Introduction

The software development landscape for hedge funds presents a complex arena where precision and strategic foresight are essential. As investment firms navigate the intricacies of technology integration, grasping the fundamental stages of software development is crucial for achieving operational success.

What key steps can transform a software project from a mere concept into a robust tool that meets the rigorous demands of the financial sector? This article explores the critical phases of software development tailored specifically for hedge funds, examining best practices that ensure alignment with stakeholder expectations and regulatory standards.

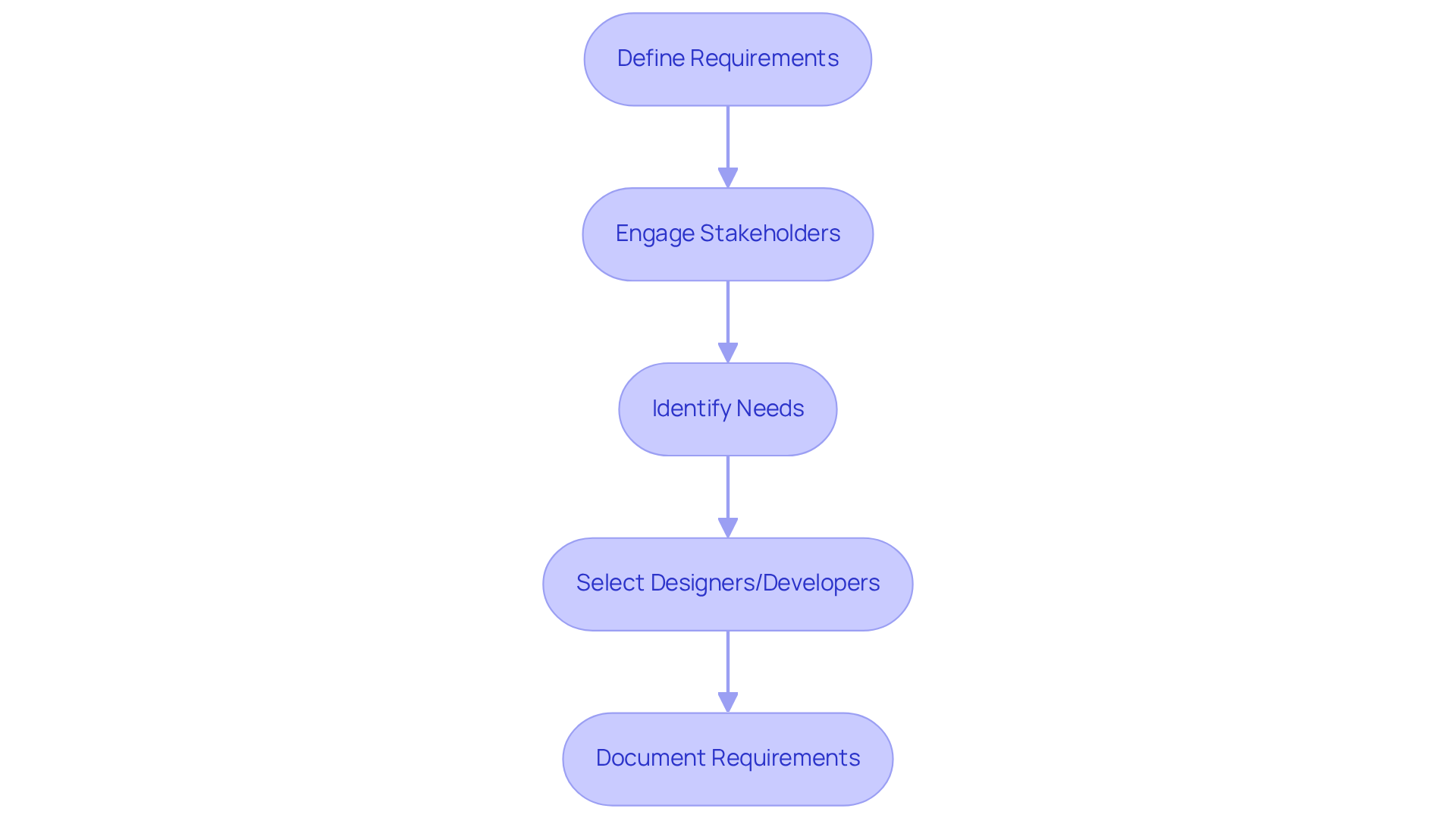

Define Requirements and Analyze Needs

The initial stage of software creation for investment firms emphasizes a thorough requirements assessment, which is vital for aligning the project with stakeholder expectations and regulatory standards. Engaging stakeholders through interviews, surveys, and workshops is essential for extracting detailed insights into their needs. This engagement not only clarifies expectations but also ensures that the software aligns with the strategic objectives of the investment firm.

At Neutech, once we collaboratively identify your needs, we provide a selection of candidate designers and developers to integrate into your team. This approach guarantees that the right talent is available to meet specific project requirements. For example, if an investment group intends to implement real-time data analytics, the design team must pinpoint the specific data sources and analytical capabilities necessary to enhance investment strategies.

Thorough documentation of these requirements is crucial, as it serves as the foundation for the entire creation process. It guides subsequent stages and ensures that the final product meets both operational and compliance needs.

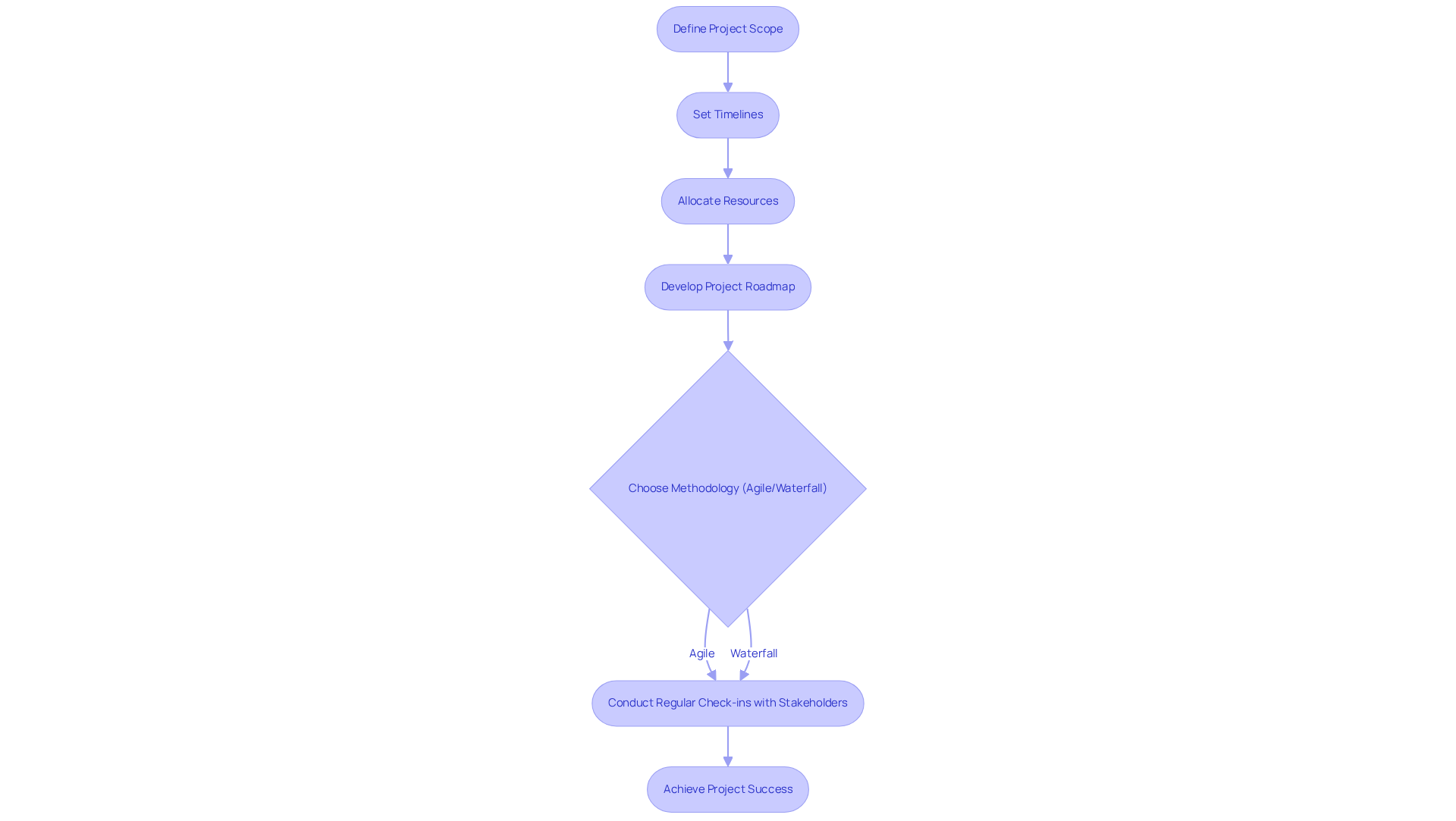

Plan Strategically for Project Success

Strategic planning is crucial in software creation, particularly for investment firms, as it involves defining the project scope, timelines, and resource allocation. A well-structured project roadmap is essential, detailing milestones and deliverables that guide the team throughout the development process.

Utilizing methodologies such as Agile or Waterfall can significantly influence project outcomes, especially within the dynamic financial services sector. For instance, Agile’s flexibility allows investment groups to adjust strategies in response to market changes, enabling modifications without compromising the overall project trajectory.

Regular check-ins and updates with stakeholders are imperative to ensure alignment with business objectives, promoting transparency and collaboration.

Statistics reveal that Agile projects achieve a success rate of 42%, compared to only 13% for Waterfall, underscoring Agile’s effectiveness in navigating the stages of software development.

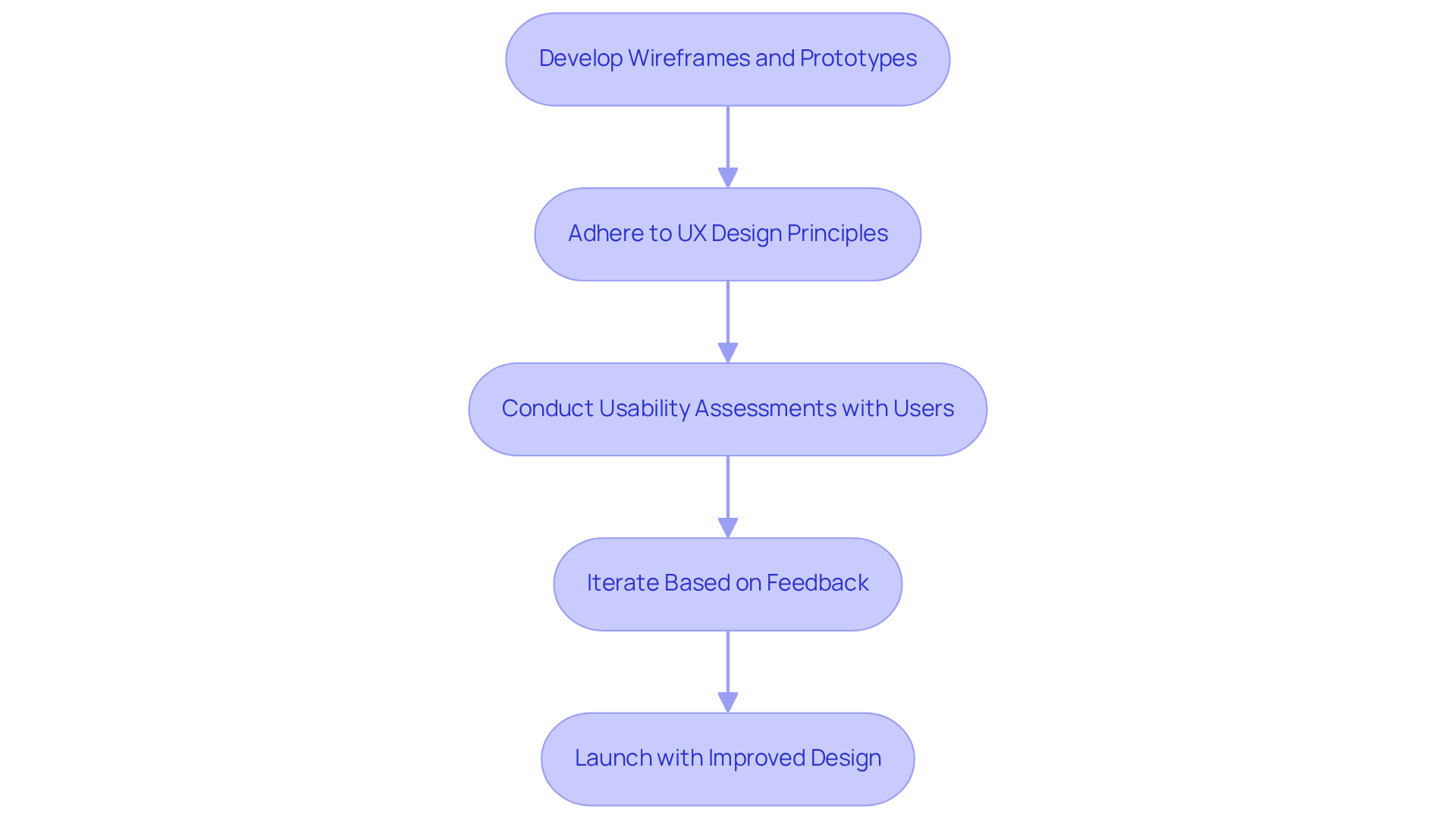

Design for Usability and Functionality

At this stage of the stages of software development, the focus is on developing wireframes and prototypes that align with previously gathered requirements. Adhering to user experience (UX) design principles is crucial for crafting intuitive interfaces that facilitate seamless navigation and quick access to vital information. For instance, dashboards should effectively display key performance indicators (KPIs), allowing hedge fund managers to make informed decisions swiftly.

Conducting usability assessments with actual users is essential, as it provides valuable insights that can enhance the design before entering full-scale production. This iterative process not only improves user satisfaction but also significantly reduces the likelihood of costly post-launch changes; correcting a UX mistake after production can be up to 100 times more expensive than addressing it beforehand.

Moreover, a well-designed user interface can boost a website’s conversion rate by as much as 200%. Investing in UX design proves financially advantageous, as every $1 invested can yield a return of $100.

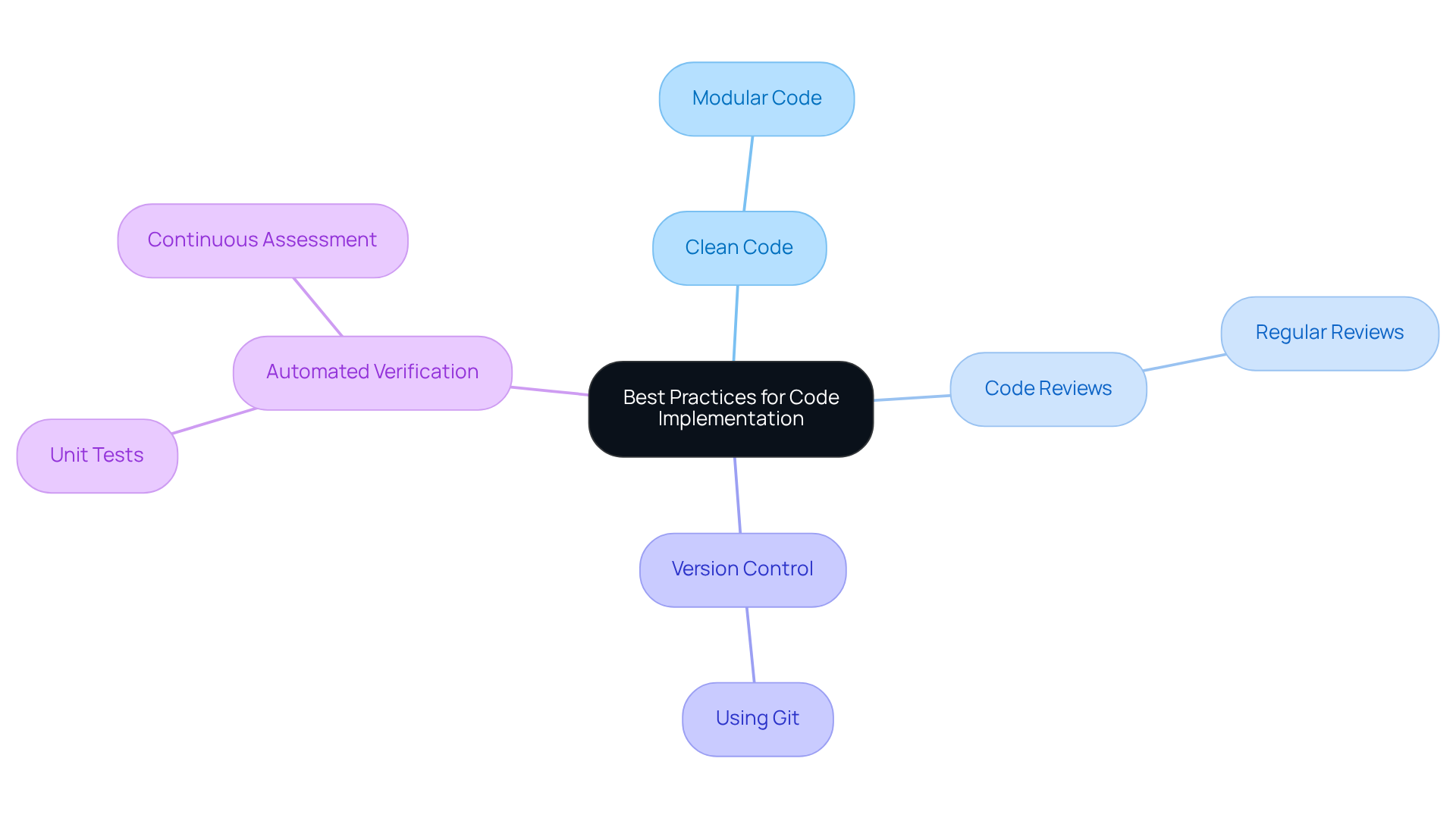

Implement Code with Best Practices

During the implementation phase, it is essential for developers to adhere to established coding standards and best practices. This includes:

- Writing clean, modular code

- Conducting regular code reviews

- Utilizing version control systems, such as Git, to facilitate effective collaboration and management of changes

- Integrating automated verification frameworks to ensure continuous assessment of the code, significantly reducing the likelihood of bugs in production

For instance, implementing unit tests can identify errors early in the development process, which is particularly crucial in regulated environments like hedge funds, where compliance is of utmost importance.

Conduct Comprehensive Testing

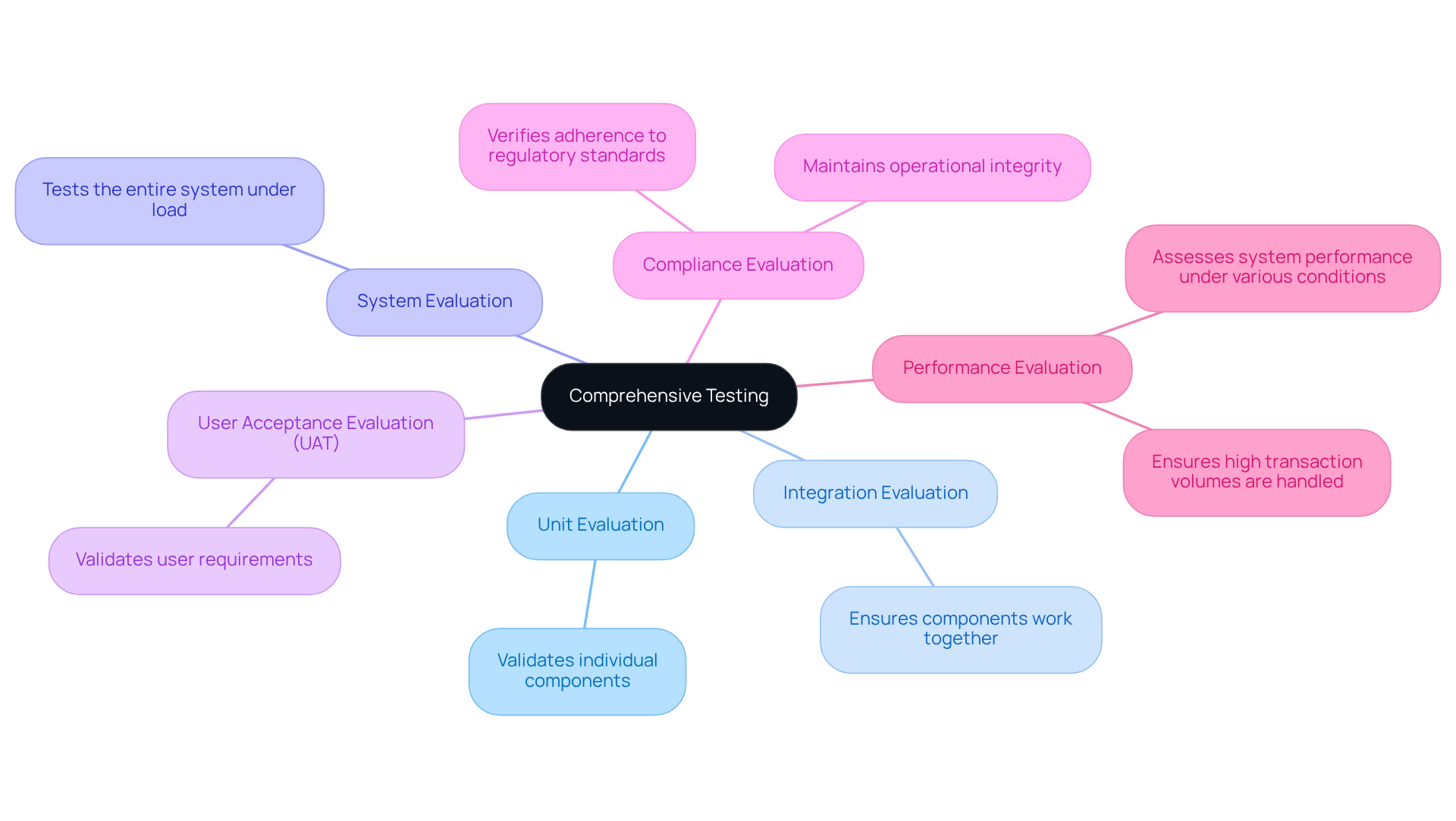

Evaluation must encompass a range of methodologies, including:

- Unit evaluation

- Integration evaluation

- System evaluation

- User acceptance evaluation (UAT)

Each type of evaluation serves a distinct purpose, from validating individual components to ensuring that the entire system functions correctly under load.

For hedge funds, compliance evaluation is particularly critical, as it verifies that the software adheres to regulatory standards. This adherence is essential for maintaining operational integrity and avoiding potential legal repercussions.

Additionally, performance evaluation plays a vital role in assessing how the software operates under various market conditions. It ensures that the system can handle high volumes of transactions without failure, thereby safeguarding the fund’s operational efficiency and reliability.

Execute Smooth Deployment Strategies

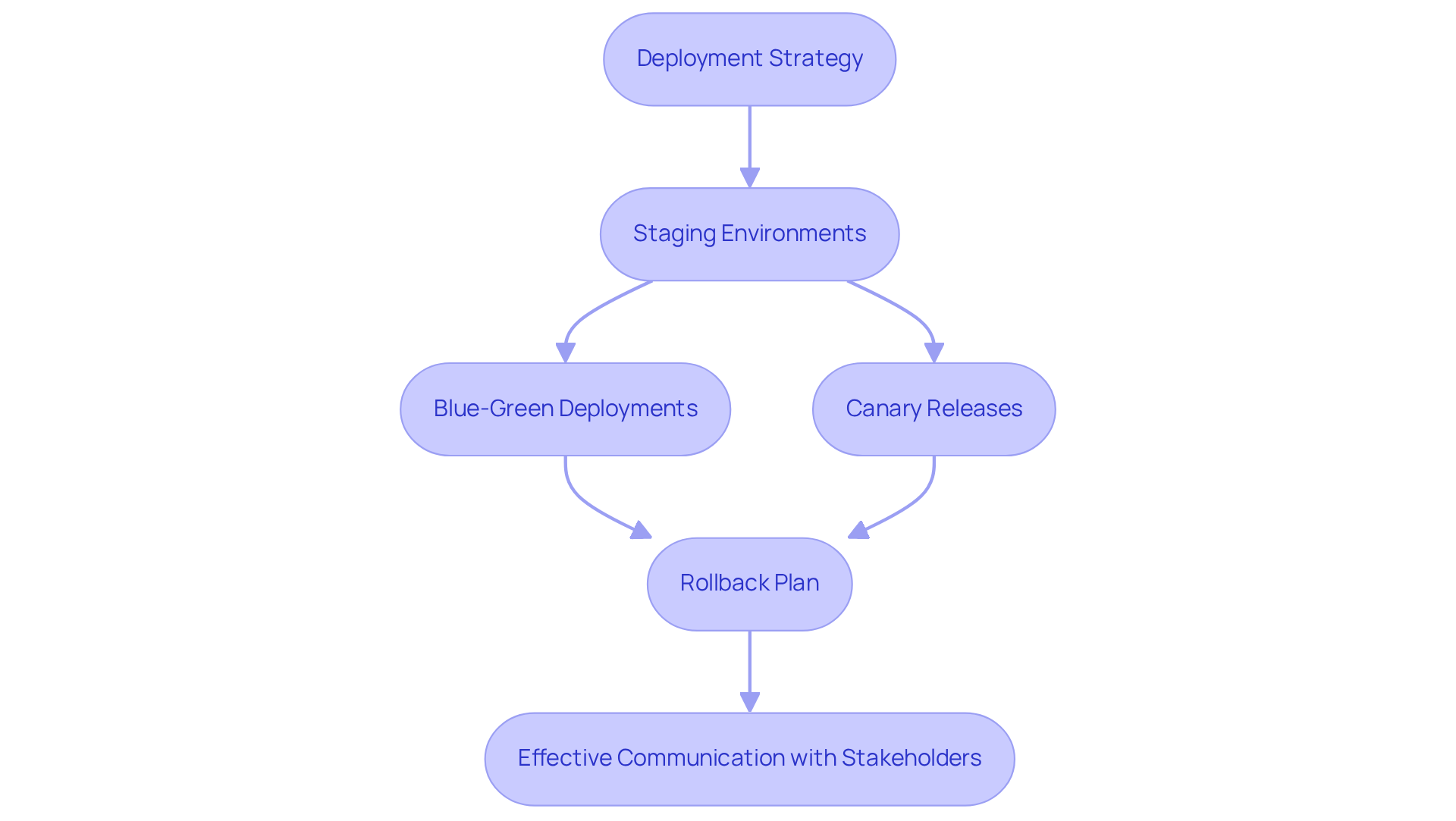

A clear strategy is essential for deployment, incorporating staging environments for testing prior to going live. Techniques such as blue-green deployments and canary releases serve to minimize risks by enabling the testing of new features with a subset of users before a full rollout. Furthermore, having a rollback plan is crucial; it ensures that if issues arise, the system can swiftly revert to a stable state. Effective communication with stakeholders during deployment is vital for managing expectations and providing timely updates on the rollout status.

Maintain and Update for Longevity

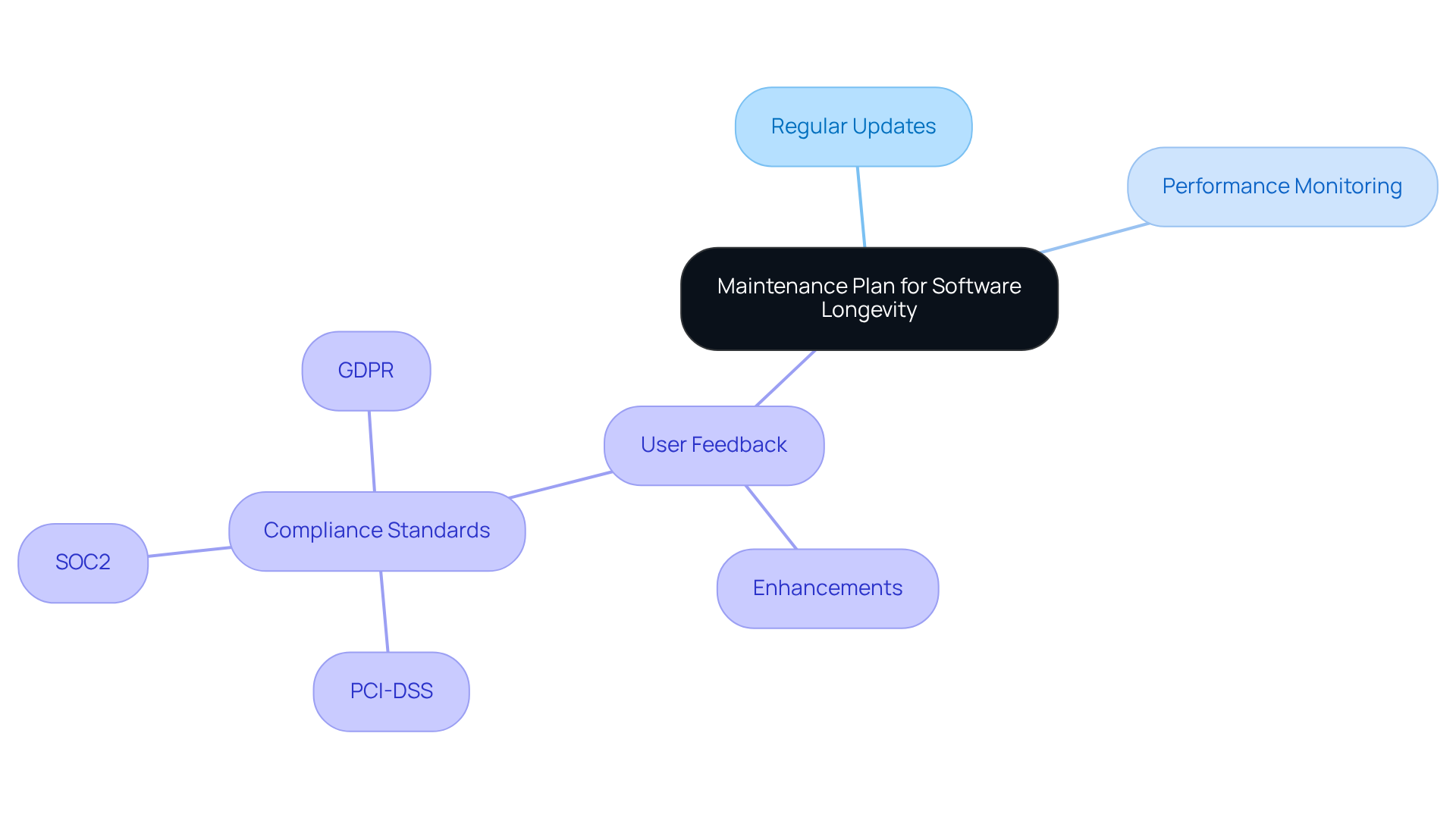

Post-deployment, it is essential to establish a robust maintenance plan to ensure software longevity and performance. This plan should prioritize:

- Regular updates

- Performance monitoring

- Utilizing user feedback to identify areas for enhancement

Such feedback is invaluable for adapting the software to meet evolving user needs and regulatory requirements, including compliance with critical standards like:

- PCI-DSS

- SOC2

- GDPR

These standards are particularly important for investment firms.

Implementing a continuous integration/continuous deployment (CI/CD) pipeline streamlines the process of delivering updates and enhancements, thereby minimizing downtime and disruption. Quality in maintenance processes should aim for close to 100% compliance to maintain operational efficiency. For hedge funds, staying attuned to technological advancements and regulatory shifts is vital for sustaining a competitive advantage.

Conclusion

The journey of software development for hedge funds is a complex process that necessitates careful navigation through critical stages to ensure success. By emphasizing thorough requirement analysis, strategic planning, and user-centric design, investment firms can develop software solutions that not only comply with regulatory standards but also improve operational efficiency and decision-making capabilities.

Key insights from the article underscore the necessity of:

- Engaging stakeholders early in the requirements phase

- Employing agile methodologies for flexible project management

- Prioritizing usability to create a seamless user experience

Additionally, the implementation of robust coding practices and comprehensive testing strategies guarantees that the software is both reliable and compliant. Effective deployment and maintenance strategies are equally vital for sustaining performance over time.

Ultimately, the importance of mastering these stages cannot be overstated. As the financial landscape evolves, investment firms must remain agile and proactive in their software development strategies. By embracing best practices and focusing on continuous improvement, they will not only enhance software longevity but also empower hedge funds to maintain a competitive edge in a rapidly changing environment. The path to software success is built on thoughtful planning, execution, and a steadfast commitment to excellence at every stage of development.

Frequently Asked Questions

What is the initial stage of software creation for investment firms?

The initial stage emphasizes a thorough requirements assessment, which is vital for aligning the project with stakeholder expectations and regulatory standards.

How can stakeholders’ needs be determined during the requirements assessment?

Stakeholders’ needs can be determined through interviews, surveys, and workshops to extract detailed insights into their expectations and ensure alignment with the firm’s strategic objectives.

What role does documentation play in the requirements assessment?

Thorough documentation of requirements serves as the foundation for the entire creation process, guiding subsequent stages and ensuring that the final product meets operational and compliance needs.

Why is strategic planning important in software creation for investment firms?

Strategic planning is crucial as it involves defining the project scope, timelines, and resource allocation, which are essential for guiding the team throughout the development process.

What methodologies can be utilized for project planning, and how do they impact outcomes?

Methodologies such as Agile and Waterfall can be utilized; Agile’s flexibility allows for adjustments in response to market changes, leading to a higher success rate compared to Waterfall.

What is the success rate of Agile projects compared to Waterfall projects?

Agile projects achieve a success rate of 42%, while Waterfall projects have a success rate of only 13%.

How important are regular check-ins with stakeholders during the project?

Regular check-ins and updates with stakeholders are imperative to ensure alignment with business objectives, promoting transparency and collaboration throughout the project.