Master Software Testing and Quality Assurance for Hedge Funds

Introduction

In the high-stakes realm of hedge funds, where each decision carries significant financial consequences, the role of robust software testing and quality assurance is paramount. These processes not only ensure adherence to stringent regulations but also protect sensitive financial data, thereby preserving operational integrity. However, the path to achieving effective software quality is laden with challenges, including legacy system integration and the demand for real-time processing capabilities.

How can hedge funds effectively navigate these complexities to develop resilient and secure applications that meet the rigorous demands of the financial sector?

Define Software Testing and Quality Assurance

Evaluating an application entails a thorough assessment to identify any gaps, errors, or missing requirements in relation to the actual specifications. In contrast, the process of software testing and quality assurance represents a systematic approach that ensures the quality of the application throughout its development lifecycle. Within the hedge fund sector, where compliance with regulations and reliability are paramount, software testing and quality assurance are crucial in guaranteeing that applications are resilient, secure, and adept at handling sensitive financial information.

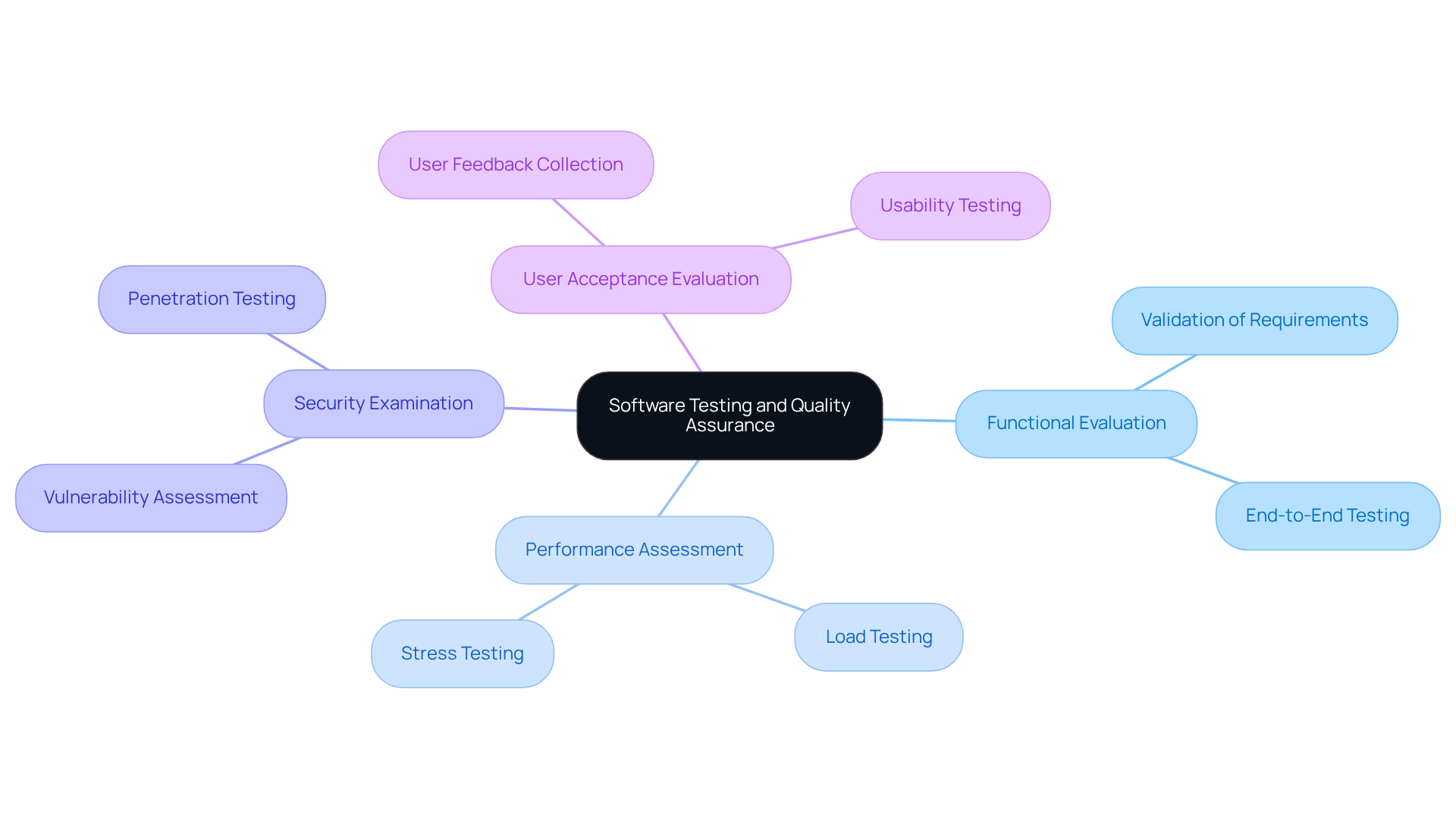

Neutech offers comprehensive engineering services, specializing in application development tailored for regulated sectors, including hedge funds. Our approach encompasses key components such as:

- Functional evaluation

- Performance assessment

- Security examination

- User acceptance evaluation

All designed to meet the rigorous demands of the financial industry. By leveraging Neutech’s expertise, hedge fund managers can ensure that their technology solutions are not only effective but also compliant with industry standards.

Identify Challenges in Hedge Fund Software Testing

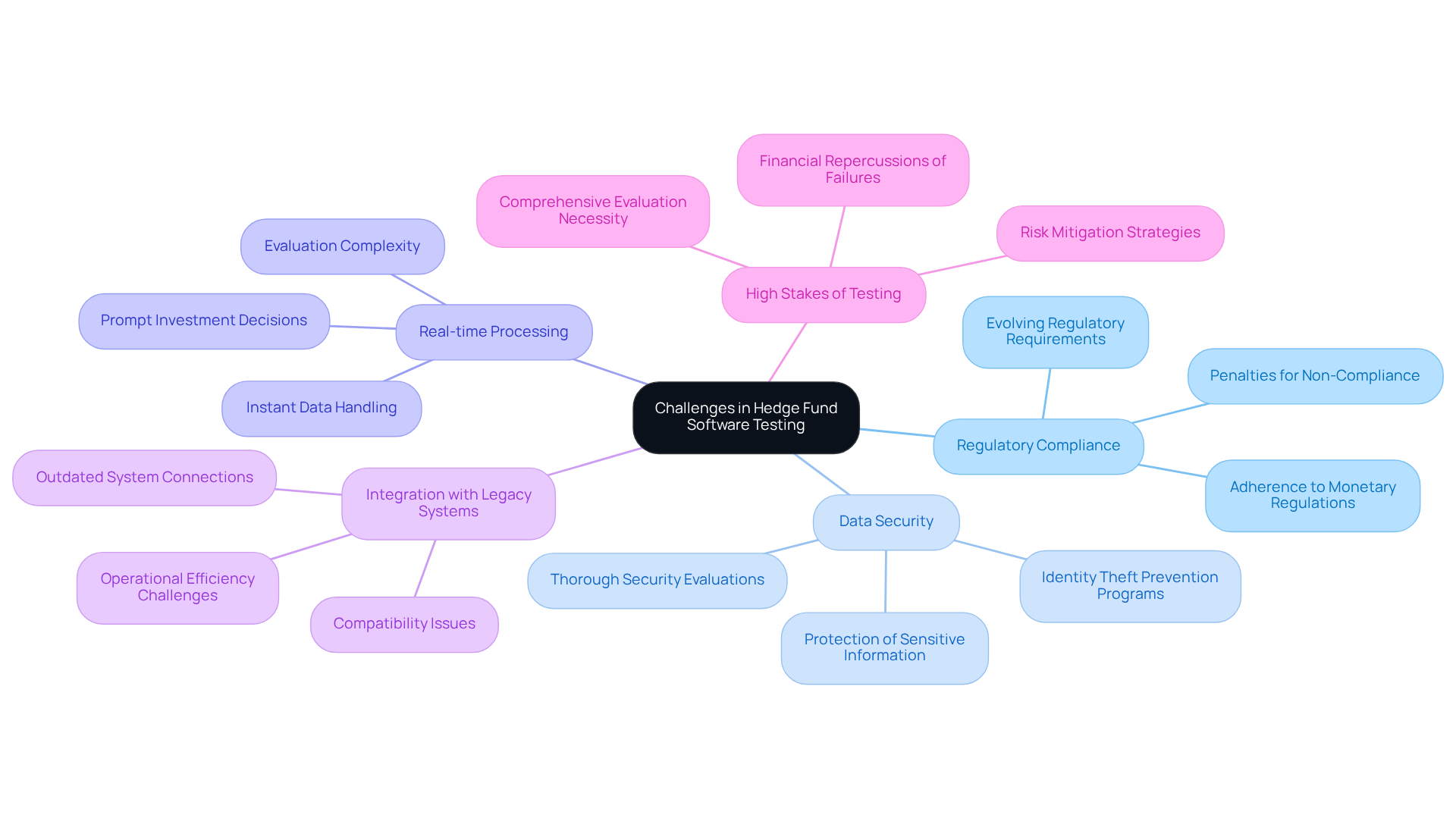

Hedge funds encounter several distinct challenges in software testing and quality assurance, which can significantly impact their operations.

-

Regulatory compliance is paramount. Ensuring that applications adhere to monetary regulations is essential, as non-compliance can result in severe penalties that jeopardize the fund’s reputation and financial standing.

-

Data security is a critical concern. Safeguarding sensitive financial information from breaches is a top priority, necessitating thorough security evaluations to protect against potential threats.

-

Real-time processing capabilities are vital. Hedge funds require applications that can handle data instantly to facilitate prompt investment decisions, complicating the evaluation scenarios due to the need for immediate responsiveness.

-

Integration with legacy systems poses significant challenges. Many hedge funds operate with outdated systems that must be connected to new applications, creating compatibility issues that can hinder operational efficiency.

-

The high stakes involved in software testing and quality assurance cannot be overlooked. The financial repercussions of program failures can be substantial, making comprehensive evaluation essential to mitigate risks and ensure reliability.

Implement Structured Testing and QA Processes

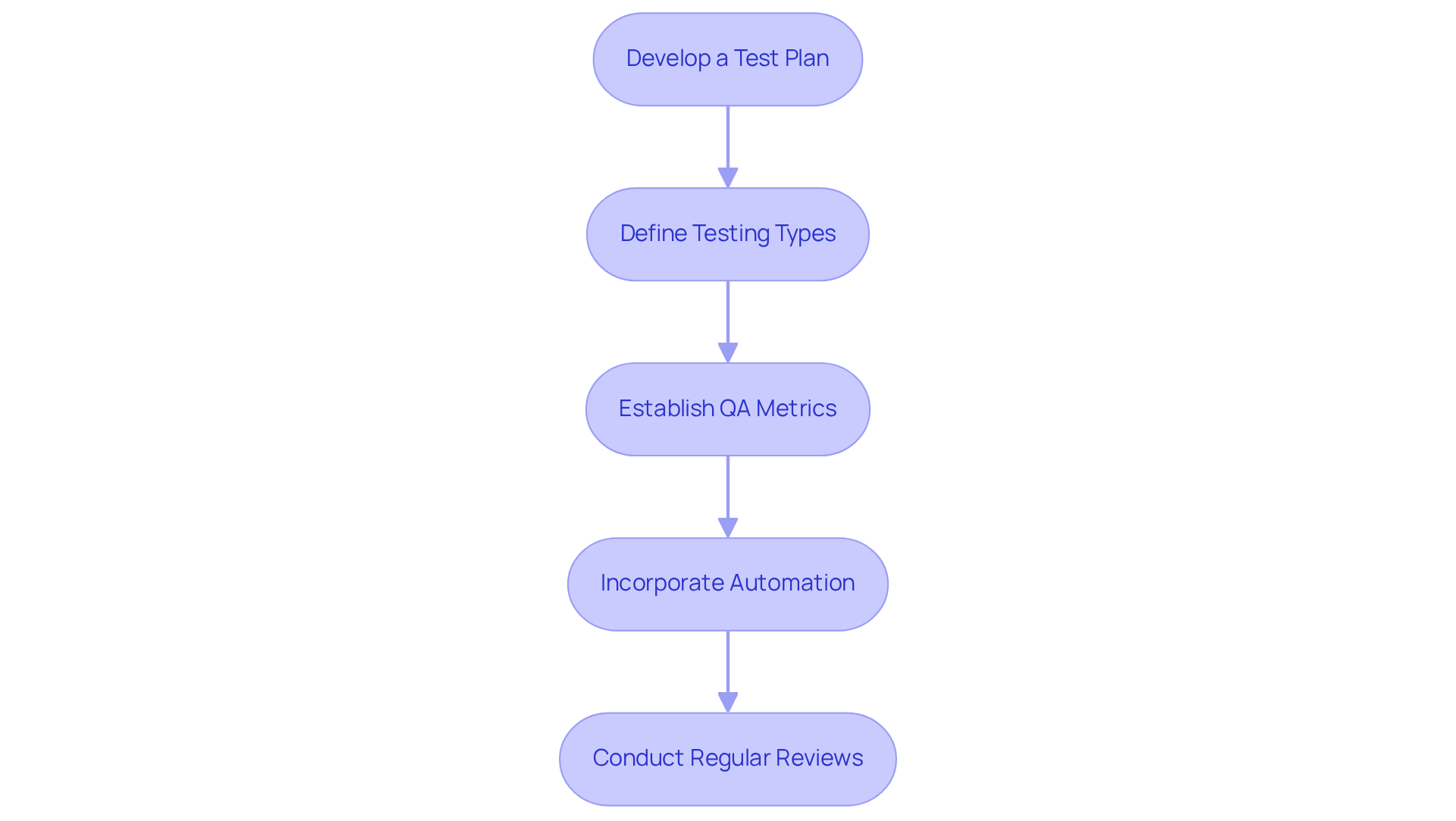

To implement structured testing and QA processes in financial software development, particularly for hedge funds, it is essential to follow these steps:

-

Develop a Test Plan: Begin by creating a comprehensive outline that details the scope, resources, schedule, and activities involved in the evaluation. This plan must align with project goals and adhere to regulatory requirements, ensuring compliance with standards such as PCI, DSS, and GDPR.

-

Define Testing Types: Identify the necessary testing types, including unit testing, integration testing, system testing, and acceptance testing. Tailor these to the application’s complexity and specific requirements, ensuring thorough validation of financial algorithms and business flows across various jurisdictions.

-

Establish QA Metrics: Set clear metrics to evaluate software quality, such as defect density, test coverage, and user satisfaction scores. These metrics provide insights into the efficiency of the evaluation method and assist in ongoing enhancement.

-

Incorporate Automation: Utilize automated evaluation tools to enhance efficiency and accuracy, particularly for regression and performance assessments. Automation accelerates the evaluation phase and guarantees consistent quality across various user scenarios, which is crucial in the highly regulated financial sector. Consider tools such as Postman, RestAssured, or Karate for effective API evaluation to validate backend integrations.

-

Conduct Regular Reviews: Schedule periodic evaluations of the assessment process to identify areas for improvement and ensure compliance with evolving regulations. This practice aids in adapting to new technologies and methodologies, such as AI-driven test case generation, which can significantly enhance evaluation efficiency and coverage. Additionally, incorporate exploratory testing to validate complex business flows and ensure compliance with accessibility standards like ADA and WCAG.

By following these steps, hedge funds can establish robust systems for software testing and quality assurance that not only meet regulatory standards but also enhance software reliability and user trust.

Utilize Tools and Resources for Effective QA

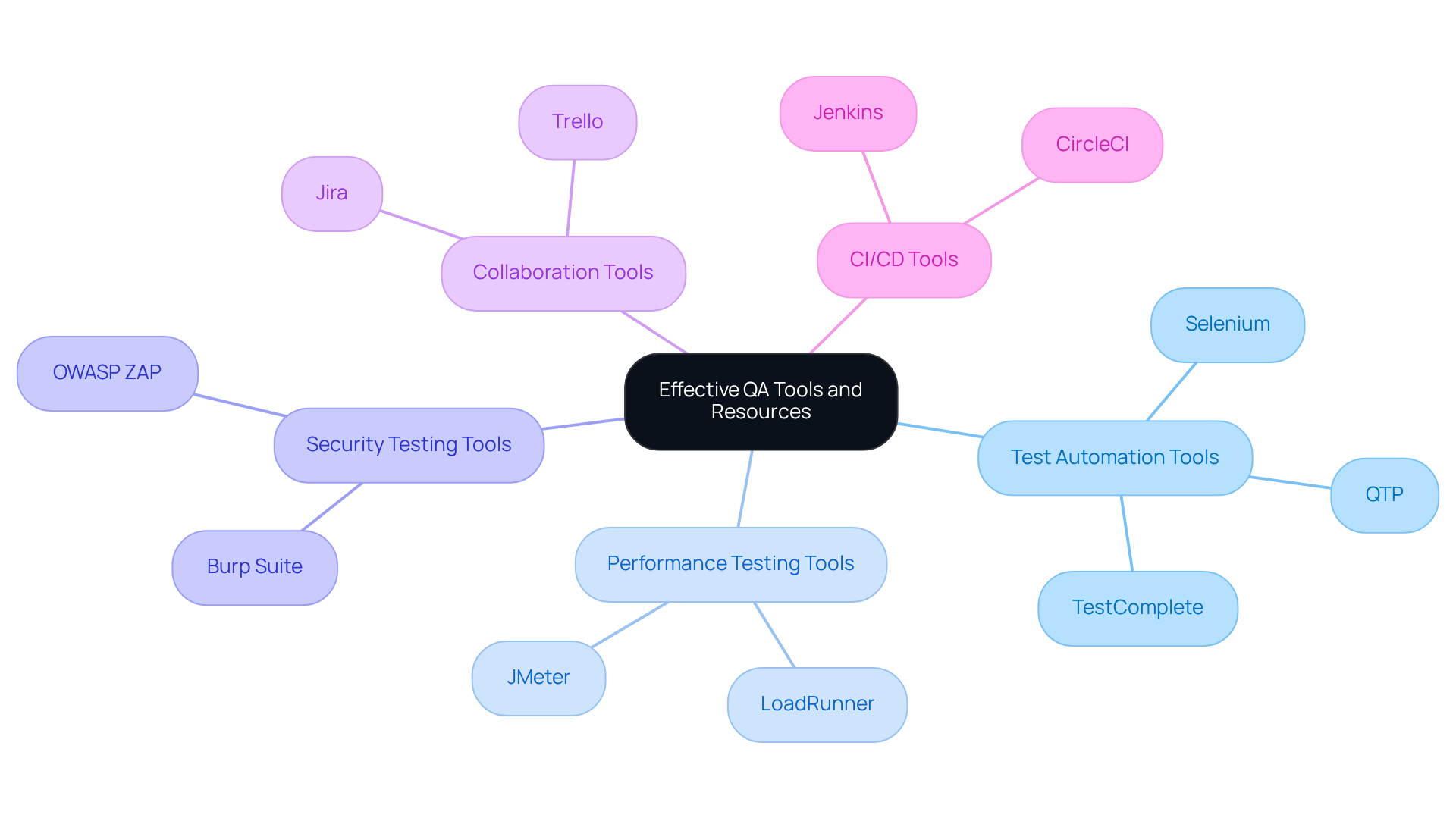

To enhance your QA processes, consider the following tools and resources:

-

Test Automation Tools: Tools such as Selenium, QTP, and TestComplete are essential for automating repetitive evaluation tasks. They significantly save time and reduce human error. With 77% of organizations adopting automated program evaluation, software testing and quality assurance tools are essential for maintaining high-quality standards in financial applications.

-

Performance Testing Tools: Utilize JMeter or LoadRunner to evaluate how your application performs under various conditions. This ensures it can effectively handle peak loads. Statistics indicate that 90% of companies recognize that software testing and quality assurance are vital for digital transformation, underscoring the importance of robust performance evaluation in the banking sector.

-

Security Testing Tools: Implement tools like OWASP ZAP or Burp Suite to detect vulnerabilities in your software, which is critical for protecting sensitive financial data. Given that 97% of organizations consider API evaluation essential, software testing and quality assurance tools are pivotal in ensuring secure integrations.

-

Collaboration Tools: Platforms such as Jira or Trello streamline the management of assessment tasks and enhance communication among team members. This is crucial for maintaining efficiency in fast-paced environments like hedge funds, especially with the implementation of software testing and quality assurance.

-

Continuous Integration/Continuous Deployment (CI/CD) Tools: Tools like Jenkins or CircleCI automate the integration and deployment processes, ensuring that testing is seamlessly incorporated into the development lifecycle. With 60% of organizations implementing CI/CD platforms, these tools play a crucial role in accelerating development cycles and improving software testing and quality assurance.

Conclusion

Mastering software testing and quality assurance is essential for hedge funds navigating the complexities of the financial landscape. A structured approach to these processes ensures that applications not only meet regulatory standards but also maintain the reliability and security necessary for managing sensitive financial data.

Key insights highlight the importance of defining clear testing strategies and addressing unique challenges such as regulatory compliance, data security, and integration with legacy systems. Implementing structured testing processes, utilizing effective tools, and conducting regular reviews are crucial steps that enhance software quality and mitigate risks associated with program failures.

In a sector where the stakes are incredibly high, prioritizing software testing and quality assurance is not merely a best practice; it is a necessity. Hedge funds must embrace these methodologies to safeguard their operations and uphold their reputations. By investing in robust QA processes and leveraging advanced tools, organizations can foster a culture of quality that ultimately leads to greater trust and success in their financial endeavors.

Frequently Asked Questions

What is software testing and quality assurance?

Software testing and quality assurance is a systematic approach that ensures the quality of an application throughout its development lifecycle, identifying gaps, errors, or missing requirements in relation to the actual specifications.

Why is software testing important in the hedge fund sector?

In the hedge fund sector, software testing is crucial for compliance with regulations and reliability, ensuring that applications are resilient, secure, and capable of handling sensitive financial information.

What services does Neutech offer in relation to software testing?

Neutech offers comprehensive engineering services specializing in application development for regulated sectors, including hedge funds, focusing on functional evaluation, performance assessment, security examination, and user acceptance evaluation.

How does Neutech’s expertise benefit hedge fund managers?

By leveraging Neutech’s expertise, hedge fund managers can ensure that their technology solutions are effective and compliant with industry standards, meeting the rigorous demands of the financial industry.