Master the Software Vendor Selection Process for Hedge Funds

Introduction

Selecting the right software vendor is a critical success factor for hedge funds, where the stakes are high and the landscape is increasingly complex. A significant 81% of hedge fund executives identify investment evaluation as a time-consuming process. Therefore, a structured approach to vendor selection can streamline operations and enhance compliance.

However, how can firms ensure they not only meet their immediate needs but also align with long-term strategic goals? This article explores best practices for navigating the software vendor selection process, providing insights on:

- Stakeholder engagement

- Effective evaluation methods

- Negotiation strategies that can foster successful partnerships

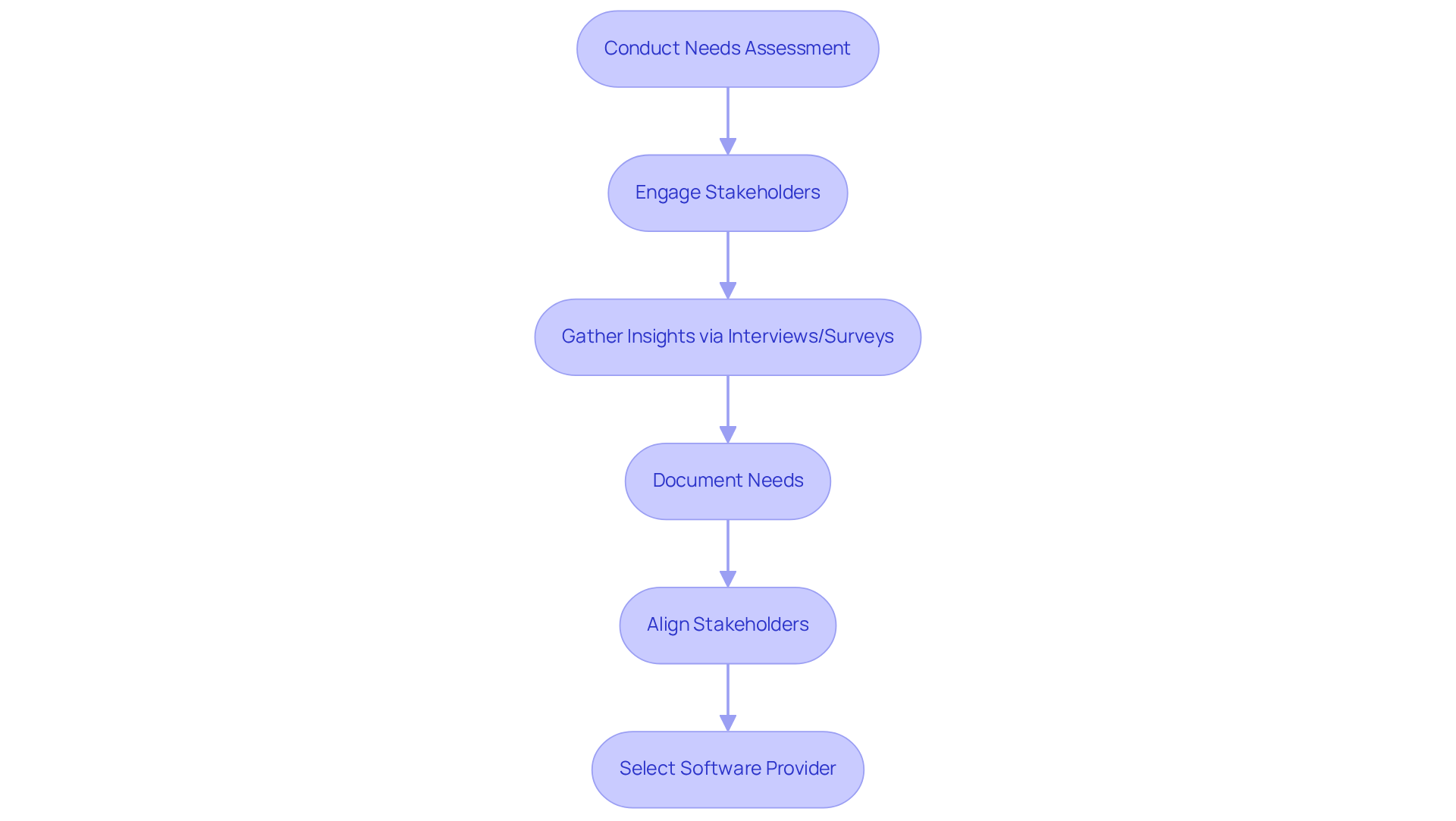

Conduct Needs Analysis and Align Stakeholders

To effectively select a software provider for investment portfolios, begin with a comprehensive needs assessment that engages all relevant stakeholders, including portfolio managers, regulatory officers, and IT teams. A recent study indicates that 81% of hedge fund executives find investment evaluation and due diligence to be time-consuming, underscoring the need for a meticulous approach.

Employ structured interviews or surveys to gather their insights, requirements, and expectations. This collaborative method cultivates a shared vision of the software’s objectives, ensuring that critical elements, such as compliance with regulatory standards, are prioritized. For example, if regulatory adherence is crucial, it is vital to verify that the supplier can fulfill these requirements.

As Rita Sallam from Gartner points out, successful AI transformation hinges on leaders establishing the tone for change, highlighting the significance of stakeholder alignment. Clearly documenting these needs not only guides the supplier selection process but also fosters productive discussions among stakeholders, enhancing alignment and commitment to the chosen solution.

A pertinent example is BBVA’s establishment of a cross-functional AI governance structure, which markedly improved their regulatory compliance and model approval processes, illustrating the effectiveness of structured stakeholder engagement.

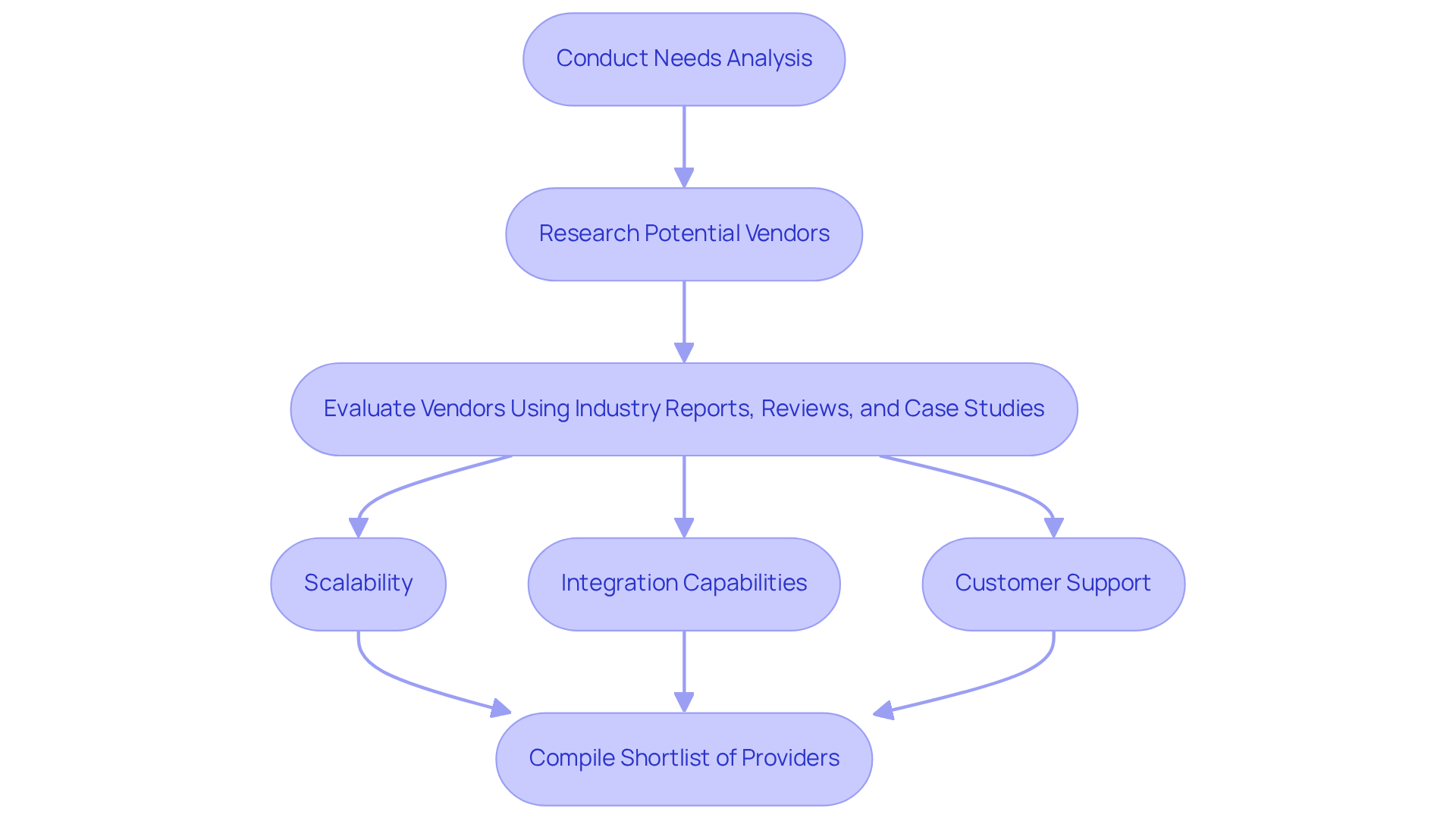

Research and Shortlist Potential Vendors

After completing the needs analysis, it is essential to conduct comprehensive research during the software vendor selection process to identify potential software providers. This involves utilizing industry reports, online reviews, and case studies to evaluate the reputations and capabilities of various suppliers. As part of the software vendor selection process, a list of providers should be compiled, focusing on those demonstrating expertise in financial services and a proven track record of delivering solutions to investment funds.

Key factors to consider include:

- Scalability

- Integration capabilities

- Customer support

For example, a supplier that has effectively implemented solutions for similar hedge funds is likely to have a better understanding of your specific challenges and requirements.

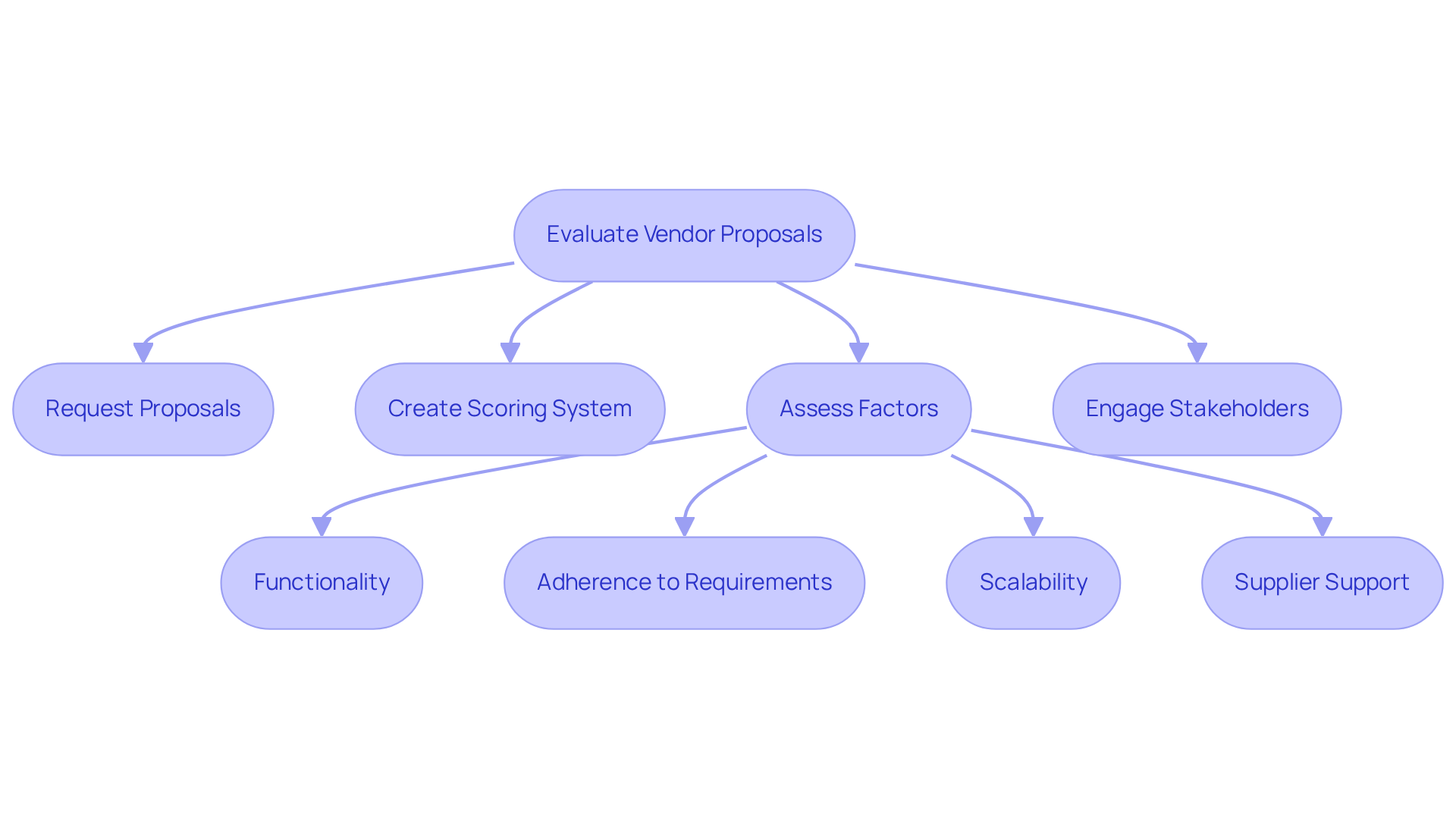

Evaluate Vendor Proposals and Assess Capabilities

After narrowing down potential suppliers, it is crucial to engage in the software vendor selection process by requesting comprehensive proposals that detail their solutions, implementation schedules, and pricing frameworks. A scoring system should be created to assess each proposal as part of the software vendor selection process based on factors such as:

- Functionality

- Adherence to requirements

- Scalability

- Supplier support

Engaging stakeholders in the software vendor selection process is vital to ensure that all perspectives are considered. For instance, a suggestion that incorporates strong regulatory features may receive a higher rating if adherence to regulations is a top priority for the investment group.

Additionally, consider organizing demonstrations from suppliers as part of the software vendor selection process to evaluate the usability and functionality of their software in real-time. Given that the average cost of non-adherence in the investment industry exceeds $14 million, it is essential to emphasize adherence capabilities in supplier proposals. Regular audits should also be conducted to identify adherence gaps, fostering a culture of compliance that reinforces the importance of regulatory standards. Integrating insights from regulatory specialists can further enhance the software vendor selection process, ensuring that the chosen provider aligns with the investment group’s operational and legal requirements.

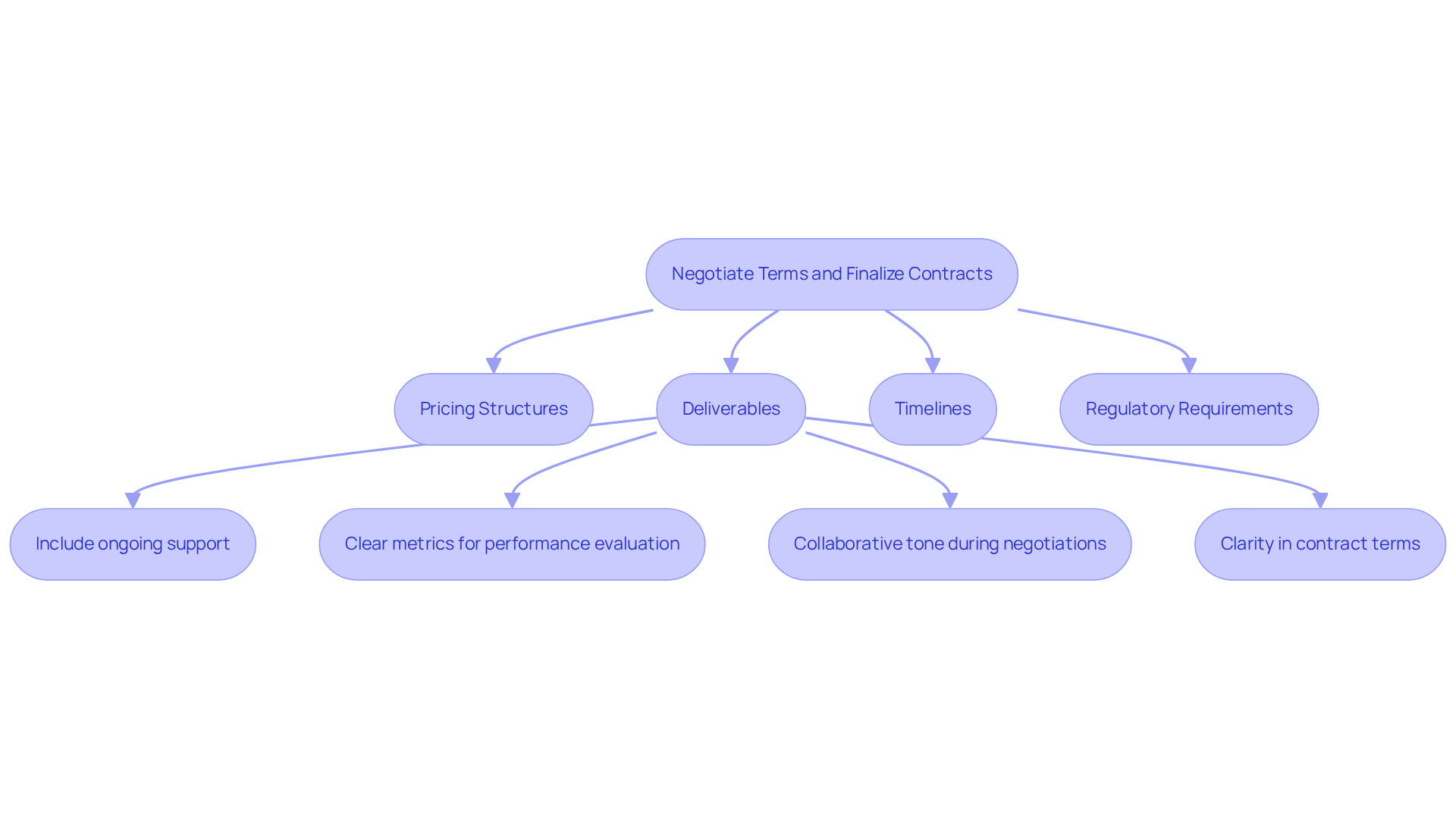

Negotiate Terms and Finalize Contracts

When selecting a supplier, initiating contract negotiations that align with the hedge fund’s strategic objectives is crucial. Focus on key components such as:

- Pricing structures

- Deliverables

- Timelines

- Regulatory requirements

Contracts must explicitly include provisions for ongoing support and maintenance, as well as clear metrics for performance evaluation. For instance, if the vendor’s software is required to comply with specific regulatory standards, it is vital to incorporate clauses that delineate their responsibilities in ensuring adherence.

Establishing a collaborative tone during negotiations promotes a productive partnership, ultimately benefiting both parties. Legal experts stress that clarity in contract terms not only safeguards compliance but also enhances operational efficiency. Therefore, addressing these elements thoroughly is imperative.

Conclusion

Selecting the appropriate software vendor is a pivotal process for hedge funds, significantly influencing operational efficiency and regulatory compliance. Engaging stakeholders early and conducting a comprehensive needs analysis ensures that software solutions align with strategic objectives and regulatory requirements. A collaborative approach is essential; it cultivates a shared vision critical for successful implementation.

Throughout the vendor selection process, key practices such as researching potential suppliers, evaluating proposals, and negotiating contract terms are vital steps. Each phase necessitates careful consideration of factors like scalability, customer support, and adherence to regulatory standards. By employing structured evaluation methods and involving relevant stakeholders, hedge funds can adeptly navigate the complexities of vendor selection, securing solutions that cater to their unique needs.

Ultimately, the software vendor selection process transcends merely identifying the right technology; it involves establishing a partnership that enhances compliance and operational effectiveness. Hedge funds should prioritize stakeholder engagement and adhere to best practices to make informed decisions. This approach positions them for success in an increasingly competitive landscape, ensuring they select a vendor capable of supporting their long-term growth and compliance objectives.

Frequently Asked Questions

What is the first step in selecting a software provider for investment portfolios?

The first step is to conduct a comprehensive needs assessment that engages all relevant stakeholders, including portfolio managers, regulatory officers, and IT teams.

Why is a needs assessment important in the software selection process?

A needs assessment is important because it helps to gather insights, requirements, and expectations from stakeholders, ensuring that critical elements such as compliance with regulatory standards are prioritized.

What methods can be used to gather stakeholder insights during the needs assessment?

Structured interviews or surveys can be used to gather insights from stakeholders.

How does stakeholder alignment impact the software selection process?

Stakeholder alignment is crucial as it establishes a shared vision of the software’s objectives, enhancing commitment to the chosen solution and guiding the supplier selection process.

What does Rita Sallam from Gartner emphasize regarding AI transformation?

Rita Sallam emphasizes that successful AI transformation depends on leaders establishing the tone for change, highlighting the importance of stakeholder alignment.

Can you provide an example of effective stakeholder engagement in software selection?

An example is BBVA’s establishment of a cross-functional AI governance structure, which significantly improved their regulatory compliance and model approval processes, demonstrating the effectiveness of structured stakeholder engagement.