Compare 4 Data Integration Software Solutions for Financial Services

Introduction

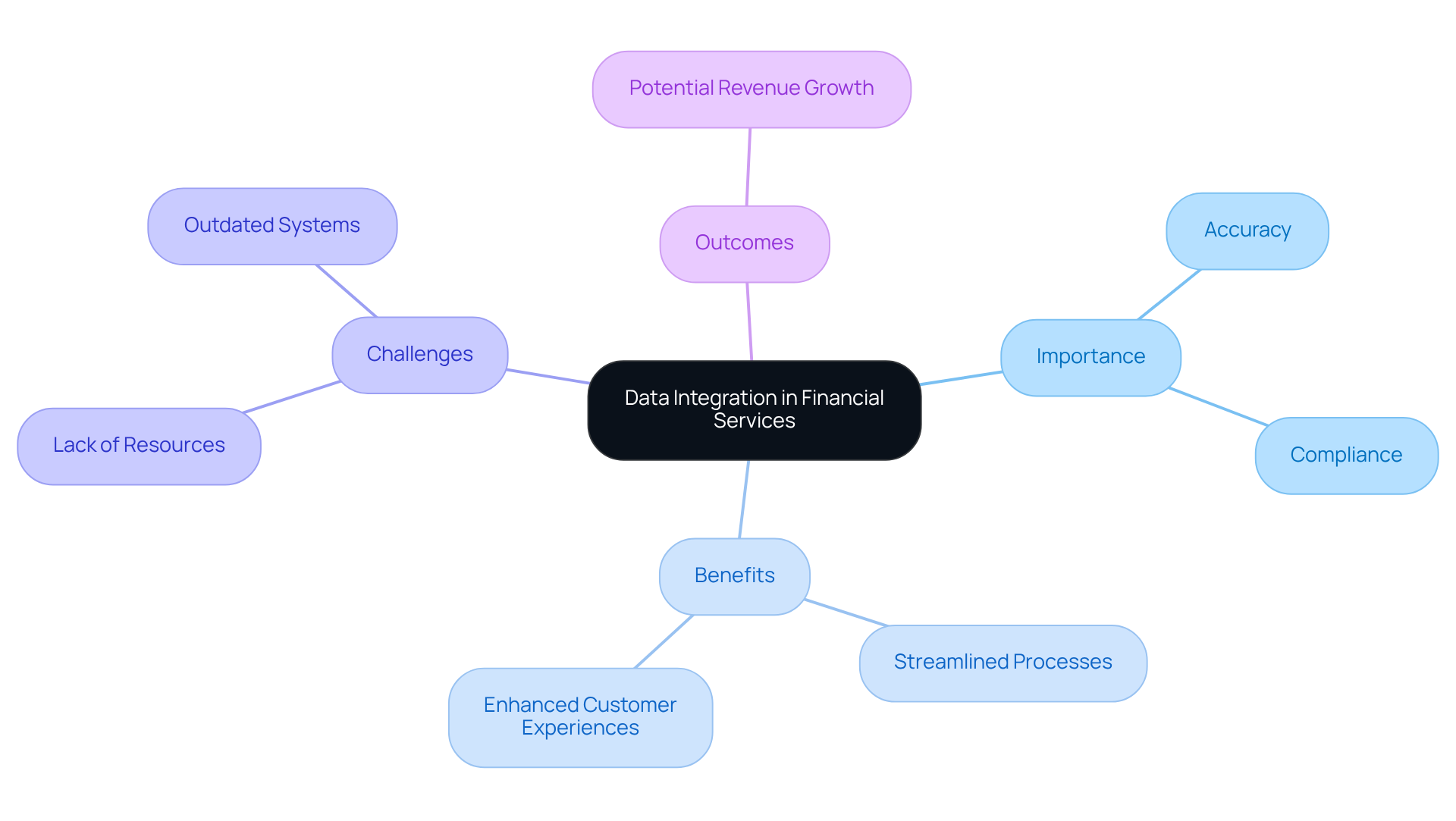

The financial services landscape increasingly relies on seamless data integration. The ability to merge insights from diverse sources can mean the difference between compliance and costly errors. Institutions that effectively harness data integration software streamline operations, enhance customer experiences, and drive growth. However, many organizations still grapple with outdated systems and resource shortages. This raises a pressing question: which data integration solutions can truly transform financial institutions into agile, data-driven powerhouses?

Define Data Integration and Its Importance in Financial Services

The process of merging insights from various sources into a unified perspective using data integration software is essential for institutions aiming to utilize their information effectively. In a sector where accuracy and timeliness are paramount, effective information amalgamation provides decision-makers with trustworthy insights that are vital for compliance with regulatory standards and operational efficiency. Data integration software allows institutions to streamline processes, minimize errors, and enhance customer experiences by providing a comprehensive view of financial data.

However, a significant challenge persists, as 70 percent of banking executives report a lack of resources for data integration software to process and analyze information effectively. Additionally, 95 percent of leading global banking executives have indicated that outdated legacy systems obstruct information optimization, underscoring the obstacles faced by financial institutions.

Organizations that have embraced centralized information systems report enhanced security and manageability, which significantly reduces the risk of misconfiguration and bolsters overall information security. Furthermore, as highlighted by the Boston Consulting Group, banks can achieve up to $300 million in revenue growth for every $100 billion in assets by personalizing customer interactions through efficient information merging. This underscores the transformative potential of integrated information in driving both compliance and customer-focused growth strategies.

Explore Key Types of Data Integration Methods

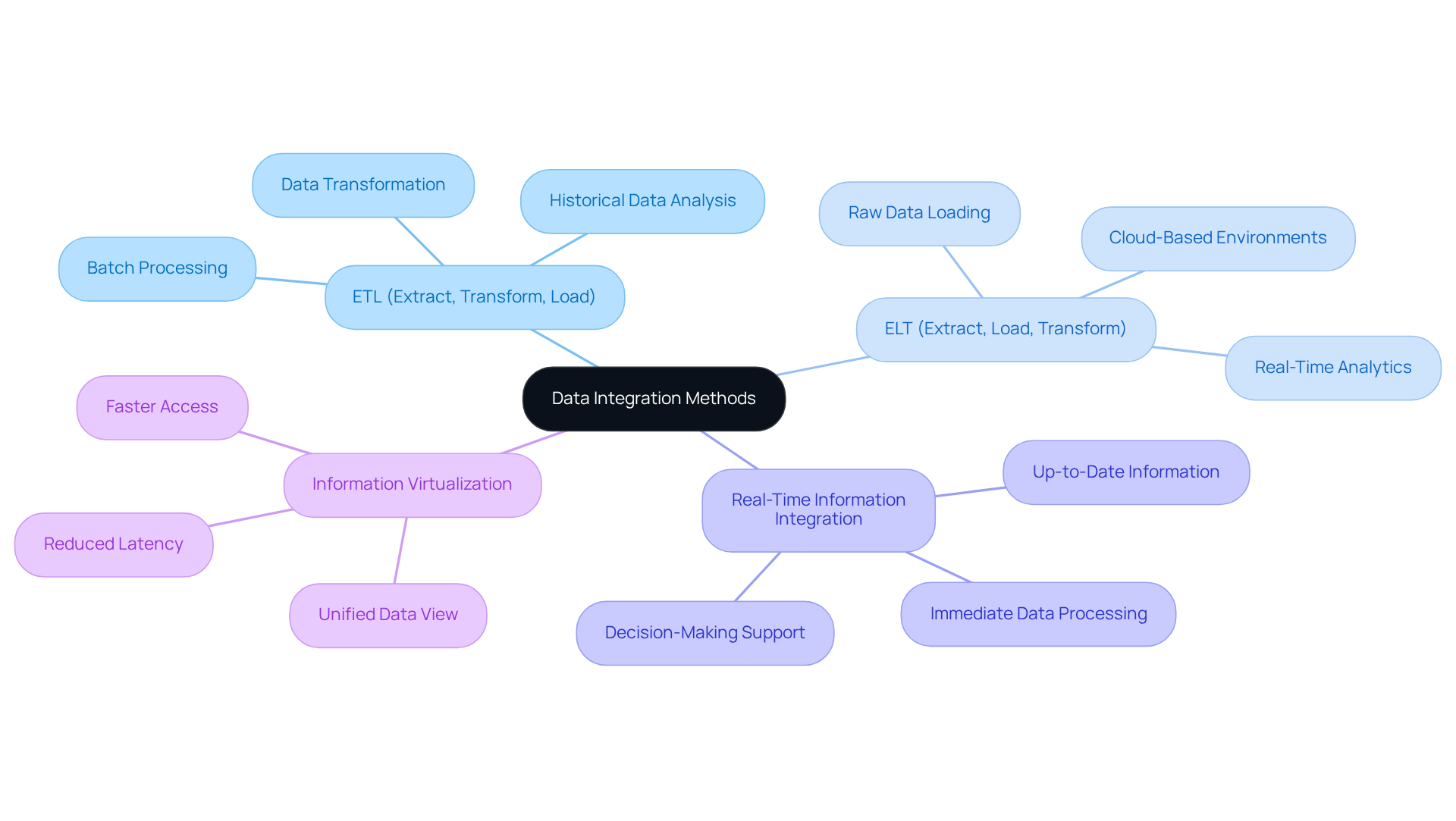

In the financial services sector, several key data integration methods are employed:

-

ETL (Extract, Transform, Load): This traditional method involves extracting data from various sources, transforming it into a suitable format, and loading it into a target system. ETL is commonly used for batch processing and is particularly effective for analyzing historical data.

-

ELT (Extract, Load, Transform): In contrast to ETL, ELT first loads raw data into the target system before transformation. This approach is advantageous for real-time analytics and is frequently utilized in cloud-based environments.

-

Real-Time Information Integration: This method facilitates the immediate processing and integration of data, which is crucial for organizations that require up-to-date information for decision-making.

-

Information Virtualization: This technique provides a unified view of data without the need for physical data movement, allowing for faster access and reduced latency.

Each of these methods presents distinct advantages and is tailored for specific scenarios, making it imperative for organizations to select the most appropriate data integration software based on their unique requirements.

Compare Leading Data Integration Tools for Financial Services

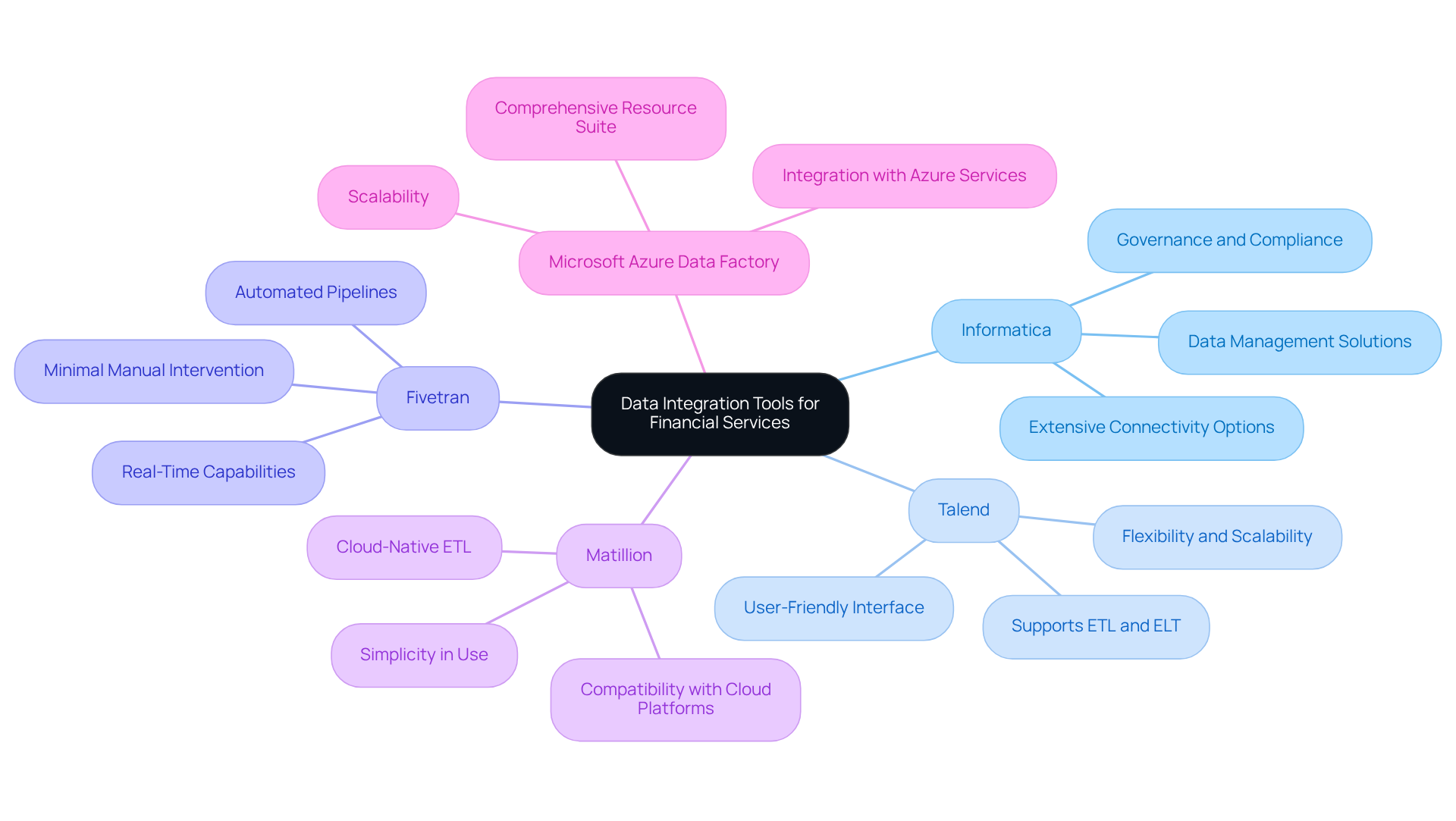

When evaluating data integration tools for financial services, several leading options emerge as noteworthy choices:

-

Informatica: Esteemed for its robust governance and compliance features, Informatica stands as a leader in the information unification sector. It offers extensive connectivity options, making it suitable for large enterprises that require comprehensive information management solutions.

-

Talend: This open-source tool is recognized for its flexibility and scalability, making it ideal for organizations looking to customize their information processing methods. Talend supports both ETL and ELT approaches and is particularly favored for its user-friendly interface.

-

Fivetran: Fivetran specializes in automated pipelines, facilitating seamless connections between various data sources with minimal manual intervention. Its real-time capabilities position it as a strong choice for organizations that require up-to-date information.

-

Matillion: As a cloud-native information processing tool, Matillion excels in ETL procedures and is specifically designed for modern storage systems. Its simplicity and compatibility with cloud platforms render it a popular option among financial institutions.

-

Microsoft Azure Data Factory: This tool offers a comprehensive suite of resources for information processing and transformation, particularly beneficial for organizations already utilizing Microsoft services. Its scalability and integration with Azure services provide a robust solution for effective information management.

Each of these tools, including data integration software, possesses distinct features that cater to varying organizational needs, underscoring the importance for service providers to evaluate their specific requirements before selecting a solution.

Identify Best Practices for Successful Data Integration Implementation

To achieve successful data integration implementation in financial services, organizations should adhere to several best practices:

-

Define Clear Objectives: Establish specific goals for the information unification project that align with broader business aims. This ensures clarity in purpose and direction.

-

Involve Stakeholders Early: Engage key stakeholders from various departments at the outset. This approach gathers requirements and ensures the integration solution addresses the needs of all users. Early involvement fosters enthusiasm and commitment, which are crucial for project success.

-

Prioritize Information Quality: Implement rigorous quality checks and validation processes to guarantee that the integrated information is accurate and trustworthy. This is especially crucial in the highly regulated financial services sector, where poor information can lead to substantial financial losses. Gartner estimates that poor information has an average yearly impact of roughly $12.9 million per entity, underscoring the importance of prioritizing information quality.

-

Choose the Appropriate Tools: Select information merging tools that suit the entity’s technical setting and commercial requirements. Consider factors such as scalability, ease of use, and vendor support to ensure the tools can grow with the organization. As Donal Tobin observes, choosing the appropriate information unification platform can determine the success or failure of your analytics strategy.

-

Observe and Improve: Continuously monitor the performance of information merging processes, making necessary adjustments to enhance efficiency and effectiveness. Proactive monitoring can help identify issues early, allowing for timely interventions.

-

Train Staff: Provide comprehensive training for personnel on the new information merging tools and processes. This facilitates smooth adoption and maximizes utilization. The skills crisis is severe, with 90% of organizations facing shortages by 2026, potentially costing $5.5 trillion in losses. Well-trained staff are crucial for maximizing the full potential of information unification initiatives.

By applying these optimal methods, institutions can significantly improve their information unification efforts, resulting in better decision-making and operational effectiveness. Engaging stakeholders early and maintaining a focus on data quality are particularly critical for achieving high success rates in data integration software projects within the financial services industry. Most organizations achieve positive ROI within 6-13 months, providing a clear expectation for the outcomes of these initiatives.

Conclusion

Data integration stands as a cornerstone of contemporary financial services, empowering institutions to extract insights from varied sources to improve decision-making, compliance, and operational efficiency. By utilizing data integration software, financial organizations can address challenges such as outdated legacy systems and resource limitations, ultimately achieving a more holistic and precise understanding of their data landscape.

This discussion has examined various data integration methods, including:

- ETL

- ELT

- Real-time information integration

- Information virtualization

Each presenting distinct advantages tailored to specific organizational requirements. Additionally, a comparison of leading tools such as:

- Informatica

- Talend

- Fivetran

- Matillion

- Microsoft Azure Data Factory

Underscores the necessity of selecting the appropriate solution based on unique business needs and technological contexts. Critical steps for successful implementation, such as:

- Defining clear objectives

- Engaging stakeholders

- Prioritizing information quality

- Providing adequate training

Have been highlighted as essential for effective data integration.

The importance of data integration in the financial sector is paramount. As organizations seek to enhance accuracy and responsiveness in an increasingly data-driven environment, adopting robust data integration strategies will not only improve operational efficiency but also foster growth and innovation. Financial institutions are urged to assess their current data integration practices, invest in suitable tools, and commit to continuous improvements, ensuring they remain competitive and compliant in the dynamic landscape of financial services.

Frequently Asked Questions

What is data integration in the context of financial services?

Data integration is the process of merging insights from various sources into a unified perspective using data integration software, which is essential for effectively utilizing information in financial institutions.

Why is data integration important for financial institutions?

Data integration is important because it provides decision-makers with trustworthy insights necessary for compliance with regulatory standards, enhances operational efficiency, minimizes errors, and improves customer experiences by offering a comprehensive view of financial data.

What challenges do financial institutions face regarding data integration?

A significant challenge is that 70 percent of banking executives report a lack of resources for effective data integration software. Additionally, 95 percent of leading global banking executives cite outdated legacy systems as obstacles to optimizing information.

How do centralized information systems benefit financial organizations?

Centralized information systems enhance security and manageability, significantly reducing the risk of misconfiguration and improving overall information security for financial organizations.

What potential revenue growth can banks achieve through effective data integration?

According to the Boston Consulting Group, banks can achieve up to $300 million in revenue growth for every $100 billion in assets by personalizing customer interactions through efficient information merging.

How does data integration contribute to compliance in financial services?

Effective information amalgamation through data integration provides trustworthy insights that are vital for compliance with regulatory standards, helping financial institutions meet their obligations.