10 Essential Software Test Services for Hedge Funds’ Success

Introduction

In the high-stakes environment of hedge funds, the margin for error is exceptionally narrow. As investment firms navigate an increasingly complex regulatory landscape, the necessity for specialized software testing services has reached unprecedented levels. This article explores ten essential software testing solutions that not only improve operational efficiency but also ensure adherence to stringent industry standards. Given the multitude of options available, how can hedge funds effectively identify strategies to mitigate risks and sustain a competitive advantage?

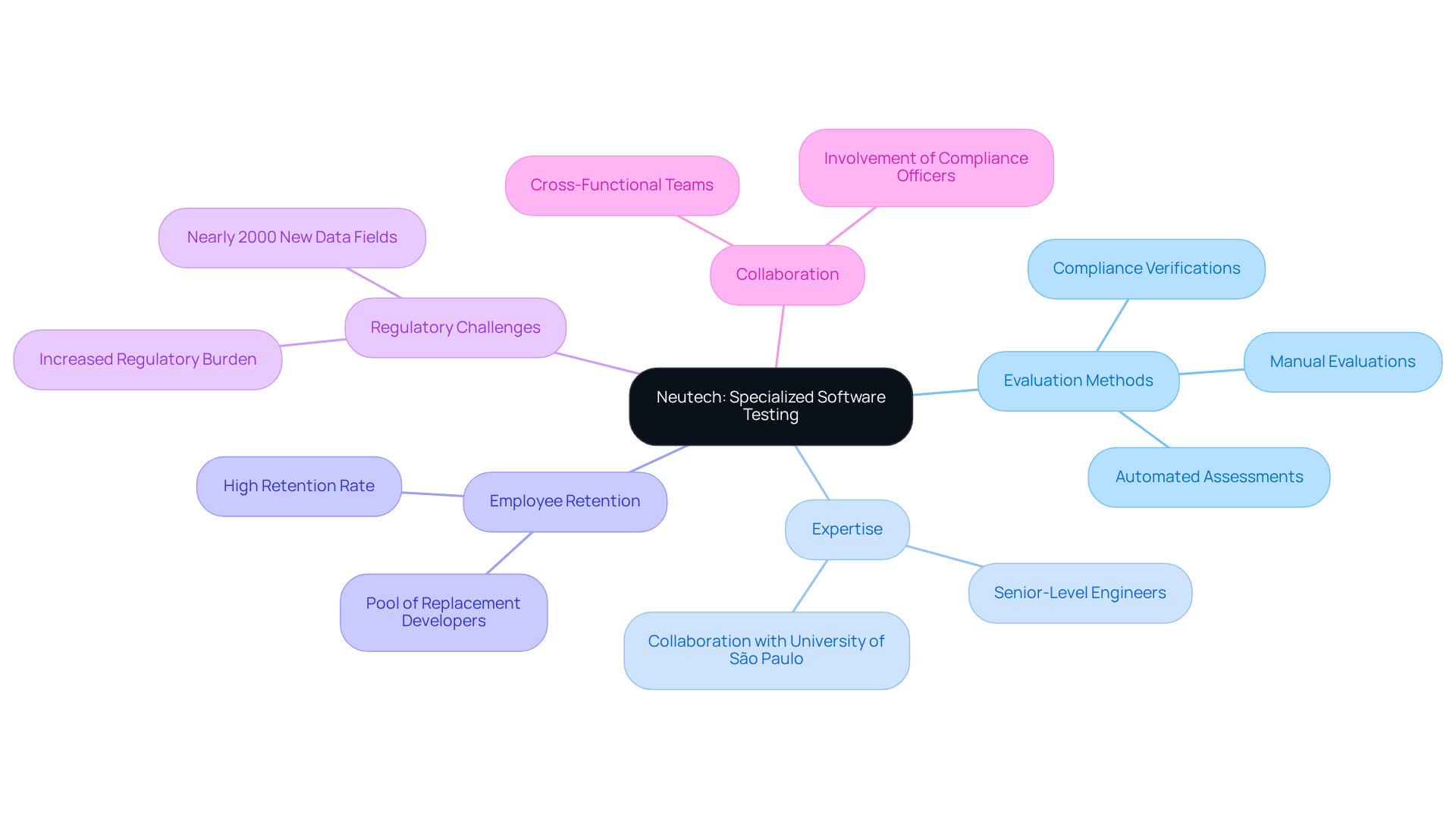

Neutech: Specialized Software Testing for Regulated Industries

Neutech stands out as a premier supplier of specialized evaluation services, particularly software test services, tailored for regulated sectors, especially in financial services. The company emphasizes adherence and dependability by employing software test services within a comprehensive evaluation approach that includes automated assessments, manual evaluations, and compliance verifications. This ensures that solutions meet the stringent requirements of investment firms.

The engineers at Neutech, trained in collaboration with the University of São Paulo, bring senior-level expertise to the evaluation process. Their involvement guarantees that every application is robust, secure, and compliant with industry regulations. This commitment to quality is essential for investment firms operating in a heavily regulated environment, where software test services are necessary to prevent software malfunctions that can lead to significant financial and reputational damage.

Neutech’s impressive employee retention rate further enhances client confidence, as developers are never pulled away from projects. Instead, the company maintains a pool of replacement developers ready to step in when necessary, ensuring seamless integration and continuity.

With nearly 2000 new data fields introduced between 2014 and 2023, the regulatory burden on investment firms has intensified, making effective compliance-driven testing more critical than ever. Neutech’s strategy not only mitigates risks but also enhances operational efficiency by utilizing software test services, enabling investment groups to navigate the complexities of compliance while maintaining high performance standards.

Moreover, cross-functional collaboration among developers, compliance officers, and QA teams is crucial in ensuring that all regulatory impacts are comprehended and addressed throughout the software development lifecycle.

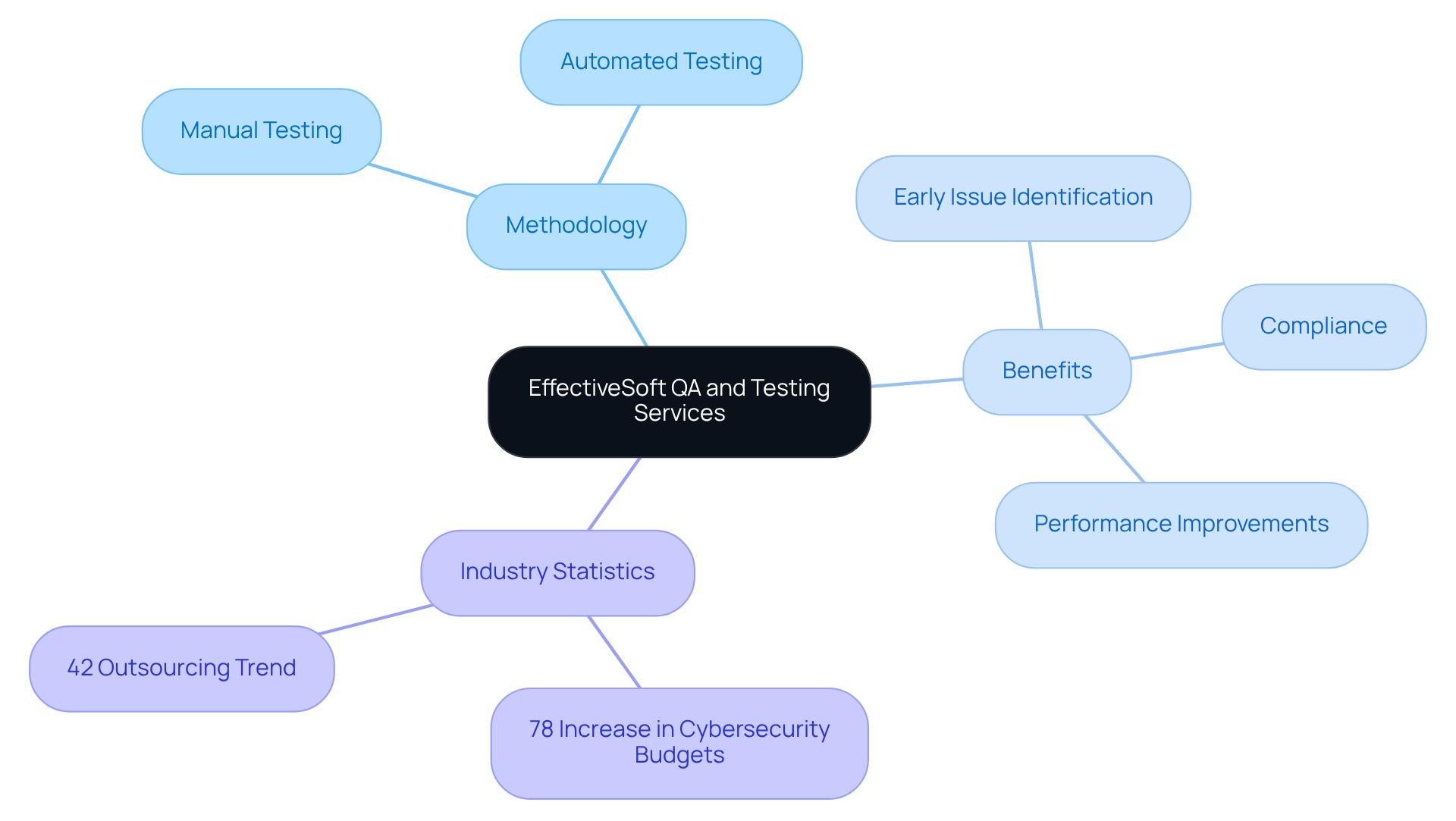

EffectiveSoft: Comprehensive QA and Testing Services

EffectiveSoft provides a robust suite of software test services and quality assurance (QA) evaluation services tailored specifically for the financial services sector, including investment pools. Their methodology combines both manual and automated testing, ensuring comprehensive coverage and reliability, which are crucial in high-stakes environments.

With a team of certified QA engineers, EffectiveSoft excels in early issue identification throughout the development lifecycle. This capability is vital for investment groups seeking to mitigate risks associated with system failures. Their proactive approach not only enhances quality but also ensures compliance with stringent regulatory standards in software test services.

Investment groups utilizing EffectiveSoft’s software test services have reported significant improvements in application performance and reliability. This underscores the critical role of thorough quality assurance in maintaining operational integrity and a competitive advantage in the market.

According to the Hedge Fund Association’s 2025 Cybersecurity Survey, 78% of firms have increased their cybersecurity budgets over the past year, reflecting the growing importance of investing in QA services. Additionally, 42% of firms intend to outsource key components of their cybersecurity programs, indicating a trend towards specialized QA solutions. These statistics highlight the necessity for hedge funds to prioritize quality assurance in their operations.

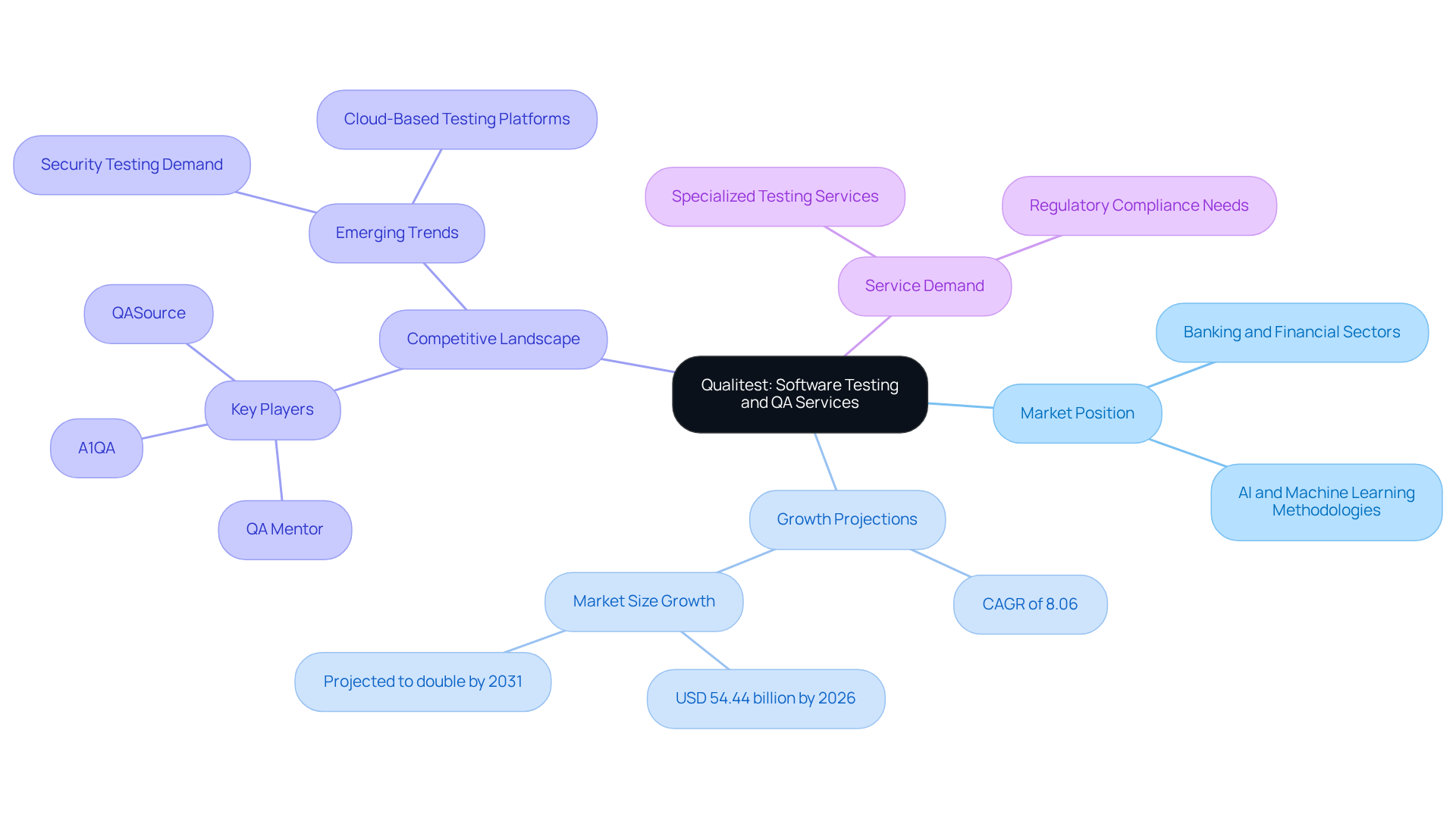

Qualitest: Leading Provider of Software Testing and QA Services

Qualitest is recognized as a leading provider of software test services and quality assurance, specifically designed for the banking and financial sectors. Their innovative methodologies leverage AI and machine learning, significantly enhancing evaluation efficiency and accuracy. For investment groups, collaborating with Qualitest offers access to cutting-edge assessment strategies that not only expedite time-to-market but also ensure compliance with stringent regulatory standards.

With a robust history in the financial sector, Qualitest serves as a dependable partner for investment firms aiming to refine their evaluation processes and achieve optimal performance. As the demand for specialized software test services escalates, especially in light of increasing software complexity and digital transformation, Qualitest’s expertise positions them advantageously within a competitive landscape.

The Software Evaluation and Quality Assurance Services market is projected to grow at a CAGR of approximately 8.06% from 2025 to 2033, underscoring the imperative for investment groups to adopt advanced evaluation methodologies. Furthermore, prominent players in the market, including QA Mentor, A1QA, and QASource, highlight the competitive environment in which Qualitest operates.

The rising demand for security evaluations and penetration assessment services, driven by data privacy concerns and regulations such as GDPR and CCPA, accentuates the importance of robust evaluation strategies in the financial industry. The application evaluation market size reached USD 54.44 billion in 2026 and is expected to nearly double by 2031, reinforcing the critical need for investment groups to enhance their application evaluation procedures.

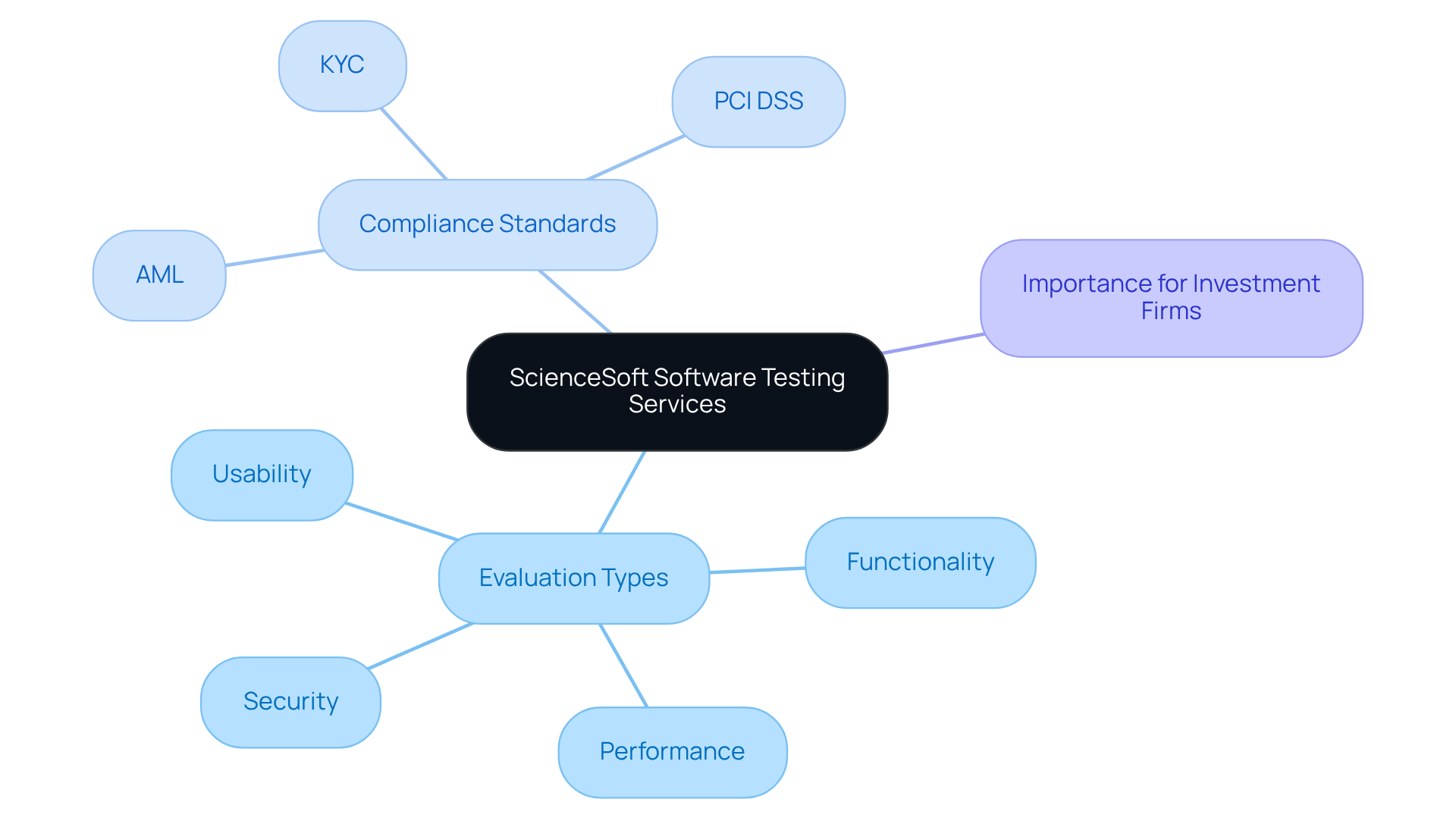

ScienceSoft: Diverse Software Testing Services for Various Applications

ScienceSoft offers a comprehensive suite of application evaluation services specifically designed to meet the unique requirements of the financial sector, particularly investment firms. Their robust evaluation capabilities include assessments of functionality, performance, security, and usability, ensuring a thorough review of all aspects of application quality. For investment groups, the availability of diverse software test services is crucial, as they facilitate tailored strategies that align with specific operational demands.

ScienceSoft’s commitment to quality and adherence to compliance standards positions them as a trustworthy partner for investment groups aiming to enhance application reliability and operational efficiency. With over 100 successful projects completed for financial organizations, ScienceSoft has demonstrated its proficiency in delivering secure and compliant technology solutions. Their recognition in the 2025 Inc. 5000 list, highlighting a growth rate of 67%, further emphasizes their capability within the industry.

As investment pools navigate complex regulatory environments, compliance with standards such as KYC, AML, and PCI DSS becomes essential. This makes various evaluation services not just beneficial but necessary. Hedge investment managers are encouraged to prioritize software test services to bolster system reliability and ensure adherence to regulatory requirements.

ThinkSys: Innovative Software Testing Solutions for Competitive Edge

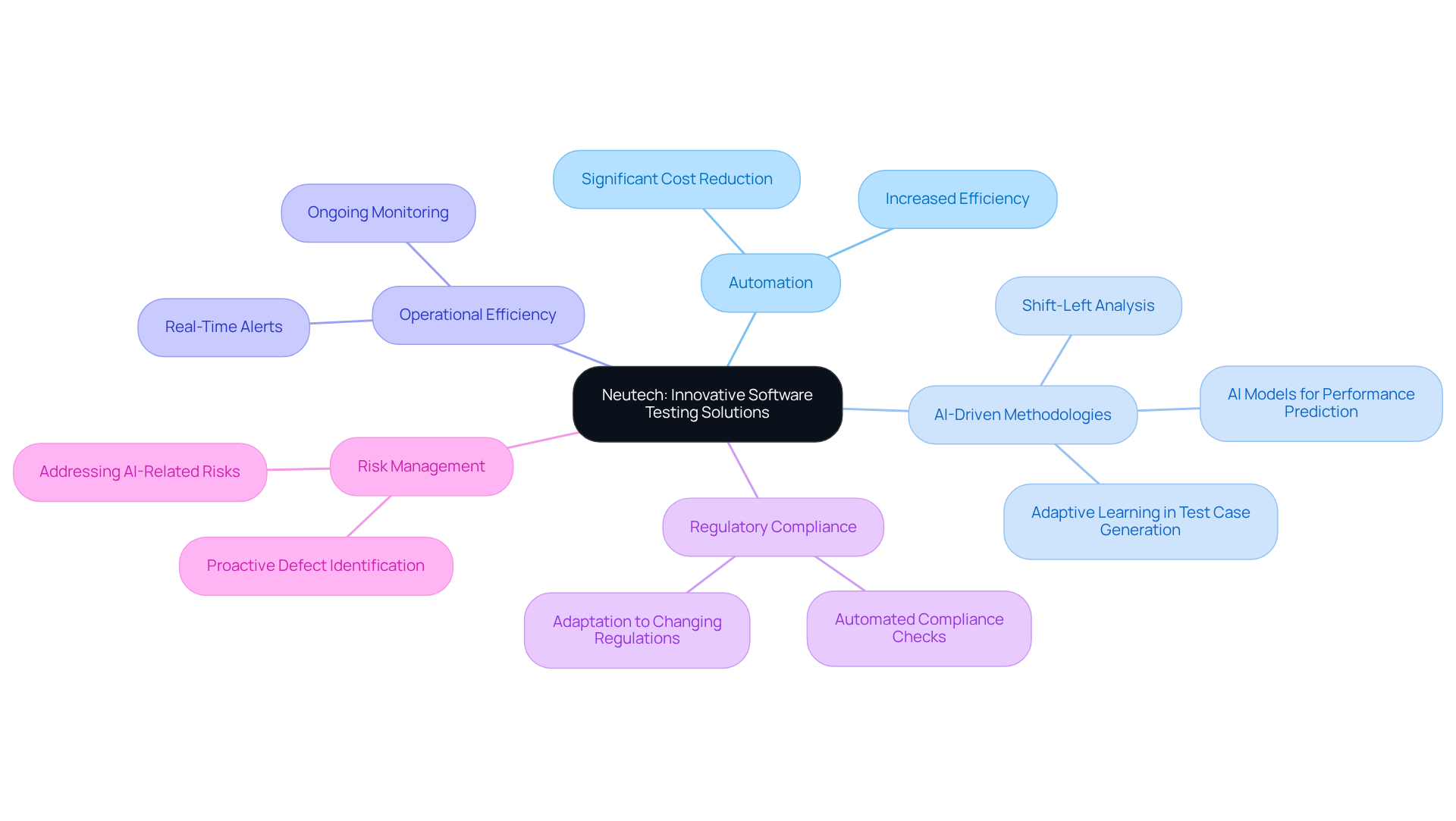

Neutech offers innovative assessment solutions designed to empower hedge funds in today’s dynamic financial landscape. By leveraging automation and AI-driven evaluation methodologies, including shift-left analysis for early defect detection, Neutech accelerates assessment cycles and enhances accuracy – both critical for maintaining a competitive edge. These advanced solutions, including software test services, streamline evaluation processes, significantly reduce operational costs through increased efficiency, and improve software quality.

With a strong commitment to innovation, Neutech enables investment groups to swiftly adapt to changing market demands while complying with stringent regulatory standards. The integration of AI models allows for the prediction of performance issues before they affect users. Additionally, ongoing monitoring, supported by real-time alerts, equips teams to quickly identify and address slowdowns, thereby reinforcing the reliability of financial applications.

As investment firms face growing competition from emerging financial hubs, the ability to implement effective evaluation strategies becomes essential for success. However, it is crucial to remain cognizant of the potential risks associated with AI, as emphasized by regulatory bodies, to ensure a balanced approach to these advanced methodologies.

Managed Testing Services: Flexible Solutions for Hedge Funds

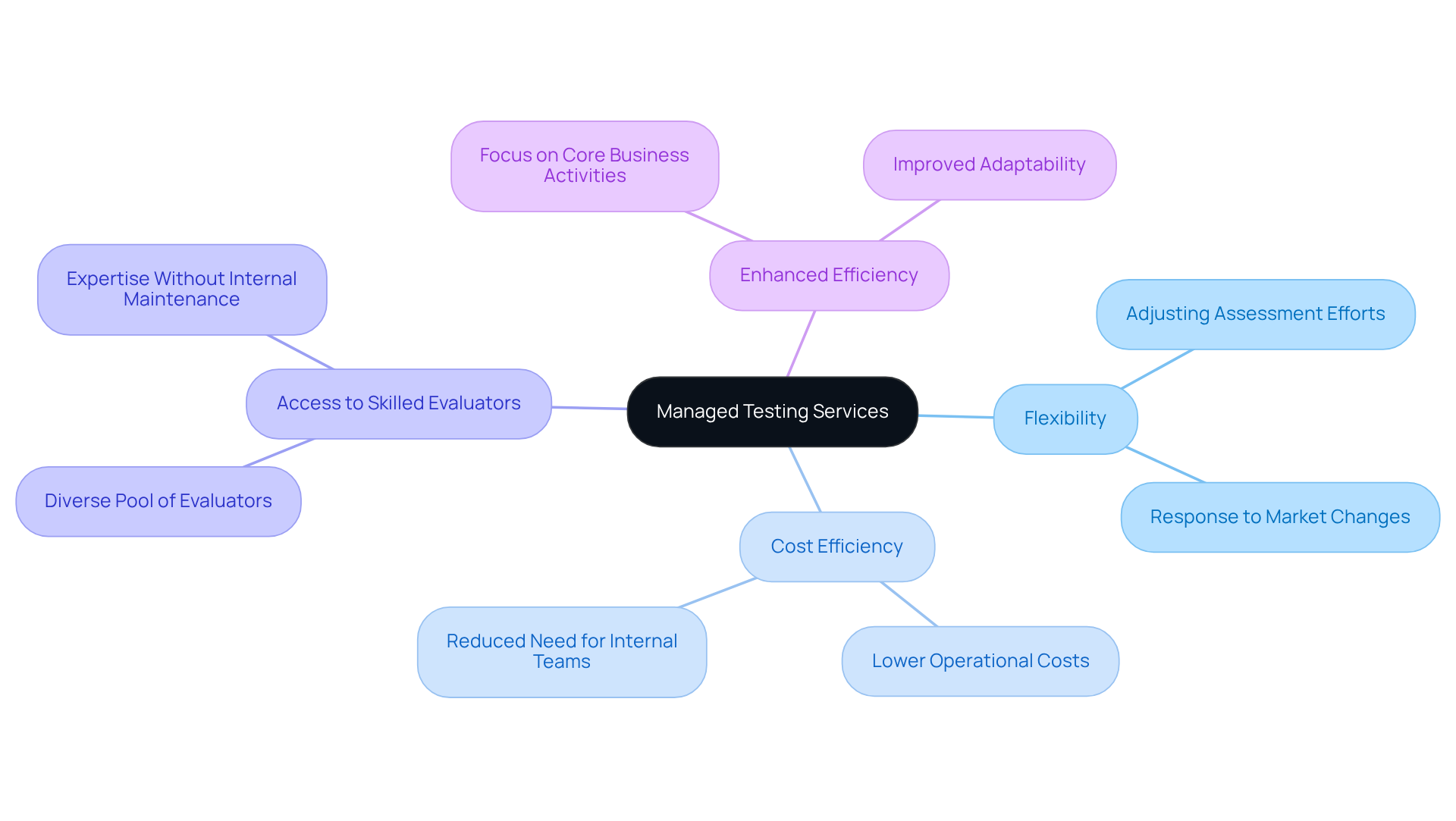

Managed evaluation services provide investment groups with the necessary flexibility to adjust their assessment efforts in response to evolving project requirements. This flexibility is particularly crucial in the financial sector, where swift changes in market conditions or regulatory frameworks can significantly affect operations.

By utilizing managed assessment services, investment groups can access a diverse pool of skilled evaluators without the need to maintain an internal team. This approach not only lowers operational costs but also ensures that evaluation processes are conducted efficiently and effectively.

Consequently, investment pools can concentrate on their core business activities, thereby enhancing overall efficiency and adaptability in a competitive landscape.

Test Automation: Enhancing Efficiency in Software Testing

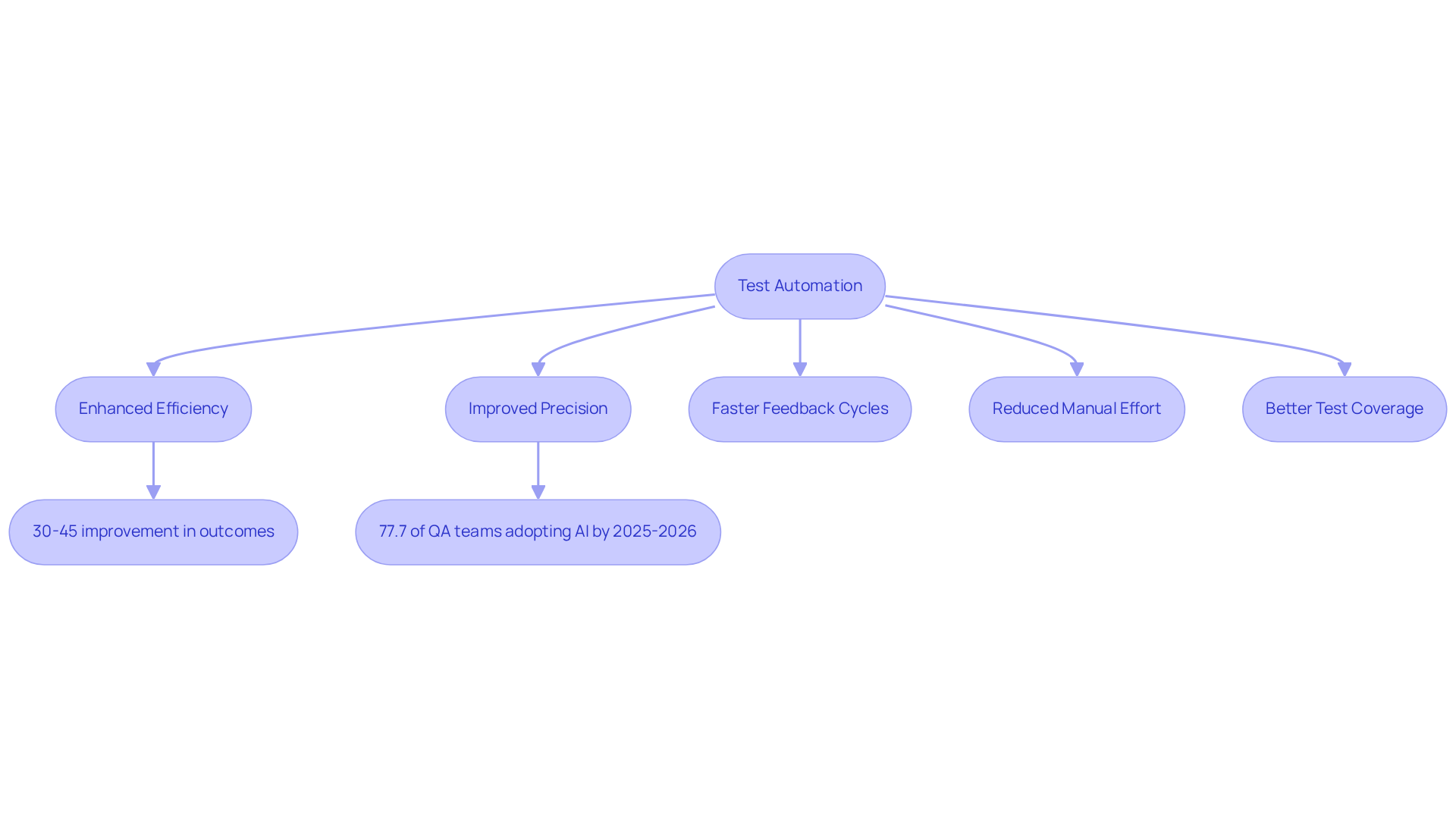

Test automation is fundamentally transforming the software evaluation landscape, particularly for investment firms, by significantly enhancing both efficiency and precision. By implementing automated evaluation processes, hedge funds can achieve faster feedback cycles, drastically reduce manual effort, and improve overall test coverage. Automation facilitates the rapid execution of repetitive tests, enabling teams to allocate valuable resources to more complex testing tasks that necessitate human insight.

This shift not only ensures that technological solutions are thoroughly vetted prior to deployment but also mitigates the risk of errors and compliance issues. Organizations that have embraced automation report a 30-45% improvement in software development outcomes, highlighting the essential role of automation in upholding high standards within regulated environments.

Moreover, with 77.7% of QA teams either utilizing or planning to utilize AI in their evaluation processes by 2025-2026, the financial services sector is increasingly adopting automation. AI compresses QA cycles from days to approximately 2 hours, further underscoring the necessity of automation for maintaining competitiveness in a fast-paced market.

QA Consulting: Building Robust Testing Frameworks for Compliance

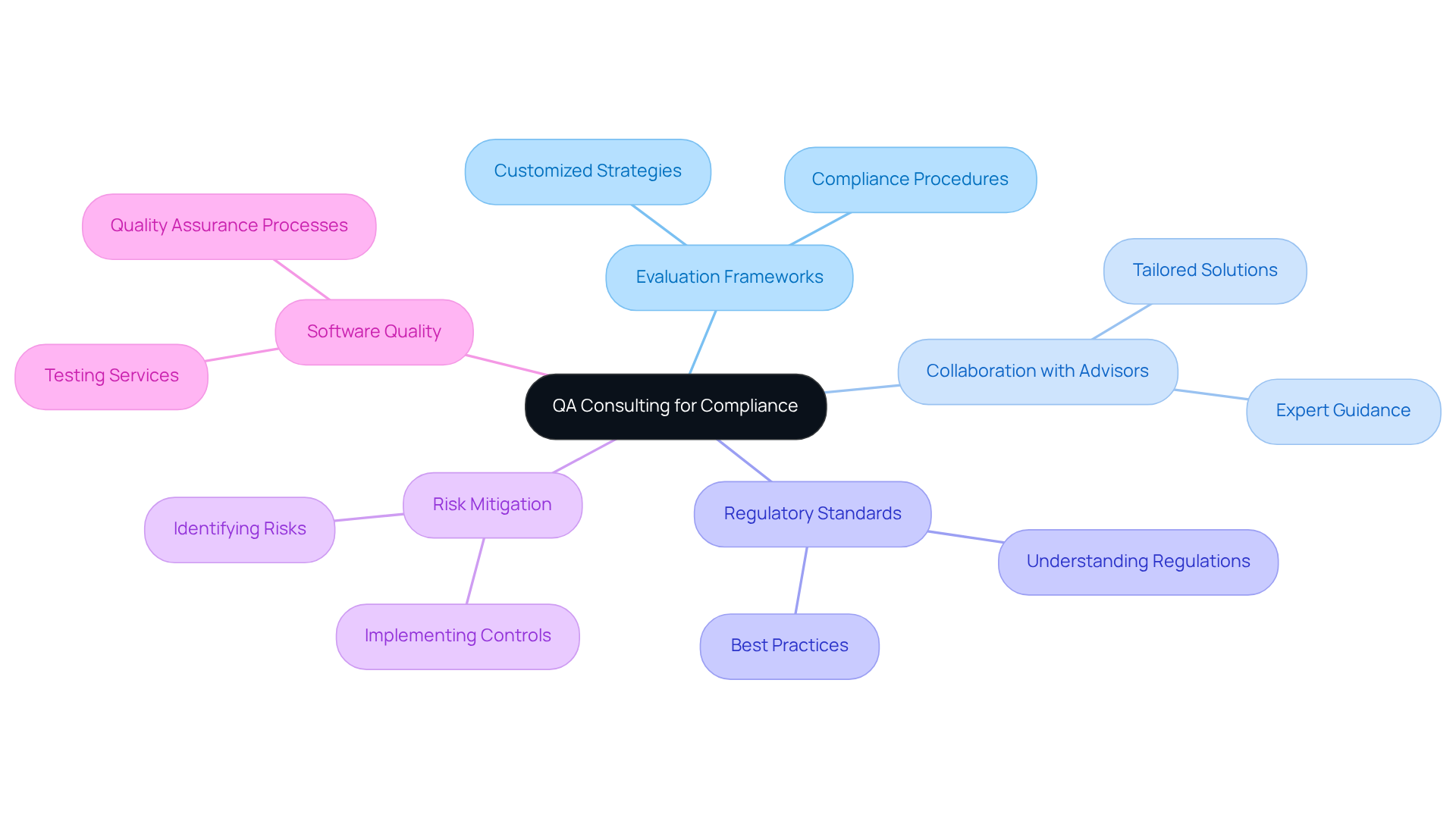

QA consulting services play a crucial role for investment firms aiming to establish robust evaluation frameworks that comply with industry regulations. By collaborating with QA advisors, these firms can devise customized evaluation strategies that effectively address their specific challenges and requirements. These experts possess a deep understanding of regulatory standards and best practices, enabling investment firms to implement evaluation procedures that not only mitigate risks but also enhance software quality by utilizing software test services.

A well-organized QA framework is essential for maintaining the integrity and reliability of financial applications, especially in an environment where compliance failures can result in severe penalties and reputational harm. As regulatory scrutiny increases, particularly regarding disclosures and compliance policies, the necessity for comprehensive evaluation frameworks becomes even more pronounced. This proactive approach not only safeguards against potential violations but also empowers investment firms to swiftly adapt to evolving regulatory demands.

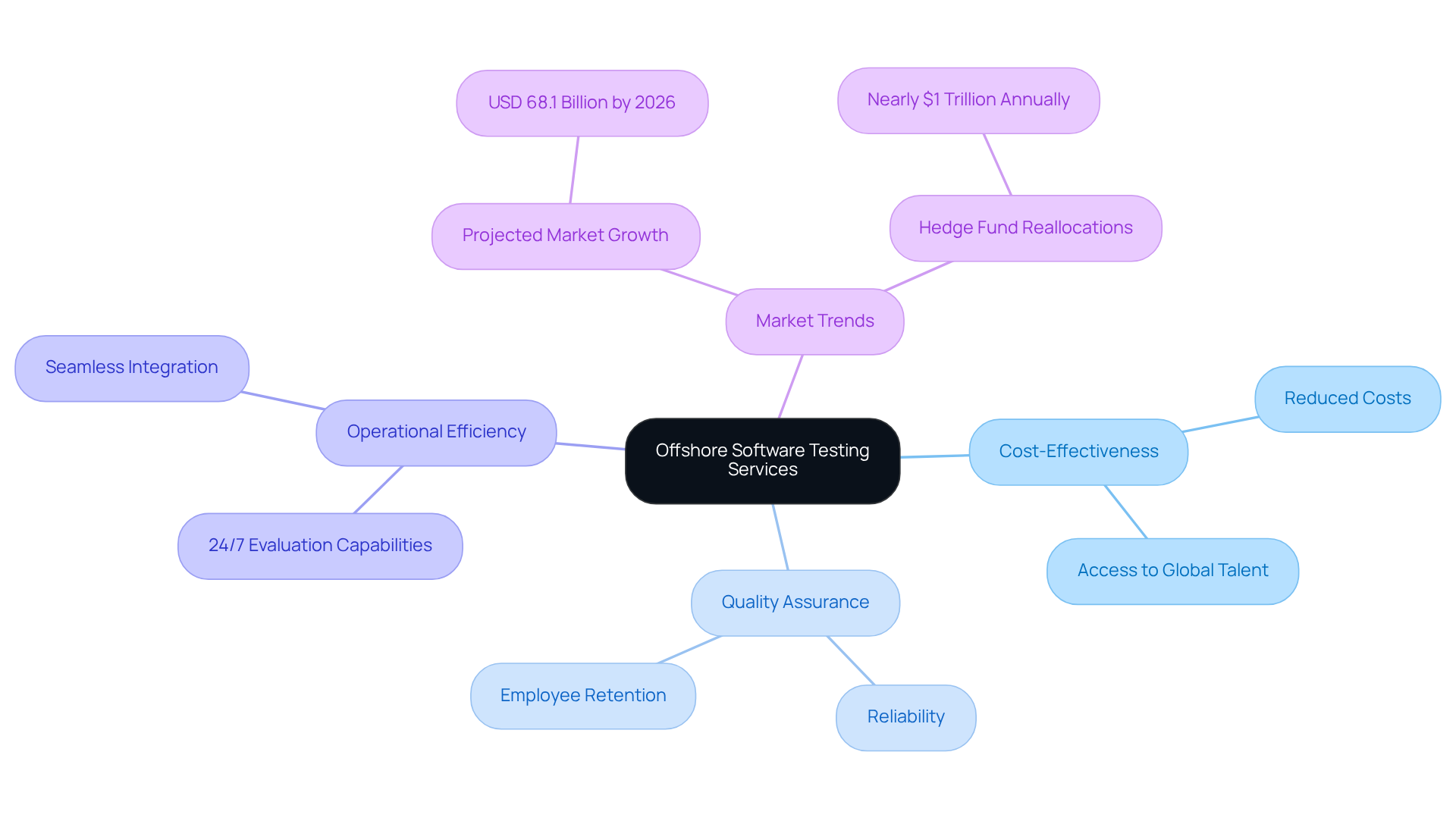

Offshore Software Testing Services: Cost-Effective Solutions for Hedge Funds

Offshore software test services offer investment groups a cost-effective strategy to enhance their assessment processes without sacrificing quality. By leveraging a global talent pool, investment firms gain access to highly skilled testers at significantly reduced costs compared to maintaining an in-house team. This approach not only decreases operational expenses but also provides the advantage of 24/7 evaluation capabilities, allowing projects to advance without delays.

Neutech exemplifies this flexibility with its commitment to reliability, showcasing a high employee retention rate and seamless integration of engineering talent into client teams. With Neutech’s emphasis on dedicated developers for each project, investment groups can trust that their evaluation needs will be met consistently and efficiently.

As the hedge fund sector anticipates substantial reallocations – nearly $1 trillion annually – employing offshore evaluations emerges as a strategic choice for firms aiming to enhance program quality while effectively managing their budgets. Furthermore, with the global application evaluation market projected to reach USD 68.1 billion by 2026, the demand for effective and reliable software test services is clear.

Maya Wilson articulates this perspective well, stating, “Outsourcing isn’t just a cost decision; it’s a strategic move to gain flexibility, improve quality, accelerate responsiveness, and align with broader enterprise transformation goals.” This underscores the necessity of adopting offshore evaluation services to maintain competitiveness in a rapidly evolving market.

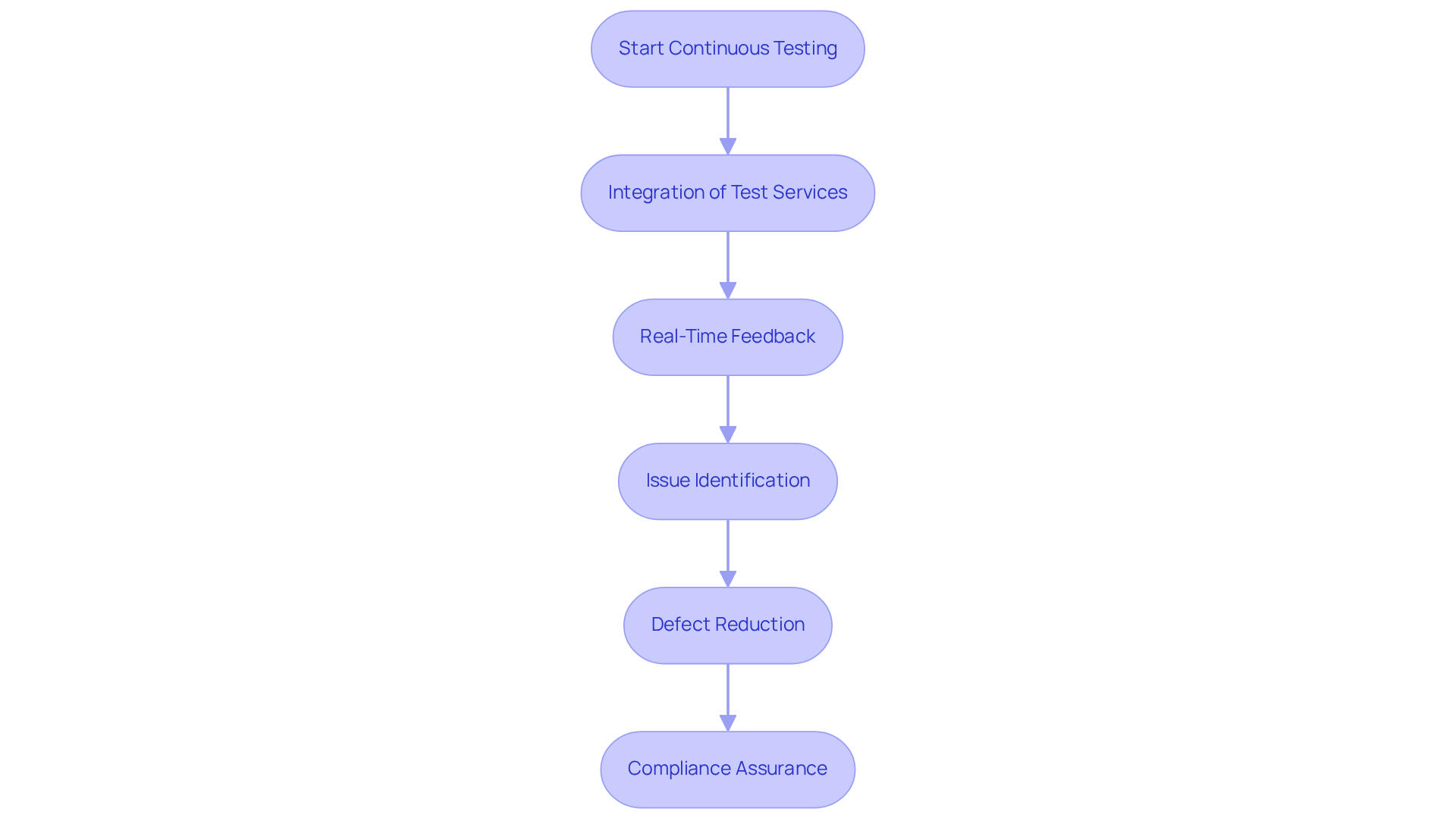

Continuous Testing: Ensuring Ongoing Quality and Compliance

Ongoing evaluation is crucial for investment groups aiming to uphold quality and compliance in their technological solutions. By integrating software test services into every phase of the application development lifecycle, investment firms can swiftly identify and address issues, significantly minimizing the likelihood of defects in production. This approach provides real-time feedback on application quality, ensuring adherence to stringent regulatory standards. Such a proactive strategy not only enhances software reliability via software test services but also expedites deployment cycles, allowing hedge funds to respond rapidly to market fluctuations.

Organizations that prioritize ongoing evaluation can achieve a reduction in defect rates by as much as 40%, highlighting its importance in the dynamic financial landscape. Moreover, the global continuous evaluation market is projected to grow from USD 2.7 billion in 2024 to USD 9.42 billion by 2033, with a compound annual growth rate (CAGR) of 14.9% from 2026 to 2033. This growth reflects the increasing investment in robust assessment frameworks. As the demand for quicker software delivery escalates, the integration of AI and machine learning in test automation is transforming industry standards, positioning continuous testing not merely as a necessity but as a strategic advantage for hedge funds.

Conclusion

Investment firms today navigate a complex landscape where the success of their operations relies heavily on effective software testing services. This article outlines ten essential software test services crucial for hedge funds, highlighting the necessity for robust evaluation strategies that ensure compliance and enhance operational efficiency. By prioritizing these services, investment groups can significantly mitigate risks associated with software failures, thereby safeguarding their financial integrity and reputation.

Key insights from the article emphasize the importance of specialized testing services, such as those offered by Neutech, EffectiveSoft, Qualitest, and others. Each service presents unique methodologies and advantages, ranging from automated testing that accelerates feedback cycles to comprehensive QA consulting that establishes robust frameworks for compliance. The focus on continuous testing further underscores the necessity of maintaining high software quality standards in a rapidly evolving regulatory environment.

In conclusion, the integration of effective software test services transcends mere technical necessity; it is a strategic imperative for hedge funds aiming to thrive in a competitive market. Investment groups are urged to adopt these advanced evaluation methodologies to enhance their software reliability and compliance. As the financial landscape continues to evolve, the proactive implementation of these testing services will be vital in navigating future challenges and seizing opportunities for growth.

Frequently Asked Questions

What types of software testing services does Neutech provide?

Neutech offers specialized software test services tailored for regulated industries, particularly in financial services. Their evaluation approach includes automated assessments, manual evaluations, and compliance verifications.

How does Neutech ensure the quality and compliance of its software testing?

Neutech employs engineers trained in collaboration with the University of São Paulo, ensuring senior-level expertise in the evaluation process. This commitment helps guarantee that applications are robust, secure, and compliant with industry regulations.

Why is software testing important for investment firms?

Software testing is essential for investment firms operating in heavily regulated environments to prevent software malfunctions that can lead to significant financial and reputational damage.

What is Neutech’s employee retention strategy?

Neutech has a high employee retention rate, ensuring that developers are not pulled away from projects. They maintain a pool of replacement developers ready to step in when necessary, ensuring seamless integration and continuity.

How has the regulatory landscape changed for investment firms recently?

Between 2014 and 2023, nearly 2000 new data fields have been introduced, intensifying the regulatory burden on investment firms and making effective compliance-driven testing more critical than ever.

What role does cross-functional collaboration play in software testing at Neutech?

Cross-functional collaboration among developers, compliance officers, and QA teams is crucial to ensure that all regulatory impacts are comprehended and addressed throughout the software development lifecycle.

What services does EffectiveSoft provide for the financial services sector?

EffectiveSoft offers a robust suite of software test services and quality assurance (QA) evaluation services specifically tailored for the financial services sector, including investment pools.

How does EffectiveSoft enhance the quality of software testing?

EffectiveSoft employs certified QA engineers who excel in early issue identification throughout the development lifecycle, which is vital for mitigating risks associated with system failures.

What improvements have investment groups reported after using EffectiveSoft’s services?

Investment groups utilizing EffectiveSoft’s software test services have reported significant improvements in application performance and reliability.

What trends are emerging in cybersecurity budgets among firms?

According to a survey, 78% of firms have increased their cybersecurity budgets over the past year, and 42% intend to outsource key components of their cybersecurity programs, indicating a trend towards specialized QA solutions.

What is Qualitest known for in the software testing industry?

Qualitest is recognized as a leading provider of software test services and quality assurance specifically designed for the banking and financial sectors, utilizing innovative methodologies that leverage AI and machine learning.

How does Qualitest’s approach benefit investment groups?

Qualitest’s cutting-edge assessment strategies help investment groups expedite time-to-market while ensuring compliance with stringent regulatory standards.

What is the projected growth rate for the Software Evaluation and Quality Assurance Services market?

The Software Evaluation and Quality Assurance Services market is projected to grow at a compound annual growth rate (CAGR) of approximately 8.06% from 2025 to 2033.

Why is there a rising demand for security evaluations in the financial industry?

The increasing concerns regarding data privacy and regulations such as GDPR and CCPA have driven the demand for robust evaluation strategies in the financial industry.

What is the expected market size for the application evaluation market by 2031?

The application evaluation market size reached USD 54.44 billion in 2026 and is expected to nearly double by 2031, highlighting the critical need for investment groups to enhance their application evaluation procedures.