Introduction

The landscape of software outsourcing is undergoing significant transformation, especially for hedge funds operating within the complexities of regulated industries. As investment firms strive to enhance compliance and mitigate risks, the integration of specialized engineering talent becomes essential. This article examines key insights from the software outsourcing wiki, highlighting how various outsourcing models can optimize operational efficiency and cost-effectiveness. However, with a multitude of options available, how can hedge funds ensure they select the right partner to address their specific needs and regulatory requirements?

Neutech: Specialized Engineering Talent for Regulated Industries

Neutech stands out as a premier software and design development agency, particularly in regulated sectors such as financial services and healthcare. By focusing on hyper-specialized engineering skills, Neutech equips investment firms with the expertise necessary to navigate complex regulatory frameworks. The company’s engineers undergo a rigorous residency program, ensuring they acquire the essential skills for developing secure and compliant applications.

This specialization is crucial for investment firms, which not only need technical proficiency but also a profound understanding of compliance regulations and risk management. As the industry continues to evolve, the integration of specialized engineering talent becomes increasingly important for enhancing compliance and mitigating risks. This focus ultimately leads to successful software development initiatives within these highly regulated environments.

Understanding Different Types of Software Development Outsourcing

Software development outsourcing includes several models, each presenting distinct advantages and disadvantages that hedge funds must evaluate:

-

Onshore Outsourcing involves partnering with companies within the same country. This model facilitates seamless communication and cultural alignment, making it particularly beneficial for projects requiring high collaboration and regulatory compliance. By reducing potential misunderstandings, it enhances responsiveness.

-

Nearshore Outsourcing engages companies in nearby countries, striking a balance between cost savings and operational efficiency. This model benefits from comparable time zones and cultural similarities, which can lead to more effective management and quicker turnaround times. It is an appealing option for hedge institutions seeking to optimize resources without sacrificing quality.

-

Offshore Outsourcing entails collaboration with companies in distant countries, often resulting in significant cost reductions. However, this approach may introduce challenges such as communication barriers, time zone differences, and oversight difficulties. Hedge investments must weigh these factors against potential savings, especially for complex projects that require careful management.

Current trends indicate a growing preference for hybrid models that integrate elements of onshore, nearshore, and offshore services. This flexibility allows investment groups to tailor their external strategies to specific needs, budget constraints, and regulatory requirements. Experts recommend that companies thoroughly assess their operational objectives and project characteristics when selecting a service model, ensuring alignment with their overall business strategy. Effective investment management often employs a combination of these strategies, leading to enhanced efficiency and improved outcomes.

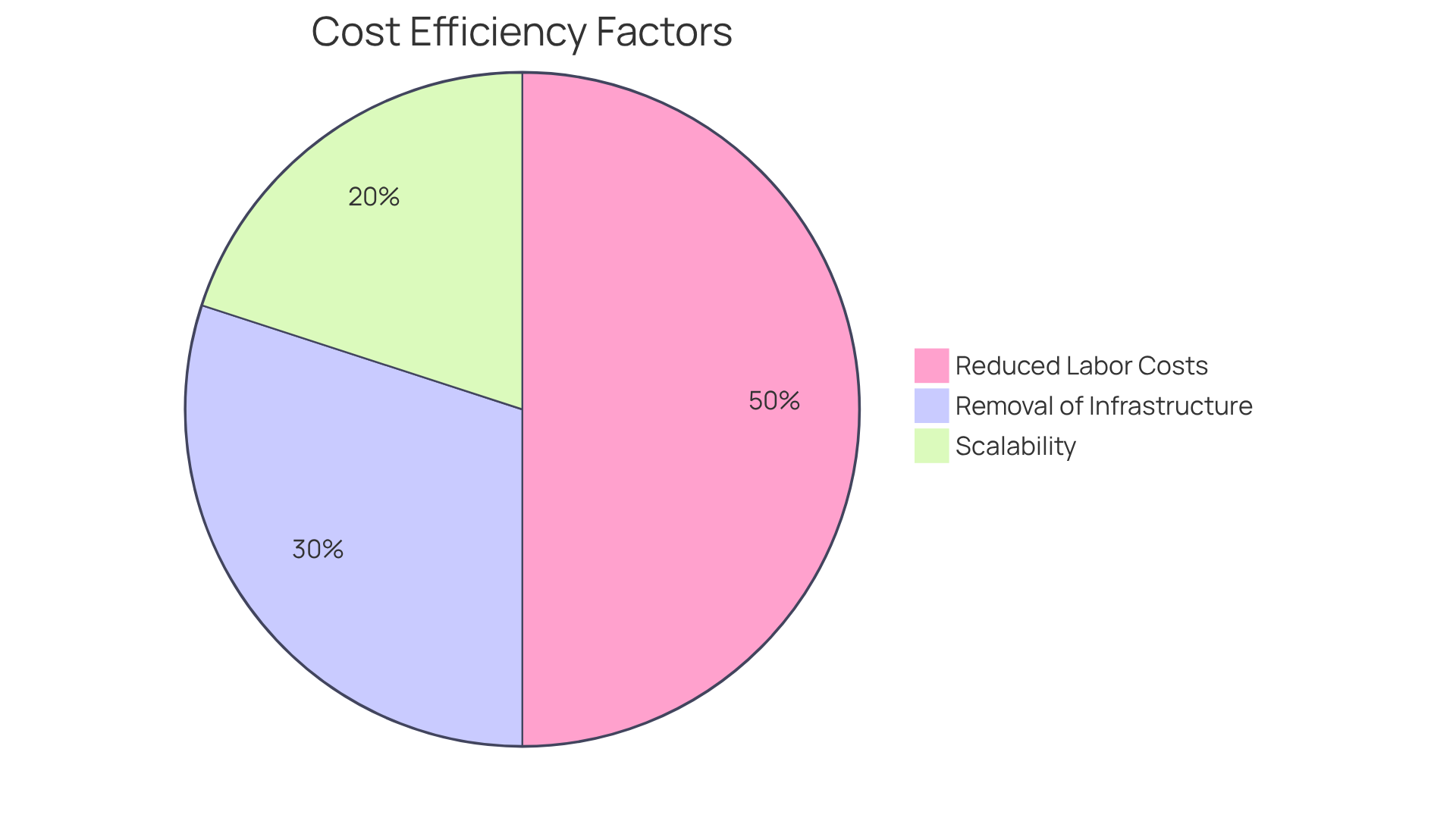

Cost Efficiency: A Key Benefit of Software Development Outsourcing

Cost efficiency stands out as a significant advantage for investment groups considering the software outsourcing wiki for externalizing software development. By tapping into global talent pools, firms can realize cost reductions ranging from 30% to 60%, thereby markedly improving their financial performance. Several key factors contribute to this cost efficiency:

- Reduced Labor Costs: Outsourcing to regions such as India, Eastern Europe, and the Philippines, where hourly rates typically range from $25 to $60, enables hedge funds to significantly lower their overall expenses compared to North American rates, which can reach $100 to $200 per hour. Derek Gallimore, founder of Outsource Accelerator, notes that “Outsourcing can reduce employment-related expenses by up to 70%, allowing firms to allocate resources more effectively.”

- Removal of Infrastructure Expenses: Many external service providers, including Neutech, supply the necessary technology and infrastructure, freeing investment firms from the burden of investing in expensive facilities and equipment. This arrangement allows companies to focus on their core competencies while external partners handle technical requirements.

- Scalability: Neutech’s tailored approach begins with assessing client needs to identify suitable candidates, enabling investment firms to adjust their development teams according to demand. This flexibility ensures that firms only incur costs for the resources they need at any given moment. A case study from a leading investment group illustrates that by outsourcing their software development, they could scale their team size as needed, resulting in a 45% faster time-to-market for new features.

By prioritizing cost efficiency and leveraging Neutech’s specialized talent acquisition process, investment firms can boost profitability while maintaining high standards in software development, as detailed in the software outsourcing wiki, ultimately positioning themselves for enhanced success in a competitive landscape.

Choosing the Right Outsourcing Partner for Your Software Project

Choosing the right outsourcing partner is crucial for the success of software initiatives in hedge funds. Key considerations include:

-

Expertise and Experience: It is essential to assess the partner’s background in the financial services sector, particularly their history of delivering projects that meet industry standards. A proven track record in similar projects can significantly enhance the likelihood of success.

-

Communication and Collaboration: Effective communication practices are vital for seamless collaboration between teams. Ensure that the partner prioritizes clear communication channels and regular updates, as these factors are often linked to higher success rates in outsourcing.

-

Cultural Fit: Evaluate whether the partner’s company culture aligns with your hedge fund’s values and work ethic. A strong cultural fit can foster better collaboration and results, making it essential for long-term partnerships.

-

Security and Compliance: Given the regulatory nature of the financial industry, it is imperative to verify that the partner adheres to stringent data security and compliance standards. This ensures that sensitive information is managed properly, thereby reducing risks associated with external services.

At Neutech, we prioritize understanding your specific needs through a structured assessment process. This approach allows us to provide you with a selection of candidate designers and developers tailored to your project requirements. By thoroughly evaluating these factors, hedge funds can select an outsourcing partner that not only fulfills their technical needs but also aligns with their strategic objectives.

Conclusion

In the hedge fund sector, the importance of software outsourcing is paramount. By utilizing specialized engineering talent and comprehending the various outsourcing models, investment firms can enhance their operations while adhering to strict regulatory requirements. The emphasis on cost efficiency, coupled with strategic partnerships, positions hedge funds to excel in a competitive environment.

Key insights from the article underscore the necessity of selecting the right outsourcing model – whether onshore, nearshore, or offshore – and recognizing the distinct advantages and challenges each option entails. Neutech’s dedication to supplying specialized talent tailored for regulated industries illustrates how firms can improve their software development processes. Moreover, the focus on partnering with organizations that align with the firm’s values and operational needs highlights the essential role of collaboration and communication in achieving successful project outcomes.

Ultimately, as hedge funds navigate the intricacies of software development, adopting outsourcing strategies and prioritizing informed decision-making will be crucial. The insights presented in this article serve as a valuable resource for investment firms seeking to leverage the benefits of outsourcing, ensuring they remain agile, compliant, and competitive in the dynamic financial landscape.

Frequently Asked Questions

What type of industries does Neutech specialize in?

Neutech specializes in regulated industries, particularly financial services and healthcare.

What is the main focus of Neutech as a software and design development agency?

Neutech focuses on providing hyper-specialized engineering skills to help investment firms navigate complex regulatory frameworks.

What type of program do Neutech engineers undergo?

Neutech engineers undergo a rigorous residency program to acquire essential skills for developing secure and compliant applications.

Why is specialization important for investment firms?

Specialization is important for investment firms because they require not only technical proficiency but also a deep understanding of compliance regulations and risk management.

How does specialized engineering talent benefit regulated industries?

Specialized engineering talent enhances compliance and mitigates risks, leading to successful software development initiatives in highly regulated environments.