Create a Data Warehouse: A Step-by-Step Guide for Hedge Funds

Introduction

Creating a data warehouse presents significant challenges, particularly for hedge funds that must navigate the complexities of financial data management. As investment firms increasingly depend on accurate and timely information to inform their strategies, the importance of a well-structured data warehouse cannot be overstated. The path to establishing an effective data repository is laden with obstacles, including the need to ensure data quality and achieve regulatory compliance. Therefore, it is crucial for hedge funds to understand the essential steps and best practices necessary to overcome these challenges and fully leverage their data.

Define Data Warehouse and Its Importance for Hedge Funds

To facilitate efficient reporting and analysis, we need to create a data warehouse that serves as a centralized repository for storing and managing substantial volumes of information from diverse sources. This is particularly vital for investment pools, as it allows us to create a data warehouse that consolidates various information sources into a unified source of truth, thereby enhancing information integrity and accessibility. In the financial services sector, where accurate and timely information is critical for making informed investment decisions, the ability to create a data warehouse is of utmost significance. By leveraging an information repository, investment firms can:

- Bolster their risk management capabilities

- Streamline reporting processes

- Gain insights that drive strategic initiatives

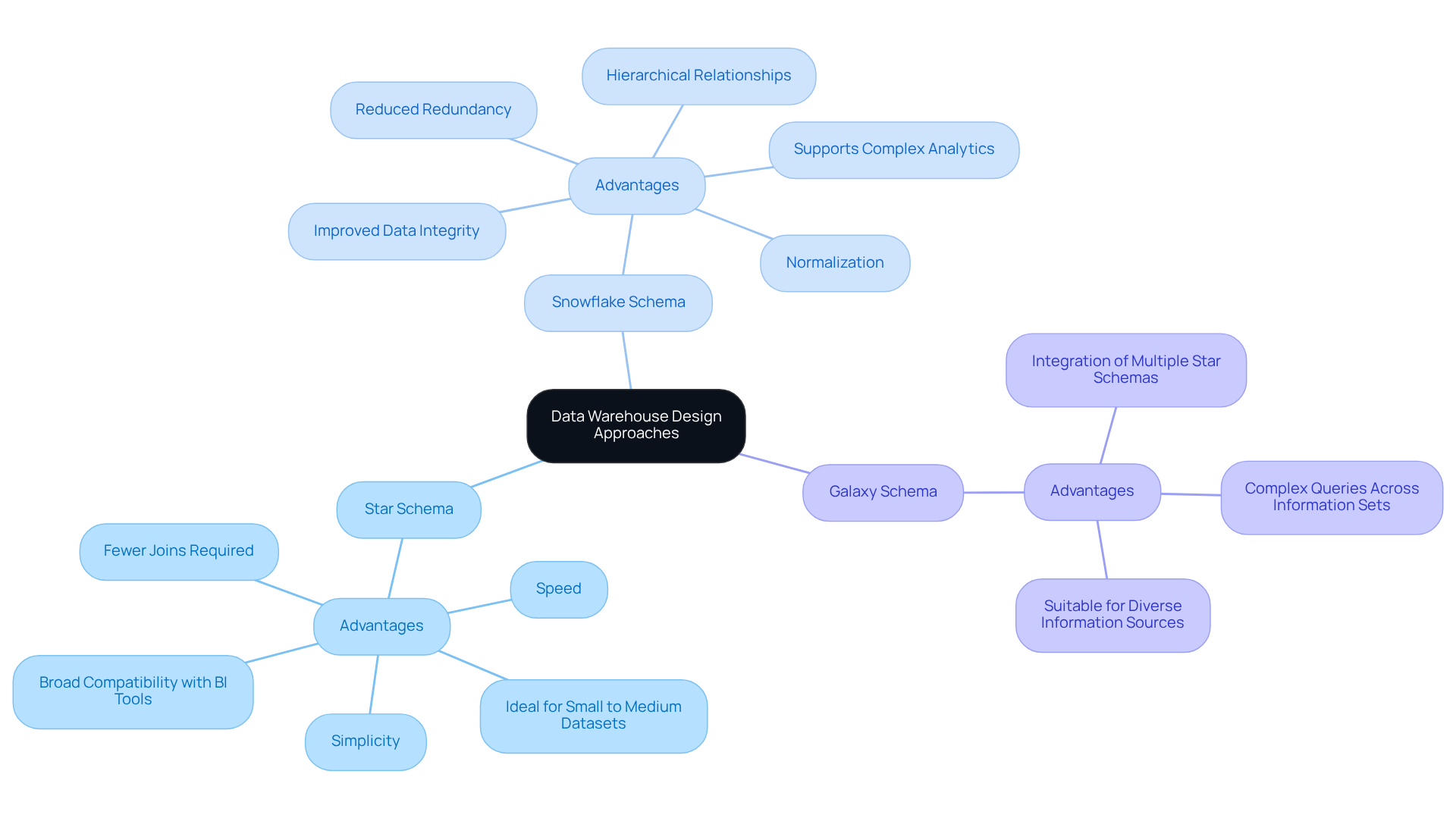

Explore Data Warehouse Design Approaches

When designing a data warehouse, hedge funds have several approaches to consider, each with distinct advantages:

-

Star Schema: This design features a central fact table connected to dimension tables, facilitating straightforward querying and reporting. It is particularly suitable for simpler information environments where speed is paramount.

-

Snowflake Schema: This method normalizes dimension tables, which reduces redundancy but increases complexity. It is well-suited for more intricate relationships and can enhance information integrity.

-

Galaxy Schema: Also known as a fact constellation, this design integrates multiple star schemas, allowing for complex queries across various information sets. It is beneficial for investment groups that manage diverse information sources.

The selection of an appropriate design strategy to create a data warehouse depends on the specific information requirements, reporting needs, and the complexity of the relationships within the investment firm’s operations.

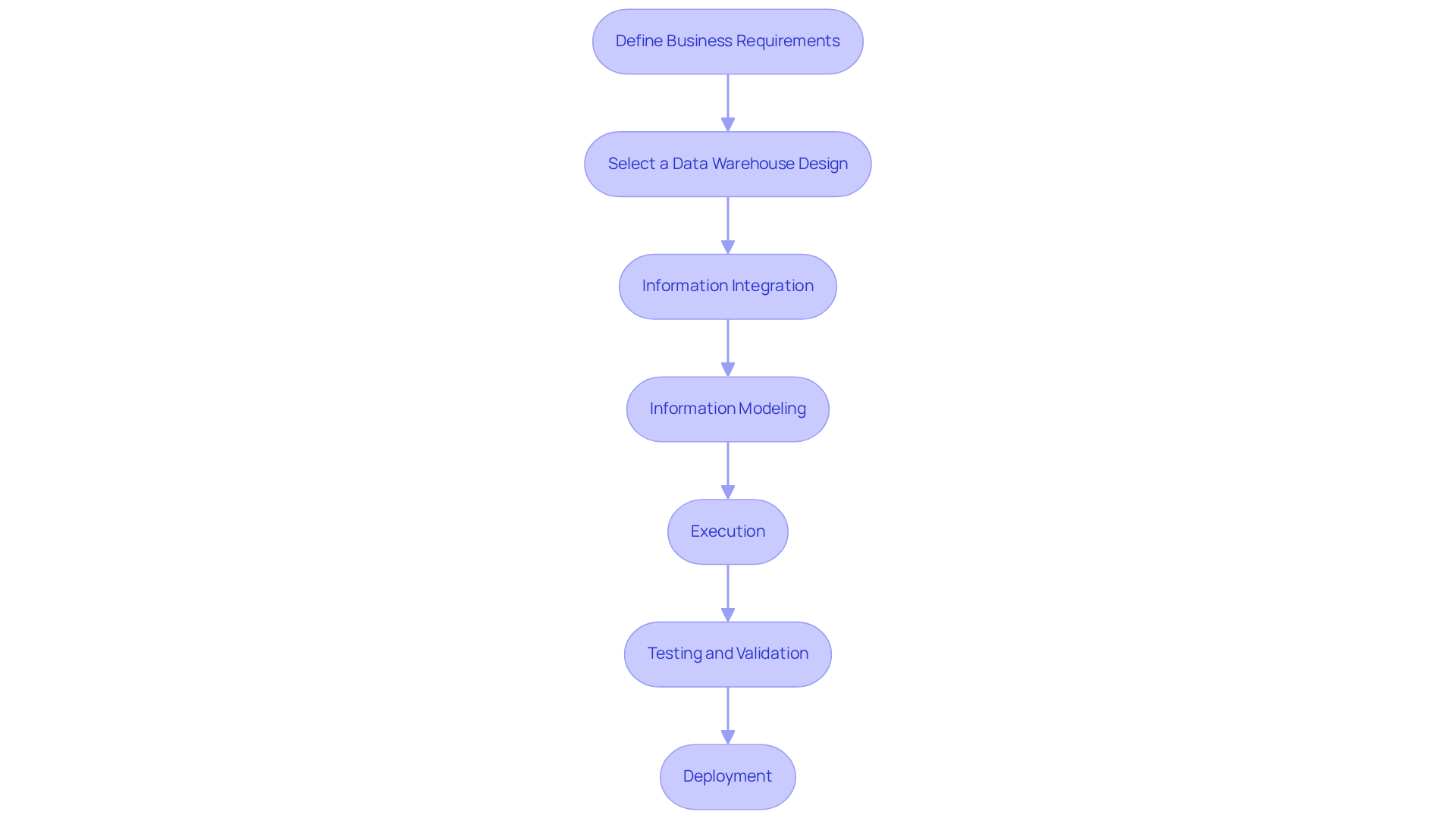

Implement Step-by-Step Process for Building Your Data Warehouse

Building a data warehouse involves several essential steps tailored to the unique needs of hedge funds:

-

Define Business Requirements: Clearly identify the specific information needs of the hedge fund, including the types of information to be stored and the reporting requirements. This foundational step ensures that the information repository aligns with strategic objectives and regulatory compliance. As Ralph Kimball highlights, comprehending the business process is essential to defining the grain of the information warehouse.

-

Select a Data Warehouse Design: Choose an appropriate design schema – such as star, snowflake, or galaxy – based on the complexity of the information and the reporting needs. Each schema offers distinct advantages in terms of query performance and ease of use, which are crucial for financial analysis. The selection of schema can significantly influence the effectiveness of information retrieval and reporting.

-

Information Integration: Implement robust ETL (Extract, Transform, Load) processes to collect information from various sources. This step is essential for ensuring information quality and consistency, as poor information quality can lead to flawed analytics, summarized as ‘garbage in, garbage out.’ Efficient ETL processes optimize information handling, minimizing manual errors and boosting productivity. As Ivan Dubouski observes, trying to construct a storage facility independently can lead to flawed reports and expensive mistakes.

-

Information Modeling: Create a logical and physical information model that represents the selected design schema. This model should be customized to satisfy the particular business needs, facilitating efficient information retrieval and analysis. Proper information modeling is essential for ensuring that the repository can support the analytical needs of the hedge fund.

-

Execution: Set up the information storage framework, including choosing appropriate database management systems and storage solutions. Evaluation of cloud-based solutions can offer flexibility and scalability, vital for adjusting to changing information requirements. The expense of constructing an information repository can vary greatly, with basic solutions beginning at approximately $70,000 and more intricate implementations surpassing $1,000,000.

-

Testing and Validation: Conduct thorough testing to ensure integrity and performance. This phase is critical for identifying any discrepancies and making necessary adjustments before full deployment. Ensuring that the information repository meets compliance standards is also essential during this phase.

-

Deployment: Launch the information storage system and provide comprehensive training for users. Making sure that team members can effectively use the system for reporting and analysis is crucial to maximizing the value of the information repository. By adhering to these steps, investment funds can create a data warehouse that serves as a strong information repository, aiding informed decision-making and improving operational efficiency.

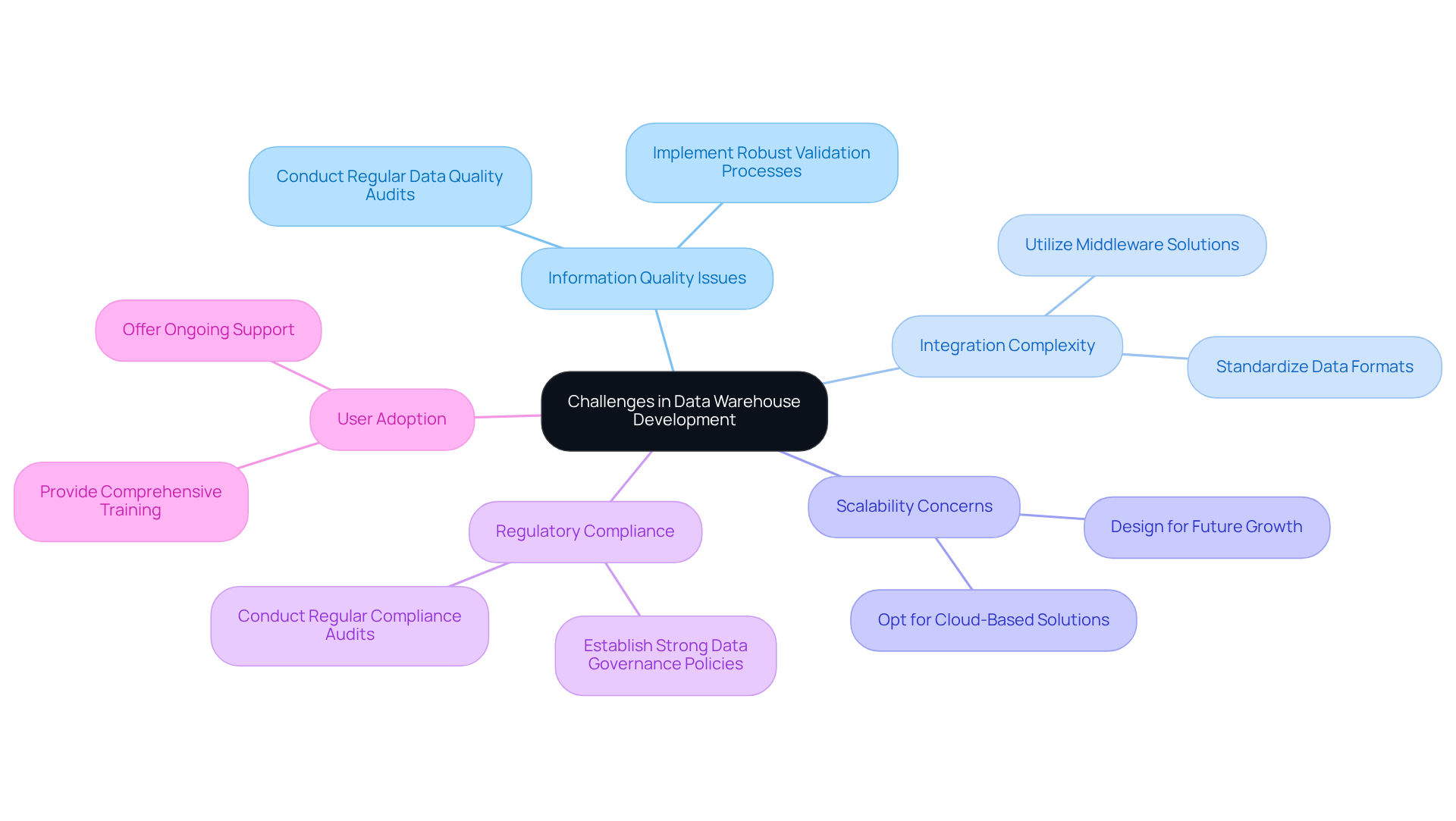

Identify and Overcome Common Challenges in Data Warehouse Development

Developing a data warehouse poses several challenges for hedge funds, each requiring careful consideration:

-

Information Quality Issues: Inconsistent or erroneous data can significantly undermine the effectiveness of the data warehouse. To mitigate this risk, it is essential to implement robust validation processes during the ETL (Extract, Transform, Load) phase.

-

Integration Complexity: The task of combining data from various sources can be quite complicated. Utilizing middleware solutions can simplify this integration process and ensure data consistency across the board.

-

Scalability Concerns: As data volumes continue to grow, the warehouse must be capable of expanding accordingly. Opting for cloud-based solutions offers the necessary flexibility to accommodate this growth.

-

Regulatory Compliance: Hedge funds are subject to stringent regulations regarding data handling. Establishing strong data governance policies and conducting regular audits are crucial steps to ensure compliance with these regulations.

-

User Adoption: It is vital to ensure that staff are adequately trained and comfortable using the new system. Providing comprehensive training and ongoing support can facilitate a smoother transition to create data warehouse.

Conclusion

Creating a data warehouse is a crucial undertaking for hedge funds, as it provides a centralized repository that significantly enhances data integrity and accessibility. This initiative streamlines reporting and analysis while strengthening risk management capabilities, ultimately leading to more informed investment decisions. The importance of establishing a robust data warehouse cannot be overstated; it serves as the backbone of effective data utilization in a highly competitive financial landscape.

The article has explored various facets of data warehouse creation. It begins by defining the importance of a data warehouse within the financial sector and proceeds to examine different design approaches, such as star, snowflake, and galaxy schemas. Each section illustrates how tailored strategies can optimize data management. The step-by-step process of building a data warehouse-encompassing the definition of business requirements, implementation of ETL processes, and ensuring user adoption-underscores the complexity and necessity of this endeavor. Furthermore, addressing common challenges, including data quality, integration complexity, and regulatory compliance, highlights the hurdles that hedge funds must navigate to achieve success.

In conclusion, the journey to create an effective data warehouse transcends mere technical execution; it is a strategic imperative for hedge funds seeking to maintain a competitive edge. By embracing best practices and proactively addressing potential challenges, investment firms can fully leverage their data, paving the way for enhanced decision-making and operational efficiency. The call to action is clear: prioritize the establishment of a well-designed data warehouse to harness the power of information and drive future success in the financial markets.

Frequently Asked Questions

What is a data warehouse?

A data warehouse is a centralized repository for storing and managing substantial volumes of information from diverse sources, facilitating efficient reporting and analysis.

Why is a data warehouse important for hedge funds?

A data warehouse is important for hedge funds as it consolidates various information sources into a unified source of truth, enhancing information integrity and accessibility, which is critical for making informed investment decisions.

How does a data warehouse benefit investment firms?

Investment firms can benefit from a data warehouse by bolstering their risk management capabilities, streamlining reporting processes, and gaining insights that drive strategic initiatives.