Master Custom Software Product Development for Hedge Funds

Introduction

In the fast-paced realm of hedge funds, the demand for tailored software solutions is increasingly critical. As the financial landscape evolves, firms encounter unique operational and regulatory challenges that necessitate innovative technology to maintain competitiveness. The path to mastering custom software product development, however, is laden with complexities. What are the essential steps to ensure that the software not only meets compliance standards but also enhances decision-making and operational efficiency? This guide explores the intricacies of developing bespoke software for hedge funds, providing insights into:

- Defining requirements

- Selecting the appropriate technology

- Ensuring ongoing support and maintenance

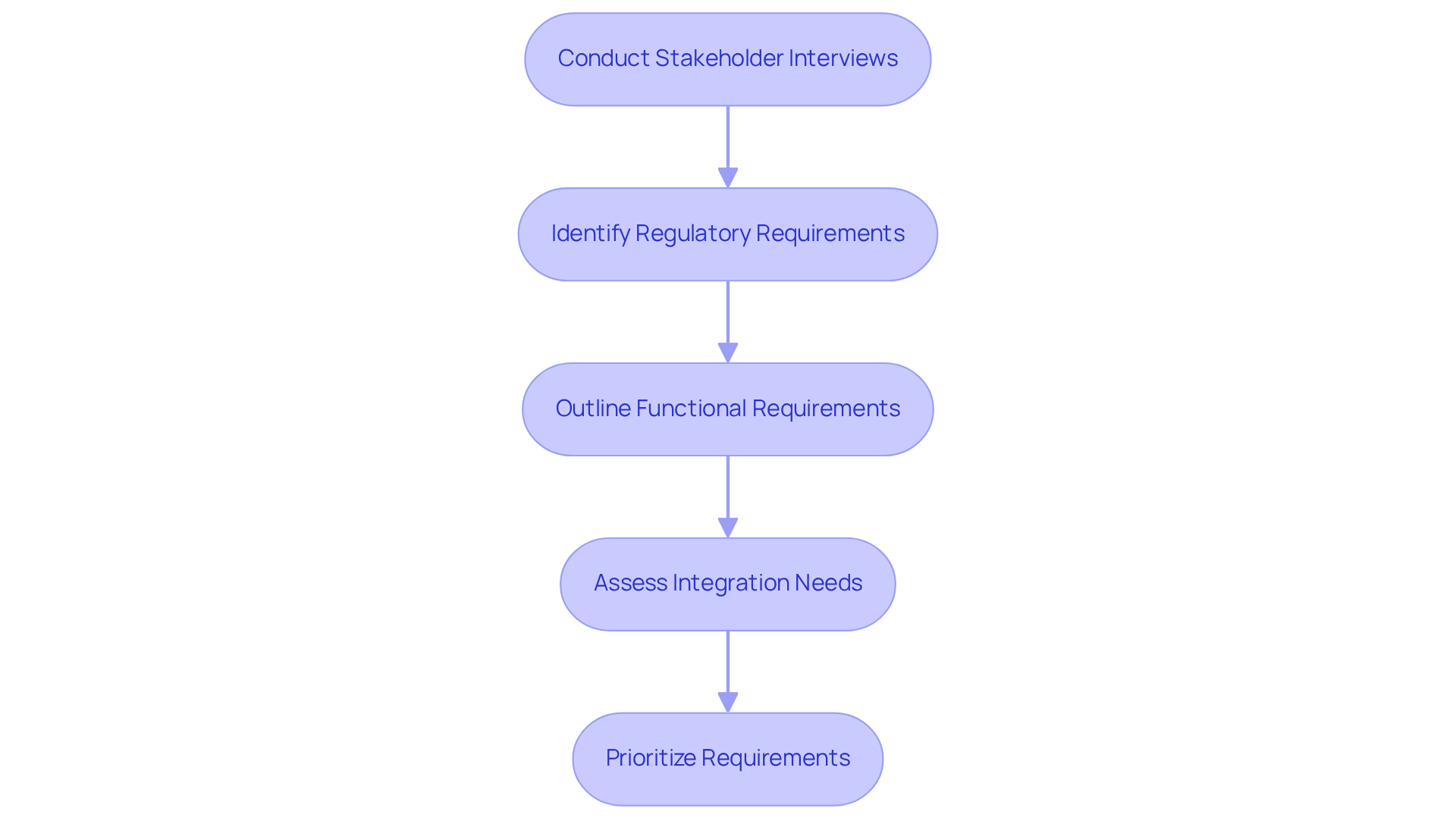

Define Your Hedge Fund’s Unique Requirements

-

Conduct Stakeholder Interviews: Engage with key stakeholders, including investment managers, compliance officers, and IT personnel, to gather insights into their specific needs and challenges. This conversation is essential for comprehending the operational environment and recognizing issues that need resolution.

-

Identify Regulatory Requirements: Conduct thorough research on the regulatory framework impacting your hedge fund, particularly focusing on SEC regulations and compliance standards for 2026. Understanding these evolving requirements is crucial, as the system must be designed to meet stringent compliance mandates, including cybersecurity protocols and information protection measures.

-

Outline Functional Requirements: Develop a comprehensive list of essential features that the application must encompass. These features should include trade execution, risk evaluation, reporting capabilities, and advanced information visualization tools, all tailored to enhance decision-making and operational efficiency. Neutech’s expertise in custom software product development ensures that these features are not only robust but also compliant with industry standards.

-

Assess Integration Needs: Evaluate how the new application will interface with existing systems, such as trading platforms and data feeds. Ensuring seamless integration is critical for maintaining operational continuity and maximizing the application’s effectiveness. Neutech’s diverse proficiencies, including React, Python, and .NET development, facilitate smooth integration with various platforms.

-

Prioritize Requirements: Rank the identified requirements based on their significance and urgency. This prioritization will guide the development process, ensuring that the most essential features are addressed first, thereby aligning the application with the hedge investment’s strategic goals. Additionally, maintain a documented business continuity and disaster recovery plan to ensure operations can continue during technology failures or cyberattacks. Neutech is committed to assisting hedge managers through custom software product development that addresses their specific operational and regulatory requirements.

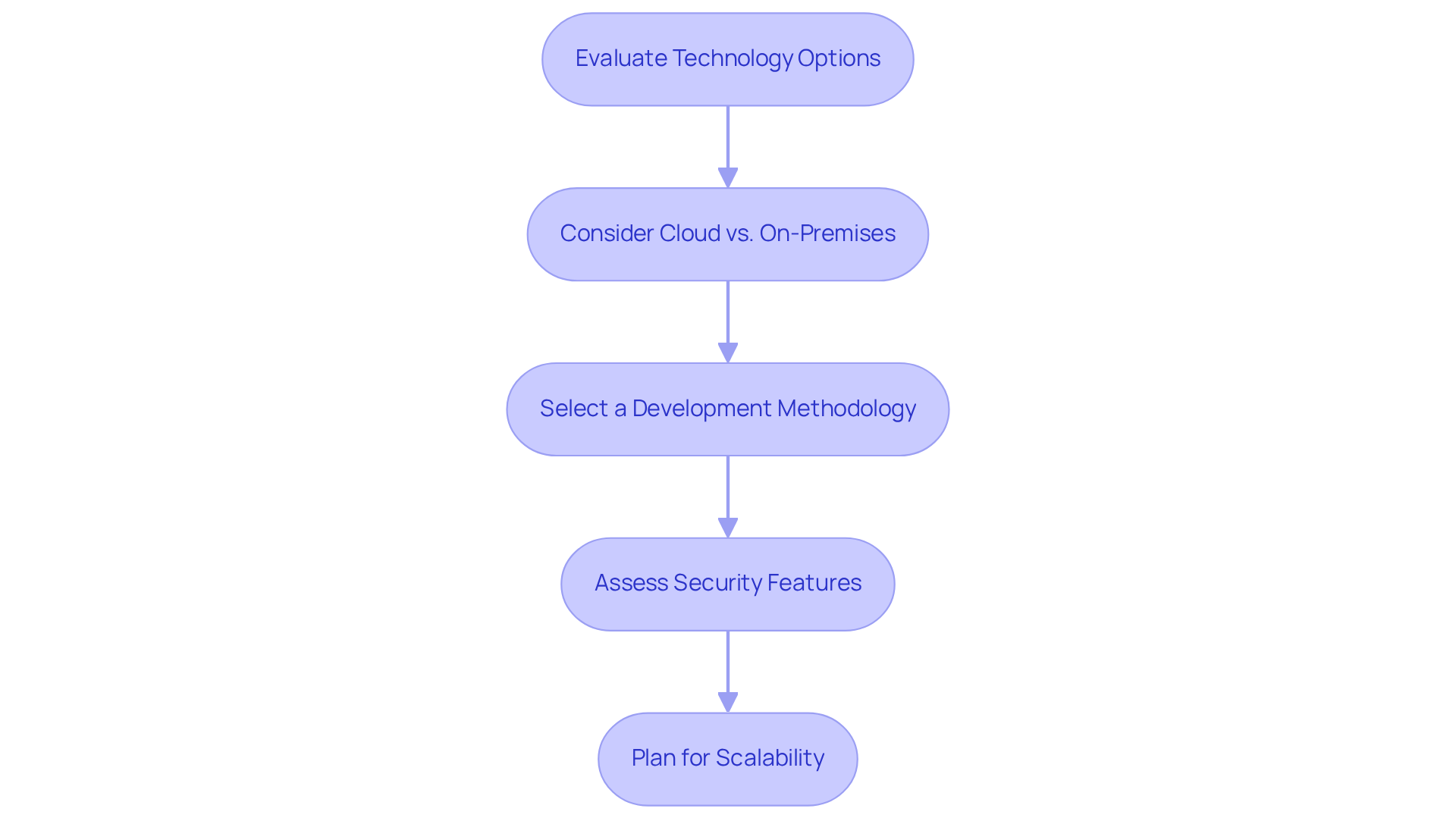

Choose the Right Technology Stack and Development Methodology

-

Evaluate Technology Options: Start by researching and comparing various programming languages, such as Python and GoLang, alongside frameworks like React and Angular. Python is particularly favored in finance due to its extensive libraries and user-friendliness, while GoLang is increasingly recognized for its performance in trading applications. Understanding the strengths and weaknesses of these technologies is essential for selecting the most suitable options for financial applications.

-

Consider Cloud vs. On-Premises: The choice between hosting software on the cloud or on-premises is crucial. Cloud solutions present significant advantages, including lower upfront costs, automatic updates, and enhanced scalability, which support custom software product development, enabling hedge funds to adjust resources swiftly without substantial infrastructure investments. Conversely, on-premises solutions may provide greater control over information security but often entail higher maintenance costs and longer implementation timelines. By 2026, custom software product development in cloud-based investment management software is projected to dominate the market, with a forecasted value of $1.67 billion by 2030, driven by its ability to facilitate real-time information access and collaboration among remote teams.

-

Select a Development Methodology: Choosing the appropriate development methodology is vital for project success. Agile methodologies are increasingly favored in the financial sector due to their flexibility and emphasis on iterative development, allowing for rapid adjustments based on feedback. This approach contrasts with the Waterfall model, which can be inflexible and less responsive to evolving requirements. A hybrid approach may also be considered, integrating elements of both methodologies to meet specific project needs.

-

Assess Security Features: Security is paramount in financial applications. It is imperative to ensure that the selected technologies incorporate robust security features to protect sensitive information and comply with industry regulations. Custom software product development often benefits from cloud-based solutions that provide advanced security measures, including AI protection, encryption, and strong authentication, which can be more challenging to implement in on-premises environments.

-

Plan for Scalability: Finally, choose technologies that can scale seamlessly as the hedge fund expands. This includes accommodating increased data loads and user demands without compromising performance. Custom software product development through cloud solutions excels in this regard, allowing firms to adjust resources according to their current needs, thereby enhancing operational efficiency and cost-effectiveness.

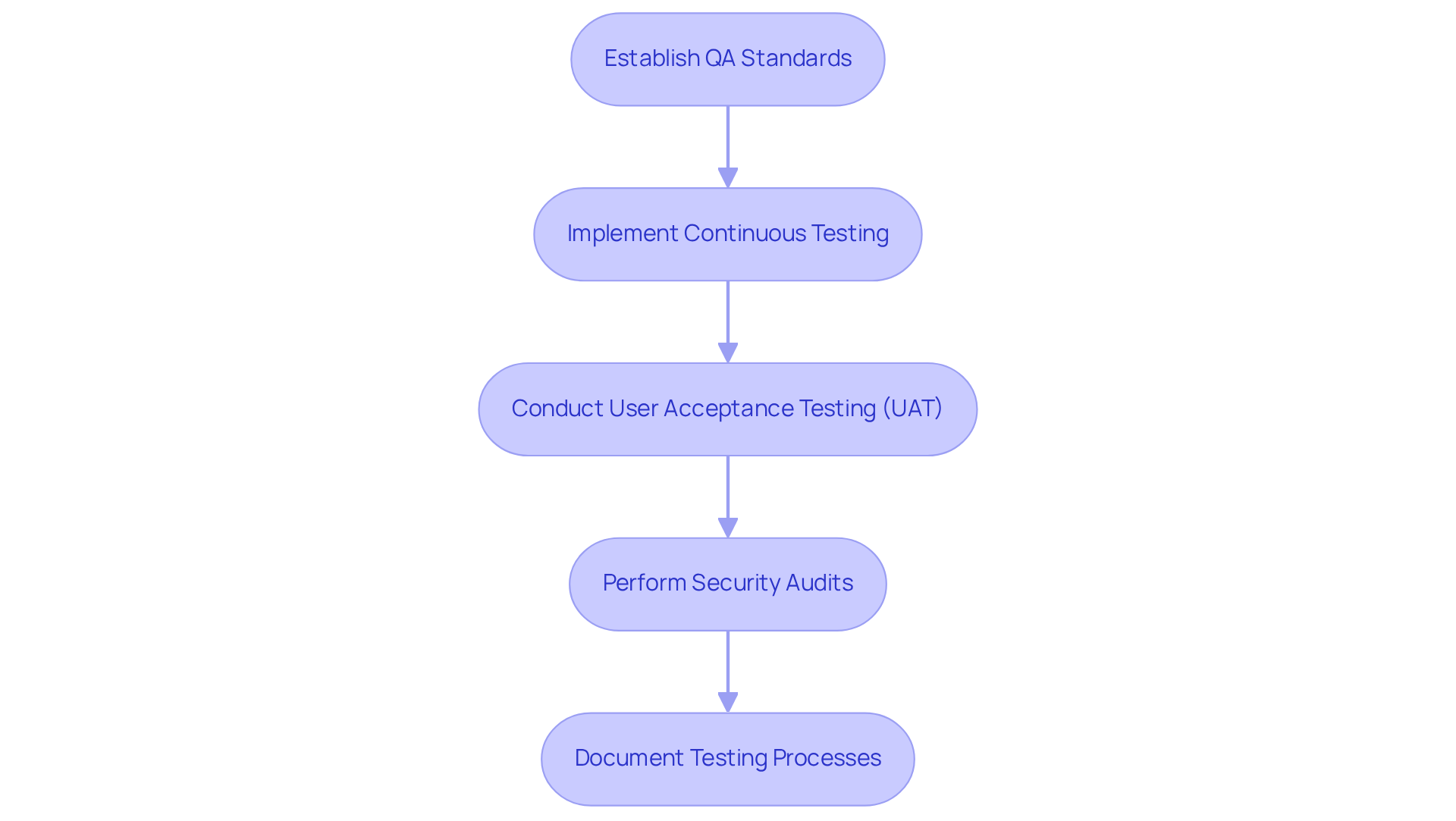

Execute Development with Rigorous Quality Assurance

-

Establish QA Standards: It is essential to define quality assurance standards and metrics that the application must meet. This includes establishing performance benchmarks and compliance requirements to ensure reliability and effectiveness.

-

Implement Continuous Testing: The utilization of automated testing tools is crucial for conducting continuous testing throughout the development cycle. This approach ensures that any issues are identified and addressed promptly, thereby maintaining the integrity of the application.

-

Conduct User Acceptance Testing (UAT): Involving end-users in the testing process is vital for gathering feedback. This step ensures that the application meets their needs and expectations, ultimately enhancing user satisfaction.

-

Perform Security Audits: Regular security evaluations are necessary to identify vulnerabilities within the system. These audits ensure compliance with industry regulations, safeguarding both the application and its users.

-

Document Testing Processes: Maintaining thorough documentation of all testing processes and results is imperative. This practice provides transparency and facilitates future audits, reinforcing the reliability of the quality assurance efforts.

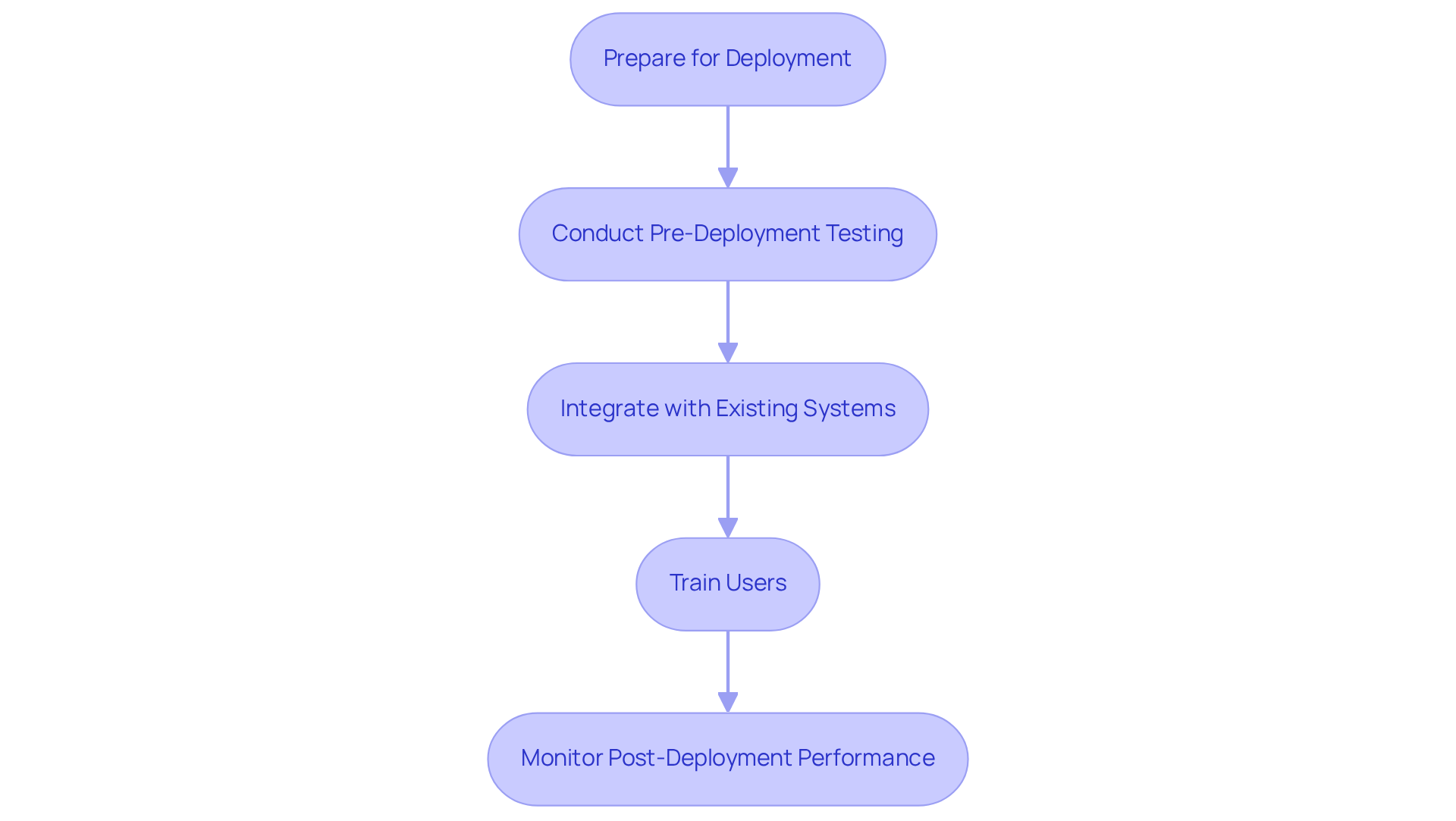

Deploy and Integrate the Custom Software

- Prepare for Deployment: Develop a comprehensive deployment plan that details the necessary steps, timeline, and resources required for a successful launch.

- Conduct Pre-Deployment Testing: Execute final testing within a staging environment to confirm that the application is fully prepared for production.

- Integrate with Existing Systems: Work collaboratively with IT teams to seamlessly integrate the new application with existing systems, ensuring smooth data flow between platforms.

- Train Users: Deliver thorough training sessions for end-users to ensure they are well-acquainted with the new application and its features.

- Monitor Post-Deployment Performance: Following deployment, diligently monitor the system’s performance and gather user feedback to identify and address any emerging issues.

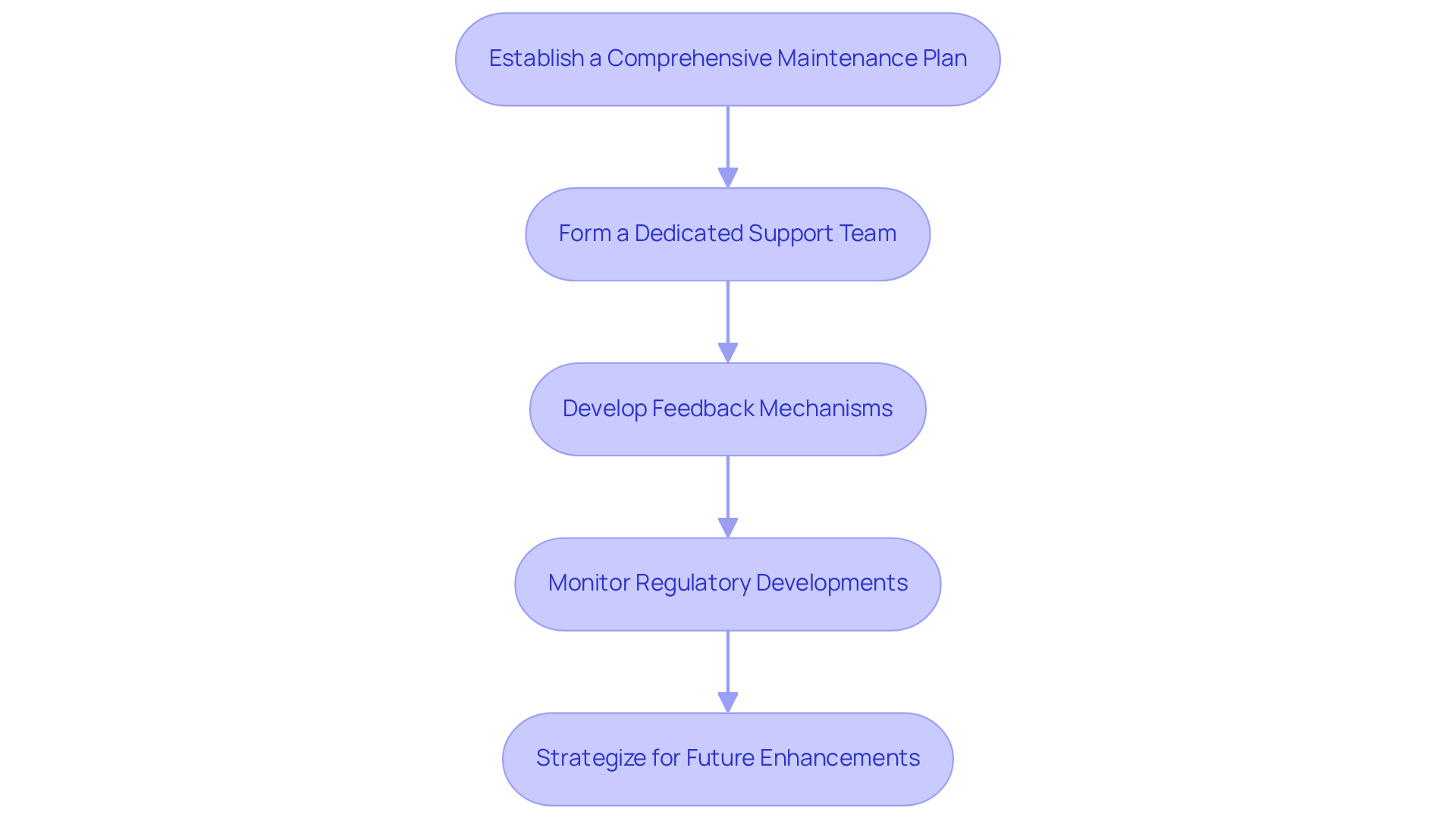

Establish Ongoing Maintenance and Support

- Establish a Comprehensive Maintenance Plan: Formulate a detailed maintenance plan that specifies the frequency of updates, security patches, and performance monitoring to ensure optimal system functionality.

- Form a Dedicated Support Team: Create a specialized support team tasked with promptly addressing user inquiries and resolving technical issues, thereby enhancing user satisfaction.

- Develop Feedback Mechanisms: Implement structured feedback loops that enable users to share their insights on the application, which will inform future updates and improvements.

- Monitor Regulatory Developments: Consistently review and analyze regulatory changes to guarantee that the system remains compliant with industry standards and best practices.

- Strategize for Future Enhancements: Identify and prioritize potential areas for future enhancements based on user feedback and the evolving needs of the market, ensuring the software continues to align with the hedge fund’s objectives.

Conclusion

Mastering custom software product development for hedge funds is a strategic endeavor that requires a comprehensive understanding of unique requirements, the selection of an appropriate technology stack, and the implementation of rigorous quality assurance measures. By precisely defining the specific needs of the hedge fund, considering regulatory compliance, and prioritizing essential features, organizations can develop software solutions that significantly enhance operational efficiency and facilitate informed decision-making.

Key steps in this process include:

- Stakeholder engagement

- Thorough technology evaluation

- A strong emphasis on security and scalability within financial applications

Moreover, the importance of continuous testing, user acceptance, and post-deployment monitoring cannot be overstated, as these elements ensure that the software remains effective and compliant over time. Each phase of the development process, from initial planning to ongoing maintenance, is critical in delivering a robust solution tailored to the hedge fund’s objectives.

Ultimately, the journey of custom software development for hedge funds transcends mere technical execution; it represents a strategic investment in the organization’s future. By adhering to best practices in development, integration, and support, hedge funds can adeptly navigate the complexities of the financial landscape and position themselves for sustained success. Embracing these principles will not only enhance operational capabilities but also foster innovation and adaptability in an ever-evolving market.

Frequently Asked Questions

What are the initial steps to define a hedge fund’s unique requirements?

The initial steps include conducting stakeholder interviews with key personnel to gather insights, identifying regulatory requirements particularly focusing on SEC regulations, outlining functional requirements for essential features, assessing integration needs with existing systems, and prioritizing these requirements based on significance and urgency.

Why is it important to conduct stakeholder interviews?

Stakeholder interviews are essential for understanding the operational environment and recognizing specific needs and challenges faced by investment managers, compliance officers, and IT personnel.

What regulatory requirements should be considered for a hedge fund?

It is crucial to research the regulatory framework impacting the hedge fund, specifically SEC regulations and compliance standards for 2026, including cybersecurity protocols and information protection measures.

What functional requirements should a hedge fund application encompass?

The application should include features such as trade execution, risk evaluation, reporting capabilities, and advanced information visualization tools to enhance decision-making and operational efficiency.

How should integration needs be assessed for a new application?

Integration needs should be evaluated by determining how the new application will interface with existing systems, such as trading platforms and data feeds, ensuring seamless integration for operational continuity.

What factors should be considered when prioritizing requirements?

Requirements should be ranked based on their significance and urgency, guiding the development process to address the most essential features first, while also maintaining a documented business continuity and disaster recovery plan.

What technology options should be evaluated for hedge fund applications?

Various programming languages, such as Python and GoLang, along with frameworks like React and Angular should be researched and compared to select the most suitable options for financial applications.

What are the advantages of cloud vs. on-premises solutions?

Cloud solutions offer lower upfront costs, automatic updates, and enhanced scalability, while on-premises solutions provide greater control over information security but may involve higher maintenance costs and longer implementation times.

What development methodology is recommended for hedge fund software development?

Agile methodologies are favored due to their flexibility and iterative development approach, allowing for rapid adjustments based on feedback, although a hybrid approach may also be considered.

Why is security important in financial applications?

Security is paramount to protect sensitive information and ensure compliance with industry regulations, necessitating the incorporation of robust security features in the selected technologies.

How should scalability be planned for hedge fund applications?

Technologies should be chosen that can scale seamlessly as the hedge fund expands, accommodating increased data loads and user demands without compromising performance, with cloud solutions being particularly effective in this regard.