Master Custom MVP Software Development for Hedge Fund Success

Introduction

Creating a successful hedge fund in today’s competitive landscape requires more than just sound investment strategies; it demands innovative software solutions tailored to meet unique market needs. Custom MVP software development emerges as a vital strategy, enabling firms to test concepts and gather invaluable user feedback without excessive financial risk.

However, hedge funds must effectively navigate the complexities of MVP creation to ensure compliance with regulatory standards while also resonating with users. This article delves into essential practices for mastering custom MVP development, offering insights that could redefine the trajectory of investment fund success.

Define the Minimum Viable Product (MVP) and Its Importance

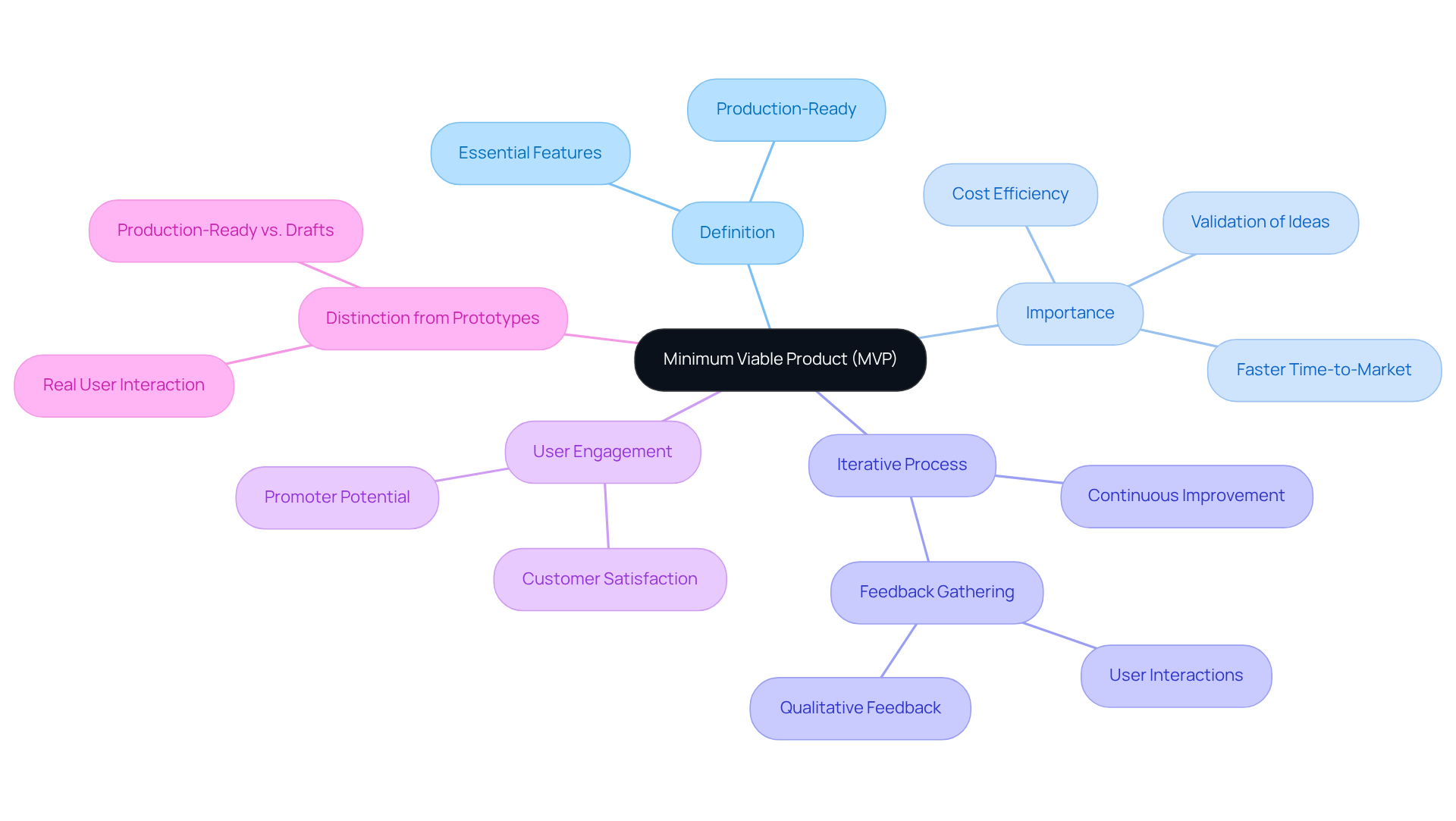

A Minimum Viable Product (MVP) created through custom MVP software development represents a streamlined version of a product, incorporating only the essential features necessary to satisfy early adopters and gather feedback for future enhancements. In the context of investment funds, custom MVP software development allows firms to experiment with investment strategies and software functionalities without incurring extensive upfront costs. This approach is particularly beneficial in the financial services sector, where compliance and effective risk management are paramount.

By concentrating on essential capabilities, hedge funds can validate their concepts, attract initial participants, and progressively refine their offerings based on authentic feedback. It is noteworthy that nearly 60% of MVPs undergo significant iterations before achieving product-market fit, highlighting the importance of this iterative process. As George Krasadakis articulates, an MVP is a product equipped with just enough features to satisfy early customers and facilitate feedback for future development.

Moreover, it is essential to distinguish MVPs from simple prototypes or drafts; they must be production-ready to effectively engage users. Capturing user interactions for historical analysis is also vital, as it yields insights that can inform further improvements. This iterative process not only enhances the product’s durability but also significantly increases the likelihood of achieving a successful market fit, ultimately leading to improved outcomes for investment fund operations through custom MVP software development.

Leverage the MVP-First Approach for Cost Efficiency and Risk Management

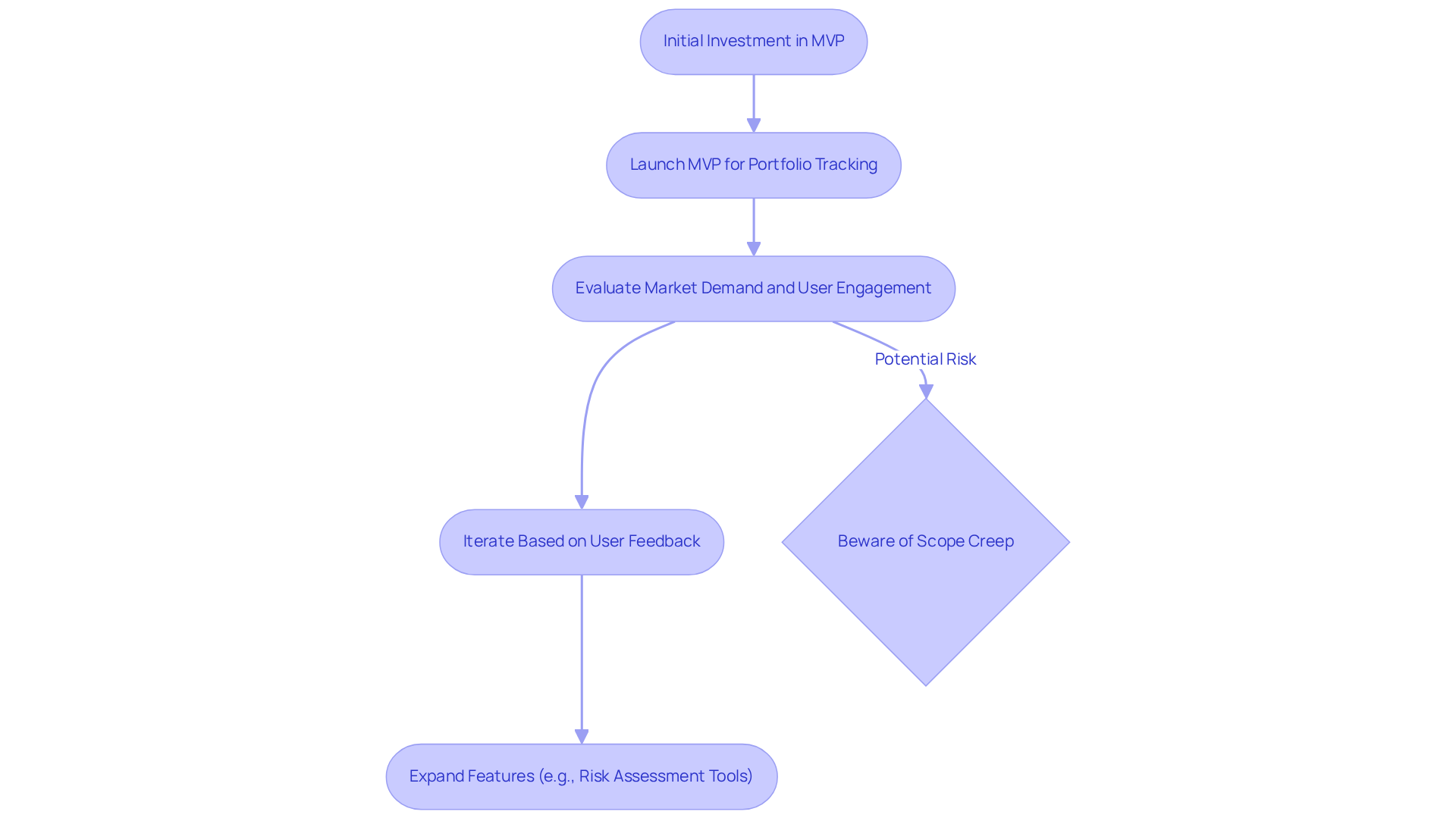

Adopting a custom MVP software development strategy enables hedge funds to significantly minimize initial investments while maximizing learning opportunities. By utilizing custom MVP software development to create a streamlined version of their software, firms can quickly evaluate market demand and user engagement. This method mitigates the risk of committing substantial resources to features that may not resonate with users in custom MVP software development. For example, an investment fund might launch an MVP centered on portfolio tracking, subsequently expanding into more sophisticated features like risk assessment tools. This iterative development process, integral to custom MVP software development, allows for real-time adjustments based on user feedback, ensuring that the final product not only aligns with market expectations but also complies with stringent regulatory standards.

In 2026, the average cost for custom MVP software development ranges from $20,000 to $120,000, making it a financially viable option for investment funds. Furthermore, meticulous budget planning is crucial to prevent hidden costs that could inflate the overall project budget. Data suggests that firms utilizing custom MVP software development strategies can reduce project risks by as much as 70%, underscoring the effectiveness of this approach in navigating the complexities of financial services. Nevertheless, hedge funds must remain cautious of common pitfalls such as scope creep, which can derail MVP projects and result in overspending.

Implement Key Steps in the MVP Development Process: From Validation to Launch

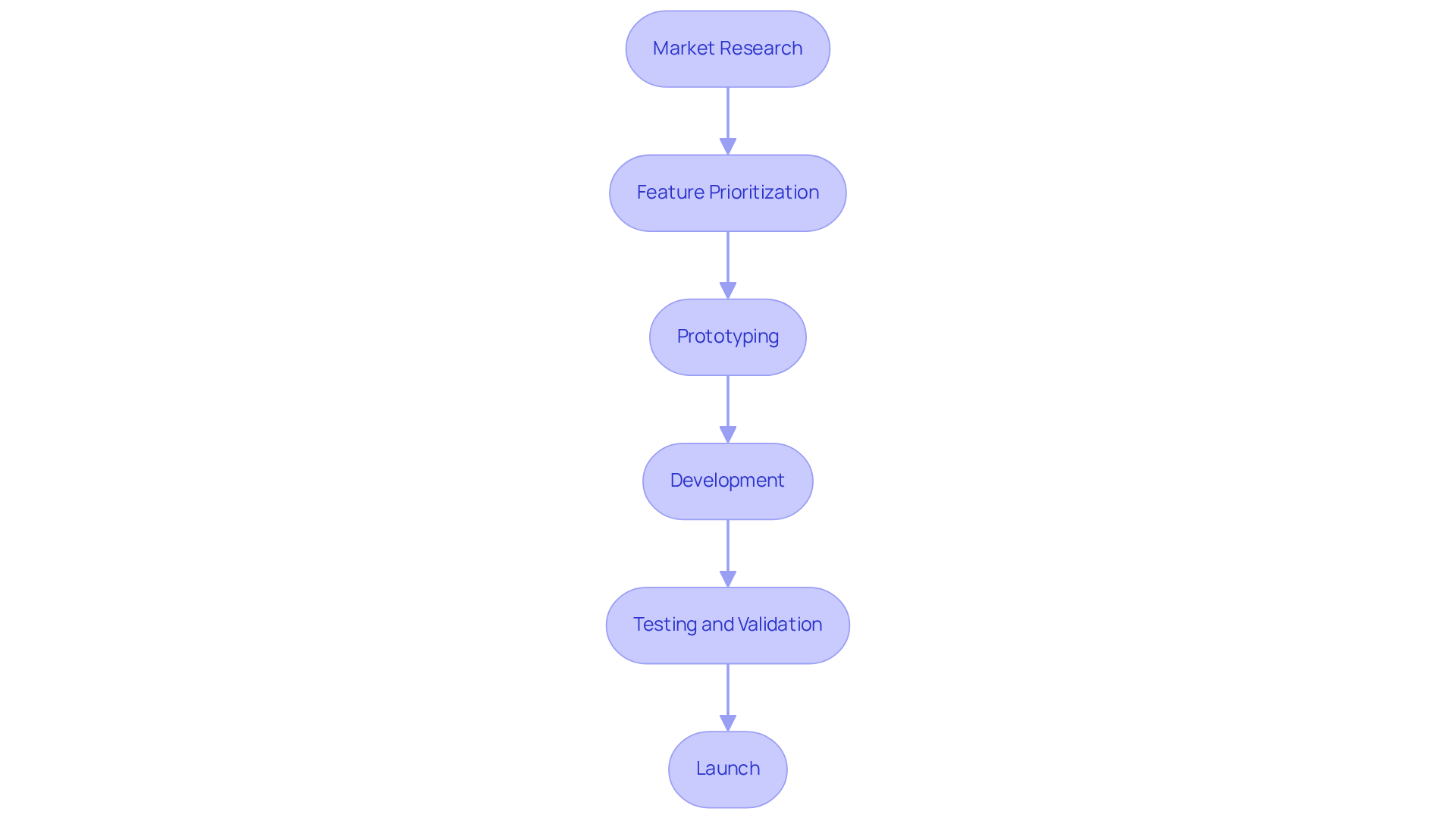

The MVP development process encompasses several critical steps:

-

Market Research: Conduct thorough research to identify customer needs and market gaps. This step is essential for understanding the competitive landscape and defining the problem your MVP will address.

-

Feature Prioritization: Focus on the essential features that deliver fundamental value to users. Employ frameworks such as MoSCoW (Must have, Should have, Could have, Won’t have) to prioritize functionalities effectively in custom mvp software development.

-

Prototyping: Develop a prototype to visualize the MVP and collect initial feedback. This can be a low-fidelity version that facilitates quick iterations.

-

Development: Construct the MVP using custom mvp software development and agile methodologies to enable rapid adjustments based on consumer feedback.

-

Testing and Validation: Introduce the MVP to a select group of users to gather insights and validate assumptions. Leverage this feedback to refine the product prior to a broader launch.

-

Launch: Once validated, release the MVP to the market, ensuring compliance with all regulatory requirements.

Choose the Right Development Partner for Successful MVP Execution

Choosing the right development associate is essential for the successful execution of custom MVP software development in the hedge fund sector. Key factors to consider include:

-

Relevant Experience: Collaborators should have a solid track record in financial software development. Their understanding of compliance and regulatory standards is crucial for navigating the complexities of the industry.

-

Technical Expertise: It is imperative that the collaborator possesses the necessary technical skills to develop the MVP, including proficiency in relevant programming languages and frameworks. This expertise directly impacts the quality and functionality of the final product.

-

Communication: Effective communication is vital for successful collaboration. A collaborator who demonstrates openness and receptiveness to input fosters a productive working relationship.

-

Scalability: The ability to adjust resources based on project demands is critical. A collaborator should offer the flexibility to scale up or down as the MVP evolves, accommodating changing requirements without compromising quality.

-

Cultural Fit: An associate that aligns with your company culture can enhance collaboration and integration with your internal teams, leading to smoother project execution.

-

Portfolio and References: Reviewing the collaborator’s previous work and seeking references is essential to assess their reliability and service quality. Successful partnerships often stem from proven capabilities and satisfied clients.

At Neutech, we recognize the importance of these factors. Once we mutually determine your needs, we will provide you with a selection of candidate designers and developers tailored to your specific requirements. Our process ensures that we connect you with professionals who not only possess relevant experience and technical expertise but also align with your company culture and project demands.

Investing in an associate with the right blend of experience and technical expertise can significantly increase the likelihood of success in custom MVP software development, especially in the competitive hedge fund landscape. Industry forecasts indicate that the financial software solutions market is projected to reach US$24.4bn by 2026, underscoring the significance of selecting a skilled development collaborator. Additionally, as noted by Vasyl Kuchma, “The MVP approach lets startups test their ideas and demand. It reduces the risk of failure while saving time and money on development.” This emphasizes the critical nature of choosing the right partner to navigate the evolving landscape of financial technology.

Conclusion

The journey toward successful hedge fund operations is significantly enhanced through custom MVP software development, which delivers a minimum viable product tailored to the unique needs of the financial sector. This approach allows hedge funds to test and validate their ideas with minimal risk while fostering an environment of continuous improvement based on real user feedback. By prioritizing essential features and maintaining a user-centric development process, firms can create solutions that resonate with their target audience and ensure compliance with industry regulations.

Key points highlighted throughout the article include:

- The importance of defining the MVP

- Leveraging an MVP-first approach for cost efficiency and risk management

- Adhering to a structured development process

Each step, from market research to selecting an appropriate development partner, is crucial for navigating the complexities of financial software solutions. The iterative nature of MVP development, combined with strategic planning and collaboration, positions hedge funds to adapt swiftly to market demands and enhance their operational effectiveness.

Ultimately, embracing the custom MVP approach is not merely a tactical decision; it is a strategic imperative for hedge funds aiming to thrive in a competitive landscape. By investing in well-defined MVPs, firms can reduce development costs, mitigate risks, and position themselves for future growth. As the financial technology landscape continues to evolve, the ability to innovate and respond to market needs will be paramount. Therefore, implementing these best practices in MVP development can lead to lasting success in the hedge fund industry.

Frequently Asked Questions

What is a Minimum Viable Product (MVP)?

A Minimum Viable Product (MVP) is a streamlined version of a product that includes only the essential features necessary to satisfy early adopters and gather feedback for future enhancements.

Why is an MVP important in custom software development?

An MVP is important because it allows firms, especially in the financial services sector, to experiment with investment strategies and software functionalities without incurring extensive upfront costs, facilitating compliance and effective risk management.

How does an MVP benefit hedge funds?

An MVP benefits hedge funds by enabling them to validate their concepts, attract initial participants, and progressively refine their offerings based on authentic feedback from users.

What percentage of MVPs undergo significant iterations before achieving product-market fit?

Nearly 60% of MVPs undergo significant iterations before achieving product-market fit.

How does an MVP differ from a prototype?

An MVP differs from a prototype in that it must be production-ready and equipped with enough features to effectively engage users, rather than being a simple draft or concept.

Why is capturing user interactions important in the MVP process?

Capturing user interactions is vital as it provides insights for historical analysis, which can inform further improvements and enhance the product’s durability.

What is the ultimate goal of developing an MVP in the context of investment funds?

The ultimate goal of developing an MVP is to increase the likelihood of achieving a successful market fit and improve outcomes for investment fund operations through custom software development.