Introduction

Hedge funds operate in a landscape characterized by intense competition and stringent regulatory demands. In this context, specialized technological solutions are not merely advantageous; they are essential. As the investment management market is projected to experience significant growth, the necessity for efficient compliance and data management tools becomes increasingly critical. This complexity raises a pivotal question: can hedge funds afford to navigate this intricate environment independently, or is collaboration with a dedicated software development firm the key to unlocking their operational potential and ensuring sustainable growth?

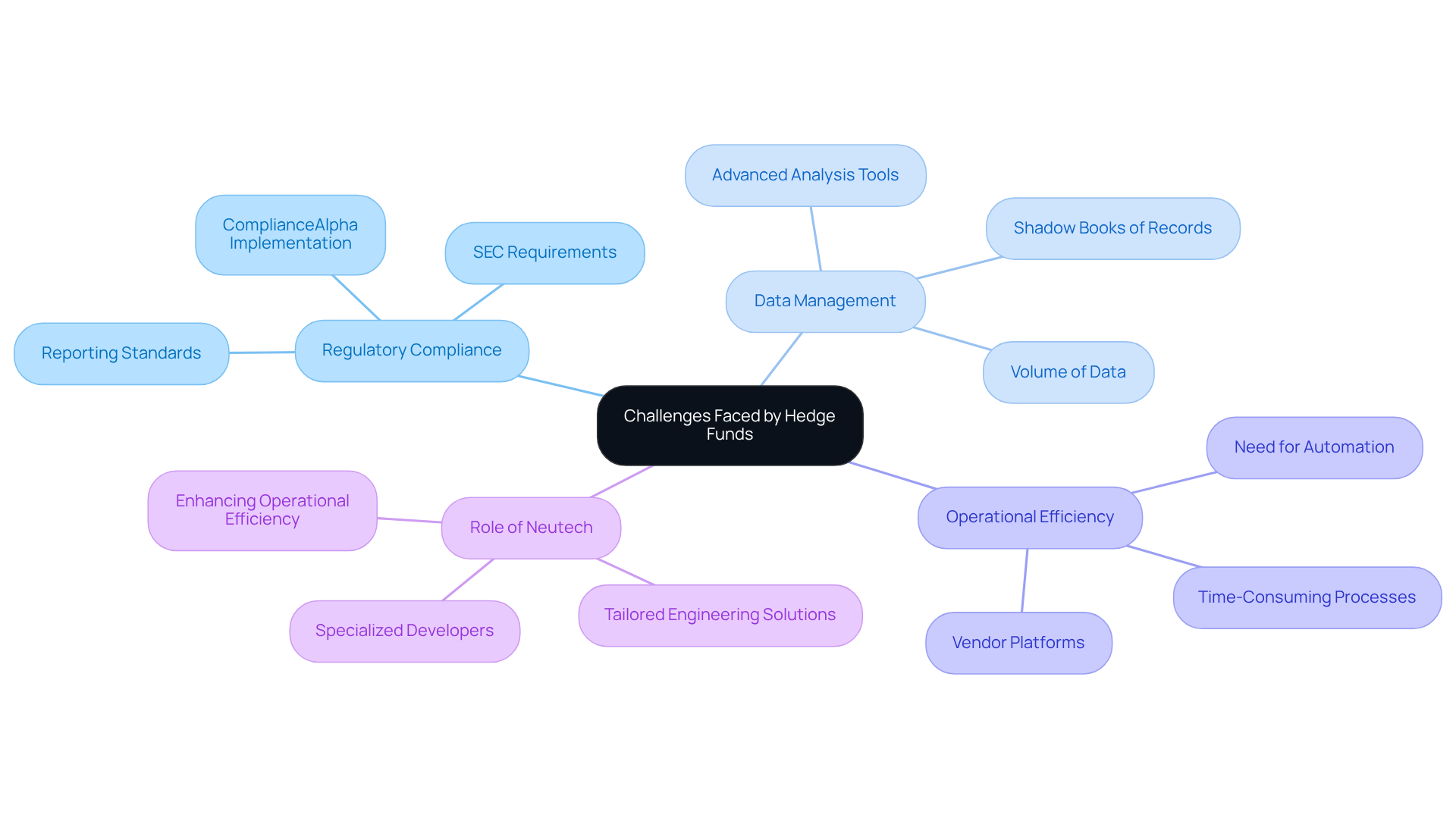

Understand the Unique Challenges Faced by Hedge Funds

Hedge investments operate within a highly competitive and heavily regulated environment, facing distinct challenges that necessitate specialized technological solutions. Regulatory compliance is critical, with SEC requirements mandating rigorous reporting standards and transparency. By 2026, the investment management program market is projected to reach approximately USD 2.51 billion, underscoring the growing demand for efficient compliance tools. Without robust software systems, upholding these standards becomes increasingly challenging.

Moreover, investment vehicles manage substantial volumes of data from diverse sources, necessitating advanced data management and analysis tools to inform investment decisions. The complexity of multi-asset portfolios further complicates operational efficiency, as investment groups must remain agile in response to economic fluctuations and evolving investor expectations. Notably, nearly 90% of allocators now regard shadow books of records as essential for validating trades and ensuring accurate reporting, highlighting the critical need for operational transparency.

These challenges underscore the importance of partnering with a dedicated product development firm like Neutech. Neutech provides a tailored engineering talent provision process, evaluating client needs and supplying specialized developers and designers skilled in various programming languages and platforms, including React, Python, and .NET. Such collaboration can yield customized solutions that enhance operational efficiency and ensure compliance, ultimately positioning hedge investments for sustainable growth in a dynamic environment. The compound annual growth rate (CAGR) for the analytic technology sector is 14.71%, further emphasizing the necessity of investing in advanced innovations to navigate complexities and achieve long-term success.

Leverage Specialized Software Solutions for Operational Efficiency

Hedge investment groups can significantly enhance their operational effectiveness by employing technology solutions tailored specifically to their unique needs. These customized applications automate routine tasks, streamline data processing, and enable real-time analytics, allowing investment groups to respond swiftly to fluctuations in the financial landscape. For instance, deploying advanced trading algorithms can refine execution strategies, leading to reduced transaction costs and improved overall performance.

Moreover, specialized applications bolster risk management by providing tools for real-time monitoring and analysis of portfolio risks. This capability enables investment groups to make informed decisions quickly. By investing in customized technology solutions, such as those developed with React, Python, or AWS DevOps, investment groups not only enhance their operational efficiency but also gain a competitive edge in a constantly evolving market environment.

Neutech offers a structured approach to development, beginning with a comprehensive evaluation of client needs. This process ensures that hedge funds receive specialized developers and designers who can seamlessly integrate into their teams. However, it is essential to recognize the challenges associated with adopting AI technologies, particularly concerning data integrity and security. Addressing these challenges is vital for maximizing the benefits of tailored applications.

Furthermore, organizations that neglect thorough discovery phases may encounter 2.5 times greater change request expenses, underscoring the importance of a systematic approach to development. Ultimately, the right tailored application can yield a return on investment between 150% and 300%, establishing it as a strategic necessity for investment groups aiming to thrive in today’s competitive landscape.

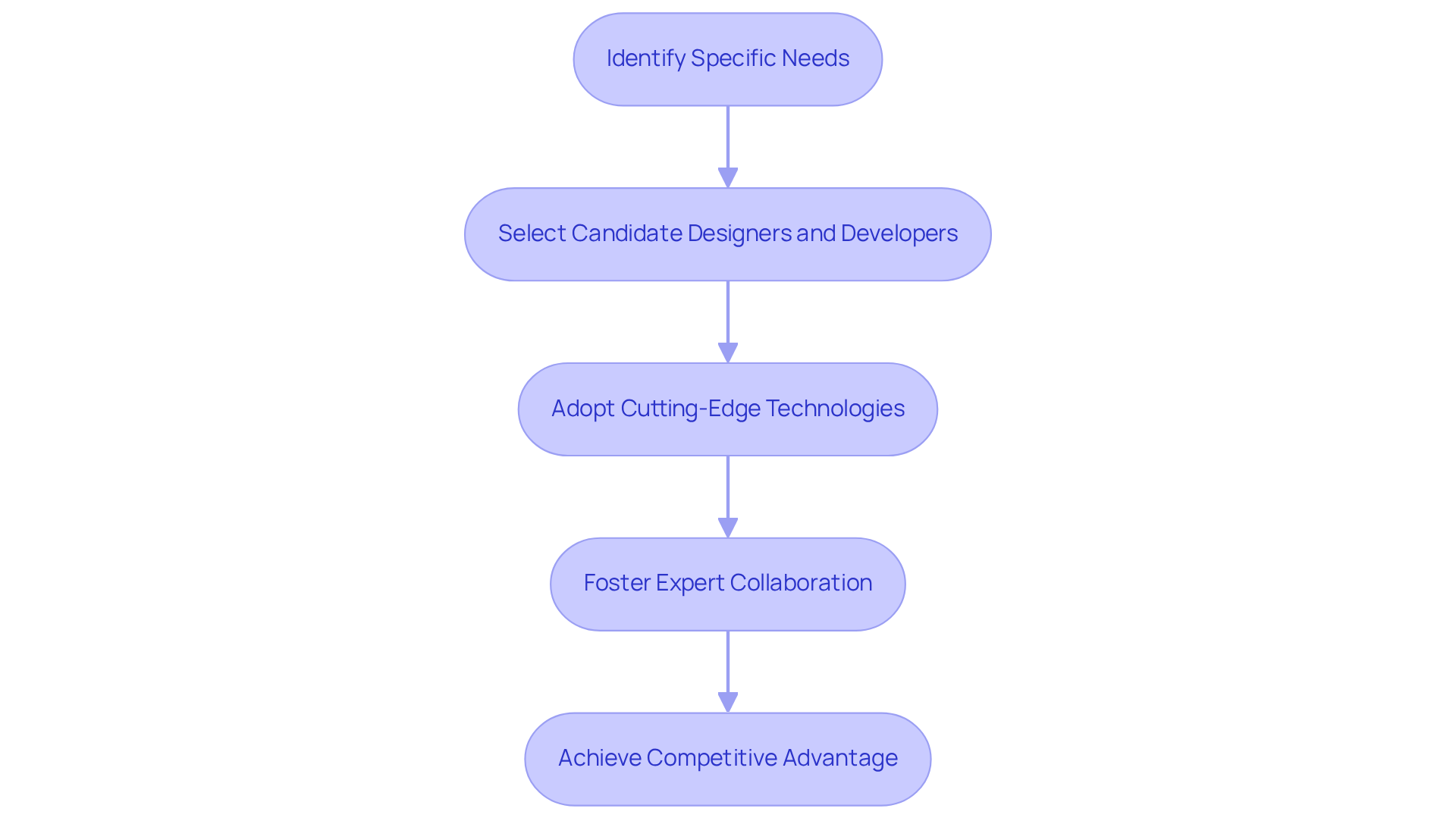

Gain Competitive Edge Through Expert Collaboration

Collaborating with specialized software development firms, such as Neutech, provides investment groups with a competitive advantage by granting access to expertise that may not be available internally. At Neutech, we initiate the process by collaboratively identifying your specific needs. This ensures that we present a selection of candidate designers and developers who can seamlessly integrate into your existing team.

This tailored approach not only facilitates the adoption of cutting-edge technologies but also aligns with industry best practices, resulting in innovative solutions that significantly enhance operational capabilities. For instance, by partnering with a firm focused on financial services, investment pools can develop customized applications that improve trading operations, enhance data analysis, and elevate client engagement.

Furthermore, fostering expert collaboration cultivates an environment of innovation, enabling investment firms to explore advanced technologies such as artificial intelligence and machine learning to refine their investment strategies. This collaborative framework not only boosts operational efficiency but also equips investment firms to navigate changing market conditions and meet evolving investor expectations.

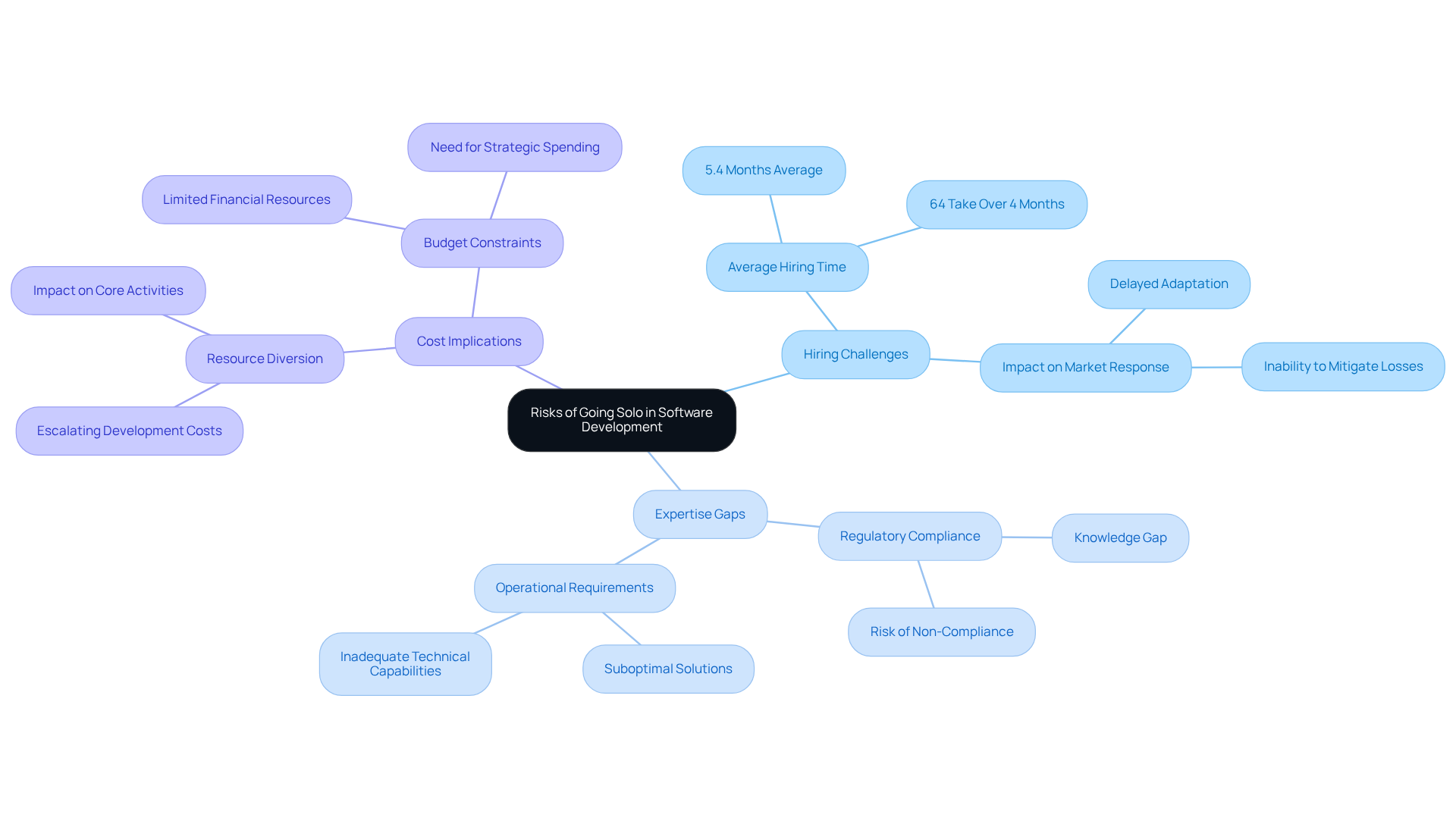

Evaluate the Risks of Going Solo in Software Development

While some investment groups may contemplate developing applications internally, this approach carries significant risks that can impede operational efficiency and stifle innovation. A primary concern is the difficulty in hiring and retaining skilled developers in a highly competitive job market, where the average hiring time for tech roles is approximately 5.4 months. Furthermore, 64% of organizations report that it takes over four months to fill these positions. Such delays can severely impact an investment group’s ability to respond to market fluctuations and technological advancements.

Moreover, internal teams frequently lack the specialized expertise required to develop complex financial applications that adhere to regulatory standards. This knowledge gap can lead to suboptimal solutions that do not fulfill operational requirements, ultimately jeopardizing compliance and performance. For example, during the GameStop trading frenzy, firms equipped with robust data strategies and tech-savvy personnel were better positioned to mitigate losses, highlighting the necessity of possessing the right technical capabilities.

Additionally, the costs associated with in-house development can escalate quickly, diverting essential resources from core investment activities. As investment groups face budgetary constraints, understanding the practical aspects of technology expenditure becomes crucial. By assessing these risks, hedge funds can recognize the benefits of partnering with specialized software development firms like Neutech, which not only evaluate client needs but also provide tailored engineering talent, including skilled developers and designers, to effectively navigate the complexities of the financial services landscape.

Conclusion

Hedge funds navigate a complex and competitive landscape where specialized software solutions are essential for success. Partnering with a dedicated software product development company allows hedge funds to effectively tackle their unique challenges, enhance operational efficiency, and ensure compliance with stringent regulations. This collaboration empowers investment groups to leverage advanced technology tailored to their specific needs, positioning them for sustainable growth in an ever-evolving market.

The critical importance of customized software solutions lies in their ability to streamline operations, manage risks, and improve decision-making processes. By automating routine tasks and enabling real-time analytics, hedge funds can respond swiftly to market fluctuations, thereby enhancing their overall performance. Furthermore, collaboration with experienced developers provides investment firms with the expertise necessary to navigate the complexities of financial technology while mitigating the risks associated with in-house development.

Investing in specialized software development is of paramount importance. As the landscape for hedge funds continues to evolve, embracing tailored technological solutions will be key to maintaining a competitive edge and meeting the demands of modern investors. By recognizing the value of expert collaboration and the risks of operating independently, hedge funds can position themselves to thrive in a challenging environment, ensuring both compliance and operational excellence.

Frequently Asked Questions

What unique challenges do hedge funds face?

Hedge funds operate in a highly competitive and heavily regulated environment, facing challenges such as regulatory compliance, data management, and the complexity of multi-asset portfolios.

Why is regulatory compliance important for hedge funds?

Regulatory compliance is critical because SEC requirements mandate rigorous reporting standards and transparency, which are essential for maintaining investor trust and operational integrity.

What is the projected market size for the investment management program by 2026?

The investment management program market is projected to reach approximately USD 2.51 billion by 2026.

What tools do hedge funds need to manage data effectively?

Hedge funds require advanced data management and analysis tools to handle substantial volumes of data from diverse sources and to inform investment decisions.

What role do shadow books of records play in hedge fund operations?

Nearly 90% of allocators regard shadow books of records as essential for validating trades and ensuring accurate reporting, highlighting the need for operational transparency.

How can partnering with a product development firm like Neutech benefit hedge funds?

Partnering with Neutech can provide tailored engineering talent and specialized developers skilled in various programming languages, leading to customized solutions that enhance operational efficiency and ensure compliance.

What is the compound annual growth rate (CAGR) for the analytic technology sector?

The compound annual growth rate (CAGR) for the analytic technology sector is 14.71%, indicating the necessity for hedge funds to invest in advanced innovations for long-term success.