What Does Data Integration Mean? Key Insights for Hedge Fund Managers

Introduction

In the finance sector, data increasingly drives decision-making, with the ability to integrate diverse information sources becoming a defining factor in a hedge fund’s success. Data integration is not just a technical necessity; it serves as a strategic advantage that enables managers to make informed decisions in real-time, navigate complex market dynamics, and ensure compliance with regulatory standards. As technological advancements reshape the landscape, it is essential for hedge fund managers to understand what data integration truly entails and how to leverage this critical tool effectively in a competitive environment.

Define Data Integration: Understanding Its Core Concept

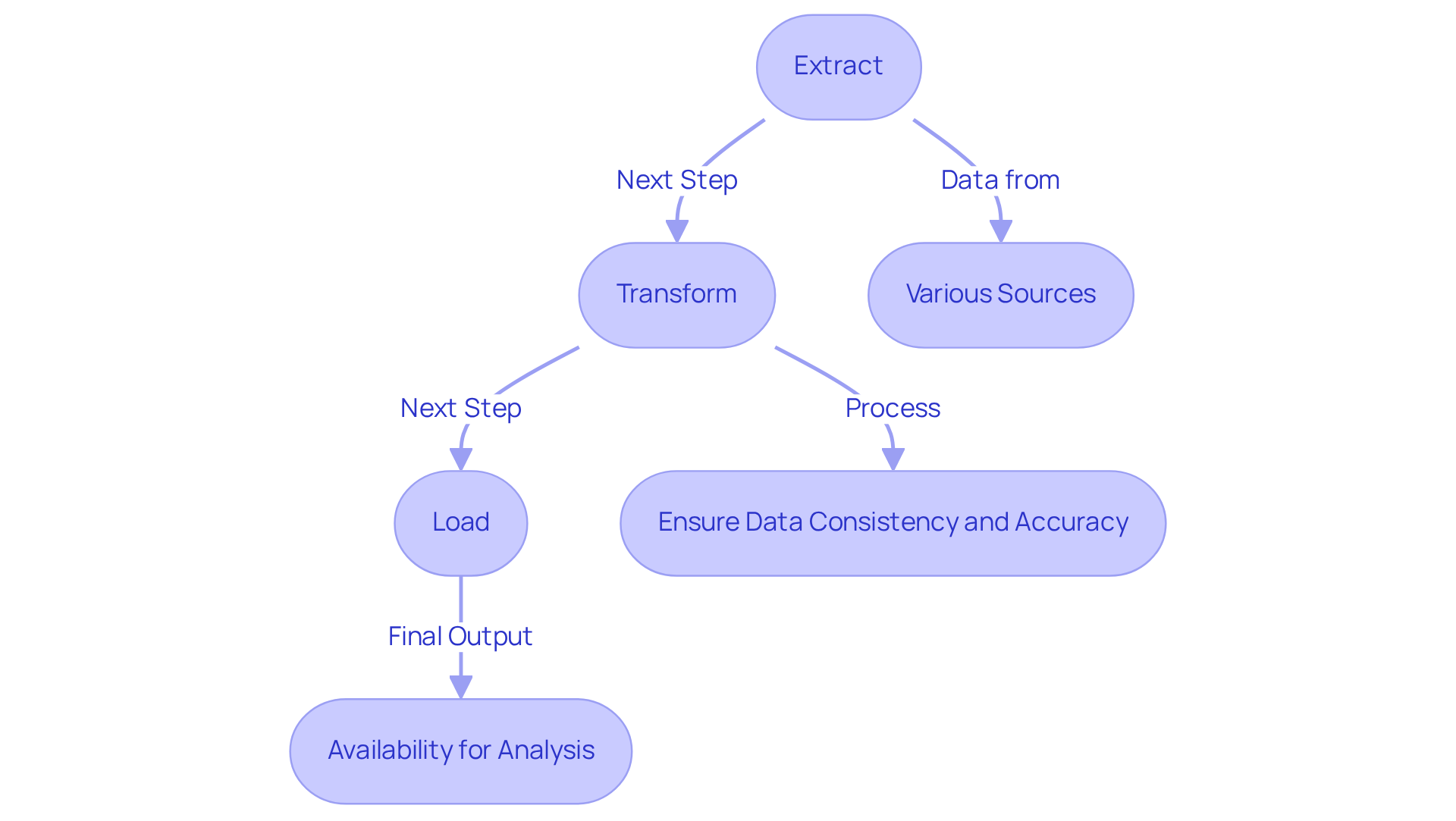

The process of merging details from various sources into a cohesive perspective is what does data integration mean. This enables organizations to access and analyze insights effectively. To understand what does data integration mean, it involves extracting, transforming, and loading (ETL) information from diverse systems, ensuring that the data is consistent, accurate, and readily available for analysis.

In the context of investment funds, efficient information unification is crucial for managing large volumes of financial data. It facilitates real-time decision-making and ensures compliance with regulatory standards. By integrating information from multiple sources, hedge fund managers can gain comprehensive insights into market trends, risk factors, and investment opportunities, which raises the question of what does data integration mean. This ultimately enhances their strategic decision-making capabilities.

Explore the Evolution of Data Integration: Historical Context and Development

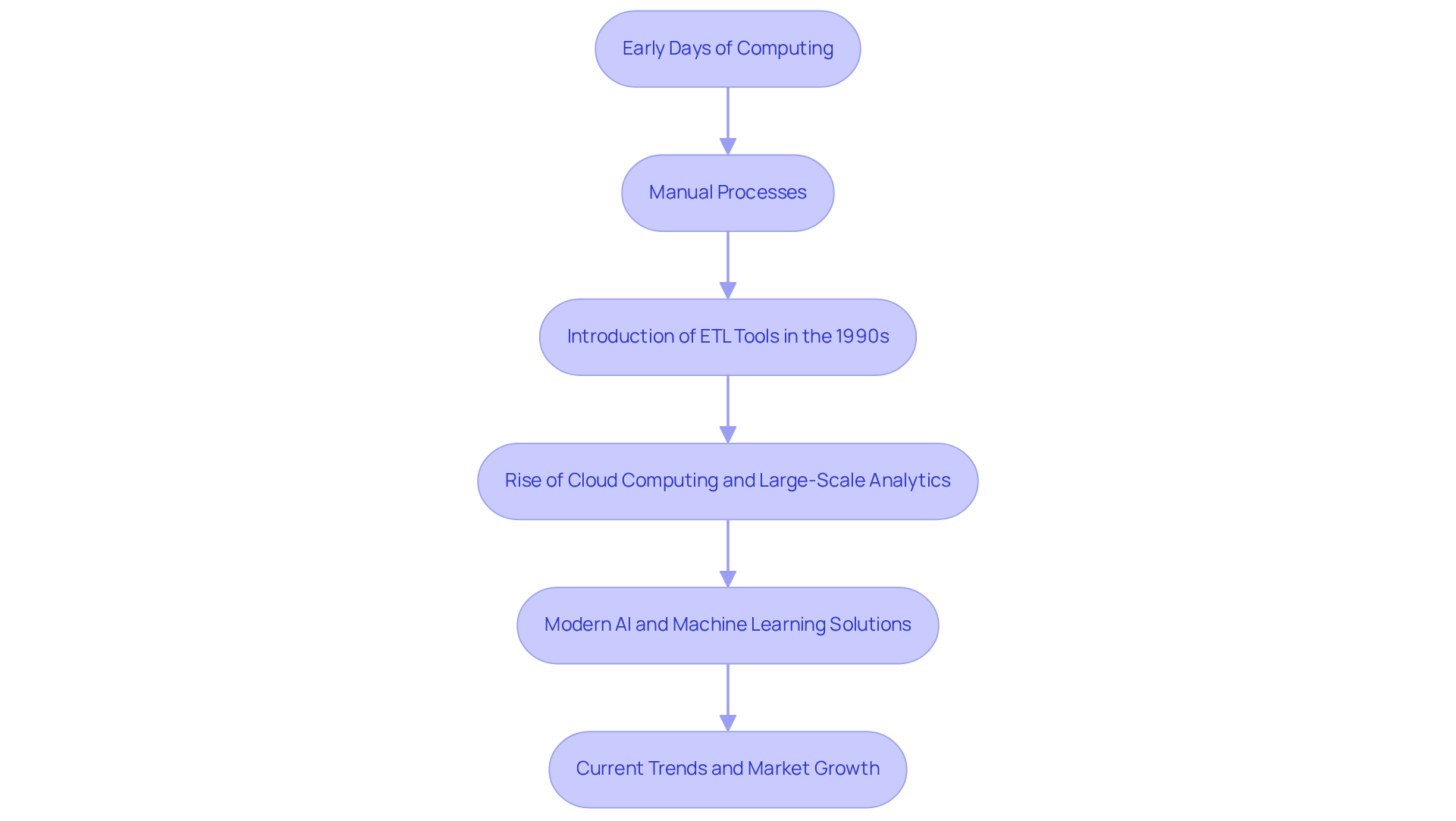

The evolution of information unification can be traced back to the early days of computing, when information was often isolated within individual systems. Initially, manual processes dominated, requiring significant human involvement to merge data. The introduction of Extract, Transform, Load (ETL) tools in the 1990s represented a pivotal shift, automating the information amalgamation process and facilitating more efficient handling.

As technology advanced, the rise of cloud computing and large-scale analytics transformed practices for combining information, which raises the question of what does data integration mean, enabling real-time processing and unification across various platforms. Today, modern information unification solutions leverage artificial intelligence and machine learning to enhance accuracy and streamline workflows, making them indispensable for hedge funds aiming to remain competitive in a rapidly evolving market.

The information amalgamation market is projected to grow from USD 17.58 billion in 2025 to USD 33.24 billion by 2030, underscoring the increasing importance of ETL tools in financial services. Citigroup’s implementation of generative AI tools has resulted in savings of approximately 100,000 developer hours each week, illustrating the tangible benefits of contemporary data unification strategies.

Moreover, 95% of IT leaders cite compatibility issues as the primary barrier to AI adoption, highlighting the challenges faced within the industry. Goldman Sachs’ investment in AI-driven technologies further underscores the critical role of ETL tools in enhancing operational efficiency and decision-making capabilities within the services sector. Additionally, 68% of organizations identify information silos as their most significant challenge, which raises the question of what does data integration mean in terms of finding effective solutions to integrate information. Notably, 80% of Fortune 500 companies utilize Apache Kafka, reflecting the prevalence and significance of modern information unification tools in large financial institutions.

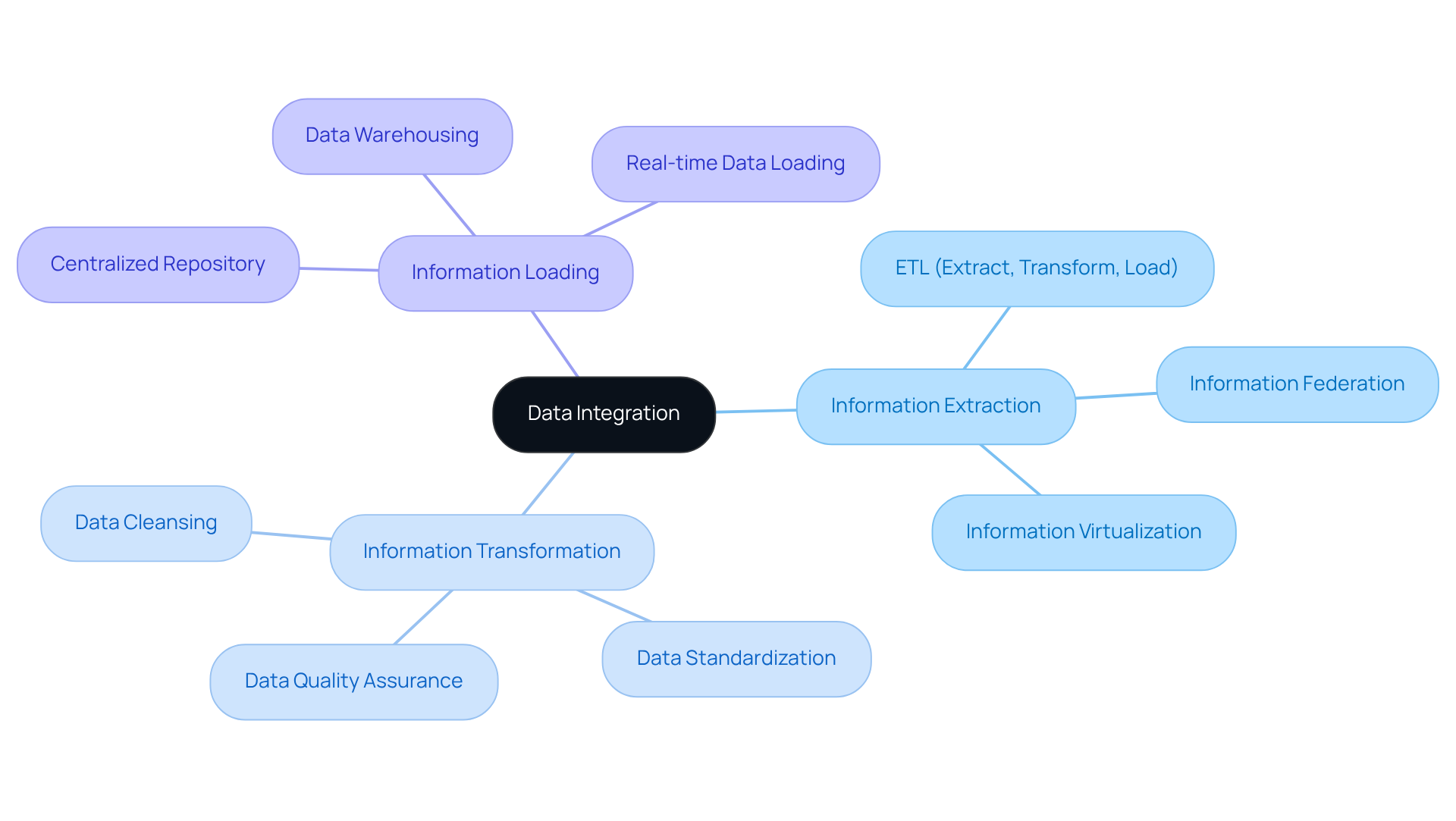

Identify Key Characteristics of Data Integration: Components and Methods

Key traits of information unification – quality, consistency, and accessibility – are essential for effective decision-making in hedge funds. The unification procedure consists of three primary elements:

- Information extraction, where content is collected from various sources;

- Information transformation, which formats and purifies the content for analysis;

- Information loading, where the unified content is stored in a centralized repository.

Various techniques of information integration, including ETL (Extract, Transform, Load), information federation, and information virtualization, illustrate what data integration means, as each provides unique benefits suited to particular situations. For hedge funds, employing these methods can significantly improve information accuracy, minimize redundancy, and bolster analytical capabilities. This ultimately supports more informed investment decisions, as precise and timely information is crucial for navigating fast-paced financial markets.

Moreover, with 70 percent of banking leaders recognizing a shortage of resources to handle and evaluate information, the appropriate unification approach becomes even more essential for sustaining a competitive advantage. ETL also supports predictive analytics, such as time-series forecasting, which can provide hedge fund managers with better visibility into future revenue and liquidity needs. As Prashanth Southekal observed, success in information management is about insight rather than mere information gathering, underscoring the importance of effective information unification strategies.

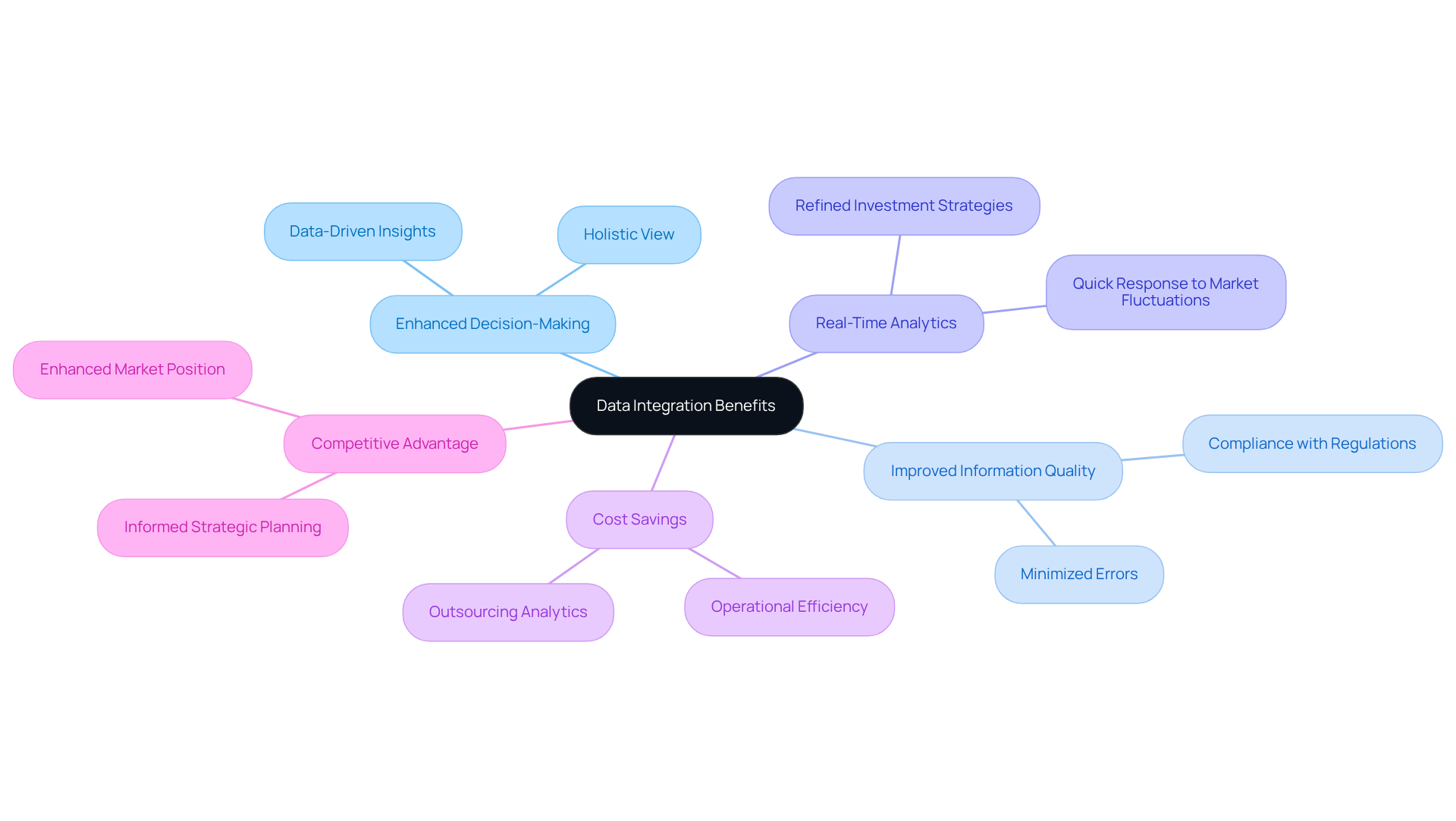

Highlight the Importance of Data Integration: Benefits for Organizations

For organizations, particularly in the banking sector, understanding what data integration means is essential, as it consolidates information from diverse sources to provide a comprehensive view of operations. This holistic perspective enhances decision-making and strategic planning, allowing investment funds to effectively navigate complex market dynamics. Improved information quality minimizes errors and bolsters compliance with stringent regulatory requirements, which is vital in the highly regulated financial environment.

Additionally, information amalgamation facilitates real-time analytics, enabling hedge fund managers to quickly respond to market fluctuations and refine investment strategies. As Clive Humby aptly noted, “Data is the new oil,” highlighting its critical role in driving business success. Furthermore, with an expected investment of $31.3 billion in AI by 2026 in the finance sector, understanding what does data integration mean becomes increasingly clear.

By prioritizing information unification, organizations can significantly enhance operational efficiency, reduce costs, and secure a competitive advantage in the marketplace. Notably, 70% of large enterprises are outsourcing analytics services to achieve savings of 30-50% on operational costs, further demonstrating the financial advantages of effective data integration.

Conclusion

Data integration is a crucial process that enables hedge fund managers to effectively unify and analyze diverse data sources. By employing methods such as Extract, Transform, Load (ETL), organizations can ensure their data is accurate, consistent, and readily available for strategic decision-making. This integration is not just a technical necessity; it serves as a vital enabler of operational efficiency and compliance within the fast-paced financial sector.

The article explored key insights into the evolution of data integration, transitioning from manual processes to the sophisticated AI-driven systems we see today. It highlighted the essential components of data integration:

- Extraction

- Transformation

- Loading

Each contributing to enhanced data quality and accessibility. Moreover, the benefits of effective data integration were emphasized, illustrating its role in improving decision-making, reducing errors, and providing a comprehensive view of market dynamics.

Ultimately, the significance of data integration extends beyond technical jargon; it is a foundational element for success in the financial industry. As hedge funds increasingly depend on data-driven insights, prioritizing effective integration strategies will not only streamline operations but also cultivate a competitive edge in an ever-evolving market landscape. Embracing these strategies is not merely a choice but a necessity for those aiming to excel in the complex world of finance.

Frequently Asked Questions

What is data integration?

Data integration is the process of merging details from various sources into a cohesive perspective, enabling organizations to access and analyze insights effectively.

What does the data integration process involve?

The data integration process involves extracting, transforming, and loading (ETL) information from diverse systems, ensuring that the data is consistent, accurate, and readily available for analysis.

Why is data integration important for investment funds?

Data integration is crucial for investment funds as it facilitates the management of large volumes of financial data, supports real-time decision-making, and ensures compliance with regulatory standards.

How does data integration benefit hedge fund managers?

By integrating information from multiple sources, hedge fund managers can gain comprehensive insights into market trends, risk factors, and investment opportunities, which enhances their strategic decision-making capabilities.