Introduction

In an industry where regulatory compliance is paramount, hedge funds are under increasing scrutiny regarding their software usage and cybersecurity practices. Effective software audit services not only protect these firms from potential legal repercussions but also provide a means to optimize costs, enhance security, and strengthen investor confidence. As the regulatory landscape continues to evolve, hedge funds must navigate the complexities of software audits to maximize returns while ensuring compliance.

Define Software Audits and Their Importance for Hedge Funds

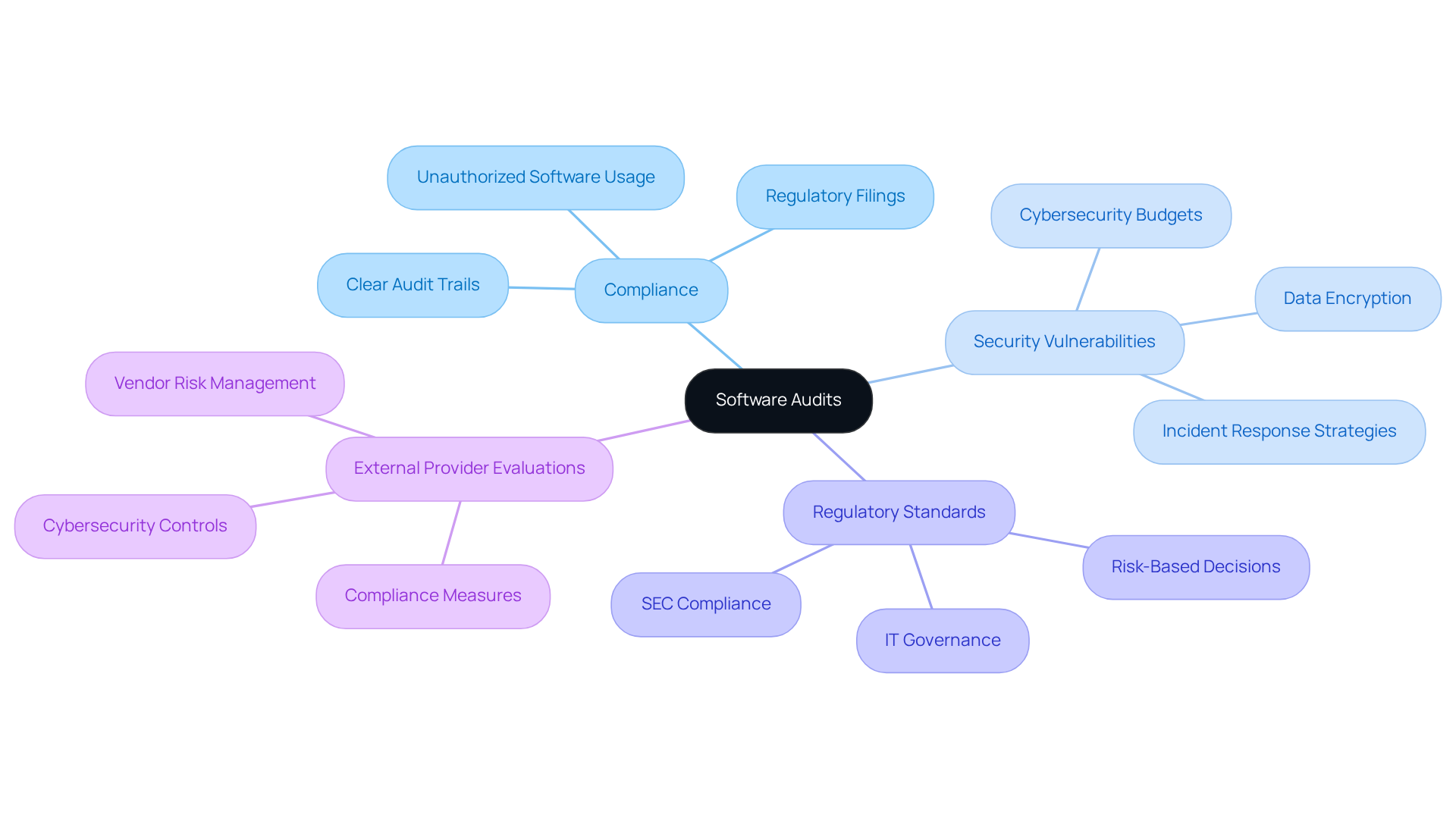

Software audit services consist of comprehensive evaluations of an organization’s software usage, aimed at ensuring compliance with licensing agreements and regulatory standards. In the investment sector, where regulatory scrutiny is particularly stringent, these evaluations are essential. They not only help identify unauthorized software usage but also assess security vulnerabilities and confirm that the software meets the organization’s operational needs. Regular software audit services enable investment groups to mitigate risks associated with non-compliance, which can result in substantial financial penalties and reputational harm.

The SEC has underscored the necessity for investment pools to maintain clear audit trails and document risk-based decisions, especially in light of heightened regulatory expectations regarding cybersecurity threats and incident response strategies. Furthermore, a recent survey conducted by the Investment Fund Association revealed that 78% of asset managers have increased their cybersecurity budgets, reflecting a growing recognition of the importance of robust regulatory frameworks.

Additionally, investment pools must evaluate external providers for compliance and cybersecurity measures to ensure a comprehensive approach to risk management. By implementing effective software audit services, investment firms can enhance their regulatory posture, build trust with authorities, and ultimately safeguard their assets.

Identify Key Benefits of Software Audits for Hedge Funds

Software audits provide several significant advantages for hedge funds:

-

Risk Mitigation: Regular audits are essential for identifying potential compliance issues before they escalate into costly penalties. This proactive approach safeguards the firm against unforeseen liabilities.

-

Cost efficiency can be achieved by investment groups by utilizing software audit services to ensure that only essential software is used, optimizing their software expenses. This practice helps avoid unnecessary licensing fees, contributing to overall financial health.

-

Enhanced security is ensured by software audit services, which play a crucial role in uncovering vulnerabilities within software systems. By addressing these weaknesses promptly, firms can significantly reduce the risk of data breaches, thereby protecting sensitive information.

-

Enhanced operational efficiency can result from optimizing software utilization and ensuring compliance through software audit services, leading to improved operational workflows. This efficiency is vital for maintaining competitive advantage in the market.

-

Investor Confidence: Demonstrating a commitment to adherence through routine evaluations can bolster investor trust. This transparency in management practices enhances confidence in the portfolio’s oversight.

Outline the Software Audit Process: Steps for Effective Implementation

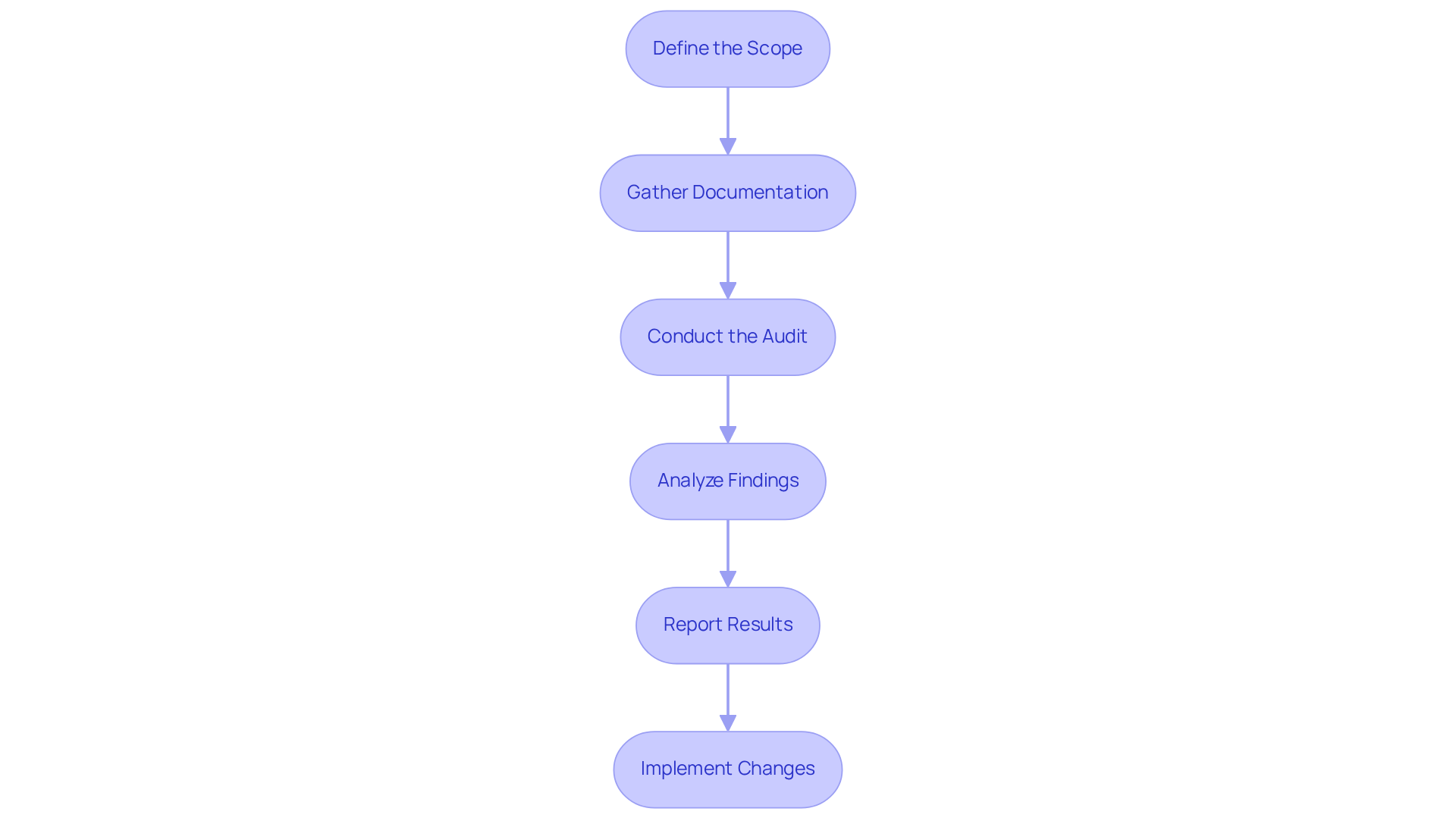

Executing software audit services in hedge funds requires a systematic approach to ensure compliance and mitigate risks. The following steps outline an effective execution process:

-

Define the Scope: Clearly identify the software applications included in the review and outline the specific regulatory requirements relevant to those applications, including adherence to the SEC’s Custody Rule and Cybersecurity Risk Management Rule.

-

Gather Documentation: Compile all relevant licensing contracts, usage data, and prior evaluation reports. This documentation serves as a foundation for the current review and aids in understanding historical compliance.

-

Conduct the Audit: Assess software usage against licensing agreements, focusing on identifying unauthorized installations and ensuring compliance with regulatory standards. This step is crucial for maintaining operational integrity and avoiding penalties associated with non-compliance.

-

Analyze Findings: Review the assessment results to identify discrepancies or areas of non-compliance. Evaluate the potential risks associated with these findings, as they can impact both financial performance and regulatory standing. For instance, companies must disclose major cybersecurity events to the SEC within four business days, underscoring the importance of timely compliance.

-

Report Results: Create a comprehensive report summarizing the examination findings, highlighting any regulatory issues and providing practical suggestions for resolution. This report should serve as a guide for future compliance efforts and may include insights from case studies, such as the importance of preparation for custody evaluations.

-

Implement Changes: Following the review results, initiate corrective measures to address identified issues and enhance compliance practices moving forward. Continuous improvement in this area is essential for maintaining operational excellence and regulatory compliance, especially in light of evolving regulations and the necessity for annual custody reviews.

Ensure Compliance and Manage Risks Through Software Audits

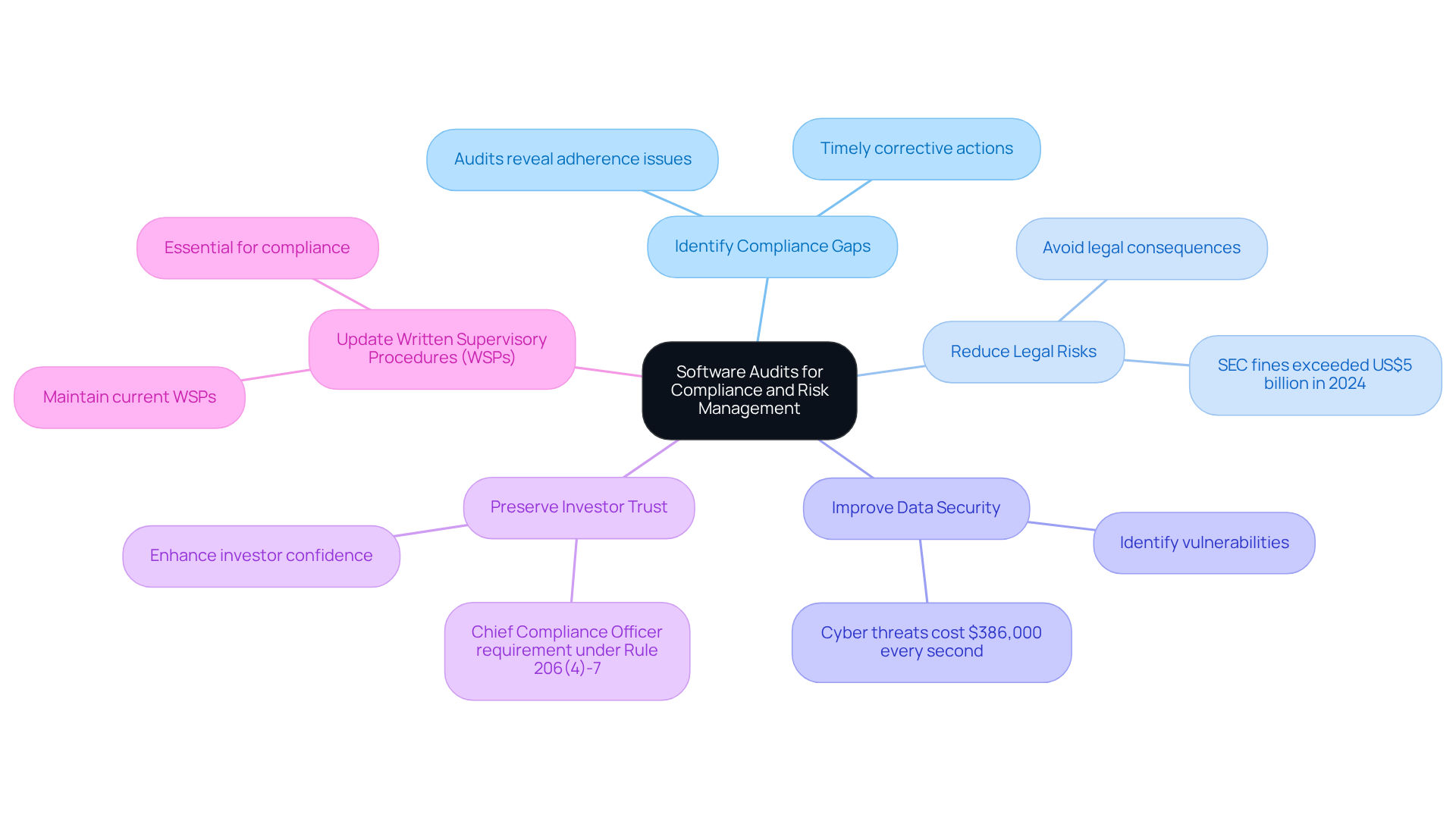

Software evaluations are essential for ensuring compliance with regulatory obligations and managing operational risks associated with investment vehicles. Regular assessments of software usage enable hedge funds to achieve several critical objectives:

-

Identify Compliance Gaps: Conducting audits reveals areas where the organization may not fully adhere to licensing agreements or regulatory standards. This allows for timely corrective actions to be implemented.

-

Reduce Legal Risks: By proactively addressing regulatory issues, hedge investment firms can avoid legal consequences and financial penalties associated with non-compliance. In 2024 alone, enforcement actions by the SEC resulted in fines exceeding US$5 billion.

-

Improve Data Security: Routine evaluations can identify vulnerabilities within software systems, facilitating prompt updates and security enhancements. This is crucial for protecting sensitive financial information from cyber threats, which cost the industry an estimated $386,000 every second. Consequently, strong cybersecurity strategies are paramount, as asset managers are expected to prioritize adherence to cybersecurity regulations.

-

Preserve Investor Trust: Demonstrating a commitment to regulatory compliance through thorough evaluations can enhance investor confidence, which is vital for attracting and retaining capital. Additionally, under Rule 206(4)-7 of the Investment Advisers Act, investment vehicles are required to appoint a Chief Compliance Officer to ensure effective oversight of compliance practices.

-

Update Written Supervisory Procedures (WSPs): Regular evaluations should also focus on maintaining current WSPs, which are essential for complying with existing regulatory standards and ensuring effective supervisory structures.

By implementing robust software audit services, hedge management companies can not only safeguard their operations but also position themselves advantageously within an increasingly scrutinized regulatory landscape.

Overcome Challenges in Software Audits: Strategies for Success

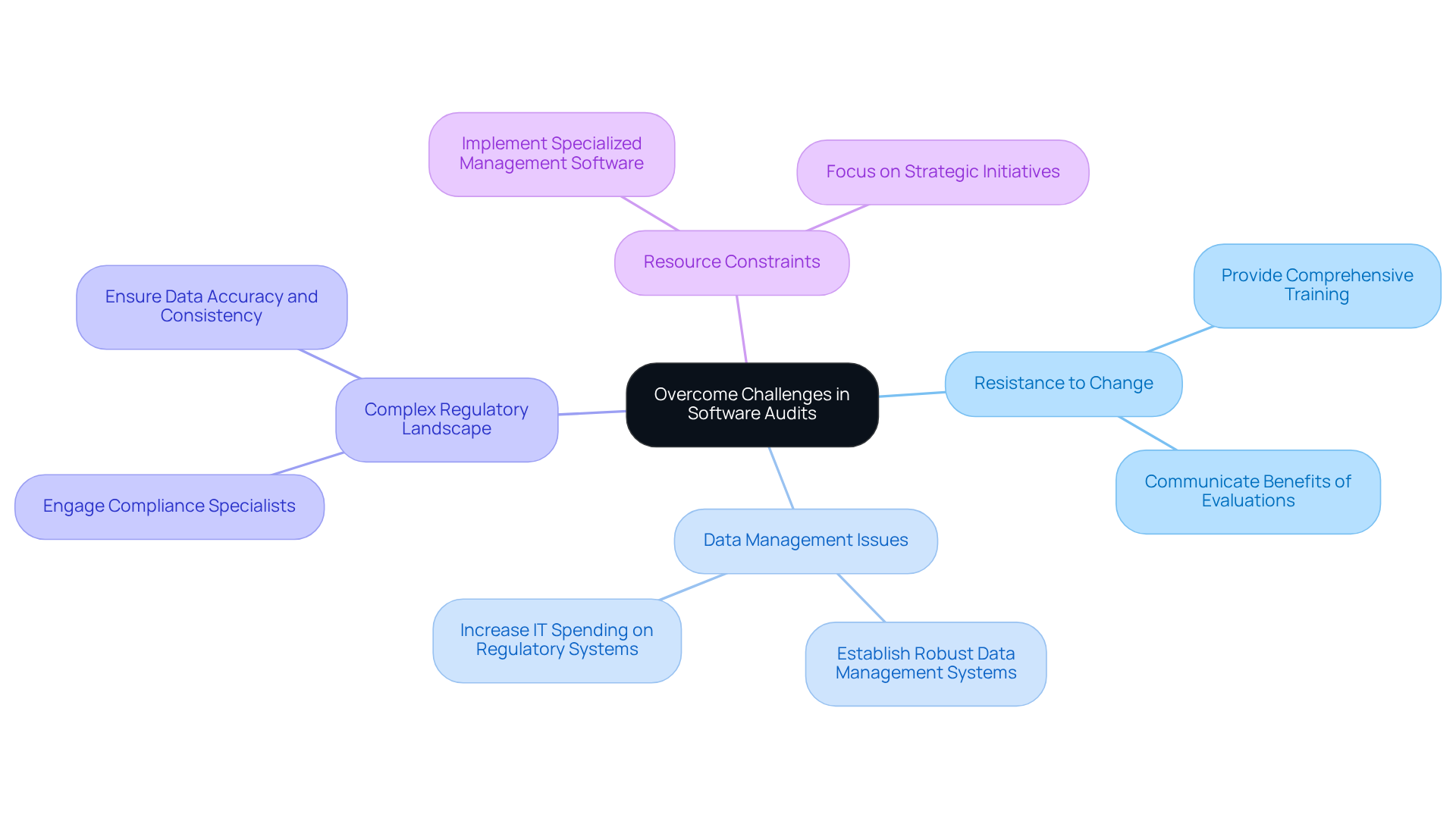

Hedge funds often face significant challenges during software audit services, which can impact their regulatory compliance and operational efficiency. Key obstacles include:

-

Resistance to Change: Employees may resist adapting to new compliance measures, fearing disruption to established workflows. To mitigate this, it is essential to provide comprehensive training and clearly communicate the benefits of evaluations, emphasizing how they enhance operational integrity and bolster investor confidence. As Frank Caccio III states, “Compliance, accuracy, and operational efficiency are paramount in the competitive and highly regulated world of hedge fund management.”

-

Data Management Issues: Inadequate data collection and management can severely hinder the review process. Establishing robust data management systems is crucial to ensure that accurate and comprehensive data is readily available for software audit services, thereby facilitating smoother assessments and regulatory checks. A Bloomberg survey revealed that 84% of respondents plan to increase IT spending on regulatory systems in the coming year, underscoring the necessity of investing in these areas.

-

Complex Regulatory Landscape: The regulatory environment for investment pools is becoming increasingly complex, with numerous requirements to navigate. Engaging compliance specialists can provide valuable guidance throughout the review process, ensuring that all regulatory obligations are met and minimizing the risk of non-compliance. The SEC highlights the importance of data accuracy and consistency across filings in 2026, emphasizing the current regulatory landscape that hedge funds must navigate.

-

Resource Constraints: Limited internal resources can impede the efficiency of the review process. Implementing specialized management software can streamline operations, automate routine tasks, and alleviate the burden on internal teams, allowing them to focus on strategic initiatives. Notably, 50 percent of investment vehicles fail due to operational risk alone, making it imperative to address these challenges effectively.

By tackling these challenges with targeted strategies, hedge funds can improve their audit processes with software audit services, ensuring compliance and fostering a culture of accountability that ultimately supports long-term success.

Conclusion

Implementing effective software audit services is essential for hedge funds navigating the complexities of compliance and risk management. These audits act as a crucial tool to ensure that software usage aligns with regulatory standards, safeguarding the organization against potential penalties and enhancing operational integrity. By prioritizing software audits, hedge funds not only protect their assets but also reinforce their commitment to transparency and ethical practices in an increasingly scrutinized financial environment.

The article outlines several key benefits of software audits, including:

- Risk mitigation

- Cost efficiency

- Enhanced security

- Improved operational workflows

Regular evaluations enable hedge funds to identify compliance gaps, reduce legal risks, and bolster investor confidence. Moreover, a systematic approach to executing software audits allows firms to effectively manage the challenges posed by a complex regulatory landscape while maintaining a competitive edge.

In conclusion, embracing robust software audit practices is not merely a regulatory obligation but a strategic imperative for hedge funds. By proactively implementing these audits, investment firms can enhance their regulatory posture, protect sensitive data, and ultimately maximize returns. The significance of software audits extends beyond compliance; it fosters a culture of accountability and operational excellence that is vital for long-term success in the dynamic world of finance.

Frequently Asked Questions

What are software audits and why are they important for hedge funds?

Software audits are comprehensive evaluations of an organization’s software usage to ensure compliance with licensing agreements and regulatory standards. They are important for hedge funds due to stringent regulatory scrutiny, helping identify unauthorized software usage, assess security vulnerabilities, and confirm that software meets operational needs.

How do software audits help hedge funds mitigate risks?

Regular software audits help identify potential compliance issues before they escalate into costly penalties, safeguarding the firm against unforeseen liabilities.

In what ways can software audits contribute to cost efficiency for hedge funds?

Software audit services help ensure that only essential software is used, optimizing software expenses and avoiding unnecessary licensing fees, which contributes to the overall financial health of the firm.

How do software audits enhance security for hedge funds?

Software audits uncover vulnerabilities within software systems, allowing firms to address weaknesses promptly and significantly reduce the risk of data breaches, thereby protecting sensitive information.

What impact do software audits have on operational efficiency for hedge funds?

By optimizing software utilization and ensuring compliance, software audits lead to improved operational workflows, which are vital for maintaining a competitive advantage in the market.

How can software audits bolster investor confidence for hedge funds?

Routine evaluations demonstrate a commitment to adherence to regulations, enhancing transparency in management practices and thereby increasing investor trust in the portfolio’s oversight.