Why Hedge Funds Should Partner with an Android Development Firm

Introduction

In a financial landscape increasingly shaped by technology, hedge funds are starting to acknowledge the crucial role that mobile applications play in optimizing their operations. By collaborating with specialized Android development firms, these investment groups can access numerous advantages, including:

- Streamlined processes

- Enhanced client engagement

- Preserving a competitive edge

However, as the demand for agility and innovation intensifies, a critical question arises: can hedge funds afford to overlook the risks and limitations associated with in-house development in favor of strategic partnerships that promise long-term success?

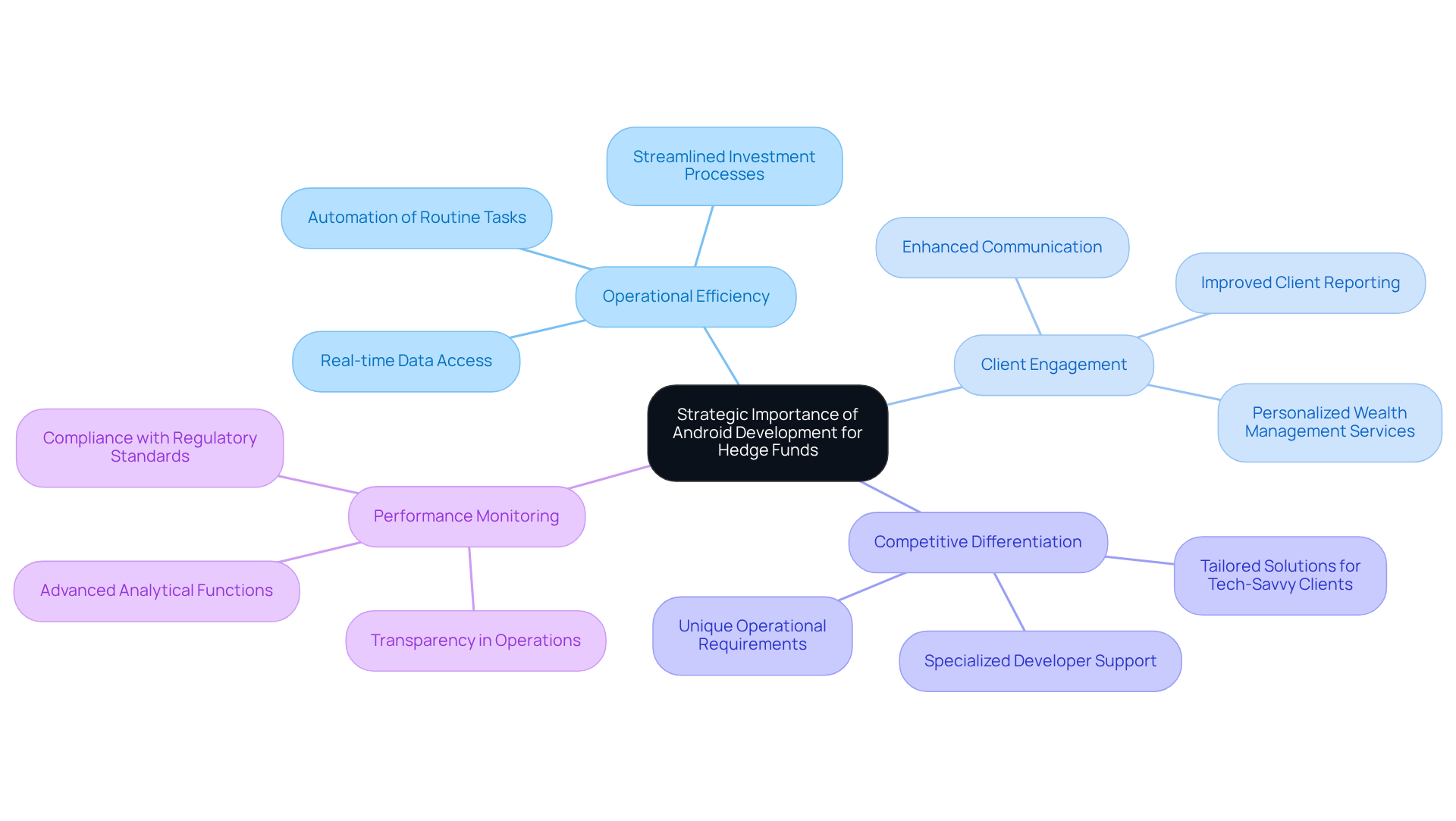

Understand the Strategic Importance of Android Development for Hedge Funds

In the rapidly evolving financial landscape, investment groups are increasingly acknowledging the strategic significance of mobile technology, particularly through the services of an android development firm. Mobile applications empower investment firms to enhance operational efficiency, improve client engagement, and streamline investment processes. As mobile-first strategies gain momentum, investment groups can partner with an android development firm to leverage Android applications that provide real-time data access, facilitate seamless communication, and support decision-making on the go. This adaptability is essential in a market where speed and agility can significantly impact investment outcomes.

Moreover, as investment vehicles seek to attract a tech-savvy clientele, robust mobile solutions serve as a competitive differentiator, enabling firms to distinguish themselves in a crowded marketplace. By partnering with the company, investment groups can benefit from a tailored engineering talent supply process, where the organization assesses specific client needs through comprehensive consultations and analysis. This approach allows Neutech to deliver specialized developers and designers with expertise in financial applications, ensuring that mobile solutions are not only optimized for performance but also aligned with the unique operational requirements of each investment group.

The integration of mobile technology not only enhances workflows but also aligns with the growing demand for transparency and performance monitoring among investors, making it a vital component of modern investment management operations.

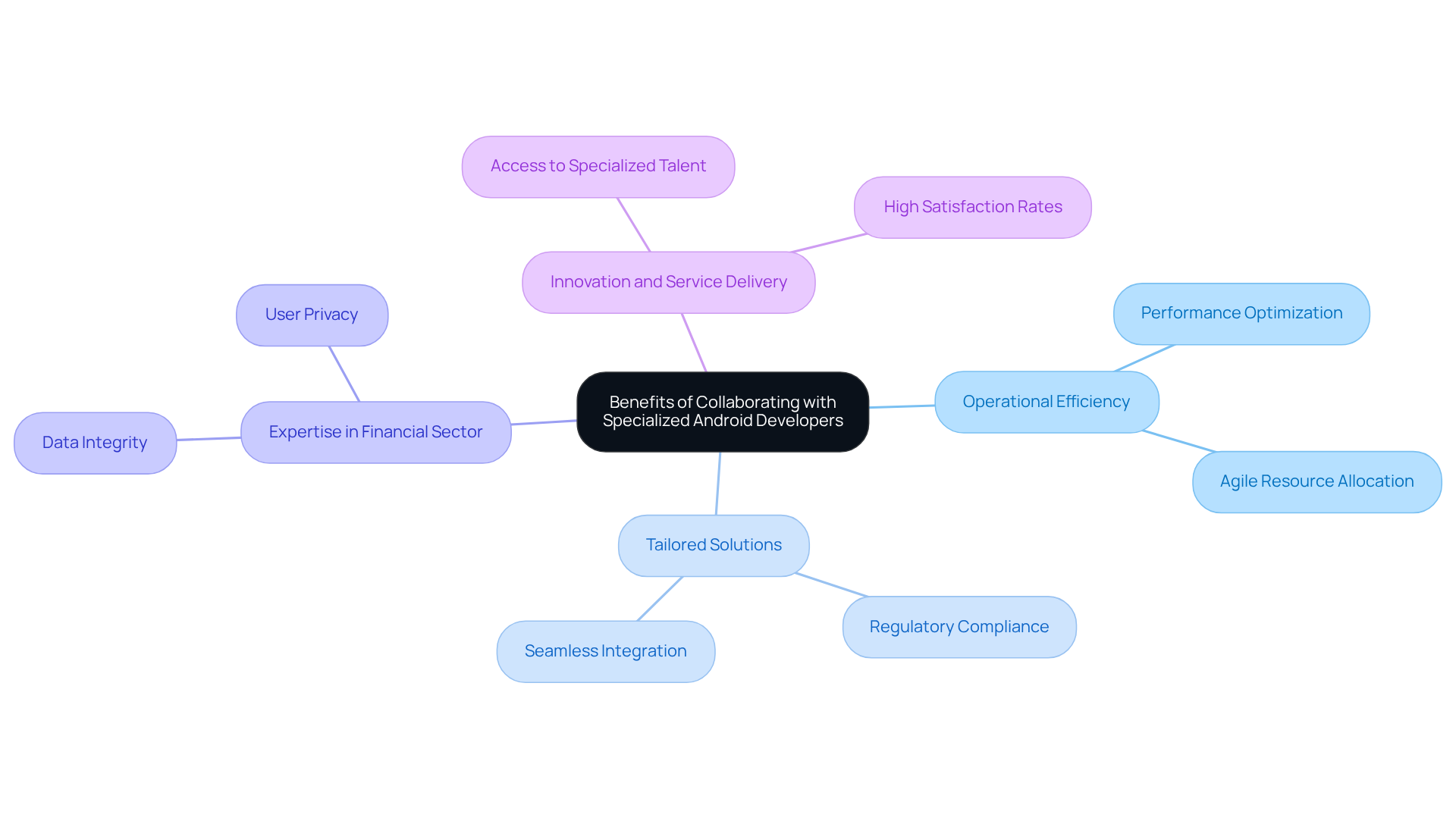

Explore the Benefits of Collaborating with Specialized Android Developers

Collaborating with specialized Android developers presents investment groups with numerous advantages that significantly enhance operational efficiency. These developers bring extensive experience in mobile application development, guaranteeing that the final product is not only functional but also optimized for performance and security-an essential requirement in the financial sector, where data integrity and user privacy are paramount. As of early 2025, the Android operating system commands over 71% of the global market share, underscoring its dominance and the critical need for robust applications on this platform.

Moreover, specialized developers offer tailored solutions that meet the unique requirements of investment groups, including adherence to regulatory standards and seamless integration with existing systems. The company exemplifies its commitment to reliability through a high employee retention rate, ensuring that clients remain secure against the risks associated with developer turnover. Their adaptable engineering talent model allows for month-to-month contracts and agile resource allocation, enabling investment firms to swiftly respond to market fluctuations and evolving client demands.

Outsourcing to an Android development firm not only allows hedge funds to concentrate on their core competencies but also leverages external expertise to foster innovation and enhance service delivery. Through a customized engineering talent provision process, the company assesses client needs and supplies specialized developers and designers, ensuring that projects are executed with precision and care. This strategic collaboration is increasingly recognized as a vital approach for success in the competitive financial landscape, with over 78% of businesses expressing satisfaction with their outsourcing partners. Furthermore, Neutech’s distinctive company culture promotes camaraderie among team members, translating into a dedicated and cohesive approach to client projects.

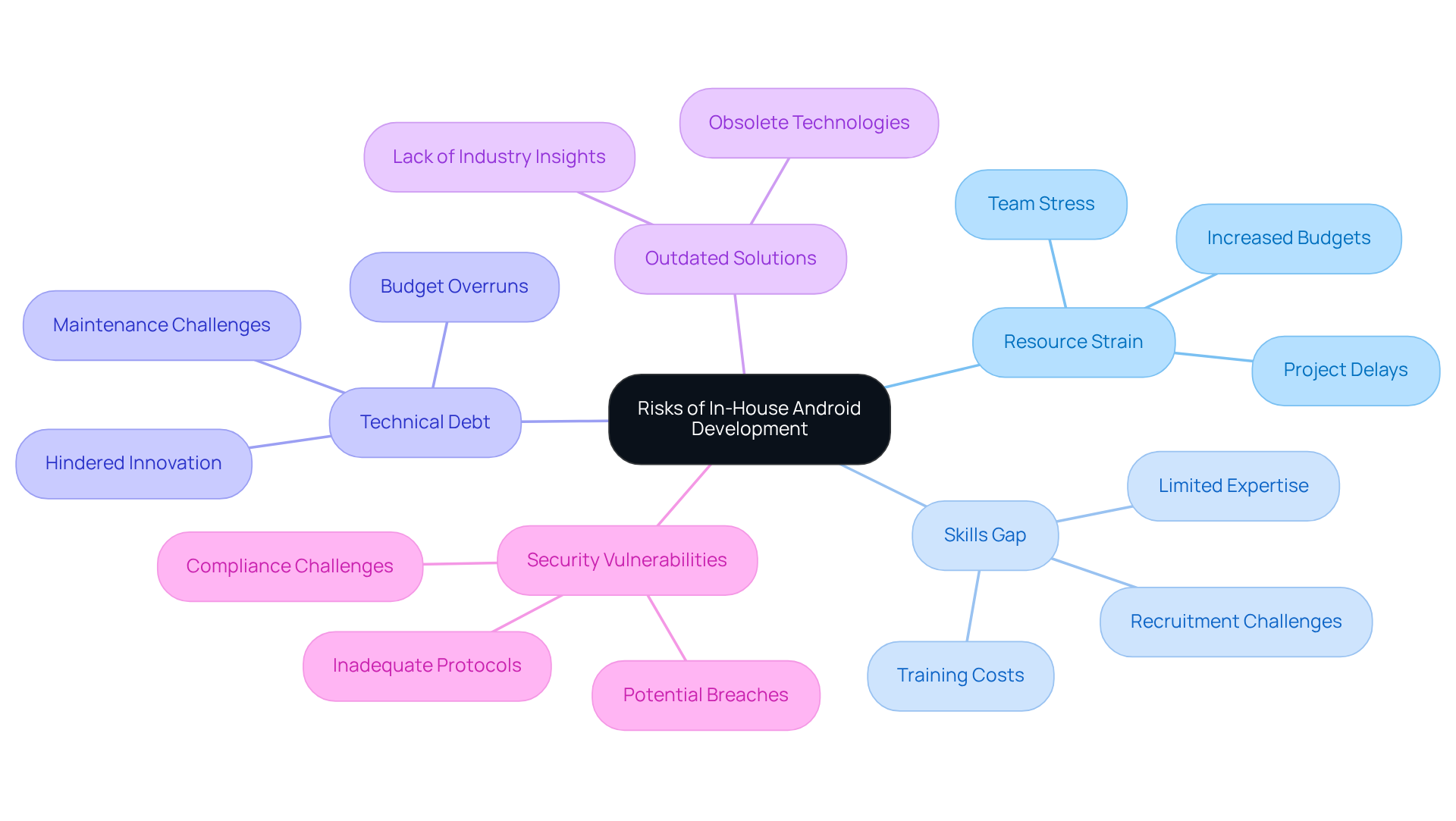

Identify Risks of In-House Android Development for Hedge Funds

While some investment groups may view internal Android development as a viable option, it is crucial to acknowledge the significant risks involved. A primary concern is the strain on resources; developing a mobile application requires specialized skills that may not be available within the existing team. This skills gap can result in project delays, budget overruns, and ultimately, a subpar product. Statistics indicate that 72% of software development teams struggle with technical debt, which can impede innovation and the timely delivery of new features. Additionally, in-house teams often lack access to the latest industry insights and technological advancements, leading to outdated solutions that do not meet evolving market demands.

Security vulnerabilities present another critical challenge, as in-house development may not adhere to the stringent security protocols essential in the financial sector. An investment group’s transformation to meet complex compliance reporting requirements underscores the importance of implementing robust security measures and real-time data management. By recognizing these risks, investment groups can make informed decisions about whether to pursue in-house development or collaborate with an android development firm, ensuring they remain competitive and secure in a rapidly evolving environment.

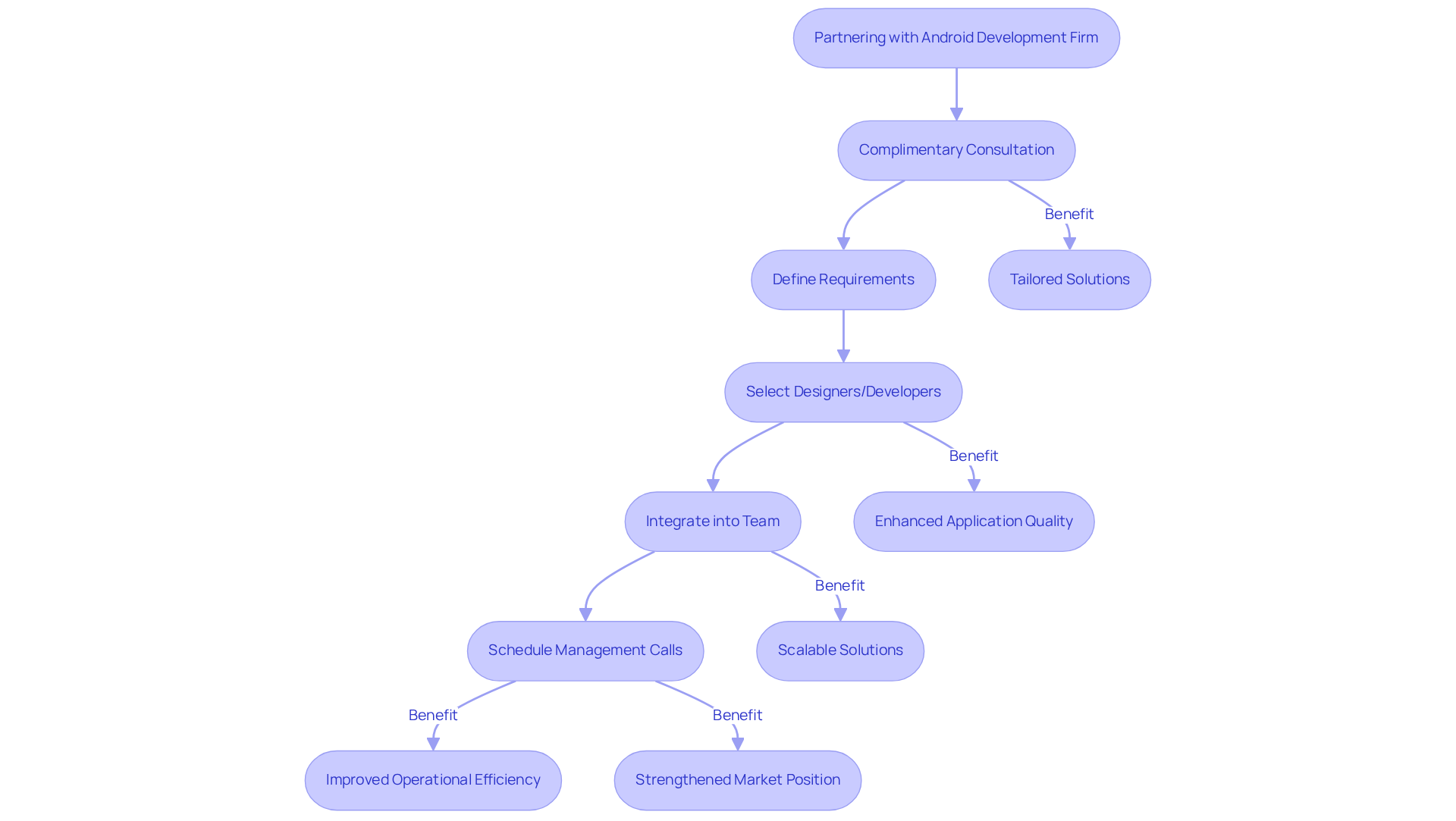

Assess Long-Term Advantages of Partnering with Android Development Firms

Collaborating with an android development firm like Neutech provides investment groups with significant long-term advantages that extend beyond immediate project needs. A primary benefit is access to cutting-edge technology and specialized expertise, which can adapt to the rapidly evolving financial landscape. This adaptability is essential for investment groups striving to maintain a competitive edge in a sector marked by continuous innovation.

Neutech’s client engagement process begins with a complimentary consultation to assess the specific operational needs of investment firms. This ensures that the solutions developed are tailored to their unique requirements. Once these requirements are clearly defined, Neutech offers a selection of designers and developers who can seamlessly integrate into the investment group’s team. This collaborative approach enhances application quality and ensures that investment groups can scale their solutions in line with business growth.

Regular management calls are scheduled to reinforce the roadmap and coordinate ongoing performance, fostering a deeper understanding of the investment group’s evolving needs. Ultimately, these partnerships can lead to improved operational efficiency, cost reductions, and a strengthened market position. Statistics indicate that 45% of investment pools face challenges due to inflexible systems and inadequate IT infrastructure, highlighting the critical need for adaptable solutions.

Moreover, as large institutional investors are projected to diversify their private debt allocations in 2026, the significance of innovative partnerships becomes increasingly evident. Case studies reveal that investment groups leveraging advanced tools have seen substantial improvements in performance, further underscoring the strategic advantage of these collaborations. Expert insights suggest that embracing technology partnerships, especially with an android development firm like Neutech, is vital for hedge funds seeking to succeed in a competitive environment.

Conclusion

The partnership between hedge funds and specialized android development firms is a crucial strategy for adapting to the fast-paced financial landscape. By embracing mobile technology, investment groups can significantly enhance operational efficiency, improve client engagement, and streamline their investment processes. This collaboration allows hedge funds to leverage real-time data and facilitate seamless communication, positioning them competitively in a marketplace that increasingly demands innovative solutions.

Key insights reveal the multifaceted advantages of working with specialized developers. These experts provide tailored solutions that meet the unique needs of investment firms, ensuring compliance with regulatory standards and optimizing application performance. The risks associated with in-house development, such as resource strain and security vulnerabilities, underscore the importance of outsourcing to a dedicated android development firm. By doing so, hedge funds can focus on their core competencies while fostering innovation and enhancing service delivery.

Ultimately, the strategic importance of partnering with an android development firm extends beyond immediate project goals. As the financial sector continues to evolve, these collaborations will be essential for maintaining a competitive edge, driving operational efficiency, and positioning hedge funds for long-term success. Embracing technology partnerships is not merely a trend; it is a vital step toward achieving sustainable growth and resilience in the ever-changing investment landscape.

Frequently Asked Questions

Why is Android development important for hedge funds?

Android development is important for hedge funds as it enhances operational efficiency, improves client engagement, and streamlines investment processes through mobile applications.

How do mobile applications benefit investment firms?

Mobile applications provide real-time data access, facilitate seamless communication, and support decision-making on the go, which is essential for agility in the fast-paced financial market.

What role does mobile technology play in attracting clients?

Robust mobile solutions serve as a competitive differentiator, enabling investment firms to attract a tech-savvy clientele and distinguish themselves in a crowded marketplace.

How can investment groups partner with an android development firm?

Investment groups can partner with an android development firm to leverage tailored mobile solutions that meet their specific operational requirements through comprehensive consultations and analysis.

What advantages do specialized developers provide for financial applications?

Specialized developers ensure that mobile solutions are optimized for performance and aligned with the unique operational needs of each investment group, enhancing overall effectiveness.

How does mobile technology align with investor demands?

The integration of mobile technology enhances workflows and meets the growing demand for transparency and performance monitoring among investors, making it essential for modern investment management.