Why Hedge Funds Need UI UX Consulting for Lasting Success

Introduction

In an environment where hedge funds compete for the attention of discerning investors, the importance of user interface (UI) and user experience (UX) is paramount. By employing UI UX consulting, these investment firms can improve their platforms, ensuring they are not only visually appealing but also intuitive and efficient. As competition intensifies, a critical question emerges: how can hedge funds effectively leverage design to attract and retain clients in an increasingly digital landscape?

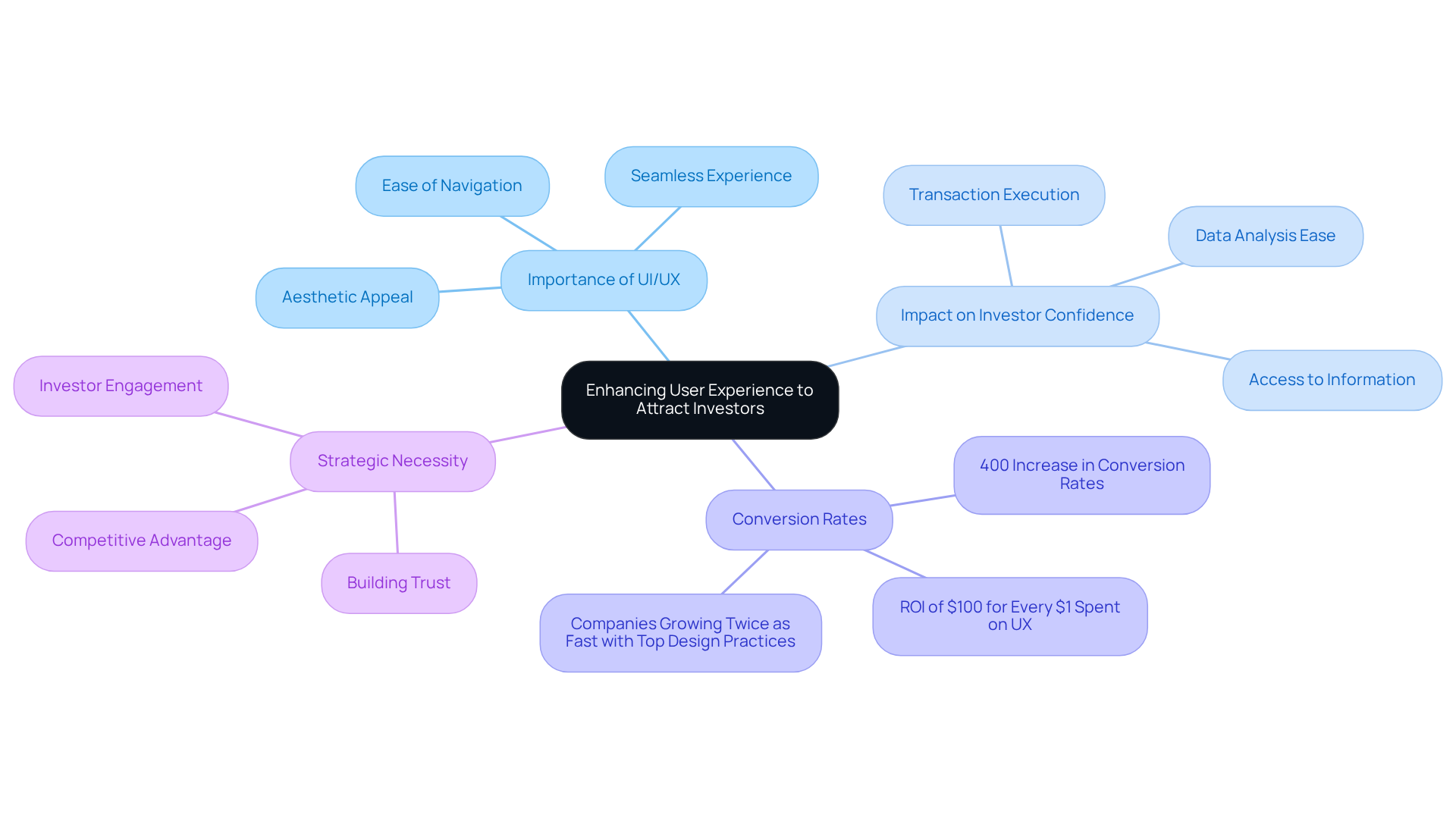

Enhance User Experience to Attract Investors

In the competitive landscape of hedge funds, attracting investors is paramount. A well-crafted user interface (UI) and user experience (UX) are important aspects addressed through UI UX consulting in this endeavor. Research indicates that a seamless and intuitive experience significantly enhances customer satisfaction, leading to increased trust and engagement. For investment groups, this suggests that prospective backers are more inclined to interact with platforms that are aesthetically pleasing and easy to navigate.

Moreover, a positive user experience can mitigate the perceived risk associated with investing. When investors can easily access information, analyze data, and execute transactions, they are more likely to feel confident in their investment decisions. This confidence can translate into higher investment volumes and a more robust client base. For instance, investment groups that focus on UI UX consulting frequently report elevated conversion rates. Forrester Research has found that a carefully considered UX design can increase conversion rates by as much as 400%. This statistic underscores the financial advantages of investing in customer experience.

In a sector characterized by intense rivalry, where only 5% of investment organizations with strong brands are anticipated to capture 90% of net flows by 2026, enhancing client experience is not merely about aesthetics; it is a strategic necessity that directly impacts investor attraction and retention. As noted by financial experts, “A seamless user experience is crucial for building trust and ensuring investor engagement in today’s digital landscape.

Improve Operational Efficiency Through Design

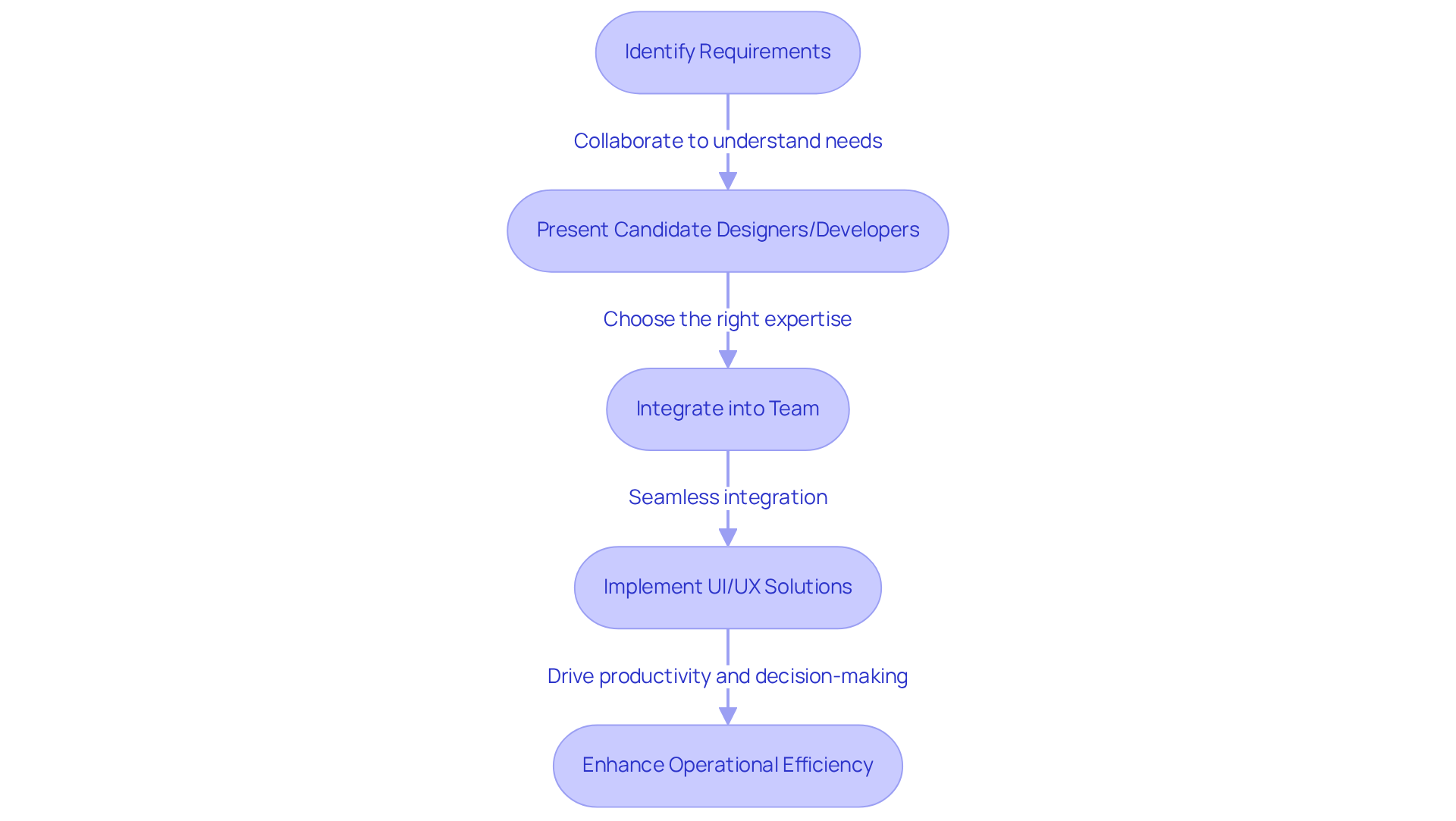

Operational efficiency is crucial for hedge funds, where every second and decision can significantly influence financial outcomes. Effective UI/UX design, supported by UI/UX consulting, is integral in streamlining processes, minimizing errors, and enhancing overall productivity. By simplifying complex workflows and providing intuitive navigation, hedge funds can substantially reduce the time spent on administrative tasks, enabling teams to focus on strategic decision-making.

Neutech recognizes the distinct needs of hedge funds. Once we collaboratively identify your requirements, we will present a selection of candidate designers and developers to seamlessly integrate into your team. This customized approach ensures that the appropriate expertise is applied to enhance your operational efficiency.

For example, a well-designed dashboard can effectively display key performance indicators (KPIs) and analytics in a clear and concise manner, allowing fund managers to make informed decisions swiftly. Research shows that users form opinions about a website within just 50 milliseconds, highlighting the significance of first impressions in financial services. Additionally, reducing cognitive load through careful planning can lead to fewer errors and a more adaptable response to market changes. This operational agility is essential in the fast-paced investment environment, where the ability to act quickly can differentiate successful portfolios from their competitors.

Investing in UI/UX consulting goes beyond aesthetics; it is a strategic necessity that can greatly enhance operational efficiency and drive improved financial outcomes for hedge funds. As investment managers increasingly recognize the importance of an efficient layout, they are leveraging it to optimize processes and minimize mistakes, ultimately fostering a more productive and agile investment atmosphere.

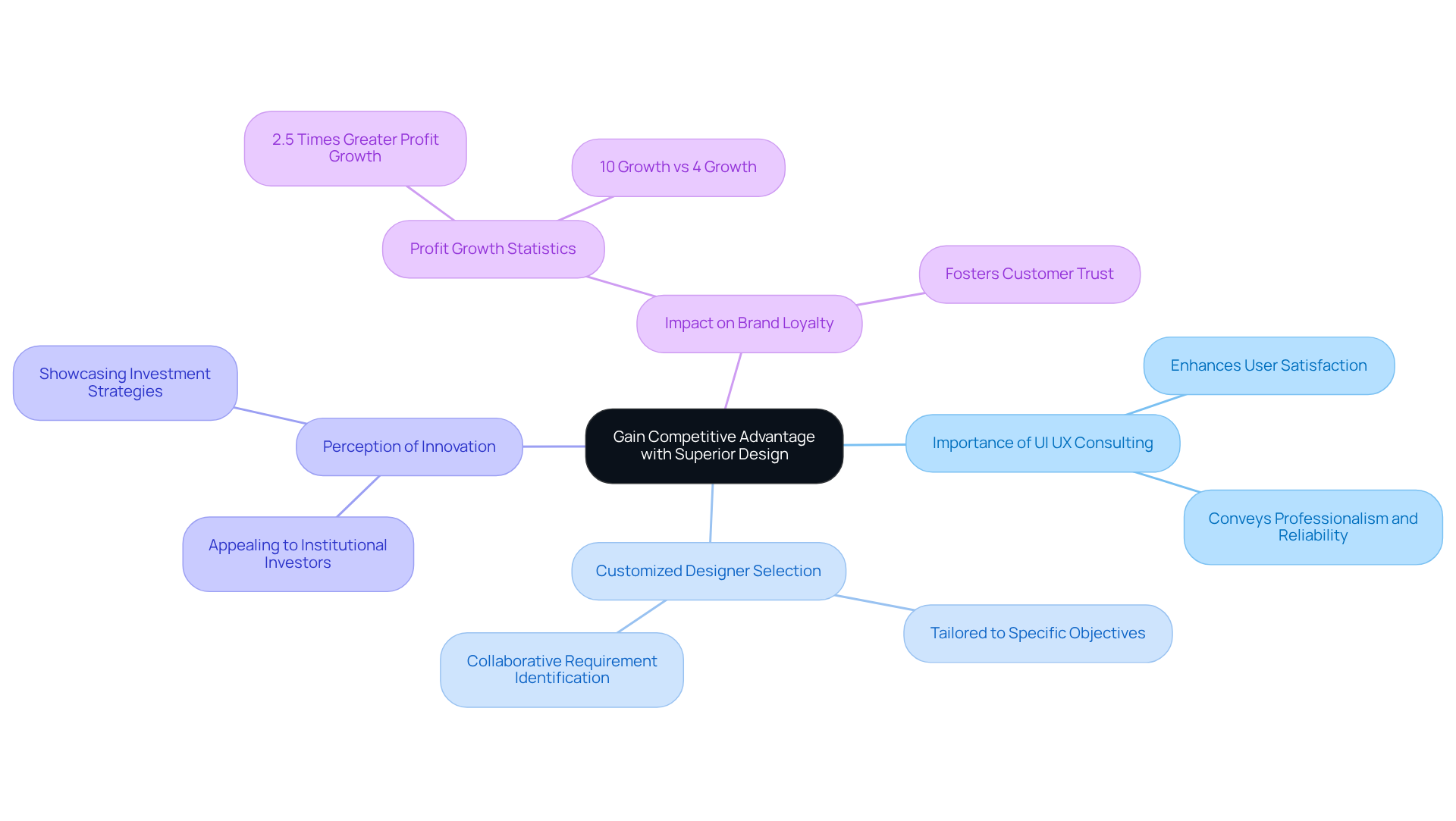

Gain Competitive Advantage with Superior Design

In the highly competitive investment landscape, distinguishing oneself is essential for attracting and retaining clients. Exceptional UI UX consulting serves as a critical differentiator, allowing hedge funds to stand out from their competitors. A well-designed platform not only enhances user satisfaction but also conveys professionalism and reliability-qualities that are vital in the financial sector.

At Neutech, we recognize that each hedge investment has distinct needs. Once we collaboratively identify your requirements, we provide a selection of candidate designers and developers tailored to your specific objectives. This customized approach to engineering talent ensures that you have the right expertise in UI UX consulting to elevate your design.

Hedge funds that emphasize high-quality design through UI UX consulting are often perceived as more innovative and forward-thinking. This perception is particularly appealing to institutional investors, who increasingly value technology and experience in their investment decisions. For example, funds that implement sophisticated aesthetic principles to create engaging and informative interfaces can effectively showcase their investment strategies and performance metrics, facilitating a clearer understanding of their value proposition for potential investors.

Investing in exceptional aesthetics with UI UX consulting not only enhances the user experience but also fosters brand loyalty and strengthens market positioning. Research indicates that companies with advanced creative strategies experience profit growth that is 2.5 times greater than those with less developed practices. By leveraging aesthetics as a competitive advantage, investment firms can enhance their appeal and thrive in an ever-evolving market.

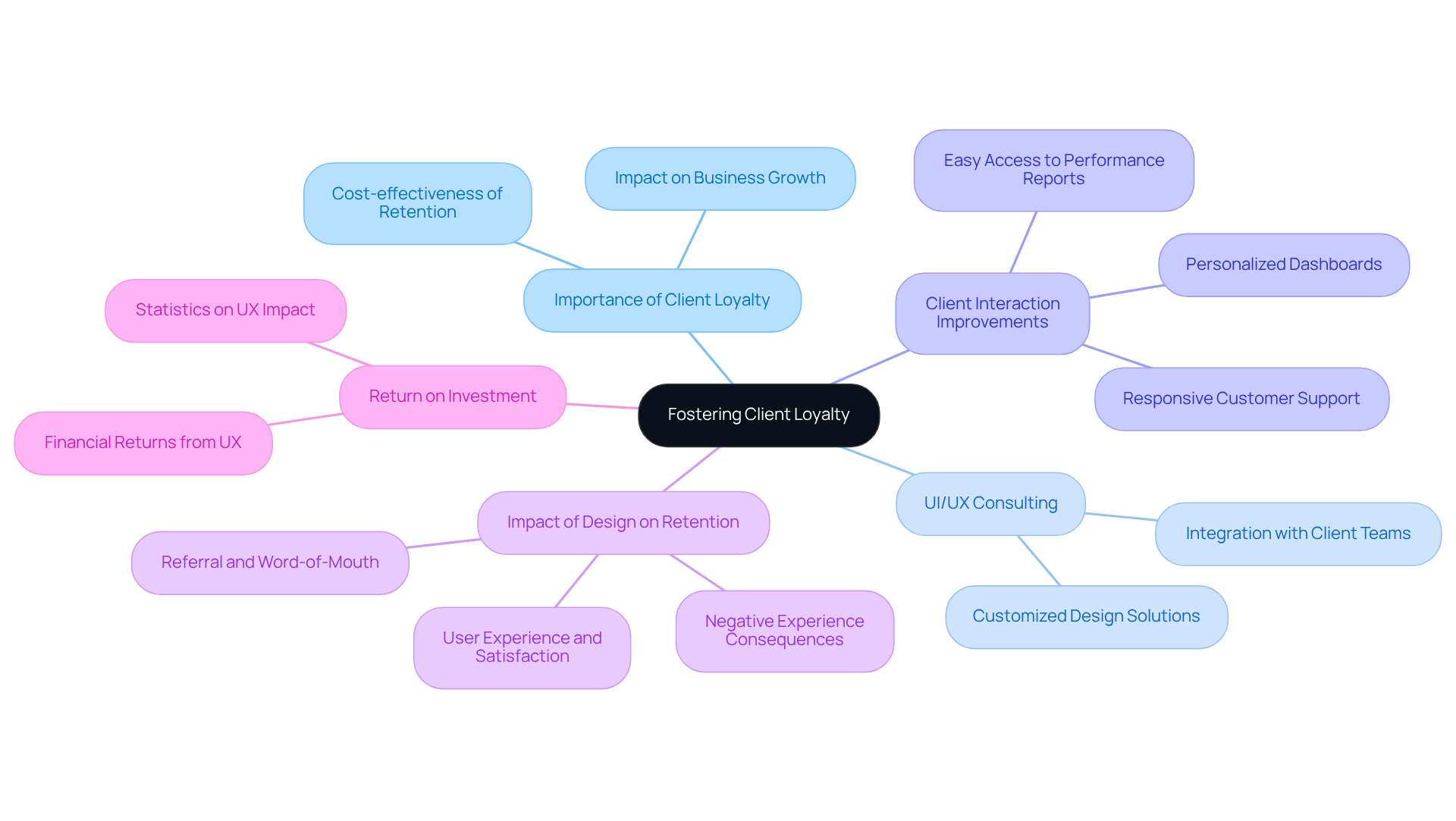

Foster Client Loyalty for Long-Term Success

Client loyalty is essential for success in the investment sector, where retaining existing clients is significantly more cost-effective than acquiring new ones. Investing in UI UX consulting is vital for crafting positive and memorable experiences that nurture this loyalty.

At Neutech, we understand that each hedge fund has distinct needs. Once we collaboratively identify your requirements, we provide a selection of candidate designers and developers who can seamlessly integrate into your team. This customized approach to UI UX consulting ensures that the design aligns precisely with your clients’ expectations, enhancing their interactions with your platform.

A well-designed platform improves client interactions, making clients feel valued and understood. Features such as personalized dashboards, easy access to performance reports, and responsive customer support can significantly boost client satisfaction. When clients perceive that their needs are prioritized and their concerns addressed promptly, their loyalty to the organization strengthens.

Moreover, effective design not only retains clients but also fosters referrals and positive word-of-mouth, which are invaluable assets in the hedge fund industry. Research shows that 88% of users are less likely to return after a negative experience, highlighting the critical nature of a well-executed user experience. Satisfied clients are more likely to recommend the fund to others, thereby expanding the client base without extensive marketing efforts.

Furthermore, every dollar invested in UX yields a return of $100, translating to a remarkable return of 9,900%. This statistic emphasizes the cost-effectiveness of investing in UI/UX design for client retention. Ultimately, investing in UI/UX consulting goes beyond aesthetics; it is a strategic initiative that fosters client loyalty and drives long-term success for hedge funds. By prioritizing user experience, hedge funds can ensure they not only meet but exceed client expectations, leading to sustained growth and profitability.

Conclusion

Investing in UI/UX consulting is not merely a trend; it represents a fundamental strategy for hedge funds striving for sustained success in a competitive marketplace. By enhancing user interface and experience, hedge funds can significantly boost their appeal to potential investors, fostering engagement and trust. A seamless and intuitive design not only attracts clients but also mitigates perceived risks, ultimately leading to increased investment volumes and a more robust client base.

The key arguments presented underscore that effective UI/UX design directly influences operational efficiency, investor attraction, and client loyalty. By simplifying workflows and providing clear navigation, hedge funds can streamline processes, reduce errors, and empower fund managers to make informed decisions swiftly. Furthermore, a strong emphasis on design can distinguish a hedge fund from its competitors, positioning it as innovative and trustworthy in the eyes of institutional investors. The statistics discussed reinforce the financial advantages of investing in user experience, demonstrating that the returns can be substantial.

In conclusion, prioritizing UI/UX consulting is essential for hedge funds aiming to thrive in an ever-evolving financial landscape. By focusing on user experience strategies that enhance client satisfaction and loyalty, hedge funds can not only meet but exceed investor expectations. As competition intensifies, embracing superior design will be crucial for attracting and retaining clients, ultimately driving long-term success and profitability. Investing in UI/UX is not simply an aesthetic choice; it is a strategic necessity that can redefine the future of hedge fund operations.

Frequently Asked Questions

Why is enhancing user experience important for attracting investors in hedge funds?

Enhancing user experience is crucial as it leads to increased customer satisfaction, trust, and engagement, making prospective backers more inclined to interact with investment platforms.

How does user experience affect investor confidence?

A positive user experience allows investors to easily access information, analyze data, and execute transactions, which boosts their confidence in making investment decisions.

What impact does UI UX consulting have on investment groups?

Investment groups that focus on UI UX consulting often report elevated conversion rates, indicating that a well-designed user interface can lead to higher investment volumes and a more robust client base.

What statistic highlights the financial advantages of investing in customer experience?

Forrester Research indicates that a carefully considered UX design can increase conversion rates by as much as 400%, showcasing significant financial benefits.

Why is enhancing client experience considered a strategic necessity in the hedge fund sector?

In a highly competitive landscape, enhancing client experience is essential for attracting and retaining investors, as only a small percentage of investment organizations with strong brands are expected to capture the majority of net flows by 2026.