Introduction

Navigating the intricate landscape of hedge funds necessitates not only financial expertise but also a comprehensive framework for quality assurance (QA). With regulatory demands intensifying and compliance stakes escalating, the selection of an appropriate outsourced QA partner becomes crucial. This article explores key practices that hedge fund entities can implement to refine their QA processes, ensuring adherence to current standards while preparing for future challenges.

How can hedge funds effectively integrate outsourced QA teams to uphold operational excellence and compliance?

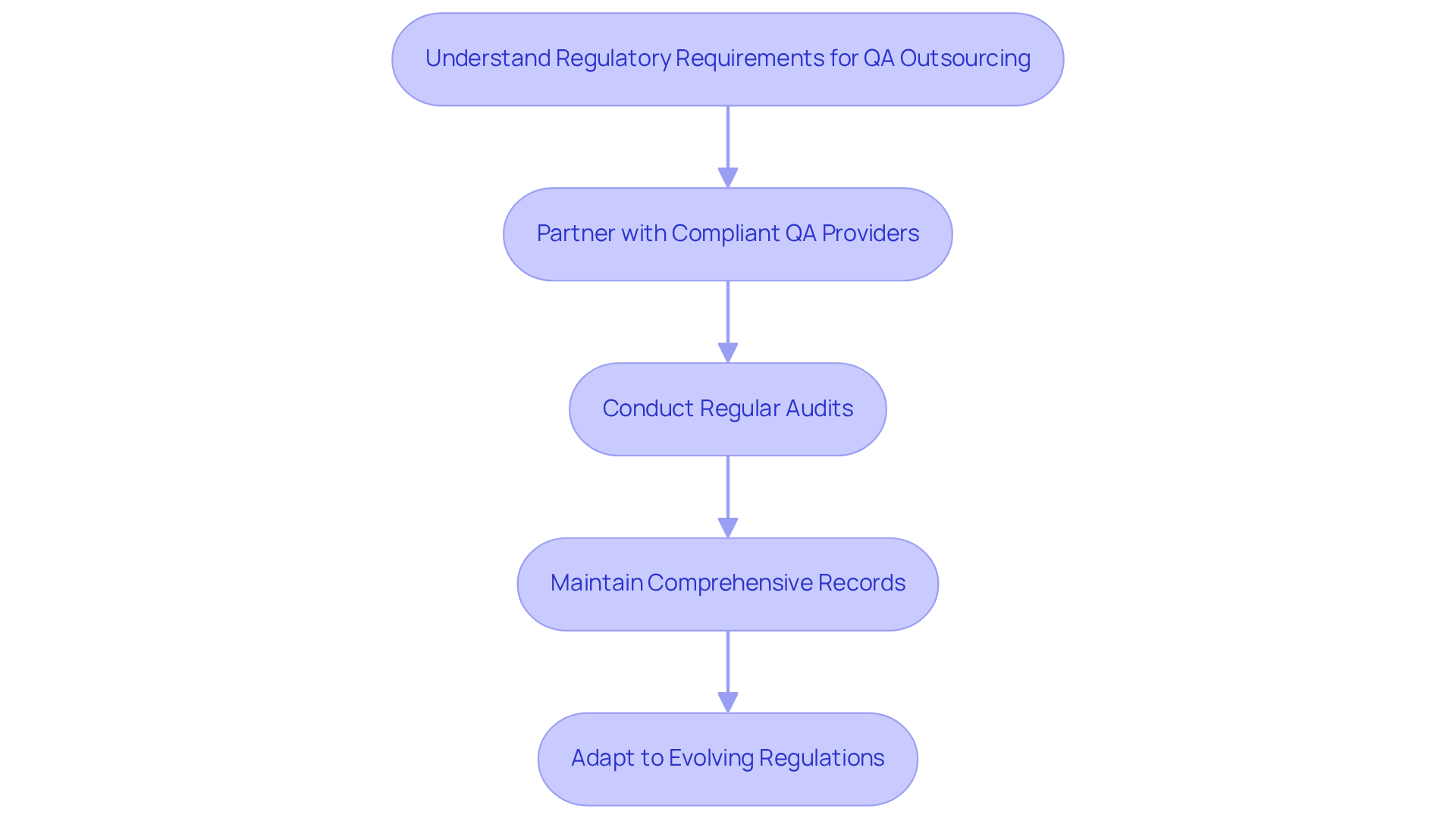

Understand Regulatory Requirements for QA Outsourcing

Hedge vehicles operate within a stringent regulatory framework, governed by entities such as the SEC and FINRA. It is crucial to partner with outsourced quality assurance (QA) providers who demonstrate compliance with these regulations. This partnership requires a thorough understanding of the implications of GDPR, MiFID II, and other pertinent compliance standards.

Regulation has emerged as a top-three driver of outsourced quality assurance investment, highlighting the significance of compliance in this sector. To ensure ongoing adherence, hedge entities should incorporate regular audits and compliance checks into their agreements for outsourced quality assurance. Additionally, maintaining comprehensive records of all outsourced quality assurance procedures is essential for demonstrating compliance during regulatory assessments, thereby safeguarding the organization’s integrity and ensuring operational continuity.

As we approach 2026, hedge entities must remain vigilant in adapting to evolving regulatory demands. It is imperative that their outsourced quality assurance practices not only meet current standards but also anticipate future compliance challenges.

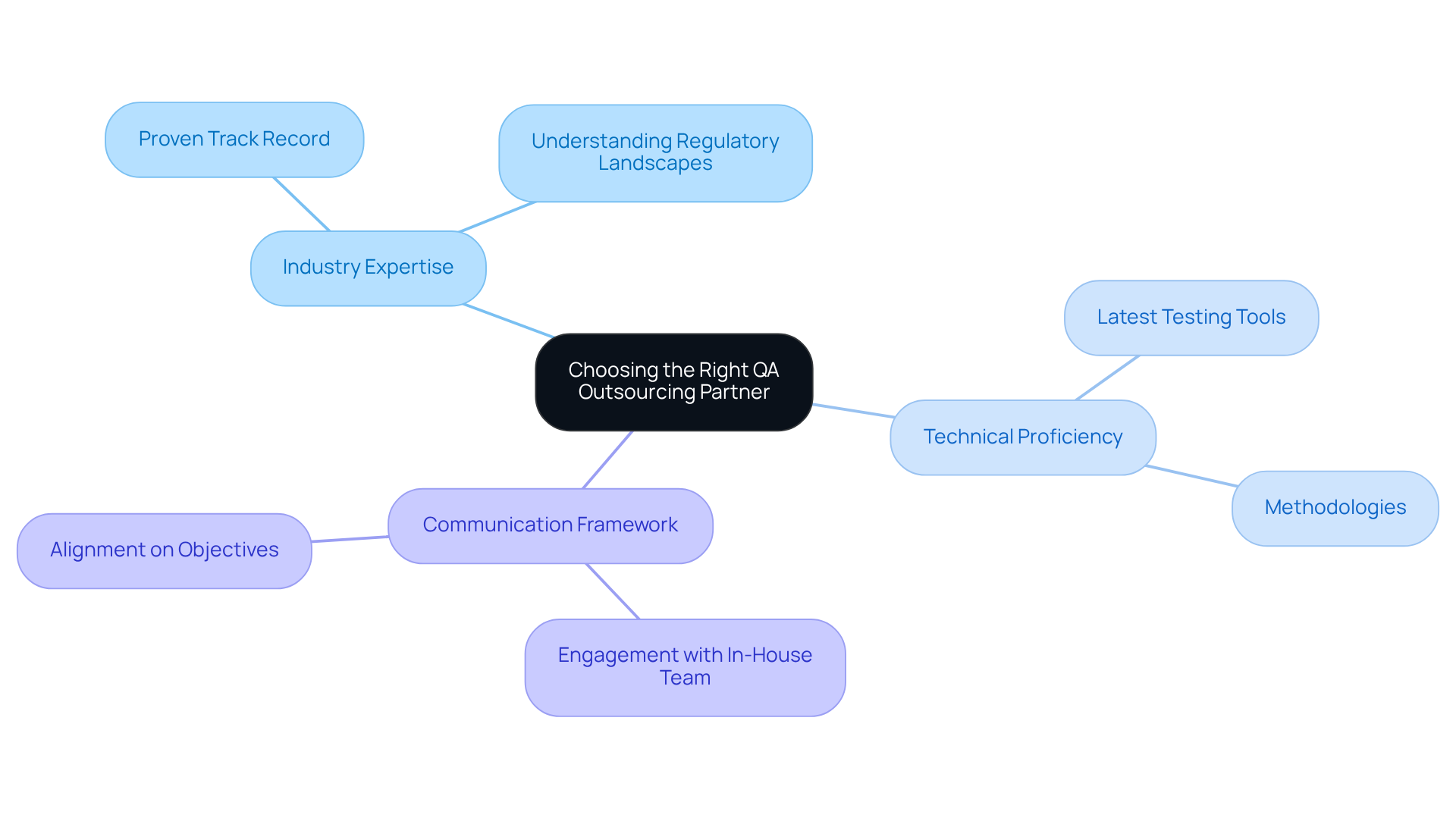

Choose the Right QA Outsourcing Partner with Industry Expertise

Choosing an outsourced quality assurance partner is a critical decision for hedge entities. It necessitates careful consideration of companies with a proven track record in the financial services sector. Collaborators must possess a deep understanding of the unique challenges and regulatory landscapes that hedge funds encounter. Assessing their experience with similar projects can yield valuable insights into their ability to deliver customized solutions that address specific requirements.

Technical proficiency is equally vital; collaborators should demonstrate familiarity with the latest testing tools and methodologies that enhance the outsourced quality assurance process. Furthermore, establishing a robust communication framework is essential for successful collaboration. It is imperative to ensure that the selected partner can effectively engage with your in-house team to align on objectives and expectations. This synergy not only streamlines workflows but also cultivates a culture of continuous improvement, ultimately resulting in superior product outcomes.

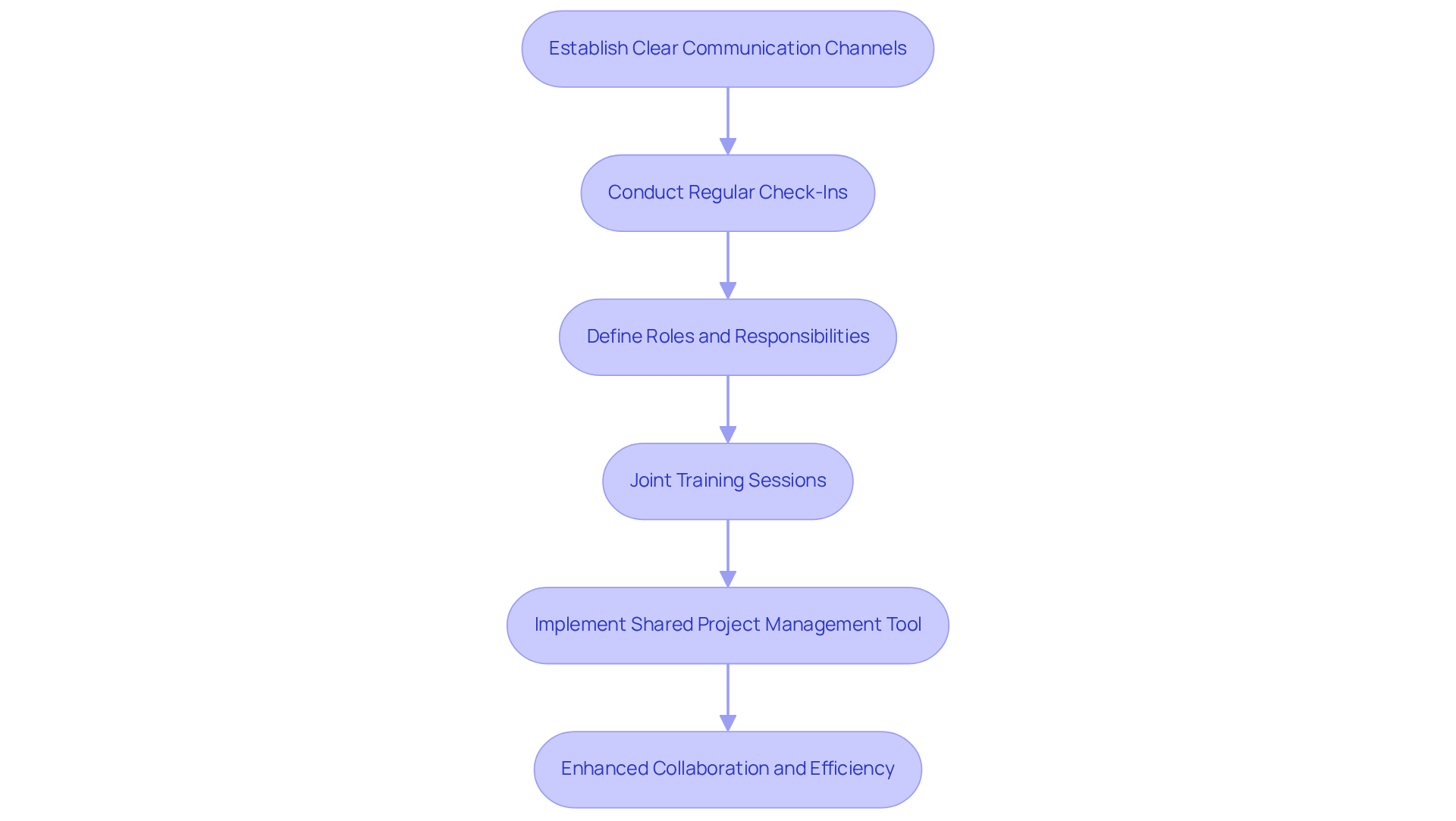

Integrate Outsourced QA Teams with In-House Operations

To effectively integrate outsourced quality assurance teams with in-house operations, establishing clear communication channels and conducting regular check-ins is essential. Collaborative tools such as Slack or Microsoft Teams facilitate ongoing dialogue, ensuring alignment among all group members. Clearly defining roles and responsibilities prevents overlaps and fosters accountability. Additionally, joint training sessions can further align both groups on processes and expectations, thereby enhancing overall efficiency.

Implementing a shared project management tool, like Jira or Asana, allows for tracking progress and maintaining transparency across groups. This integration not only cultivates a culture of collaboration but also incorporates outsourced quality assurance throughout the development lifecycle. Statistics indicate that organizations employing Agile methodologies and collaboration tools achieve quicker time-to-market outcomes; notably, 89% of companies delegating work to Agile groups report enhanced productivity. This underscores the effectiveness of these practices in the QA integration process.

As Volodymyr Holub emphasizes, ‘To ensure seamless collaboration between in-house and outsourced QA teams, establish clear communication and unified processes.

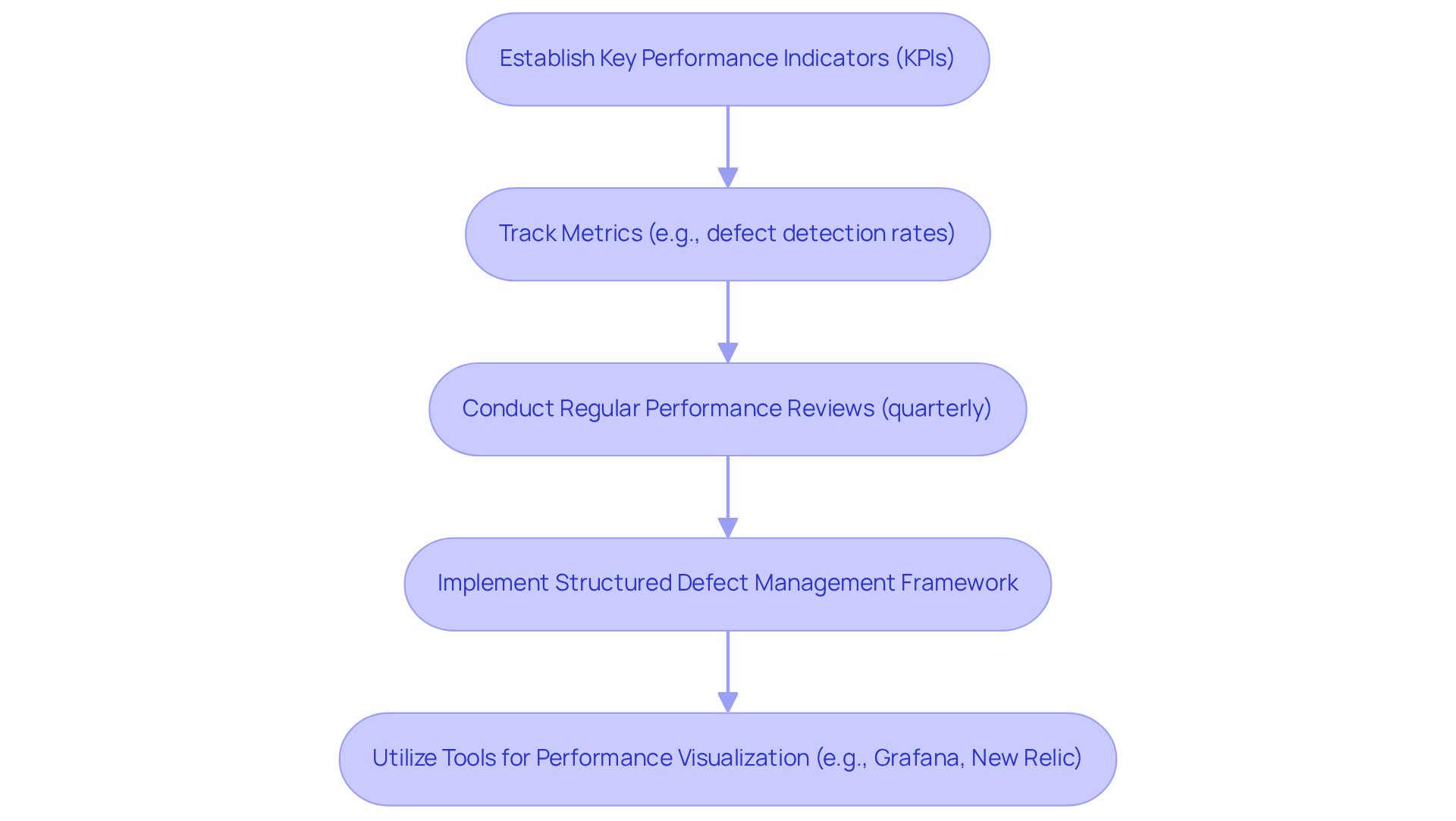

Monitor and Evaluate QA Outsourcing Performance Regularly

Establishing key performance indicators (KPIs) is crucial for effectively monitoring outsourced QA services. Metrics such as defect detection rates, which typically range from 40-60% in outsourced environments, should be consistently tracked. Organizations that utilize QA services often experience a 50-70% reduction in post-release defects, highlighting the effectiveness of these evaluations in achieving superior software quality and operational efficiency.

Regular performance reviews, ideally conducted quarterly, enable organizations to assess whether their outsourcing partner meets established standards. Implementing a structured defect management framework, as developed by Inspired Testing, serves as a concrete example of effective evaluation practices. Feedback from both the in-house team and the outsourced QA team is invaluable for identifying areas that require improvement. This collaborative approach not only sustains high quality but also fosters a culture of accountability and continuous enhancement within QA processes.

Additionally, tools like Grafana and New Relic can be employed for performance visualization, assisting organizations in effectively monitoring QA performance.

Conclusion

Outsourced quality assurance (QA) is a crucial component for hedge funds operating within a complex regulatory environment. By collaborating with the right QA providers who possess a deep understanding of compliance requirements, hedge entities can ensure their operations not only meet current regulations but are also equipped to tackle future challenges. This proactive strategy is vital for preserving the integrity and operational continuity of hedge funds.

The article outlines essential practices for effective QA outsourcing. These practices encompass:

- A thorough understanding of regulatory requirements

- The selection of partners with relevant industry expertise

- The integration of outsourced teams with in-house operations

- The continuous monitoring of performance through key performance indicators

Each of these elements is instrumental in enhancing the overall quality and efficiency of hedge fund operations, ultimately facilitating better decision-making and improved outcomes.

In summary, the importance of adopting best practices for outsourced quality assurance is paramount. As hedge funds confront evolving regulatory demands and intensifying competition, a strategic approach to QA outsourcing will not only ensure compliance but also promote innovation and efficiency. By prioritizing these practices, hedge entities can position themselves for sustainable success in an ever-evolving financial landscape.

Frequently Asked Questions

What regulatory bodies govern hedge vehicles in relation to QA outsourcing?

Hedge vehicles are governed by regulatory bodies such as the SEC (Securities and Exchange Commission) and FINRA (Financial Industry Regulatory Authority).

Why is compliance important for outsourced quality assurance (QA) providers?

Compliance is crucial for outsourced QA providers as it ensures they adhere to relevant regulations like GDPR and MiFID II, which are essential for maintaining operational integrity and legal standards.

What role does regulation play in outsourced quality assurance investment?

Regulation is one of the top three drivers of outsourced quality assurance investment, underscoring its significance in ensuring compliance within the sector.

How can hedge entities ensure ongoing compliance with QA outsourcing?

Hedge entities can ensure ongoing compliance by incorporating regular audits and compliance checks into their agreements with outsourced QA providers.

What is necessary for demonstrating compliance during regulatory assessments?

Maintaining comprehensive records of all outsourced quality assurance procedures is necessary for demonstrating compliance during regulatory assessments.

What should hedge entities do as they approach 2026 regarding regulatory demands?

As they approach 2026, hedge entities must remain vigilant in adapting to evolving regulatory demands and ensure that their outsourced quality assurance practices meet current standards while anticipating future compliance challenges.