Why Hedge Funds Need a Web Application Development Firm for Success

Introduction

Hedge funds navigate a landscape filled with unique challenges, including stringent regulatory frameworks and the management of extensive data. The stakes are high for these investment vehicles, making the need for specialized solutions more critical than ever.

By partnering with a dedicated web application development firm, hedge funds can:

- Streamline operations

- Enhance compliance

- Secure a competitive edge in a rapidly evolving market

However, overlooking the significance of technological partnerships can lead to dire consequences, potentially jeopardizing operational efficiency and undermining investor trust.

Understanding the Unique Challenges Faced by Hedge Funds

Hedge vehicles operate within a highly competitive and regulated environment, facing unique challenges that necessitate specialized solutions. These challenges include:

-

Regulatory Compliance: Navigating a complex array of regulations that differ by jurisdiction is essential for hedge funds. Compliance is not merely a legal obligation; it is vital for maintaining investor trust and avoiding substantial penalties. In 2024, the SEC imposed over $5 billion in fines, underscoring the importance of robust adherence frameworks that can adapt to evolving regulatory demands. Non-adherence can lead to reputational harm and investor exits, making effective adherence strategies essential.

-

Data Management: The vast amounts of data generated from market activities, client interactions, and transaction records require efficient management and analysis. Hedge vehicles must utilize custom software solutions, such as those developed using React or Python, to streamline data processing and enhance analytical capabilities, enabling informed investment decisions. Effective data management is projected to be a cornerstone of compliance by 2026, as regulators emphasize data accuracy and consistency across filings.

-

Operational Efficiency: In the fast-paced investment management sector, operational efficiency is vital. Delays in transaction processing or data analysis can result in missed investment opportunities. Customized applications, including those developed on platforms such as .NET or Node.js, can automate routine tasks, reduce errors, and improve overall workflow, enabling hedge organizations to react quickly to market changes. Neutech specializes in providing tailored engineering talent, assessing client needs, and supplying specialized developers and designers to enhance operational efficiency.

-

Risk Management: Hedge pools are exposed to significant risks, including market volatility and operational challenges. Advanced software solutions equipped with real-time risk assessment tools empower asset managers to make proactive decisions, mitigating potential losses. As compliance frameworks evolve, integrating risk management into daily operations will become increasingly critical.

-

Technological Integration: Numerous investment firms encounter challenges in merging legacy systems with modern technologies, resulting in information silos that obstruct operational efficiency. A dedicated web application development firm, such as Neutech, can facilitate smooth integration, ensuring that all systems operate cohesively and support the initiative’s strategic objectives. This integration is essential for maintaining a competitive edge in a rapidly changing market.

By effectively addressing these challenges, investment groups can enhance their operational resilience and prepare for success in a demanding market. Neutech’s extensive engineering services, featuring proficiency in Angular, React Native, and AWS DevOps, are tailored to meet the distinct requirements of regulated sectors and startups, ensuring that investment firms receive the specific assistance they need.

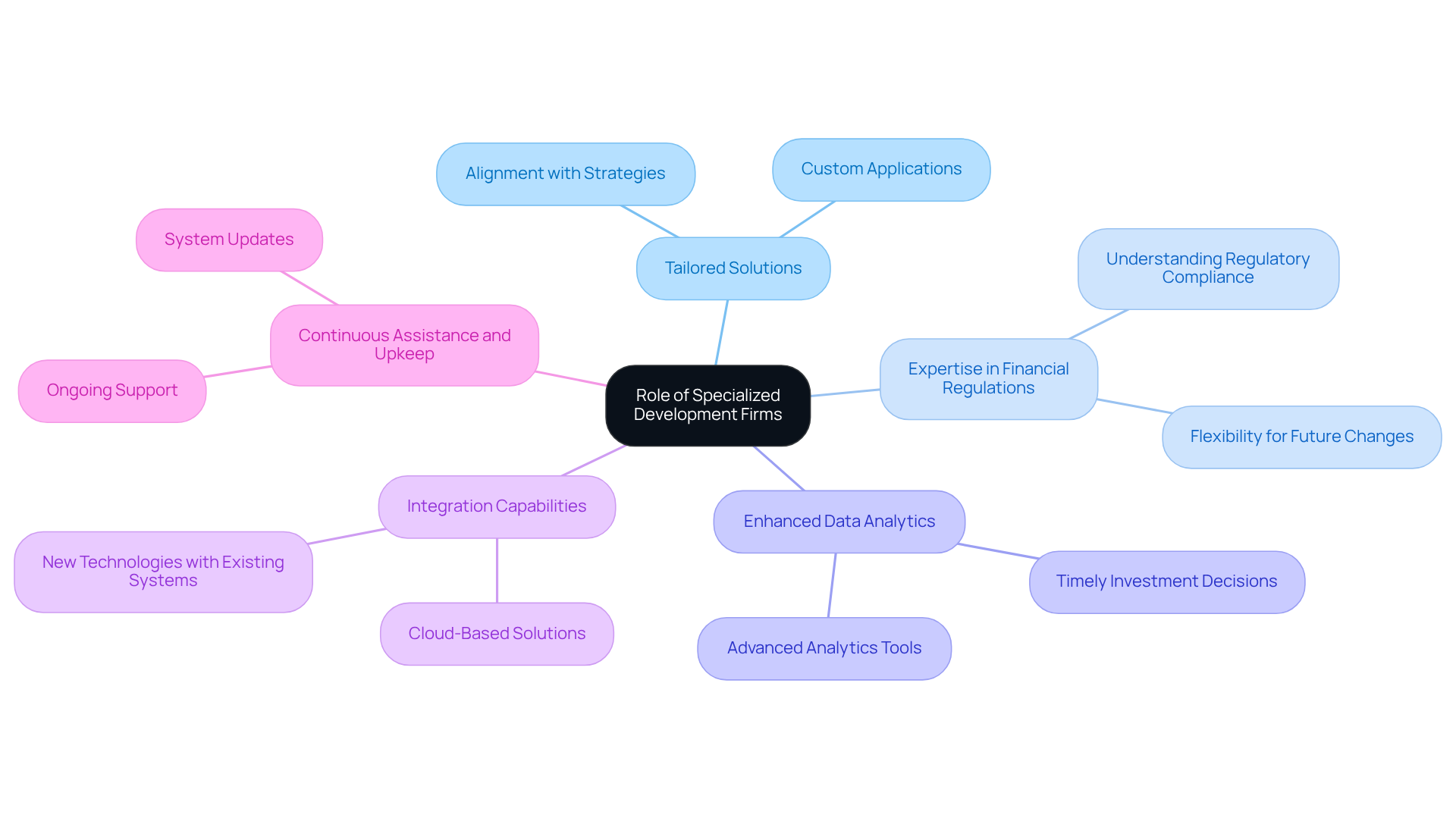

The Role of Specialized Development Firms in Addressing Hedge Fund Needs

Specialized development companies play a vital role in helping investment groups tackle their unique challenges. They contribute in several key ways:

-

Tailored Solutions: Unlike off-the-shelf software, specialized companies create custom applications designed to meet the specific operational and regulatory needs of hedge entities. This ensures that the software seamlessly aligns with the organization’s strategies and compliance requirements, thereby enhancing overall effectiveness.

-

Expertise in Financial Regulations: Development firms that focus on financial services possess a profound understanding of the complexities surrounding regulatory compliance. They design systems that not only comply with current regulations but are also flexible enough to adapt to future changes, significantly mitigating the risk of non-compliance. Given that 81% of investment executives find evaluation and due diligence to be time-consuming, having compliant systems is crucial for operational efficiency.

-

Enhanced Data Analytics: These companies are capable of developing advanced analytics tools that enable investment groups to efficiently process and analyze large datasets. This capability is essential for making timely investment decisions and improving portfolio performance, especially since 92% of investment executives report spending excessive time consolidating and integrating data from multiple sources.

-

Integration Capabilities: Specialized companies facilitate the integration of new technologies with existing systems, allowing investment firms to capitalize on their current investments while enhancing their technological capabilities. This is particularly important as investment groups increasingly prefer cloud-based solutions for their scalability and flexibility.

-

Continuous Assistance and Upkeep: Partnering with a dedicated development company ensures that investment firms receive ongoing support, keeping their systems up-to-date and operational. This is critical in a rapidly evolving technological landscape, where 69% of C-level executives believe that technological advancements are driving the introduction of new investments.

By collaborating with a web application development firm, investment firms can enhance operational efficiency, ensure compliance, and ultimately strengthen their competitive edge in the market.

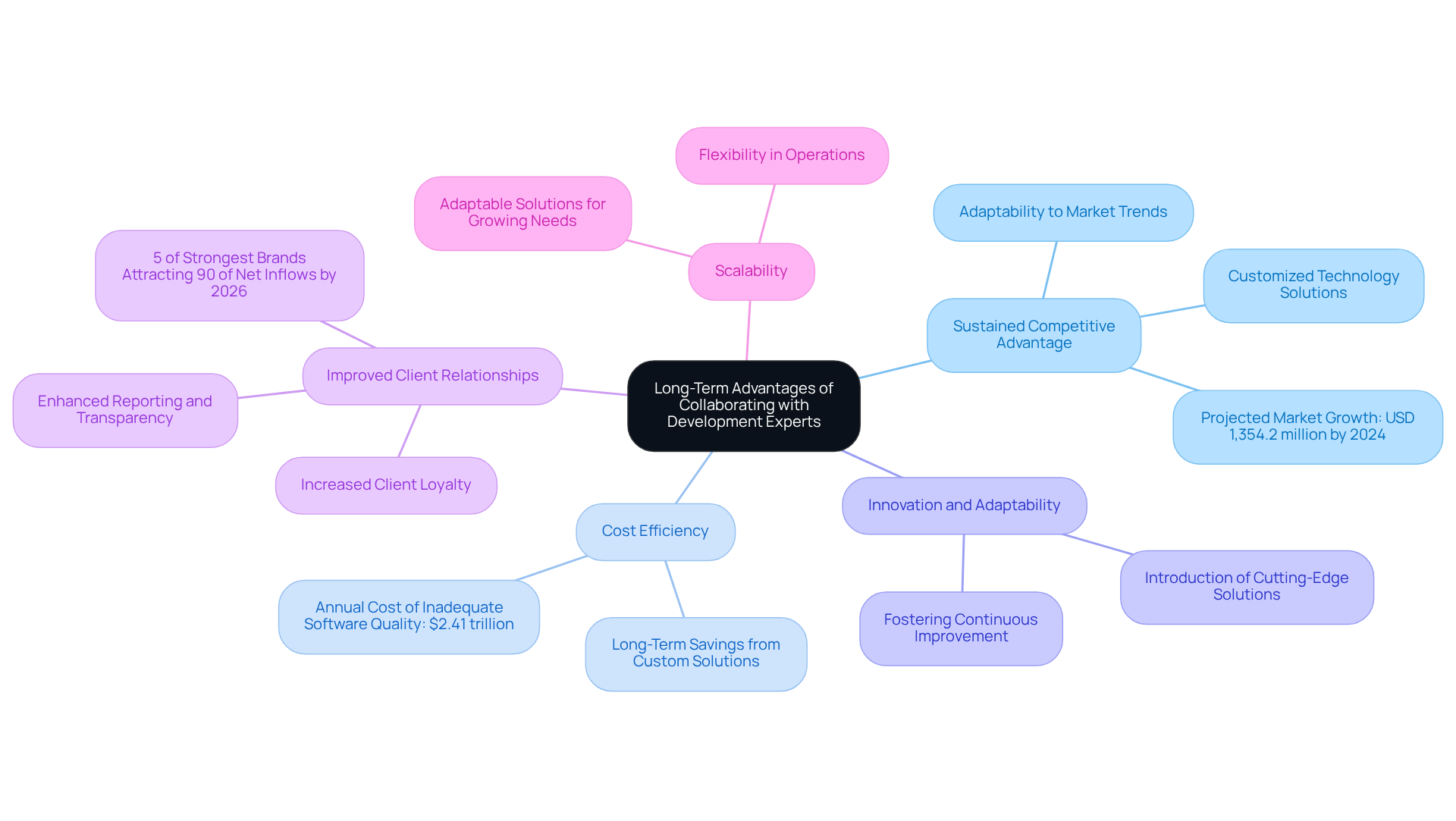

Long-Term Advantages of Collaborating with Development Experts

Collaborating with specialized web application development firms like Neutech provides hedge funds with numerous long-term advantages.

-

Sustained Competitive Advantage: By utilizing customized technology solutions, investment firms can maintain a competitive edge in a rapidly evolving market. Custom applications are designed to adapt to market trends, ensuring agility and responsiveness. The global hedge fund software market is projected to reach USD 1,354.2 million by 2024, underscoring the importance of investing in targeted development to stay competitive. Neutech plays a pivotal role in this process by assessing client needs and supplying qualified designers and developers to enhance these tailored solutions.

-

Cost Efficiency: While the initial investment in specialized development may seem significant, the long-term savings can be substantial. Custom solutions streamline operations, mitigate compliance risks, and reduce costs associated with data management and analysis. For instance, the annual cost of inadequate software quality is estimated at $2.41 trillion, highlighting the financial impact of investing in robust software solutions tailored for investment firms.

-

Innovation and Adaptability: Development firms frequently introduce innovative ideas and technologies. By partnering with a web application development firm like Neutech, investment firms can implement cutting-edge solutions that enhance investment strategies and operational processes, fostering a culture of continuous improvement.

-

Improved Client Relationships: Tailored software solutions significantly enhance the client experience through improved reporting, transparency, and communication. This leads to stronger connections with investors and increased client loyalty, which is crucial in a competitive landscape where 5% of investment firms with the strongest brands are expected to attract 90% of net inflows by 2026.

-

Scalability: As investment groups expand, their technological needs evolve. Specialized companies, particularly a web application development firm like Neutech, can create scalable solutions that adapt to these changing requirements, allowing firms to grow their operations without major disruptions. This flexibility is vital in a market where large institutional investors are diversifying their allocations and seeking innovative strategies.

In conclusion, the long-term benefits of partnering with development specialists like Neutech can significantly enhance an investment firm’s operational capabilities and market position, ultimately driving success in a competitive environment.

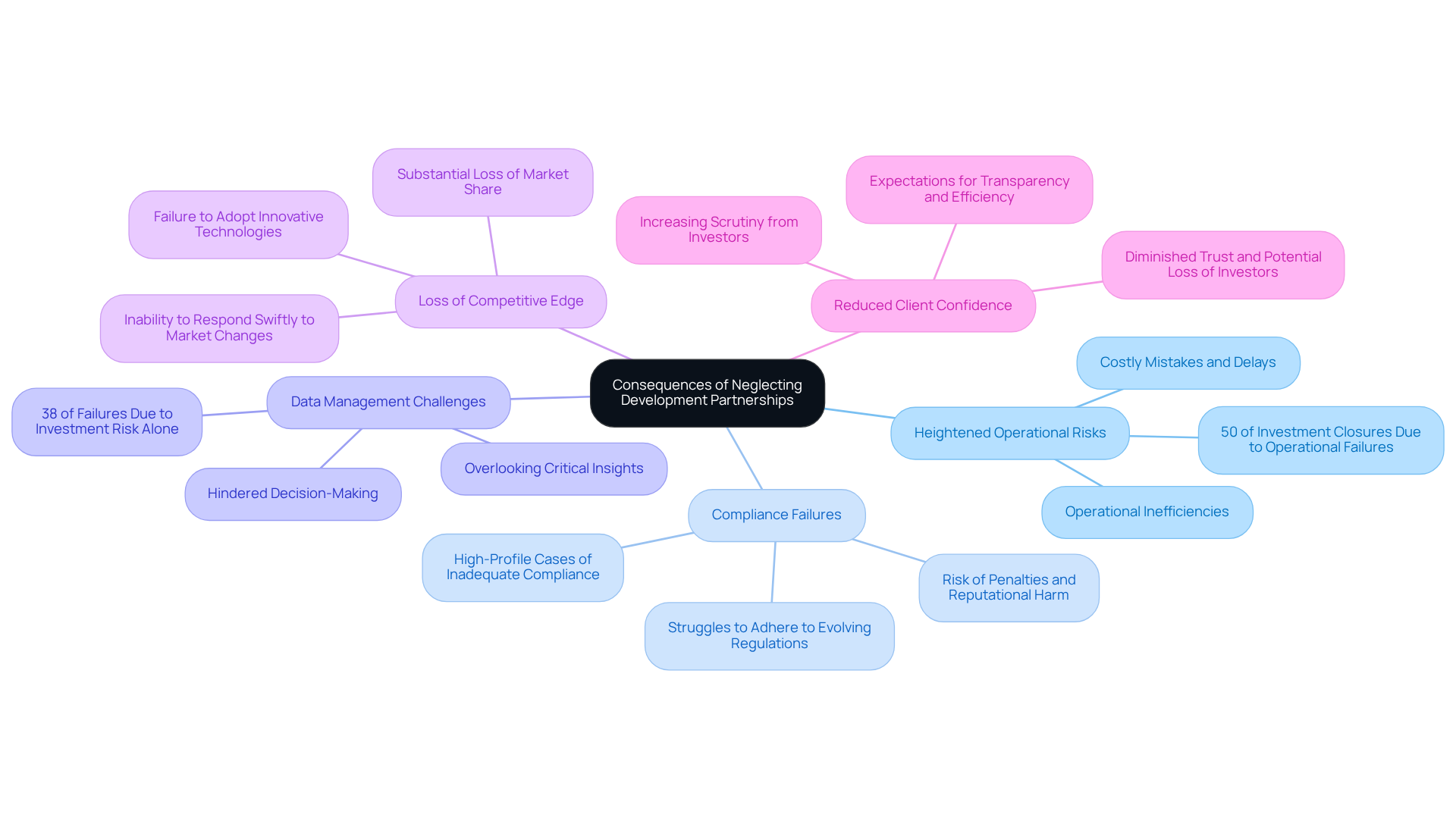

Consequences of Neglecting Development Partnerships

Neglecting to establish partnerships with specialized development firms like Neutech can lead to several detrimental consequences for hedge funds:

-

Heightened Operational Risks: Without customized software solutions, investment pools may encounter operational inefficiencies that can result in costly mistakes and delays. As a web application development firm, Neutech’s method of evaluating client requirements and providing expert developers and designers can help mitigate these risks, ensuring that investment groups have the appropriate tools to enhance their operations. A study indicates that operational failures account for 50% of investment closures, with misrepresentation, fraud, and unauthorized trading contributing to 85% of these failures, underscoring the essential need for regulation and oversight.

-

Compliance Failures: The regulatory landscape is constantly evolving. Hedge entities that do not invest in specialized development may struggle to adhere to regulations, risking penalties and reputational harm. Neutech’s customized strategy ensures that hedge funds possess the essential technology provided by a web application development firm to uphold robust regulatory frameworks. High-profile cases have shown that inadequate adherence measures can lead to significant investor losses, emphasizing the necessity of investing in technology. As compliance expert Stephen Van de Wetering notes, “Proper audits and oversight would have caught criminal behavior like this earlier.”

-

Data Management Challenges: Inefficient data management can hinder an investment firm’s ability to make informed decisions. As a web application development firm, Neutech’s expert developers can provide the necessary tools to enhance data management, ensuring that resources do not overlook critical insights that could improve their strategies. This concern is particularly pressing given that only 38% of investment pools fail due to risk alone, suggesting that operational challenges are often more significant.

-

Loss of Competitive Edge: In a highly competitive market, failing to adopt innovative technologies can lead to a substantial loss of market share. Competitors who leverage specialized development from a web application development firm like Neutech are likely to outperform those who do not, as they can respond more swiftly to market changes and client needs.

-

Reduced Client Confidence: Clients expect transparency and efficiency from investment firms. Neglecting to invest in technology can result in poor client experiences, leading to diminished trust and potential loss of investors. Neutech’s commitment to providing customized engineering expertise as a web application development firm can assist investment firms in maintaining strong client relationships, particularly in a time when investor scrutiny is increasing.

In summary, the repercussions of overlooking development partnerships can be severe, impacting an investment firm’s operational efficiency, compliance with regulations, and overall success in the market. Investing in technology and compliance, especially through partnerships with a web application development firm like Neutech, is essential for hedge funds to mitigate risks and ensure long-term success.

Conclusion

Hedge funds navigate a complex and competitive landscape, where specialized web application development can significantly impact their success. By collaborating with dedicated development firms like Neutech, hedge funds can effectively tackle unique challenges such as regulatory compliance, data management, and operational efficiency. These partnerships not only enhance the firms’ capacity to adapt to a rapidly evolving market but also play a crucial role in maintaining investor trust and fostering long-term growth.

Key insights emphasize the necessity of tailored solutions that cater to the specific needs of hedge funds. The expertise of specialized development firms in financial regulations, advanced data analytics, and seamless technological integration empowers investment groups to streamline operations and mitigate risks. Furthermore, the long-term benefits of such collaborations, including sustained competitive advantages and improved client relationships, highlight the importance of investing in technology to thrive in the current financial environment.

In an era where operational efficiency and compliance are critical, neglecting development partnerships can have severe consequences. Hedge funds that do not adopt innovative technologies risk losing their competitive edge, encountering compliance failures, and ultimately jeopardizing client confidence. Therefore, it is essential for hedge funds to acknowledge the strategic value of collaborating with web application development firms, ensuring they are well-prepared to meet future demands and succeed in their investment endeavors.

Frequently Asked Questions

What are the unique challenges faced by hedge funds?

Hedge funds face challenges such as regulatory compliance, data management, operational efficiency, risk management, and technological integration.

Why is regulatory compliance important for hedge funds?

Regulatory compliance is crucial for maintaining investor trust, avoiding penalties, and adhering to a complex array of regulations that differ by jurisdiction. Non-compliance can lead to reputational harm and investor exits.

How significant were the penalties imposed by the SEC in 2024?

In 2024, the SEC imposed over $5 billion in fines, highlighting the importance of robust compliance frameworks for hedge funds.

What role does data management play in hedge funds?

Efficient data management is essential for processing vast amounts of data from market activities and client interactions. Custom software solutions help streamline this process and enhance analytical capabilities for informed investment decisions.

How is data management projected to evolve by 2026?

By 2026, effective data management is expected to be a cornerstone of compliance, as regulators will increasingly emphasize data accuracy and consistency across filings.

Why is operational efficiency critical in the investment management sector?

Operational efficiency is vital because delays in transaction processing or data analysis can lead to missed investment opportunities. Customized applications can automate tasks and improve workflow.

How can hedge funds improve operational efficiency?

Hedge funds can enhance operational efficiency by using customized applications developed on platforms like .NET or Node.js to automate routine tasks and reduce errors.

What risks do hedge funds face, and how can they manage them?

Hedge funds face risks such as market volatility and operational challenges. Advanced software solutions with real-time risk assessment tools help asset managers make proactive decisions to mitigate potential losses.

What challenges do investment firms encounter with technological integration?

Investment firms often struggle to merge legacy systems with modern technologies, leading to information silos that hinder operational efficiency.

How can Neutech assist hedge funds with technological integration?

Neutech can facilitate smooth integration of systems to ensure cohesive operation, helping hedge funds maintain a competitive edge in a rapidly changing market.