Best Practices for Financial & Banking Software Development Services

Introduction

In the rapidly evolving landscape of financial services, selecting a software development partner is crucial for an organization’s success. By emphasizing key criteria such as:

- Domain expertise

- Technical proficiency

- Agile methodologies

businesses can better navigate the complexities of the financial sector. However, with a multitude of options available, how can organizations effectively assess potential collaborators to ensure compliance, security, and adaptability in their software solutions? This article explores best practices for choosing the right software development services tailored to the unique demands of the banking and finance industry.

Identify Key Selection Criteria for Software Development Services

When selecting a software development partner for financial services, organizations should prioritize several key criteria:

-

Domain Expertise: A profound understanding of monetary regulations and market dynamics is essential. This expertise guarantees the creation of compliant and effective software solutions as part of our financial & banking software development services that meet industry standards.

-

Technical proficiency is crucial to assess the technical skills of the development team, particularly their familiarity with programming languages and frameworks relevant to financial & banking software development services. This ensures that the collaborator can deliver high-quality, robust solutions in financial & banking software development services.

-

Organizations should seek out case studies or testimonials that emphasize the collaborator’s success in financial & banking software development services. This evidence provides insights into their reliability and the quality of their financial & banking software development services, which is vital for informed decision-making.

-

Agile Methodologies: Evaluate whether the collaborator utilizes agile development practices. Neutech’s flexible engineering talent model allows for month-to-month contracts and agile resource allocation, enhancing flexibility and responsiveness. This enables teams to adapt effectively to changing requirements.

-

Given the sensitive nature of financial data, it is imperative that the associate implements robust security protocols within financial & banking software development services to safeguard against data breaches and cyber threats, ensuring the integrity of client information.

-

Strong communication is vital for successful collaboration in financial & banking software development services. Neutech emphasizes the importance of work ethic, communication ability, and leadership in their engineering talent. It is essential to evaluate how effectively the collaborator conveys technical concepts and project updates to non-technical stakeholders, as this can significantly impact the alignment and success of financial & banking software development services. Reliability and transparency are essential qualities of an excellent collaborator in financial & banking software development services, and understanding how the collaborator conveys these aspects can improve the overall relationship.

-

Tailored Engineering Talent Provision: Neutech’s process begins with a thorough assessment of client needs, ensuring that the right specialized developers and designers are supplied to meet specific project requirements. This customized strategy not only aligns with the client’s goals but also enhances the efficiency and effectiveness of the creation process.

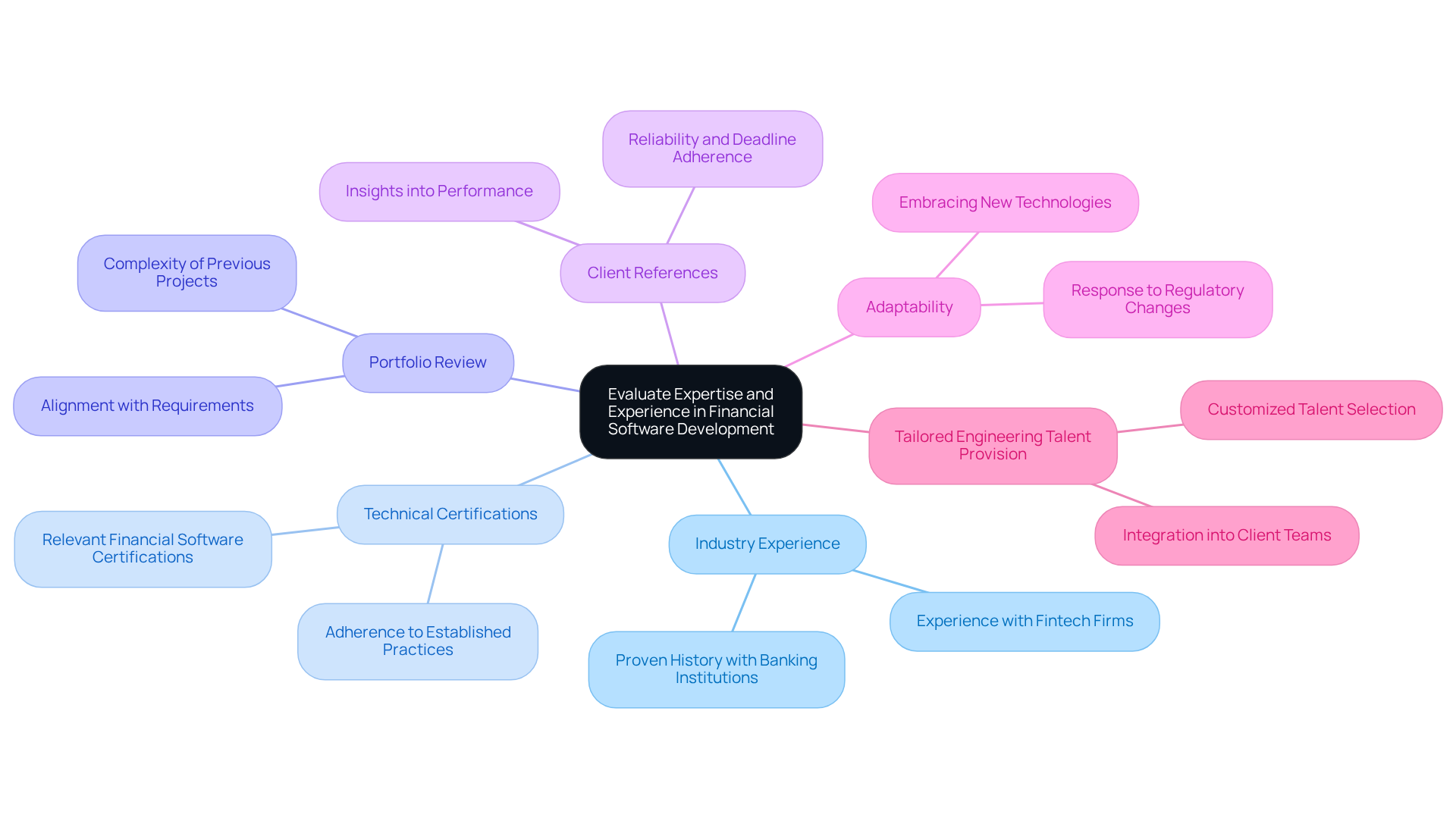

Evaluate Expertise and Experience in Financial Software Development

To effectively assess a potential software development partner’s expertise and experience in the financial sector, consider the following key factors:

-

Industry Experience: Seek collaborators with a proven history of working with banking institutions or fintech firms. Their understanding of industry-specific challenges can lead to more tailored and effective solutions.

-

Technical Certifications: Ensure that the development team possesses relevant certifications in financial & banking software development services. This not only reflects their commitment to quality but also adherence to established practices in the field.

-

Portfolio Review: Analyze the collaborator’s portfolio for projects that align with your requirements. Focus on the complexity and scale of previous projects to evaluate their capability and experience in handling similar challenges.

-

Client References: Request references from previous clients to gain insights into the associate’s performance, reliability, and ability to meet deadlines. This feedback can provide valuable context regarding their operational effectiveness.

-

Adaptability: Assess the partner’s capacity to embrace new technologies and methodologies. In the fast-paced financial landscape, adaptability is crucial for staying ahead of emerging trends and regulatory changes related to financial & banking software development services.

-

Tailored Engineering Talent Provision: At Neutech, once we mutually determine your needs, we will supply you with a selection of candidate designers and developers to integrate into your team. This customized approach ensures that you obtain specialized talent that aligns with your specific project requirements, enhancing the overall effectiveness of your software development efforts.

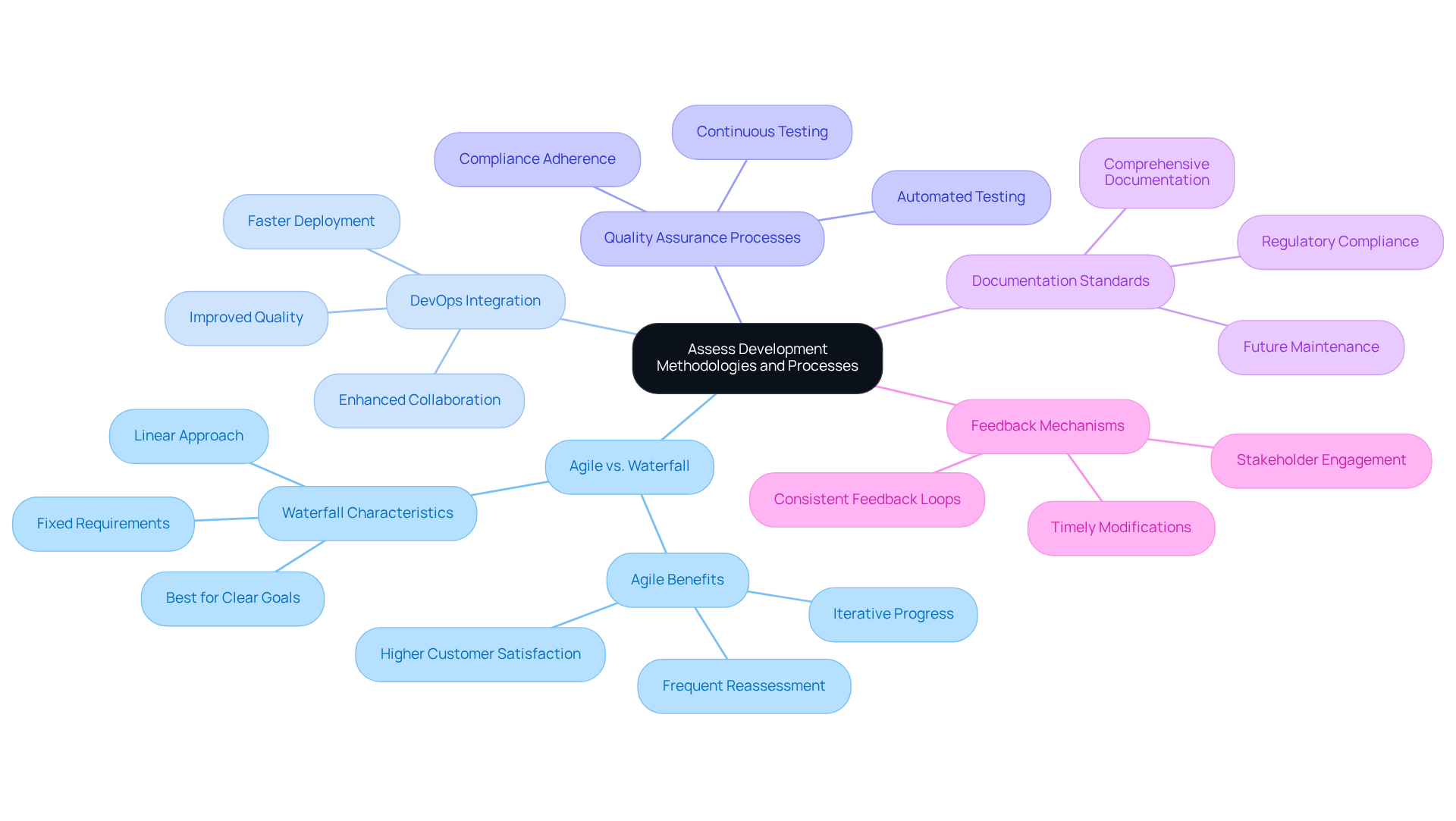

Assess Development Methodologies and Processes

When assessing development methodologies, it is essential to consider several key factors:

-

Agile vs. Waterfall: It is crucial to understand the distinctions between agile and waterfall methodologies. Agile facilitates iterative progress and frequent reassessment, which can be particularly beneficial in a dynamic regulatory environment.

-

DevOps Integration: Evaluate whether the associate incorporates DevOps practices. This integration can significantly enhance collaboration between development and operations teams, resulting in faster deployment and improved quality of deliverables.

-

Quality Assurance Processes: Investigate the associate’s quality assurance practices. Continuous testing and integration are vital for upholding high standards in financial & banking software development services.

-

Documentation Standards: Ensure that the collaborator maintains comprehensive documentation throughout the development process. This practice is critical for regulatory adherence and future maintenance.

-

Feedback Mechanisms: Seek collaborators who establish consistent feedback loops with stakeholders. This approach enables timely modifications based on user input and evolving requirements.

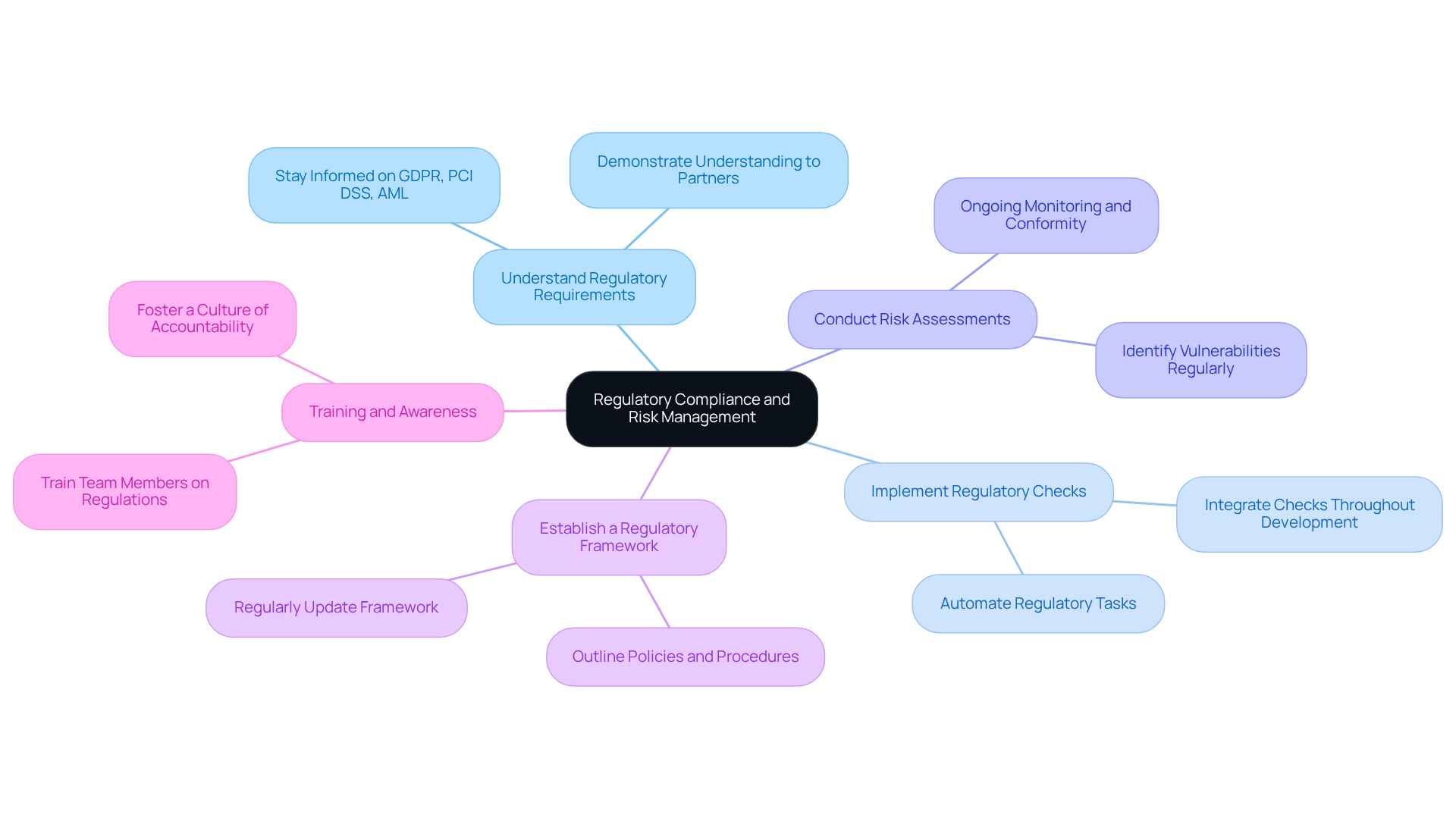

Ensure Regulatory Compliance and Risk Management

To ensure regulatory compliance and effective risk management in financial software development, organizations should adopt several best practices:

-

Understand Regulatory Requirements: Staying informed about relevant regulations such as GDPR, PCI DSS, and AML is crucial. Development partners must demonstrate a clear understanding of these requirements to ensure adherence from the outset.

-

Implement Regulatory Checks: Integrating regulatory checks throughout the development process enables teams to identify and address potential issues early, thereby minimizing risks associated with breaches. Automating regulatory tasks can enhance efficiency and reduce human error in this process.

-

Conduct Risk Assessments: Regular risk assessments are essential for identifying vulnerabilities within the software. Proactively addressing these vulnerabilities helps mitigate potential threats before they escalate. Ongoing monitoring and real-time conformity are vital for upholding adherence to regulations and addressing emerging risks.

-

Establish a Regulatory Framework: Developing a comprehensive regulatory framework that outlines policies and procedures is vital for maintaining adherence to regulations throughout the software lifecycle. This framework should be regularly updated to reflect changing regulatory environments and ensure that adherence strategies adapt accordingly.

-

Training and Awareness: Ensuring that all team members are well-trained on regulatory matters fosters a culture of accountability. Understanding the significance of following regulatory standards is essential for the success of software projects related to finance.

By implementing these practices and utilizing financial & banking software development services, organizations can effectively navigate the complexities of regulatory compliance and risk management, ultimately enhancing their operational resilience and trustworthiness in the financial sector.

Conclusion

Selecting the right software development partner for financial and banking services is essential for ensuring compliance, security, and overall project success. Organizations must prioritize domain expertise, technical proficiency, and a proven track record in the financial sector. By focusing on these key criteria, businesses can establish partnerships that not only address their immediate needs but also adapt to the continuously evolving landscape of financial regulations and technologies.

Critical factors such as agile methodologies, robust security protocols, and effective communication are vital components of successful collaboration. The emphasis on tailored engineering talent ensures that organizations can align specialized skills with their unique project requirements. Additionally, a thorough understanding of regulatory compliance and risk management practices is crucial for maintaining the integrity and trustworthiness of financial software solutions.

Ultimately, the importance of selecting the right software development partner cannot be overstated. Organizations are urged to adopt a proactive approach by rigorously evaluating potential collaborators against established best practices. This diligence will enable them to navigate the complexities of financial software development and position themselves for success in a competitive market. By embracing these best practices today, they will pave the way for a more secure and efficient financial future.

Frequently Asked Questions

What are the key criteria to consider when selecting a software development partner for financial services?

The key criteria include domain expertise, technical proficiency, evidence of past success (case studies or testimonials), utilization of agile methodologies, implementation of robust security protocols, strong communication skills, and tailored engineering talent provision.

Why is domain expertise important in software development for financial services?

Domain expertise ensures a profound understanding of monetary regulations and market dynamics, which is essential for creating compliant and effective software solutions that meet industry standards.

What role does technical proficiency play in selecting a software development partner?

Technical proficiency is crucial as it assesses the development team’s skills, particularly their familiarity with relevant programming languages and frameworks, ensuring the delivery of high-quality, robust solutions.

How can organizations evaluate a potential partner’s reliability in financial software development?

Organizations should seek out case studies or testimonials that highlight the collaborator’s success in financial and banking software development services, providing insights into their reliability and quality.

What are agile methodologies, and why are they important in software development?

Agile methodologies are flexible development practices that allow for month-to-month contracts and agile resource allocation, enabling teams to adapt effectively to changing requirements, which is crucial in the dynamic financial sector.

What security measures should a software development partner implement?

A software development partner should implement robust security protocols to safeguard against data breaches and cyber threats, ensuring the integrity of sensitive financial data.

Why is strong communication important in financial software development?

Strong communication is vital for successful collaboration, as it impacts how effectively technical concepts and project updates are conveyed to non-technical stakeholders, influencing alignment and project success.

How does Neutech approach tailored engineering talent provision?

Neutech begins with a thorough assessment of client needs to supply the right specialized developers and designers, ensuring that the strategy aligns with the client’s goals and enhances the efficiency of the development process.