Compare 4 Key Banking Software Vendors for Hedge Fund Success

Introduction

In the competitive landscape of hedge funds, selecting the right banking software is crucial for enhancing operational efficiency and achieving investment success. Given the multitude of vendors that provide a range of features, it is essential to grasp the key functionalities – such as portfolio management, risk assessment, and compliance support. As firms navigate this intricate environment, a critical question emerges: how do these vendors compare regarding pricing models, performance metrics, and overall value? This article presents a comparative analysis of four prominent banking software vendors, offering insights that can assist hedge funds in making well-informed decisions regarding their technological investments.

Identify Key Features of Banking Software Vendors

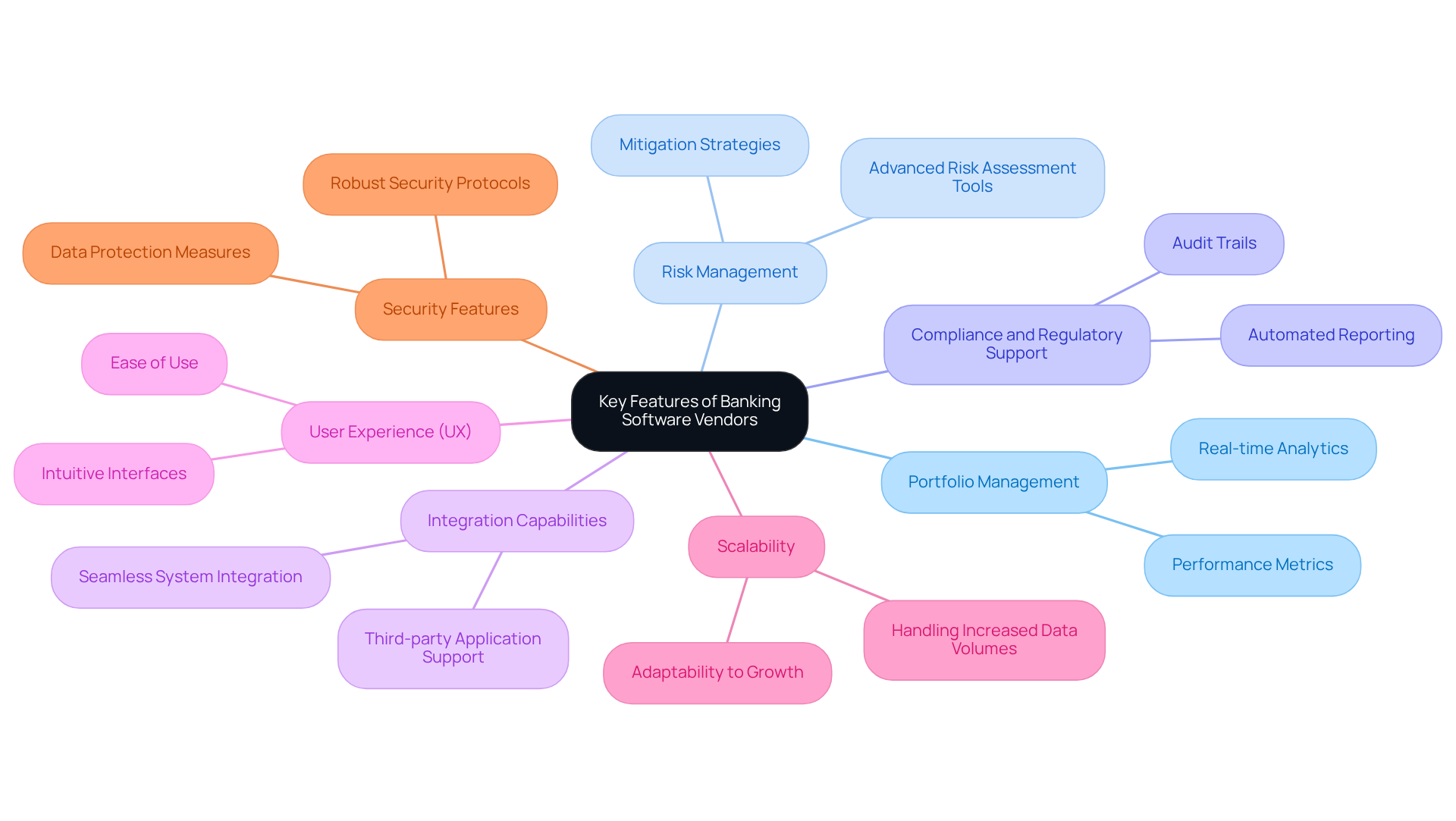

When evaluating banking software vendors, several key features emerge as essential for hedge fund operations:

-

Portfolio Management: Effective tools for tracking and managing investment portfolios are crucial. These include real-time analytics and performance metrics that provide insights into portfolio performance.

-

Risk Management: Advanced risk assessment tools play a vital role in assisting hedge groups. They help identify and mitigate potential financial risks, ensuring informed decision-making.

-

Compliance and Regulatory Support: Features that ensure adherence to financial regulations are indispensable. This includes automated reporting and audit trails that facilitate compliance and transparency.

-

Integration Capabilities: The ability to seamlessly integrate with existing systems and third-party applications enhances operational efficiency. This integration is essential for streamlining processes and improving data flow.

-

User Experience (UX): Intuitive interfaces are necessary for promoting ease of use among asset managers and analysts. A positive user experience can significantly impact productivity and decision-making.

-

Scalability: Solutions must be scalable, allowing them to expand with the organization’s needs. This adaptability is crucial for accommodating increasing data volumes and user demands.

-

Security Features: Robust security protocols are imperative to protect sensitive financial data from breaches and unauthorized access. Ensuring data security is a top priority for investment firms.

These attributes are essential for investment firms as they navigate complex financial landscapes and regulatory environments, particularly when working with banking software vendors.

Analyze Pricing Models of Leading Banking Software

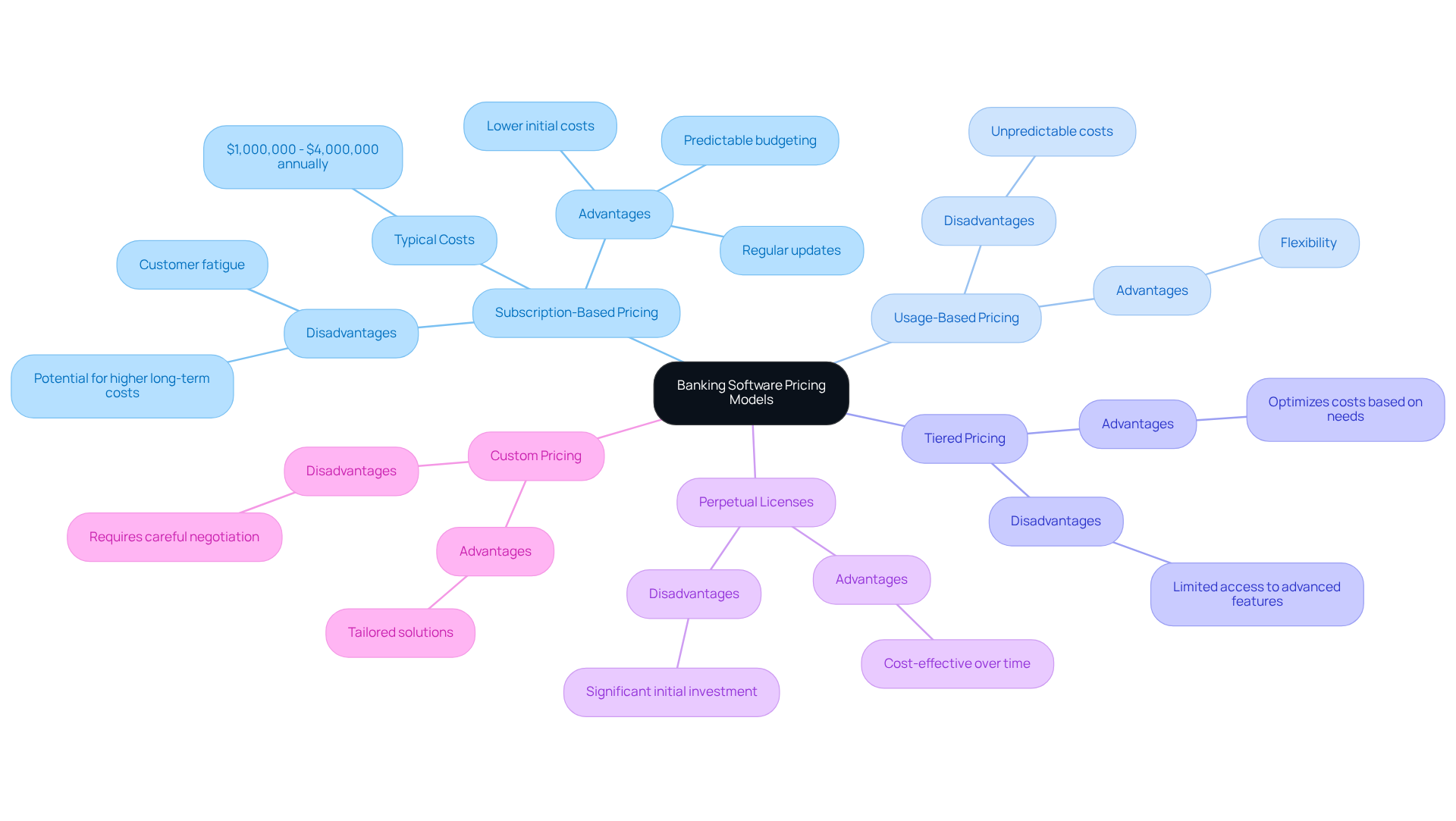

The total expenses incurred by investment groups are significantly influenced by the pricing structures of banking software vendors. Understanding these models is crucial for aligning technological investments with financial strategies. Below are some common pricing structures:

-

Subscription-Based Pricing: Many vendors provide monthly or annual subscriptions, which facilitate predictable budgeting and lower initial costs. This model has gained popularity due to its accessibility, enabling investment firms to utilize advanced systems without substantial upfront payments. However, if banking software vendors do not manage it carefully, it may lead to higher long-term costs. For instance, the projected expense for investment management systems typically ranges from $1,000,000 to $4,000,000 USD annually, a factor that hedge organizations must incorporate into their budgeting.

-

Usage-Based Pricing: This model charges based on actual software usage, making it suitable for organizations with varying needs. While it offers flexibility, it can result in unpredictable costs, particularly during periods of heightened activity.

-

Tiered Pricing: Tiered pricing offered by banking software vendors often presents various service levels, allowing organizations to select packages that align with their size and requirements. While this can optimize costs, it may limit access to advanced features that could enhance operational efficiency.

-

Perpetual Licenses: Some banking software vendors impose a one-time fee for perpetual licenses, which can be cost-effective over time. However, this approach typically requires a significant initial investment, which may not be feasible for all investment firms.

-

Custom Pricing: Larger investment groups may negotiate custom pricing based on specific needs, allowing for tailored solutions. This method can lead to better alignment with functional requirements but necessitates careful negotiation to ensure value.

By evaluating these pricing models, investment groups can make informed decisions that align with their financial objectives and functional needs. As Alan Goodrich observes, “For those operating in the financial services sector, the regulators continue to pile on the pressure with a wave of new challenges in the pipeline to add to those already implemented.” This underscores the importance of comprehending the total cost of ownership and the implications of each pricing model.

Evaluate Performance Metrics of Banking Software Solutions

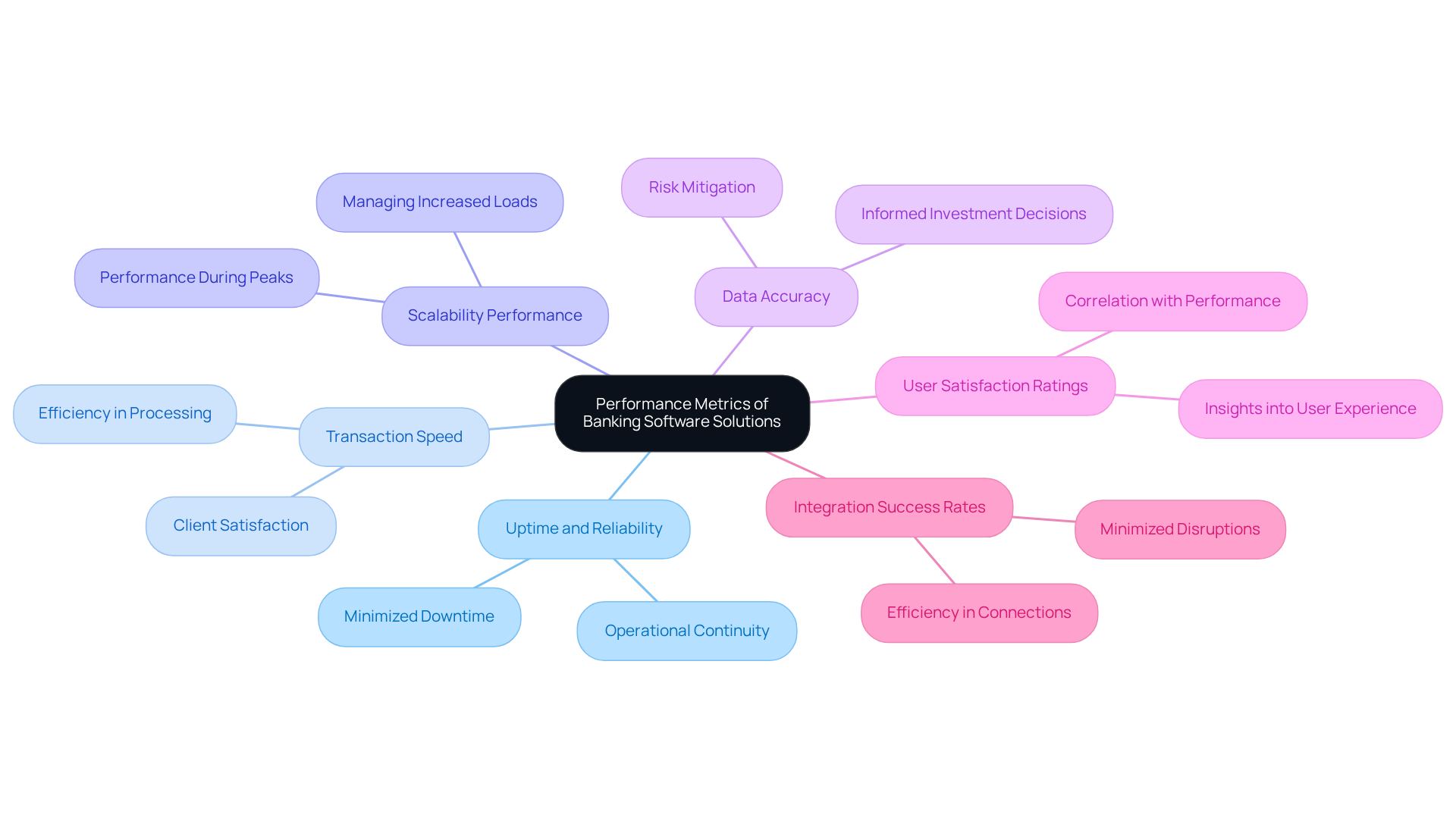

When evaluating banking software solutions, hedge funds must prioritize several key performance metrics that directly impact their operations.

-

Uptime and Reliability is a critical metric, indicating the percentage of time the application remains operational. This is essential for ensuring uninterrupted trading and operational continuity. A high uptime percentage minimizes the risk of downtime during critical trading periods.

-

Transaction Speed is another vital factor. The efficiency of transaction processing is crucial, as delays can hinder trading effectiveness and negatively affect client satisfaction. Rapid transaction speeds enable investment groups to capitalize on market opportunities swiftly.

-

Scalability Performance refers to the software’s ability to manage increased loads, particularly during peak trading times. Effective scalability ensures that investment pools can maintain performance levels, even as trading volumes fluctuate.

-

Data Accuracy is fundamental for informed investment decisions. Software that delivers precise and reliable data helps hedge funds mitigate risks and enhance their strategic planning.

-

User Satisfaction Ratings provide insights into user experiences with the application, revealing potential strengths and weaknesses. Elevated user satisfaction often correlates with improved performance results and fewer issues. As of 2025, the average Customer Satisfaction Score (CSAT) in the banking and financial services sector is 79%, serving as a benchmark for user satisfaction ratings.

-

Integration Success Rates reflect the application’s efficiency in connecting with existing systems, which is vital for overall functional effectiveness. Successful integration minimizes disruptions and enhances workflow.

These performance metrics form a comprehensive framework for hedge funds to evaluate banking solutions, aligning them with their operational needs and performance expectations. Incorporating insights from industry experts, such as Samantha Mehra’s assertion that a good CSAT score for banks falls between 75% to 85%, can further strengthen the evaluation process. Additionally, case studies like Rogue Credit Union’s 20% rise in scheduled appointments through efficient data analysis illustrate the tangible benefits of reliable banking systems.

Compare Strengths and Weaknesses of Banking Software Vendors

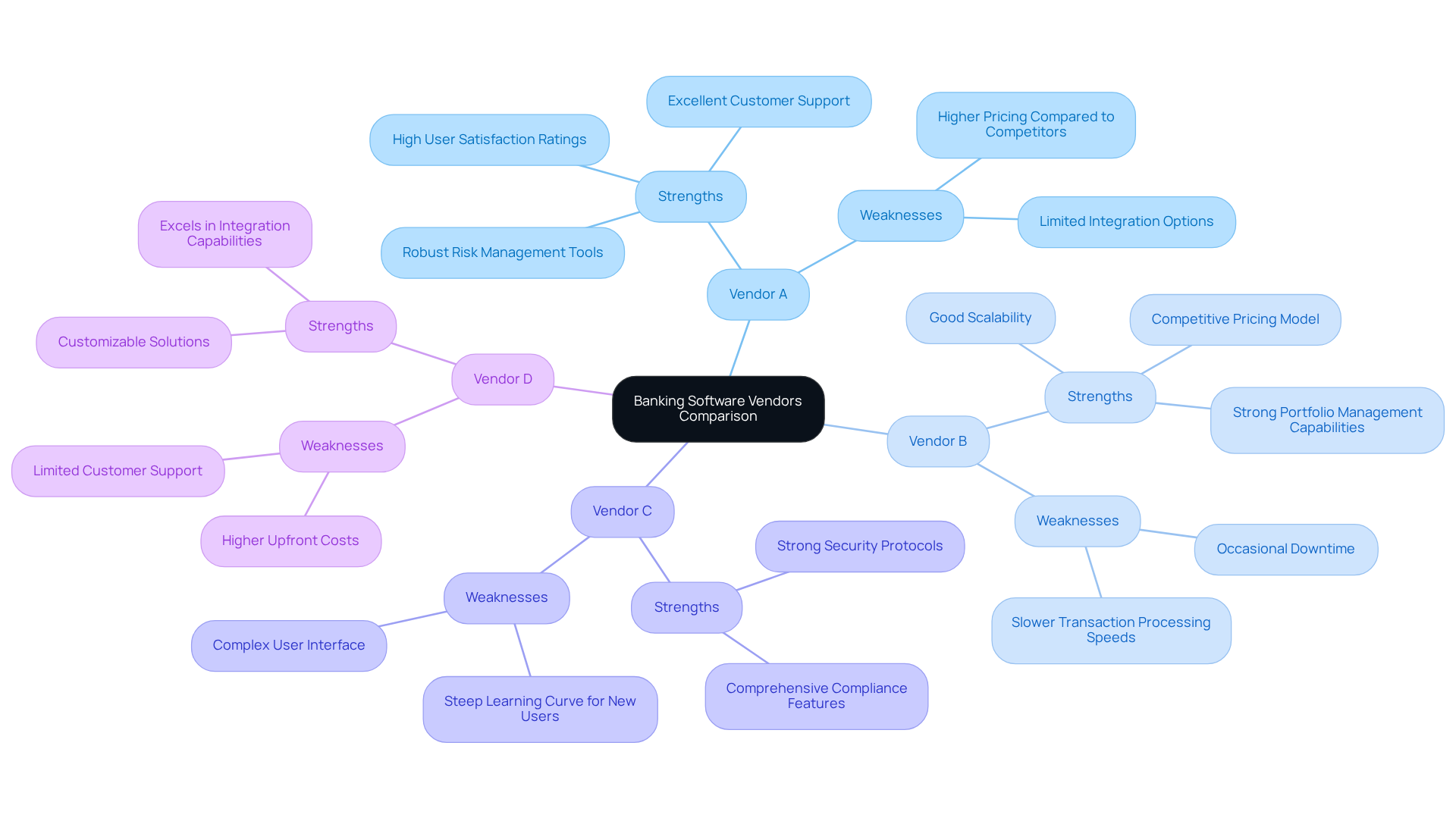

A comparative analysis of banking software vendors reveals distinct strengths and weaknesses that can guide hedge funds in their decision-making process:

-

Vendor A:

- Strengths: This vendor offers robust risk management tools, excellent customer support, and high user satisfaction ratings.

- Weaknesses: However, it has higher pricing compared to competitors and limited integration options.

-

Vendor B:

- Strengths: Vendor B features a competitive pricing model, strong portfolio management capabilities, and good scalability.

- Weaknesses: On the downside, it experiences slower transaction processing speeds and occasional downtime.

-

Vendor C:

- Strengths: This vendor is noted for its comprehensive compliance features and strong security protocols.

- Weaknesses: Nevertheless, it presents a complex user interface and a steep learning curve for new users.

-

Vendor D:

- Strengths: Vendor D excels in integration capabilities and offers customizable solutions.

- Weaknesses: Conversely, it has limited customer support and higher upfront costs.

This comparison serves as a valuable tool for hedge funds to identify which banking software vendors align best with their operational needs and strategic goals.

Conclusion

Evaluating the right banking software vendor is essential for hedge funds seeking operational success. Key features such as portfolio management, risk assessment, compliance support, and integration capabilities play a significant role in influencing performance. By grasping these elements, firms can make informed decisions that align their technological investments with strategic objectives.

The article explores various pricing models, underscoring the necessity of selecting a structure that fulfills both financial goals and operational requirements. It highlights critical performance metrics, including uptime, transaction speed, and user satisfaction, which are vital for sustaining a competitive edge in the dynamic financial landscape. A comparative analysis of leading vendors reveals their strengths and weaknesses, assisting hedge funds in identifying the most suitable solutions for their specific needs.

Ultimately, choosing banking software transcends mere functionality; it involves ensuring that the selected vendor can adapt and scale with the market’s evolving demands. As investment firms navigate complex regulatory environments and pursue efficiency, a strategic approach to evaluating banking software vendors will be crucial for achieving long-term success. Engaging with these insights empowers hedge funds to optimize operations and enhance overall performance in the financial sector.

Frequently Asked Questions

What are the key features to look for in banking software vendors for hedge fund operations?

Key features include portfolio management tools, risk management capabilities, compliance and regulatory support, integration capabilities, user experience (UX), scalability, and security features.

Why is portfolio management important in banking software?

Portfolio management tools are crucial for tracking and managing investment portfolios, providing real-time analytics and performance metrics for insights into portfolio performance.

How do risk management tools assist hedge funds?

Advanced risk management tools help identify and mitigate potential financial risks, ensuring informed decision-making for hedge groups.

What role does compliance and regulatory support play in banking software?

Compliance features ensure adherence to financial regulations through automated reporting and audit trails, facilitating compliance and transparency.

Why are integration capabilities significant in banking software?

Integration capabilities enhance operational efficiency by allowing seamless integration with existing systems and third-party applications, streamlining processes and improving data flow.

How does user experience (UX) affect banking software?

An intuitive user interface promotes ease of use for asset managers and analysts, significantly impacting productivity and decision-making.

What is the importance of scalability in banking software solutions?

Scalability allows solutions to expand with the organization’s needs, accommodating increasing data volumes and user demands.

What security features should be prioritized in banking software?

Robust security protocols are essential to protect sensitive financial data from breaches and unauthorized access, making data security a top priority for investment firms.