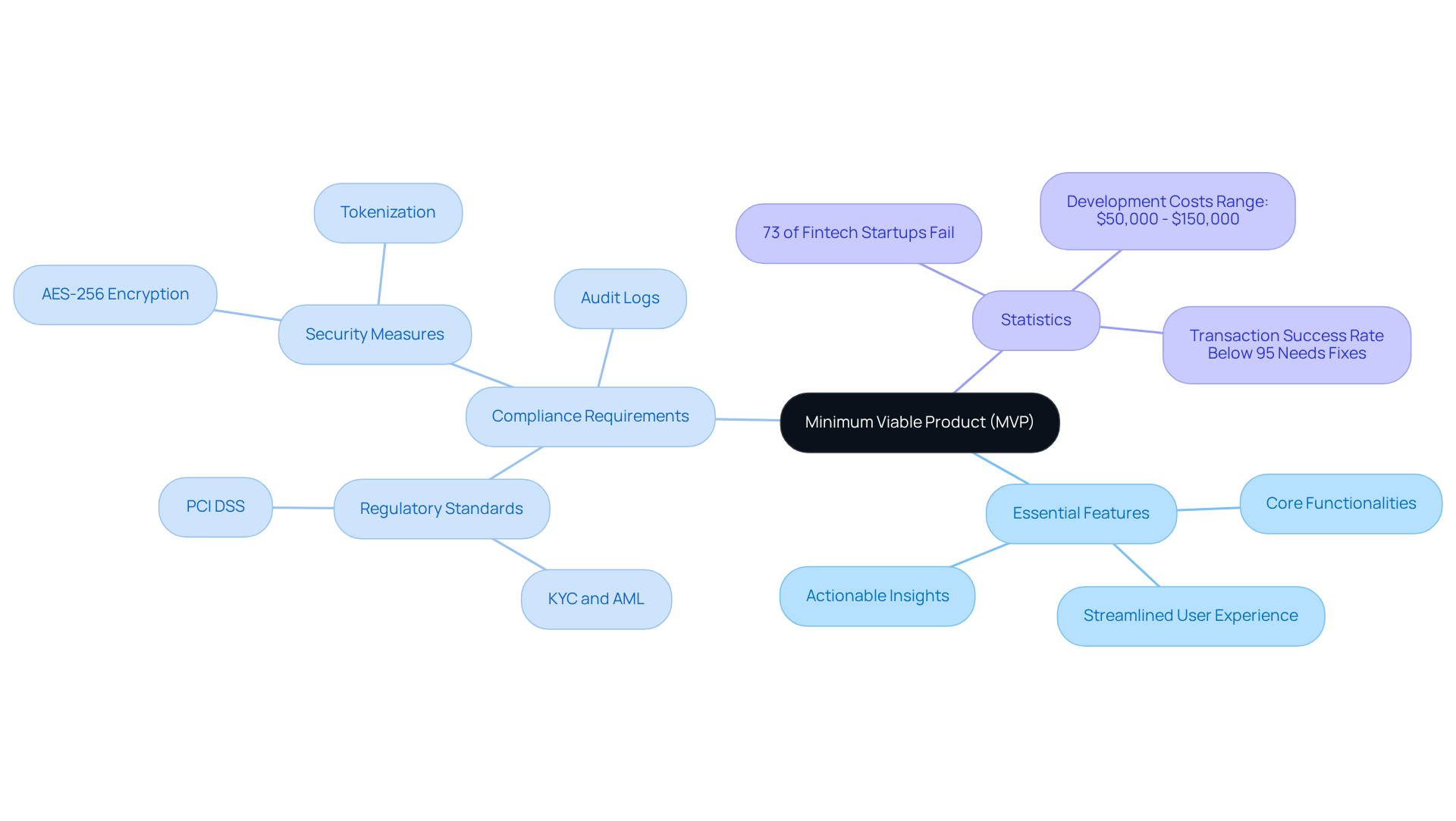

Define the Minimum Viable Product (MVP)

A Minimum Viable Offering (MVP) represents a streamlined version of your creation, encompassing only the essential features needed to satisfy early adopters. The primary objective of an MVP is to validate your product idea with minimal investment, enabling you to collect feedback and make data-informed decisions for future enhancements. In the financial services sector, it is crucial that an MVP complies with stringent regulatory and security standards, ensuring it meets all necessary legal obligations while delivering value to users. By focusing on core functionalities, you can effectively test your hypotheses and identify what resonates with your target audience.

Key features of an MVP for early adopters include:

- An emphasis on essential functionalities that address consumer pain points

- A streamlined user experience

- The capability to gather actionable insights through user interactions

Compliance is not merely an afterthought; it is a foundational aspect that must be integrated from the beginning. By 2026, the landscape of financial applications will require MVPs to adhere to regulations such as KYC and AML, which are vital for ensuring legitimate transactions and safeguarding user data. Regular oversight of compliance modifications is essential to keep the offering lawful and regulated.

Statistics indicate that 73% of fintech startups fail within their first three years due to regulatory compliance issues, underscoring the importance of adhering to regulations during MVP development. Successful MVPs in fintech demonstrate how compliance with regulatory standards can be achieved while still delivering an attractive product. For instance, MVPs that incorporate robust security measures, such as AES-256 encryption and tokenization, not only enhance user trust but also align with regulatory requirements. Furthermore, maintaining comprehensive audit logs to monitor every transaction and user action is critical for compliance.

Prioritizing compliance in the MVP development process helps mitigate the risk of costly rebuilds or operational disruptions, ultimately positioning your offering for success in a competitive market. However, it is essential to avoid overengineering security at the MVP stage, as this can impede progress and deplete budgets without enhancing learning. As emphasized, “Compliance is not negotiable in fintech.

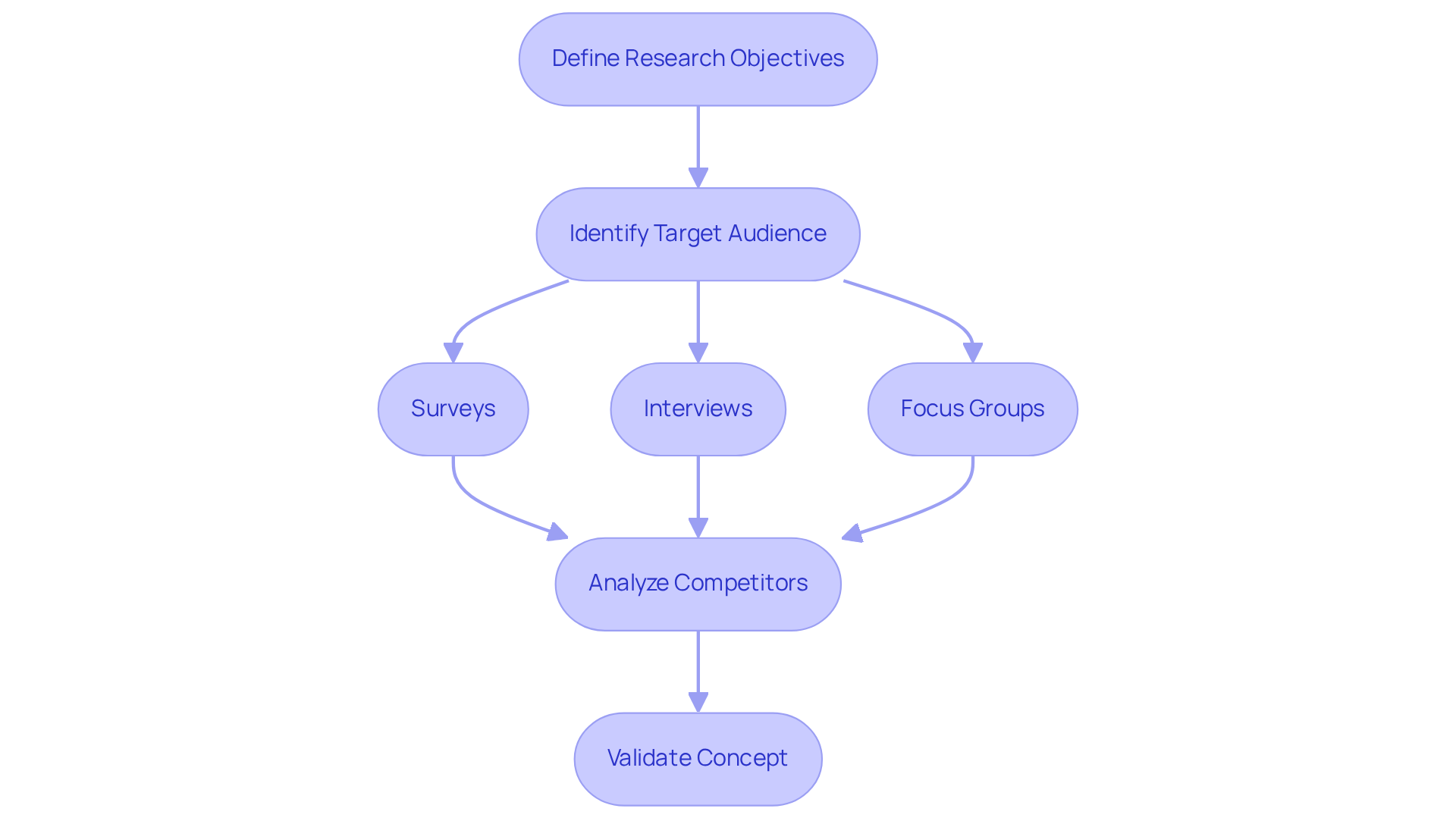

Conduct Market Research and Validate Ideas

To conduct effective market research, it is essential to begin by clearly defining your research objectives. Identifying your target audience is crucial; understanding their pain points, preferences, and behaviors will provide valuable insights.

Employing methods such as:

- Surveys

- Interviews

- Focus groups

allows for the collection of qualitative data that can inform your strategy. Additionally, analyzing competitors helps to clarify their offerings and market positioning, which is vital for contextualizing your approach.

This comprehensive research will assist in validating your concept, ensuring that the MVP development process addresses a genuine demand within the market. In the realm of financial services, it is also important to consider regulatory requirements and compliance standards, as these factors may significantly influence the design and functionality of your offering.

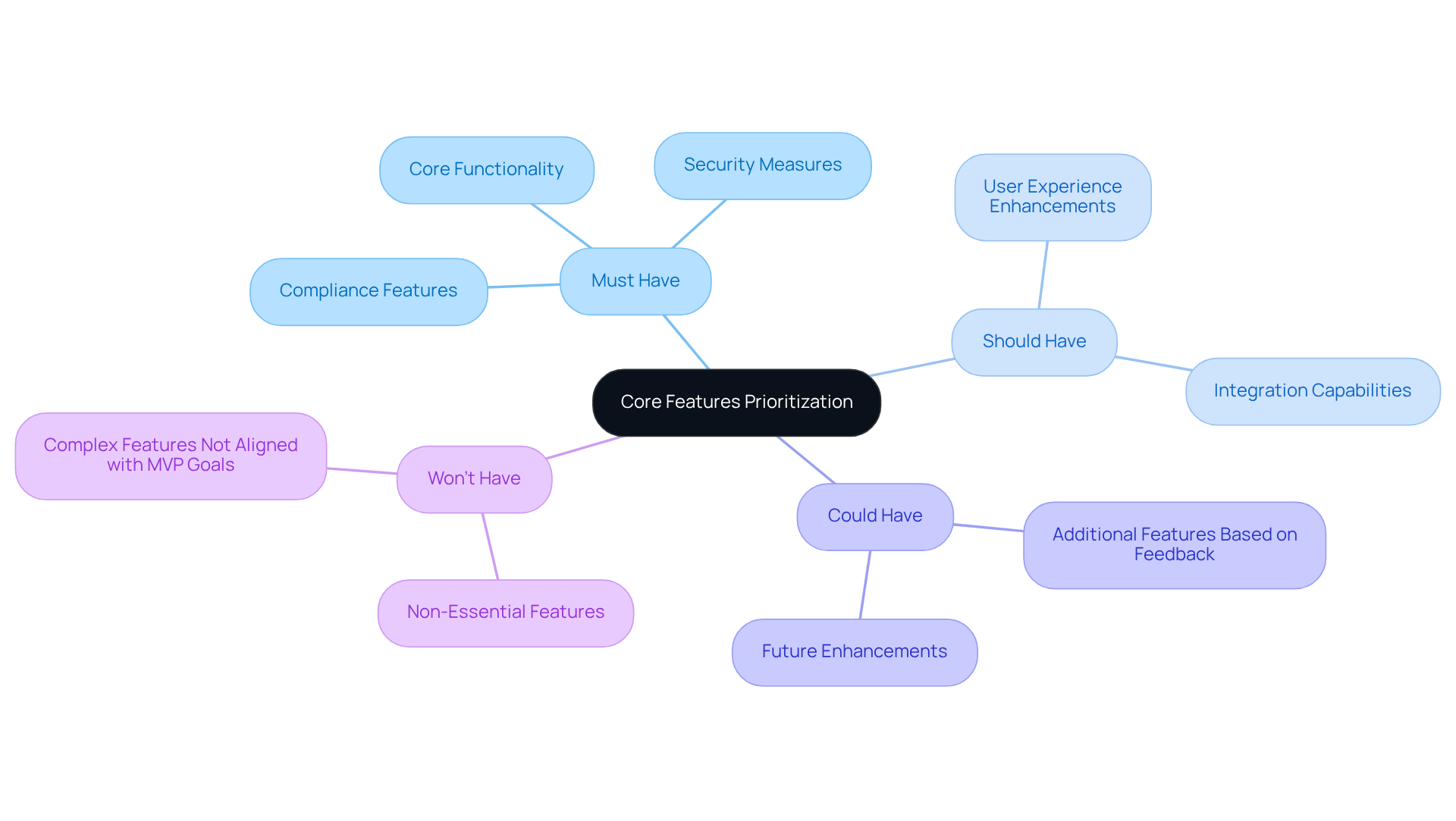

Identify and Prioritize Core Features

Start by compiling a comprehensive list of potential features for your product. Following this, categorize these features using the MoSCoW framework, which divides them into:

- Must have

- Should have

- Could have

- Won’t have

This method allows for effective prioritization of features based on client needs and business objectives. In the financial sector, it is essential to emphasize ‘Must have’ features that ensure compliance and security, as these elements are critical for building trust and adhering to regulatory standards.

Additionally, a Minimum Viable Product (MVP) enables startups to engage real users early in the MVP development process, gathering valuable feedback that can refine the product and ensure it meets market demands. By concentrating on these vital features, you can streamline your development process and maintain a clear focus on delivering significant value while avoiding unnecessary expenditures on unused features.

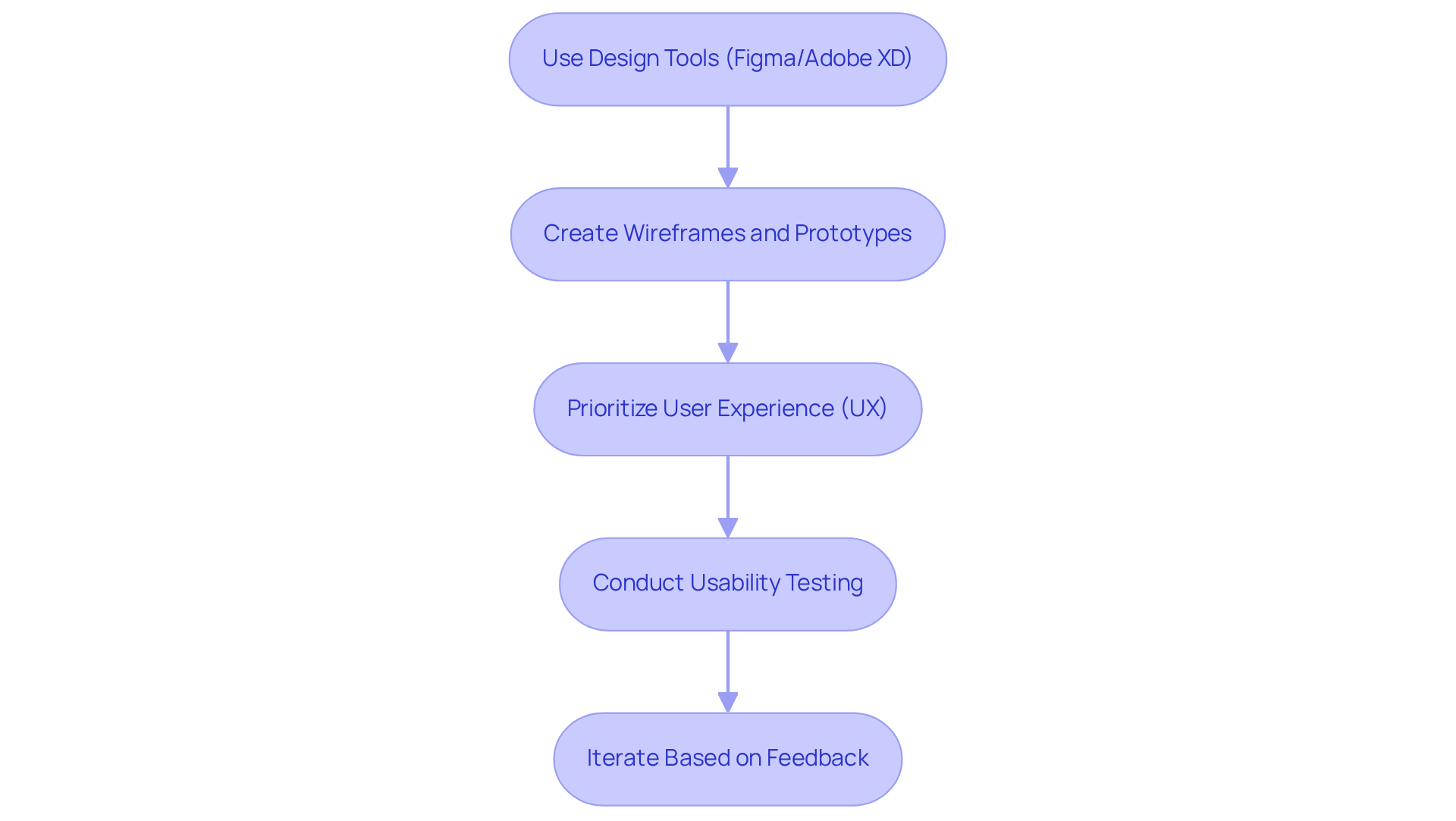

Prototype and Design the MVP

Employ design tools such as Figma or Adobe XD during the MVP development process to create wireframes and prototypes for your Minimum Viable Product. Prioritize user experience (UX) by ensuring that the design is intuitive and meets user needs. Conduct usability testing with potential users to collect feedback on both design and functionality. Use this feedback to iterate on the design, refining the user interface (UI) to ensure that the MVP development process results in a visually appealing and easy-to-navigate MVP. In the context of financial applications, it is crucial to adhere to industry standards regarding security and regulations.

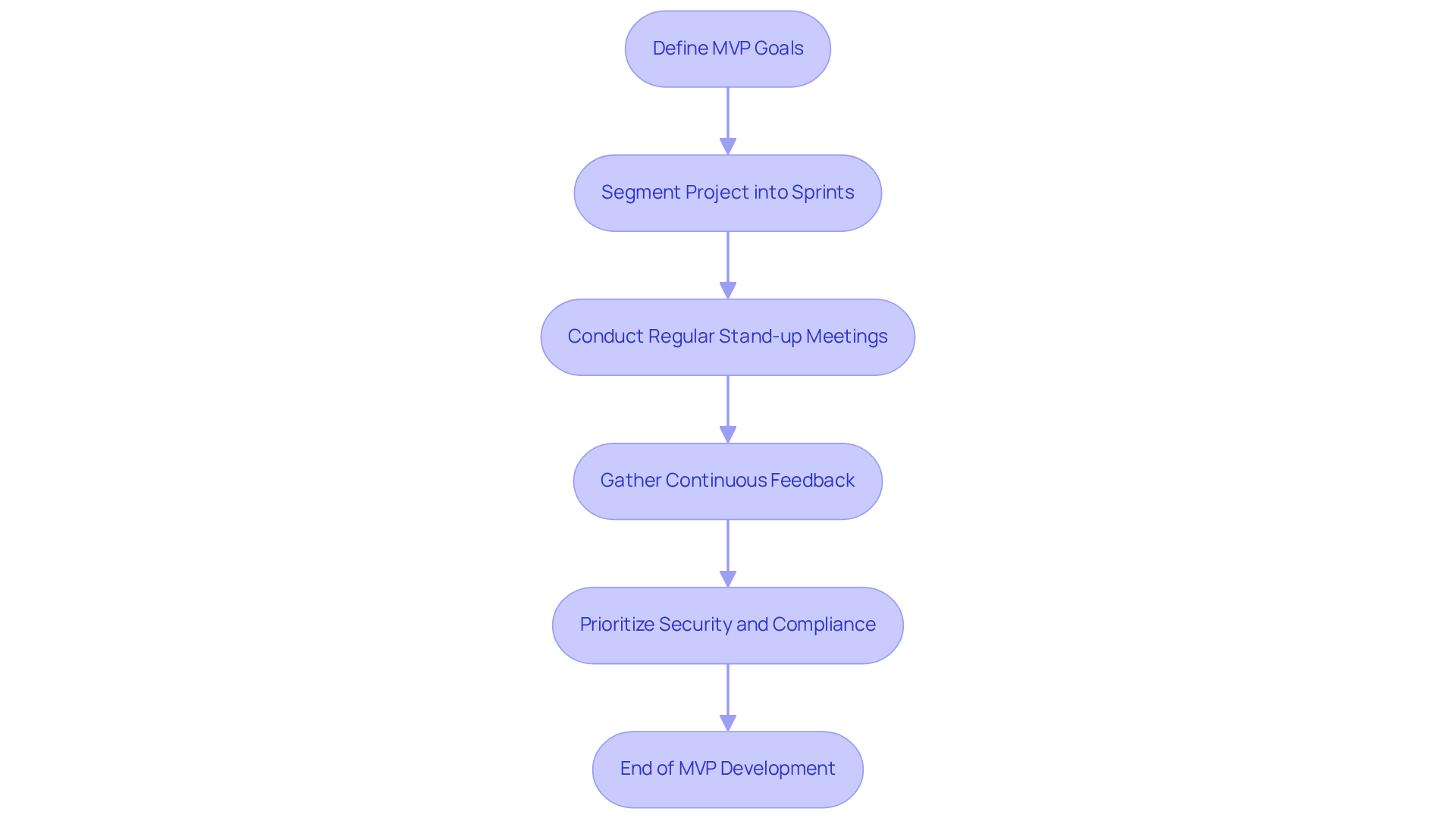

Develop the MVP Using Agile Methodologies

Employ agile methodologies like Scrum or Kanban to manage your MVP development process effectively. By segmenting the project into smaller, manageable sprints that concentrate on specific features or functionalities, teams can significantly enhance productivity and responsiveness.

Regular stand-up meetings promote open communication, enabling team members to discuss progress and address challenges promptly. This iterative approach encourages continuous feedback and improvement within the MVP development process, ensuring that the MVP evolves in response to user needs and market demands.

In the financial sector, prioritizing security and compliance in every sprint is crucial, as these elements are vital for meeting regulatory standards and protecting sensitive data.

The adoption of agile practices not only accelerates the MVP development process but also elevates the overall quality of the offering, making it more competitive in a rapidly changing landscape.

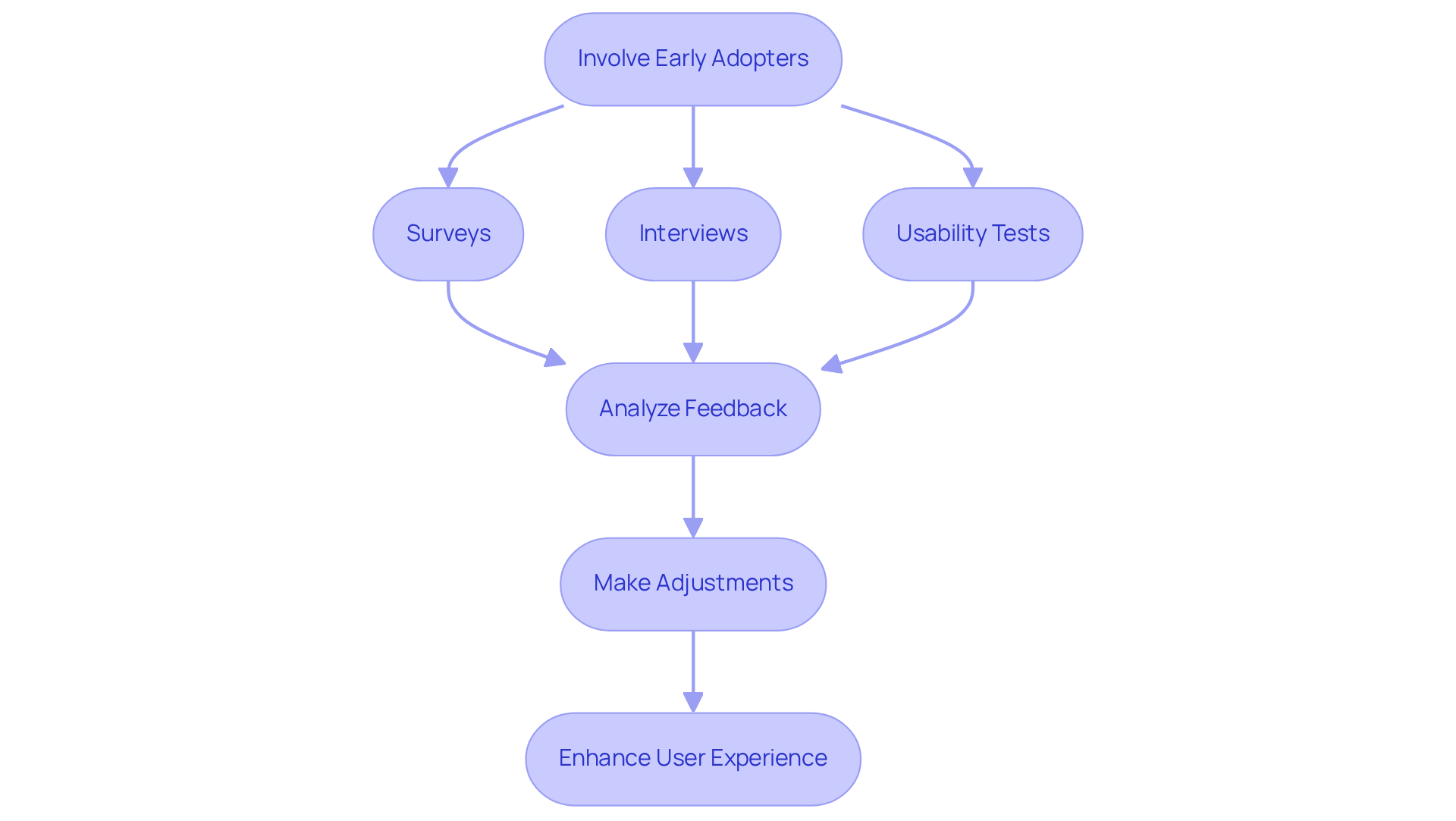

Test and Gather User Feedback

Involving early adopters in testing sessions is crucial for gathering valuable feedback on your MVP. Employing a variety of methods – such as surveys, interviews, and usability tests – can yield qualitative insights that are essential for identifying areas needing enhancement. Analyzing this feedback allows for necessary adjustments to the product, ensuring it meets user expectations.

In the financial industry, adherence to regulations and security standards is paramount, as client trust is a top priority. Engaging legal and compliance teams early in the development process can further bolster this trust. Iterating on the offering based on consumer insights not only improves functionality but also significantly enhances the overall user experience.

Research from Forrester indicates that investing in usability testing can yield a return of $100 for every dollar spent, underscoring its importance in the development process. Furthermore, according to PWC, 32% of individuals will disengage after one negative experience, highlighting the critical role of user experience in client retention.

Incorporating testing with end-users into the MVP development process allows you to create an offering that resonates with individuals and effectively meets their needs. Additionally, including case studies of successful client testing in fintech service launches can provide practical insights and demonstrate the effectiveness of these strategies.

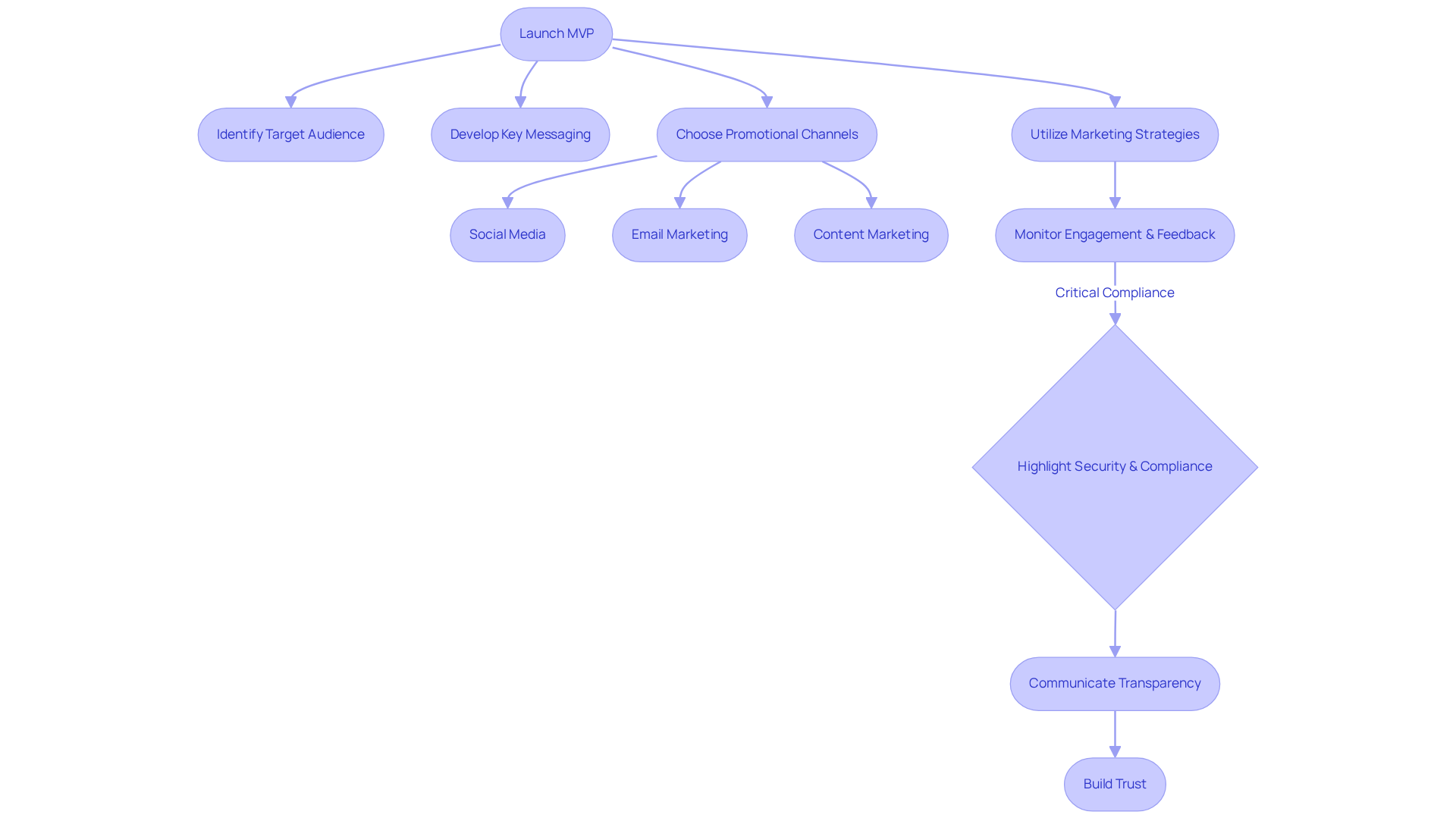

Launch the MVP and Implement Marketing Strategies

To successfully launch your MVP, it is essential to incorporate a comprehensive marketing plan into the MVP development process that clearly identifies your target audience, key messaging, and promotional channels. Utilize social media, email marketing, and content marketing to generate excitement and awareness around your product. Collaborating with influencers or industry leaders can significantly enhance your visibility and credibility. During the launch phase, it is crucial to actively monitor participant engagement and feedback, enabling real-time adjustments to your marketing strategies.

In the financial sector, highlighting the security and compliance features of your MVP is paramount. Effectively communicating these aspects not only reassures potential clients but also fosters trust, which is vital in a competitive market. Given that trust is the currency in the fintech industry, campaigns that emphasize transparency and adherence to regulatory standards can greatly enhance client confidence, making them more inclined to engage with your product. For example, successful fintech marketing campaigns often showcase robust security measures and compliance protocols, reinforcing the message that client data is protected. By prioritizing these elements, you can establish a strong foundation for trust and long-term engagement. Furthermore, staying updated with regulatory changes is essential for maintaining credibility and customer trust.

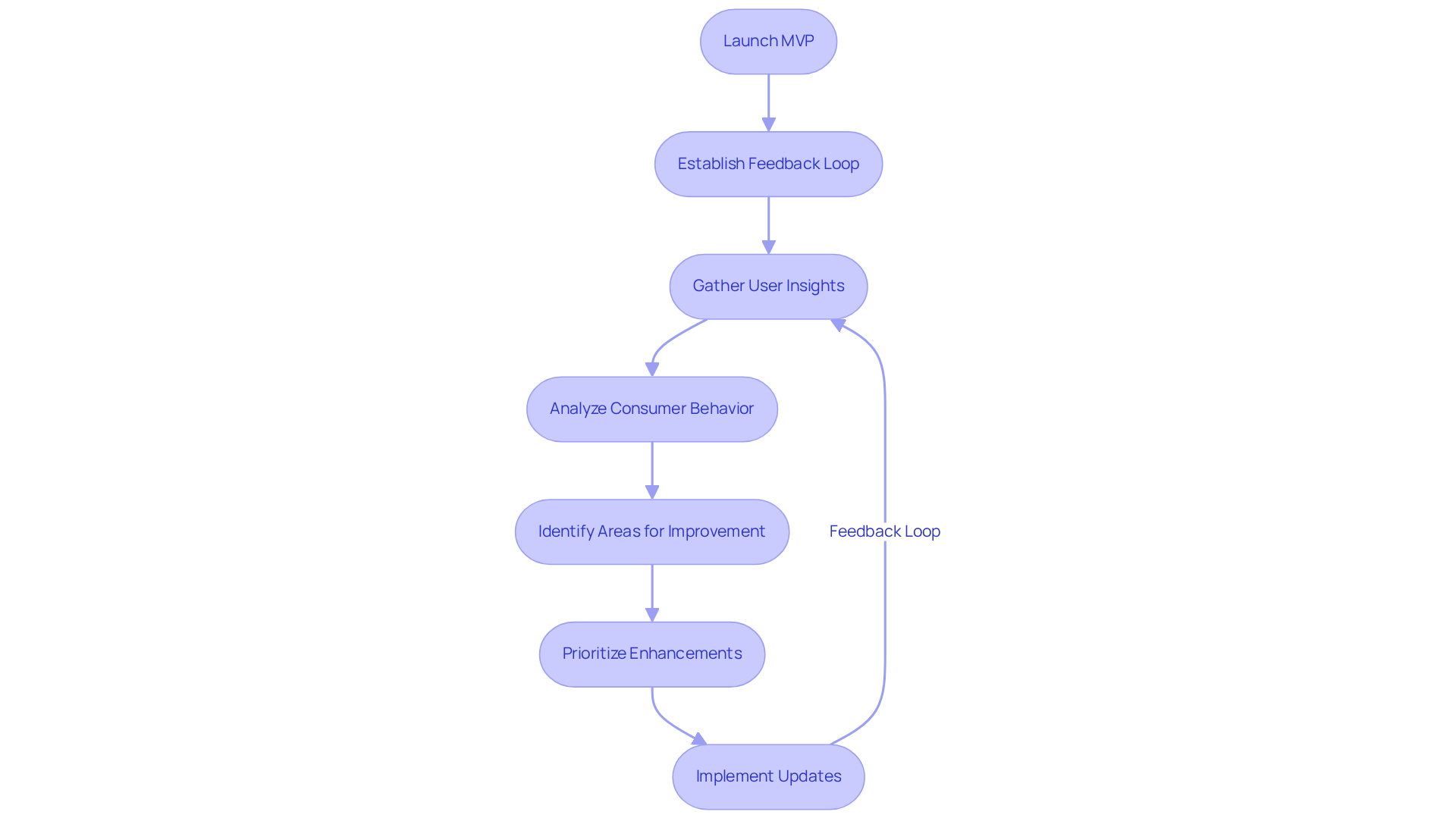

Iterate and Improve Based on Feedback

Following the launch of your MVP, establishing a robust feedback loop is essential for continuously gathering insights from users. Examining consumer behavior and feedback is vital for identifying areas that require improvement. Statistics reveal that 50% of individuals who download a fintech application never complete registration, underscoring the significance of engagement in the MVP development process. Enhancements should be prioritized based on customer needs and prevailing market trends to ensure ongoing relevance.

Frequent updates to the MVP not only enhance existing features but also introduce new functionalities that align with audience expectations. As Jesse Daniels, Co-Founder and CTA of Fixtops Technology, states, “The aim is to keep the MVP as lean as possible, focusing on key functionalities that solve the main problems.” In the financial sector, it is crucial that all updates comply with regulatory standards, thereby fostering trust and confidence among clients.

This iterative approach within the MVP development process enables swift adjustments to changing market conditions, ensuring that your offering remains competitive and responsive to demands. For instance, companies like Foursquare and Airbnb have successfully integrated user feedback into their product updates, resulting in significant improvements in user engagement and satisfaction. Additionally, conducting customer interviews is essential for gathering insights into your target audience’s needs, preferences, and pain points, reinforcing the value of a user-centered development strategy.

Conclusion

Mastering the MVP development process is crucial for startups, especially within the fast-paced and highly regulated financial sector. By concentrating on the creation of a Minimum Viable Product, businesses can test their ideas with minimal investment while ensuring adherence to necessary regulations. This strategy not only validates product concepts but also facilitates iterative improvements based on genuine user feedback, ultimately resulting in a more polished and market-ready offering.

The article outlines key steps in the MVP development process, including:

- Defining the MVP

- Conducting comprehensive market research

- Prioritizing core features

- Employing agile methodologies for development

Each stage underscores the significance of compliance and user engagement, illustrating how these elements contribute to the overall success of the product. By integrating user feedback and continuously refining the product, startups can enhance user experience and maintain relevance in a competitive market.

In conclusion, embracing the MVP development process transcends merely launching a product; it establishes a foundation for long-term success. Startups should prioritize compliance, user feedback, and agile practices to effectively navigate the complexities of product development. As the fintech landscape evolves, remaining attuned to user needs and regulatory changes will be essential. By adopting these best practices, businesses can cultivate trust and build enduring relationships with their clients, ultimately achieving their objectives in a dynamic environment.

Frequently Asked Questions

What is a Minimum Viable Product (MVP)?

A Minimum Viable Product (MVP) is a streamlined version of a product that includes only the essential features needed to satisfy early adopters. Its primary goal is to validate a product idea with minimal investment, allowing for feedback collection and data-informed decisions for future enhancements.

Why is compliance important for an MVP in the financial services sector?

Compliance is crucial for an MVP in the financial services sector because it must adhere to stringent regulatory and security standards. This ensures that the product meets legal obligations while delivering value to users, particularly with regulations like KYC and AML, which are vital for legitimate transactions and user data protection.

What are the key features of an MVP for early adopters?

Key features of an MVP for early adopters include an emphasis on essential functionalities that address consumer pain points, a streamlined user experience, and the capability to gather actionable insights through user interactions.

What risks are associated with failing to comply with regulations during MVP development?

Failing to comply with regulations during MVP development can lead to costly rebuilds or operational disruptions. Statistics indicate that 73% of fintech startups fail within their first three years due to regulatory compliance issues, highlighting the importance of adherence to regulations.

How can successful MVPs in fintech achieve compliance with regulatory standards?

Successful MVPs in fintech can achieve compliance by incorporating robust security measures such as AES-256 encryption and tokenization, which enhance user trust and align with regulatory requirements. Additionally, maintaining comprehensive audit logs to monitor transactions and user actions is critical for compliance.

What methods can be used to conduct effective market research for an MVP?

Effective market research can be conducted using methods such as surveys, interviews, and focus groups. These approaches allow for the collection of qualitative data that can inform strategy and validate the concept of the MVP.

Why is it important to analyze competitors during market research?

Analyzing competitors is important during market research as it helps clarify their offerings and market positioning. This context is vital for developing a unique approach and ensuring that the MVP addresses genuine demand within the market.

What should be considered regarding regulatory requirements in MVP development?

In MVP development, it is essential to consider regulatory requirements and compliance standards, as these factors can significantly influence the design and functionality of the offering, particularly in the financial services sector.