10 Python Application Development Services for Hedge Funds

Introduction

In the dynamic realm of finance, hedge funds are increasingly adopting Python application development services to improve their operational efficiency and investment strategies. Python’s robust capabilities in data analysis, machine learning, and regulatory compliance have established it as an essential tool for investment firms seeking to navigate complex market environments.

Nevertheless, a significant challenge persists: how can hedge funds effectively utilize this programming language to address their immediate requirements while also ensuring long-term adaptability and maintaining a competitive edge in an ever-evolving industry?

Neutech: Specialized Python Development for Hedge Funds

Neutech distinguishes itself in the financial services sector by offering specialized python application development services that are tailored for investment firms. By focusing on the creation of robust and adaptable applications, Neutech’s engineers leverage their extensive expertise in financial markets to provide python application development services that address the specific needs of investment managers. This specialization not only ensures technical proficiency but also provides valuable insights into market trends and compliance requirements.

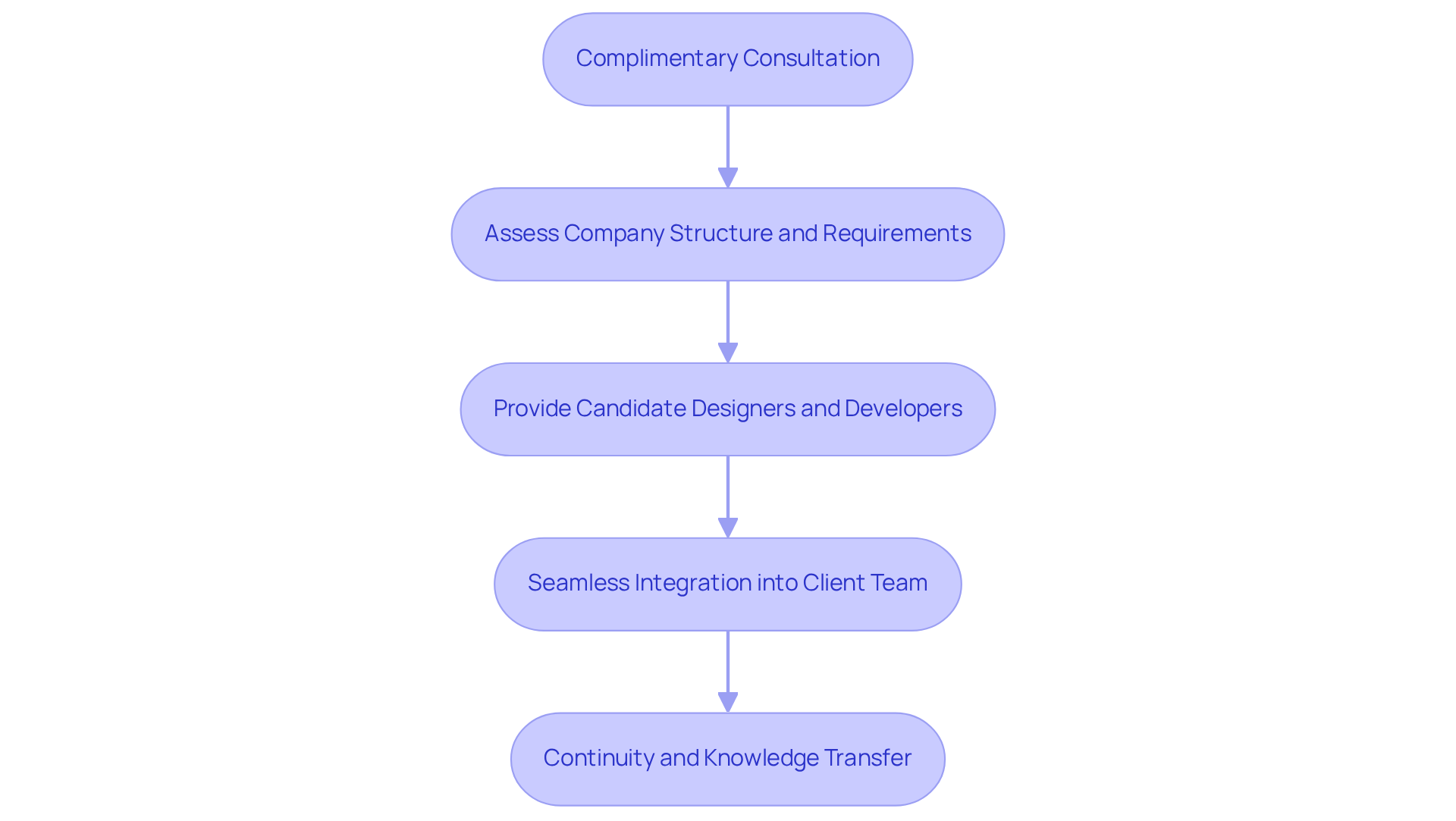

The client engagement process at Neutech begins with a complimentary consultation, during which we assess your company’s structure and requirements. Subsequently, we provide candidate designers and developers to seamlessly integrate into your team. Our commitment to reliability is reflected in our high employee retention rate, which ensures that clients are not left vulnerable due to unexpected developer departures. We maintain a pool of replacement developers ready to step in as needed, guaranteeing continuity and knowledge transfer, thereby fostering the seamless integration of engineering talent into client teams.

The demand for programming languages within investment firms has surged, with 39% of tech job advertisements highlighting its significance in the industry. Experts note that the flexibility and functionality of these programming languages make them ideal for quantitative analysis and machine learning applications, which are increasingly vital to investment strategies. As investment groups transition from traditional programming languages such as R and Matlab, a popular tool has emerged for bridging research and technology.

Furthermore, the impact of specialized programming development on investment performance is substantial. By automating workflows and enhancing data analysis capabilities, investment firms can execute trades with greater efficiency and control. This transition not only boosts operational efficiency but also positions firms to respond swiftly to market fluctuations, ultimately leading to improved investment outcomes. Neutech’s commitment to delivering high-quality, customized programming solutions, such as python application development services, ensures that investment groups are well-equipped to navigate the complexities of today’s financial landscape.

Scalability of Python Solutions for Dynamic Hedge Fund Needs

The versatility of the programming language empowers investment firms to create solutions that can adapt to shifting market conditions and evolving operational needs. As hedge funds expand or modify their strategies, programming applications can be swiftly adjusted or enhanced, ensuring they align with business objectives. This adaptability is crucial for sustaining a competitive advantage in the fast-paced financial landscape. Analysts emphasize that the language’s ability to handle both quantitative and qualitative analysis makes it a preferred choice for developing robust financial models and trading strategies. Additionally, the extensive library support of the language facilitates the integration of machine learning and data visualization tools, thereby improving decision-making processes.

As noted by the Coralogix Team, “While no forecasts are fool-proof, the programming language’s predictions can help to guide informed decision-making in changing market conditions.” With this programming language being the most favored among developers worldwide, hedge investments can effectively respond to market fluctuations, ensuring their technological framework remains resilient and adaptable.

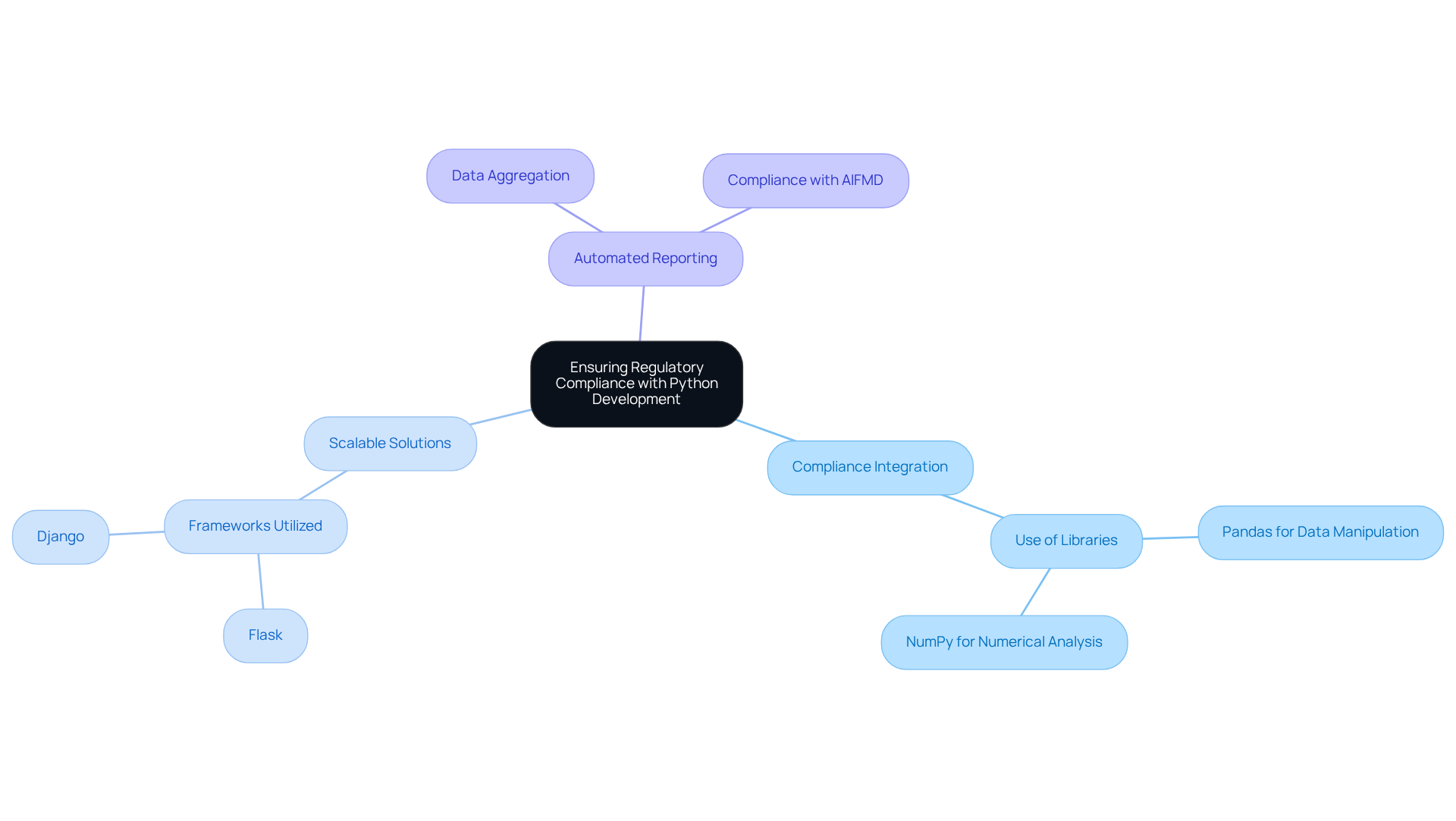

Ensuring Regulatory Compliance with Python Development

Hedge investments navigate a complex regulatory environment, making Neutech’s programming development services essential for ensuring compliance. By leveraging extensive libraries in programming languages, such as Pandas for data manipulation and NumPy for numerical analysis, our python application development services enable developers to create applications that effectively integrate compliance checks and reporting functionalities. This strategy not only mitigates operational risks but also enhances the fund’s credibility with regulators and investors.

Key Benefits of Neutech’s Python Development Services:

- Compliance Integration: Employ libraries like Pandas and NumPy to guarantee robust data handling and analysis.

- Scalable Solutions: Our python application development services utilize frameworks such as Flask and Django to develop applications that adapt to changing regulatory requirements.

- Automated Reporting: Facilitate compliance through automated data aggregation and analysis using python application development services, particularly in accordance with regulations like the Alternative Investment Fund Managers Directive (AIFMD).

As the demand for programming expertise grows, particularly in investment technology roles, companies that prioritize these capabilities are better positioned to tackle compliance challenges and enhance their market reputation.

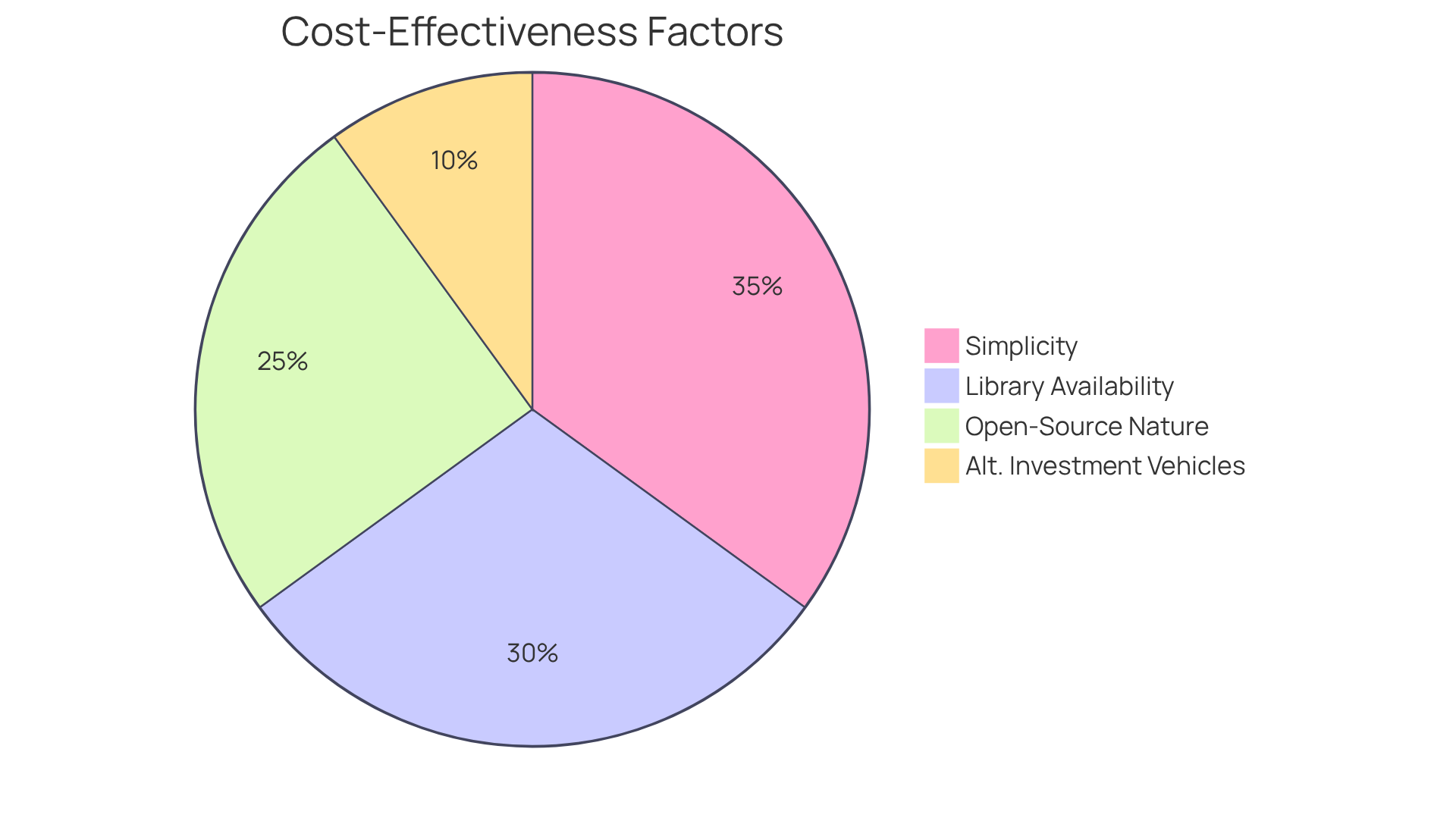

Cost-Effectiveness of Python Development for Hedge Funds

This programming language is a highly economical choice for developing investment applications. Its inherent simplicity, combined with the extensive availability of libraries, streamlines the development process, significantly reducing both time and costs. The open-source nature of this programming language allows investment firms to utilize existing frameworks and tools without incurring expensive licensing fees, making it particularly appealing for companies operating on limited budgets.

For example, hedge funds can implement cost-effective solutions such as algorithmic trading systems and risk management tools by leveraging programming libraries like NumPy and pandas, which are specifically designed to handle complex financial data efficiently. Financial analysts have noted that adopting this programming language can result in substantial savings in development costs, enabling firms to allocate resources more effectively.

As Jeff Sekinger states, “Finance utilizes the programming language for financial analysis, quantitative modeling, and algorithmic trading, leveraging its various libraries to enhance investment strategies.” By harnessing the capabilities of this programming language, investment firms can not only enhance their operational efficiency but also maintain a competitive edge in the fast-paced financial landscape.

Moreover, with alternative investment vehicles representing 12% of AiEX users, the growing reliance on this programming language within the sector underscores its effectiveness in reducing development expenses.

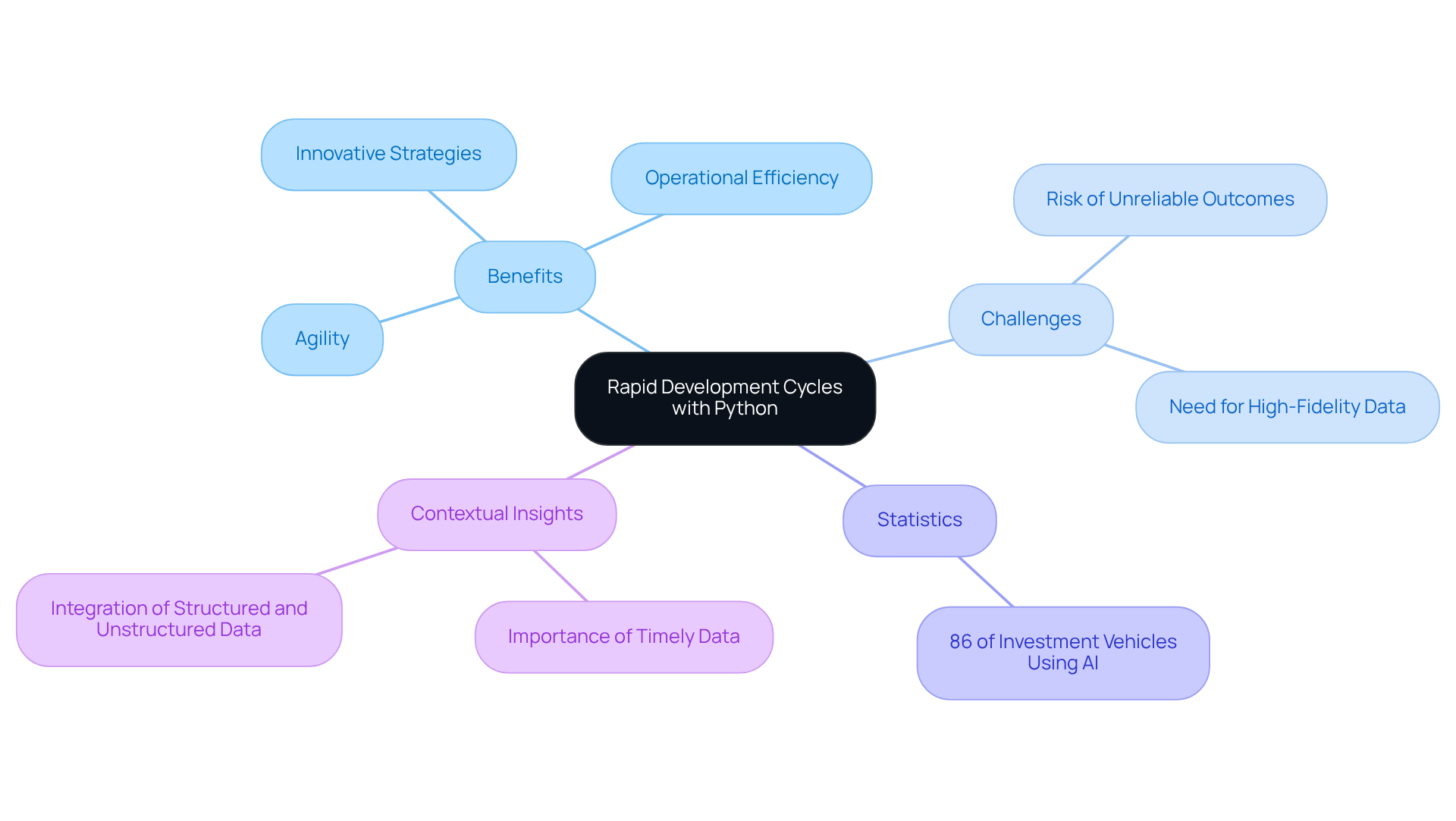

Rapid Development Cycles with Python for Hedge Funds

In the competitive landscape of investment pools, the ability to swiftly create and launch applications is essential. The intuitive syntax and extensive library ecosystem of Python greatly enhance Python application development services, significantly streamlining development cycles and allowing teams to iterate quickly and adapt to changing market conditions. At Neutech, we recognize that this agility is vital; once we collaboratively identify your needs, we provide a selection of candidate designers and developers to seamlessly integrate into your team. This tailored approach not only empowers investment groups to implement innovative strategies and tools more swiftly than their competitors but also enhances overall operational efficiency.

However, it is important to understand that speed alone is insufficient; relying solely on rapid deployment without the necessary context can result in unreliable outcomes. Additionally, the importance of high-fidelity time-series data cannot be overstated, as it serves as the foundation for dependable quantitative research. Traditional research workflows often struggle to adapt to rapid market changes, making it imperative for investment firms to incorporate timely, context-rich insights into their application development processes.

Recent statistics reveal that 86% of investment vehicles are now utilizing AI tools, highlighting the industry’s shift towards faster, data-driven decision-making. Technology leaders within the investment sector stress that the speed of Python application development services is a critical factor in sustaining a competitive advantage, as timely insights and rapid deployment can directly impact strategy performance and market responsiveness.

Seamless Integration of Python Applications in Hedge Fund Operations

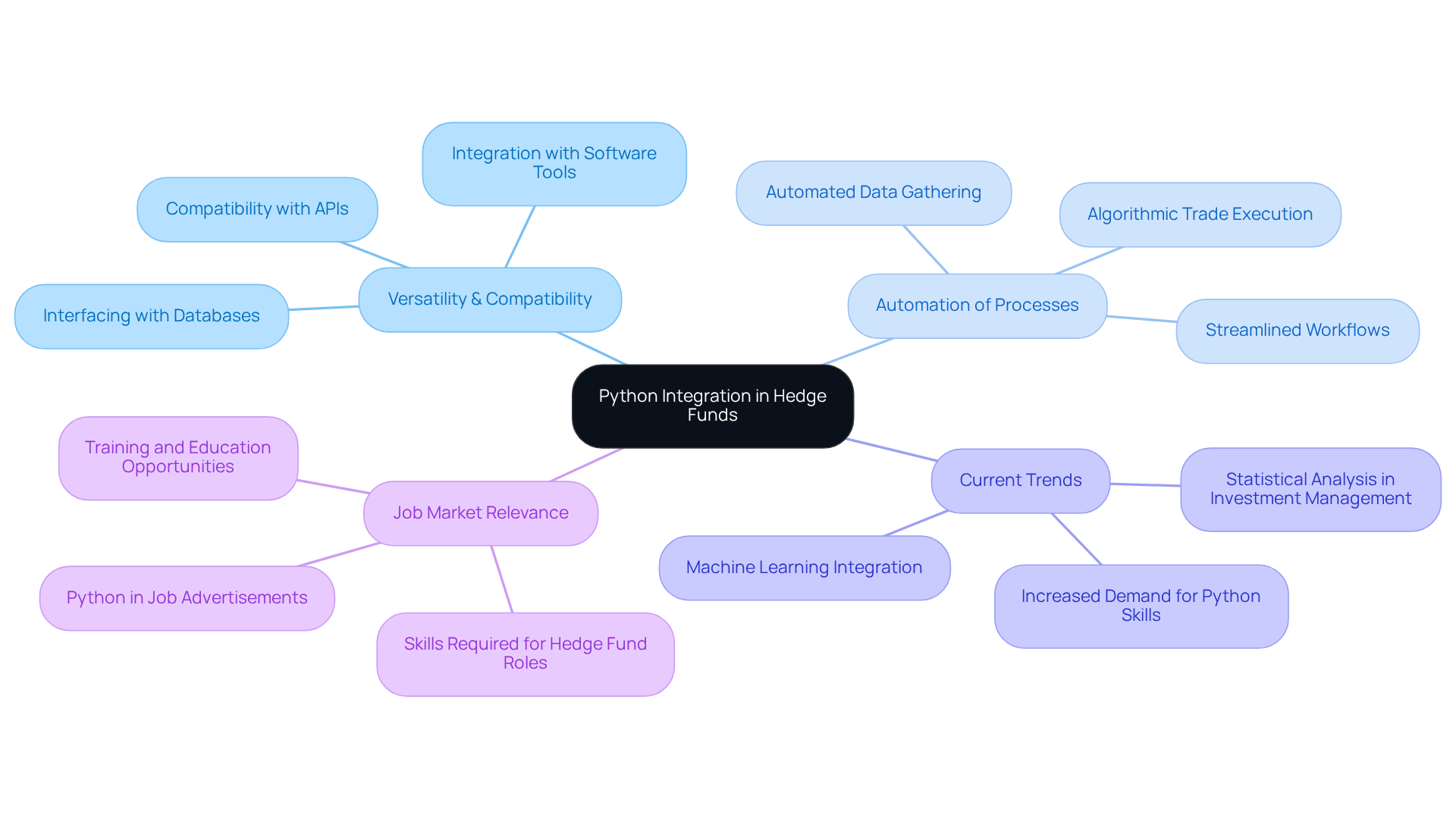

The versatility and compatibility of the programming language with various systems position it as an ideal choice for seamless integration into existing investment operations. By effectively interfacing with databases, APIs, and diverse software tools, applications can be tailored to fit within the technological ecosystem of investment groups. This integration minimizes disruptions and significantly enhances operational efficiency, enabling teams to focus on strategic decision-making.

For instance, the programming language’s ability to automate data gathering and analysis processes streamlines workflows, allowing investment firms to quickly identify trading opportunities and execute strategies with precision. Current trends indicate a growing reliance on this programming language for incorporating machine learning and statistical analysis into investment management operations, further solidifying its role as a critical component in modern financial technology.

As investment groups evolve, the demand for programming solutions that enhance compatibility with existing systems will continue to rise, ensuring that firms remain competitive in a rapidly changing market. Notably, the programming language appears in 39% of job advertisements for investment management technology, underscoring its increasing importance in the sector. Additionally, scripts written in this programming language can rapidly analyze thousands of financial options, significantly improving the speed and accuracy of opportunity detection-an essential capability for investment analysts facing challenges in identifying potential trades.

Enhanced Data Analysis and Machine Learning with Python

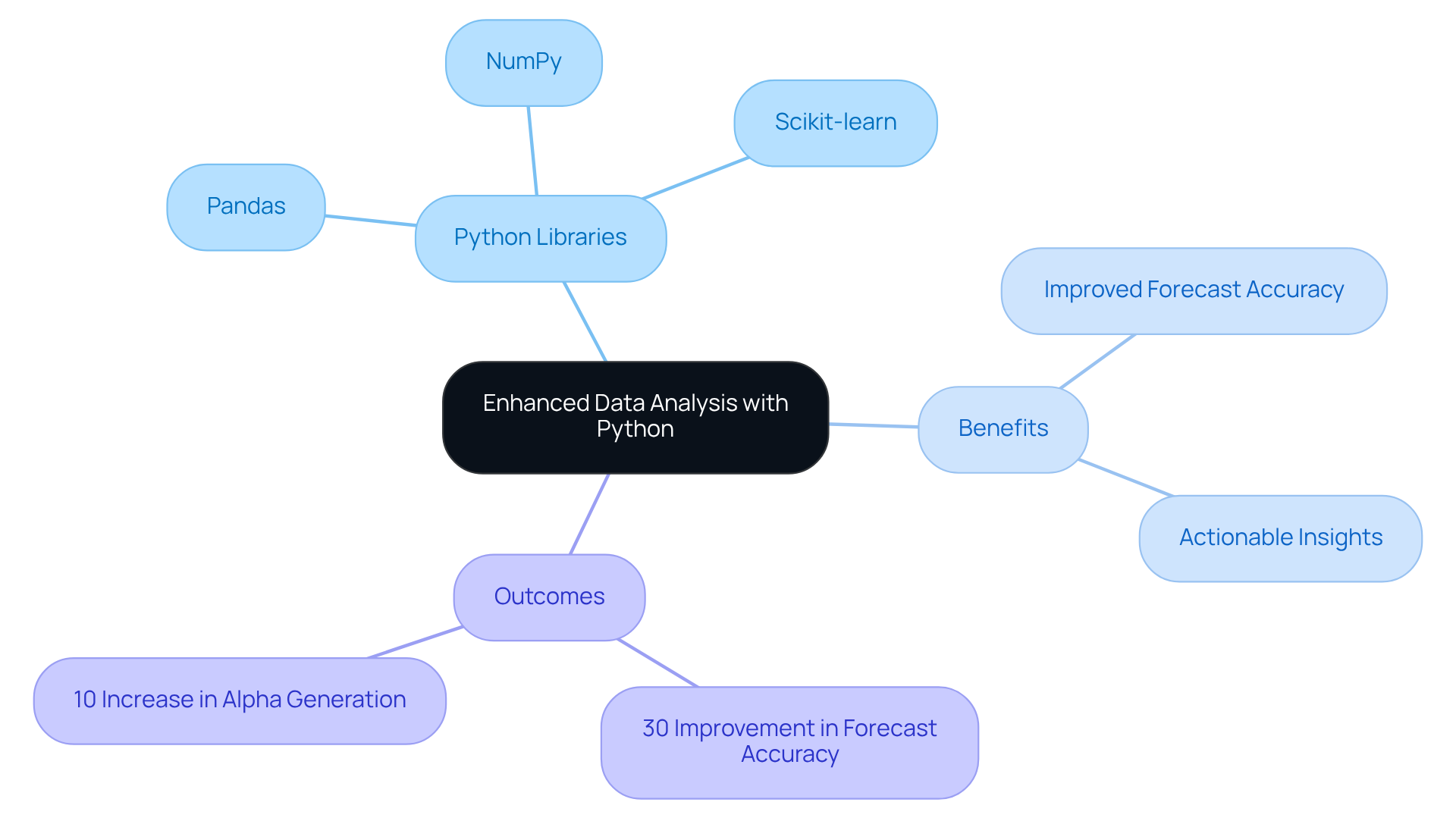

Python stands out as a leading language for analysis and machine learning, serving as an essential tool for investment firms aiming to leverage data for strategic decision-making. Libraries such as Pandas, NumPy, and Scikit-learn empower developers to build sophisticated models that effectively analyze market trends, assess risks, and optimize portfolios.

For instance, an investment group that integrated machine learning algorithms into its trading models reported a 30% improvement in forecast accuracy for commodity prices. This analytical capability allows investment firms to derive actionable insights from data, enhancing their decision-making processes and ultimately leading to superior investment outcomes.

As the financial landscape evolves, the adoption of the latest programming libraries continues to advance financial data analysis, ensuring that investment firms remain competitive in a data-driven market. A recent study indicates that companies utilizing alternative datasets experienced a 10% increase in alpha generation, underscoring the importance of employing programming to refine investment strategies.

Robust Community Support for Python Development in Hedge Funds

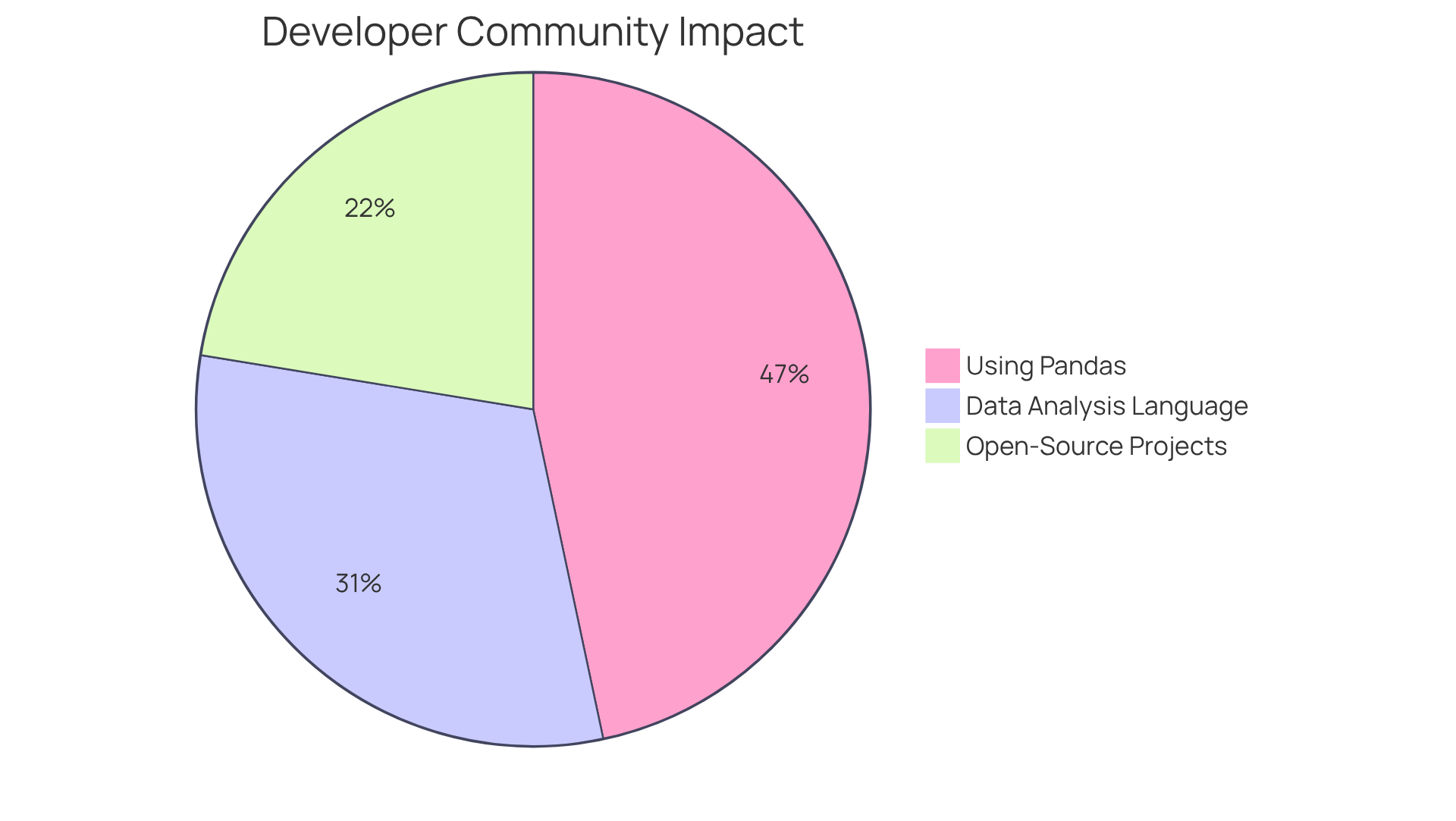

The programming community serves as a dynamic ecosystem that supports developers in the financial sector, particularly within investment partnerships. This collaborative environment, rich with forums, libraries, and shared knowledge, accelerates development and enhances problem-solving capabilities. For instance, 77% of developers utilize libraries such as Pandas for data management, which is crucial for investment firms handling extensive datasets. Furthermore, 51% of respondents employ a specific programming language for data analysis, underscoring its broader relevance in financial services. The community’s emphasis on open-source contributions – 37% of Python developers reported participating in such projects – fosters innovation and positions hedge investments at the forefront of technological advancements.

Hedge funds have significantly leveraged community resources. A notable example is Two Sigma, which has successfully integrated the Ibis library to manage large datasets, overcoming the limitations of Pandas when dealing with information exceeding 10 gigabytes. This shift not only improved their data processing capabilities but also underscored the community’s pivotal role in the provision of Python application development services for financial applications. As Jodie Burchell from JetBrains remarked, “The minority of people who are not sure whether they work with big data reflects the fuzziness of this term, especially as personal computers get more and more powerful hardware.” As investment groups increasingly rely on data-driven strategies, the resources provided by the programming community become indispensable, enabling them to adapt swiftly to market fluctuations and technological advancements.

Customizable Python Solutions for Tailored Hedge Fund Applications

The flexibility of Python is one of its most significant advantages, which is why investment groups often seek Python application development services to create tailored solutions that address their unique operational challenges and investment strategies. Collaborating with skilled developers from Neutech, who specialize in various programming languages such as React, GoLang, and .NET, investment groups can create applications that meet their specific needs. This approach ensures that these tools not only satisfy current demands but also evolve alongside the project’s objectives. Such customization delivers long-term value, improving operational efficiency and strategic execution.

For instance, the development of an API for Tradeweb integration has transformed how investment firms handle orders, significantly reducing latency and enhancing control over execution costs. These bespoke solutions empower investment groups to automate trading processes, enabling analysts to focus on strategy development rather than manual execution. Furthermore, scripting in a programming language can swiftly analyze thousands of financial options, facilitating the identification of potential trades and accelerating decision-making.

The impact of these customized programming applications on investment performance is substantial. Hedge investments utilizing tailored programming solutions from Neutech report improved efficiency in trade execution and data analysis, which are critical in today’s fast-paced financial landscape. As investment groups increasingly adopt algorithmic trading, the demand for Python application development services continues to grow, highlighting the importance of adaptability and personalization in securing competitive advantages in the market. To discover how Neutech can assist your investment group’s specific needs, schedule a free consultation today.

Long-Term Viability of Python for Hedge Fund Applications

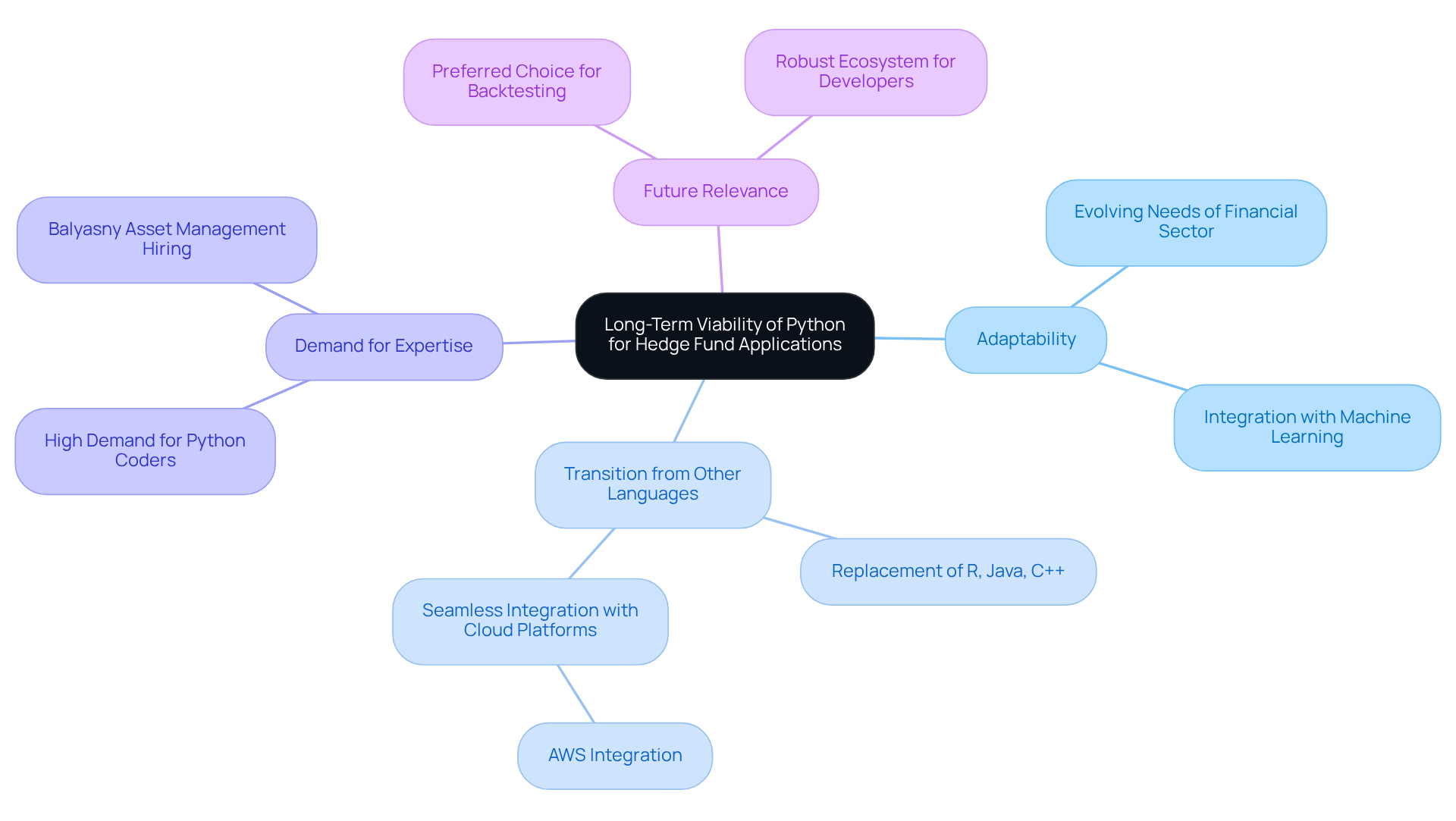

The growing importance and adaptability of this programming language underscore its long-term viability for investment strategy applications. As the language progresses, it consistently addresses the evolving needs of the financial sector, especially with the rising dependence on machine learning and statistical analysis. Hedge investment groups are increasingly prioritizing this programming language due to its ability to bridge research and technology, with numerous firms transitioning from traditional languages such as R, Java, and C++ to take advantage of its extensive libraries and seamless integration with cloud platforms like AWS.

The demand for programming expertise within investment firms has reached unprecedented levels, with companies like Balyasny Asset Management actively seeking data analysts proficient in this language for fundamental research and data processing. This trend signifies a broader movement towards Python application development services for trading applications, enhancing analytics and providing a competitive edge in the marketplace. Indeed, investment firms are progressively utilizing Python application development services to refine analytics and sustain a competitive advantage.

Industry experts assert that this programming language is poised to remain the preferred choice for backtesting investment strategies, with its robust ecosystem ensuring that developers have the essential resources to maintain and enhance applications. As the programming language continues to evolve, its relevance in financial services appears assured, positioning it as a strategic option for investment firms seeking Python application development services to future-proof their software solutions.

For hedge fund managers, adopting Python not only aligns with prevailing industry trends but also equips their firms to effectively leverage advanced analytics and machine learning capabilities.

Conclusion

The significance of Python application development services in optimizing hedge fund operations is profound. These services offer tailored solutions that effectively address the unique challenges faced by investment firms, enabling them to navigate the complexities of the financial landscape with both agility and precision. By focusing on specialized development, scalability, and seamless integration, hedge funds are well-equipped to respond efficiently and effectively to market demands.

This article highlights key insights into how Python’s versatility supports various facets of hedge fund operations. It ensures regulatory compliance through robust data handling and enhances operational efficiency via automated workflows. Such capabilities empower investment groups to optimize their strategies. Additionally, the cost-effectiveness of Python development further enhances its appeal, allowing firms to allocate resources judiciously while maintaining a competitive edge in a rapidly evolving market.

In an era where data-driven decision-making is crucial, the necessity of adopting advanced technologies like Python is clear. Investment firms are urged to explore the advantages of customized Python solutions tailored to their specific needs, ensuring they remain at the forefront of innovation. By embracing Python, hedge funds not only align with industry trends but also position themselves to leverage advanced analytics and machine learning, ultimately driving superior investment outcomes.

Frequently Asked Questions

What services does Neutech offer for hedge funds?

Neutech offers specialized python application development services tailored for investment firms, focusing on creating robust and adaptable applications that meet the specific needs of investment managers.

How does Neutech ensure a seamless client engagement process?

The client engagement process begins with a complimentary consultation to assess the company’s structure and requirements, followed by providing candidate designers and developers who integrate into the client’s team. Neutech also maintains a pool of replacement developers to ensure continuity and knowledge transfer.

Why is there a growing demand for programming languages like Python in investment firms?

The demand for programming languages has surged, with 39% of tech job advertisements highlighting their significance. Python’s flexibility and functionality make it ideal for quantitative analysis and machine learning applications, which are increasingly important for investment strategies.

What impact does specialized programming development have on investment performance?

Specialized programming development automates workflows and enhances data analysis capabilities, allowing investment firms to execute trades more efficiently and respond swiftly to market fluctuations, ultimately leading to improved investment outcomes.

How does Python’s scalability benefit hedge funds?

Python’s versatility allows investment firms to create solutions that adapt to changing market conditions and operational needs. As hedge funds modify their strategies, programming applications can be swiftly adjusted, helping them maintain a competitive advantage.

What are the key benefits of Neutech’s Python development services in terms of regulatory compliance?

Neutech’s services integrate compliance checks and reporting functionalities using libraries like Pandas and NumPy, mitigate operational risks, and enhance the fund’s credibility with regulators and investors.

What frameworks does Neutech use to develop scalable solutions?

Neutech utilizes frameworks such as Flask and Django to develop applications that can adapt to changing regulatory requirements.

How does Neutech facilitate automated reporting for compliance?

Neutech’s python application development services automate data aggregation and analysis, particularly in accordance with regulations like the Alternative Investment Fund Managers Directive (AIFMD).