Why Hedge Funds Should Partner with an Android Software Development Company

Introduction

In the highly competitive landscape of hedge funds, achieving technological superiority is paramount. By collaborating with an android software development company, these investment firms gain access to specialized expertise and innovative solutions tailored to the distinct challenges of the financial sector. As the demand for advanced technology escalates, a critical question arises: how can hedge funds effectively leverage these partnerships to enhance operational efficiency while also navigating the complexities of regulatory compliance and market fluctuations?

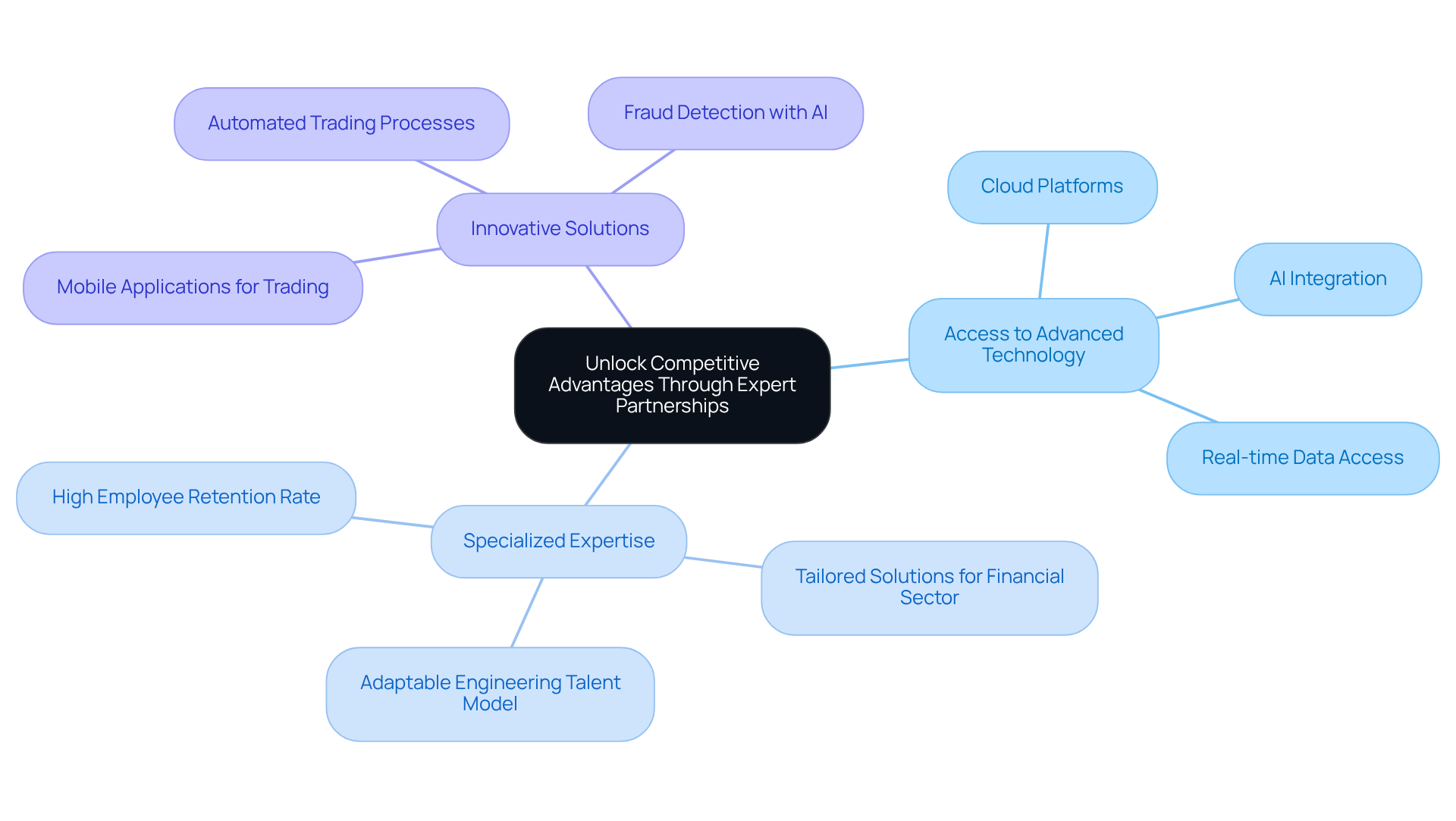

Unlock Competitive Advantages Through Expert Partnerships

In the competitive landscape of hedge funds, securing a technological edge is essential. Partnering with an android software development company offers numerous benefits, including:

- Access to advanced technology

- Specialized expertise

- Innovative solutions tailored for the financial sector

This company exemplifies reliability, boasting a high employee retention rate that ensures clients remain secure against developer turnover. Their commitment to maintaining a stable team allows investment groups to seamlessly integrate skilled developers into their operations, significantly enhancing operational efficiency and streamlining processes, ultimately leading to increased profitability.

For instance, firms that implement sophisticated mobile applications can facilitate real-time data access and informed decision-making, positioning themselves ahead of competitors still reliant on outdated systems. The company’s adaptable engineering talent model supports month-to-month agreements and flexible resource allocation, enabling investment firms to swiftly respond to market fluctuations and evolving client needs, thereby fortifying their standing in the sector.

As investment groups plan to increase spending on cloud platforms and applications by 26% over the next two years, the necessity for technological partnerships becomes increasingly apparent. Furthermore, as David Csiki, Managing Director and President of INDATA, observes, “AI can be a great tool for finding fraud,” underscoring the significance of integrating advanced technology to bolster operational capabilities. Addressing the challenges of digitalization, particularly the 45% of investment groups facing difficulties due to inflexible systems, highlights the critical need for collaborations with an android software development company to overcome these obstacles.

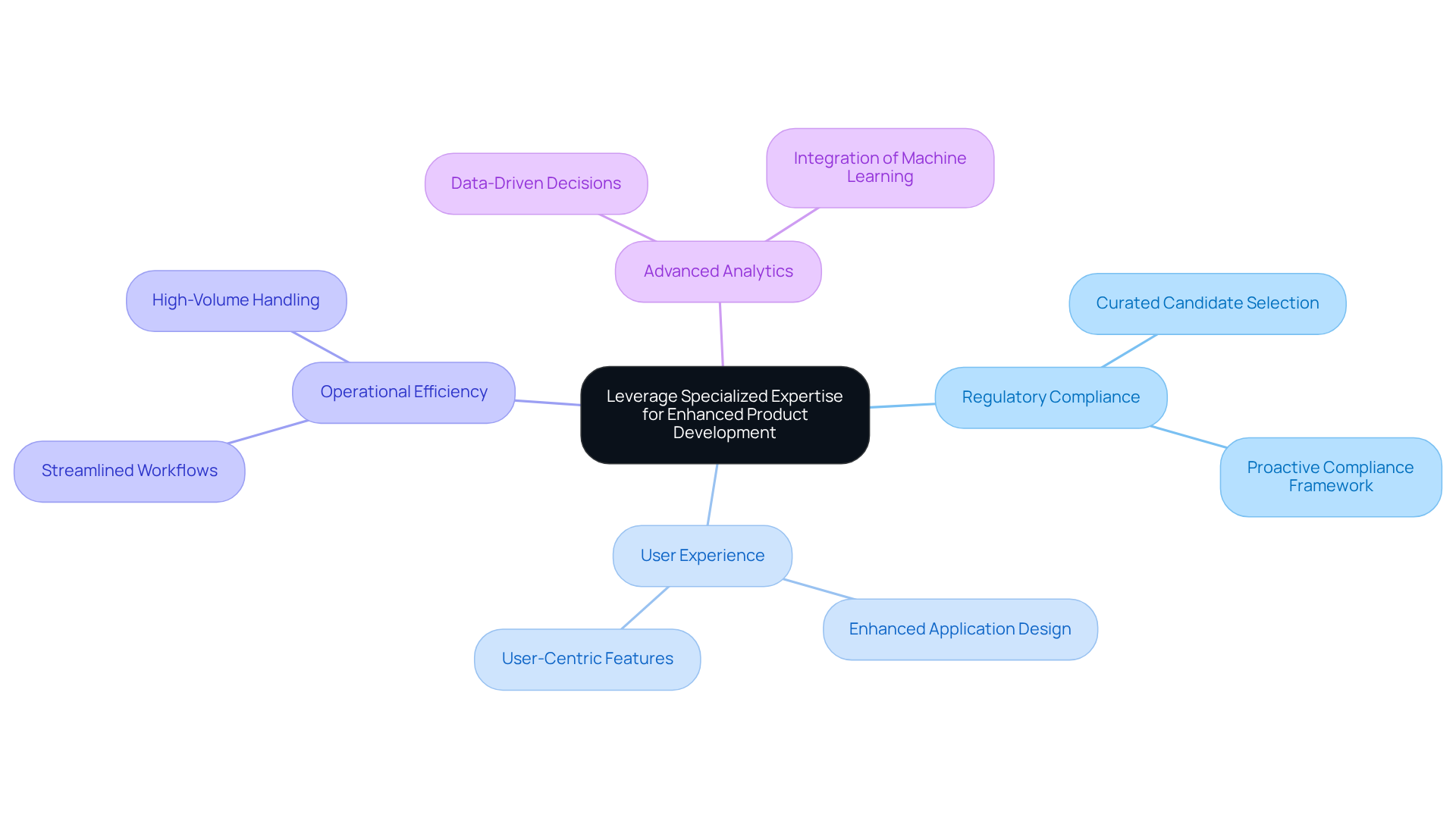

Leverage Specialized Expertise for Enhanced Product Development

Hedge vehicles function within a highly regulated environment where adherence to standards and effective risk management are paramount. By collaborating with an android software development company that specializes in financial services, investment firms gain access to developers who possess a deep understanding of industry complexities. Neutech’s tailored engineering talent supply process begins with a thorough assessment of client needs, allowing them to present a curated selection of candidate designers and developers who can seamlessly integrate into the investment group’s team. This specialized expertise is crucial for developing robust applications that not only comply with regulatory requirements but also enhance user experience and operational efficiency.

For instance, a team proficient in financial modeling and algorithm development can create applications that support complex investment strategies, enabling investment firms to optimize their portfolios and respond swiftly to market changes. Moreover, such partnerships can facilitate the integration of advanced analytics and machine learning capabilities, empowering investment firms to make data-driven decisions that bolster their competitive edge. Statistics indicate that the financial software development market is projected to reach 250 billion dollars by 2025, underscoring the growing demand for innovative solutions that address compliance challenges faced by investment firms. As Paul Koziarz aptly notes, ‘You have to evaluate compliance not as an expense, but as a money saver.’ By leveraging specialized knowledge from a technology firm, investment groups can enhance their product development processes, ensuring they remain agile and compliant in a rapidly evolving market.

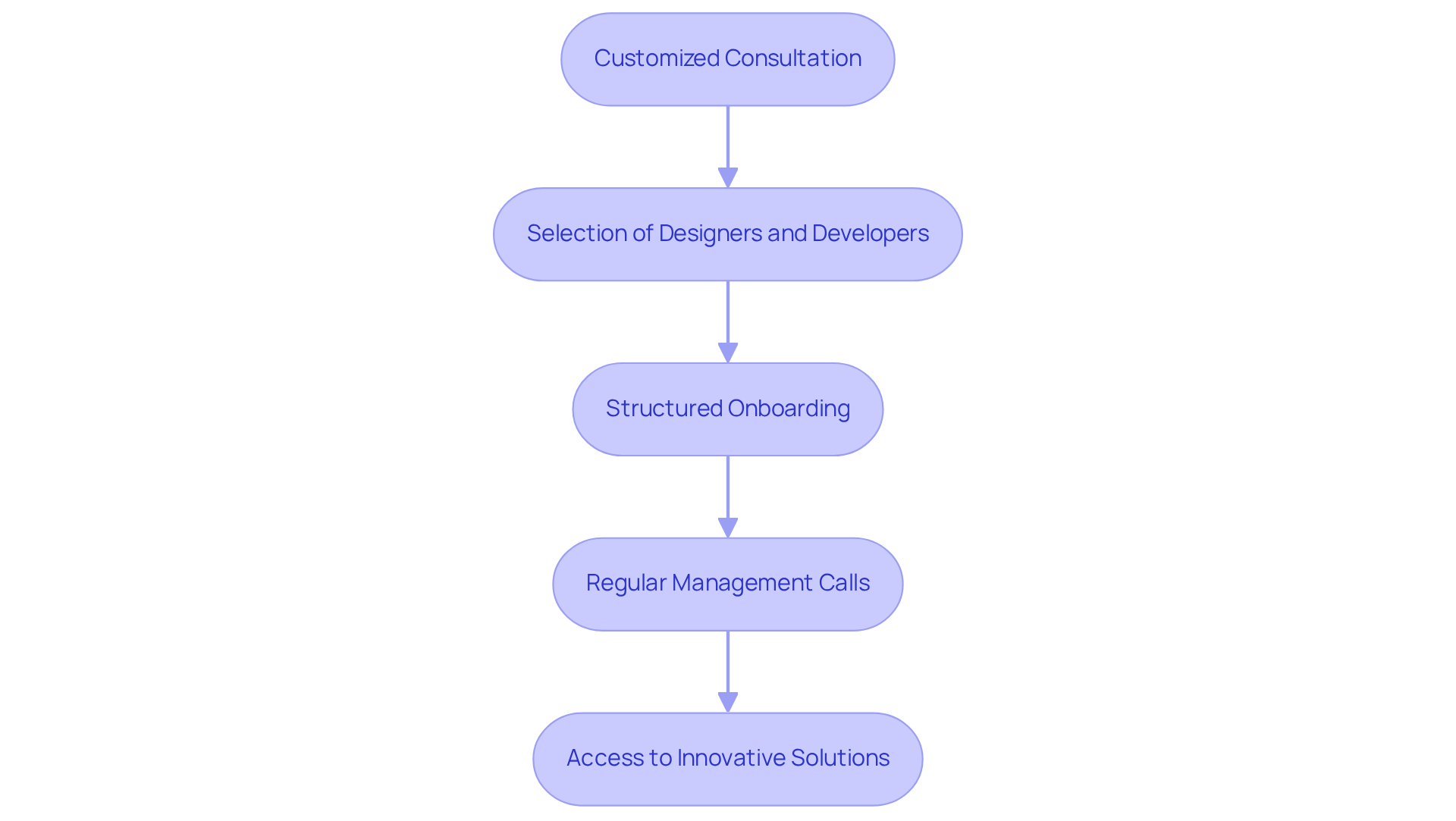

Ensure Sustainable Growth and Innovation Through Strategic Alliances

In an industry marked by rapid technological advancements and evolving market dynamics, hedge funds must prioritize sustainable growth and innovation. Strategic partnerships with an android software development company provide essential resources and expertise to foster this growth.

The client engagement process begins with a customized consultation to understand unique requirements, followed by the selection of specialized designers and developers who seamlessly integrate into the team. This process includes structured onboarding and regular management calls to ensure ongoing alignment with the roadmap. Such measures guarantee that investment groups can access innovative solutions that enhance operational capabilities and improve client offerings.

For example, the integration of mobile technology can facilitate better client engagement and streamline communication, ultimately leading to improved client satisfaction and retention. Furthermore, Neutech’s continuous management and support enable investment groups to stay ahead of industry trends, ensuring they are well-prepared to capitalize on emerging opportunities. As the financial landscape continues to evolve, innovation and flexibility emerge as essential differentiators for investment groups striving for long-term success.

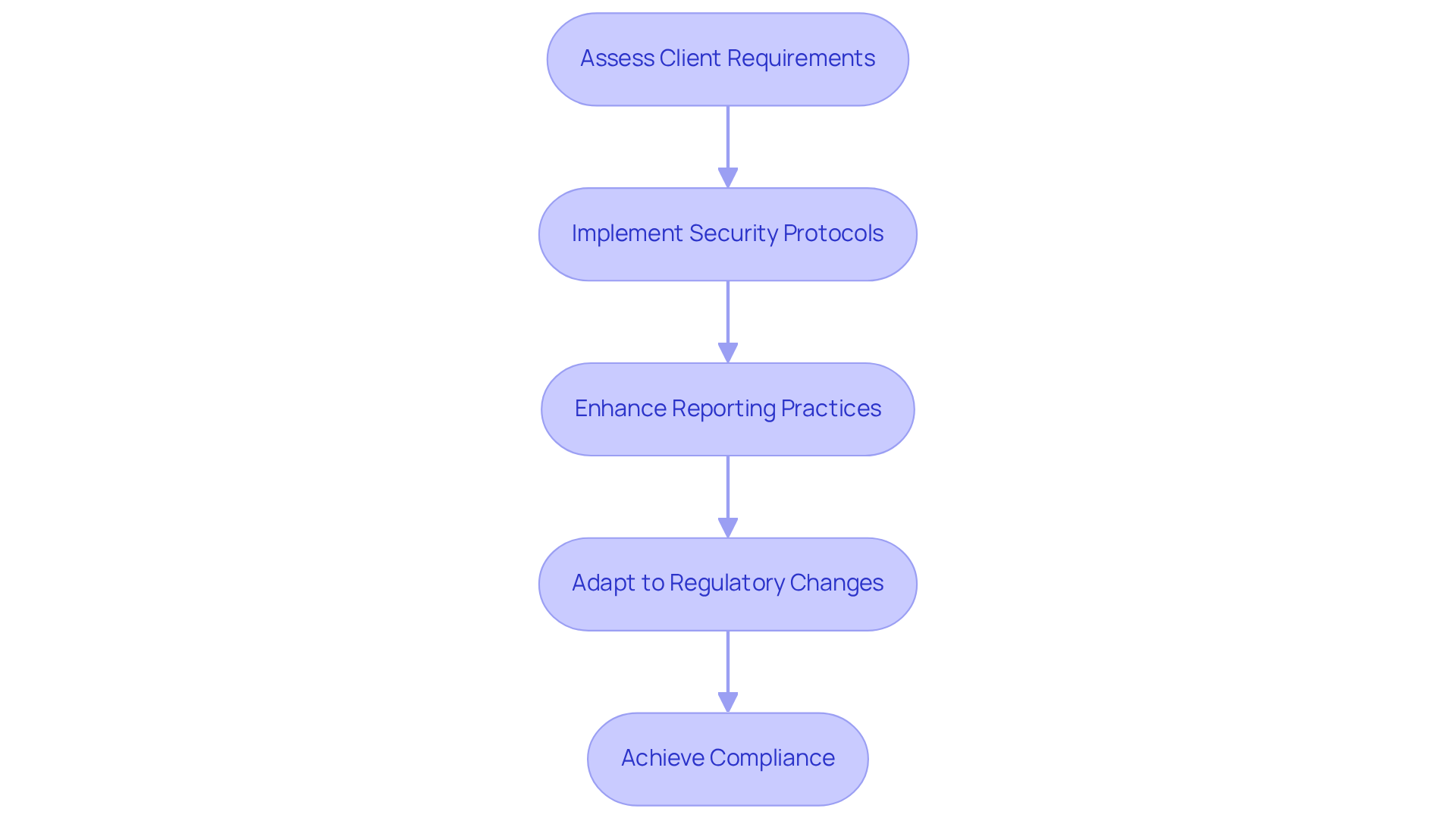

Navigate Regulatory Challenges with Expert Guidance

The regulatory environment for investment vehicles is intricate and continuously evolving, making compliance a critical concern for companies in this sector. Collaborating with an android software development company that specializes in financial services equips hedge funds with the necessary expertise to effectively navigate these challenges. The process of providing customized engineering talent begins with a thorough assessment of client requirements, ensuring that software solutions prioritize compliance. This includes the integration of features that support adherence to regulatory mandates such as SEC Form PF and Form ADV.

For example, the developers at this firm can implement robust security protocols to protect sensitive financial data and incorporate functionalities that enhance transparent reporting and auditing practices. By leveraging the specialized skills of the android software development company’s developers, including expertise in Android, React, and Python, investment firms can significantly reduce the risks associated with non-compliance, which can lead to substantial financial penalties and reputational damage.

Furthermore, these partnerships foster a proactive stance towards regulatory changes, enabling investment firms to swiftly adapt their operations and technology in response to new requirements. This adaptability is increasingly vital as compliance expectations tighten in 2026. The heightened scrutiny from regulators underscores the urgency for hedge funds to prioritize compliance, thereby amplifying the importance of specialized software solutions from the firm. Schedule a free consultation with Neutech to discover how we can assist you in navigating these challenges.

Conclusion

Strategic partnerships with Android software development companies are crucial for hedge funds aiming to secure a competitive advantage in a rapidly evolving financial landscape. By leveraging specialized expertise and innovative technology, investment firms can enhance operational efficiency, streamline processes, and ensure compliance with regulatory standards. This collaboration facilitates real-time data access and informed decision-making, positioning hedge funds to adapt swiftly to market changes.

Key insights throughout the article illustrate the multifaceted benefits of such partnerships. Access to advanced technology, tailored solutions for financial services, and the ability to navigate complex regulatory environments are among the advantages highlighted. Moreover, the emphasis on sustainable growth and continuous innovation underscores the necessity for hedge funds to remain agile and responsive to emerging trends and client needs.

In conclusion, the importance of collaborating with expert software development firms cannot be overstated. As the financial sector faces increasing regulatory scrutiny and technological demands, hedge funds must prioritize these strategic alliances to foster innovation and secure long-term success. Embracing this approach not only enhances competitiveness but also ensures that investment groups are well-equipped to thrive in an increasingly complex market.

Frequently Asked Questions

Why is securing a technological edge important for hedge funds?

Securing a technological edge is essential for hedge funds to remain competitive in the industry, allowing them to improve operational efficiency and profitability.

What benefits do hedge funds gain from partnering with an android software development company?

Benefits include access to advanced technology, specialized expertise, and innovative solutions tailored for the financial sector.

How does the reliability of a software development company impact hedge funds?

A reliable software development company with a high employee retention rate ensures that clients are secure against developer turnover, allowing for seamless integration of skilled developers into their operations.

What advantages do sophisticated mobile applications provide to investment firms?

Sophisticated mobile applications facilitate real-time data access and informed decision-making, helping firms position themselves ahead of competitors using outdated systems.

How does the adaptable engineering talent model benefit investment firms?

The adaptable engineering talent model supports month-to-month agreements and flexible resource allocation, enabling firms to quickly respond to market fluctuations and evolving client needs.

What trend is observed regarding investment groups’ spending on cloud platforms and applications?

Investment groups plan to increase spending on cloud platforms and applications by 26% over the next two years, highlighting the growing necessity for technological partnerships.

How can AI contribute to the operations of investment groups?

AI can be a valuable tool for detecting fraud, emphasizing the importance of integrating advanced technology to enhance operational capabilities.

What challenges do investment groups face due to digitalization?

Many investment groups face challenges due to inflexible systems, with 45% reporting difficulties, underscoring the need for partnerships with software development companies to overcome these obstacles.