Introduction

Automated data integration has become a fundamental element for hedge fund managers as they navigate the complexities of financial services. This process consolidates data from various sources, significantly enhancing decision-making and reducing the risks associated with manual errors.

However, the path to effective integration presents numerous challenges, including:

- Information silos

- Compliance hurdles

Hedge funds must explore best practices and leverage advanced technologies, such as AI, to address these obstacles and gain a competitive edge in an increasingly data-driven environment.

Understand Automated Data Integration in Financial Services

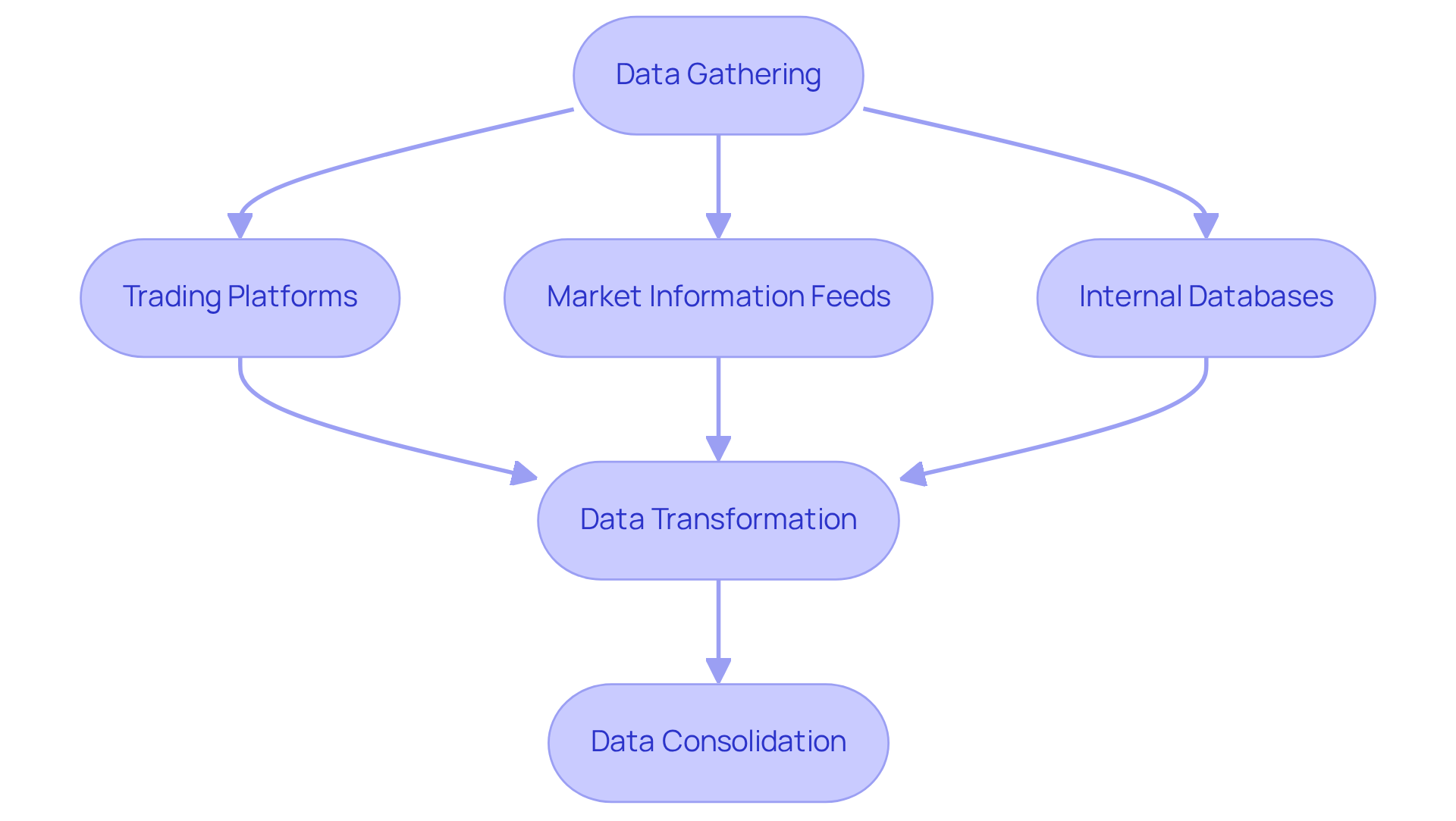

Automated data integration involves the process of automatically gathering, transforming, and consolidating data from various sources into a cohesive system. For hedge investment managers, this process is essential for optimizing information flows from trading platforms, market information feeds, and internal databases into a unified, coherent view. The critical role of automated data integration is essential for real-time analytics, risk management, and compliance reporting.

By employing automated information merging, hedge funds can significantly reduce manual errors, improve accuracy, and expedite decision-making. Understanding the types of information sources and integration techniques – such as ETL (Extract, Transform, Load) and ELT (Extract, Load, Transform) – is vital for implementing effective information strategies.

Identify and Overcome Implementation Challenges

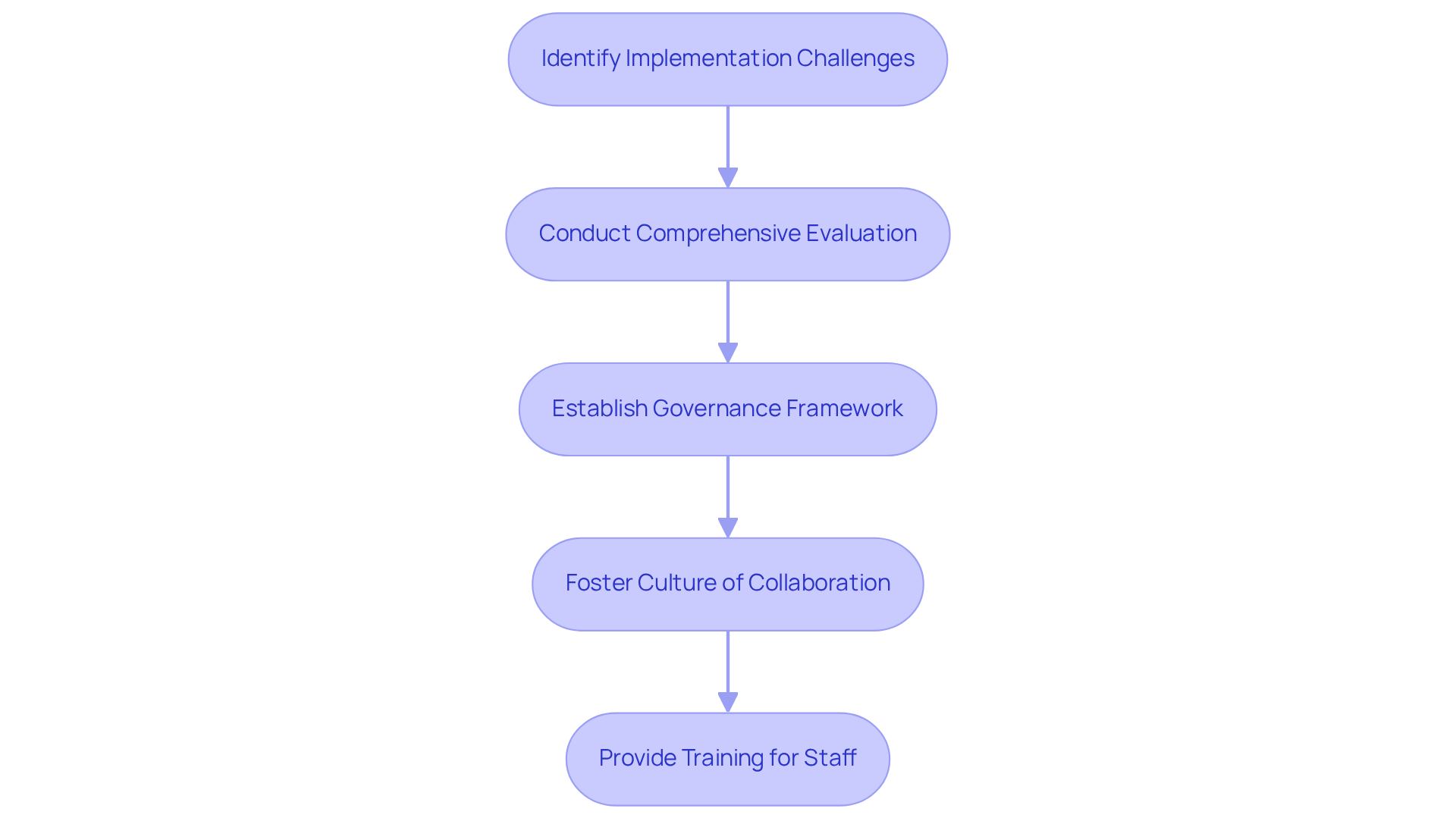

Implementing automated information unification poses several challenges, such as information silos, varying formats, and resistance to change within teams. Hedge fund managers should begin by conducting a comprehensive evaluation of their current information structure to identify potential silos and connection points. Establishing a clear governance framework can aid in standardizing formats and ensuring consistency across systems. Furthermore, fostering a culture of collaboration and providing training for staff can help mitigate resistance to new technologies. Real-world examples indicate that companies prioritizing change management alongside technical execution achieve higher success rates in their integration efforts.

Leverage AI for Enhanced Data Integration

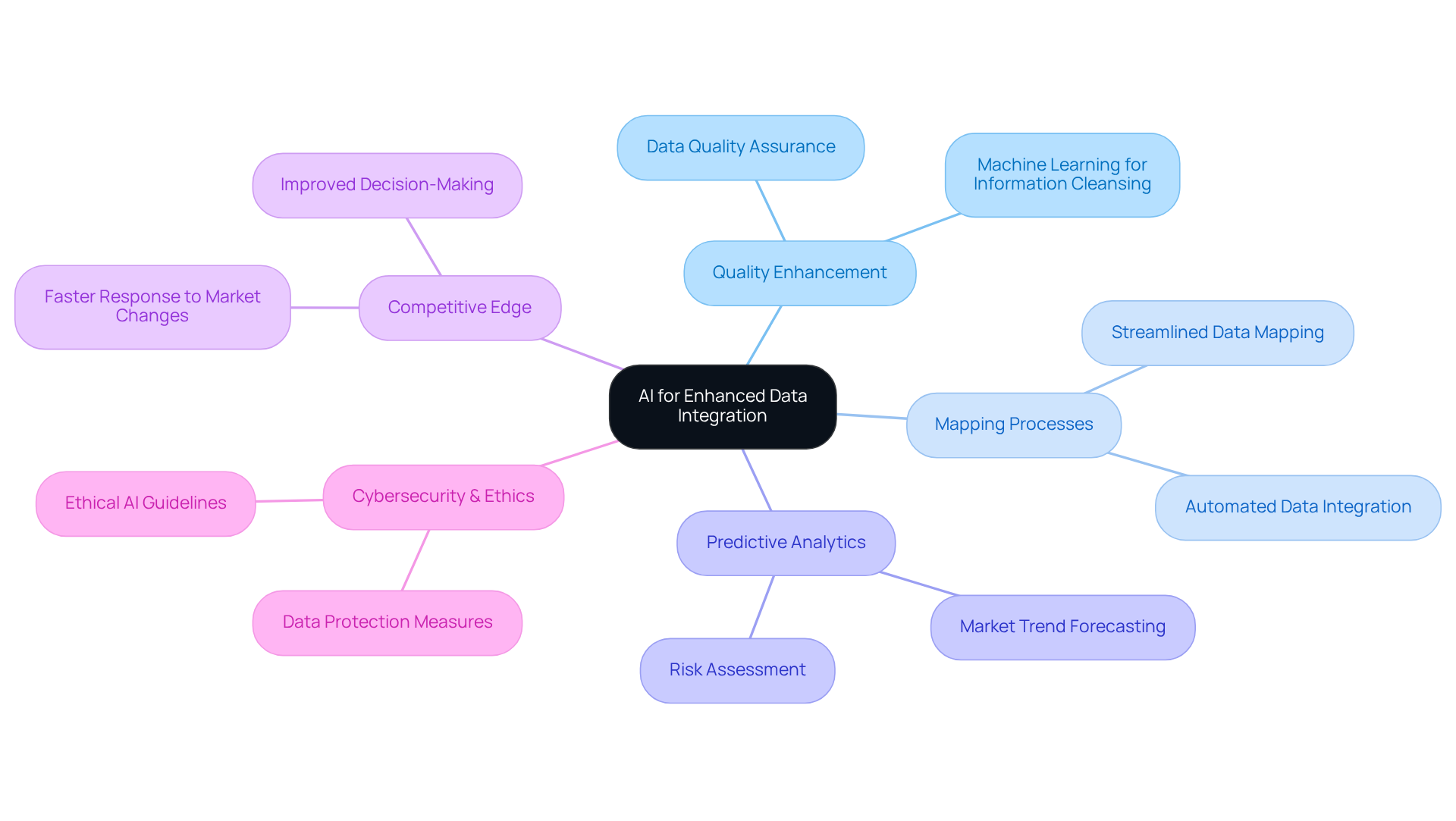

Artificial Intelligence (AI) is revolutionizing the field of automated data integration by significantly enhancing quality, streamlining mapping processes, and facilitating advanced predictive analytics. For hedge funds, AI-driven tools efficiently analyze extensive datasets from diverse sources, revealing patterns and recommending strategies for automated data integration.

For example, machine learning algorithms are pivotal in improving information cleansing processes, ensuring that only high-quality inputs are integrated into systems. Furthermore, AI supports real-time data processing, enabling investment firms to respond swiftly to market fluctuations.

By adopting AI solutions, firms not only refine their processes for automated data integration but also secure a competitive edge through improved decision-making capabilities. A report indicates that AI in hedge operations yielded a return of 34% from May 2017 to May 2020, compared to 12% for global hedge activities, highlighting the effectiveness of these technologies.

Derek Waldron, Chief Analytics Officer at JPMorgan Chase, underscores the necessity of evolving into a truly AI-connected enterprise, which emphasizes the strategic significance of AI in financial services. Additionally, as firms embrace AI, they must prioritize cybersecurity and ethical guidelines to safeguard sensitive information and uphold client trust.

Ensure Data Security and Compliance

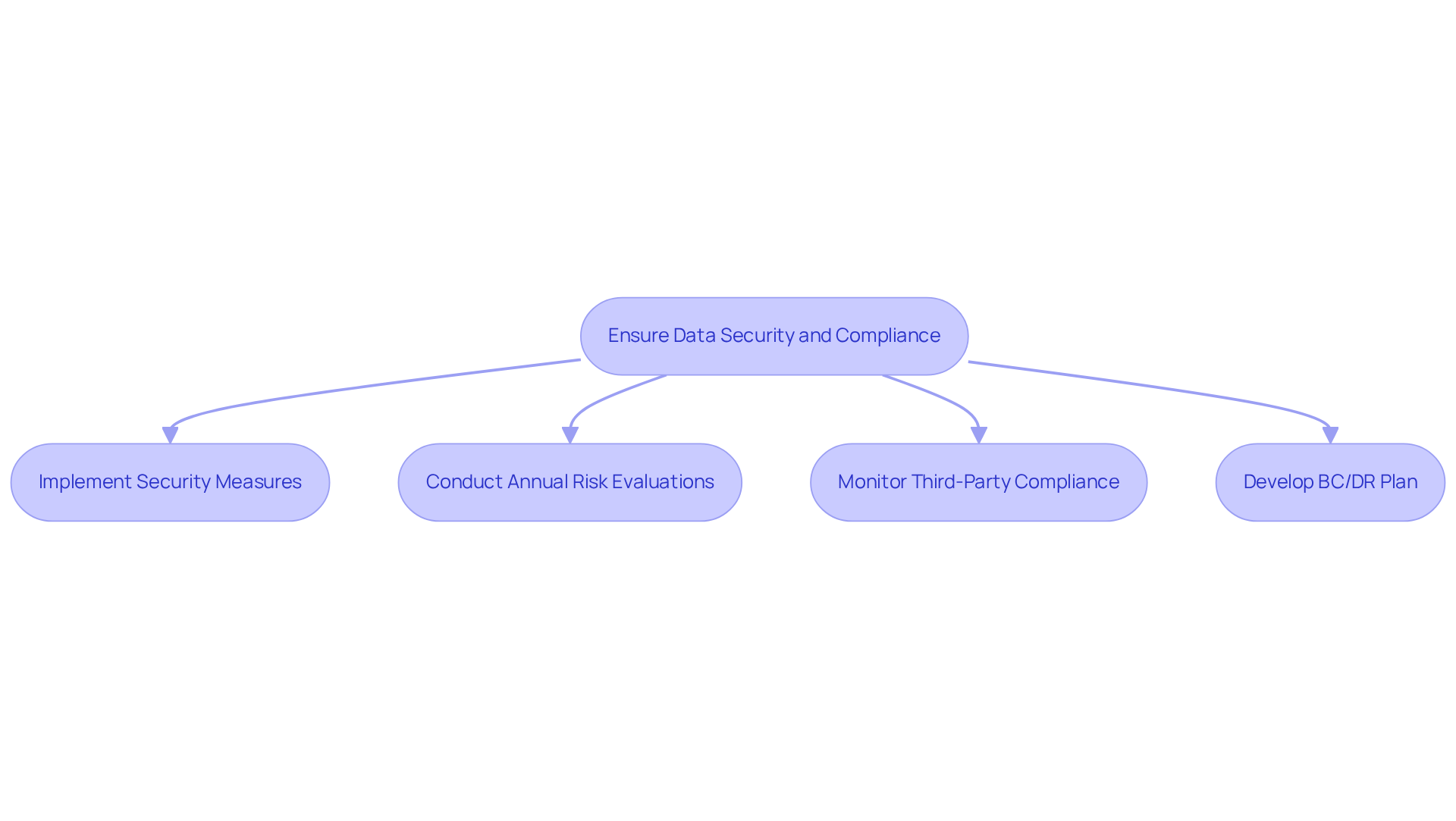

In the financial services sector, information security and adherence to regulations are paramount. Hedge investment managers must implement stringent security measures throughout the automated data integration process. This includes encryption, access controls, and regular audits. Establishing a comprehensive regulatory framework that aligns with standards such as GDPR and SEC guidelines is essential for mitigating risks.

Hedge funds are advised to conduct annual IT and cybersecurity risk evaluations to identify vulnerabilities and document findings. This practice is crucial for ensuring compliance and preparing for potential SEC audits. Additionally, leveraging automated data integration can significantly enhance the monitoring of data usage, ensuring adherence to established standards.

Ongoing oversight of third-party compliance with security standards is vital for managing risks associated with external vendors. Conducting thorough due diligence on vendors before onboarding is critical for ensuring regulatory compliance and robust cybersecurity measures, particularly for cloud platforms and trading systems. By applying the principle of least privilege and enforcing strict access controls, hedge funds can effectively mitigate insider threats.

Moreover, only 49% of organizations plan to increase security spending following a breach, underscoring the importance of proactive measures in regulatory and security strategies. A documented business continuity and disaster recovery (BC/DR) plan is essential for compliance and maintaining investor confidence during technology failures or cyberattacks.

By prioritizing security and regulatory compliance, hedge organizations not only protect sensitive information but also uphold their reputation in a highly scrutinized market. As regulatory oversight intensifies, particularly with the forthcoming EU AI Act and other evolving regulations, a proactive approach to compliance will be crucial for sustaining trust and credibility within the industry.

Monitor and Optimize Integration Systems

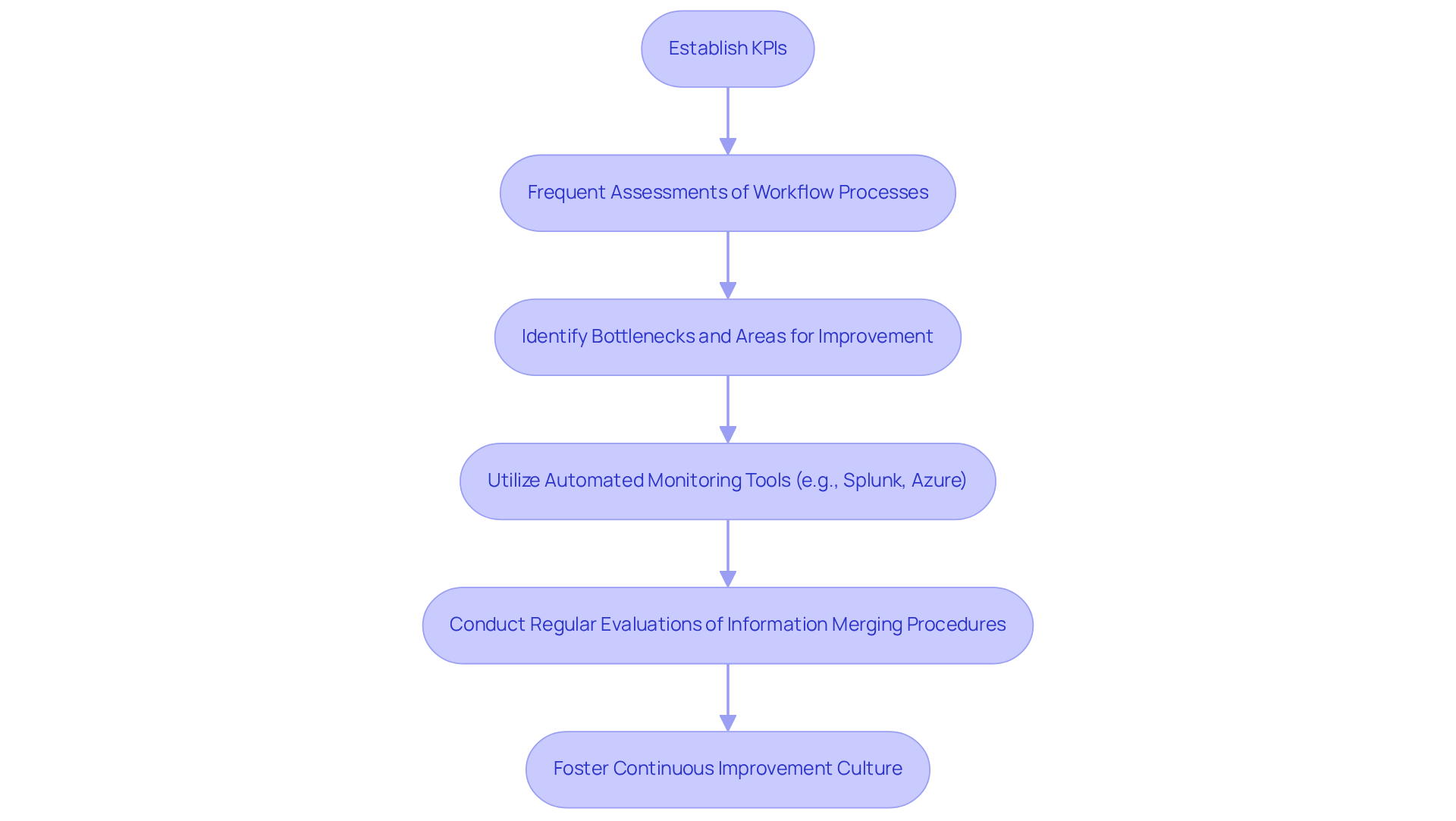

To achieve successful automated data integration, hedge fund managers must establish key performance indicators (KPIs) that effectively monitor the performance of the system. Frequent assessments of workflow processes and information accuracy are crucial for identifying bottlenecks and recognizing areas for improvement. Statistics indicate that only 2% of organizations have more than half their applications integrated, which highlights the challenges in achieving effective automated data integration.

Automated monitoring tools, such as Splunk and Azure Integration Services, are essential for automated data integration by providing real-time insights into system performance. This capability enables proactive adjustments that can mitigate risks. Furthermore, conducting regular evaluations of information merging procedures is essential for maintaining compliance and uncovering potential security vulnerabilities.

By fostering a culture of continuous improvement and being mindful of common pitfalls – such as neglecting data quality or failing to adapt KPIs to evolving business needs – hedge funds can significantly enhance their automated data integration capabilities. This proactive approach is crucial for maintaining a competitive edge in the rapidly changing financial landscape.

Conclusion

Automated data integration is a crucial component for hedge fund managers seeking to streamline operations and enhance decision-making processes. By effectively leveraging automation, investment firms can consolidate disparate data sources into a cohesive system, facilitating real-time analytics and compliance reporting while minimizing manual errors and improving accuracy.

This article has explored several critical aspects of automated data integration. Key topics include:

- Identifying and overcoming implementation challenges

- Leveraging AI to enhance integration processes

- Ensuring data security and compliance

- The necessity of monitoring and optimizing integration systems

Each of these elements is vital in establishing a robust framework that aids hedge funds in navigating the complexities of financial data management.

Ultimately, adopting best practices in automated data integration not only protects sensitive information but also enables hedge fund managers to maintain a competitive advantage in a rapidly evolving financial landscape. As the industry progresses, embracing innovative technologies and proactive compliance strategies will be essential for sustaining investor trust and achieving long-term success. Implementing these practices now can lead to significant enhancements in operational efficiency and data-driven decision-making for hedge funds.

Frequently Asked Questions

What is automated data integration in financial services?

Automated data integration is the process of automatically gathering, transforming, and consolidating data from various sources into a cohesive system, essential for hedge investment managers to optimize information flows from trading platforms, market information feeds, and internal databases.

Why is automated data integration important for hedge funds?

It is important because it enables real-time analytics, risk management, and compliance reporting, while also reducing manual errors, improving accuracy, and expediting decision-making.

What are ETL and ELT in the context of data integration?

ETL (Extract, Transform, Load) and ELT (Extract, Load, Transform) are techniques used for integrating data, where ETL involves transforming data before loading it into the target system, and ELT involves loading data first and then transforming it within the system.

What challenges do hedge funds face when implementing automated information unification?

Challenges include information silos, varying data formats, and resistance to change within teams.

How can hedge fund managers address implementation challenges?

Managers can address these challenges by conducting a comprehensive evaluation of their current information structure, establishing a clear governance framework to standardize formats, fostering a culture of collaboration, and providing training for staff.

What role does change management play in successful data integration?

Change management is crucial as companies that prioritize it alongside technical execution tend to achieve higher success rates in their integration efforts.