Introduction

In the high-stakes realm of hedge funds, the intricacies of software development outsourcing present both significant opportunities and formidable challenges. As firms seek to enhance operational efficiency while adhering to a stringent regulatory framework, grasping the nuances of outsourcing becomes essential. Hedge funds must consider strategies that ensure their software projects not only comply with regulatory standards but also foster innovation and agility. This article explores best practices for outsourcing software projects within the hedge fund sector, providing insights into how to maximize benefits while effectively navigating potential pitfalls.

Understand Software Development Outsourcing in the Hedge Fund Sector

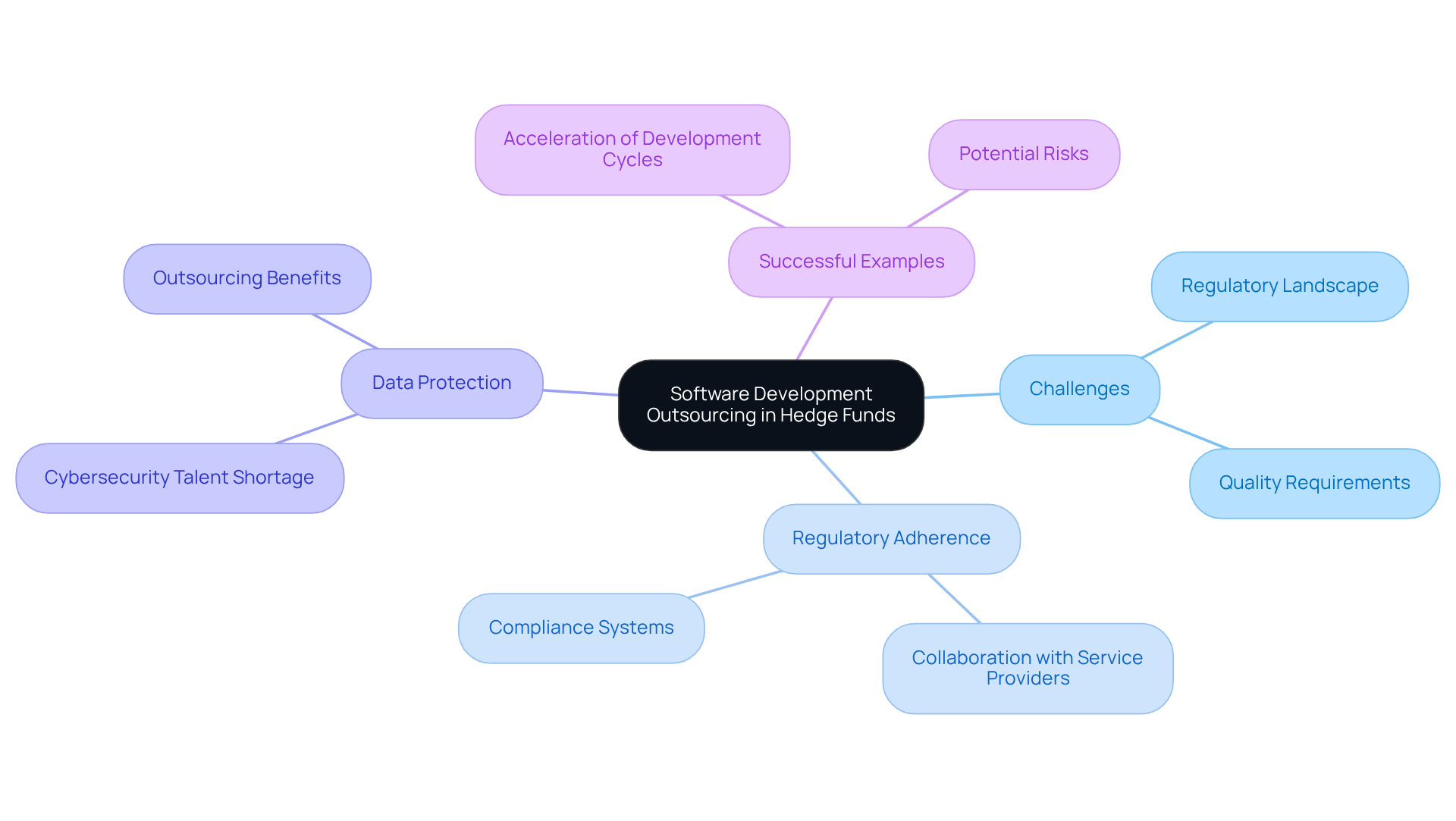

The hedge investment sector faces distinct challenges when attempting to outsource software projects, primarily due to the stringent regulatory landscape and the necessity for high-quality, secure applications. Hedge funds require specialized software solutions capable of handling complex financial modeling, risk assessment, and regulatory reporting. A profound comprehension of these particular requirements is essential for effectively outsourcing software projects, particularly in relation to data security and regulatory adherence.

The impact of regulatory adherence on software procurement in financial services is significant. Hedge funds must navigate a complex web of regulations that dictate how data is handled and reported. This necessitates collaboration with external service providers who not only understand these regulations but also have robust systems in place to ensure compliance. Recent collaborations, such as Brevan Howard’s alliance with Behavox, underscore the importance of integrating regulatory solutions that oversee corporate communications to mitigate risks associated with market abuse and misconduct.

Moreover, the importance of data protection in investment management software cannot be overstated. With a reported 30% shortage in cybersecurity talent, many organizations are increasingly relying on specialized service providers to enhance their defenses. Outsourcing cybersecurity functions has proven effective, with mid-sized banks reporting a 40% reduction in security breach risks while maintaining compliance. This trend highlights the necessity for investment firms to outsource software projects to external entities that prioritize data security and regulatory compliance.

Successful examples of how companies outsource software projects in the financial services sector further illustrate the advantages of strategic partnerships. Companies that leverage third-party IT representatives can accelerate development cycles by up to 50%, thereby enhancing their responsiveness to market demands. As investment groups increasingly adopt external services, they must remain vigilant to potential risks, such as losing oversight of critical processes and ensuring effective communication with outside partners. By prioritizing regulatory compliance and data protection, hedge management firms can navigate the complexities of subcontracting while improving their operational efficiency.

Leverage Key Benefits of Outsourcing for Hedge Funds

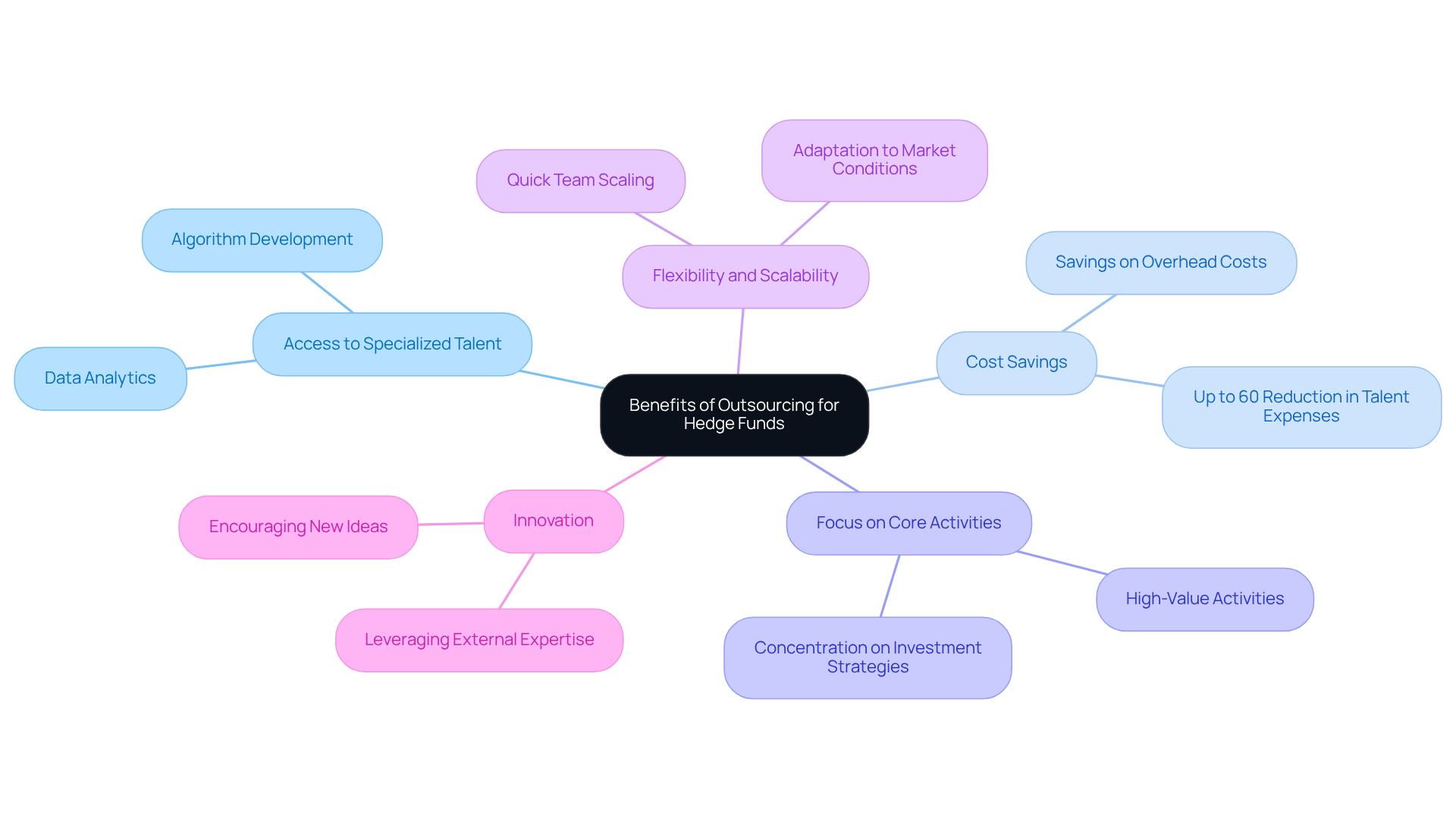

Hedge investment groups can gain significant advantages when they outsource software projects, particularly through a tailored approach like that offered by Neutech. A primary benefit is access to specialized talent and expertise that may be limited in-house, especially in niche areas such as algorithm development and data analytics. This access is crucial, as approximately 70% of organizations cite cost savings as the main reason for external hiring, with potential reductions of up to 60% in talent expenses compared to local recruitment.

Neutech initiates this process with a complimentary consultation to assess your company’s setup and specific needs. Once these needs are clearly defined, Neutech provides a selection of candidate designers and developers who can seamlessly integrate into your team. This customized engagement not only minimizes overhead costs associated with hiring and training internal staff but also enables hedge funds to allocate resources more effectively. Such flexibility allows firms to scale operations in response to market conditions and project demands, a critical capability in the fast-paced financial landscape where agility can offer a competitive advantage.

Moreover, by choosing to outsource software projects, internal teams can concentrate on core investment strategies, dedicating more time to high-value activities rather than routine maintenance. Neutech’s ongoing management calls ensure that the integration of their talent remains aligned with your roadmap and performance objectives. This strategic focus not only boosts productivity but also encourages innovation, as teams can leverage external expertise to advance their initiatives. Furthermore, over 85% of companies report that their external partnerships meet or exceed expectations, underscoring the effectiveness of this strategy.

As the trend of nearshoring continues to grow, investment firms can take advantage of time zone alignment and cultural similarities, which facilitate real-time collaboration and agile development solutions. However, it is vital to select external partners judiciously; choosing providers based solely on cost can result in quality issues and higher long-term expenses. In summary, an investment firm’s operational strategy can benefit from outsourcing software projects, especially through Neutech’s comprehensive engineering solutions, leading to substantial cost reductions and improved efficiency.

Select the Right Outsourcing Partner for Compliance and Quality

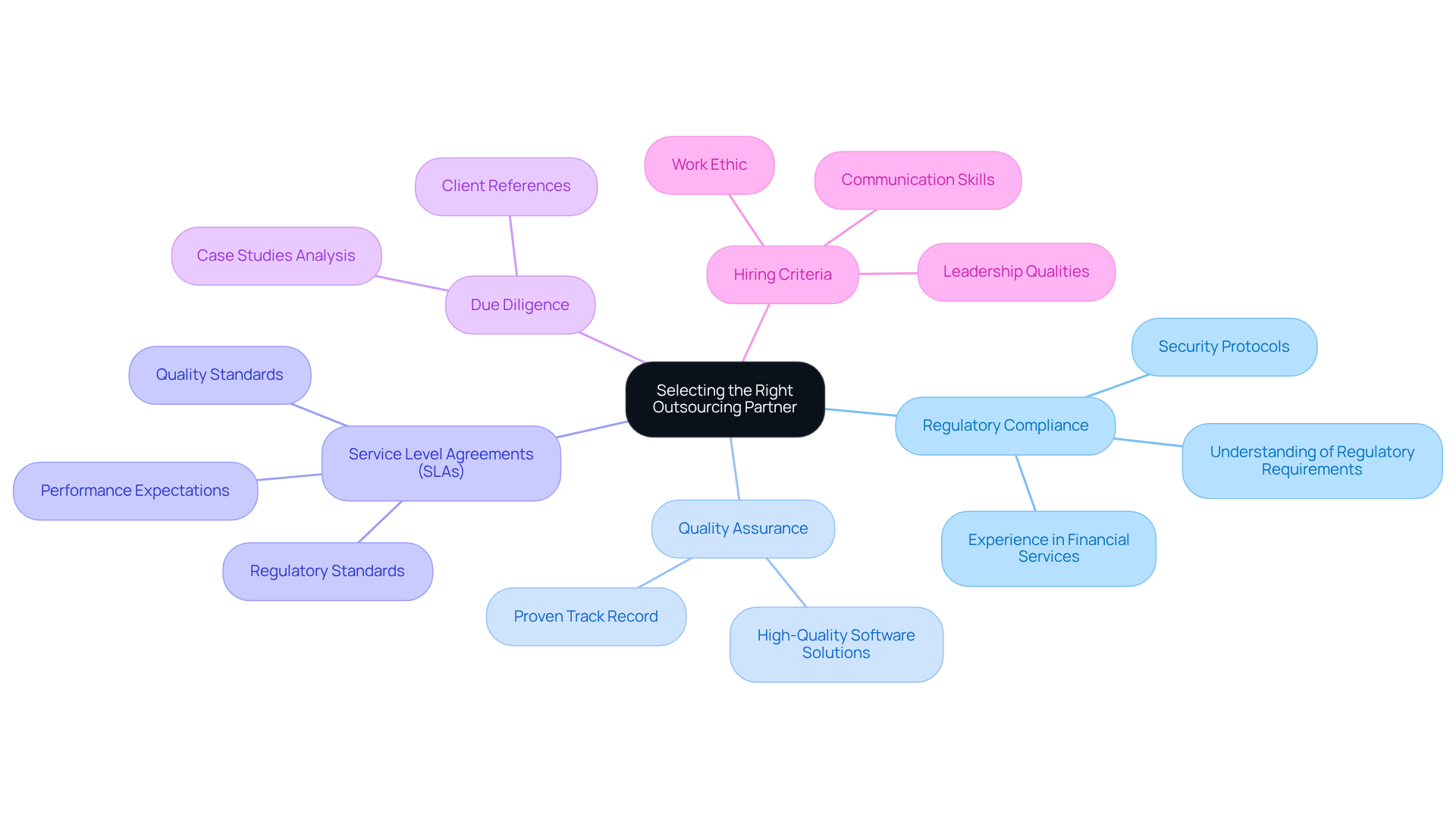

In pursuing outsourcing alliances, investment firms must prioritize regulations and quality to safeguard their operations. A partner’s demonstrated experience within the financial services sector, a robust understanding of regulatory requirements, and a proven track record of delivering high-quality software solutions are essential criteria for selection. At Neutech, we understand that security protocols are paramount; partners must implement stringent measures to protect sensitive financial data from breaches.

Creating clear service level agreements (SLAs) is crucial, as these documents define expectations related to performance, quality, and regulatory standards. Furthermore, Neutech’s commitment to reliability is evident in our focus on hiring developers based on their work ethic, communication skills, and leadership qualities-intangible assets vital in regulated industries. Our tailored engineering talent provision process begins with assessing client needs, enabling us to supply specialized developers and designers who can seamlessly integrate into your team. This flexibility allows investment firms to adjust their staffing solutions as necessary.

Conducting thorough due diligence, such as reviewing client references and analyzing case studies, empowers investment groups to identify partners that not only meet operational needs but also adhere to necessary compliance standards. This meticulous approach ensures that investment groups can confidently navigate the complexities involved when they outsource software projects while maintaining regulatory integrity.

Implement Effective Management Strategies for Outsourced Projects

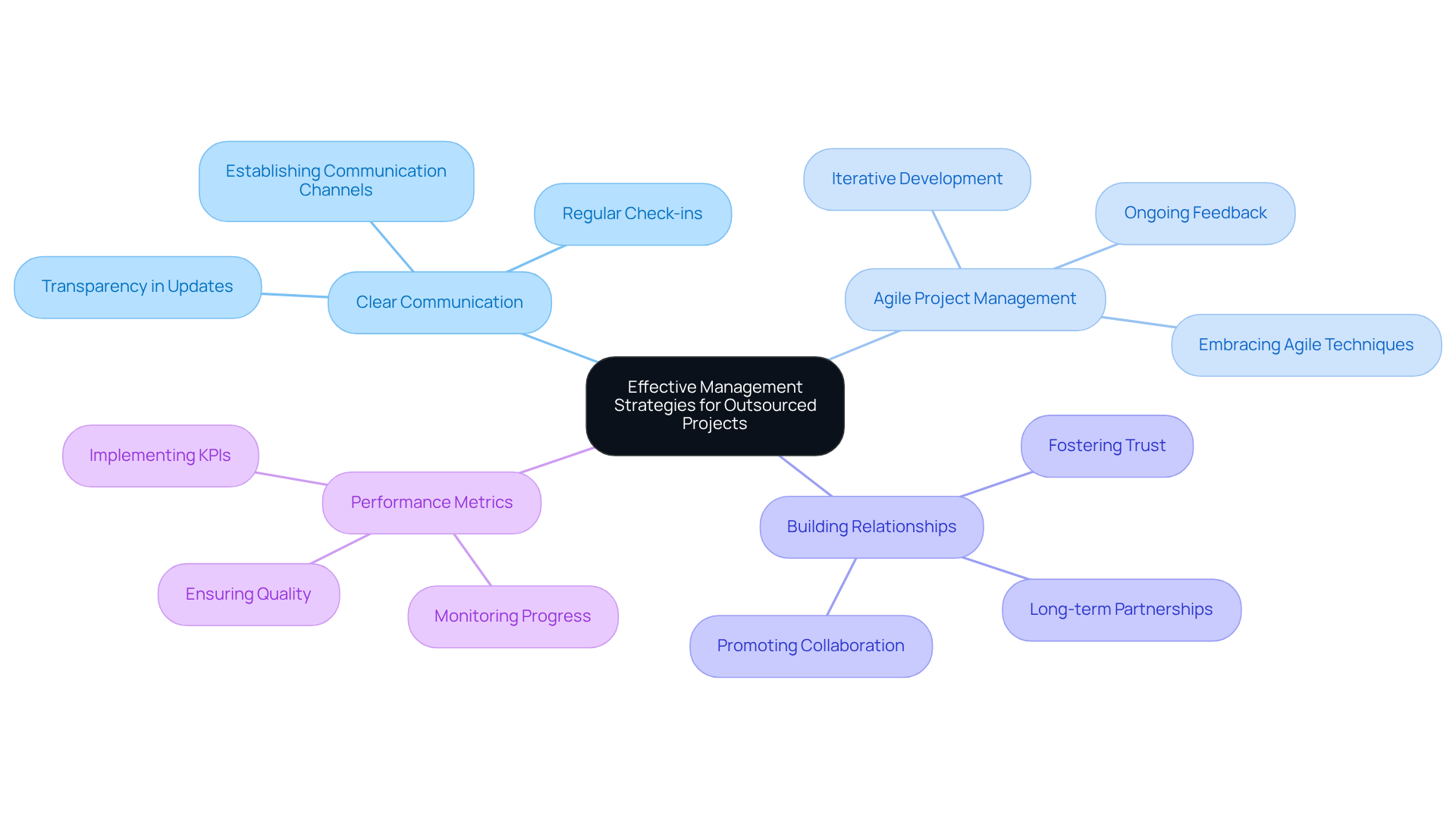

To effectively manage outsourced software projects, investment groups must implement several essential strategies. First and foremost, establishing clear communication channels is crucial for aligning all stakeholders on project goals and expectations. Regular check-ins and updates foster transparency, enabling prompt resolution of any issues that may arise.

Moreover, embracing agile project management techniques enhances adaptability and responsiveness to changing requirements. This approach facilitates iterative development and ongoing feedback, which is particularly fitting for the fast-paced investment environment.

Building strong relationships with partners is vital when you outsource software projects. Such relationships promote collaboration and trust, both of which are key to achieving successful project outcomes.

Finally, implementing robust performance metrics and key performance indicators (KPIs) allows hedge funds to monitor project progress and quality. This ensures that final deliverables consistently meet their high standards.

Conclusion

Outsourcing software projects offers hedge funds a significant opportunity to enhance efficiency and effectively navigate the complexities of the financial landscape. By recognizing the unique challenges within this sector – such as stringent regulatory requirements and the demand for high-quality applications – investment firms can strategically utilize outsourcing to fulfill their operational needs while ensuring compliance and safeguarding data security.

Key insights emphasize the critical nature of selecting the appropriate outsourcing partner, highlighting the necessity for substantial experience in financial services and a steadfast commitment to quality. The advantages of outsourcing, including access to specialized talent and considerable cost savings, are reinforced by successful case studies that illustrate enhanced operational agility and productivity. Furthermore, effective management strategies – such as clear communication and agile methodologies – are essential to ensure that outsourced projects align with the firm’s objectives and regulatory standards.

Ultimately, embracing outsourcing in software development not only addresses immediate operational challenges but also positions hedge funds for sustained success. By prioritizing compliance, quality, and strategic partnerships, investment firms can explore new avenues for growth and innovation, thereby maintaining competitiveness in an ever-evolving market. Implementing these best practices will empower hedge funds to adeptly navigate the complexities of software outsourcing while achieving their strategic objectives.

Frequently Asked Questions

What are the main challenges of software development outsourcing in the hedge fund sector?

The main challenges include navigating a stringent regulatory landscape and the need for high-quality, secure applications tailored for complex financial modeling, risk assessment, and regulatory reporting.

Why is regulatory adherence important in software procurement for hedge funds?

Regulatory adherence is crucial because hedge funds must comply with complex regulations that dictate how data is handled and reported, necessitating collaboration with service providers who understand these regulations and ensure compliance.

Can you provide an example of a collaboration that emphasizes regulatory solutions in the hedge fund sector?

An example is Brevan Howard’s alliance with Behavox, which focuses on integrating regulatory solutions to oversee corporate communications and mitigate risks associated with market abuse and misconduct.

What is the significance of data protection in investment management software?

Data protection is vital due to the reported 30% shortage in cybersecurity talent, leading organizations to rely on specialized service providers to enhance their defenses and maintain compliance.

How effective is outsourcing cybersecurity functions for investment firms?

Outsourcing cybersecurity functions has proven effective, with mid-sized banks reporting a 40% reduction in security breach risks while still maintaining compliance.

What advantages do companies gain from outsourcing software projects in the financial services sector?

Companies can accelerate development cycles by up to 50%, enhancing their responsiveness to market demands through strategic partnerships with third-party IT representatives.

What risks should investment groups be aware of when outsourcing software projects?

Investment groups should be cautious of losing oversight of critical processes and the importance of maintaining effective communication with outside partners.

How can hedge management firms navigate the complexities of subcontracting?

By prioritizing regulatory compliance and data protection, hedge management firms can improve their operational efficiency while managing the challenges of outsourcing.