Compare Development Software Solutions for Hedge Funds’ Success

Introduction

In the fast-paced realm of hedge funds, selecting the appropriate development software can significantly impact a firm’s trajectory, distinguishing between success and stagnation. Investment firms are increasingly pressured to enhance performance, streamline operations, and adhere to stringent regulations, leading to an unprecedented demand for effective technological solutions. Given the multitude of options available, firms must navigate the complexities of identifying the software that best addresses their unique needs and challenges.

This article examines the foremost development software solutions designed specifically for hedge funds, analyzing their functionalities, advantages, and the essential factors that influence technology selection in a competitive financial landscape.

Define Software Development in Financial Services

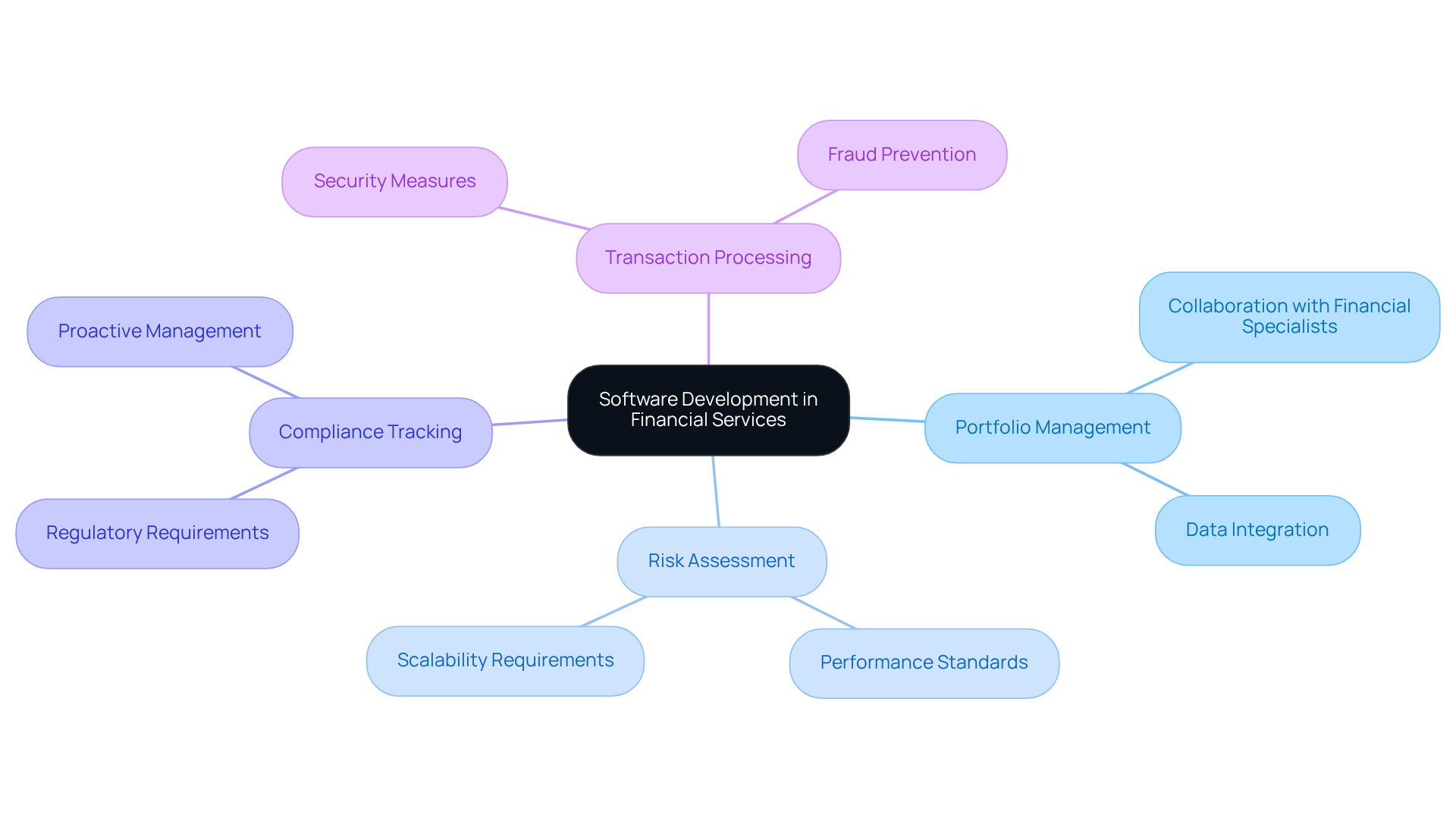

Software development software in the banking sector encompasses the design and implementation of applications and systems aimed at enhancing the management, analysis, and reporting of monetary data. Key functionalities include:

- Portfolio management

- Risk assessment

- Compliance tracking

- Transaction processing

Hedge funds, in particular, require technological solutions that not only meet rigorous performance and scalability standards but also adhere to stringent regulatory requirements.

The development software process typically involves close collaboration with financial specialists to ensure that applications align with current market trends and effective risk management practices. Security is paramount, given the sensitivity of financial data, necessitating robust protection against breaches and fraud. Notably, 92% of investment executives report spending excessive time consolidating and integrating data from multiple sources, underscoring the need for efficient technological solutions that enhance operational effectiveness.

Furthermore, as cybersecurity becomes increasingly critical, integrating security measures into application development is essential for safeguarding sensitive information and complying with industry regulations.

Compare Leading Software Development Solutions for Financial Services

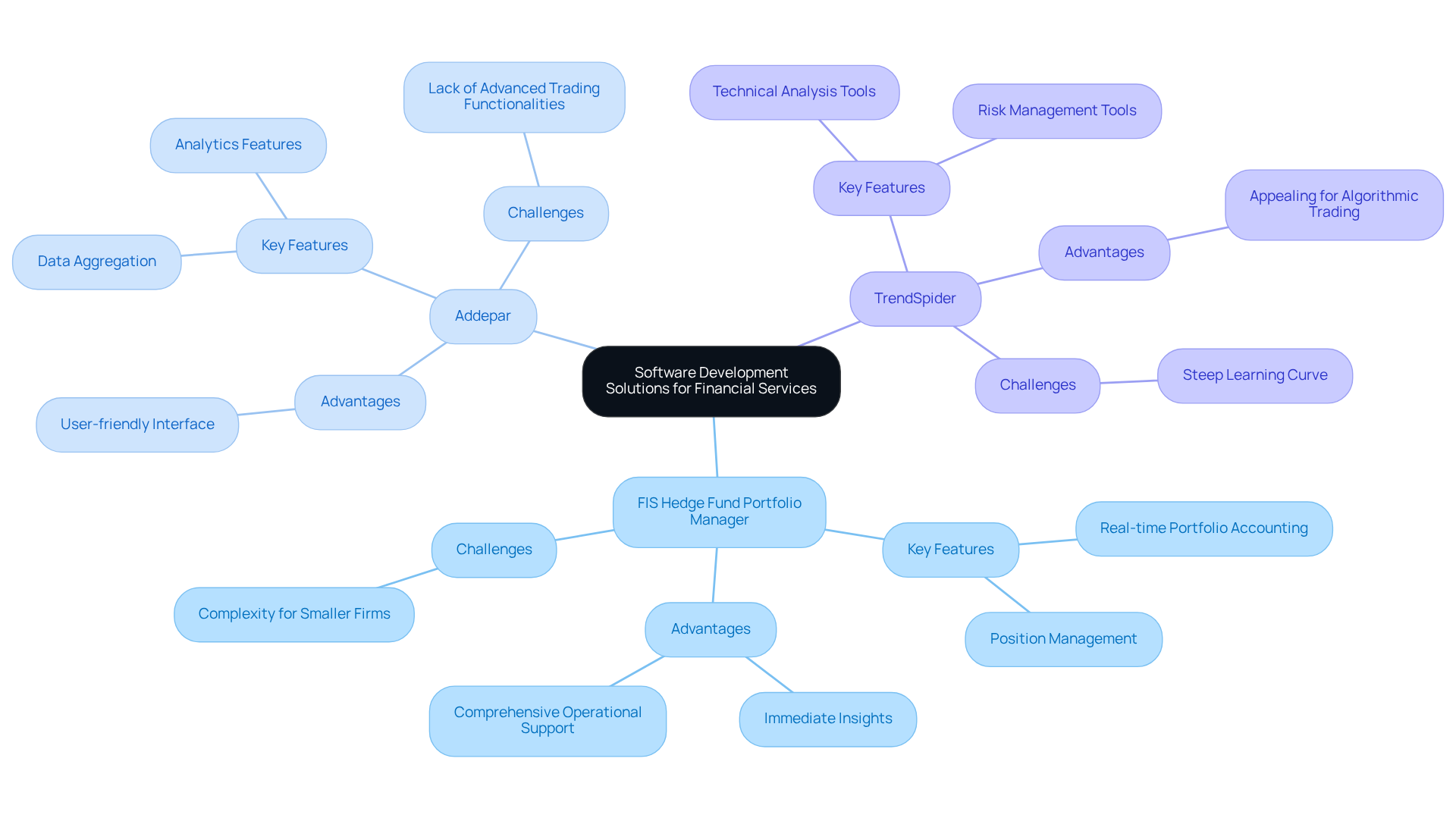

When evaluating development software options for investment firms, three key players emerge: FIS Hedge Fund Portfolio Manager, Addepar, and TrendSpider.

-

FIS Hedge Fund Portfolio Manager stands out for its real-time portfolio accounting and position management capabilities, making it particularly suitable for investment groups that demand immediate insights into their investments. Its comprehensive features support various operational aspects; however, its complexity may present challenges for smaller firms.

-

Addepar is recognized for its robust data aggregation and analytics features, enabling investment firms to manage multi-asset portfolios effectively. The user-friendly interface is a notable advantage, although it may lack some advanced trading functionalities that certain firms might require.

-

TrendSpider offers advanced tools for technical analysis and risk management, appealing to investment firms focused on algorithmic trading. Nonetheless, its steep learning curve may discourage less tech-savvy users from fully utilizing its capabilities.

In summary, while FIS provides extensive operational support, Addepar excels in analytics, and TrendSpider delivers advanced trading tools. The optimal choice ultimately depends on the specific requirements and expertise of the investment group. With the investment management program market projected to reach approximately USD 2.51 billion by 2026, the importance of adopting suitable technological solutions is underscored. Furthermore, the analytic technology sector is expected to grow at a compound annual growth rate (CAGR) of 14.71%, highlighting the necessity for investment groups to invest in advanced innovations to maintain a competitive edge. According to the Neutech Team, “The right tailored application can yield a return on investment between 150% and 300%, establishing it as a strategic necessity for investment groups aiming to thrive in today’s competitive landscape.” Additionally, investment groups face challenges in attracting and retaining skilled developers, which impacts operational efficiency and highlights the importance of selecting the right development software. Neutech addresses this by assessing client needs and providing specialized developers and designers, ensuring that investment groups have access to the customized engineering expertise essential for their success.

Identify Essential Skills for Financial Services Developers

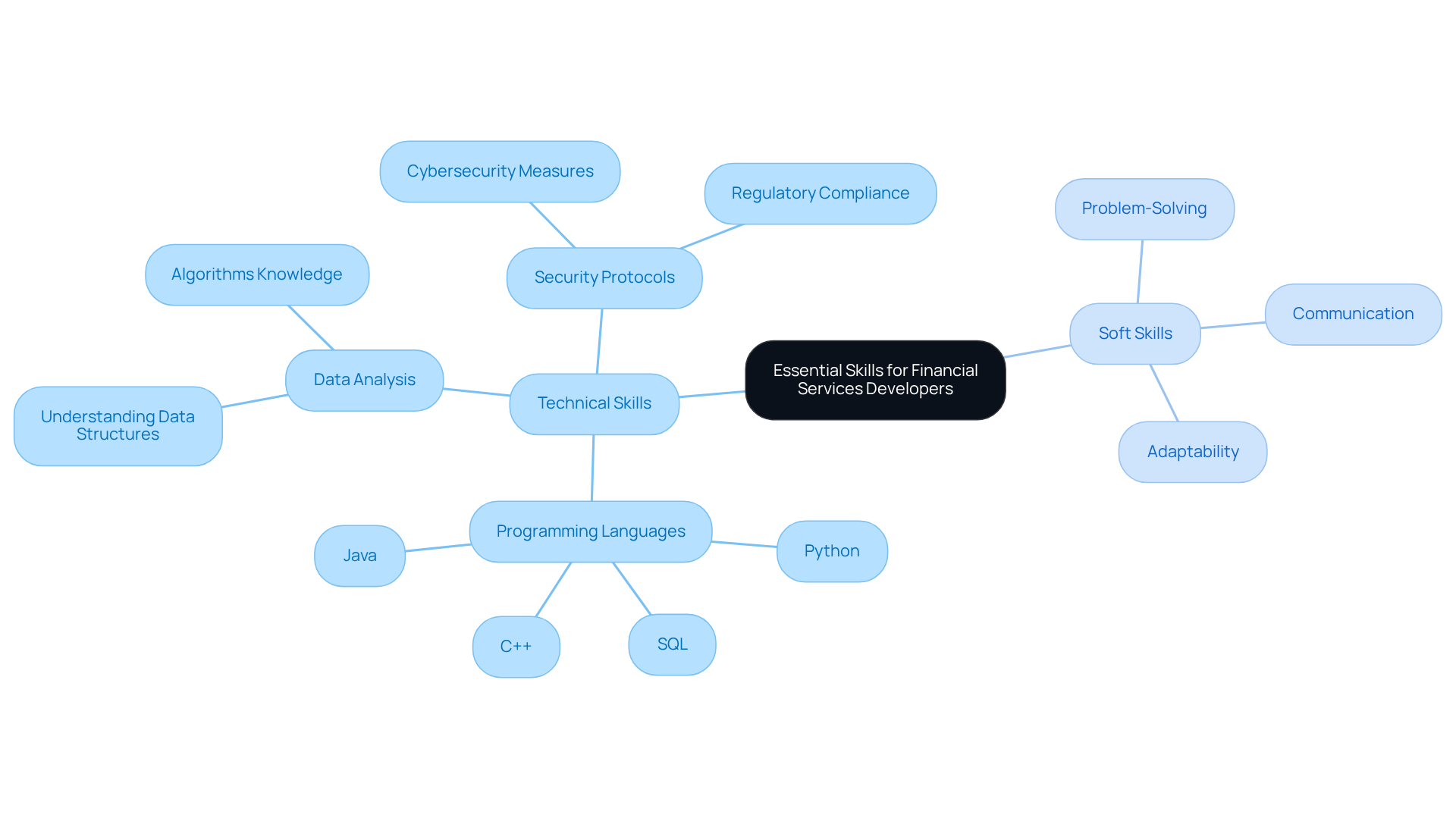

Developers in the finance services sector, particularly those engaged with hedge funds, must possess a distinctive combination of technical and soft skills. The essential technical skills include:

- Programming Languages: Proficiency in languages such as Python, Java, C++, and SQL is crucial for developing complex financial applications. SQL, in particular, is widely utilized in the economic sector for extracting specific data from databases, making it a vital skill for developers.

- Data Analysis: A solid understanding of data structures and algorithms is necessary for creating effective software capable of managing substantial amounts of monetary data. This expertise in development software allows developers to optimize performance and ensure accuracy in financial computations.

- Security Protocols: Knowledge of cybersecurity measures is imperative to protect sensitive financial information from breaches. Developers must implement robust security protocols to safeguard client data and comply with regulatory standards, especially in light of the increasing number of data breaches in various sectors, underscoring the importance of security in all financial applications.

In addition to technical skills, soft skills such as effective communication, problem-solving, and adaptability are equally significant. Developers must collaborate with financial analysts and stakeholders to ensure that the software aligns with business needs and regulatory requirements. This blend of skills enables developers to create development software that is not only functional but also aligned with the strategic objectives of investment firms. Furthermore, with 87% of organizations facing skills gaps, the demand for well-rounded developers in the finance services sector is more critical than ever. As the AI in FinTech market is projected to expand from $30 billion in 2025 to over $83 billion by 2030, the need for skilled developers will continue to escalate.

Examine the Impact of AI on Software Development Practices

Artificial Intelligence (AI) is significantly transforming development software methods within the financial services industry, particularly for investment firms. By 2026, adoption rates of AI technologies are expected to rise considerably, with over 30% of investment firms planning to enhance their AI infrastructure. As Mahesh Chandra, senior vice president at Wipro, observes, “AI only moves the needle when it’s adopted with intention and aligned to actual business outcomes.” These technologies automate routine tasks, enhance data analysis, and improve decision-making processes. For instance, AI-driven algorithms can analyze extensive datasets to identify market trends and predict price changes, enabling investment firms to make more informed decisions.

Moreover, AI can streamline compliance procedures by automating the monitoring of regulatory updates, ensuring that solutions remain compliant. However, the integration of AI also introduces challenges, such as the necessity for robust data governance frameworks and the risk of algorithmic bias. The case study on AI-driven transformation in banking illustrates that organizations prioritizing AI as a foundational capability can achieve significant operational efficiencies and competitive advantages.

As investment groups navigate these complexities, the impact of AI on development software practices becomes increasingly pronounced, presenting both opportunities for innovation and risks that require careful management. The ongoing evolution of AI in this sector highlights the imperative for hedge funds to adapt and leverage these technologies to enhance their operational efficiency and decision-making capabilities.

Conclusion

The exploration of development software solutions for hedge funds underscores the pivotal role technology plays in achieving success within the financial services sector. As investment firms navigate intricate regulatory landscapes and strive to enhance operational efficiency, the selection of appropriate software emerges as a strategic necessity. Tailored applications can significantly elevate returns on investment, making it imperative for hedge funds to invest in robust technological solutions that cater to their specific requirements.

Key insights derived from the comparison of leading software solutions, such as FIS Hedge Fund Portfolio Manager, Addepar, and TrendSpider, highlight the diverse functionalities and trade-offs associated with each option.

- FIS excels in real-time portfolio management

- Addepar stands out in data analytics

- TrendSpider provides advanced trading tools

Recognizing these distinctions empowers investment groups to make informed decisions aligned with their operational needs and expertise levels.

As the financial landscape continues to evolve, particularly with the integration of AI technologies, the demand for skilled developers possessing both technical and soft skills is set to intensify. Investment firms must prioritize not only the selection of effective software but also the cultivation of talent capable of leveraging these tools to foster innovation and sustain a competitive edge. Embracing this dual focus on technology and human expertise is essential for hedge funds aiming to thrive in an increasingly complex market.

Frequently Asked Questions

What is software development in financial services?

Software development in financial services refers to the design and implementation of applications and systems that enhance the management, analysis, and reporting of monetary data within the banking sector.

What are some key functionalities of software development in the banking sector?

Key functionalities include portfolio management, risk assessment, compliance tracking, and transaction processing.

Why do hedge funds require specialized technological solutions?

Hedge funds need technological solutions that meet rigorous performance and scalability standards while adhering to stringent regulatory requirements.

How does the software development process in financial services work?

The development process typically involves close collaboration with financial specialists to ensure applications align with current market trends and effective risk management practices.

Why is security important in software development for financial services?

Security is crucial due to the sensitivity of financial data, requiring robust protection against breaches and fraud to safeguard sensitive information and comply with industry regulations.

What challenges do investment executives face regarding data management?

92% of investment executives report spending excessive time consolidating and integrating data from multiple sources, highlighting the need for efficient technological solutions to enhance operational effectiveness.

How is cybersecurity integrated into application development in financial services?

Integrating security measures into application development is essential for safeguarding sensitive information and ensuring compliance with industry regulations, especially as cybersecurity becomes increasingly critical.