Best Practices for Custom Database Development Services in Hedge Funds

Introduction

In the fast-paced realm of hedge funds, where data is pivotal to decision-making, the significance of effective custom database development is paramount. Investment firms encounter distinct challenges that necessitate tailored solutions for managing extensive information while complying with stringent regulations.

To address these challenges, firms must consider how their database systems can not only fulfill current requirements but also adapt to future demands. This article explores best practices for custom database development services, providing insights into:

- Assessing client needs

- Selecting appropriate technology

- Implementing robust security measures

- Optimizing performance to enhance operational efficiency within the investment sector.

Assess Client Needs for Tailored Database Solutions

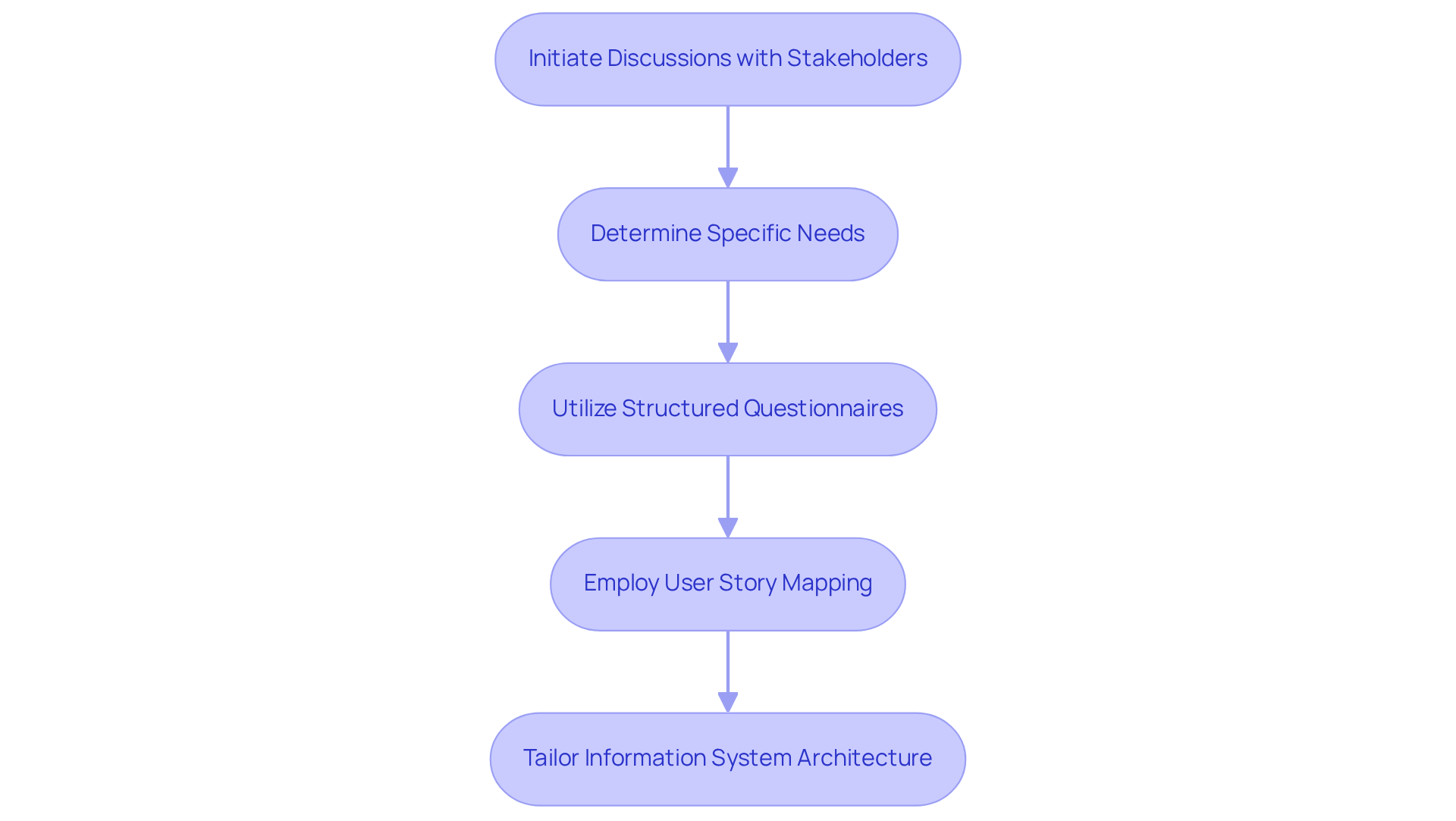

To effectively evaluate client requirements for tailored information management solutions in investment firms, Neutech initiates in-depth discussions with key stakeholders regarding custom database development services. This process involves collaboratively determining the client’s specific needs and subsequently providing a selection of candidate designers and developers to integrate into the client’s team. Utilizing structured questionnaires that address critical areas such as information volume, types of information processed, and specific compliance requirements is essential. For instance, an investment group may require real-time information processing capabilities to support trading strategies, necessitating a system capable of managing high-frequency transactions.

Moreover, employing techniques like user story mapping can help visualize the end-user experience and pinpoint pain points. This method not only clarifies requirements but also promotes collaboration among team members. By gaining insights into the client’s operational workflows and regulatory landscape, Neutech can tailor the information system architecture to enhance both performance and compliance.

Stakeholder interviews typically last between 30 to 45 minutes, establishing a clear expectation for the engagement. It is also crucial to secure permission to record interviews, ensuring that sensitive information is managed appropriately.

A real-world example illustrates this process: a financial client previously encountered challenges with information silos that hindered their analytical capabilities. Through a comprehensive needs evaluation, Neutech identified the necessity for custom database development services that provided a cohesive information management solution, integrating diverse information sources and ultimately improving their decision-making process and operational effectiveness. As Pat Hayes, a senior managing director with State Street Alternative Investment Solutions, noted, “Providers of outsourced services not only can assist investment managers in fulfilling the new requirements of regulators and investors for more detailed and timely investment information, they can help managers better utilize the information they possess to streamline their operations or enhance their product offerings.”

Statistics indicate that nearly 70% of C-level executives believe technological advancement is vital for initiating new investments, underscoring the importance of customized information solutions in meeting compliance needs and enhancing operational efficiency within the investment sector.

Select the Right Database Technology for Financial Applications

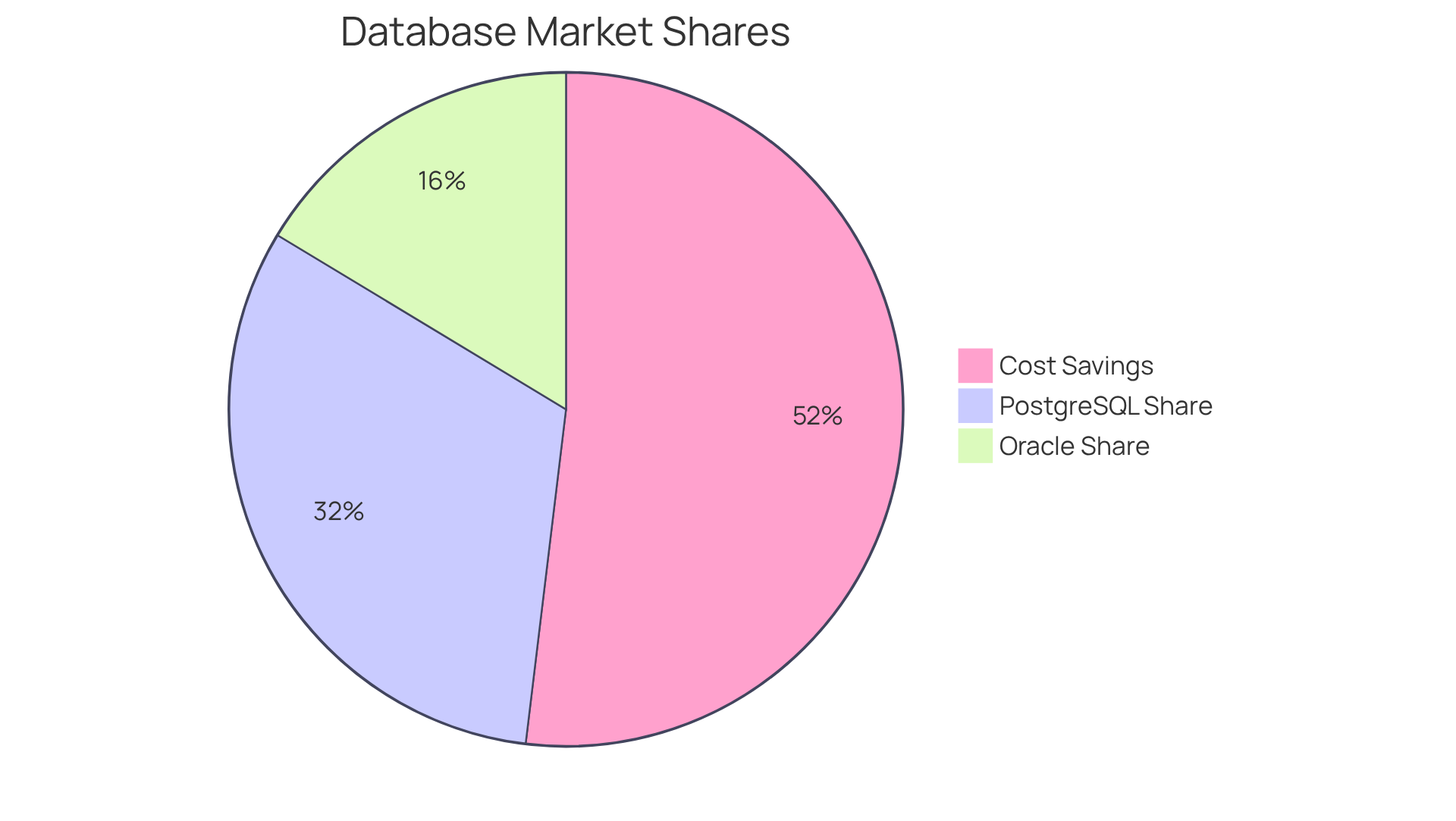

Selecting the appropriate information storage technology for financial applications necessitates a careful evaluation of factors such as data structure, transaction volume, and regulatory compliance. For hedge funds, relational systems like PostgreSQL and Oracle are often favored due to their robustness, ACID compliance, and ability to manage complex queries. Notably, PostgreSQL commands an 18.34% market share in the relational database sector, significantly outpacing Oracle’s 9.45%, thereby establishing itself as a preferred choice among financial institutions. Furthermore, PostgreSQL’s lack of licensing fees presents a considerable advantage for businesses aiming to innovate without financial constraints.

Conversely, NoSQL databases such as MongoDB offer distinct benefits for managing unstructured data or when scalability is a critical concern. The architecture of MongoDB facilitates horizontal scaling, making it suitable for applications that require rapid data access and flexibility in schema design. This adaptability is particularly relevant for hedge funds that process diverse data types and must swiftly respond to changing market dynamics.

When assessing specific use cases, it is essential to determine whether real-time analytics are required. In such scenarios, a database equipped with in-memory capabilities may be crucial. Additionally, it is important to evaluate how well the chosen technology integrates with existing systems and the ease of data transfer, as these factors can significantly impact operational efficiency. The Relational Migrator tool can assist in large-scale migrations, incorporating Kafka for effective data management.

A pragmatic approach involves conducting a proof of concept (PoC) with shortlisted technologies to assess their performance under anticipated workloads. This hands-on evaluation can reveal potential bottlenecks and refine the selection process.

For instance, a hedge fund recently transitioned from a traditional SQL system to a NoSQL solution to enhance the management of alternative data sources. This shift resulted in a remarkable 30% increase in data processing speed and improved analytical capabilities, illustrating the tangible benefits of selecting the right technology. Companies have reported cost reductions of 30-70% after migrating from SQL Server or Oracle to PostgreSQL, further underscoring its cost-effectiveness.

Implement Strong Security Protocols for Data Protection

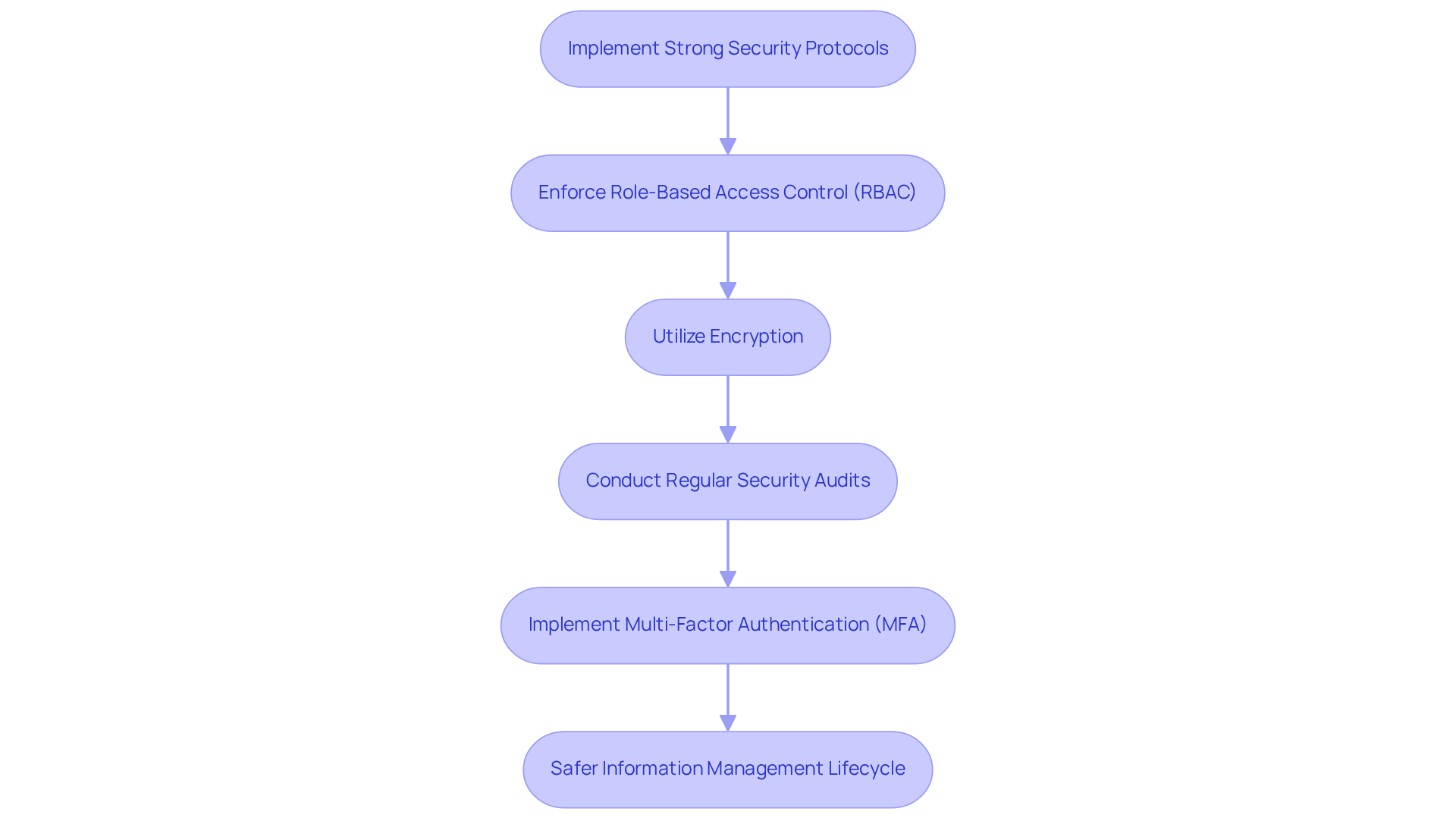

To safeguard sensitive financial information, it is essential to implement robust security measures throughout the information management lifecycle. Begin by enforcing role-based access control (RBAC), which ensures that only authorized personnel can access sensitive information. Additionally, utilize encryption for information both at rest and in transit, employing industry-standard protocols such as TLS to secure communications.

Regular security audits and vulnerability assessments should be conducted to identify and mitigate potential risks. The implementation of multi-factor authentication (MFA) provides an additional layer of security, particularly for remote access to data systems.

For instance, a financial institution experienced a data breach due to inadequate access controls. By adopting a comprehensive security framework that included encryption, RBAC, and regular audits, they significantly reduced their risk profile and regained client trust.

Monitor and Optimize Database Performance Regularly

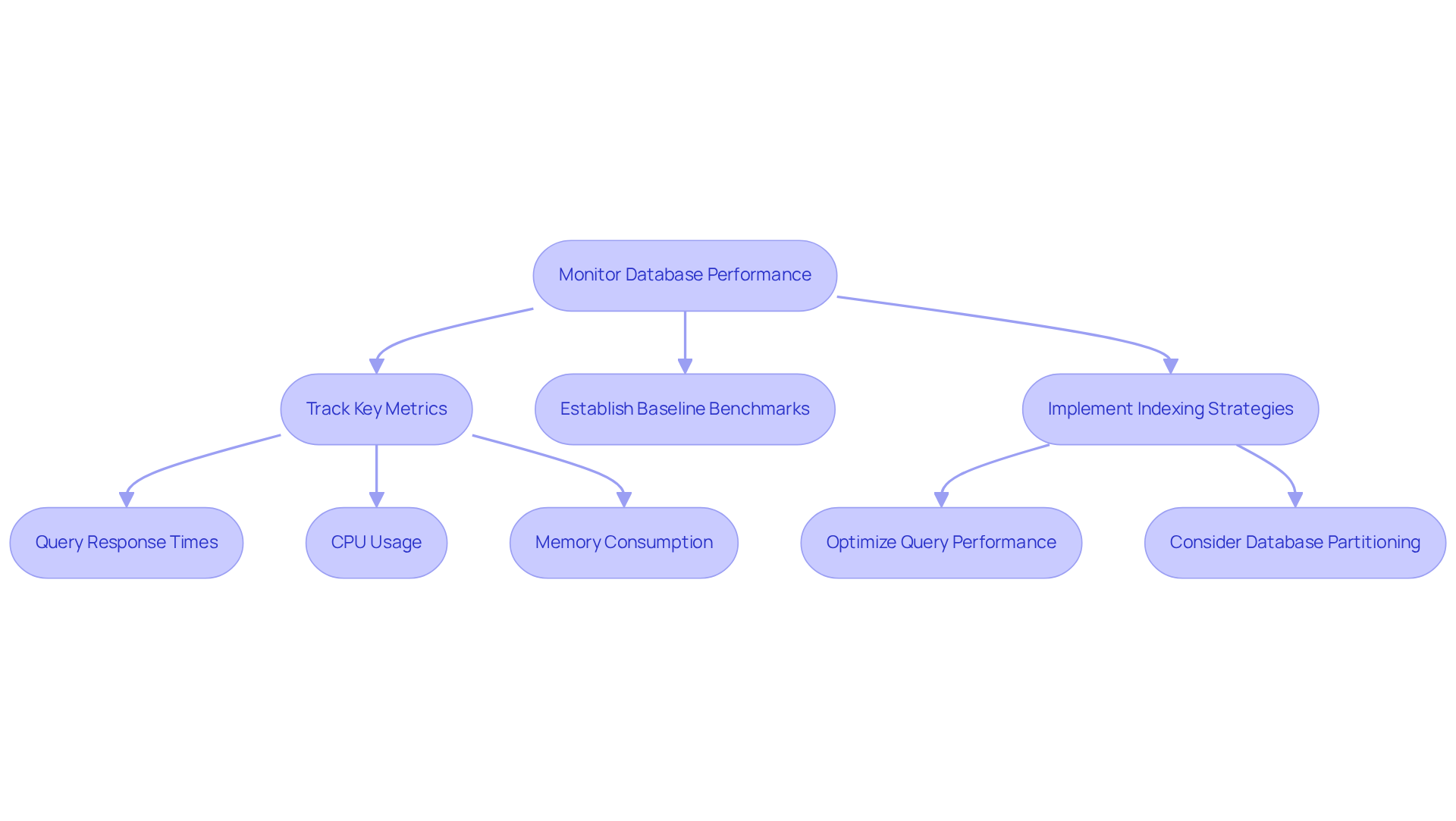

Consistent oversight and enhancement of system performance are crucial for ensuring that investment applications operate effectively. Performance monitoring tools should be utilized to track key metrics, including:

- Query response times

- CPU usage

- Memory consumption

Establishing baseline performance benchmarks is essential to identify deviations that may signal underlying issues.

Implementing indexing strategies can significantly improve query performance and reduce latency. Additionally, database partitioning should be considered to enhance scalability and effectively manage large datasets.

For instance, a hedge fund faced slow query performance during peak trading hours. By adopting a robust monitoring solution and optimizing their indexing strategy, they achieved a 50% reduction in query response times, which markedly improved their trading operations.

Conclusion

Custom database development services play a crucial role for hedge funds seeking to improve operational efficiency and comply with regulatory requirements. By thoroughly assessing client needs, selecting appropriate database technologies, implementing robust security protocols, and continuously monitoring performance, investment firms can develop tailored solutions that foster success in a competitive environment.

This article underscores the significance of understanding client requirements through comprehensive discussions and structured evaluations. Key insights include the selection of suitable database technologies, such as PostgreSQL and NoSQL options, tailored to specific operational needs. Furthermore, the implementation of strong security measures and ongoing performance optimization is essential for protecting sensitive data and ensuring smooth operations.

Ultimately, the success of custom database development in hedge funds relies on a proactive approach to addressing unique challenges and effectively leveraging technology. By prioritizing these best practices, firms can not only fulfill regulatory obligations but also position themselves for growth and innovation in a rapidly changing financial landscape. Embracing these strategies will enable hedge funds to fully harness their data’s potential, resulting in improved decision-making and a strengthened competitive edge.

Frequently Asked Questions

How does Neutech assess client needs for tailored database solutions?

Neutech assesses client needs by initiating in-depth discussions with key stakeholders, collaboratively determining specific requirements, and utilizing structured questionnaires to address critical areas such as information volume, types of information processed, and compliance requirements.

What techniques does Neutech use to visualize client requirements?

Neutech employs techniques like user story mapping to visualize the end-user experience, clarify requirements, and promote collaboration among team members.

What is the typical duration of stakeholder interviews conducted by Neutech?

Stakeholder interviews typically last between 30 to 45 minutes.

Why is it important to secure permission to record interviews?

Securing permission to record interviews is crucial to ensure that sensitive information is managed appropriately.

Can you provide an example of how Neutech’s needs evaluation has helped a client?

A financial client faced challenges with information silos that hindered their analytical capabilities. Neutech’s comprehensive needs evaluation led to the development of a custom database solution that integrated diverse information sources, improving decision-making and operational effectiveness.

What do statistics indicate about C-level executives’ views on technological advancement in investment firms?

Statistics indicate that nearly 70% of C-level executives believe that technological advancement is vital for initiating new investments, highlighting the importance of customized information solutions for compliance and operational efficiency in the investment sector.