Why Hedge Funds Need IT Outstaffing Services for Success

Introduction

Hedge funds navigate a landscape characterized by stringent regulations and rapidly evolving technological demands, which creates a complex environment for IT management. As investment firms work to maintain compliance while optimizing operational efficiency, the necessity for specialized IT outstaffing services becomes increasingly evident. This raises an important question: how can these services not only alleviate the burdens faced by in-house IT teams but also foster long-term success in such a competitive industry?

Understanding the Challenges Hedge Funds Face in IT Management

Hedge vehicles operate within a highly regulated environment where adherence to financial regulations is not merely important but essential. This environment necessitates robust IT systems that can securely manage sensitive data while complying with a multitude of regulatory standards. A significant challenge arises from the demand for real-time analytics and reporting capabilities, which are crucial for informed decision-making. The complexity of trading algorithms and the requirements of high-frequency trading systems further complicate IT management, necessitating advanced technological solutions.

Moreover, the rapid pace of technological advancement compels investment firms to continuously adapt their IT infrastructure, a process that can be resource-intensive and costly. Recent surveys highlight this issue, revealing that:

- 43% of investment respondents view regulatory requirements as major cost pressures

- 42% cite technology expenses as significant challenges

These statistics underscore the limitations of relying solely on in-house IT teams, which may lack the specialized skills and flexibility required to effectively navigate these evolving demands.

Real-world examples vividly illustrate these challenges. Hedge funds, for instance, have faced substantial operational difficulties due to outdated regulatory procedures, leading to inefficiencies and increased risk exposure. The implementation of automated regulatory solutions, such as the ComplianceAlpha platform, has proven beneficial, enabling firms to optimize operations and focus on strategic initiatives that promote growth.

As the industry continues to evolve, it becomes increasingly evident that specialized IT outstaffing services are necessary. The company offers tailored engineering talent solutions, providing specialized developers and designers who understand the unique challenges of regulated sectors. With a plug-and-play model, the company delivers flexible engineering talent solutions via IT outstaffing services that allow investment firms to swiftly scale their IT resources, ensuring compliance with regulatory requirements without the burden of long-term commitments.

Furthermore, Neutech’s strong retention rates for developers ensure that investment groups receive reliable quality and expertise, enabling them to manage regulations effectively while maintaining a competitive edge. The long-term repercussions of a breach, including the loss of stakeholder and investor trust, further emphasize the critical importance of robust governance protocols. Viewing compliance as a cost-saving measure rather than an expense can also assist investment groups in optimizing their operational costs.

Exploring the Strategic Benefits of IT Outstaffing for Hedge Funds

It outstaffing services provide investment groups with strategic advantages, primarily by granting access to specialized expertise that may not be readily available internally. By collaborating with external IT firms, investment groups can tap into a diverse pool of specialists skilled in critical areas such as cybersecurity, data analytics, and software development. The client engagement process begins with a tailored consultation to understand the unique needs of each investment group, ensuring that the right candidates are selected to seamlessly integrate into their teams. This partnership not only improves the quality of IT services but also enables investment groups to adaptively scale operations in response to evolving market demands. Furthermore, Neutech offers ongoing management and support to ensure that the integration of outsourced talent aligns with the strategic objectives of the investment firm, thereby reinforcing their operational framework.

Outsourcing IT functions can also lead to substantial cost savings, transforming fixed costs into variable ones and allowing hedge organizations to allocate resources more effectively. Research indicates that companies can achieve savings of 20% to 30% in operational expenses by outsourcing specialized functions, such as financial accounting and regulatory reporting. This financial flexibility is particularly crucial in an environment where 68% of asset managers view outsourcing as an essential strategy for risk mitigation and process optimization.

Moreover, it outstaffing services enhance compliance by ensuring that IT systems are overseen by professionals who are knowledgeable about the latest regulatory requirements and industry best practices. As investment groups navigate increasingly complex regulatory environments, access to specialized expertise becomes vital for maintaining operational resilience and credibility. The strategic incorporation of outsourced IT services not only bolsters a robust investment infrastructure but also positions investment groups to effectively meet allocator expectations.

Operational resilience has emerged as a key component of credibility for investment firms in volatile markets, making the strategic integration of outsourced IT services essential for supporting a strong investment infrastructure and fulfilling allocator expectations.

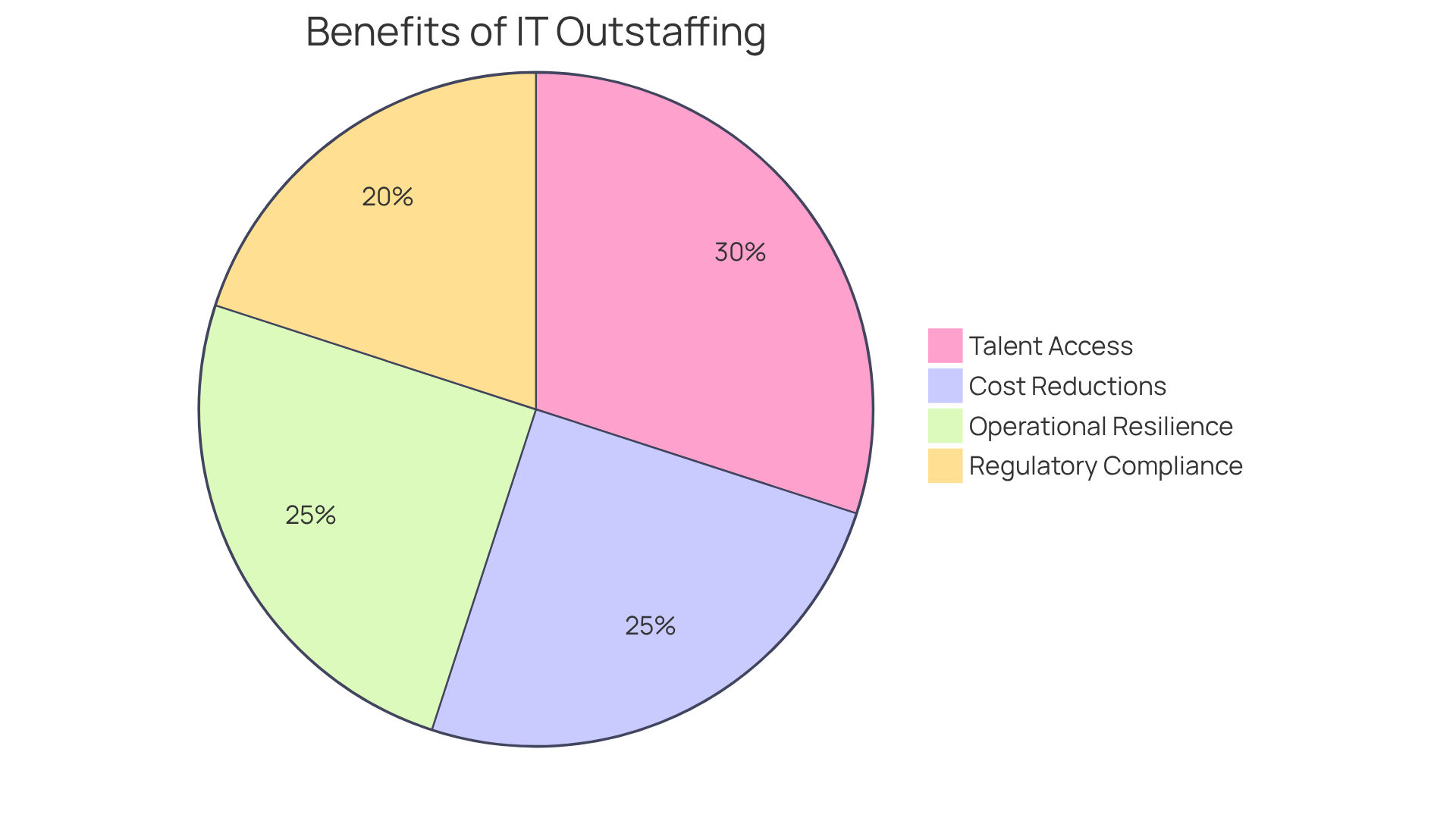

In summary, the strategic benefits of it outstaffing services for investment groups include enhanced access to specialized talent, significant cost reductions, improved regulatory compliance, and increased operational resilience-factors that are critical for success in today’s competitive landscape.

How Neutech’s Tailored IT Outstaffing Solutions Enhance Hedge Fund Performance

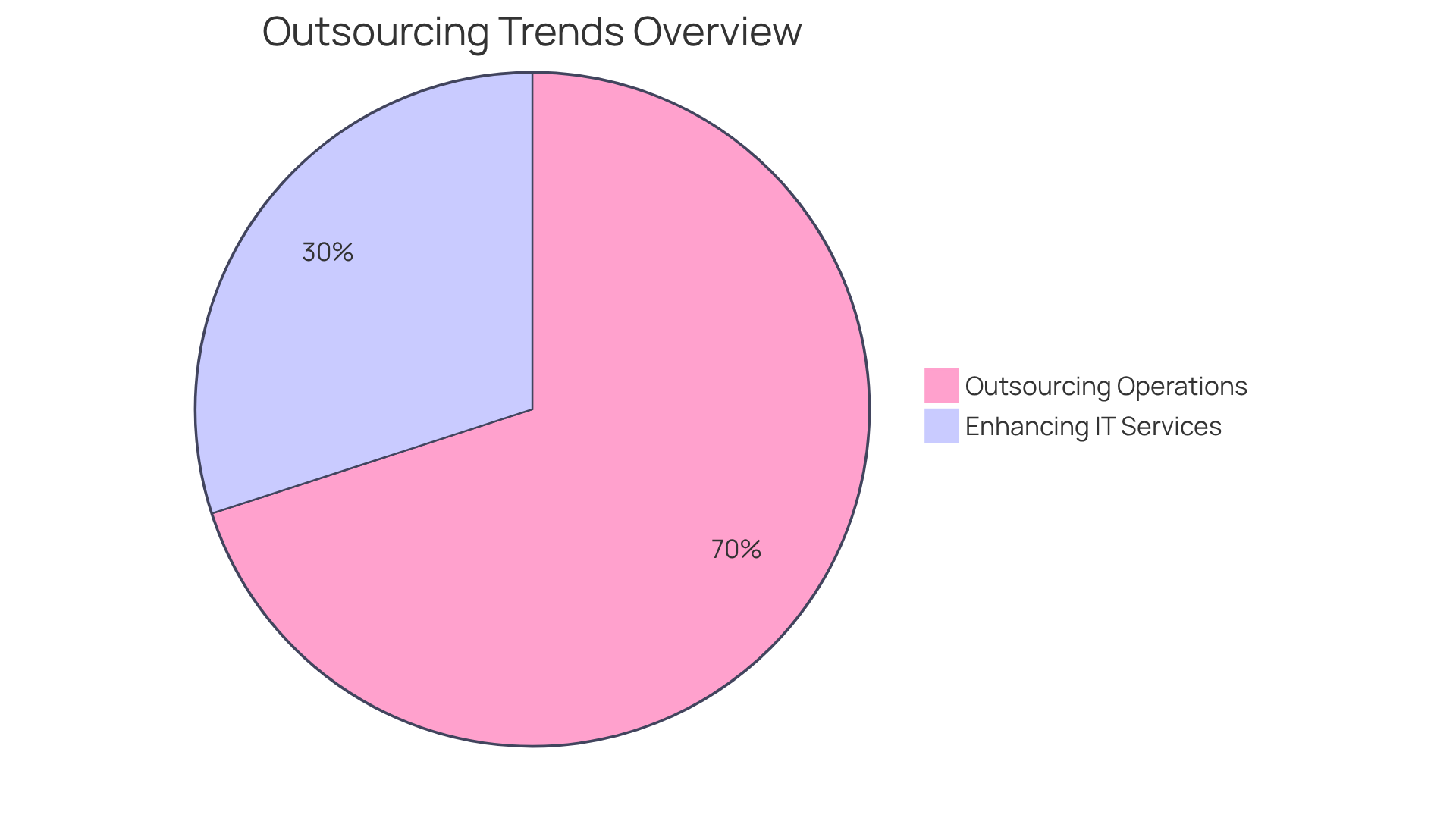

The company provides a suite of customized IT outstaffing services tailored specifically for investment firms, effectively addressing their distinct operational challenges. With a strong focus on compliance and security, Neutech’s engineers excel at implementing robust systems that meet regulatory standards while offering real-time data analytics capabilities. This emphasis is vital, as over 70% of investment firms outsource back-office operations to improve efficiency and reduce costs.

The organization’s zero-bench philosophy guarantees that all engineers are actively engaged in projects, enabling investment groups to scale their IT resources swiftly and effectively. This agility is crucial in a market where one-third of investment companies are considering enhancing their IT outstaffing services to effectively navigate operational complexities.

The company’s adaptable contract model allows investment groups to adjust their IT staffing levels in response to fluctuating market conditions, ensuring they can promptly react to changes in demand. By leveraging the specialized expertise of the company, investment groups can significantly enhance their operational efficiency, mitigate risks, and ultimately improve their investment outcomes. Regular management calls are scheduled to provide ongoing support and reinforce performance, further solidifying the partnership. For instance, investment groups utilizing advanced IT solutions have reported reductions in operational expenses by as much as 70%, while also benefiting from improved compliance and reporting capabilities.

Evaluating the Long-Term Impact of IT Outstaffing on Hedge Fund Success

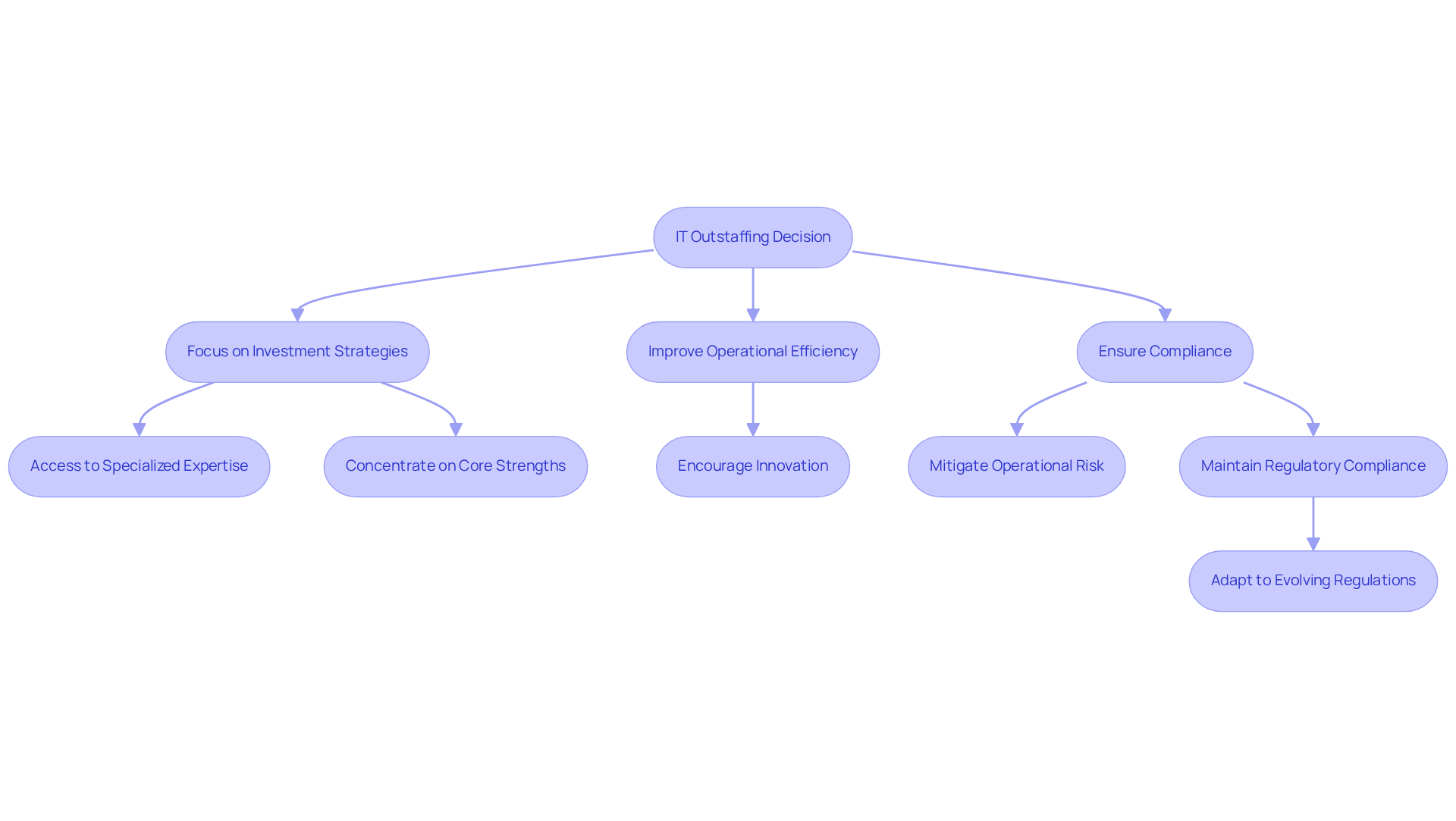

The long-term effect of it outstaffing services on investment success can be profound. By consistently utilizing specialized expertise and cutting-edge technologies through a customized engineering talent provision process, investment firms can sustain a competitive advantage in a constantly changing market. Once client requirements are mutually established, Neutech provides a range of potential designers and developers to smoothly incorporate into the investment group’s team.

Outsourcing IT functions through it outstaffing services enables investment firms to concentrate on their primary strengths, such as investment strategies and client relations, while entrusting the intricacies of IT management to specialists. This strategic division of labor not only improves operational efficiency but also encourages innovation. Investment firms can swiftly embrace new technologies and methodologies without the burden of extensive in-house training.

Moreover, as regulatory landscapes continue to evolve, having a dedicated IT partner like Neutech ensures that hedge funds remain compliant and agile. This partnership positions them for sustained growth and success in the future.

Conclusion

Hedge funds operate in a challenging environment that necessitates advanced IT solutions to navigate regulatory complexities and ensure operational efficiency. The demand for specialized IT outstaffing services has reached a critical point, as these services offer the expertise and flexibility essential for managing the intricate requirements of the financial sector. By leveraging external talent, hedge funds can enhance their technological capabilities, comply with regulatory standards, and concentrate on their core investment strategies.

This article highlights several key insights, including:

- The substantial cost savings associated with IT outstaffing

- Access to specialized skills

- The capacity to adapt to evolving market demands

Real-world examples demonstrate how hedge funds have effectively utilized IT outstaffing to overcome operational challenges, streamline compliance processes, and improve overall performance. Strategic partnerships with firms like Neutech not only optimize IT management but also position hedge funds for sustained success in a competitive landscape.

Ultimately, embracing IT outstaffing services is not merely a tactical decision; it is a strategic imperative for hedge funds aiming to thrive in an increasingly complex financial environment. By prioritizing specialized expertise and flexible IT solutions, investment firms can bolster their operational resilience, innovate effectively, and maintain a competitive edge. The future of hedge fund success hinges on recognizing the significance of robust IT management and the transformative potential of outstaffing solutions.

Frequently Asked Questions

What are the main challenges hedge funds face in IT management?

Hedge funds face challenges related to regulatory compliance, the need for real-time analytics and reporting, the complexity of trading algorithms, and the demands of high-frequency trading systems.

Why is regulatory compliance important for hedge funds?

Regulatory compliance is essential for hedge funds as they operate in a highly regulated environment, and adherence to financial regulations is crucial for managing sensitive data and avoiding legal penalties.

What cost pressures do hedge funds experience related to IT management?

According to recent surveys, 43% of investment respondents view regulatory requirements as a major cost pressure, while 42% cite technology expenses as significant challenges.

How do outdated regulatory procedures impact hedge funds?

Outdated regulatory procedures can lead to operational difficulties, inefficiencies, and increased risk exposure for hedge funds.

What solutions have hedge funds implemented to address IT management challenges?

Hedge funds have implemented automated regulatory solutions, such as the ComplianceAlpha platform, which help optimize operations and allow firms to focus on strategic initiatives for growth.

What is the role of specialized IT outstaffing services for hedge funds?

Specialized IT outstaffing services provide tailored engineering talent solutions, offering developers and designers who understand the unique challenges of regulated sectors, allowing investment firms to scale their IT resources flexibly.

How does Neutech support investment groups in managing regulations?

Neutech offers strong retention rates for developers, ensuring that investment groups receive reliable quality and expertise, which helps them manage regulations effectively while maintaining a competitive edge.

What are the long-term repercussions of a breach for hedge funds?

The long-term repercussions of a breach include the potential loss of stakeholder and investor trust, highlighting the importance of robust governance protocols.

How can viewing compliance as a cost-saving measure benefit investment groups?

Viewing compliance as a cost-saving measure can assist investment groups in optimizing their operational costs, making it a strategic priority rather than just an expense.