Comparing Software Dev Companies: Neutech vs. Competitors for Hedge Funds

Introduction

In the high-stakes realm of hedge funds, selecting a software development partner is pivotal to achieving operational success. As investment firms navigate intricate regulatory landscapes and pursue innovative solutions, it becomes essential to comprehend the strengths and weaknesses of various software development companies. This article presents a comparative analysis of Neutech and its competitors, highlighting key criteria that hedge funds should consider when choosing a development partner.

What distinguishes Neutech in this competitive landscape, and how can firms ensure they select a provider that aligns with their specific operational requirements?

Identifying Key Criteria for Software Development Companies

When evaluating software development companies for hedge funds, several critical criteria must be prioritized:

-

Regulatory Compliance: Adherence to stringent regulations is paramount. Software solutions must comply with SEC regulations and anti-money laundering (AML) requirements to mitigate legal risks and ensure operational integrity.

-

Technical Expertise: Proficiency in advanced technologies such as data analytics, machine learning, and secure coding practices is essential. This expertise enables firms to develop robust solutions that meet the complex demands of the financial sector.

-

Scalability: Hedge vehicles often encounter varying demands, making the capability to swiftly expand development resources essential. Neutech excels in this area with its month-to-month contracts, allowing investment groups to adjust their development resources as needed, whether that means scaling up or down based on project requirements.

-

Industry Experience: A strong track record in the financial services sector is vital. Development groups, particularly software dev companies with pertinent experience, are better prepared to address the distinct challenges and regulatory environments that investment vehicles face.

-

Communication and Collaboration: Effective communication and seamless integration with existing teams are key to successful project outcomes. Companies should foster a collaborative environment that enhances project efficiency.

-

Adaptability in Contracting: The option for adaptable contracts enables investment groups to modify their development resources as required, ensuring they can react quickly to market fluctuations.

Additionally, the company provides ongoing assistance from expert-level engineers and product management, ensuring that developers are well-equipped to meet project demands. This comprehensive framework for assessing Neutech’s performance relative to its competitors empowers investment groups to make informed decisions tailored to their operational requirements.

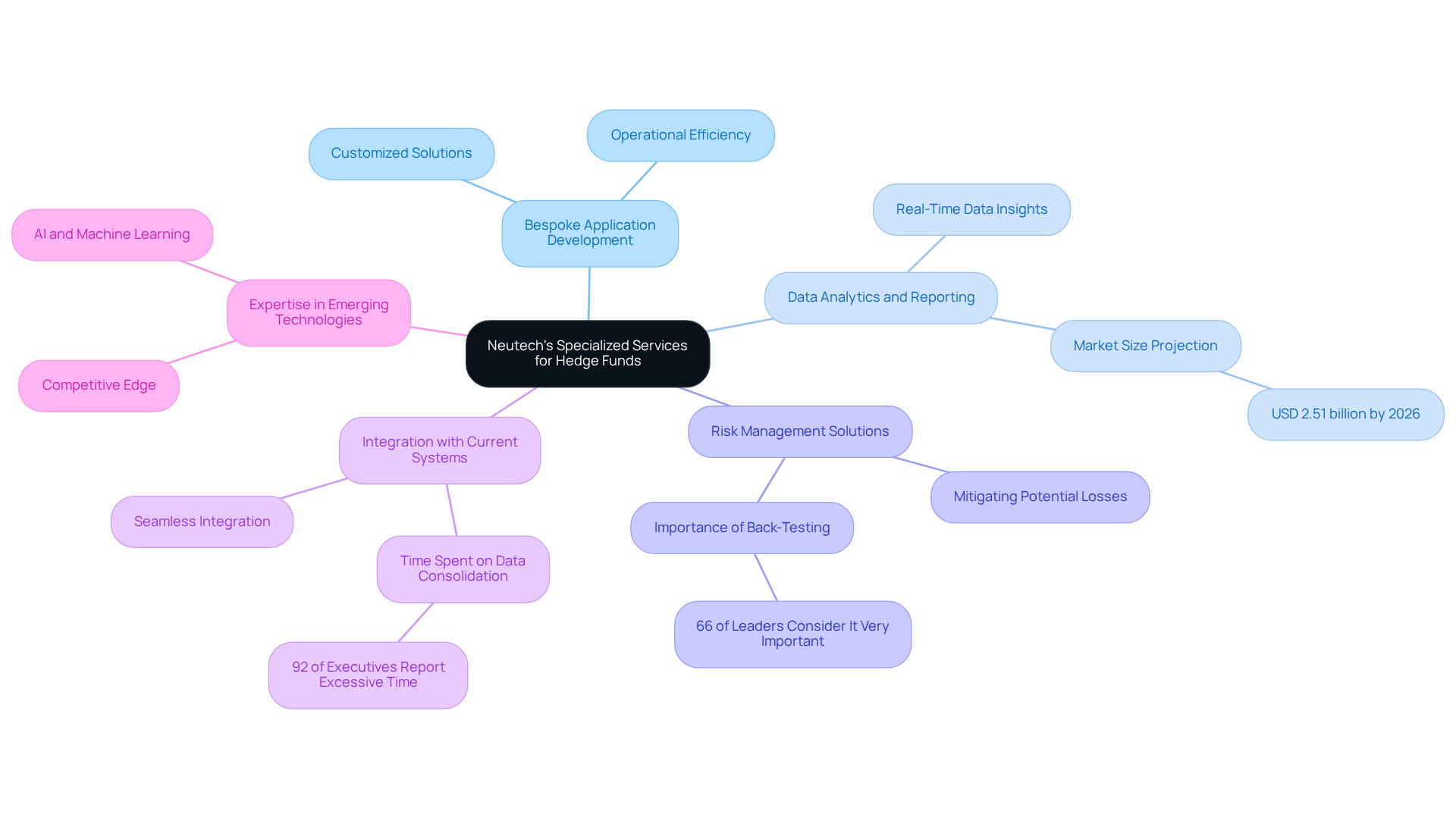

Evaluating Neutech’s Specialized Services for Hedge Funds

Neutech offers a comprehensive suite of specialized services tailored to the unique requirements of hedge funds, which include:

-

Bespoke Application Development: Neutech develops customized application solutions that effectively address the specific operational challenges faced by investment firms, ensuring compliance and enhancing operational efficiency.

-

Data Analytics and Reporting: The organization delivers advanced data analytics capabilities, empowering investment groups to make informed financial decisions based on real-time data insights. The analytical tools market for investment portfolios is projected to reach approximately USD 2.51 billion by 2026, underscoring the necessity for such capabilities.

-

Risk Management Solutions: The company’s software features robust risk management tools that assist investment groups in mitigating potential losses while adhering to regulatory requirements. This aspect is crucial, as 66% of investment firm leaders consider back-testing in trading systems to be very important.

-

Integration with Current Systems: Neutech ensures seamless integration of its solutions with existing investment systems, minimizing disruption and enhancing overall operational efficiency. This capability is essential, given that 92% of investment executives report spending excessive time consolidating and integrating data from various sources.

-

Expertise in Emerging Technologies: The company leverages advanced technologies such as AI and machine learning to refine investment strategies, providing a competitive edge in a rapidly evolving market.

These specialized services position Neutech as a leader among software dev companies in the development landscape for investment groups, distinguishing it from competitors who may not provide the same level of customized solutions and industry-specific expertise.

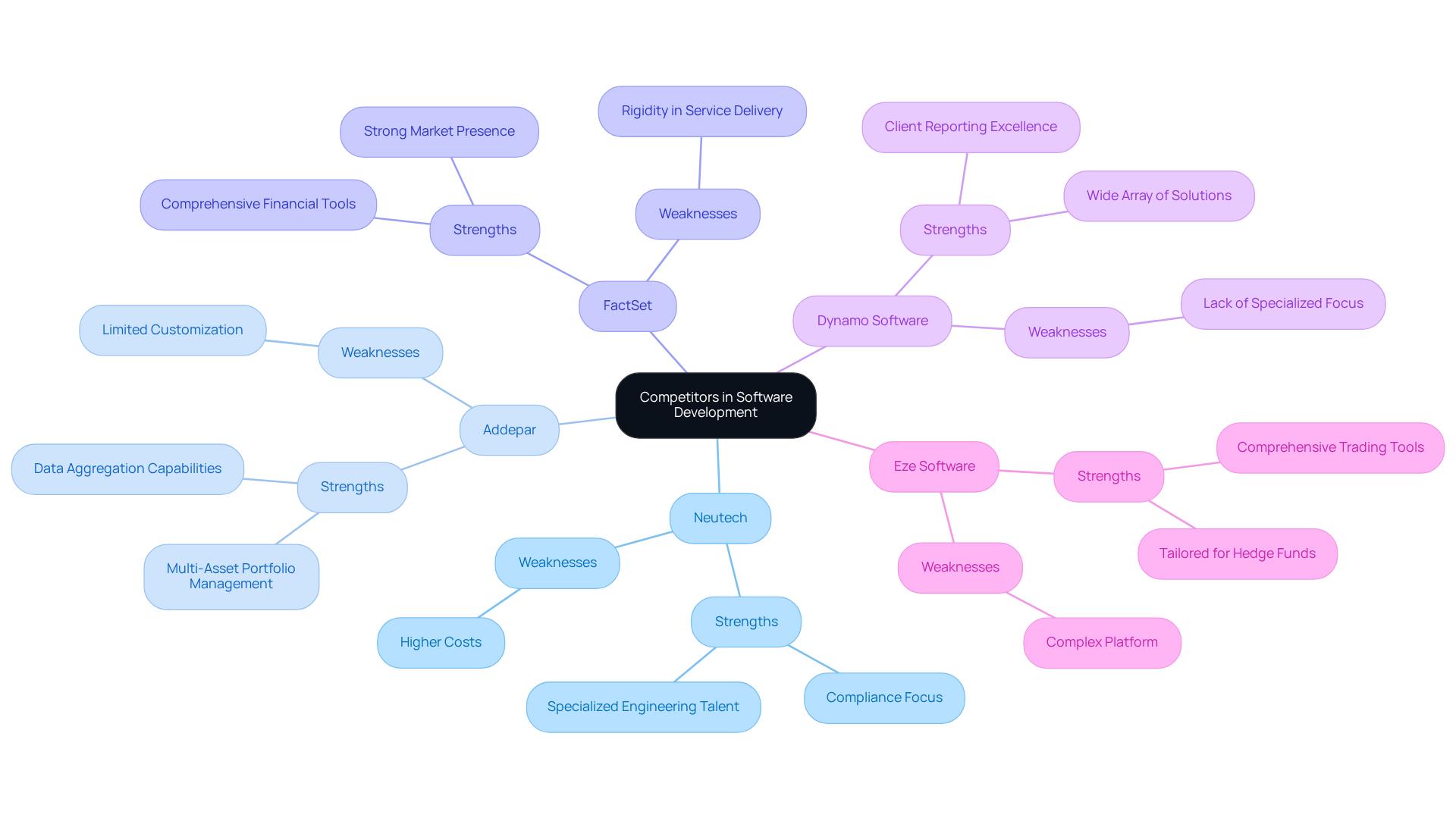

Comparing Competitors: Strengths and Weaknesses in Software Development

In the competitive landscape of software dev companies for investment firms, several key players emerge alongside this company. Below is a comparative analysis of their strengths and weaknesses:

-

Neutech:

- Strengths: Neutech excels in regulated industries, placing a strong emphasis on compliance and delivering specialized engineering talent. Its rigorous training program ensures that engineers possess senior-level proficiency and industry-specific expertise, equipping them to meet the demands of investment firms effectively.

- Weaknesses: The specialized nature of Neutech’s services may lead to higher costs, which could be a consideration for budget-conscious firms.

-

Addepar:

- Strengths: Known for its robust data aggregation and analytics capabilities, Addepar is tailored for managing multi-asset portfolios, providing hedge funds with comprehensive insights into their investments.

- Weaknesses: However, Addepar may offer limited customization options, which can hinder its flexibility to meet distinct investment requirements.

-

FactSet:

- Strengths: FactSet boasts a comprehensive suite of financial information and analytics tools, supported by a strong market presence that many hedge funds rely on for data-driven decision-making.

- Weaknesses: Its perceived rigidity in service delivery and integration can be a drawback for firms seeking more adaptable solutions.

-

Dynamo Software:

- Strengths: Dynamo provides a wide array of investment management solutions, excelling particularly in client reporting, which is crucial for hedge funds managing diverse portfolios.

- Weaknesses: Nevertheless, it may lack the specialized focus on investment strategies that this company offers, potentially limiting its effectiveness in this specific market.

-

Eze Software:

- Strengths: Eze Software is well-regarded in the hedge fund sector, offering comprehensive trading and portfolio management tools tailored to the specific needs of hedge funds.

- Weaknesses: The complexity of its platform can require extensive training for users, which may pose a barrier to swift adoption.

This comparative analysis underscores Neutech’s distinctive position in the market, particularly its commitment to compliance and specialized services designed for investment firms, setting it apart from its competitors.

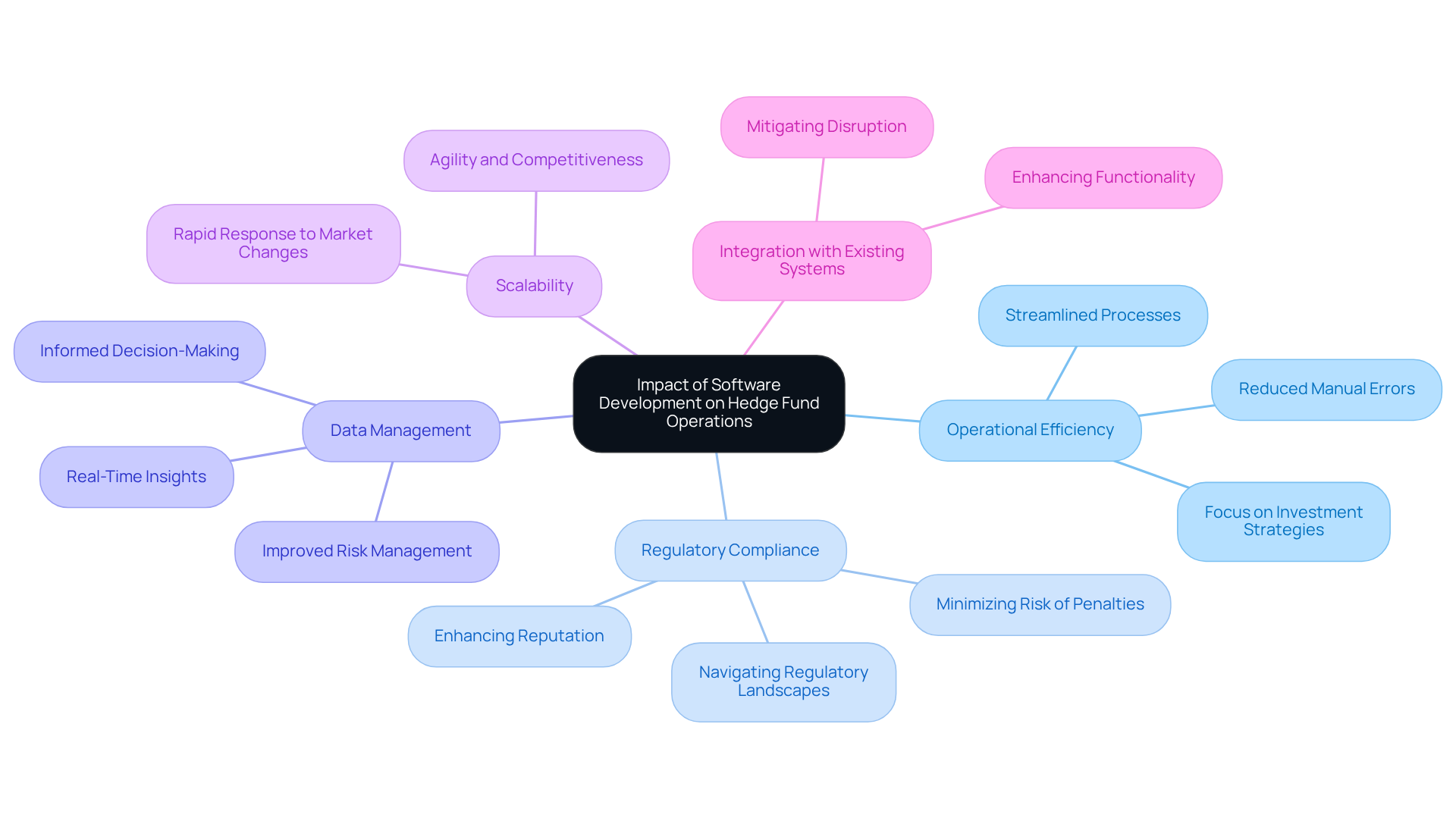

Assessing the Impact of Software Development Choices on Hedge Fund Operations

The selection of a software development partner can profoundly influence hedge fund operations in several key areas:

- Operational Efficiency: Customized software solutions can streamline processes, reduce manual errors, and enhance overall effectiveness. This enables investment firms to focus on investment strategies rather than administrative tasks.

- Regulatory Compliance: Software designed with compliance in mind helps investment firms navigate complex regulatory landscapes, thereby minimizing the risk of penalties and bolstering their reputation.

- Data Management: Robust data analysis tools empower investment groups to make informed decisions based on real-time insights, thereby improving investment performance and risk management.

- Scalability: The ability to rapidly scale technological solutions in response to changing market conditions or business needs is crucial for investment firms, allowing them to remain agile and competitive.

- Integration with Existing Systems: Seamless integration with current systems mitigates disruption and enhances the overall functionality of investment operations.

At Neutech, we understand that selecting the right software dev companies as your development partner can significantly impact your success. After collaboratively assessing your needs, we provide you with a selection of candidate designers and developers to integrate into your team, ensuring you have the specialized engineering talent that meets your specific requirements.

In summary, the implications of software development decisions extend beyond mere functionality; they play a critical role in shaping the strategic direction and operational success of hedge funds.

Conclusion

Selecting the right software development partner is essential for hedge funds seeking to effectively navigate the complexities of the financial landscape. Neutech distinguishes itself from competitors by providing tailored solutions that emphasize compliance, technical expertise, and adaptability. This ensures that investment firms can thrive in a rapidly evolving market. By focusing on specialized services, Neutech positions itself as a leader in the software development sector for hedge funds, making it an optimal choice for firms aiming to enhance operational efficiency and strategic decision-making.

The article discussed key criteria for evaluating software development companies, including:

- Regulatory compliance

- Technical proficiency

- Scalability

- The capacity to foster effective communication and collaboration

Neutech’s strengths, such as bespoke application development and advanced data analytics, were highlighted. A comparative analysis of its competitors illustrated the unique advantages Neutech offers in addressing the specific needs of investment firms.

In conclusion, the implications of software development choices extend well beyond the immediate functionality of tools and systems; they fundamentally influence the operational success and strategic direction of hedge funds. By prioritizing the selection of a capable software development partner like Neutech, investment firms can ensure they are well-equipped to tackle the challenges of the financial sector, ultimately leading to improved performance and sustained competitive advantage.

Frequently Asked Questions

What are the key criteria for evaluating software development companies for hedge funds?

The key criteria include regulatory compliance, technical expertise, scalability, industry experience, communication and collaboration, and adaptability in contracting.

Why is regulatory compliance important for software solutions in hedge funds?

Regulatory compliance is crucial to adhere to SEC regulations and anti-money laundering (AML) requirements, which helps mitigate legal risks and ensures operational integrity.

What technical expertise should software development companies possess?

Companies should have proficiency in advanced technologies such as data analytics, machine learning, and secure coding practices to develop robust solutions for the financial sector.

How does scalability impact software development for hedge funds?

Scalability is important because hedge vehicles often face varying demands. Companies like Neutech offer month-to-month contracts that allow investment groups to adjust their development resources as needed.

Why is industry experience significant for software development companies?

A strong track record in the financial services sector equips development groups to better address the unique challenges and regulatory environments that investment vehicles encounter.

What role does communication and collaboration play in software development projects?

Effective communication and seamless integration with existing teams are essential for successful project outcomes, enhancing project efficiency.

What is meant by adaptability in contracting for software development?

Adaptability in contracting allows investment groups to modify their development resources as required, enabling them to respond quickly to market fluctuations.

What additional support does Neutech provide to its clients?

Neutech offers ongoing assistance from expert-level engineers and product management to ensure that developers are well-equipped to meet project demands.