Introduction

Navigating the intricate landscape of custom software development for hedge funds necessitates a comprehensive understanding of both technological requirements and regulatory obligations. As investment firms increasingly seek tailored software solutions to improve operational efficiency and ensure compliance, the challenge becomes identifying the appropriate vendor capable of fulfilling these essential needs. Hedge funds must consider several critical criteria to ensure they partner with a provider that can address their unique challenges and foster success in a competitive market.

Understand Custom Software Development for Hedge Funds

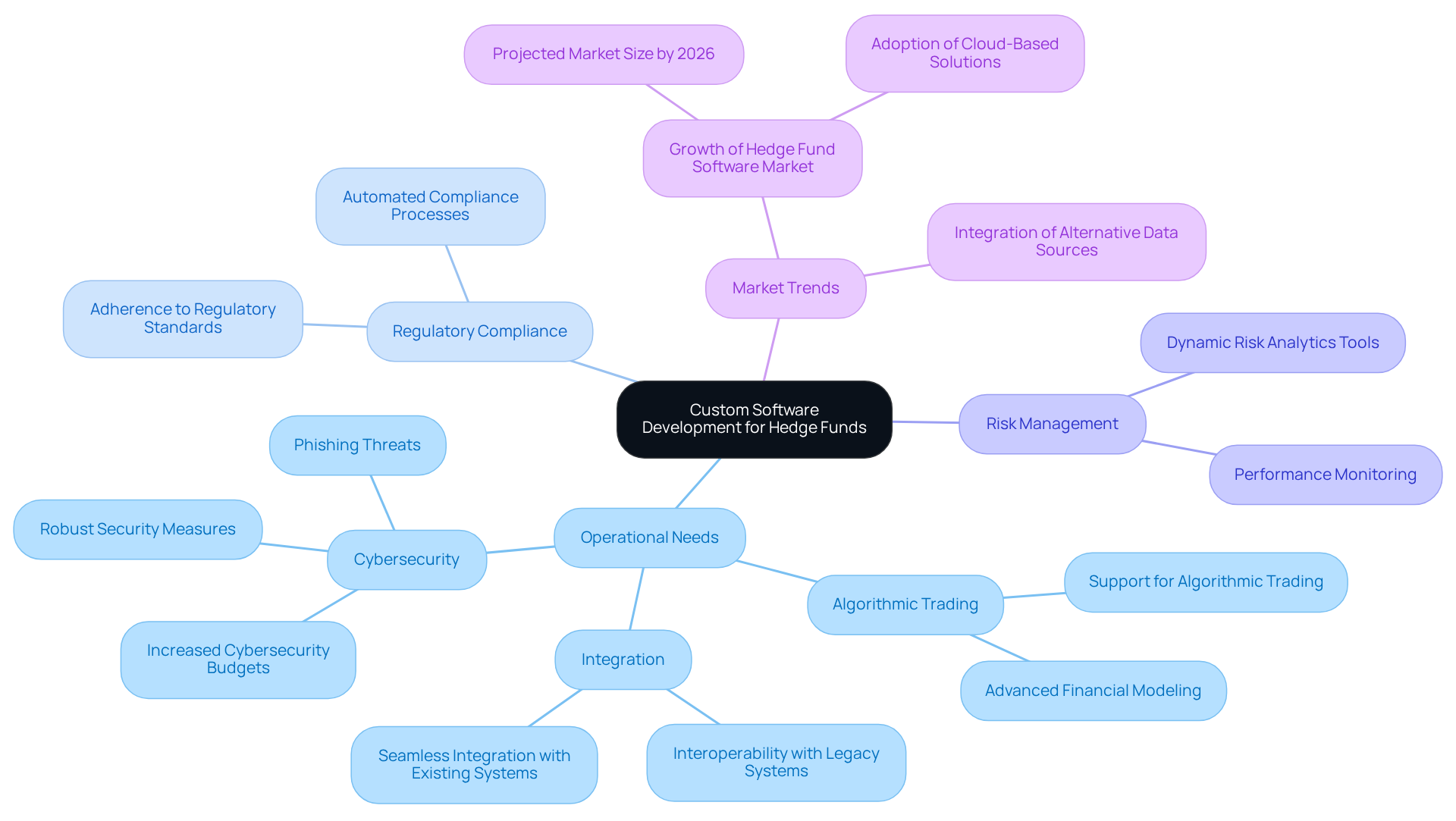

Bespoke software creation for investment companies focuses on developing customized applications that meet specific operational needs, regulatory compliance, and risk management demands. As investment groups increasingly rely on advanced technology, the demand for software capable of managing complex financial modeling, real-time data analysis, and secure transactions has surged. By 2026, the investment management software market is projected to expand significantly, driven by the need for enhanced portfolio management and dynamic risk analytics tools.

When selecting a supplier, key considerations include:

- The software’s ability to integrate seamlessly with existing systems

- Support for algorithmic trading

- Adherence to stringent regulatory standards

Notably, 78% of investment managers have increased their cybersecurity budgets, highlighting the critical importance of robust security measures in software solutions. Furthermore, firms are prioritizing the integration of alternative data sources to enhance performance and differentiation in their investment strategies.

Understanding these components will enable you to articulate your requirements clearly to potential custom software development vendors, ensuring they grasp the unique challenges faced in the investment management landscape. Effective custom software development vendor solutions not only improve operational efficiency but also promote compliance and resilience in a rapidly evolving market environment.

Identify Key Criteria for Vendor Evaluation

When evaluating potential software development vendors, it is essential to consider several key criteria that align with the unique needs of hedge funds:

-

Industry Experience: Prioritize suppliers with a proven track record in the financial services sector, particularly those who have successfully collaborated with investment pools. This experience is crucial as it ensures familiarity with the specific challenges and regulatory requirements of the industry.

-

Technical Expertise: Ensure the supplier possesses proficiency in relevant technologies and programming languages that match your project requirements. As investment groups increasingly adopt advanced technologies, having a supplier skilled in these areas is vital for successful implementation.

-

Regulatory Awareness: The supplier should have a thorough understanding of regulatory obligations specific to investment portfolios, including data protection and reporting criteria. This knowledge is critical to avoid compliance pitfalls that could jeopardize your operations.

-

Scalability: Assess whether the provider can offer solutions that are scalable and can grow with your business. Given the dynamic nature of investment firms, the ability to adapt and expand is a significant advantage.

-

Support and Maintenance: Evaluate the provider’s capacity to deliver ongoing support and updates after deployment. Continuous support is essential to ensure that your software remains functional and compliant with evolving regulations.

Establishing these criteria will streamline your supplier selection process, ensuring alignment with your hedge fund’s objectives and enhancing your operational efficiency by incorporating a custom software development vendor in a competitive landscape.

Research and Shortlist Potential Vendors

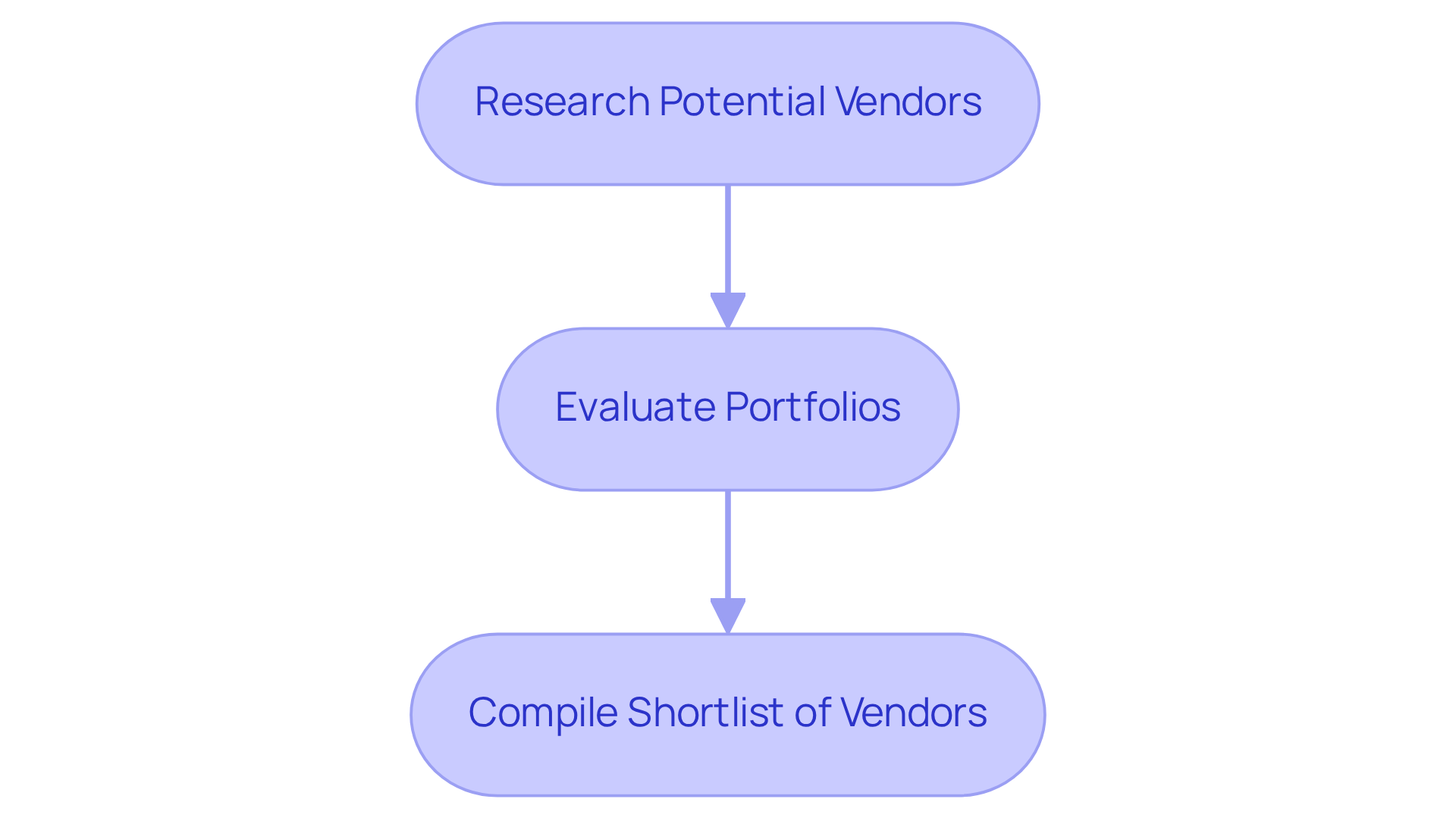

Begin the supplier selection process by leveraging industry networks, online platforms, and professional associations to identify potential custom software development vendors. Resources such as LinkedIn, Clutch.co, and specialized forums offer valuable insights and reviews. Recent statistics indicate that 70% of financial services firms believe that utilizing industry networks significantly enhances their supplier selection process.

After compiling a list of candidates, evaluate their portfolios with a focus on work that aligns with your specific requirements. Seek out case studies that demonstrate their success in the financial services sector, as these examples can illustrate their ability to deliver results. As hedge fund manager John Doe states, ‘Selecting the appropriate supplier is vital; their knowledge can determine the success or failure of your endeavor.’

Following thorough research, compile a shortlist of custom software development vendors that meet your essential criteria, ensuring they possess the necessary experience and expertise to effectively manage your initiative. At Neutech, we enhance this process by collaboratively identifying your needs and providing you with a selection of candidate designers and developers tailored to your specific requirements, ensuring an optimal match for your endeavor.

Evaluate Vendor Capabilities and Track Record

To effectively assess a custom software development vendor’s capabilities, it is crucial to request detailed information regarding their previous work, including client testimonials and case studies. Focus on examining their success rates, particularly for initiatives that mirror your own in terms of scope and complexity. Key metrics to consider include:

- Completion timelines

- Adherence to budgets

- Client satisfaction ratings

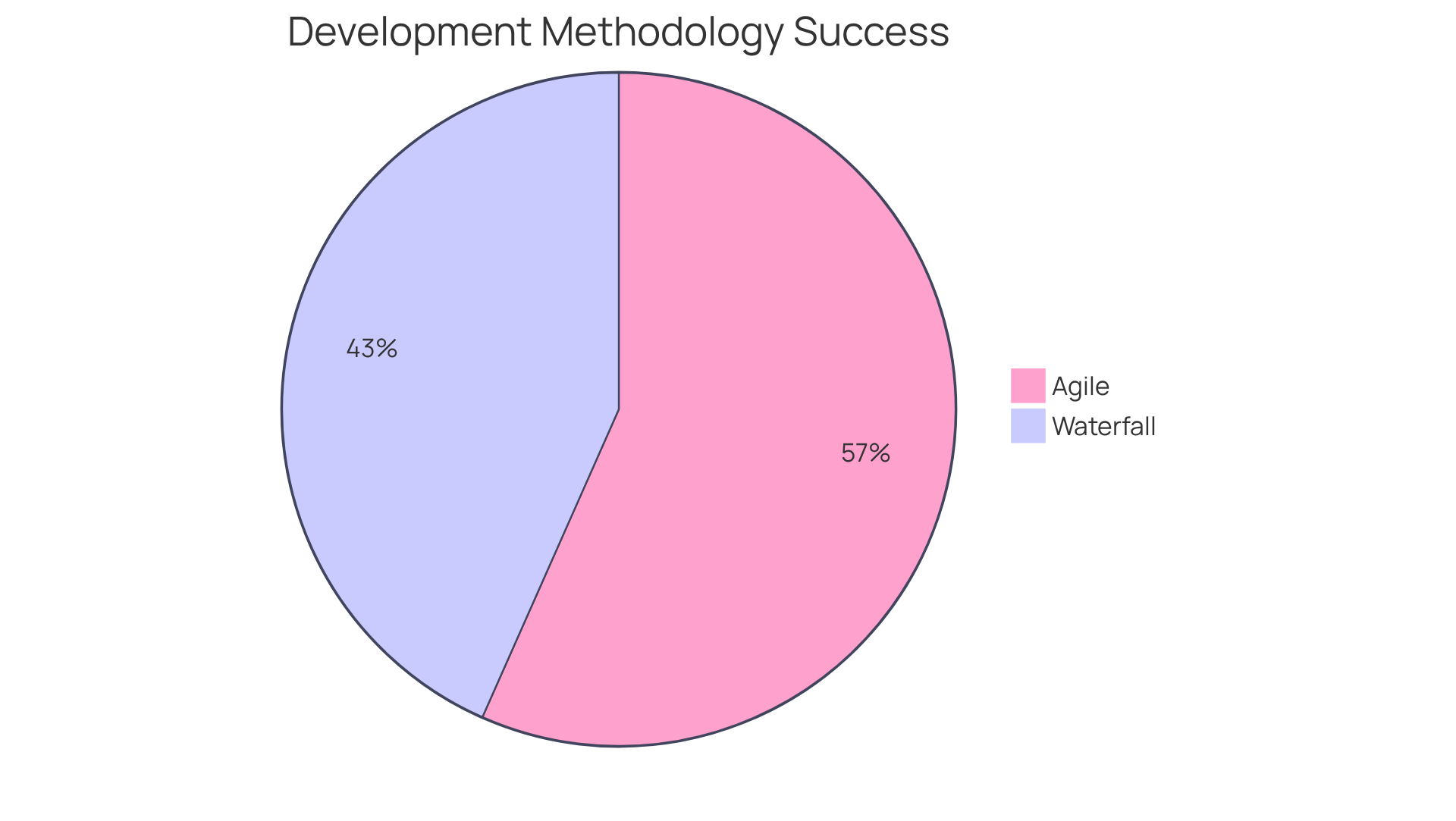

For example, research indicates that Agile initiatives boast a success rate of 64%, significantly surpassing the 49% success rate of Waterfall initiatives. This highlights the importance of development methodologies in achieving favorable outcomes.

Inquire about the supplier’s project management approach, whether they utilize Agile, Waterfall, or a hybrid model, as this will provide insight into their operational efficiency. The established history of a custom software development vendor in delivering high-quality software solutions is essential for instilling confidence in their ability to meet the specific requirements of your hedge fund.

Furthermore, it is vital to stress test supplier assertions through scenario-based demonstrations and peer reference checks, as this can further validate their reliability and effectiveness. Testimonials from satisfied clients, along with insights from financial services specialists regarding provider track records, can enhance your evaluation process, making them an integral part of your selection strategy.

Assess Communication and Collaboration Skills

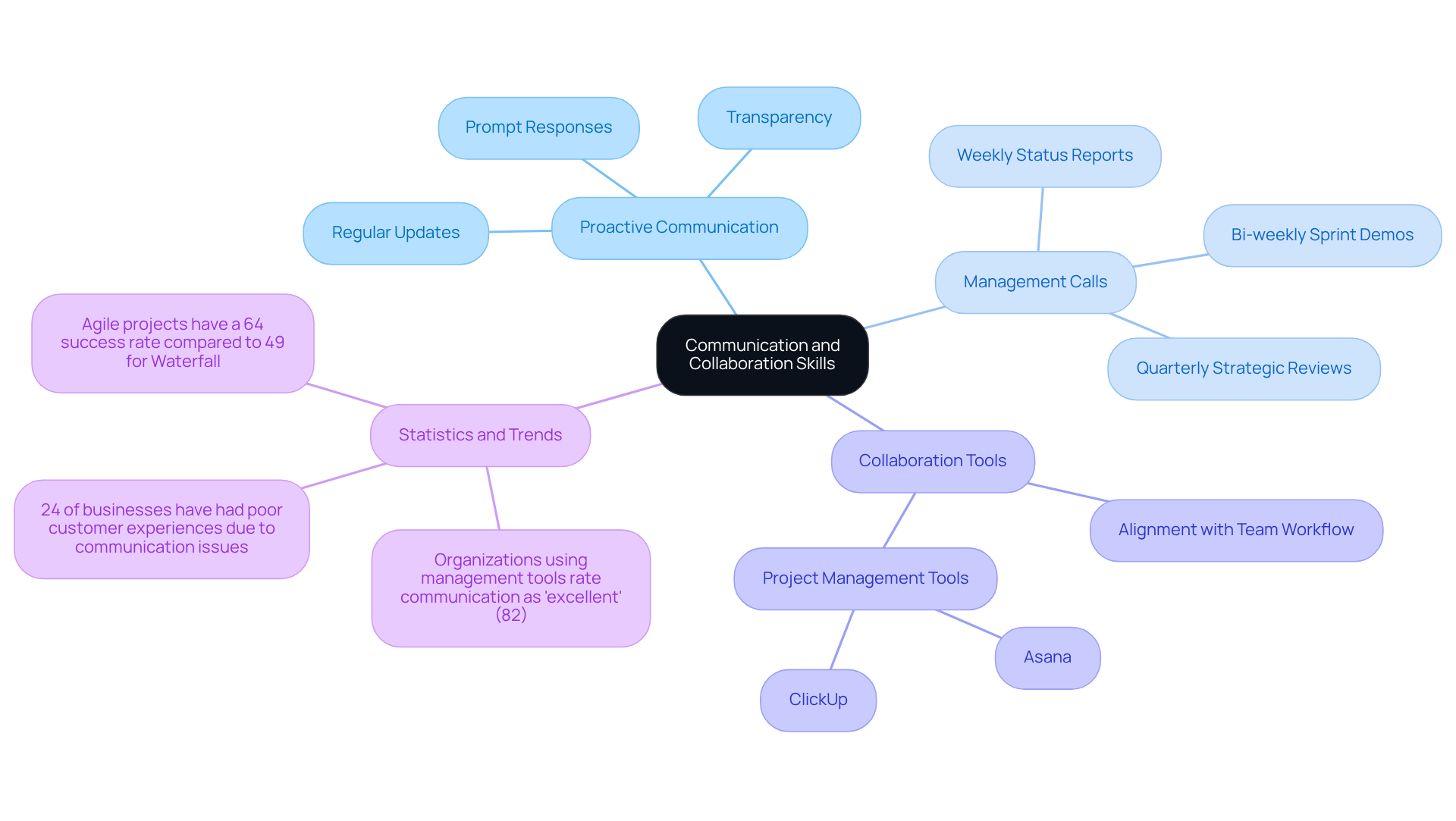

Effective communication is crucial for successful collaboration with your custom software development vendor, particularly as we approach 2026, a time when communication dynamics are set to evolve significantly. At Neutech, we emphasize a tailored consultation process that starts with a thorough understanding of your specific needs and company setup. This foundational step ensures that we effectively convey our comprehension of your initiative.

Proactive communication indicators, such as regular updates and prompt responses to inquiries, are hallmarks of our commitment to reliability and seamless client integration. Our approach includes presenting you with candidate designers and developers who not only possess the necessary technical skills but also embody essential intangibles like work ethic, communication ability, and leadership.

We also prioritize regular management calls to reinforce your roadmap and ensure ongoing performance alignment. It is important to assess their collaboration tools and practices to confirm they align with your team’s workflow. A custom software development vendor that emphasizes clear communication and fosters a collaborative environment, such as Neutech, is more likely to navigate challenges effectively and deliver successful results.

Statistics reveal that organizations utilizing management tools for communication are nearly three times more likely to rate their communication as ‘excellent,’ underscoring the importance of organized communication practices. Furthermore, successful partnerships between hedge funds and software providers often stem from a mutual commitment to transparency and alignment, significantly enhancing success rates. As the industry transitions towards two-way messaging, fostering direct dialogue will be essential for meeting evolving client expectations.

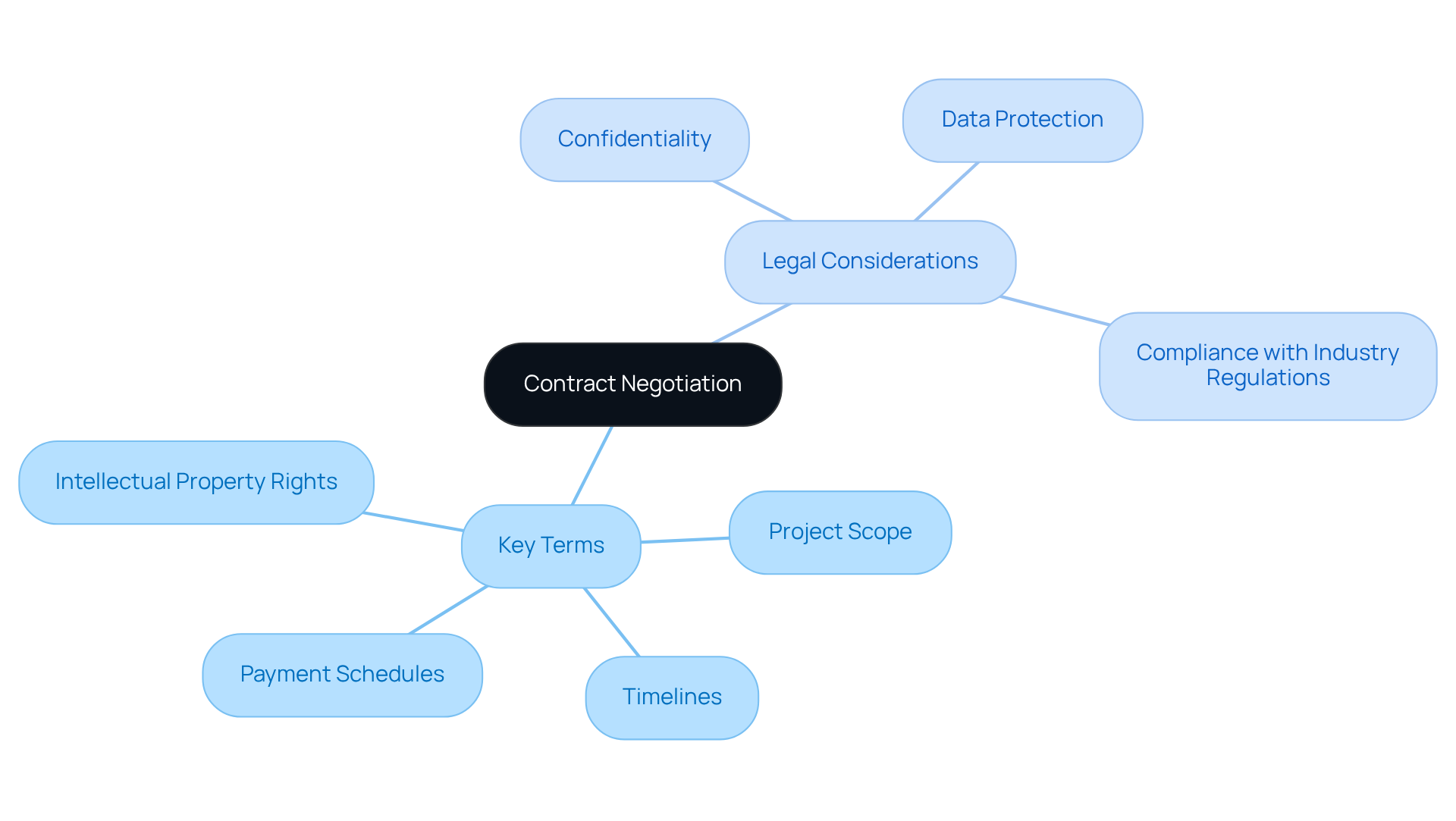

Negotiate Contracts and Understand Legal Considerations

When negotiating contracts with your chosen vendor, it is essential to clearly define all key terms. This includes:

- Project scope

- Timelines

- Payment schedules

- Intellectual property rights

Attention must also be given to clauses related to:

- Confidentiality

- Data protection

- Compliance with industry regulations

Involving legal counsel to review the contract can be beneficial, as it ensures that your interests are adequately protected. Establishing clear expectations and legal protections from the outset will help prevent misunderstandings and disputes in the future. This proactive approach contributes to a smoother development process.

Conclusion

Selecting the appropriate custom software development vendor is a crucial decision for hedge funds seeking to improve operational efficiency and ensure compliance within a dynamic financial environment. This guide highlights the importance of comprehending the distinct requirements of tailored software solutions, which encompass:

- Regulatory compliance

- Cybersecurity measures

- The capability to integrate with existing systems

By explicitly defining these requirements, hedge funds can effectively communicate their expectations to prospective vendors, thereby facilitating a more suitable alignment with their specific challenges.

The article presents a systematic approach to vendor selection, emphasizing essential criteria such as:

- Industry experience

- Technical proficiency

- Scalability

It also stresses the necessity of conducting comprehensive research and evaluating vendor capabilities, including their historical performance and communication skills. By adopting these strategies, investment firms can optimize their selection process and cultivate successful partnerships with software providers adept at navigating the intricacies of the financial sector.

Ultimately, the decision regarding a custom software development vendor can profoundly influence the operational success of a hedge fund. By emphasizing clear communication, strong collaboration, and meticulous contract negotiations, firms can secure a vendor that not only addresses their immediate requirements but also fosters long-term growth and adaptability. Implementing these measures will ensure that investment managers are well-equipped to leverage technology effectively, driving innovation and sustaining a competitive advantage in the marketplace.

Frequently Asked Questions

What is custom software development for hedge funds?

Custom software development for hedge funds focuses on creating tailored applications that address specific operational needs, regulatory compliance, and risk management requirements in the investment sector.

Why is there a growing demand for custom software in investment management?

The demand for custom software is increasing due to the need for advanced technology to manage complex financial modeling, real-time data analysis, and secure transactions, as investment groups rely more on technology.

What are some key considerations when selecting a software supplier for hedge funds?

Key considerations include the software’s ability to integrate with existing systems, support for algorithmic trading, and adherence to regulatory standards.

How important is cybersecurity in custom software for hedge funds?

Cybersecurity is critical, with 78% of investment managers increasing their cybersecurity budgets, underscoring the importance of robust security measures in software solutions.

What role do alternative data sources play in custom software for hedge funds?

Firms are prioritizing the integration of alternative data sources to enhance performance and differentiation in their investment strategies.

What criteria should be evaluated when choosing a software development vendor?

Important criteria include industry experience, technical expertise, regulatory awareness, scalability, and support and maintenance capabilities.

Why is industry experience important for software suppliers in the financial services sector?

Industry experience ensures that the supplier is familiar with the specific challenges and regulatory requirements of the financial services sector, which is crucial for successful collaboration.

What is the significance of regulatory awareness in software development for hedge funds?

Regulatory awareness is essential to avoid compliance pitfalls that could jeopardize operations, as the supplier should understand obligations related to data protection and reporting.

How can scalability impact the choice of a software vendor?

Scalability allows the software solutions to grow with the business, which is important for investment firms that operate in a dynamic environment.

Why is ongoing support and maintenance important after software deployment?

Continuous support and maintenance are essential to ensure that the software remains functional and compliant with evolving regulations.