4 Best Practices for Effective Credit Scoring Solutions

Introduction

Understanding the complexities of credit scoring is crucial in today’s lending environment, where financial decisions can profoundly affect individuals’ lives. Lenders are increasingly seeking accurate assessments of creditworthiness, making it essential to explore best practices in credit scoring solutions. Organizations can adopt innovative strategies to enhance precision, ensure compliance, and promote fair lending practices. This article examines the most effective approaches to credit scoring, offering insights that empower financial institutions to successfully navigate this intricate landscape.

Understand Different Credit Scoring Models

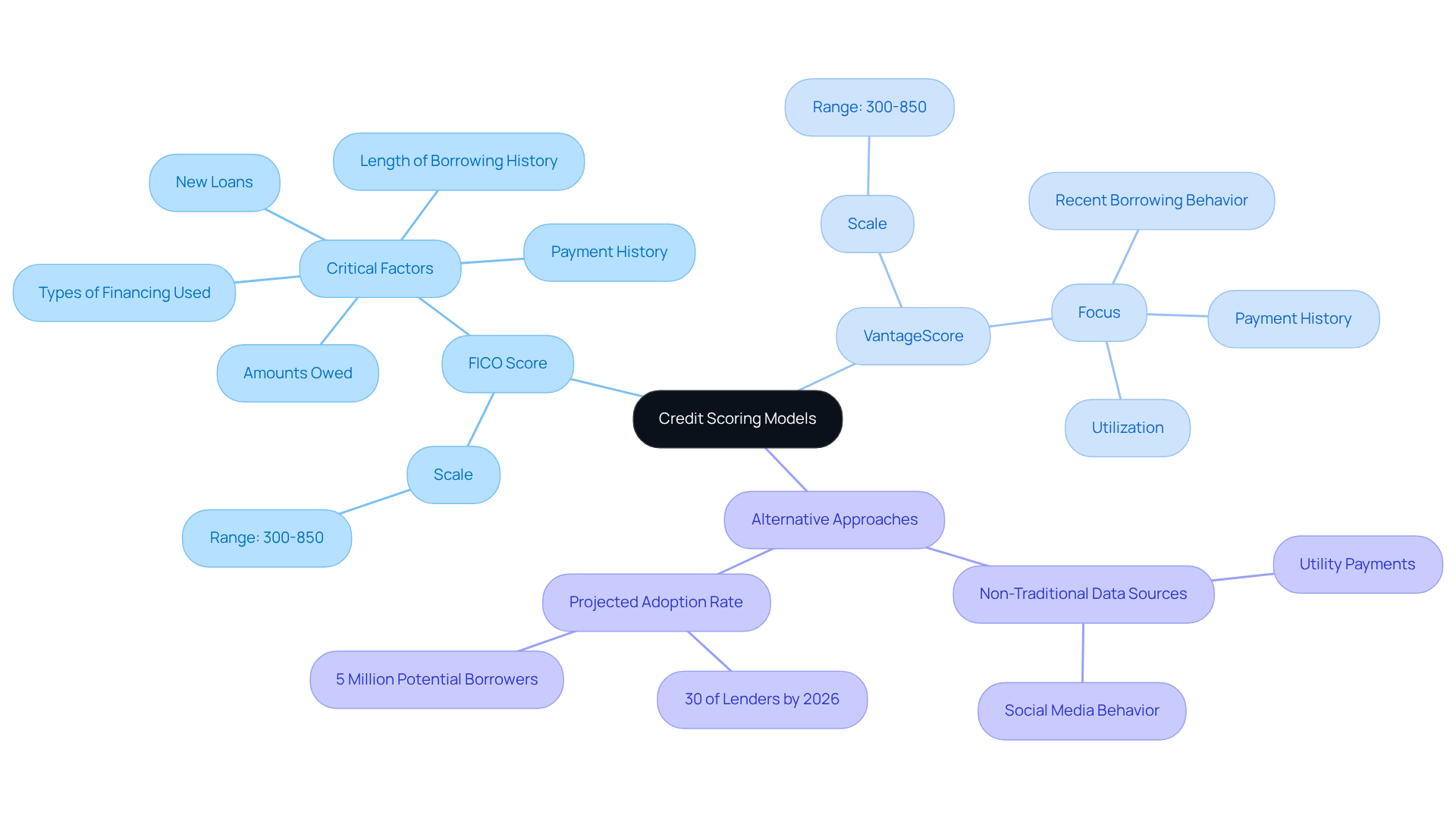

Credit assessment frameworks serve as essential tools for lenders to evaluate borrowers’ creditworthiness with a credit scoring solution. The two most recognized frameworks are FICO and VantageScore, each employing distinct methodologies and evaluation ranges.

-

FICO Score: This system operates on a scale from 300 to 850, grounded in five critical factors: payment history, amounts owed, length of borrowing history, new loans, and types of financing used. It stands as the predominant assessment system in the United States, influencing lending decisions for millions of individuals.

-

VantageScore: Developed by the three major reporting agencies, this system also ranges from 300 to 850 but utilizes a different evaluation approach. It emphasizes recent borrowing behavior and incorporates factors such as payment history and utilization, providing a more current overview of a borrower’s financial habits.

-

Alternative Approaches: The rise of fintech has led to the emergence of alternative scoring systems that leverage non-traditional data sources, including utility payments and social media behavior, to assess creditworthiness. These frameworks can shed light on individuals who may lack conventional financial histories. VantageScore estimates that approximately 5 million potential borrowers will benefit from these innovative credit modeling techniques.

By 2026, it is projected that around 30% of lenders will adopt these alternative evaluation systems, signaling a shift towards more inclusive lending practices. Understanding these various models allows financial organizations to choose the most appropriate credit scoring solution for their target demographics, which leads to more accurate risk assessments and informed lending decisions. This adaptability is crucial in a rapidly evolving financial landscape, where consumer behavior and lending dynamics are in constant flux. Additionally, updates to the Fair Credit Reporting Act will enhance consumer protections, including expedited dispute timelines and improved documentation standards for errors, further shaping the lending evaluation environment.

Leverage AI and Machine Learning for Enhanced Accuracy

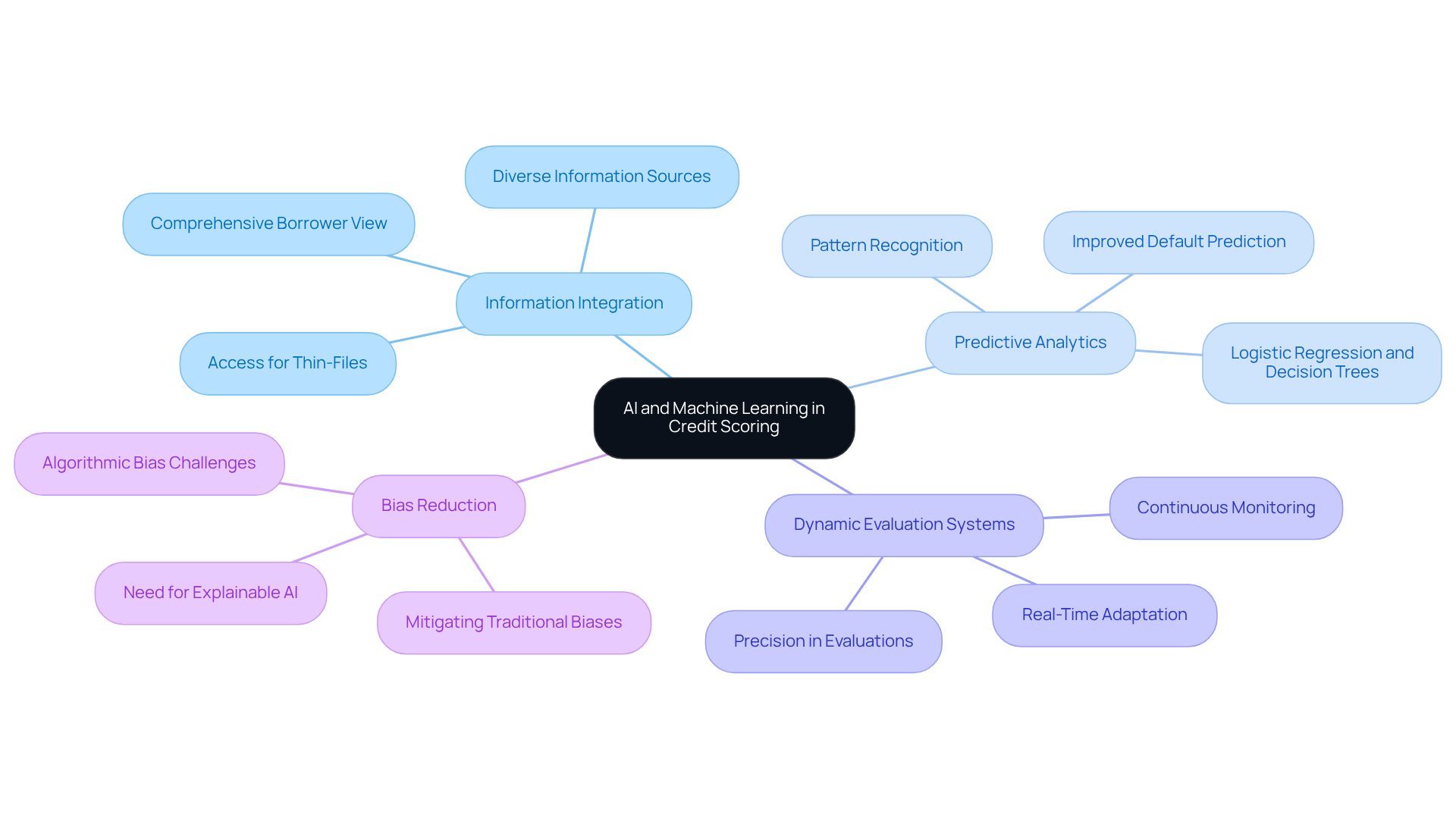

Artificial Intelligence (AI) and Machine Learning (ML) are revolutionizing credit scoring solutions by enhancing precision and effectiveness. Key strategies for leveraging these technologies include:

-

Information Integration: AI can analyze diverse information sources, such as transaction history, social media activity, and behavioral insights, to construct a comprehensive view of a borrower’s creditworthiness. This broader information set acts as a credit scoring solution that facilitates the evaluation of borrowers with limited financial histories, thereby improving access to funding for those previously overlooked.

-

Predictive Analytics: Machine learning algorithms are adept at identifying patterns in historical data to predict future financial behavior. For example, logistic regression and decision trees are frequently employed to assess the likelihood of default. AI development expert Olivia Robinson notes, ‘The credit scoring solution using AI represents a fundamental advancement in lending technology,’ as it can predict defaults with greater accuracy than traditional scores, ultimately reducing losses.

-

Dynamic Evaluation Systems: In contrast to fixed systems, AI-driven assessment frameworks can adapt in real-time to changes in a borrower’s financial condition, enabling more precise evaluations. Continuous monitoring of these systems is vital to ensure ongoing accuracy and fairness, as highlighted in recent studies.

-

Bias Reduction: AI has the potential to mitigate biases inherent in traditional evaluation models by incorporating a broader range of data points, thus fostering fairer lending practices. However, it is essential to address potential challenges, such as algorithmic bias and the necessity for explainable AI, to maintain trust in these systems.

The integration of AI and ML in loan assessment acts as a credit scoring solution that not only enhances precision but also streamlines the decision-making process, empowering lenders to make quicker and more informed lending choices. For instance, Pagaya has authorized over $38 billion in consumer financing that would have otherwise been declined, illustrating the practical application of AI in expanding access to funding.

Ensure Compliance with Regulatory Standards

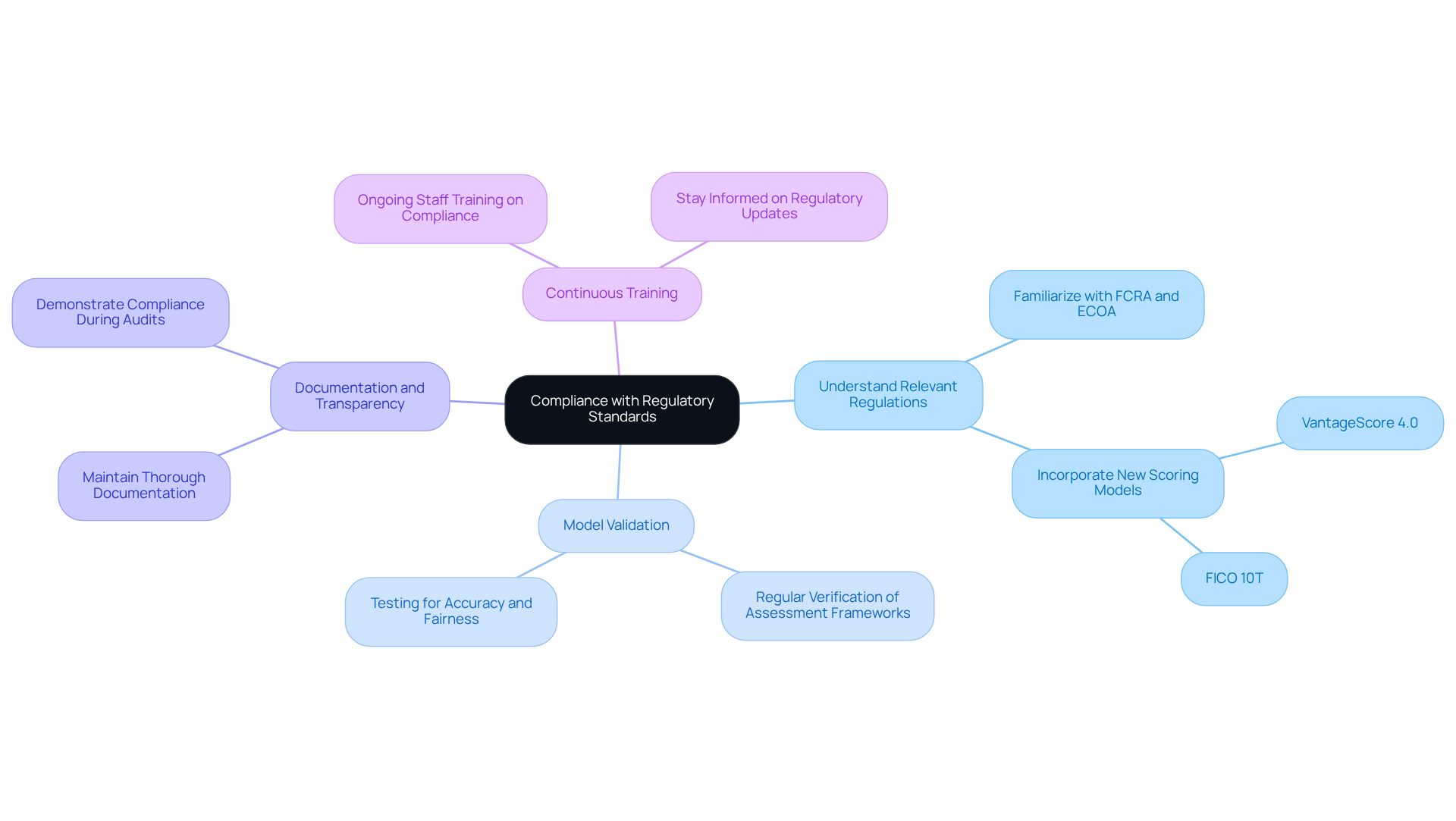

Adherence to regulatory standards is crucial in the development and execution of a credit scoring solution. To ensure compliance, consider the following best practices:

-

Understand Relevant Regulations: Familiarize yourself with regulations such as the Fair Reporting Act (FCRA) and the Equal Opportunity Act (ECOA), which govern reporting and lending practices. Recent updates to the FCRA, effective in 2026, highlight the necessity for financial institutions to modify their assessment techniques. This includes incorporating newer versions like VantageScore 4.0 and FICO 10T, scheduled for introduction in early 2026, which take into account a wider array of borrower information.

-

Model Validation: Regularly verify assessment frameworks to ensure they meet recognized professional standards. This verification includes testing for accuracy, fairness, and compliance with legal requirements. Organizations should implement optimal methods for assessment validation within their credit scoring solution, ensuring that their evaluation systems remain robust and dependable, especially as the loan evaluation environment evolves.

-

Documentation and Transparency: Maintain thorough documentation of the rating process, including data sources, model development, and validation procedures. Transparency is essential for demonstrating compliance during audits and can help mitigate risks associated with regulatory scrutiny.

-

Continuous Training: Provide ongoing training for staff on compliance issues and updates to regulations. This ensures that all participants in the evaluation process are aware of their responsibilities and the importance of adherence. As the FCRA evolves, staying informed about changes will enhance the institution’s ability to navigate the regulatory landscape effectively.

By prioritizing compliance, financial institutions can mitigate risks and enhance their reputation in the marketplace. Notably, FCRA litigation filings have increased by 37.4% from January to November 2025 compared to the same period in 2024, underscoring the growing scrutiny in this area. As Timothy St. George, a partner at Troutman Pepper Locke, notes, “At the state level, legislation continues to move forward in ways that will affect consumer reporting agencies and the users of their services.” Furthermore, beginning in April 2026, New York will ban most employers from utilizing an applicant’s or employee’s financial history for employment-related decisions, a notable regulatory change that may affect compliance strategies.

Implement Continuous Monitoring and Model Adjustment

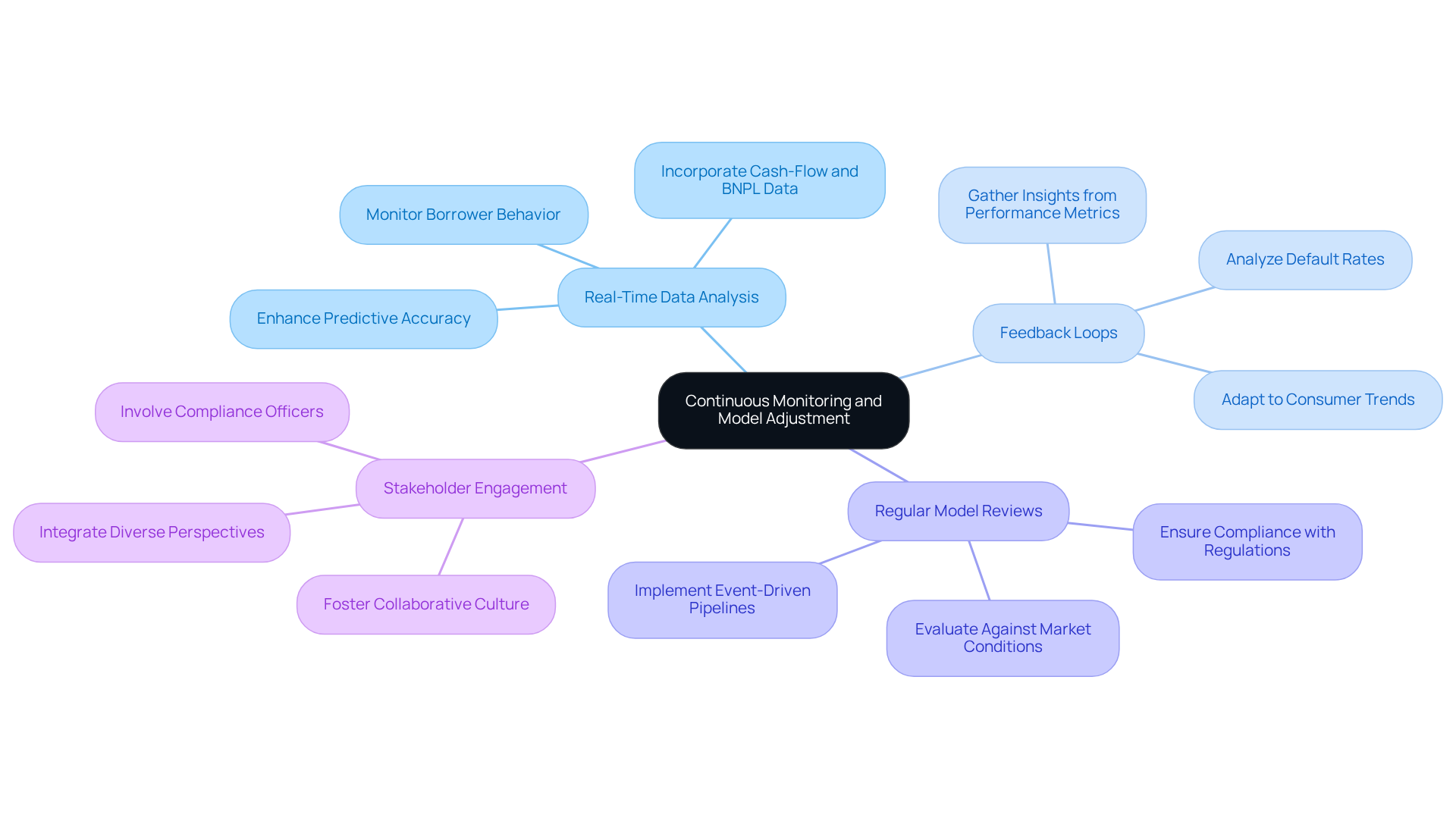

Ongoing observation and modification of credit assessment systems are essential for maintaining their efficiency in a rapidly evolving financial landscape. The following best practices outline an effective approach to this process:

-

Real-Time Data Analysis: Utilize real-time data analytics to monitor borrower behavior and market dynamics. This enables timely adjustments to evaluation models, ensuring they reflect emerging trends and enhance predictive accuracy. For example, incorporating cash-flow and Buy Now Pay Later (BNPL) information into credit scoring systems allows lenders to better evaluate repayment capacity, particularly for thin-file borrowers. As highlighted by GlobalData, “Real-time analytics adoption will surge as institutions modernize data pipelines and governance to support risk, fraud, onboarding, and personalization.”

-

Feedback Loops: Implement robust feedback systems to gather insights from performance metrics. Analyzing default rates and borrower repayment behaviors helps identify areas for improvement, ensuring that systems adapt to changing consumer trends and economic conditions. This aligns with the forecast that by 2026, compliance will evolve to become proactive and integrated with autonomous risk engines.

-

Regular Model Reviews: Conduct regular evaluations of credit scoring models to assess their performance against current market conditions and regulatory requirements. Necessary modifications should be made to maintain accuracy and compliance, particularly as organizations move towards event-driven pipelines and streaming frameworks that enhance data ownership and decision-making speed. By 2026, institutions are expected to decisively adopt these modern data strategies.

-

Stakeholder Engagement: Engage key stakeholders, including compliance officers and risk managers, in the monitoring process. Their insights are vital for ensuring that diverse perspectives are considered in adjustments, fostering a collaborative culture that enhances reliability. As the financial landscape continues to evolve, the integration of varied viewpoints in decision-making processes remains critical.

By embracing continuous monitoring and model adjustment practices, financial institutions can significantly enhance the reliability of their credit scoring solution, leading to more informed lending decisions and reduced risk.

Conclusion

Understanding and implementing effective credit scoring solutions is essential for financial institutions that seek to enhance their lending practices and expand their reach. By examining various credit scoring models, utilizing advanced technologies such as AI and machine learning, ensuring regulatory compliance, and committing to ongoing monitoring, organizations can significantly enhance their credit assessment processes.

This article explores the nuances of different credit scoring models, including the widely recognized FICO and VantageScore systems, while also highlighting the rise of alternative approaches designed for underserved borrowers. It underscores the pivotal role of AI and machine learning in improving the accuracy and fairness of credit scoring, alongside the imperative for compliance with evolving regulations to mitigate risks and uphold trust.

Ultimately, integrating these best practices not only facilitates more informed lending decisions but also fosters inclusivity within the financial landscape. As institutions adapt to shifting consumer behaviors and regulatory requirements, prioritizing these strategies will be crucial for success in a competitive environment. Embracing innovation and adhering to compliance will enhance credit scoring solutions and empower lenders to make more equitable decisions that benefit both borrowers and the broader economy.

Frequently Asked Questions

What are the main credit scoring models discussed in the article?

The main credit scoring models discussed are FICO and VantageScore.

How does the FICO Score work?

The FICO Score operates on a scale from 300 to 850 and is based on five critical factors: payment history, amounts owed, length of borrowing history, new loans, and types of financing used.

What is the range of the VantageScore and how does it evaluate creditworthiness?

The VantageScore also ranges from 300 to 850 and emphasizes recent borrowing behavior, incorporating factors such as payment history and utilization to provide a current overview of a borrower’s financial habits.

What alternative credit scoring approaches have emerged due to fintech?

Alternative scoring systems have emerged that use non-traditional data sources, such as utility payments and social media behavior, to assess creditworthiness, particularly for individuals lacking conventional financial histories.

How many potential borrowers could benefit from alternative credit modeling techniques according to VantageScore?

Approximately 5 million potential borrowers could benefit from these innovative credit modeling techniques.

What is projected about the adoption of alternative evaluation systems by lenders by 2026?

By 2026, it is projected that around 30% of lenders will adopt alternative evaluation systems, indicating a shift towards more inclusive lending practices.

Why is understanding different credit scoring models important for financial organizations?

Understanding these models allows financial organizations to choose the most appropriate credit scoring solution for their target demographics, leading to more accurate risk assessments and informed lending decisions.

What updates to the Fair Credit Reporting Act are mentioned in the article?

Updates to the Fair Credit Reporting Act will enhance consumer protections, including expedited dispute timelines and improved documentation standards for errors.