Comparing Fintech Solutions Software Development Services for Hedge Funds

Introduction

The rapid evolution of fintech solutions is fundamentally reshaping the landscape for hedge funds, introducing both significant opportunities and notable challenges. As these financial entities strive to enhance operational efficiency and comply with stringent regulations, the demand for specialized software development services has surged. However, with a plethora of options available, hedge funds must discern which fintech development companies genuinely align with their unique needs. This article explores the comparative advantages of leading fintech software providers, emphasizing key considerations that hedge funds must evaluate to make informed decisions in this complex environment.

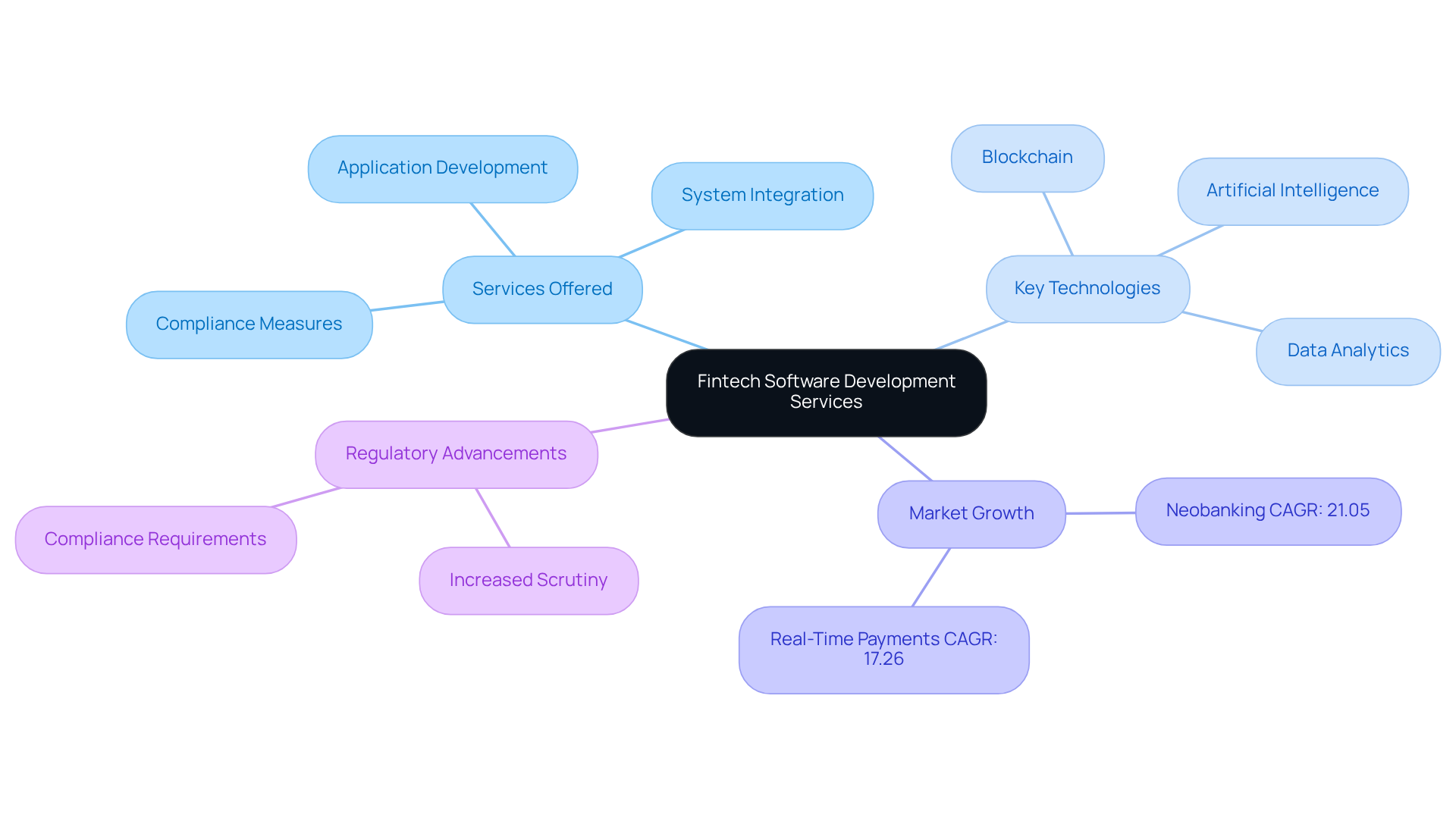

Overview of Fintech Software Development Services

Fintech solutions software development services offer a wide range of tailored solutions for financial institutions, especially hedge funds. These services encompass application development, system integration, and compliance measures that ensure adherence to rigorous regulatory standards. Key technologies driving fintech innovation include blockchain, artificial intelligence, and data analytics, which significantly improve operational efficiency and decision-making capabilities.

For example, Neutech leverages its extensive expertise in regulated industries to deliver robust solutions that enhance portfolio management and operational efficiency while ensuring compliance with regulatory requirements. Their tailored engineering talent provision process begins with a comprehensive assessment of client needs, enabling Neutech to supply specialized developers and designers who seamlessly integrate into existing teams. As the fintech landscape evolves, the demand for secure, scalable, and innovative applications continues to rise. This trend highlights the necessity for hedge funds to partner with specialized development agencies that are capable of providing fintech solutions software development services to address their unique challenges.

The fintech software creation market is expected to experience substantial growth, with neobanking alone projected to increase at a 21.05% CAGR through 2031, driven by branchless models that lower costs and facilitate fee-free checking. Furthermore, the integration of real-time payments and automated invoicing is anticipated to boost business customer growth at a 17.26% CAGR during the same timeframe.

Recent developments in the sector, such as Telcoin’s conditional approval for a digital-asset depository, underscore the regulatory advancements paving the way for further innovations in fintech. As hedge funds navigate this dynamic environment, expert opinions stress the importance of leveraging technology to enhance compliance and operational capabilities, ensuring they remain competitive in an increasingly complex market.

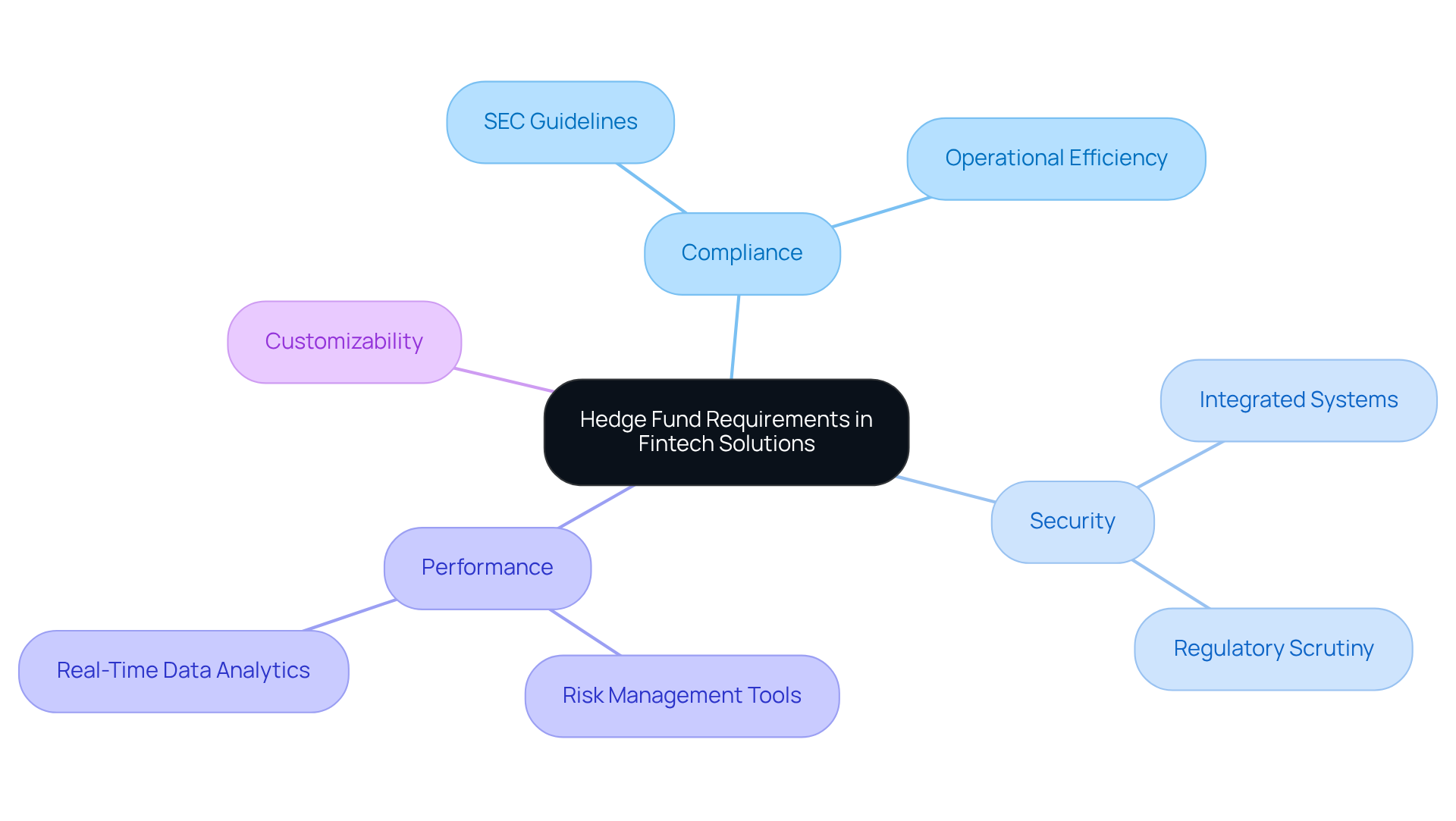

Understanding Hedge Fund Requirements in Fintech Solutions

Hedge funds operate within a stringent regulatory framework, making it essential for software solutions to prioritize compliance, security, and performance. Key requirements include robust risk management tools and real-time data analytics, which are crucial for monitoring liquidity, leverage, and counterparty exposure. For example, advanced analytics are increasingly employed to detect suspicious trading patterns, highlighting the necessity for integrated systems that enhance transparency and accountability.

Neutech’s comprehensive engineering services, which encompass expertise in React, Python, and .NET development, facilitate the creation of tailored solutions that address these demands. Furthermore, hedge funds require solutions that can support complex financial modeling and algorithmic trading strategies. Compliance with regulations, such as SEC guidelines, is non-negotiable; therefore, software providers must incorporate features that promote adherence to these standards. As the SEC emphasizes operational efficiency in compliance initiatives, investment firms must ensure their software applications reflect actual practices rather than merely policies.

Customizability is another critical aspect, as investment groups seek options that can adapt to their unique investment strategies and operational workflows. This flexibility is vital for maintaining a competitive edge in a rapidly evolving market. As hedge fund managers increasingly acknowledge the significance of effective compliance frameworks, the integration of security measures within software solutions becomes paramount to safeguard against regulatory scrutiny and potential penalties.

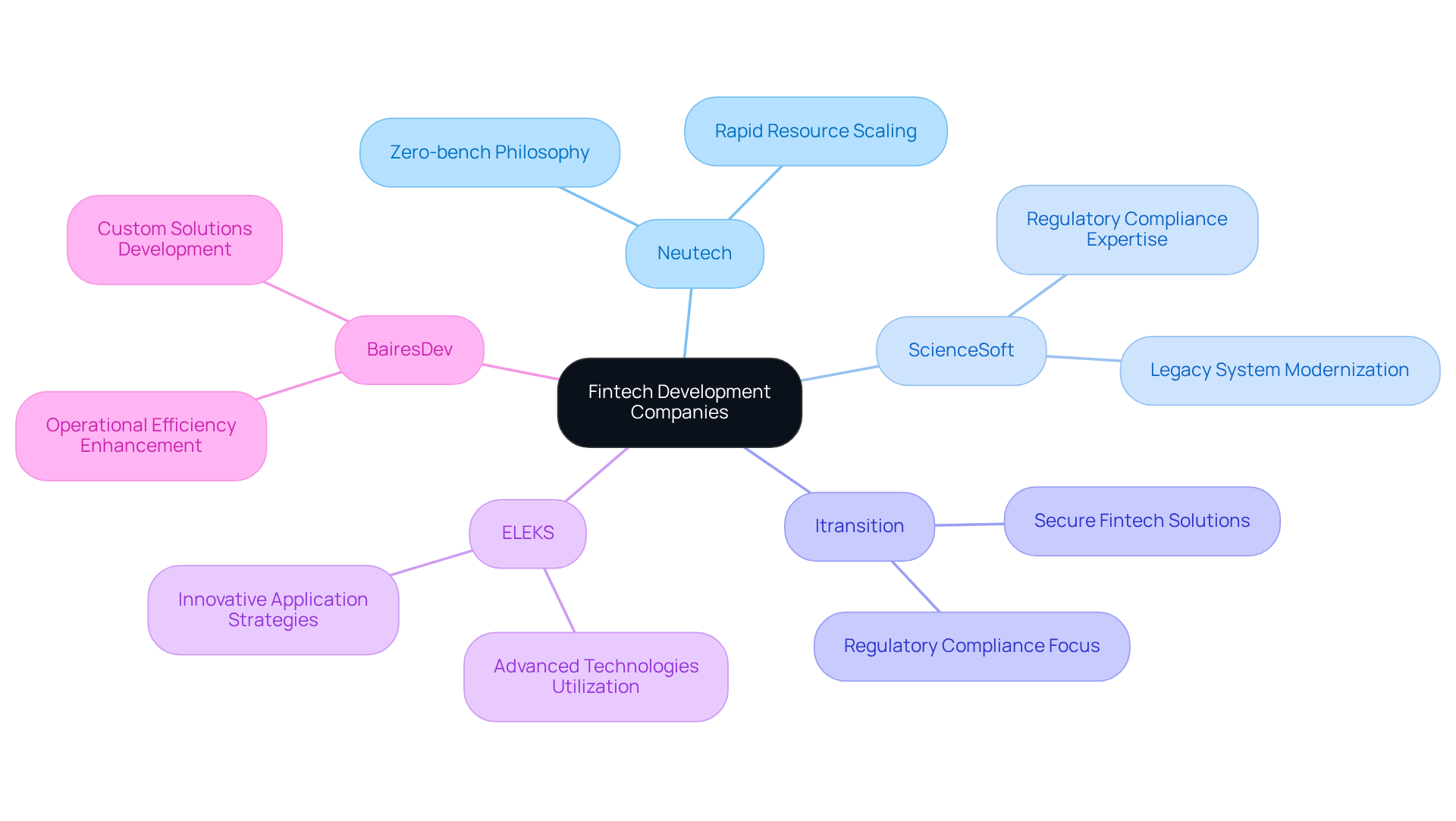

Comparative Analysis of Leading Fintech Development Companies

In the competitive realm of fintech solutions software development services, several firms distinguish themselves with specialized offerings tailored for hedge funds. Neutech stands out with its zero-bench philosophy, guaranteeing that clients have access to engineers actively engaged in projects. This approach enhances efficiency and allows for rapid scaling of resources as needed, a critical factor for hedge funds navigating dynamic market conditions. Neutech’s tailored engineering talent provision process begins with a mutual assessment of client needs, followed by supplying a selection of candidate designers and developers to seamlessly integrate into the client’s team.

In comparison, companies like ScienceSoft and Itransition offer comprehensive solutions that integrate software development with regulatory compliance. ScienceSoft has built a solid reputation over the years, while Itransition is noted for its focus on secure and scalable fintech solutions, addressing the stringent requirements of the financial sector.

Companies such as ELEKS and BairesDev are acknowledged for their innovative application creation strategies, utilizing advanced technologies to enhance operational efficiency. Each of these companies presents unique advantages, making it crucial for hedge funds to assess their specific needs against the diverse offerings available in the market.

As the fintech landscape evolves, the integration of AI and cloud computing technologies is becoming increasingly important. The anticipated expansion of the AI in fintech sector, predicted to attain $83.1 billion by 2030, underscores the necessity for investment groups to collaborate with firms that can effectively utilize these advancements. Neutech’s commitment to maintaining a zero-bench model, along with its expertise in regulated industries, positions it as an appealing option for investment groups seeking dependable and specialized engineering talent, particularly in fintech solutions software development services.

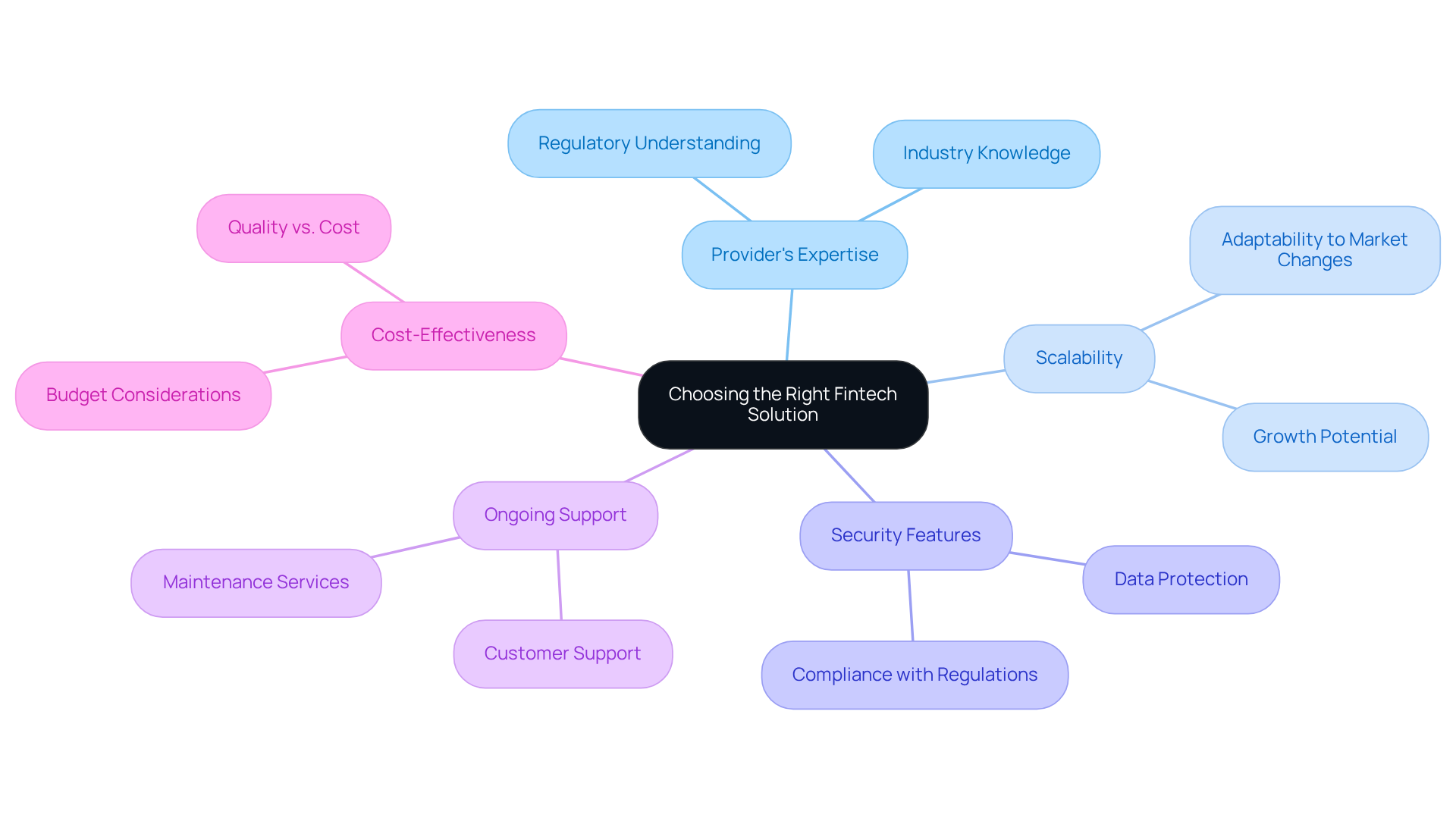

Key Considerations for Choosing the Right Fintech Solution

Selecting a partner for fintech solutions software development services is a pivotal decision for hedge funds. This choice necessitates careful consideration of several key factors.

- The provider’s expertise in the financial industry is crucial; companies with a strong history in creating strategies tailored for investment firms possess a deeper understanding of the unique challenges and regulatory environments they face.

- Scalability is equally critical; hedge funds require solutions that can evolve alongside their business and adapt to fluctuating market conditions.

- Given the sensitive nature of financial data, robust security features are non-negotiable.

- Furthermore, the capacity for ongoing support and maintenance is essential to ensure that the software remains compliant and functional over time.

- Lastly, cost-effectiveness must be assessed, striking a balance between high-quality solutions and budgetary constraints.

By meticulously evaluating these factors, hedge funds can identify a partner for fintech solutions software development services that aligns seamlessly with their strategic objectives.

Conclusion

The exploration of fintech solutions in software development services underscores their vital role in enhancing the operational efficiency and compliance of hedge funds. As these financial institutions navigate increasingly complex regulatory environments, partnering with specialized development agencies becomes essential. Tailored solutions that integrate advanced technologies, such as AI and blockchain, not only enhance decision-making but also ensure adherence to stringent guidelines, ultimately positioning hedge funds for success in a competitive landscape.

Key insights from this analysis emphasize the importance of selecting a development partner that comprehends the unique needs of hedge funds. Factors such as industry expertise, scalability, security, and ongoing support are pivotal in making an informed choice. Companies like Neutech, ScienceSoft, and Itransition present distinct advantages that cater to these requirements, making it imperative for hedge funds to carefully assess their options.

In light of the rapid evolution of fintech, it is crucial for hedge funds to embrace innovation and collaborate with experienced software development firms. By prioritizing compliance and operational effectiveness, investment groups can navigate the complexities of the market while harnessing the full potential of fintech solutions to drive growth and sustainability. The future of hedge fund operations hinges on these strategic partnerships, underscoring their significance in achieving long-term success.

Frequently Asked Questions

What are fintech software development services?

Fintech software development services provide tailored solutions for financial institutions, particularly hedge funds, including application development, system integration, and compliance measures to meet regulatory standards.

What technologies are driving fintech innovation?

Key technologies driving fintech innovation include blockchain, artificial intelligence, and data analytics, which enhance operational efficiency and decision-making capabilities.

How does Neutech contribute to fintech software development?

Neutech utilizes its expertise in regulated industries to deliver robust solutions that improve portfolio management and operational efficiency while ensuring compliance with regulations, starting with a thorough assessment of client needs.

Why is there a growing demand for fintech solutions?

The demand for secure, scalable, and innovative applications is rising as the fintech landscape evolves, particularly for hedge funds that face unique challenges requiring specialized development agencies.

What is the projected growth rate for neobanking in the fintech software creation market?

Neobanking is projected to grow at a 21.05% compound annual growth rate (CAGR) through 2031, driven by branchless models that reduce costs and enable fee-free checking.

What factors are expected to boost business customer growth in fintech?

The integration of real-time payments and automated invoicing is anticipated to increase business customer growth at a 17.26% CAGR during the same timeframe as neobanking.

What recent developments have occurred in the fintech sector?

Recent developments, such as Telcoin’s conditional approval for a digital-asset depository, highlight regulatory advancements that facilitate further innovations in the fintech industry.

What is the importance of technology for hedge funds in the fintech landscape?

Experts emphasize that leveraging technology is crucial for hedge funds to enhance compliance and operational capabilities, ensuring they remain competitive in a complex and evolving market.