Why Software Cost Management is Crucial for Hedge Fund Success

Introduction

The financial landscape for hedge funds is increasingly influenced by the significant costs associated with software, which can represent as much as 30% of operational budgets. As these firms become more reliant on advanced technology for trading and compliance, effectively managing these expenses is essential for sustaining profitability and maintaining a competitive edge.

How can hedge funds adeptly navigate the complexities of software cost management to not only mitigate risks but also harness technology for improved operational efficiency?

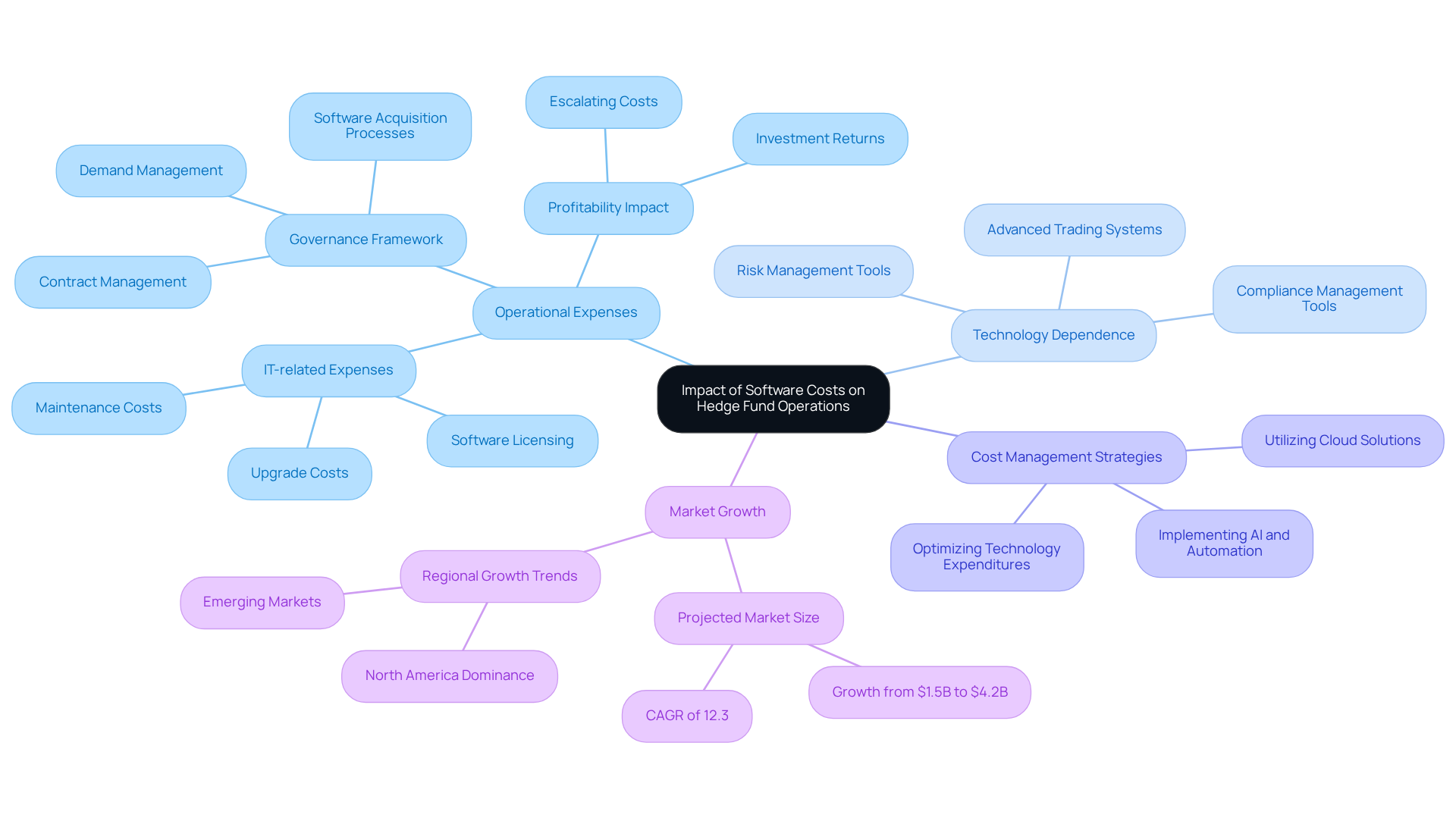

Recognize the Impact of Software Costs on Hedge Fund Operations

Software cost constitutes a significant portion of operational expenses for investment firms, often impacting their profitability. As these firms increasingly depend on advanced technology for trading, risk management, and compliance, the associated financial burden can escalate rapidly. Reports indicate that investment groups may allocate as much as 30% of their operational budget to IT-related expenses, which include software cost for licensing, maintenance, and upgrades. This substantial allocation underscores the importance for investment firms to invest in high-quality technology while also implementing effective strategies for managing software cost to safeguard profitability.

Moreover, the integration of advanced software can lead to enhanced operational efficiencies, allowing investment firms to process large volumes of data and execute trades more swiftly. For instance, firms utilizing cloud-based solutions have reported greater scalability and flexibility, which are essential in today’s dynamic market landscape. By optimizing technology expenditures and utilizing resources effectively, investment firms can sustain a competitive edge, ensuring that their investments yield tangible financial returns. Furthermore, as the global investment management application market is projected to grow from approximately $1.5 billion in 2023 to $4.2 billion by 2032, managing software costs will become increasingly important. Additionally, with regulatory requirements becoming more stringent, the need for robust compliance management tools that can elevate technology costs is evident. Therefore, establishing a governance framework for technology expenditures is vital for investment firms to navigate these challenges and improve their operational cost management.

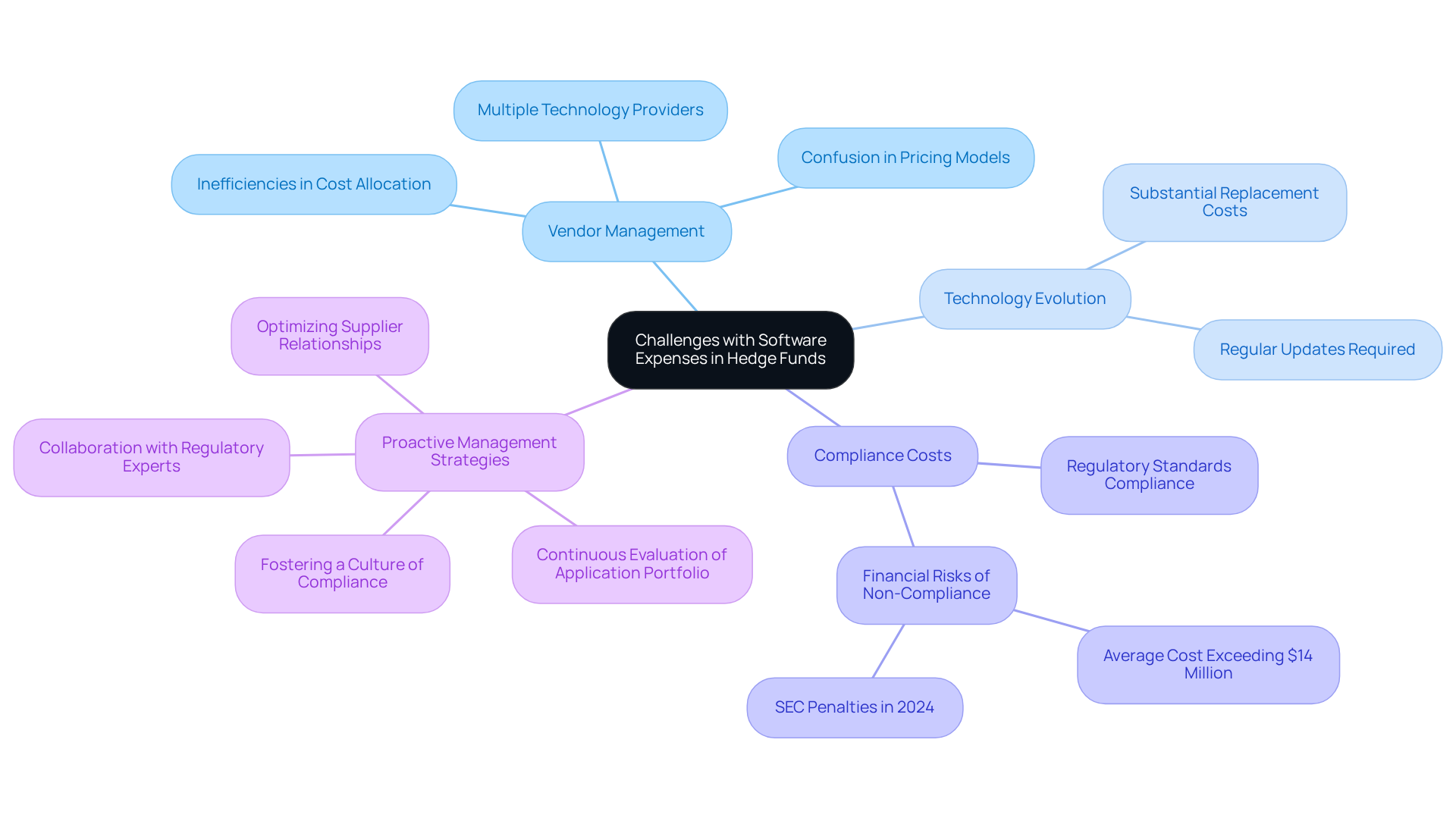

Identify Challenges Hedge Funds Face with Software Expenses

Hedge investments face significant challenges in managing software costs, primarily due to the complexities of their operational requirements. A key issue is vendor management; many investment groups collaborate with multiple technology providers, each presenting different pricing models and service contracts. This fragmentation can result in confusion and inefficiencies in cost allocation.

Additionally, the rapid evolution of technology necessitates regular updates or replacements of applications to maintain a competitive edge, which can incur substantial expenses. Compliance with regulatory standards adds another layer of complexity, as investment firms must ensure their technological solutions meet stringent requirements, often necessitating further investments in specialized compliance applications. For instance, the average cost of non-compliance in the investment sector exceeds $14 million, underscoring the financial risks associated with inadequate program oversight.

To effectively navigate these challenges, investment groups must adopt a proactive approach to managing software cost, continuously evaluating their application portfolio and supplier relationships to optimize spending and improve operational efficiency. Fostering a culture of compliance within organizations is essential for promoting adherence to regulations and ethical standards. Furthermore, collaborating with regulatory experts and integrating cross-functional teams can enhance an investment group’s compliance framework, ensuring that all regulatory measures are implemented effectively.

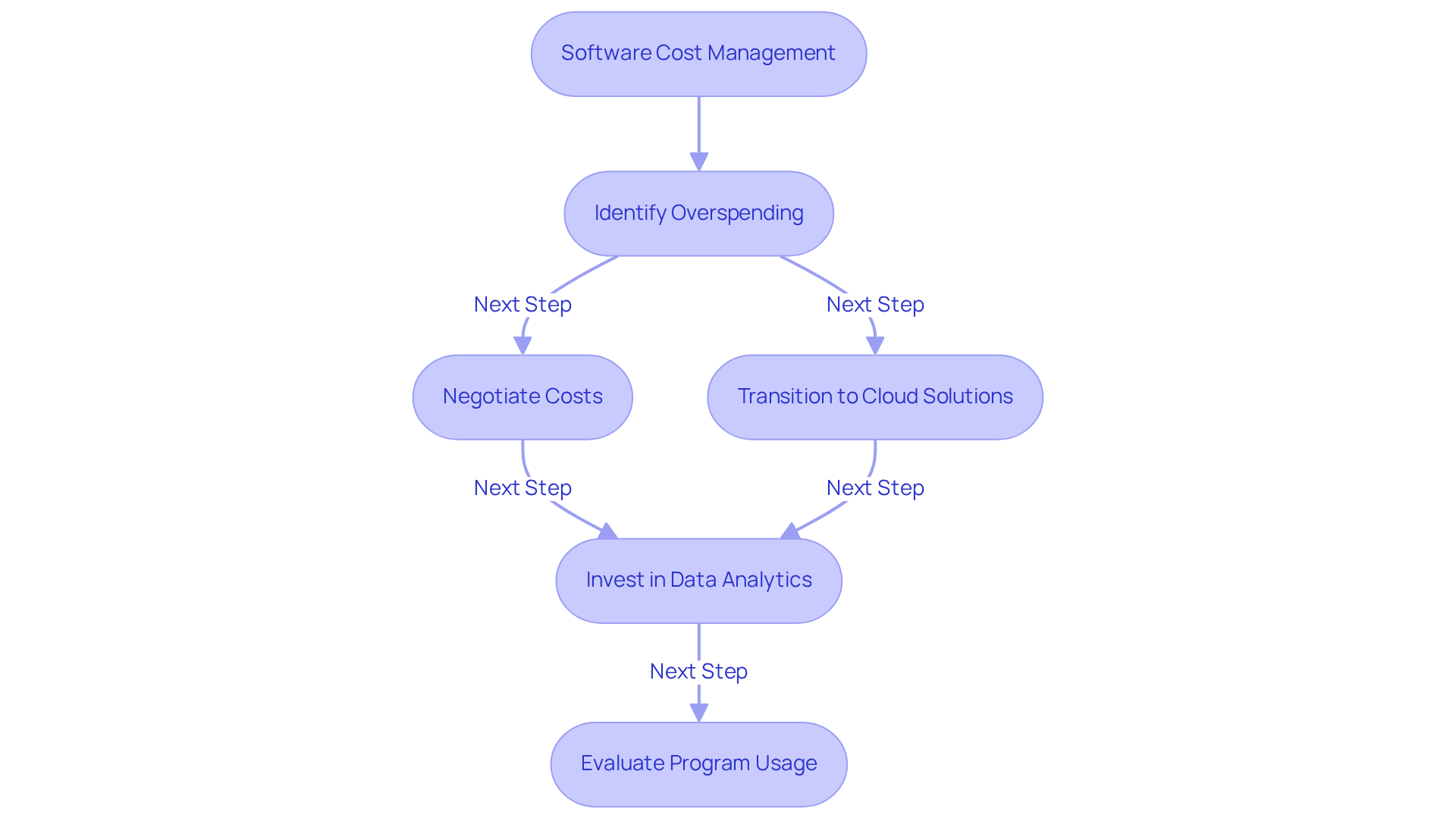

Leverage Software Cost Management for Strategic Advantage

Efficient oversight of software costs is essential for hedge portfolios seeking a competitive edge in the rapidly evolving market, especially considering that M&A activity has surged by over 65% annually. By implementing stringent cost management practices, financial resources can identify areas of overspending related to software cost and strategically reallocate assets to initiatives that deliver greater impact. Regular evaluations of program usage can uncover underutilized licenses, enabling resources to negotiate improved software cost terms with suppliers or eliminate unnecessary software costs altogether. Transitioning to cloud-based solutions not only lowers initial expenses and software cost but also offers scalability, allowing hedge funds to adjust their system requirements in response to fluctuating market conditions.

Furthermore, investing in tools that enhance data analytics capabilities can significantly refine decision-making processes, ultimately resulting in superior investment outcomes. In 2025, the cost of inadequate program quality in the U.S. was projected to reach $2.41 trillion, highlighting the urgent need for effective system oversight. As investment groups anticipate a favorable outlook for strategies in 2026, the implementation of technology expense oversight becomes increasingly crucial. By addressing evolving cybersecurity threats and optimizing software cost, investment groups can manage their overall costs while fostering innovation and adaptability in a continuously shifting financial landscape.

Assess Risks of Ignoring Software Cost Management

Ignoring cost management in technology exposes investment pools to significant risks that can jeopardize both operational integrity and financial stability. A primary concern is the potential for compliance violations; without diligent monitoring of technology expenses, hedge funds may inadvertently rely on outdated or non-compliant systems, resulting in severe penalties and reputational harm. For instance, Two Sigma faced a $90 million fine and returned $165 million to clients due to unauthorized alterations in their trading models, underscoring the financial repercussions of inadequate system governance.

Moreover, findings from the SEC revealed systemic issues in risk oversight, illustrating how a lack of proper controls can lead to substantial financial liabilities. Certain client resources exceeded expectations by $400 million, while others fell short by $165 million due to these unauthorized alterations, demonstrating the tangible impact of insufficient program oversight on resource performance.

Furthermore, the absence of a strategic approach to software cost can impede an investment organization’s capacity to invest in innovative solutions that enhance competitive positioning. In an environment where agility and responsiveness are crucial, ineffective program cost oversight can leave hedge funds vulnerable to market fluctuations and operational challenges, ultimately threatening their long-term success. Therefore, investors must prioritize robust compliance programs and effective software management to mitigate these risks and protect their interests.

Conclusion

Effective software cost management is not just an operational necessity for hedge funds; it serves as a fundamental driver of success in today’s competitive financial landscape. Recognizing the significant impact of software expenses on overall profitability allows investment firms to take proactive steps in optimizing their technology expenditures. This approach safeguards financial resources and enhances operational efficiencies, ultimately positioning hedge funds for sustained growth and success.

Key arguments throughout the article highlight the challenges hedge funds encounter in managing software costs, including vendor complexities, compliance requirements, and the need for continuous technological updates. By adopting a proactive stance on software cost oversight, investment groups can identify areas of overspending, streamline their application portfolios, and foster a culture of compliance that mitigates risks associated with outdated systems. Transitioning to cloud-based solutions and investing in advanced data analytics tools further empower firms to refine their decision-making processes and adapt to evolving market conditions.

The significance of effective software cost management extends beyond immediate financial implications; it is essential for maintaining a competitive edge in a rapidly changing environment. Hedge funds must prioritize robust governance frameworks and continuously evaluate their technology strategies to navigate the complexities of software expenses successfully. By embracing these practices, investment firms can protect their financial interests while innovating and thriving in an increasingly dynamic market landscape.

Frequently Asked Questions

Why are software costs significant for hedge fund operations?

Software costs constitute a significant portion of operational expenses for investment firms, often impacting their profitability. Investment groups may allocate as much as 30% of their operational budget to IT-related expenses, including software licensing, maintenance, and upgrades.

How does advanced software impact operational efficiency in hedge funds?

The integration of advanced software can enhance operational efficiencies, allowing investment firms to process large volumes of data and execute trades more swiftly. Firms using cloud-based solutions have reported greater scalability and flexibility, which are essential in today’s dynamic market.

What is the projected growth of the global investment management application market?

The global investment management application market is projected to grow from approximately $1.5 billion in 2023 to $4.2 billion by 2032.

Why is managing software costs increasingly important for investment firms?

Managing software costs is becoming increasingly important due to the projected growth of the investment management application market and the need for robust compliance management tools, which can elevate technology costs. Effective management of these costs is crucial for ensuring profitability.

What strategies can investment firms implement to manage software costs effectively?

Investment firms should invest in high-quality technology while also implementing effective strategies for managing software costs. Establishing a governance framework for technology expenditures is vital for navigating challenges and improving operational cost management.