Best Practices for Banking & Financial Software Development Success

Introduction

In the rapidly evolving landscape of banking and financial software development, the stakes are at an all-time high. Developers are confronted with stringent regulations and escalating cyber threats, creating a dual challenge: ensuring compliance while protecting sensitive customer data. This article explores essential best practices that not only streamline development processes but also enhance security measures. It offers organizations a structured roadmap to navigate these complexities.

How can financial institutions effectively balance the drive for innovation with the critical need for regulatory compliance and robust security?

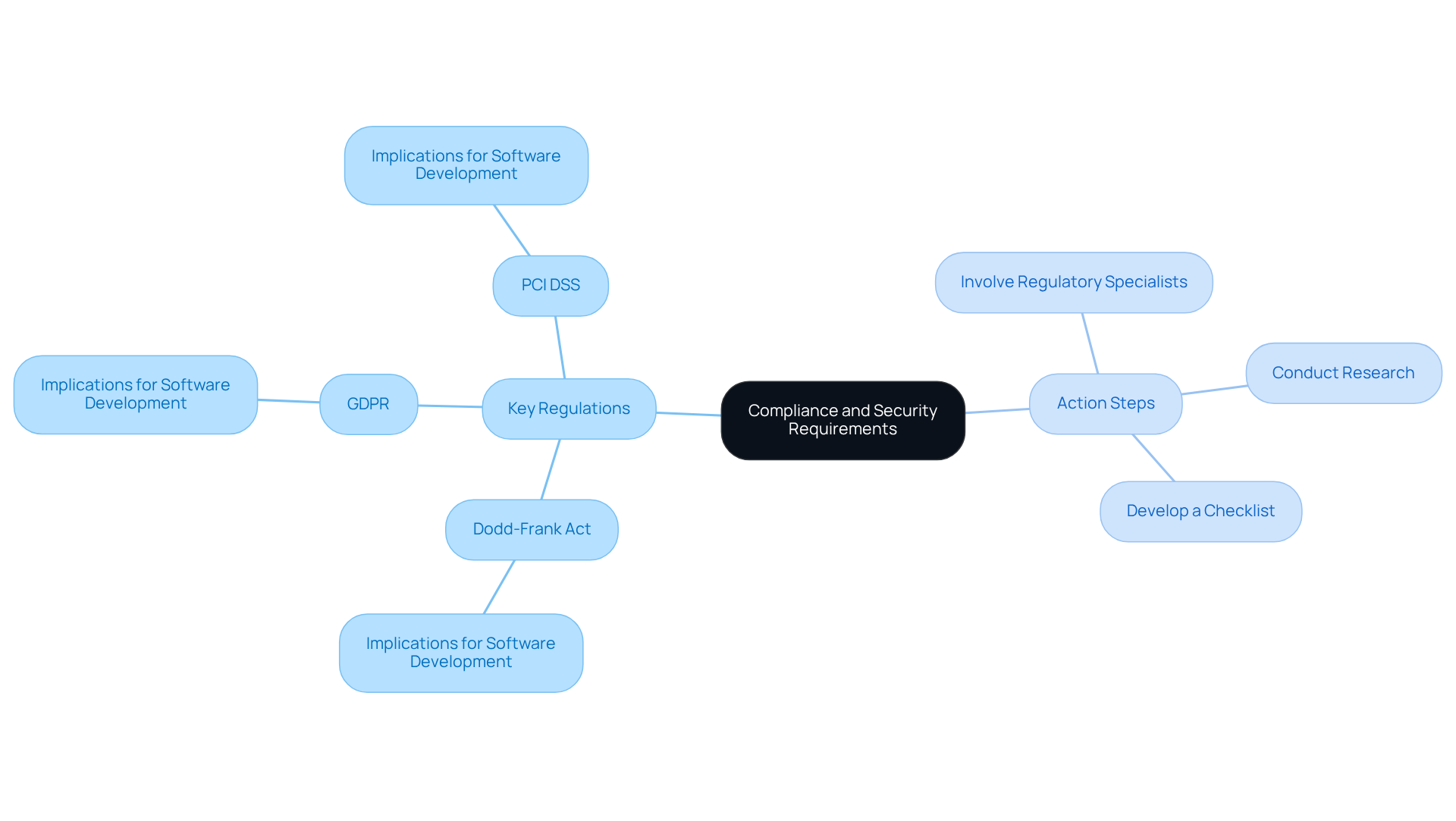

Understand Compliance and Security Requirements

In banking & financial software development, it is crucial to understand regulations and safety requirements. Financial institutions face numerous regulations, such as the Dodd-Frank Act, GDPR, and PCI DSS, which dictate the handling and protection of data. Developers in banking & financial software development must familiarize themselves with these regulations to ensure their software solutions not only comply with legal standards but also safeguard sensitive customer information.

Starting in 2026, banks will be required to maintain a tamper-proof record of document alterations, which is vital for compliance. Furthermore, the rising threat of fraud necessitates enhanced security measures, making it imperative for banking & financial software development developers to integrate robust defenses into their software.

To effectively navigate these requirements, teams should:

- Conduct thorough research on applicable regulations relevant to their target market.

- Involve regulatory specialists early in the development process to identify potential pitfalls.

- Develop a checklist for regulations that aligns with the specific requirements of the banking sector, ensuring that all aspects of the software adhere to legal standards.

By incorporating adherence factors into the banking & financial software development process, organizations can mitigate risks and avoid costly penalties associated with non-compliance. Industry experts indicate that failure to adapt to these evolving demands can lead to significant financial repercussions, underscoring the importance of proactive adherence management.

Implement Robust Security Measures and Compliance Protocols

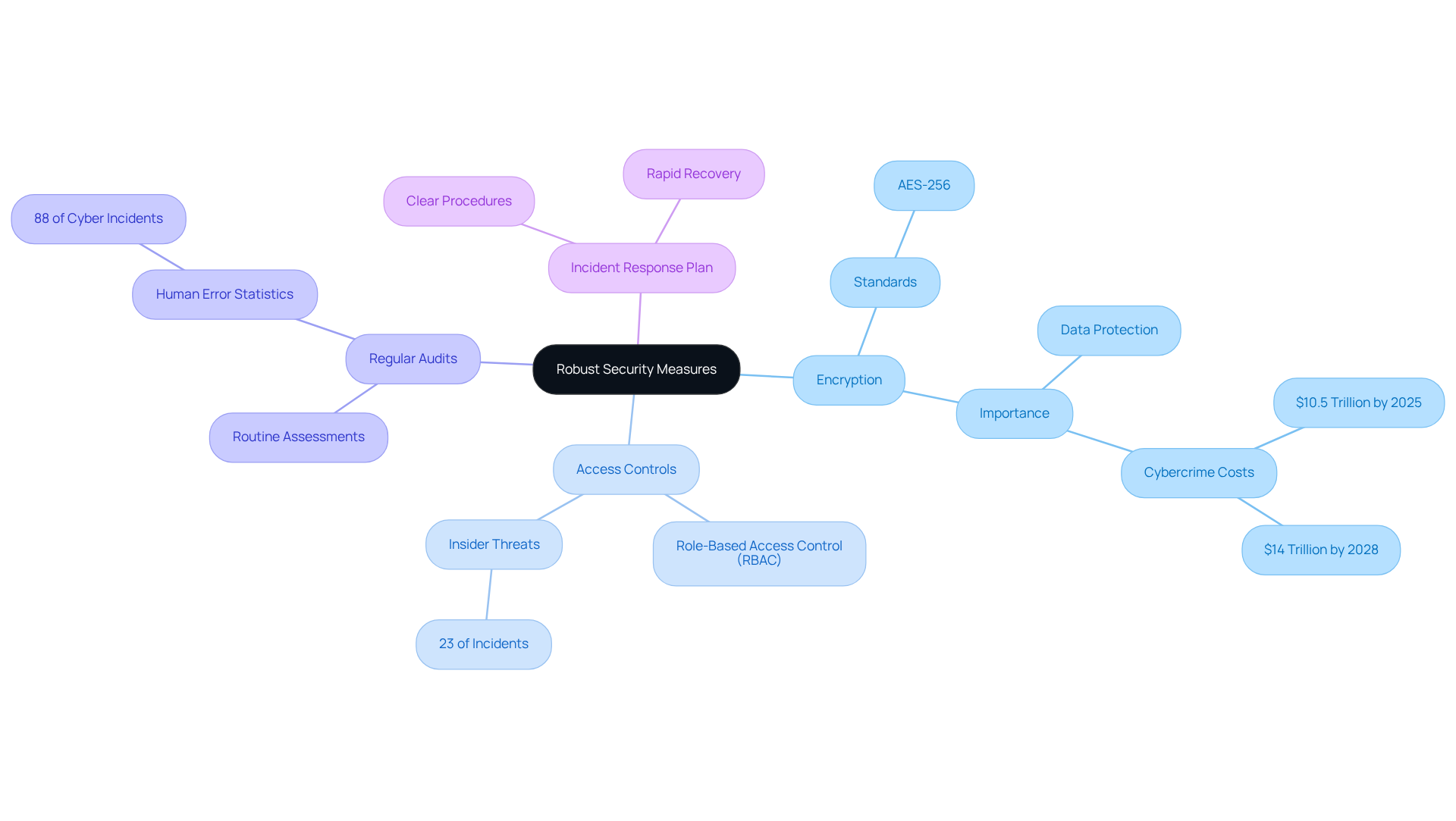

To safeguard banking & financial software development, organizations must implement a comprehensive protection framework that prioritizes strong encryption and adherence protocols. The key components of this framework include:

-

Encryption: Implementing strong encryption standards, such as AES-256, is essential for safeguarding data both at rest and in transit. This is particularly crucial as financial institutions face increasing threats. Projections indicate that cybercrime could cost businesses up to $10.5 trillion by 2025 and escalate to almost $14 trillion by 2028.

-

Access Controls: Establishing stringent access controls is vital to ensure that only authorized personnel can access sensitive data. Utilizing role-based access control (RBAC) mechanisms can significantly reduce the risk of unauthorized access and insider threats, which account for 23% of incidents according to industry leaders.

-

Regular Audits: Performing routine assessments and vulnerability evaluations is essential to uncover and address possible flaws within the system. This proactive approach assists companies in staying ahead of evolving cyber threats, as 88% of cyber incidents are attributed to human errors.

-

Incident Response Plan: Creating and sustaining a thorough incident response plan is essential for effectively managing breaches. This plan should outline clear procedures for rapid recovery and minimizing impact, ensuring that organizations can respond swiftly to incidents that may disrupt operations.

By prioritizing these protective measures, banking & financial software development can enable banking institutions to create a robust framework that not only meets regulatory standards but also effectively reduces the risks posed by increasingly sophisticated cyber threats. As Sarika Sharma emphasizes, “You need robust cybersecurity measures from day one, or you’ll mitigate risks the hard way after something goes wrong.

Adopt Continuous Improvement Practices for Security and Compliance

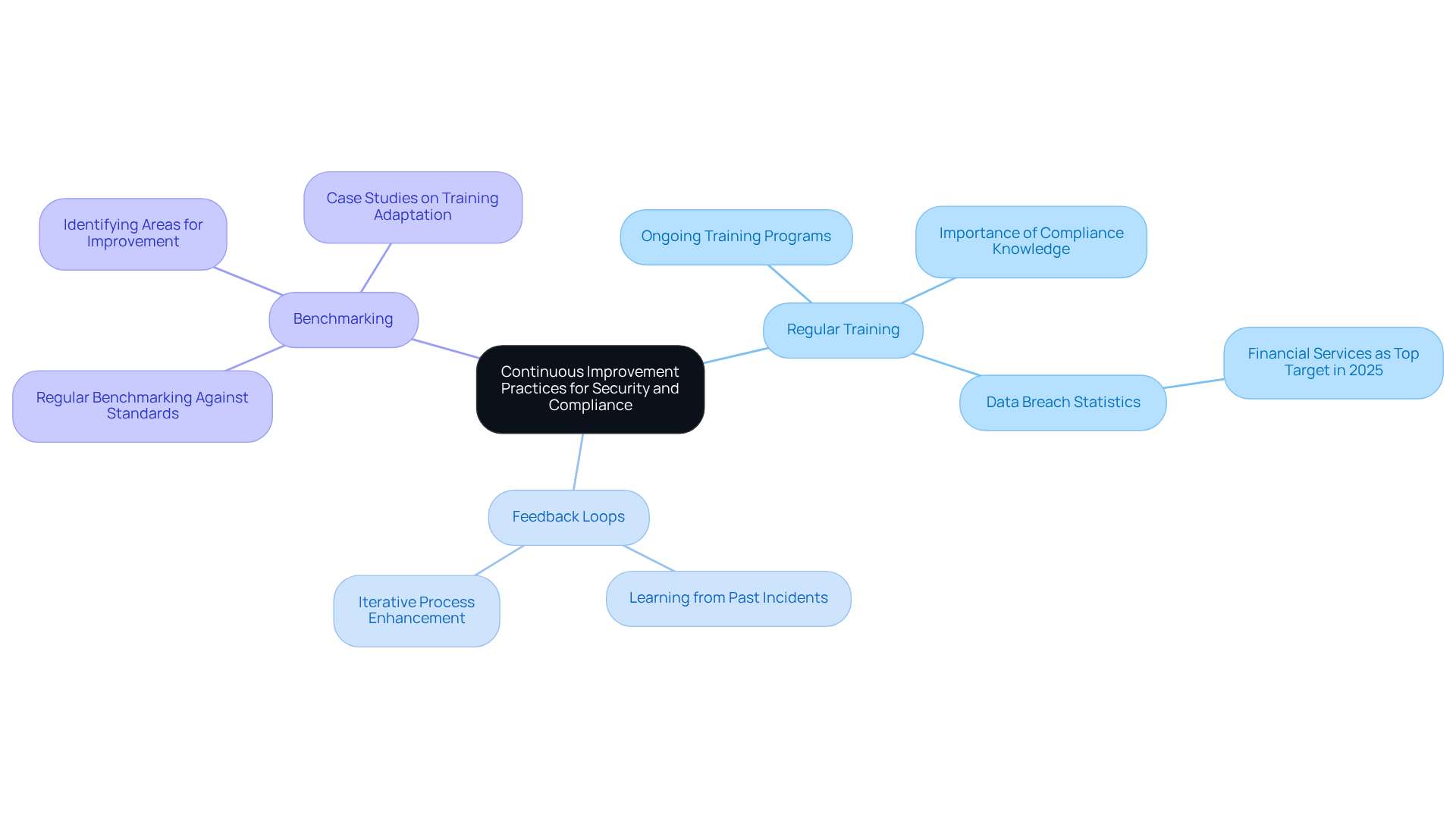

In the dynamic landscape of banking & financial software development, implementing continuous enhancement practices for protection and regulatory adherence is crucial. Organizations should prioritize the following strategies:

-

Regular Training: Ongoing training programs are essential for keeping employees updated on the latest compliance requirements and security best practices. This ensures that all team members understand their roles and responsibilities in upholding regulations. Notably, financial services were the top target for data breaches in 2025, underscoring the urgency of effective training.

-

Feedback Loops: Establishing feedback mechanisms allows teams to learn from past incidents, fostering an environment of growth and process enhancement. This iterative approach assists firms in refining their regulatory strategies over time.

In the context of banking & financial software development, embracing agile methodologies facilitates iterative development and frequent evaluation of regulations and protective measures. This flexibility enables organizations to swiftly adapt to new regulations or emerging threats, ensuring that compliance remains a priority. Industry leaders have noted that AI and cybersecurity will be critical focuses for community institutions in 2026.

- Benchmarking: Regular benchmarking against industry standards and best practices is vital for identifying areas needing improvement. This practice ensures that protective measures are not only effective but also aligned with the latest regulatory expectations. Case studies, such as ‘Training Preparation Strategies,’ illustrate how companies are adapting their training programs to meet evolving regulatory demands.

By fostering a culture of ongoing enhancement, organizations can strengthen their safeguards against regulatory risks and security threats, ultimately promoting greater trust among clients and stakeholders. The integration of agile methodologies into compliance training enhances responsiveness and adaptability, making it a key component of successful banking & financial software development operations in 2026.

Choose the Right Technology Stack and Development Partners

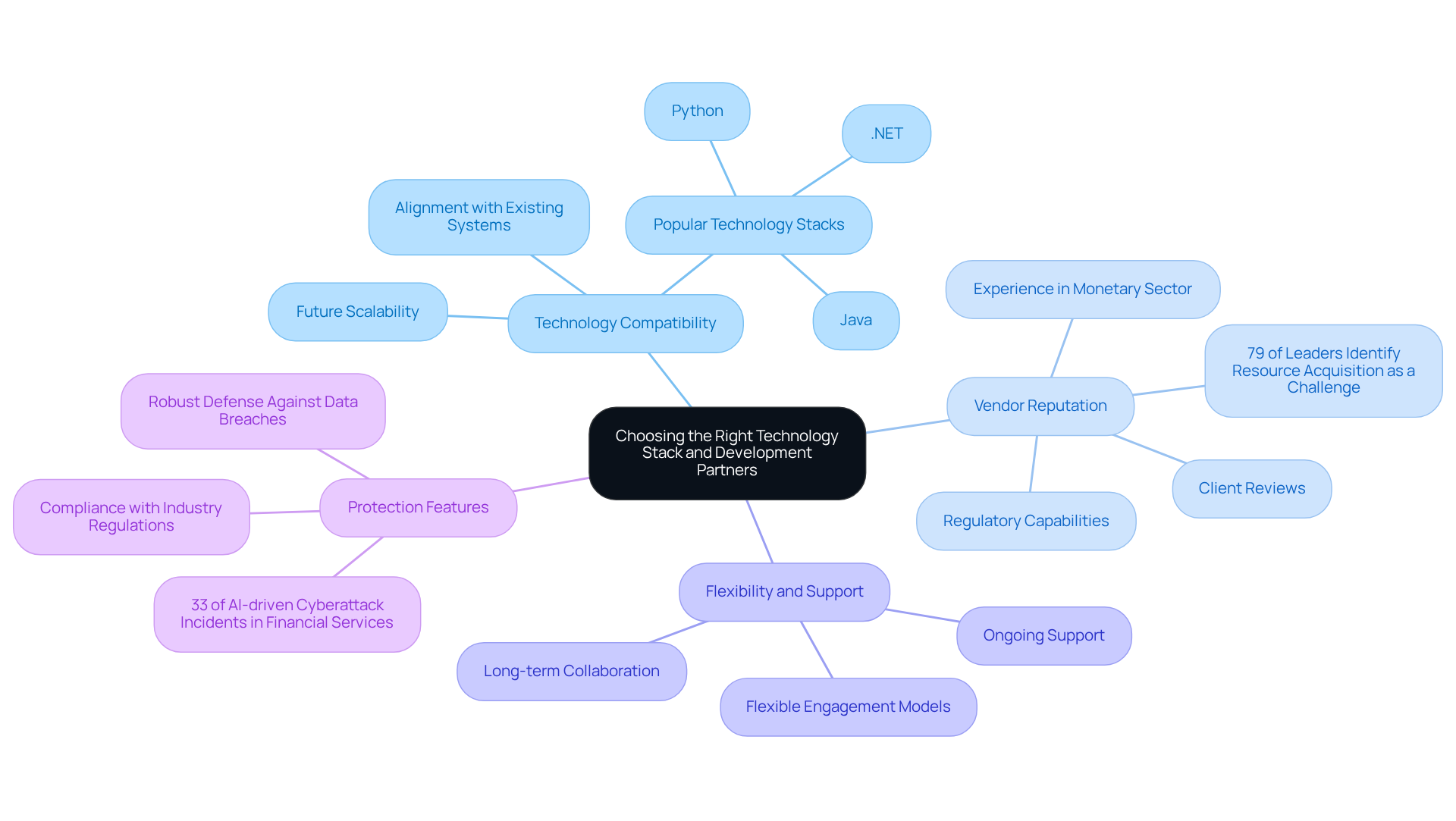

Choosing the appropriate technology stack and development partners is crucial for the success of banking and economic software projects. Organizations must consider several key factors:

-

Technology Compatibility: It is essential to ensure that the selected technology stack aligns with existing systems and supports future scalability. Popular stacks for monetary applications, such as Java, .NET, and Python, are recognized for their robustness and adaptability in high-demand environments.

-

Vendor Reputation: Organizations should assess potential development partners based on their experience in the monetary sector, client reviews, and regulatory capabilities. In 2026, a significant 79% of business leaders identified acquiring the right resources and skills as the biggest challenge in maintaining mainframe platforms, underscoring the importance of partnering with reputable vendors.

-

Flexibility and Support: It is advisable to choose partners that offer flexible engagement models and ongoing support to adapt to evolving business needs and regulatory requirements. Successful partnerships often arise from vendors who demonstrate a commitment to long-term collaboration and responsiveness to client demands.

-

Protection Features: Evaluating the protection features of the technology stack is vital to ensure robust defense against data breaches and compliance with industry regulations. As monetary services face increasing cyber threats, which accounted for 33% of all AI-driven cyberattack incidents in 2025, emphasizing security in software development becomes essential.

By making informed decisions regarding technology and partnerships, organizations can enhance their software development processes, ensuring the delivery of secure, compliant financial solutions that meet the demands of a rapidly evolving market.

Conclusion

In banking and financial software development, success is fundamentally tied to a thorough understanding of compliance and security requirements. Developers face a complex landscape of regulations, including the Dodd-Frank Act and GDPR, while also needing to implement robust security measures to safeguard sensitive customer information. By prioritizing compliance from the beginning and integrating strong security protocols, organizations can significantly reduce risks and enhance their operational integrity.

Key insights emphasize the necessity of a comprehensive protection framework that encompasses:

- Strong encryption

- Stringent access controls

- Regular audits

- A well-defined incident response plan

Furthermore, adopting continuous improvement practices – such as ongoing training and feedback loops – ensures that teams remain agile and responsive to evolving regulatory demands. Selecting the appropriate technology stack and development partners further strengthens an organization’s capacity to deliver secure and compliant financial solutions.

Ultimately, the landscape of banking and financial software development is characterized by rapid change and increasing threats. Embracing best practices in compliance and security not only protects organizations from potential pitfalls but also builds trust among clients and stakeholders. As the industry progresses, a commitment to continuous improvement and strategic partnerships will be crucial in navigating future challenges and achieving long-term success.

Frequently Asked Questions

Why is understanding compliance and security requirements important in banking and financial software development?

Understanding compliance and security requirements is crucial because financial institutions face numerous regulations that dictate how they handle and protect data. Compliance ensures that software solutions meet legal standards and safeguard sensitive customer information.

What are some key regulations that developers need to be aware of in this field?

Key regulations include the Dodd-Frank Act, GDPR, and PCI DSS, which govern the handling of financial data and protect consumer privacy.

What new requirement will banks face starting in 2026?

Starting in 2026, banks will be required to maintain a tamper-proof record of document alterations, which is vital for compliance.

Why is there a need for enhanced security measures in banking software?

The rising threat of fraud necessitates enhanced security measures, making it imperative for developers to integrate robust defenses into their software.

What steps should development teams take to navigate compliance requirements effectively?

Teams should conduct thorough research on applicable regulations, involve regulatory specialists early in the development process, and develop a checklist for regulations tailored to the banking sector.

How can organizations mitigate risks associated with non-compliance?

Organizations can mitigate risks by incorporating adherence factors into the software development process, which helps avoid costly penalties and ensures compliance with legal standards.

What are the potential consequences of failing to adapt to compliance demands in banking software development?

Failure to adapt can lead to significant financial repercussions, highlighting the importance of proactive adherence management.