Introduction

Outsourced software product development is reshaping the landscape for hedge funds, presenting a strategic opportunity for enhanced cost efficiency and access to specialized expertise. By leveraging global talent pools and advanced technologies, investment firms can significantly improve their operational capabilities while preserving a competitive advantage.

However, as firms explore this promising avenue, they must confront challenges such as communication barriers and security concerns. To fully capitalize on the benefits of outsourcing, hedge funds need to implement effective strategies that address these potential risks.

Achieve Cost Efficiency Through Outsourced Development

Outsourced software product development presents investment groups with significant opportunities for cost reductions. By engaging external partners, firms can substantially lower overhead costs linked to hiring, training, and retaining in-house personnel. This strategic approach transforms fixed expenses into variable ones, enabling investment groups to adjust resources according to project needs. Such adaptability is crucial in today’s unpredictable financial landscape, where effective management of operational costs is paramount.

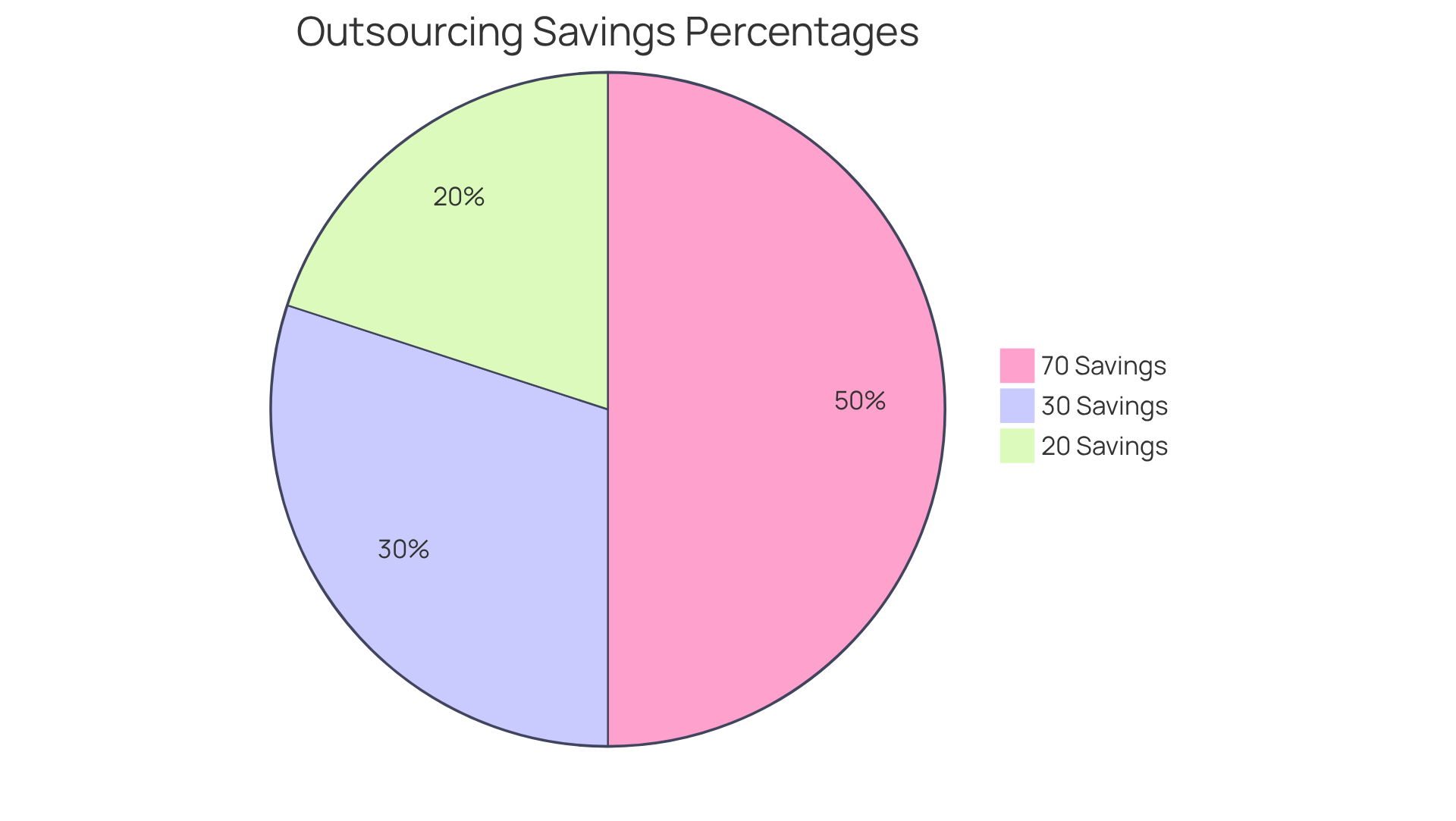

For instance, firms can realize savings of 20% to 30% in operational costs by engaging in outsourced software product development for specialized tasks. Some reports even suggest that outsourced software product development by partnering with teams in regions with lower labor costs can lead to savings of up to 70% on development expenses, all while still accessing top-tier talent. This strategy not only enhances cost efficiency but also allows investment firms to focus on their core strategies and strengthen client relationships.

Access Specialized Talent for Enhanced Project Outcomes

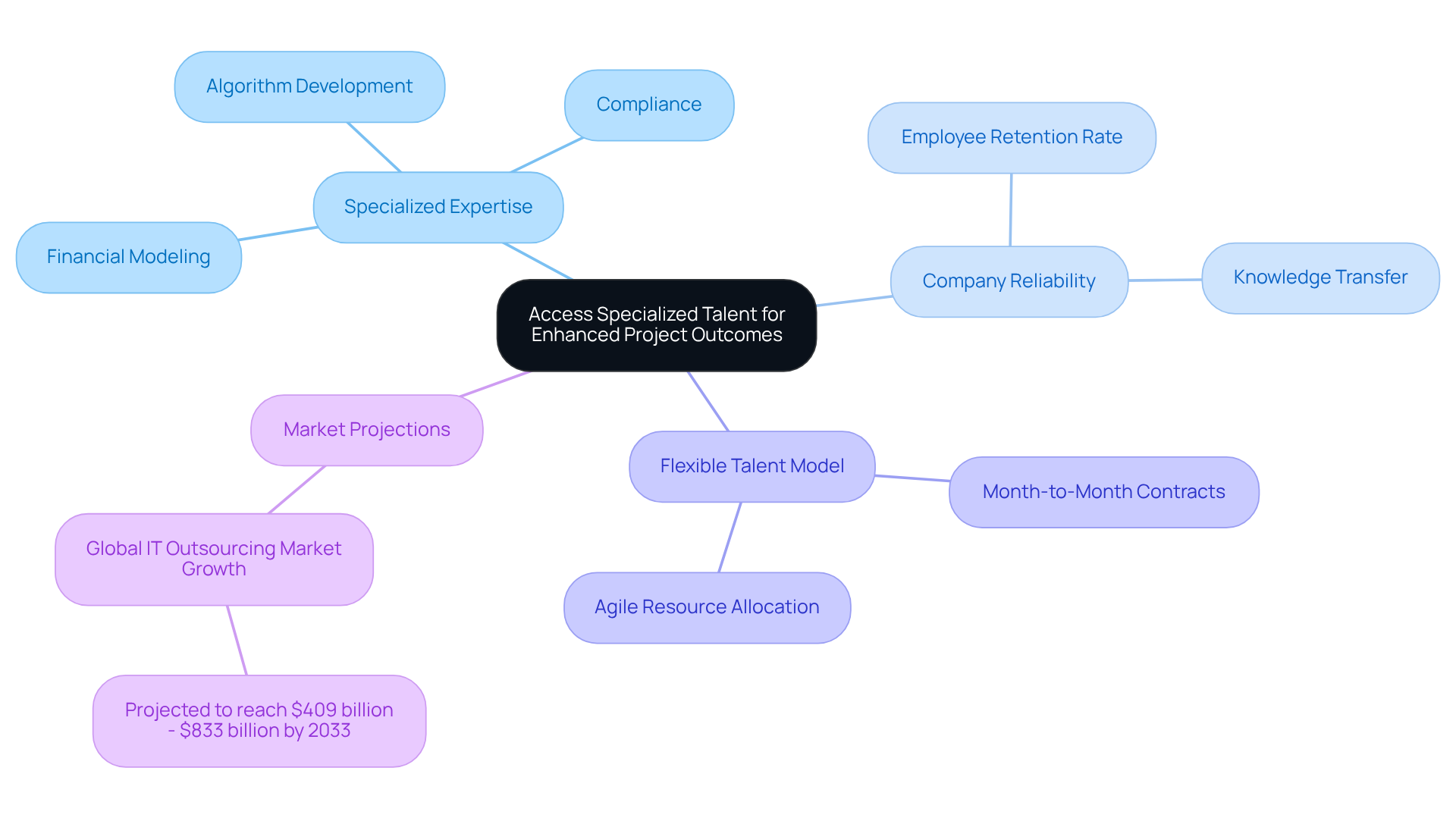

Outsourcing through outsourced software product development allows investment firms to tap into a global pool of specialized expertise that may not be readily available internally. This includes professionals adept in financial modeling, algorithm development, and compliance-essential components for developing robust software solutions. Collaborating with specialized companies like Neutech enables investment groups to improve project outcomes through innovative, tailored solutions.

Neutech exemplifies a commitment to reliability, demonstrated by a high employee retention rate, which ensures that clients remain secure despite potential staff turnover. Their flexible engineering talent model facilitates month-to-month contracts and agile resource allocation, optimizing project management. For example, a hedge fund could engage professionals skilled in machine learning to develop predictive analytics tools, significantly enhancing their investment strategies.

Neutech’s customized approach begins with a thorough assessment of client needs, providing specialized developers and designers who seamlessly integrate into existing teams. With a strong company culture that promotes camaraderie and support, Neutech ensures effective knowledge transfer, further bolstering reliability.

As the global IT outsourcing market is projected to reach between $409 billion and $833 billion by 2033, this strategic approach to outsourced software product development addresses the shortage of in-house expertise while aligning with the industry’s increasing dependence on advanced data analytics and technology-driven insights. As Kevin Ricci observes, businesses that adopt these trends will experience enhanced operational flexibility and continuous innovation.

Improve Time to Market with Efficient Outsourcing Strategies

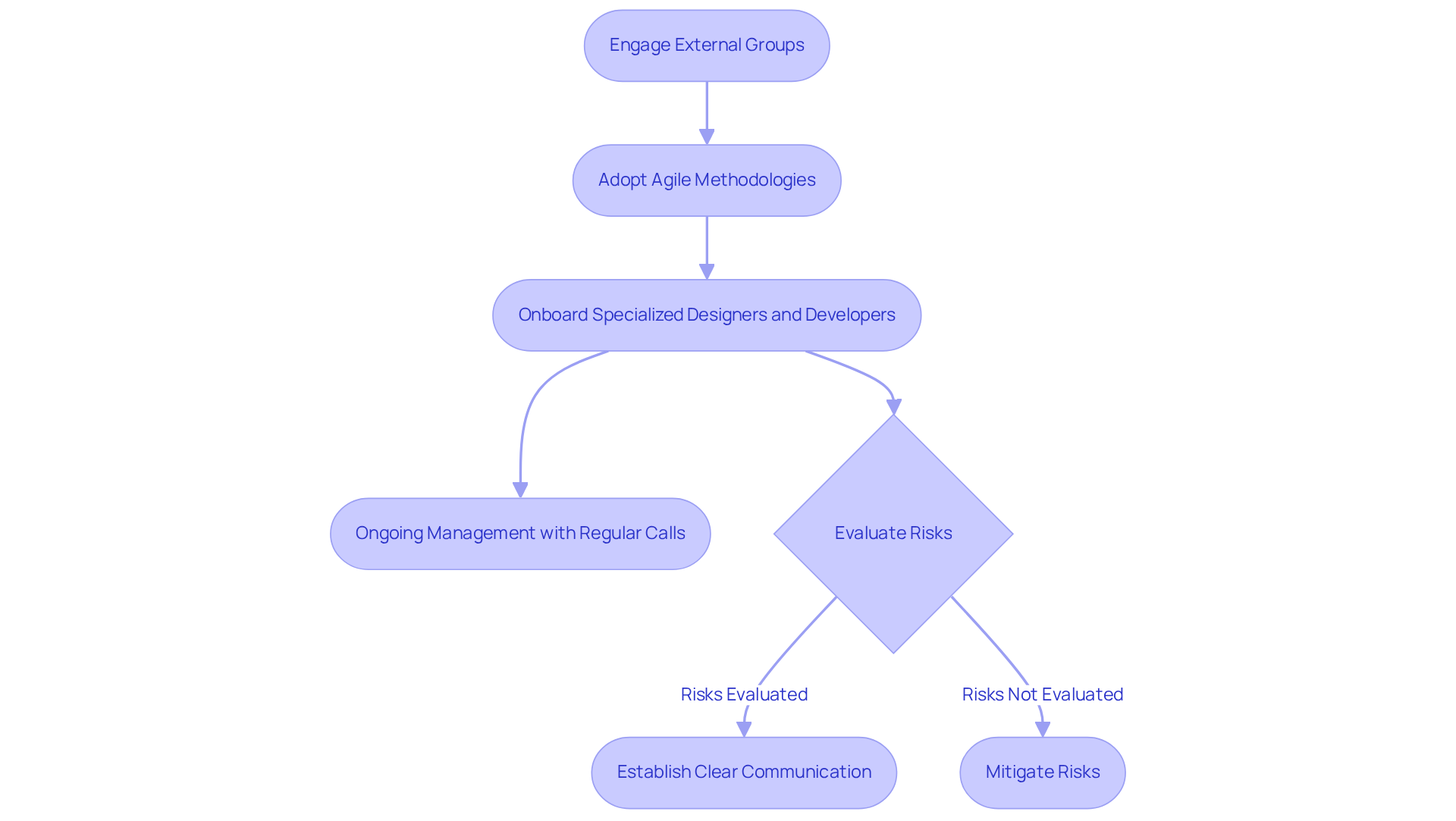

Outsourced software product development significantly reduces the time required to launch software products, allowing investment firms to accelerate their development cycles. By engaging external groups, these firms can adopt agile methodologies that facilitate rapid iterations and prompt feedback. This agility is essential in the fast-paced financial landscape, where being first to market can provide substantial competitive advantages. For example, an investment group that engages in outsourced software product development may successfully introduce a new trading platform weeks ahead of its competitors, thereby capturing market share and enhancing client satisfaction.

Neutech enhances this process by offering a complimentary consultation to assess client needs, followed by the provision of specialized designers and developers who seamlessly integrate into the client’s team. Once onboarded, Neutech ensures ongoing management through regular calls to reinforce the project roadmap and performance metrics.

Moreover, outsourced software product development allows investment firms to leverage advanced technology and expertise without incurring significant capital expenditures, as illustrated in the case study ‘Access to Advanced Technology and Expertise.’ Notably, 38% of US investment pools outsourced technology functions in 2020, indicating a growing trend within the industry.

However, it is crucial to consider potential risks, such as the loss of control over operations and increased reliance on third-party providers. Hedge managers should thoughtfully evaluate these factors and establish clear communication and governance frameworks to mitigate risks while reaping the benefits of outsourcing.

Utilize Workforce Scalability to Meet Dynamic Needs

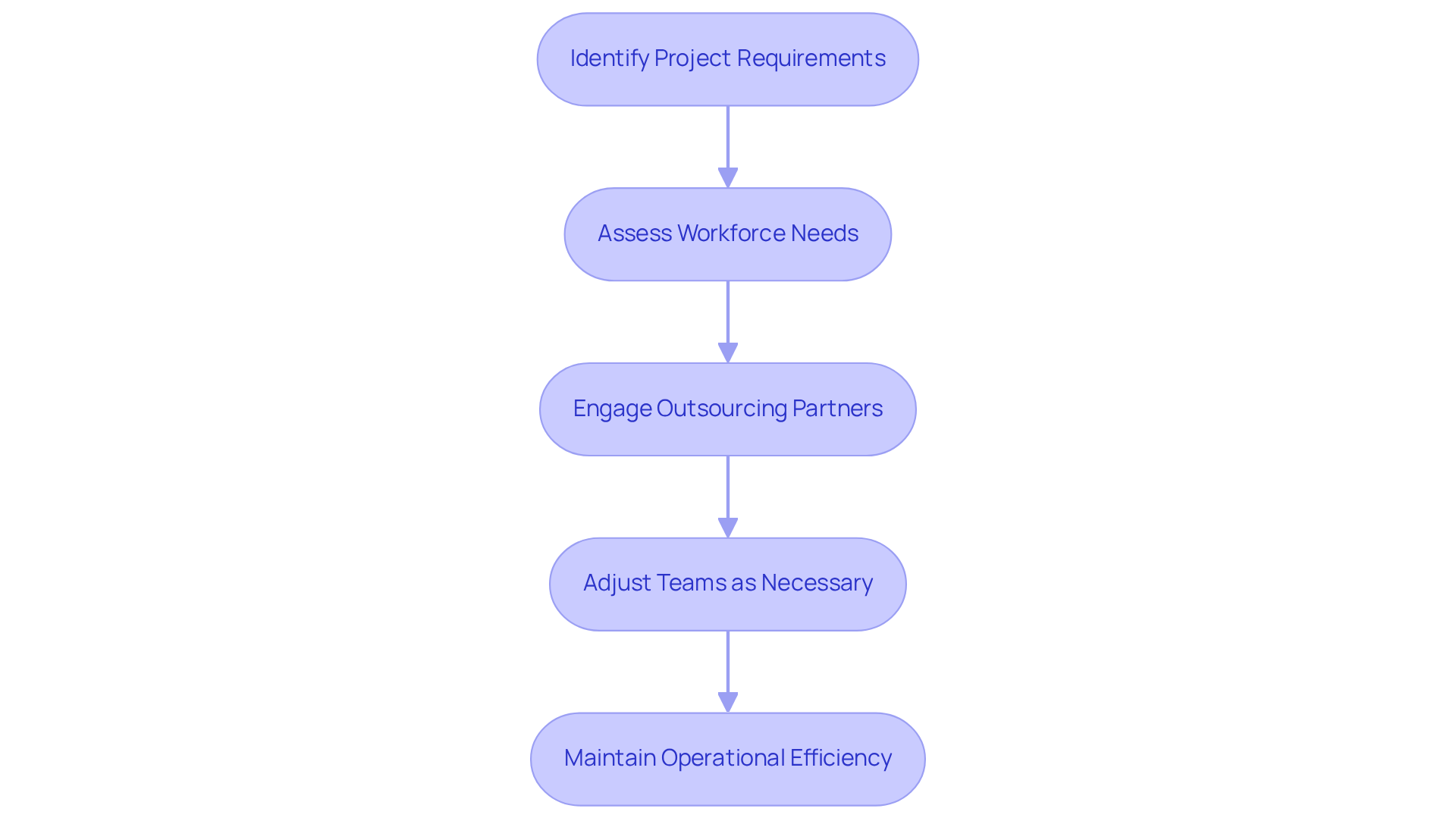

Outsourcing allows investment firms to adjust their workforce based on project requirements, eliminating the long-term commitment associated with hiring full-time employees. This flexibility is essential during peak trading periods or when introducing new products. For instance, investment groups may face sudden regulatory changes that necessitate a swift increase in their development teams. Neutech’s adaptable engineering talent model enables these firms to scale up rapidly, often with minimal lead time, ensuring they can respond to market fluctuations while maintaining operational efficiency.

With month-to-month agreements, investment groups can readily replace developers as necessary, retaining only the critical skills needed to stay within budget and address evolving project demands. Research indicates that nearly 50% of investment pools are considering or preparing to engage in outsourced software product development and other functions to manage costs effectively, highlighting a growing trend towards leveraging external expertise to navigate complex technological and regulatory landscapes. As David Goldstein, Director of Fund Services, observes, “They know that expertise is very potentially better off outsourced.”

This adaptability not only enhances responsiveness but also empowers investment groups to maintain a competitive edge in a rapidly changing market. A relevant case study underscores the increasing demand for data management services from external providers, demonstrating how investment groups are utilizing outsourced software product development to concentrate on core investment strategies.

Leverage Technology and Innovation for Competitive Edge

Outsourcing allows investment groups to leverage cutting-edge technologies and innovations without the ongoing burden of internal upgrades. By collaborating with specialized development companies like Neutech, investment firms gain access to advanced tools and platforms that significantly enhance their operational capabilities. Neutech’s client engagement process starts with a customized consultation to understand your company’s structure and needs, ensuring the selection of the appropriate engineering talent.

For example, cloud-based solutions streamline data management and analytics, empowering investment firms to make more informed decisions. Furthermore, external companies often possess the latest software development techniques, ensuring that investment groups stay at the forefront of technological advancement. With the IT offshoring market projected to exceed $806 billion by 2030, this strategic approach not only fosters innovation but also enables investment firms to respond swiftly to market changes and client demands.

As highlighted, “Firms that modernise incrementally will move faster and innovate with confidence,” underscoring the vital role of continuous improvement in sustaining a competitive advantage. Additionally, larger investment managers are increasingly outsourcing compliance and back-office operations to reduce costs and distinguish themselves in a competitive fundraising environment, further emphasizing the significance of this strategy in the current market landscape. With Neutech’s ongoing management and support, hedge investments can ensure that their development teams align with their strategic objectives, thereby enhancing their capacity to innovate and adapt.

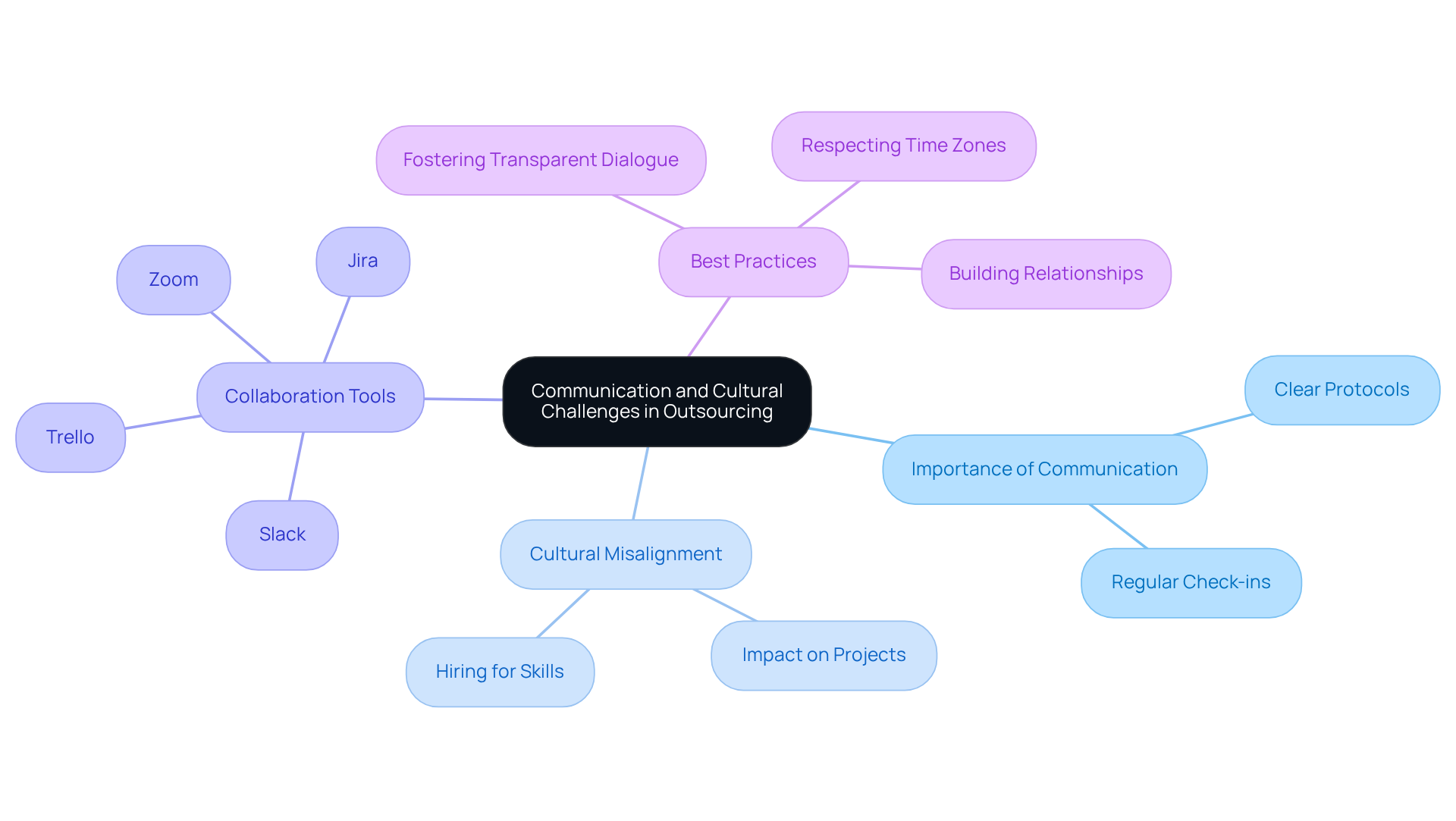

Navigate Communication and Cultural Challenges in Outsourcing

Effective communication is essential in outsourcing partnerships, particularly when collaborating with teams across diverse cultures and time zones. Hedge entities must prioritize the establishment of clear communication protocols to mitigate potential misunderstandings, as cultural misalignment accounts for the failure of 60% of offshore projects. Neutech acknowledges the importance of these intangible factors, hiring developers not solely for their technical expertise but also for their work ethic, communication skills, and leadership qualities.

Utilizing collaboration tools such as Jira, Trello, Zoom, or Slack can significantly enhance transparency and accountability. These tools ensure that all stakeholders remain aligned with project goals and expectations. Regular check-ins and feedback loops are vital for sustaining momentum and promptly addressing any issues that may arise. As Tom Fountain, CTO of Pneuron, observes, a lack of communication frequently derails projects.

By fostering a culture of transparent dialogue and respecting members involved in outsourced software product development, hedge organizations can substantially improve project outcomes and strengthen their collaborations with external teams. This is particularly effective when employing a flexible engineering talent model like Neutech’s, which allows for agile resource distribution and month-to-month agreements.

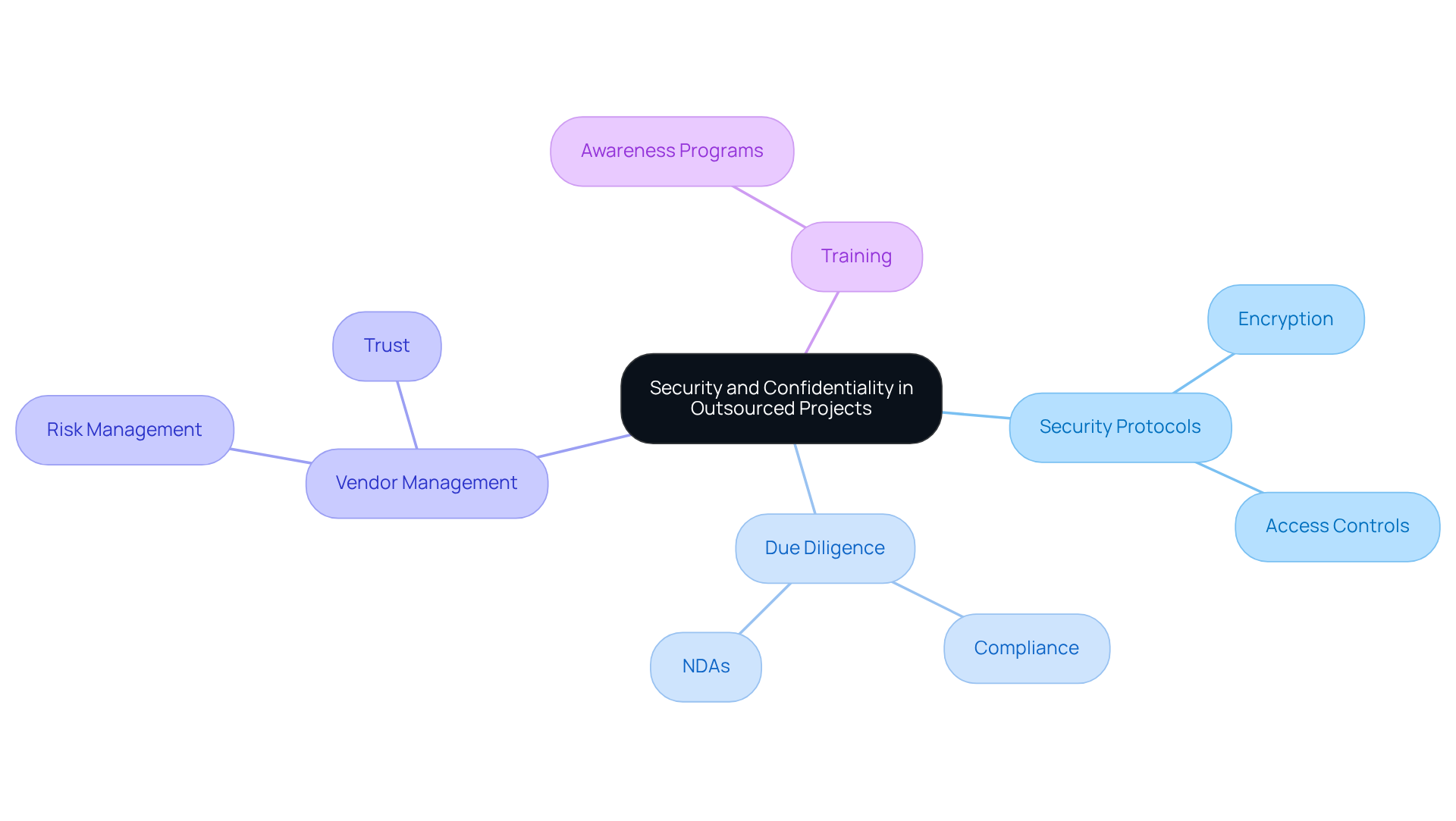

Ensure Security and Confidentiality in Outsourced Projects

Hedge agencies must prioritize security and confidentiality when contracting software development. Robust security protocols, including encryption and access controls, are essential for protecting sensitive data. A recent survey indicates that 78% of firms have increased their cybersecurity budgets over the past year, underscoring the growing importance of cyber resilience within the financial sector.

Conducting thorough due diligence on potential service partners is crucial to ensure compliance with industry standards and regulations. For example, requiring vendors to sign non-disclosure agreements (NDAs) effectively safeguards proprietary information. The Hedge Fund Association highlights an increasing emphasis on vendor risk management as investment firms strive to mitigate operational and reputational harm.

Establishing clear security measures not only mitigates risks associated with data breaches but also reinforces client trust, which is paramount in the financial sector. Furthermore, continuous security awareness training for all parties involved in the external service process can significantly strengthen the overall security posture, ensuring preparedness to identify and respond to potential threats.

A documented security management process, as emphasized in various case studies, is vital for maintaining compliance and effectively managing security risks.

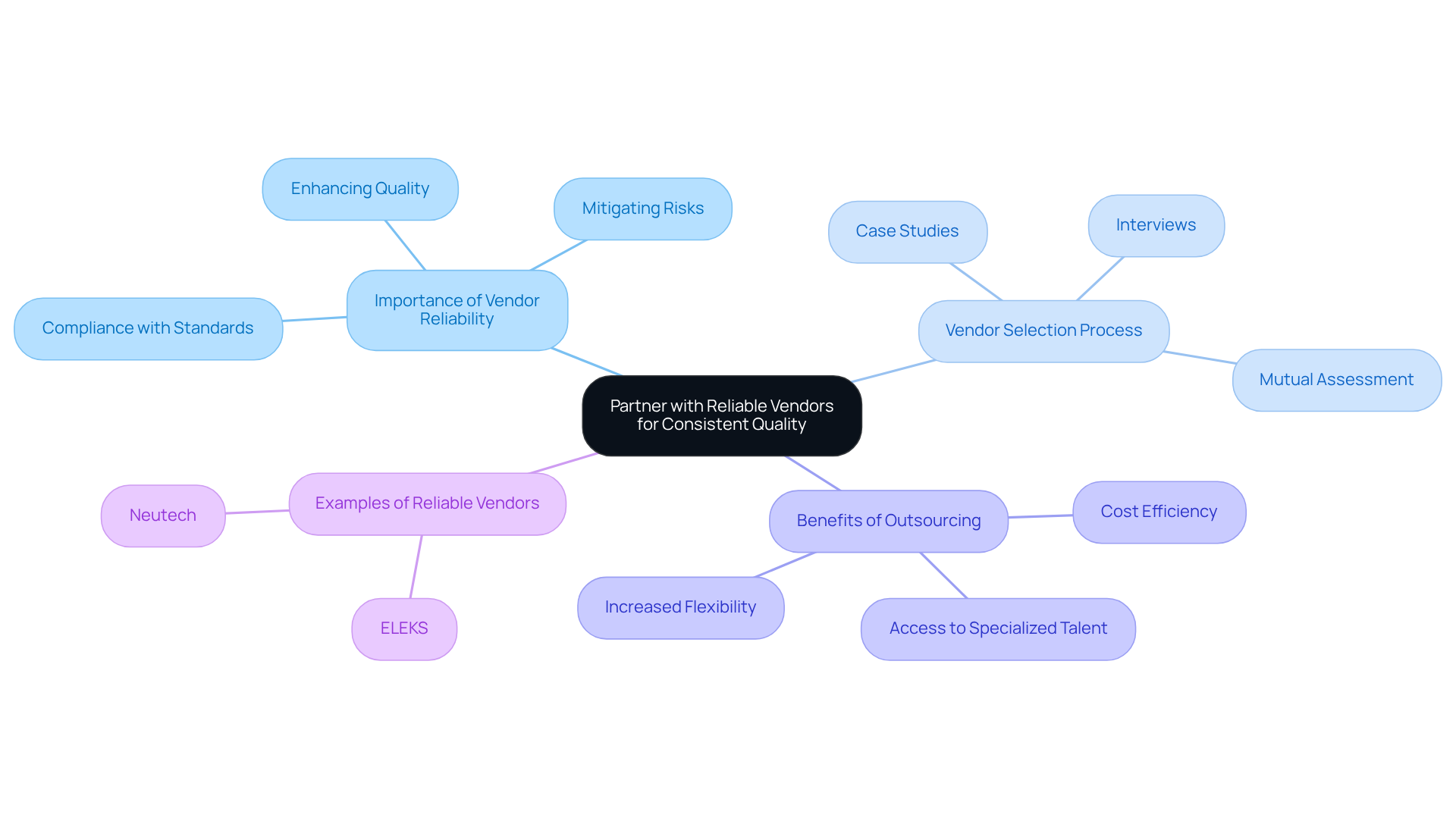

Partner with Reliable Vendors for Consistent Quality

Choosing the appropriate external partner is essential for ensuring consistent quality in software development, particularly for hedge funds. With 72% of companies engaging in outsourced software product development, vendors like Neutech, which have a proven track record in the financial services sector, become invaluable assets.

Neutech’s tailored engineering talent provision process begins with a mutual assessment of client needs, followed by supplying specialized developers and designers to seamlessly integrate into your team. Engaging in thorough interviews and reviewing case studies can provide insights into a vendor’s reliability and expertise. For instance, an investment group may partner with a provider specializing in regulatory compliance software, ensuring that their solutions conform to industry standards.

According to Deloitte, 77% of companies rely on outsourced software product development for IT infrastructure services and cybersecurity, highlighting the importance of vendor reliability in financial services outsourcing. By establishing collaborations with reliable suppliers such as Neutech, investment firms can significantly enhance the quality of their outsourced software product development while mitigating the risks associated with project failures. This strategic approach not only fosters innovation but also reinforces the investment group’s commitment to excellence in a highly regulated environment.

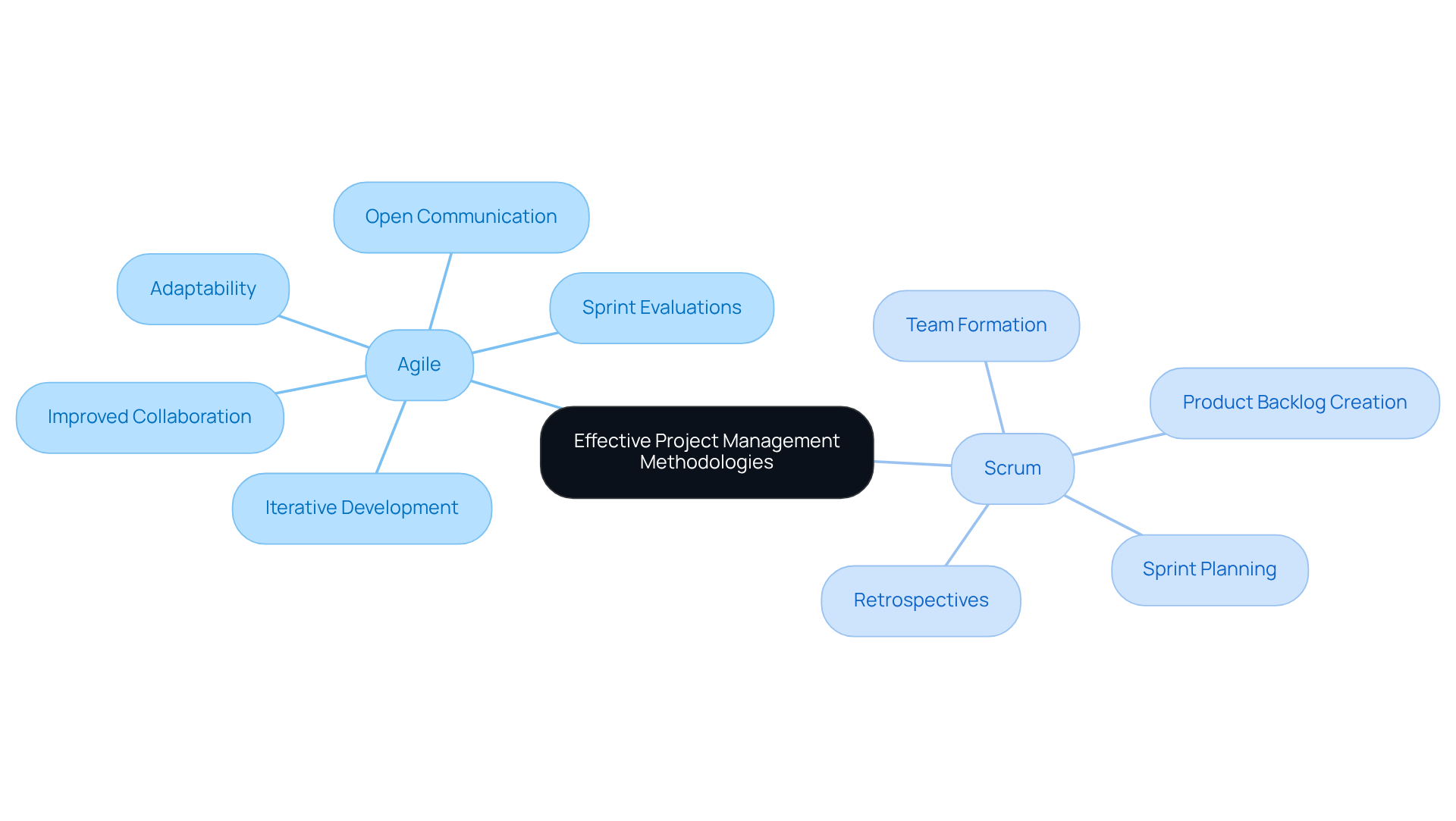

Implement Effective Project Management Methodologies

Effective project management is essential for successful outsourced software product development, particularly in the dynamic environment of hedge funds. By implementing methodologies such as Agile and Scrum, teams can significantly improve collaboration and adaptability throughout the software development lifecycle. These frameworks emphasize iterative development, allowing teams to respond swiftly to changes and incorporate feedback effectively.

Frequent sprint evaluations not only help ensure that projects remain aligned with business objectives but also foster open communication among team members. By adopting structured project management practices, hedge funds can enhance communication, streamline workflows, and ensure the timely delivery of high-quality outsourced software product development. This method has demonstrated a 40% improvement in project transparency and an increase in overall productivity, making it a strategic choice for financial services aiming to optimize their development processes.

At Neutech, we elevate this approach by offering a complimentary consultation to assess your specific needs. Once we understand your requirements, we provide tailored candidates-designers and developers-who integrate seamlessly into your team. Our ongoing management calls ensure continuous alignment with your roadmap and performance objectives, thereby enhancing the effectiveness of your project management initiatives.

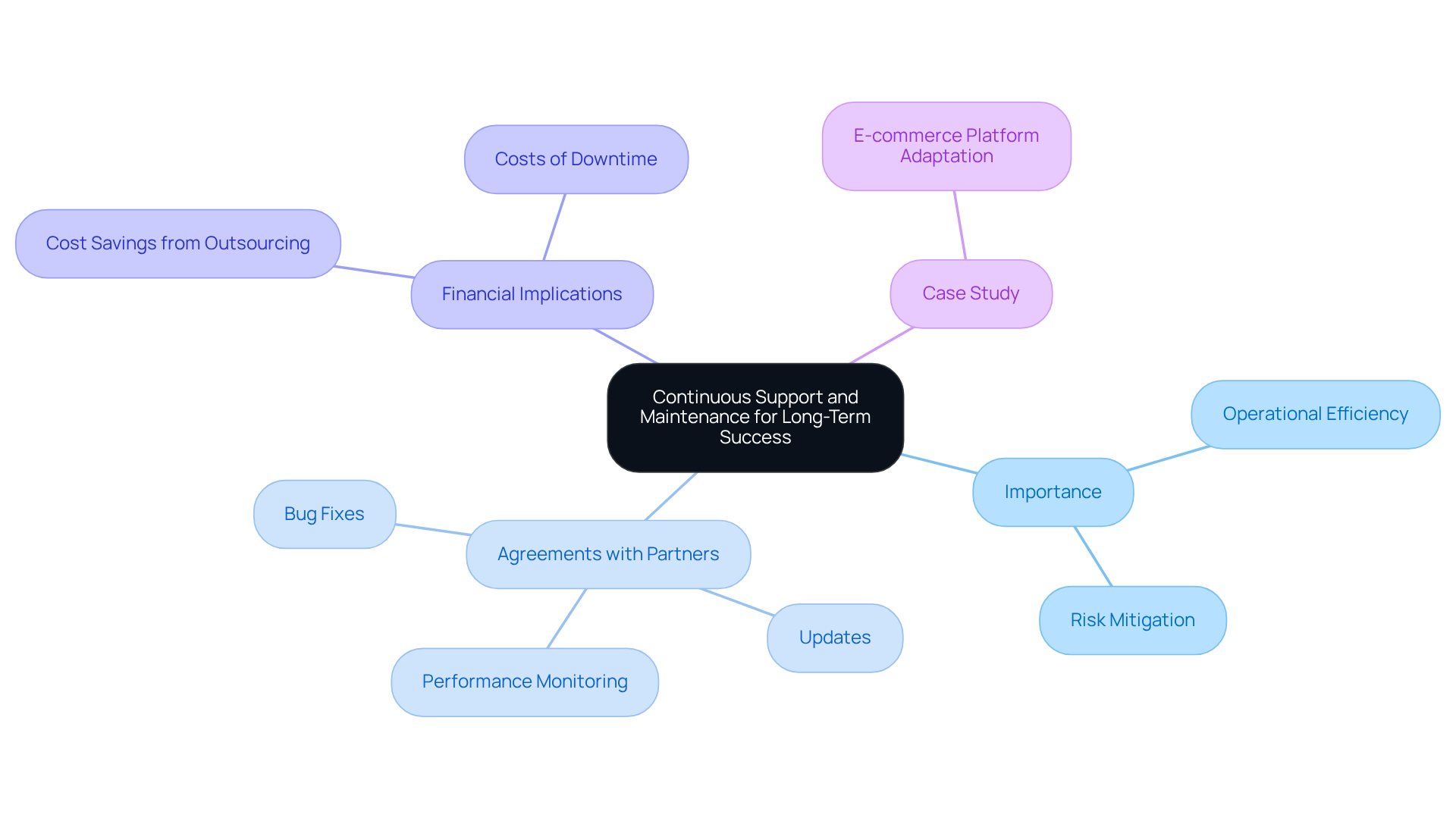

Secure Continuous Support and Maintenance for Long-Term Success

Outsourcing software development typically includes provisions for continuous support and maintenance, which are essential for the long-term success of software products. At Neutech, once we mutually determine your needs, we provide a selection of candidate designers and developers who can seamlessly integrate into your team.

Organizations should establish clear agreements with outsourcing partners regarding ongoing support services, encompassing bug fixes, updates, and performance monitoring. For instance, an investment group may require a supplier to offer round-the-clock support to swiftly address any issues that arise. Securing continuous support not only guarantees that software remains functional and secure but also aligns it with the evolving needs of the business. This proactive strategy can significantly enhance operational efficiency and mitigate risks associated with software failures, ultimately contributing to the hedge fund’s overall success.

Moreover, outsourcing IT services can result in savings of 30-40% compared to maintaining in-house capabilities. The average costs of downtime for enterprises range from $2.3K to $9K per minute, highlighting the financial implications of insufficient support. A notable example is the e-commerce platform for a leading retailer in Singapore, which successfully adapted to market changes through continuous support, underscoring the critical role of ongoing maintenance in achieving software success.

Conclusion

Outsourced software product development provides hedge funds with a strategic advantage by enhancing cost efficiency, granting access to specialized talent, and improving time-to-market capabilities. By leveraging external partnerships, investment firms can transform fixed costs into variable ones, allowing for greater flexibility and resource management. This strategy not only facilitates significant savings but also enables firms to focus on their core investment strategies while strengthening client relationships.

The article outlines several key benefits of outsourcing, including:

- The ability to access a global talent pool

- Utilizing advanced technologies without the burden of internal upgrades

- Dynamically scaling workforce resources to meet project demands

Effective communication and project management methodologies are essential for overcoming potential challenges, ensuring that projects remain aligned with business objectives. Furthermore, prioritizing security and confidentiality measures is crucial to protect sensitive data, thereby reinforcing client trust in outsourced partnerships.

As the financial landscape continues to evolve, the importance of adopting outsourced software development strategies is paramount. Investment groups are urged to explore these advantages to enhance operational efficiency, foster innovation, and maintain a competitive edge in a rapidly changing market. By embracing these practices, hedge funds can navigate complexities more effectively and position themselves for long-term success in an increasingly technology-driven environment.

Frequently Asked Questions

What are the cost benefits of outsourced software product development?

Outsourced software product development allows firms to reduce overhead costs associated with hiring, training, and retaining in-house personnel, transforming fixed expenses into variable ones. Firms can achieve savings of 20% to 30% in operational costs, and partnering with teams in regions with lower labor costs can lead to savings of up to 70% on development expenses.

How does outsourcing help firms access specialized talent?

Outsourcing enables investment firms to tap into a global pool of specialized expertise that may not be available internally, including skills in financial modeling, algorithm development, and compliance. Collaborating with specialized companies like Neutech enhances project outcomes through tailored solutions and reliable talent.

What is Neutech’s approach to outsourced software product development?

Neutech begins with a thorough assessment of client needs and provides specialized developers and designers who integrate seamlessly into existing teams. They promote a strong company culture and ensure effective knowledge transfer, which enhances reliability and project success.

How does outsourcing improve time to market for software products?

Outsourced software product development accelerates development cycles by allowing investment firms to adopt agile methodologies that enable rapid iterations and prompt feedback. This agility can help firms launch new products faster than competitors, capturing market share and improving client satisfaction.

What trends are observed in the outsourcing of technology functions in the investment industry?

The global IT outsourcing market is projected to grow significantly, with 38% of US investment pools outsourcing technology functions in 2020. This trend reflects the industry’s increasing dependence on advanced data analytics and technology-driven insights.

What risks should firms consider when outsourcing software development?

Potential risks include the loss of control over operations and increased reliance on third-party providers. Firms should evaluate these risks and establish clear communication and governance frameworks to mitigate them while benefiting from outsourcing.