Master Software Entwicklung Outsourcing: Best Practices for Hedge Funds

Introduction

In the competitive landscape of investment firms, the demand for specialized software development has reached unprecedented levels. Outsourcing these tasks allows hedge funds to tap into a wealth of expertise, streamline their operations, and enhance agility in a rapidly evolving market. However, the journey of software development outsourcing presents several challenges, including:

- Ensuring quality

- Safeguarding data security

- Maintaining effective communication

How can hedge funds effectively navigate these complexities while capitalizing on the significant benefits that external partnerships offer?

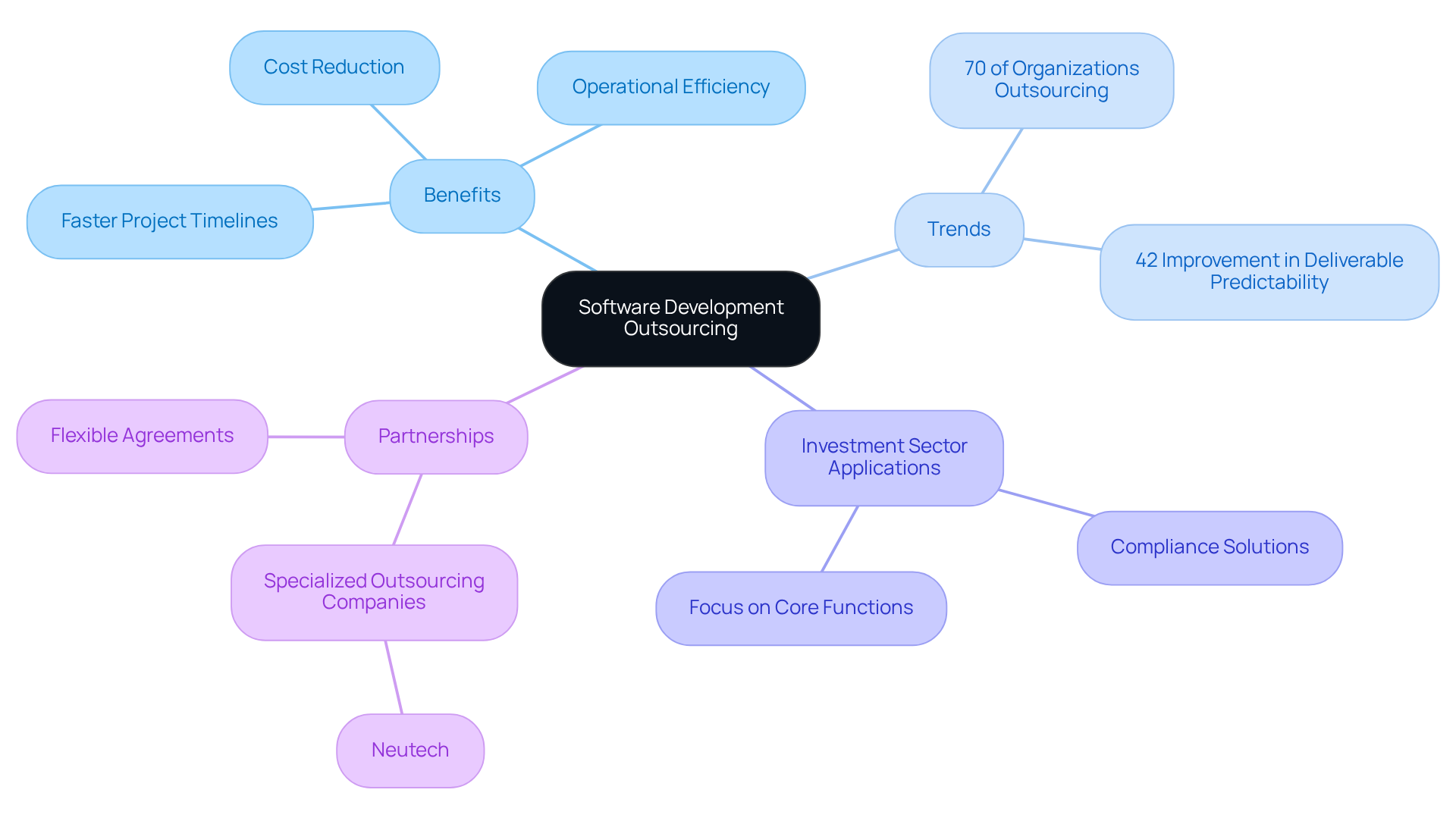

Define Software Development Outsourcing

Software development outsourcing involves hiring external teams or companies to manage software development tasks that could otherwise be handled in-house. This strategy enables organizations, particularly investment firms, to tap into specialized skills and expertise that may not be readily available within their internal teams. Software entwicklung outsourcing encompasses various aspects of software development, such as coding, testing, and maintenance, and is often employed to improve operational efficiency, reduce costs, and accelerate project timelines. In the investment sector, external support also includes compliance-related software solutions, ensuring adherence to stringent regulatory standards.

Recent trends reveal that approximately 70% of organizations in regulated sectors are leveraging external resources to address the tech talent shortage, with many investment firms recognizing the strategic advantages this approach offers. For instance, outsourcing can lead to significant improvements in deliverable predictability, with research indicating a 42% increase when projects are executed with established expert partners. Furthermore, investment groups that adopt external strategies can achieve faster project completion times, as evidenced by a startup that delivered updates 42% quicker by outsourcing its quality assurance tasks.

The importance of software entwicklung outsourcing for contracting services in software development for investment firms is substantial. It allows these firms to concentrate on core business functions while ensuring that compliance and operational requirements are met effectively. By partnering with specialized outsourcing companies like Neutech, which emphasizes intangibles such as work ethic, communication, and leadership, investment firms can navigate the complexities of regulatory demands while maintaining a competitive edge in the market. Neutech’s flexible month-to-month agreements enable investment groups to adjust their development resources as needed, ensuring optimal project management and seamless integration of talent into their operations.

Highlight Advantages of Outsourcing Software Development

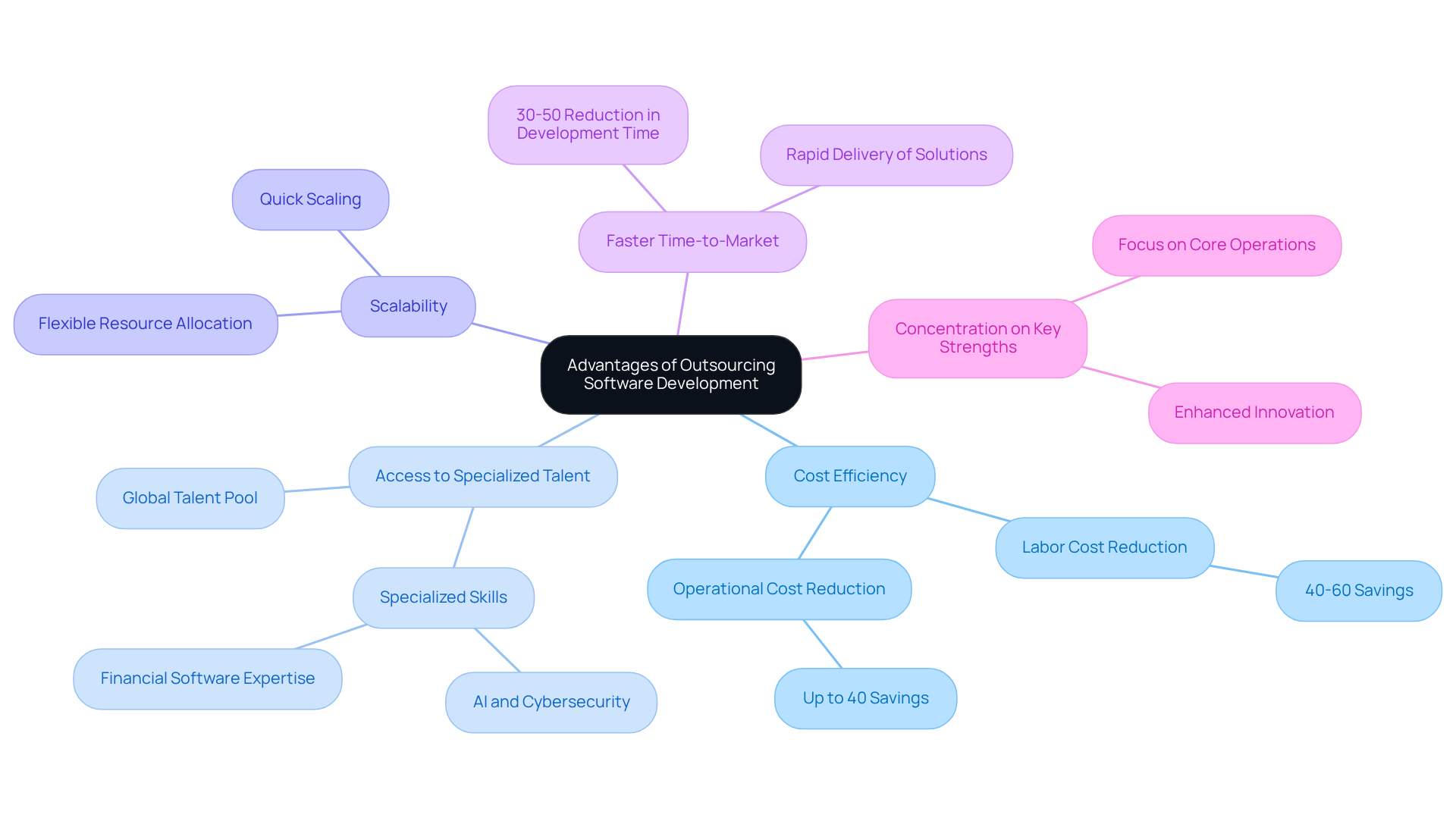

Outsourcing software development offers significant advantages for hedge funds, including:

-

Cost Efficiency: Outsourcing can lead to a reduction in labor costs by 40-60% compared to internal hiring. This enables investment firms to allocate resources more effectively toward primary investment strategies, minimizing overhead and enhancing financial agility during market fluctuations.

-

Access to Specialized Talent: By tapping into a global talent pool, investment firms can engage developers with specialized expertise in financial software, including AI and cybersecurity. Neutech plays a pivotal role in this process by assessing client needs and providing specialized designers and developers tailored to those requirements. This access ensures the implementation of advanced technologies without the burden of maintaining a full-time team, which is essential in a rapidly evolving industry.

-

Scalability: Outsourcing provides the flexibility to quickly scale development efforts in response to project demands. This adaptability is crucial for investment groups, allowing them to adjust resources without the challenges associated with recruitment or terminations, thereby preserving operational efficiency.

-

Faster Time-to-Market: Dedicated external teams can significantly expedite the delivery of software solutions, with companies reporting a 30-50% reduction in product development time. This speed enables investment groups to capitalize on market opportunities more swiftly, enhancing their competitive advantage.

-

Concentration on Key Strengths: By delegating non-essential tasks, investment firms can focus on their core investment operations. This strategic focus enhances operational efficiency and fosters innovation, as internal teams can devote more time to developing investment strategies and improving client services.

In 2026, the average salary for in-house software developers is projected to be considerably higher than that of external developers, further underscoring the financial benefits of software entwicklung outsourcing. As investment funds increasingly recognize these advantages, the trend toward strategic externalization is expected to continue its expansion.

Identify Risks and Challenges in Outsourcing

Outsourcing software development presents notable advantages, but it also brings inherent risks and challenges, particularly for hedge funds:

-

Quality Assurance: Upholding the high standards essential in the financial sector is paramount. Insufficient quality assurance can result in compliance failures and significant financial consequences. Neutech addresses this concern by implementing stringent testing and validation processes, ensuring that software entwicklung outsourcing adheres to industry benchmarks from the outset.

-

Data Security: The outsourcing model can expose sensitive financial data to third-party vendors, increasing the risk of data breaches and regulatory violations. In 2026, statistics indicated that a considerable portion of projects in software entwicklung outsourcing experienced data security incidents, underscoring the necessity for investment firms to partner with providers like Neutech, which adhere to strict security protocols, including data encryption and regular audits.

-

Communication Barriers: Differences in time zones, languages, and cultural practices can lead to misunderstandings and delays in project timelines. To mitigate these challenges, investment groups should establish effective communication strategies, such as regular updates and shared dashboards, to ensure alignment and transparency throughout the software entwicklung outsourcing development process. Neutech facilitates software entwicklung outsourcing by assigning managers on both sides to enhance accountability.

-

Loss of Control: Relying on external teams can create a perceived loss of control over the development lifecycle. It is crucial for hedge funds to implement robust management practices and oversight mechanisms. Neutech supports software entwicklung outsourcing by providing dedicated managers who ensure timely decision-making and maintain alignment.

-

Hidden Costs: While delegating tasks can be a cost-effective strategy, it may also introduce hidden expenses related to project management, quality assurance, and potential rework. Hedge funds should conduct thorough cost assessments and maintain clear financial reporting to avoid budget overruns. Neutech recommends including a 10-20% contingency buffer for scope changes or technical challenges to ensure that all potential expenses are accounted for in the agreement.

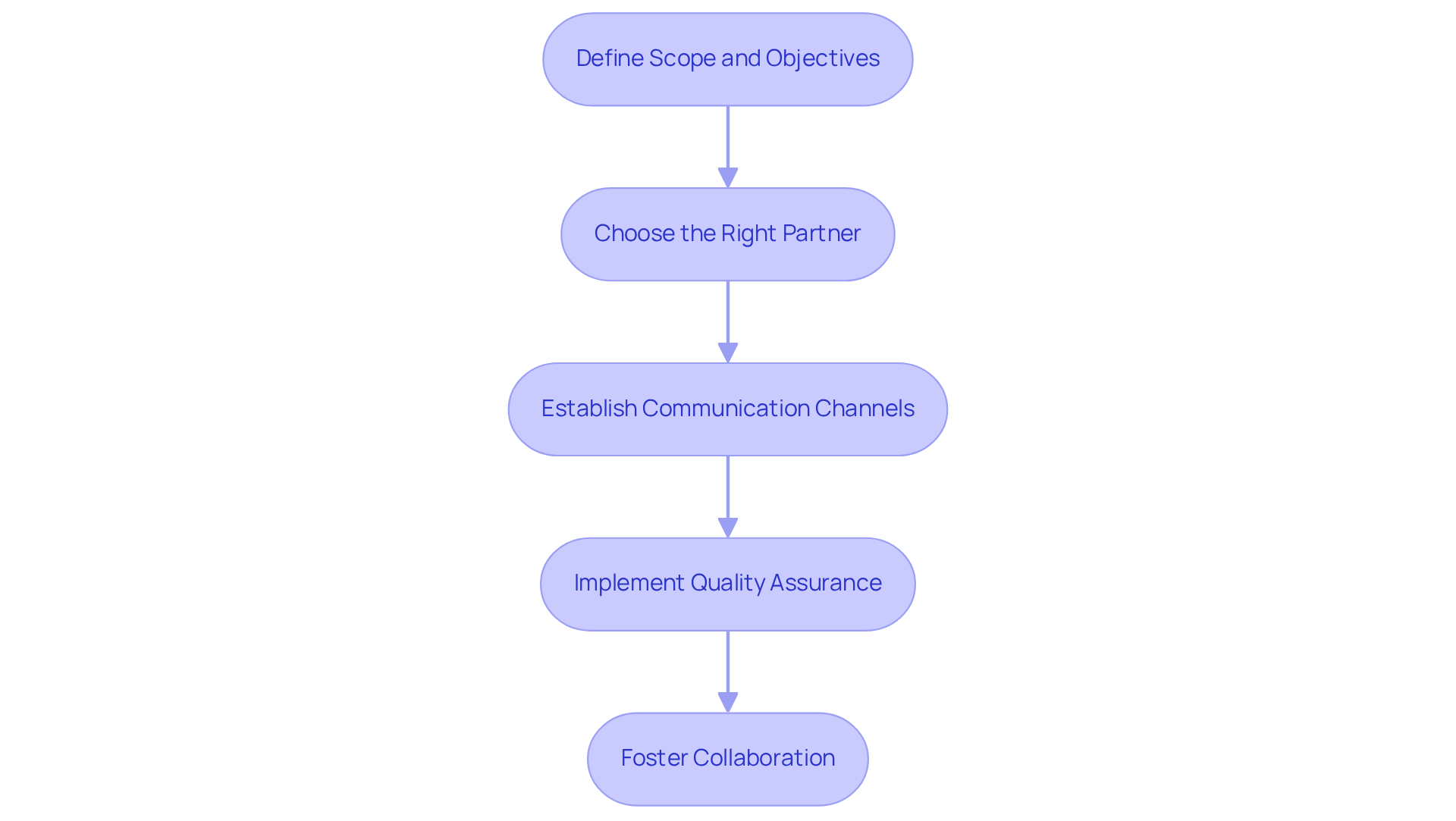

Implement Best Practices for Successful Outsourcing

To ensure successful software development outsourcing, hedge funds should implement several best practices:

-

Clearly Define Scope and Objectives: Establishing a detailed scope and clear objectives is essential for aligning expectations between the hedge fund and the external partner. This involves defining deliverables, timelines, and success metrics. At Neutech, we emphasize understanding client needs to effectively tailor our software entwicklung outsourcing approach, ensuring that the right candidates are supplied for the project.

-

Choose the Right Partner: Conduct thorough due diligence when selecting an outsourcing partner. Evaluate their expertise, past performance, and cultural fit to ensure alignment with the hedge fund’s values and operational needs. Neutech can assist in this process by providing candidate designers and developers through software entwicklung outsourcing, ensuring they meet your specific requirements and thereby enhancing the likelihood of success.

-

Establish Effective Communication Channels: Regular communication is vital for successful outsourcing. Utilize project management tools and schedule regular check-ins to maintain transparency and promptly address any issues, ensuring that all team members, including those from Neutech, are aligned in the context of software entwicklung outsourcing.

-

Implement Quality Assurance Processes: Develop a robust quality assurance framework to monitor the development process and ensure that the final product meets the required standards and compliance regulations. Neutech’s involvement in software entwicklung outsourcing can help streamline these processes by leveraging their expertise in quality assurance.

-

Foster a Collaborative Environment: Encourage collaboration between in-house teams and outsourced developers. This can be achieved through joint meetings, shared tools, and a culture of open feedback, which helps integrate the outsourced team into the hedge fund’s operations, including those provided by Neutech, as part of their software entwicklung outsourcing efforts.

Conclusion

Outsourcing software development has become a strategic necessity for hedge funds, allowing them to leverage external expertise, improve operational efficiency, and sustain a competitive edge. By collaborating with specialized teams, investment firms can concentrate on their core functions while adeptly managing the complexities of compliance and technological demands. This strategy not only optimizes resource allocation but also accelerates project timelines, enabling hedge funds to respond promptly to market fluctuations.

The article underscores several key advantages of outsourcing, including:

- Cost efficiency

- Access to specialized talent

- Scalability

- Expedited time-to-market

Nonetheless, it is crucial to recognize the associated risks, such as:

- Quality assurance

- Data security

- Communication barriers

- Loss of control

- Potential hidden costs

By adopting best practices such as clearly defining project scope, selecting the appropriate partner, establishing effective communication, and fostering collaboration, hedge funds can mitigate these challenges and secure successful outsourcing outcomes.

As the software development landscape continues to evolve, embracing outsourcing not only signifies a tactical advantage but also represents a necessary evolution in the operational strategies of hedge funds. By strategically partnering with capable providers like Neutech, firms can position themselves to excel in an increasingly competitive environment. The future of software development outsourcing for hedge funds hinges on recognizing its potential and proactively addressing its challenges, ensuring that organizations remain agile and innovative in their pursuit of excellence.

Frequently Asked Questions

What is software development outsourcing?

Software development outsourcing involves hiring external teams or companies to manage software development tasks that could otherwise be handled in-house. This strategy allows organizations to access specialized skills and expertise not readily available within their internal teams.

What aspects of software development can be outsourced?

Various aspects of software development can be outsourced, including coding, testing, and maintenance.

Why do organizations, particularly investment firms, outsource software development?

Organizations outsource software development to improve operational efficiency, reduce costs, and accelerate project timelines. In the investment sector, outsourcing also helps in providing compliance-related software solutions to adhere to regulatory standards.

What recent trends are observed in software development outsourcing?

Recent trends show that approximately 70% of organizations in regulated sectors are leveraging external resources to address the tech talent shortage. Many investment firms recognize the strategic advantages of this approach.

How does outsourcing affect project deliverables?

Outsourcing can lead to significant improvements in deliverable predictability, with research indicating a 42% increase when projects are executed with established expert partners.

Can outsourcing speed up project completion times?

Yes, outsourcing can lead to faster project completion times. For example, a startup was able to deliver updates 42% quicker by outsourcing its quality assurance tasks.

What is the importance of software development outsourcing for investment firms?

It allows investment firms to focus on core business functions while effectively meeting compliance and operational requirements.

How can investment firms benefit from partnering with specialized outsourcing companies?

By partnering with specialized outsourcing companies, investment firms can navigate regulatory complexities while maintaining a competitive edge. Companies like Neutech emphasize intangibles such as work ethic, communication, and leadership.

What kind of agreements do companies like Neutech offer to investment firms?

Neutech offers flexible month-to-month agreements, allowing investment groups to adjust their development resources as needed for optimal project management and seamless integration of talent into their operations.