Master Risk and Compliance Software Solutions for Hedge Funds

Introduction

Navigating the intricate realm of hedge fund management necessitates a profound understanding of risk and compliance software solutions, which have become essential tools for investment groups. These solutions not only facilitate regulatory compliance but also bolster risk assessment capabilities, enabling firms to adapt to a constantly changing financial landscape. As the regulatory environment becomes increasingly complex, hedge funds must consider how to select and implement the appropriate software to effectively manage these challenges while seizing potential opportunities.

Define Risk and Compliance Software Solutions

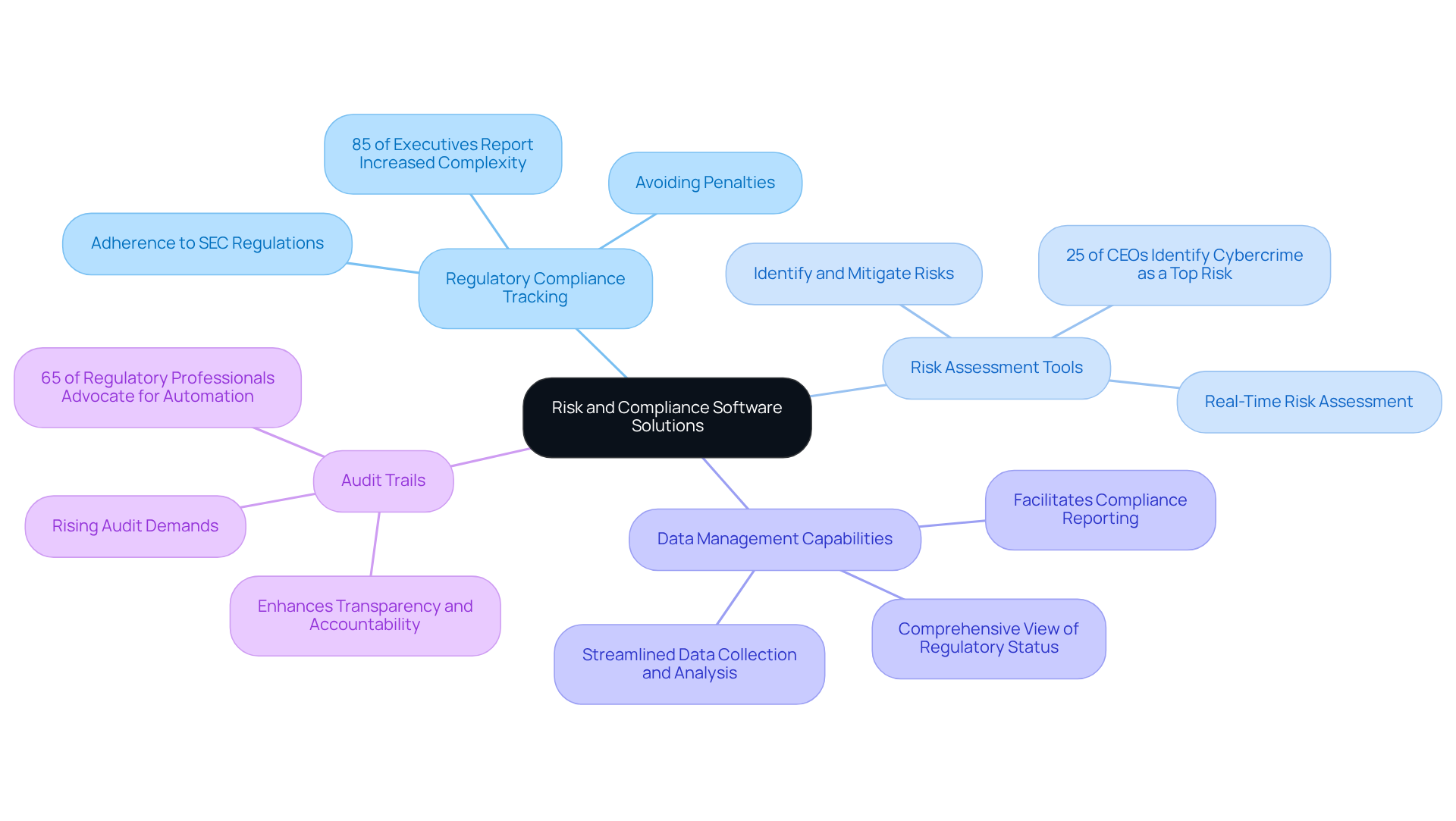

Risk and compliance software solutions serve as essential tools for investment groups, enabling them to navigate the intricate landscape of regulatory obligations and risk management effectively. These solutions incorporate several key features:

- Regulatory Compliance Tracking: This feature guarantees adherence to industry-specific laws and regulations, such as SEC regulations and GIPS standards, which are vital for maintaining investor trust and avoiding penalties. Notably, 85% of executives believe that regulatory requirements have become increasingly complex over the past three years, underscoring the necessity for robust tracking tools.

- Risk Assessment Tools: These tools empower investment firms to identify, analyze, and mitigate potential risks associated with their strategies. As market conditions shift, the capacity to assess risks in real-time becomes crucial, particularly as 25% of CEOs identify cybercrime as a top three risk, a significant increase from 19% in 2024.

- Data Management Capabilities: Effective data management is essential for compliance reporting and risk analysis. By facilitating the collection, storage, and examination of data, these tools help hedge funds maintain a comprehensive view of their regulatory status and risk exposure.

- Audit Trails: Keeping detailed logs of all transactions and compliance activities enhances transparency and accountability. This aspect is increasingly important as organizations face rising audit demands, with 65% of regulatory professionals advocating for automation to streamline these processes.

Understanding these components allows investment groups to evaluate their system requirements more effectively and select risk and compliance software solutions that meet their operational goals and regulatory obligations. The global risk management technology market is projected to reach USD 35.9 billion by 2032, growing at a CAGR of 13% from 2024 to 2032, reflecting the escalating demand for advanced tracking tools within the financial services sector.

Evaluate Key Selection Criteria for Software Solutions

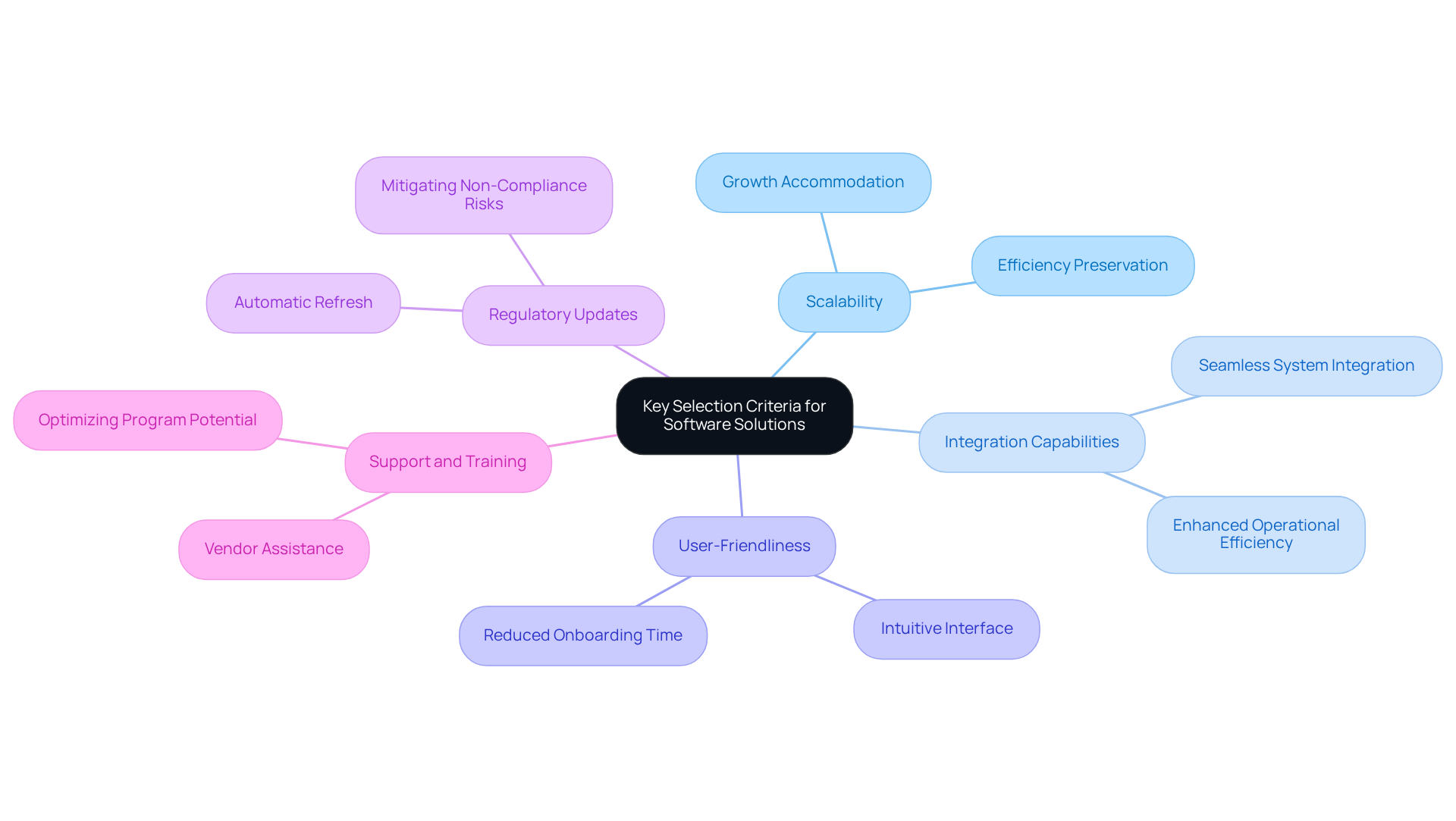

When selecting risk and compliance software solutions, hedge funds must prioritize several key criteria to ensure effective management of their operations:

- Scalability: The software should be designed to grow alongside the organization, accommodating increasing data volumes and user demands. This flexibility is crucial for preserving efficiency as the investment group expands.

- Integration Capabilities: Seamless integration with existing systems, such as trading platforms and data analytics tools, is essential. For instance, a hedge fund that partnered with Innovative Network Solutions successfully established a structured security program by integrating their regulatory tools with existing resources, thereby enhancing operational efficiency and adherence. As Robert E. Davis observes, “The regulatory environment has become more intricate, necessitating entities to show adherence through documented assurance assessments.”

- User-Friendliness: An intuitive interface is vital for ensuring that all team members can effectively utilize the application without extensive training. This accessibility can significantly reduce onboarding time and improve overall productivity.

- Regulatory Updates: The application should automatically refresh to reflect changes in regulations, ensuring continuous adherence. This feature is particularly important in the fast-evolving regulatory landscape, where staying compliant can mitigate risks associated with non-compliance. Recent discussions highlight that the costs associated with a security breach can far exceed the costs of implementing compliance protocols.

- Support and Training: It is important to evaluate the level of customer support and training provided by the vendor. Adequate assistance ensures that your group can optimize the program’s potential, resulting in improved adherence outcomes and operational effectiveness.

By carefully assessing these criteria, hedge funds can select risk and compliance software solutions that not only meet their current needs but also adapt to future challenges, ultimately enhancing their risk management and compliance capabilities.

Implement Effective Strategies for Software Deployment

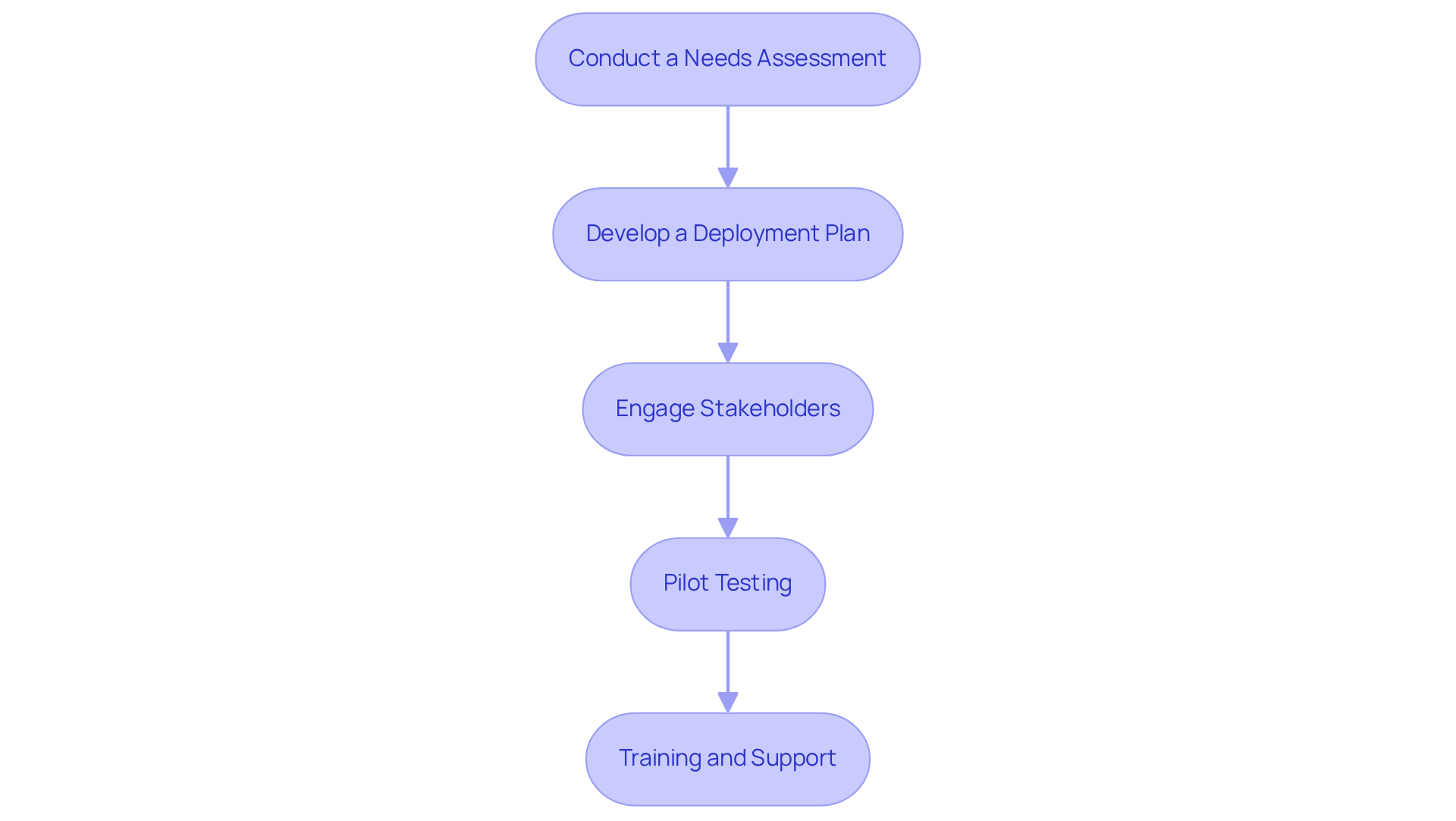

To ensure a successful deployment of risk and compliance software solutions, hedge funds should implement several key strategies:

-

Conduct a Needs Assessment: Prior to deployment, evaluating the specific requirements of the organization is essential. This assessment allows for a customized system configuration that meets unique operational demands. Notably, over 60% of hedge funds conduct needs evaluations before implementation, underscoring its significance.

-

Develop a Deployment Plan: A comprehensive deployment plan should clearly outline timelines, responsibilities, and key milestones. This structured approach guides the implementation process and helps manage expectations effectively.

-

Engage Stakeholders: Early involvement of key stakeholders from various departments is crucial. Their input enriches the assessment process and fosters buy-in, which is vital for successful adoption. Experts assert that stakeholder engagement can significantly enhance the effectiveness of software deployment.

-

Pilot Testing: Implementing a pilot phase allows the application to be tested in a controlled environment. This step is critical for identifying potential issues and making necessary adjustments before full-scale deployment. For example, a hedge fund that conducted a pilot test was able to identify integration issues early, ultimately saving time and resources.

-

Training and Support: Comprehensive training for all users is essential to maximize the program’s effectiveness. Establishing a robust support system ensures that any post-deployment issues are promptly addressed, facilitating a smoother transition. Common pitfalls include inadequate training and lack of ongoing support, which can hinder user adoption.

By following these strategies, investment groups can significantly improve the chances of a smooth transition and efficient use of their new risk and compliance software solutions, which ultimately leads to better risk management and regulatory outcomes.

Ensure Continuous Improvement and Compliance Adaptation

To effectively manage risks and maintain compliance, hedge funds must cultivate a culture of continuous improvement through essential practices:

-

Regular Compliance Audits: Periodic audits are vital for assessing adherence to regulations and identifying areas needing enhancement. Notably, 37% of organizations conduct one or more internal regulatory audits annually. This proactive strategy guarantees adherence and mitigates risks linked to noncompliance, as organizations that frequently assess their adherence measures can significantly lower the chances of financial penalties.

-

Feedback Mechanisms: Establishing robust channels for user input on application performance and adherence processes is crucial. By actively seeking feedback from stakeholders, hedge funds can refine their regulatory strategies, leading to improved system functionality and overall performance. As highlighted in the case study “Establish a Culture of Feedback,” organizations that implement feedback mechanisms can continuously enhance their compliance strategies, resulting in better outcomes.

-

Stay Informed on Regulatory Changes: Keeping abreast of evolving regulations and industry standards is essential for ensuring that technological solutions remain compliant. Organizations that embrace adaptability can navigate regulatory changes effectively, maintaining compliance and avoiding potential penalties.

-

Invest in Training: Continuous training for staff is essential to ensure they are knowledgeable about the latest regulatory requirements and software capabilities. An informed workforce is better prepared to recognize regulatory gaps and propose enhancements, fostering a culture of accountability. As Finn O’Brien, Operations Manager, states, “Continuous improvement is essential for effective compliance management in today’s dynamic regulatory environment.”

-

Leverage Technology: Utilizing advanced analytics and reporting tools enables investment groups to monitor adherence metrics and identify trends that may require strategic adjustments. Organizations that implement automation in their compliance processes can save significant resources while enhancing operational efficiency.

By embedding these practices into their operational framework, hedge funds can bolster their resilience and ensure that their risk and compliance software solutions continue to be effective and aligned with regulatory demands over time. Furthermore, it is crucial to identify potential challenges in regulatory management, such as reliance on outdated tools or inadequate training, which can obstruct adherence efforts. Proactively addressing these challenges will further enhance the effectiveness of compliance strategies.

Conclusion

Navigating the complexities of risk and compliance is essential for hedge funds striving to uphold regulatory standards and protect their operations. By utilizing advanced risk and compliance software solutions, investment groups can streamline their processes, ensuring compliance while effectively managing potential risks. The integration of these technologies not only boosts operational efficiency but also cultivates a culture of accountability and continuous improvement.

This article underscores several critical features of risk and compliance software, such as:

- Regulatory compliance tracking

- Risk assessment tools

- Data management capabilities

- The significance of audit trails

Furthermore, it highlights the necessity of selecting appropriate software based on factors like:

- Scalability

- Integration capabilities

- User-friendliness

- Ongoing support

Implementing effective deployment strategies, including conducting needs assessments and engaging stakeholders, further ensures that hedge funds can fully leverage the benefits of these solutions.

Ultimately, the importance of risk and compliance software in the financial sector is profound. As regulatory environments evolve, hedge funds must remain vigilant and adaptable, continuously refining their compliance strategies to mitigate risks and enhance operational resilience. By prioritizing these practices, investment groups can navigate the current landscape and position themselves for future success. Embracing these tools and strategies is not merely a necessity; it represents a strategic advantage in an increasingly complex financial environment.

Frequently Asked Questions

What are risk and compliance software solutions?

Risk and compliance software solutions are essential tools for investment groups that help navigate regulatory obligations and manage risks effectively.

What key features do risk and compliance software solutions include?

Key features include regulatory compliance tracking, risk assessment tools, data management capabilities, and audit trails.

How does regulatory compliance tracking work?

Regulatory compliance tracking ensures adherence to industry-specific laws and regulations, such as SEC regulations and GIPS standards, which are crucial for maintaining investor trust and avoiding penalties.

Why is risk assessment important for investment firms?

Risk assessment tools help investment firms identify, analyze, and mitigate potential risks associated with their strategies, particularly as market conditions change and cybercrime becomes a significant concern.

What role does data management play in risk and compliance software?

Effective data management is essential for compliance reporting and risk analysis, allowing hedge funds to collect, store, and examine data to maintain a comprehensive view of their regulatory status and risk exposure.

What is the significance of audit trails in these software solutions?

Audit trails keep detailed logs of all transactions and compliance activities, enhancing transparency and accountability, which is increasingly important due to rising audit demands.

What is the projected growth of the global risk management technology market?

The global risk management technology market is projected to reach USD 35.9 billion by 2032, growing at a CAGR of 13% from 2024 to 2032, indicating a rising demand for advanced tracking tools in the financial services sector.