Comparing Analytic Software: Key Insights for Hedge Fund Managers

Introduction

The landscape of hedge fund management is experiencing a significant transformation, primarily driven by an increasing reliance on advanced analytic software. These tools enhance decision-making and operational efficiency, while also playing a critical role in risk management and regulatory compliance. As the market for such software is projected to grow substantially, hedge fund managers are confronted with the pressing challenge of selecting the right solutions from a vast array of options. Identifying which analytic tools will deliver the most value and align with their strategic objectives in this rapidly evolving environment is essential.

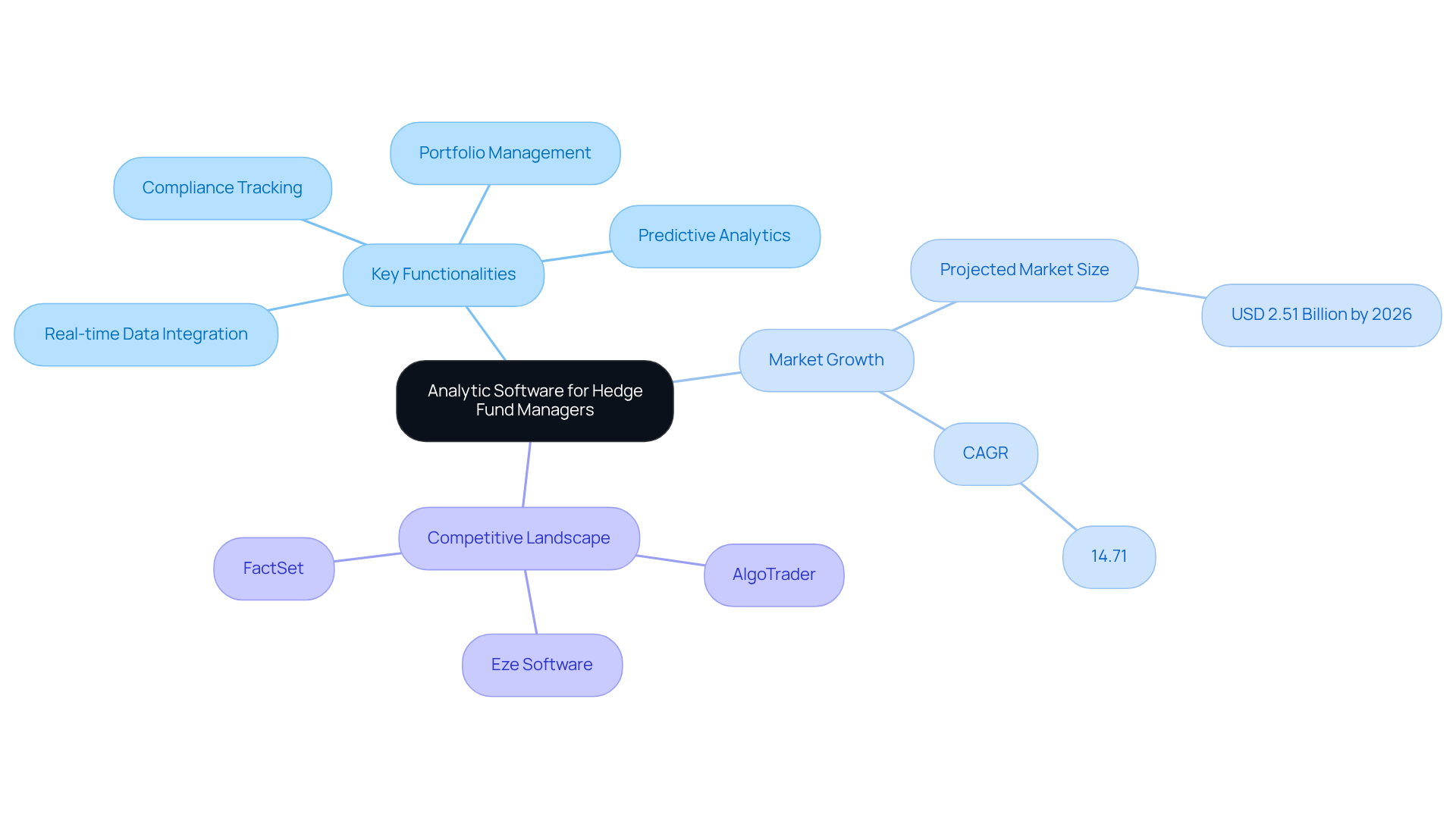

Overview of Analytic Software for Hedge Fund Managers

The tools encompassed by analytic software for hedge fund managers are aimed at enhancing analysis, risk management, and investment decision-making. These solutions leverage advanced technologies, including artificial intelligence (AI), machine learning, and comprehensive analytics, to deliver insights that are crucial for navigating the complexities of financial markets. Key functionalities comprise:

- Portfolio management

- Predictive analytics

- Compliance tracking

- Real-time data integration

As investment groups increasingly adopt data-driven strategies, the demand for sophisticated analytic software is projected to grow significantly. The market size is expected to reach approximately USD 2.51 billion by 2026, up from USD 2.20 billion in 2025, reflecting a compound annual growth rate (CAGR) of 14.71%. This growth is propelled by the need for enhanced performance metrics, effective risk mitigation strategies, and adherence to stringent regulatory compliance.

The competitive landscape features prominent companies such as:

- AlgoTrader

- Eze Software

- FactSet

These companies play vital roles in this market. Moreover, the introduction of U.S. tariffs in 2025 has impacted investment management platform providers, thereby influencing market dynamics and program selection. Consequently, it is imperative for investment managers to select tools that align with their operational objectives and bolster their competitive edge in a rapidly evolving environment.

Comparative Analysis of Leading Analytic Tools

In the competitive landscape of analytic software for investment analysis, several tools distinguish themselves through their unique features and capabilities. This analysis compares three leading solutions:

-

Bloomberg Terminal: Renowned for its extensive market information and analytics, the Bloomberg Terminal offers real-time financial insights, news, and trading functionalities. Its robust analytic software tools facilitate portfolio management and risk assessment, establishing it as a staple for hedge fund managers. However, its high cost may pose a barrier for smaller firms.

-

FactSet: This platform excels in providing integrated financial information and analytics, featuring customizable dashboards tailored to specific investment strategies. FactSet’s strength lies in its user-friendly interface and comprehensive information coverage, although it may lack some advanced predictive capabilities found in competing analytic software.

-

Advent Software: Focusing on portfolio management and accounting, Advent Software delivers solutions that enhance operations for investment groups. Its capabilities in compliance tracking and reporting are particularly advantageous for firms navigating regulatory requirements. However, it may not offer as comprehensive market data as Bloomberg or FactSet.

Each of these tools presents distinct advantages and disadvantages, and the ultimate decision regarding the analytic software depends on the specific requirements and budget of the investment group.

Impact of Analytic Software on Hedge Fund Operations

The incorporation of analytic software into investment operations has fundamentally transformed the approach managers take towards investment strategies. This shift has several key impacts:

-

Enhanced Decision-Making: Access to real-time data and advanced analytics empowers hedge fund managers to make informed investment decisions, allowing for swift adaptations to market fluctuations.

-

Improved Risk Management: Analytic software facilitates the identification and mitigation of risks by providing critical insights into market volatility and potential threats to portfolio performance.

-

Operational Efficiency: The automation of information analysis and reporting processes significantly reduces the time spent on manual tasks, enabling teams to focus on strategic initiatives. This efficiency is particularly advantageous for firms handling large volumes of data.

-

Regulatory Compliance: Many analytic applications offer features that assist investment firms in meeting regulatory obligations, ensuring compliance with industry standards and minimizing the risk of penalties.

In summary, the influence of analytic tools is profound, enhancing performance and enabling investment groups to capitalize on emerging market opportunities.

Recommendations for Hedge Fund Managers: Choosing the Right Analytic Software

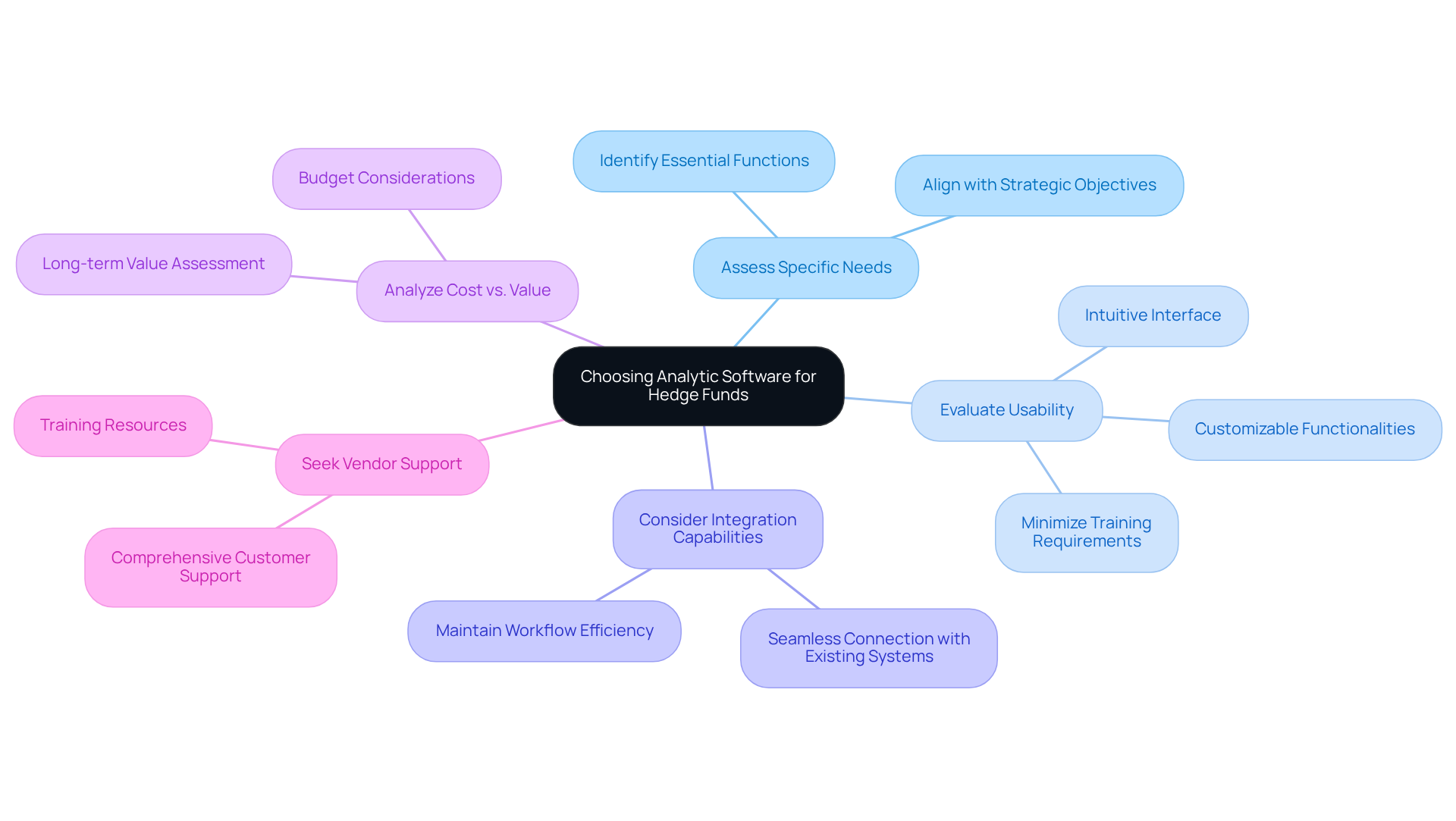

When selecting analytic software, hedge fund managers should prioritize several key recommendations:

-

Assess Specific Needs: It is crucial to clearly identify the essential functions required, such as portfolio management, risk analysis, or compliance tracking. This targeted approach helps narrow down options to those that align with the firm’s strategic objectives by utilizing analytic software.

-

Evaluate Usability: Opt for a program that provides an intuitive interface, customizable functionalities, and effective analytic software. This ensures that team members can effectively utilize the tool without extensive training, which is vital since usability issues can lead to significant productivity losses. As Aarti Bagekari notes, “the main drivers of the growth of the Hedge Fund Software market are complex financial instruments, risk management, and regulatory compliance.”

-

Consider Integration Capabilities: Ensure that the chosen application can seamlessly connect with existing systems and information sources. This capability is essential for maintaining workflow efficiency and data consistency across platforms with analytic software.

-

Analyze Cost vs. Value: While budget considerations are important, it is essential to weigh the long-term value that the analytic software can deliver in terms of enhanced performance and risk management. The worldwide investment management application market is expected to expand at a CAGR of 13.30% from 2024 to 2031, indicating the potential return on investment in premium tools.

-

Seek Vendor Support: Choose vendors that provide comprehensive customer support and training resources. This assistance is vital for maximizing the software’s potential and ensuring that the investment group can adapt to evolving market conditions.

By adhering to these recommendations, hedge fund managers can make informed decisions that significantly enhance their operational efficiency and investment outcomes.

Conclusion

The discussion surrounding analytic software for hedge fund managers underscores the essential role these tools play in enhancing investment strategies and operational efficiency. By leveraging advanced technologies such as AI and machine learning, hedge funds can acquire invaluable insights that inform decision-making, risk management, and compliance tracking. As the market for these solutions continues to grow, it becomes increasingly crucial for investment managers to select software that aligns with their specific needs and strategic objectives.

Throughout the article, key arguments were presented regarding the functionalities of various analytic tools, including:

- portfolio management

- predictive analytics

- real-time data integration

A comparative analysis of leading platforms – Bloomberg Terminal, FactSet, and Advent Software – illustrated the unique advantages and limitations of each, emphasizing the importance of usability, integration capabilities, and cost-value considerations. Furthermore, the impact of these tools on hedge fund operations was explored, demonstrating how they enhance decision-making, improve risk management, and streamline compliance processes.

In light of the evolving financial landscape, it is imperative for hedge fund managers to adopt a proactive approach to analytic software. By following the outlined recommendations – such as assessing specific needs, evaluating usability, and considering vendor support – managers can make informed decisions that not only enhance their operational efficiency but also position them for success in a competitive market. Embracing the right analytic tools will ultimately empower hedge funds to navigate complexities, capitalize on emerging opportunities, and achieve sustainable growth in the years to come.

Frequently Asked Questions

What is the purpose of analytic software for hedge fund managers?

Analytic software for hedge fund managers is designed to enhance analysis, risk management, and investment decision-making by leveraging advanced technologies such as artificial intelligence (AI) and machine learning.

What are the key functionalities of analytic software for hedge fund managers?

Key functionalities include portfolio management, predictive analytics, compliance tracking, and real-time data integration.

What is the projected market size for analytic software in the hedge fund industry?

The market size for analytic software is projected to reach approximately USD 2.51 billion by 2026, up from USD 2.20 billion in 2025.

What is the expected compound annual growth rate (CAGR) for this market?

The expected compound annual growth rate (CAGR) for the analytic software market is 14.71%.

What factors are driving the demand for analytic software in hedge funds?

The demand is driven by the need for enhanced performance metrics, effective risk mitigation strategies, and adherence to stringent regulatory compliance.

Which companies are prominent in the analytic software market for hedge funds?

Prominent companies in this market include AlgoTrader, Eze Software, and FactSet.

How have U.S. tariffs introduced in 2025 affected the market for investment management platforms?

The introduction of U.S. tariffs has impacted investment management platform providers, influencing market dynamics and program selection for hedge fund managers.

Why is it important for investment managers to select the right analytic tools?

It is imperative for investment managers to select tools that align with their operational objectives and enhance their competitive edge in a rapidly evolving environment.