Best Practices for Web Application Development in USA for Hedge Funds

Introduction

In the high-stakes realm of hedge funds, financial integrity and regulatory compliance are of utmost importance. Consequently, the development of web applications assumes a critical role. This article examines best practices that not only ensure adherence to stringent compliance standards but also enhance the quality and security of these essential tools. As technology continues to evolve, hedge funds must consider how to leverage innovative strategies and skills to maintain a competitive edge while safeguarding their operations. Addressing this question uncovers key opportunities and challenges that developers must navigate to deliver robust web solutions tailored to the unique needs of the financial sector.

Understand Compliance Standards in Web Application Development

In the hedge fund sector, adherence to regulations such as SEC guidelines, GDPR, and FINRA rules is essential. To protect sensitive financial data and uphold investor trust, developers engaged in web application development in USA must ensure that web platforms comply with these standards. Recent statistics indicate that around 70% of financial services firms face challenges in meeting SEC compliance requirements, highlighting the urgent need for effective compliance measures.

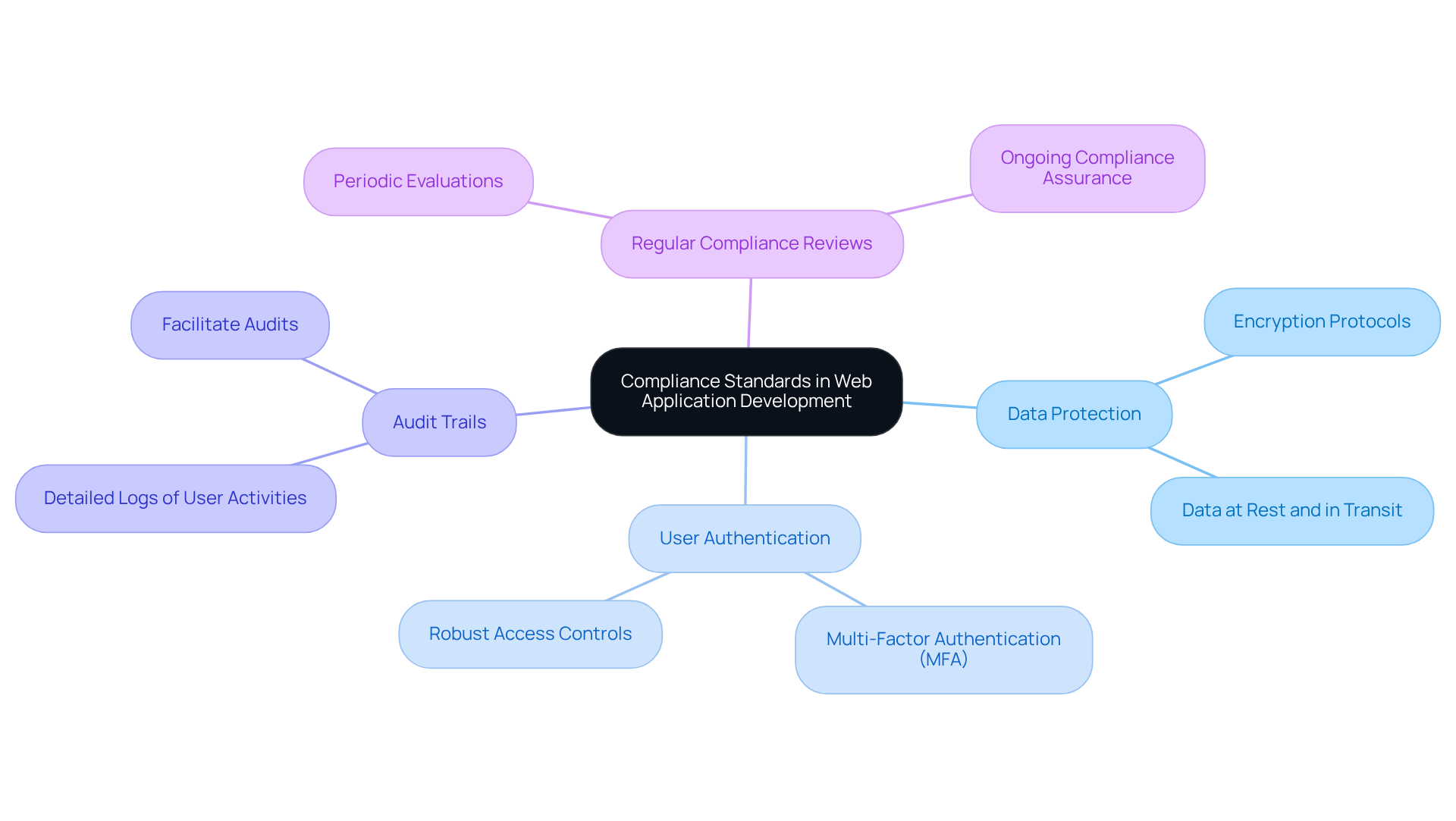

Key practices include:

- Data Protection: Implement encryption protocols for data at rest and in transit to safeguard sensitive information.

- User Authentication: Utilize multi-factor authentication (MFA) to enhance security and comply with regulations that mandate robust access controls.

- Audit Trails: Maintain detailed logs of user activities to facilitate audits and ensure accountability.

- Regular Compliance Reviews: Schedule periodic evaluations of your software against current regulations to ensure ongoing compliance.

As Brian McCormack from FINRA states, “Outsourcing does not outsource responsibility,” underscoring the necessity of maintaining rigorous compliance standards. By integrating these practices into the web application development in USA lifecycle, investment groups can mitigate risks associated with non-compliance and enhance their operational integrity.

Develop Essential Skills for Quality Web Applications

To excel in web application development in the USA for hedge funds, developers must cultivate a robust skill set that addresses the unique challenges of the financial sector.

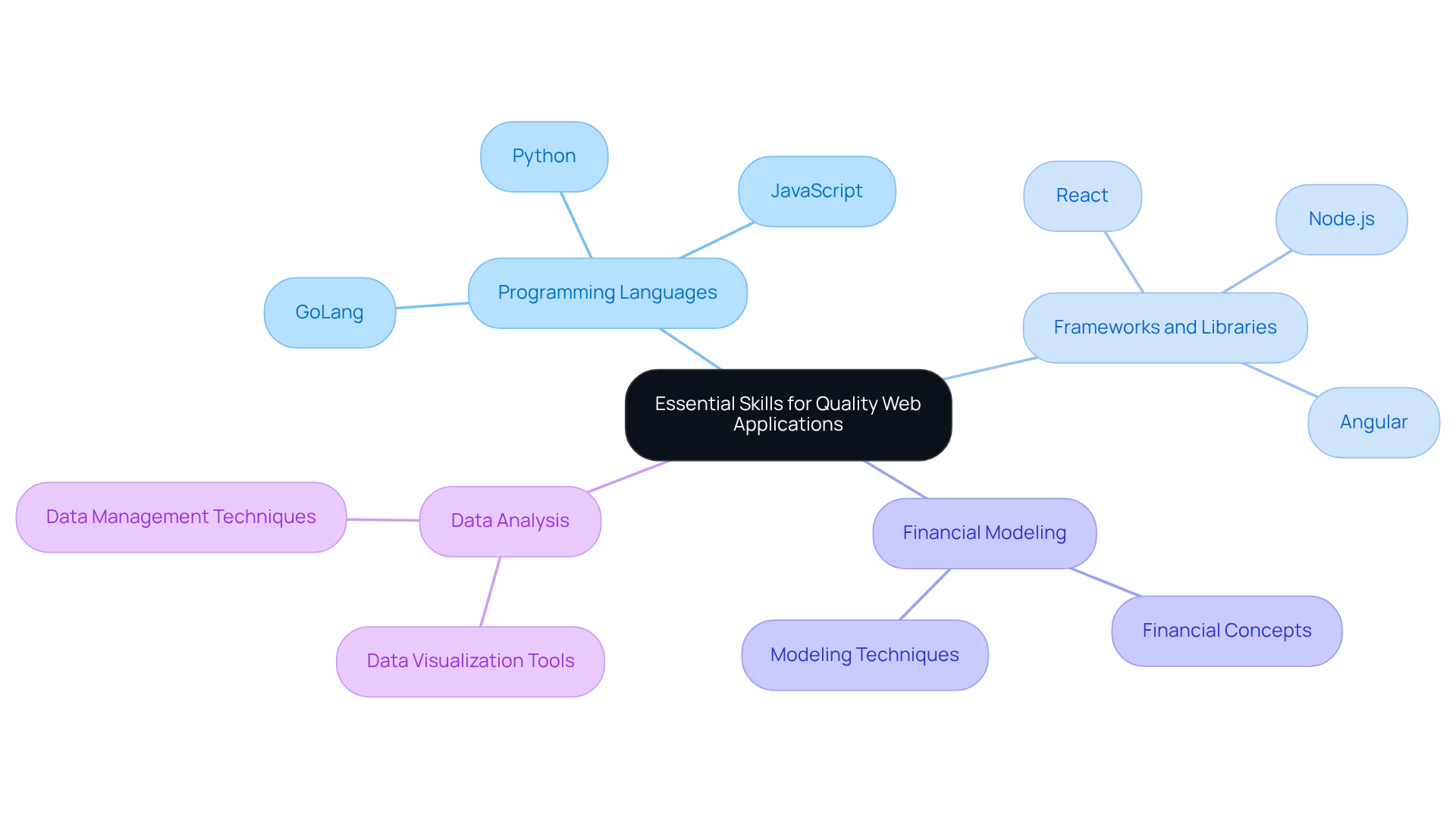

Programming Languages: Mastery of languages such as Python, JavaScript, and GoLang is essential for creating scalable and efficient applications tailored to the needs of hedge funds. As Neutech emphasizes, “Custom solutions streamline operations, mitigate compliance risks, and reduce costs associated with data management and analysis.” This tailored approach ensures that hedge funds receive the specific expertise they require.

Frameworks and Libraries: Proficiency in frameworks like React, Angular, and Node.js can significantly enhance coding speed and software performance. This enables developers to deliver high-quality solutions swiftly, which is crucial as competitors leveraging specialized development are likely to outperform those who do not.

Financial Modeling: A solid understanding of financial concepts and modeling techniques is crucial for developing applications that effectively support investment strategies and decision-making processes. Ignoring these aspects can lead to operational difficulties, such as regulatory compliance and data management challenges that investment firms encounter.

Data Analysis: Proficiency in data analysis and visualization tools enables developers to create software that extracts actionable insights from complex datasets. This enhances operational efficiency and strategic planning. In fact, operational failures account for 50% of investment closures, underscoring the importance of effective data management.

Investing in ongoing training and professional development in these areas will equip developers to create innovative applications that meet the evolving demands of hedge funds. Ultimately, this drives success in a competitive landscape. As noted by industry leaders, effective partnerships with development firms like Neutech enhance hedge funds’ capacity to adapt to market changes.

Implement Best Practices for Quality Assurance and Security

-

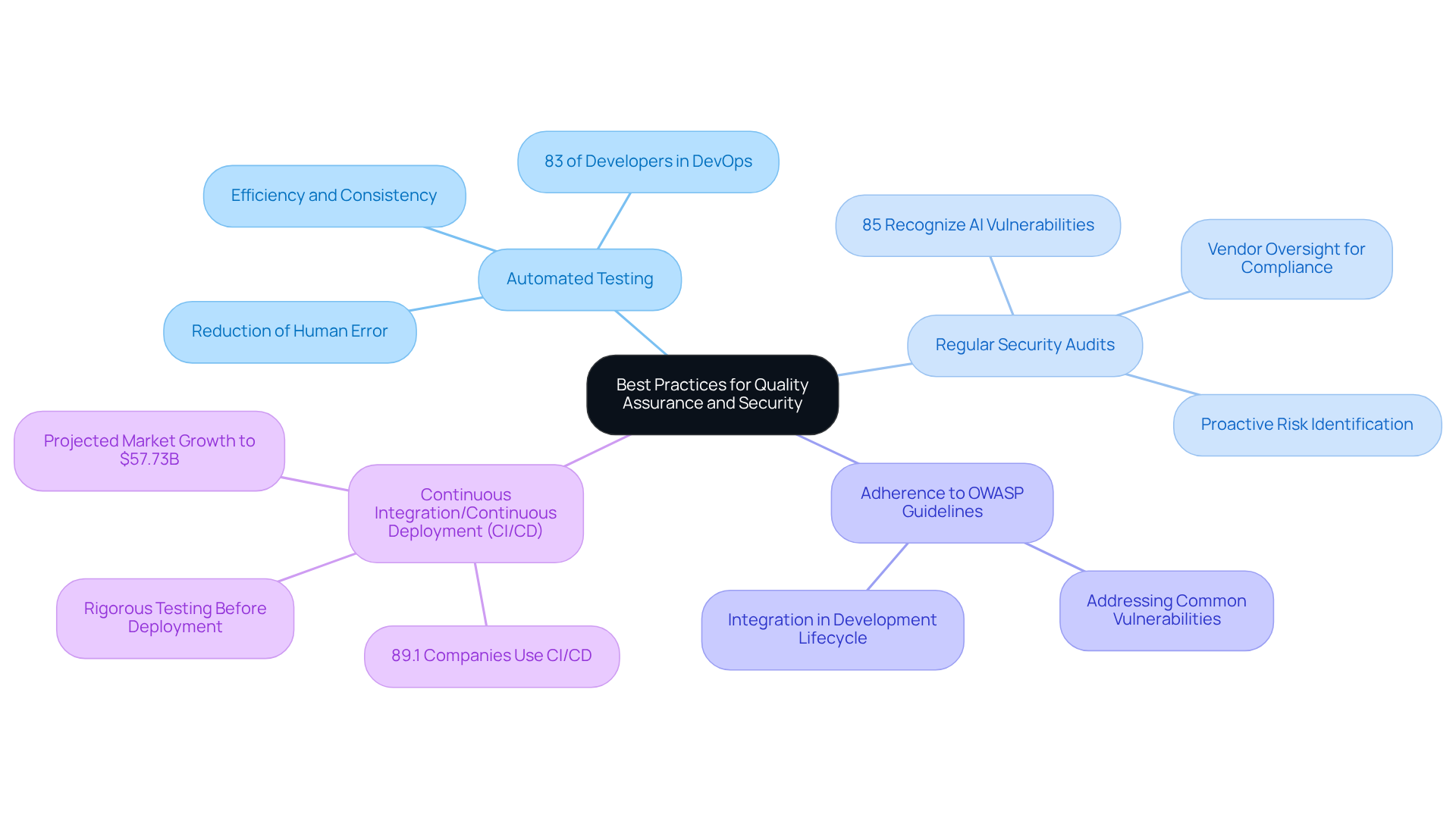

Automated Testing: Automated testing frameworks should be leveraged to enhance efficiency and ensure consistent performance across web applications. This approach accelerates the testing process while minimizing human error, leading to more reliable outcomes. Notably, 83% of developers are engaged in DevOps-related activities, underscoring the trend towards automation in testing.

-

Regular Security Audits: Frequent security audits and vulnerability assessments are essential for proactively identifying and addressing potential risks. A robust security audit framework is particularly crucial in the financial sector, where the stakes are high. Organizations that prioritize regular audits can significantly reduce the likelihood of breaches; over 85% of firms recognize AI-related vulnerabilities as a major cyber risk. Regulators now consider vendor oversight a component of operational compliance, further emphasizing the importance of these audits.

-

Adherence to OWASP Guidelines: The application of the OWASP Top Ten guidelines is vital for effectively addressing common security vulnerabilities in web platforms. These guidelines serve as a fundamental resource for developers, ensuring that essential security measures are integrated into the development lifecycle.

-

Continuous Integration/Continuous Deployment (CI/CD): CI/CD pipelines should be utilized to automate testing and deployment processes. This practice guarantees that code changes undergo rigorous testing before going live, thereby enhancing the overall reliability of software. In fact, 89.1% of companies now employ CI/CD pipelines, reflecting a growing trend towards integrating quality assurance within development workflows. The global software testing industry is projected to reach $57.73 billion by 2026, highlighting the increasing significance of quality assurance in the financial sector.

By prioritizing these best practices, hedge funds can significantly enhance the reliability and security of their web application development in USA, thereby safeguarding their assets and maintaining their reputation in a highly regulated industry.

Embrace Continuous Improvement and Adaptation in Development

In the rapidly evolving landscape of hedge funds, embracing continuous improvement is essential for maintaining a competitive edge. Key strategies to foster a culture of adaptability and responsiveness include the following:

-

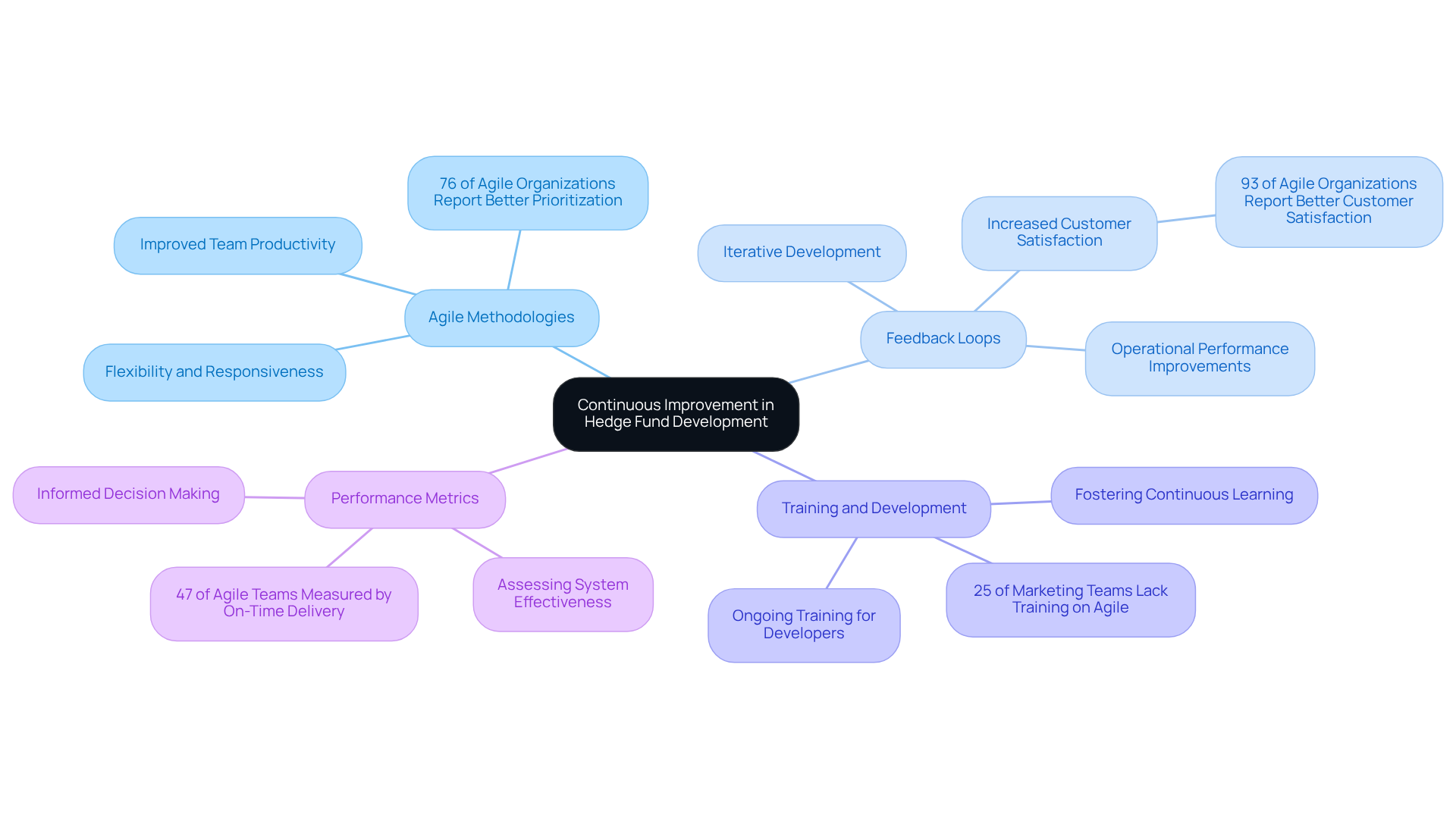

Agile Methodologies: Implementing Agile practices enhances flexibility, enabling teams to swiftly respond to changing requirements and market dynamics. This approach has been shown to improve team productivity and morale, with 76% of Agile organizations reporting better prioritization of work (Digital.ai).

-

Feedback Loops: Establishing robust mechanisms for gathering feedback from users and stakeholders is crucial. These feedback loops inform iterative development, ensuring that applications align with user needs and market demands. Organizations that effectively utilize feedback mechanisms often see significant improvements in customer satisfaction and operational performance. For instance, Agile teams practicing full Scrum achieve 250% better quality than teams that do not estimate.

-

Training and Development: Investing in ongoing training for developers is vital to keep them updated on the latest technologies and best practices. This commitment not only enhances technical proficiency but also fosters a culture of continuous learning and improvement. Notably, 25% of marketing teams lack training or knowledge about Agile approaches, underscoring the importance of training in Agile adoption.

-

Performance Metrics: Utilizing performance metrics to assess system effectiveness helps identify areas for enhancement. By consistently evaluating these metrics, investment firms can make informed decisions that promote software development and align with strategic objectives.

By integrating these strategies, hedge funds can ensure their web application development in the USA evolves alongside market demands, positioning themselves for sustained success. However, it is essential to recognize common pitfalls, such as resistance to change and insufficient management support, which can hinder the successful implementation of these strategies.

Conclusion

In the domain of web application development for hedge funds, the integration of compliance, skill development, quality assurance, and continuous improvement stands as a crucial foundation for success. Upholding stringent regulatory standards while fostering innovation is not merely a best practice; it is essential for ensuring the security and reliability of financial applications. As the landscape evolves, a steadfast commitment to these principles will significantly influence the operational integrity and competitive advantage of hedge funds.

Key insights emphasize the necessity of understanding compliance standards to safeguard sensitive data, the importance of cultivating essential programming and analytical skills, and the critical role of implementing rigorous quality assurance practices. Collectively, these elements contribute to a robust development process that mitigates risks and enhances the overall effectiveness of web applications tailored for the financial sector. Furthermore, embracing agile methodologies and fostering a culture of continuous improvement ensures that hedge funds remain adaptable to market fluctuations and technological advancements.

Ultimately, the imperative for hedge funds is clear: investing in best practices for web application development transcends merely meeting current demands; it involves anticipating future challenges. By prioritizing compliance, skill enhancement, and quality assurance, hedge funds can secure their position in a rapidly changing environment, paving the way for sustained growth and innovation in a competitive landscape.

Frequently Asked Questions

What compliance standards are important in web application development for the hedge fund sector?

Important compliance standards include SEC guidelines, GDPR, and FINRA rules, which are essential for protecting sensitive financial data and maintaining investor trust.

What challenges do financial services firms face regarding SEC compliance?

Approximately 70% of financial services firms encounter challenges in meeting SEC compliance requirements, indicating a significant need for effective compliance measures.

What are key practices for ensuring compliance in web application development?

Key practices include implementing data protection through encryption, utilizing multi-factor authentication for user access, maintaining audit trails of user activities, and conducting regular compliance reviews of software against current regulations.

Why is data protection important in web application development?

Data protection is crucial to safeguard sensitive information both at rest and in transit, thereby ensuring compliance with regulations and protecting investor data.

How does multi-factor authentication (MFA) contribute to compliance?

MFA enhances security by requiring multiple forms of verification for user access, which helps comply with regulations that demand robust access controls.

What role do audit trails play in compliance?

Audit trails maintain detailed logs of user activities, facilitating audits and ensuring accountability, which are essential for compliance with regulatory standards.

How often should compliance reviews be conducted?

Regular compliance reviews should be scheduled periodically to evaluate software against current regulations and ensure ongoing compliance.

What does Brian McCormack from FINRA emphasize regarding outsourcing and compliance?

Brian McCormack emphasizes that “Outsourcing does not outsource responsibility,” highlighting the importance of maintaining rigorous compliance standards even when using third-party services.