Why Hedge Funds Need Custom IoT Software Solutions for Success

Introduction

Hedge funds operate within a complex landscape where operational efficiency is critical to their success. The integration of custom IoT software solutions presents a significant opportunity, allowing firms to automate processes, improve compliance, and gain valuable insights into market dynamics. As technology and regulatory demands evolve rapidly, hedge funds must consider how to effectively leverage these tailored solutions to not only survive but also thrive in an increasingly competitive environment.

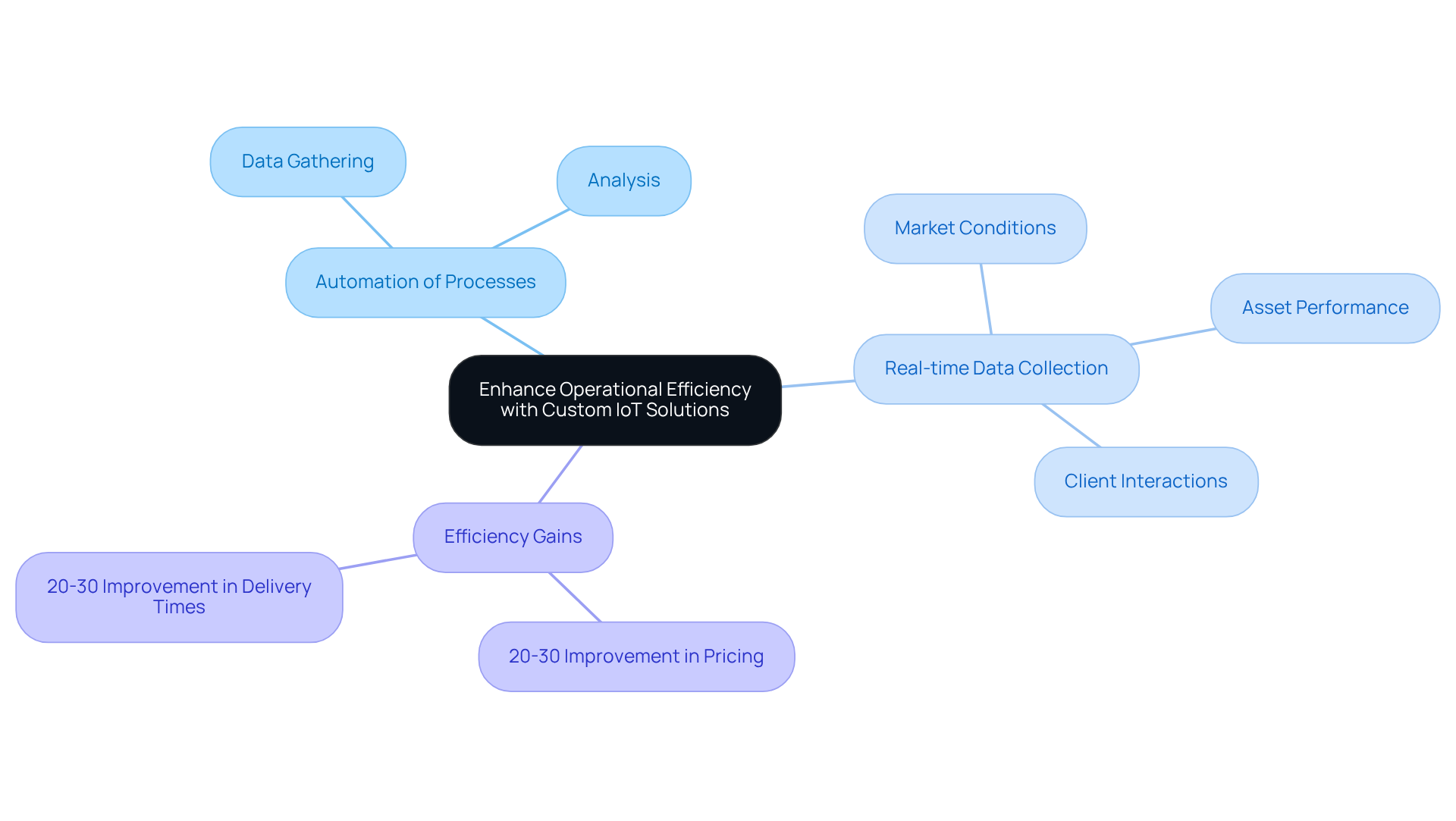

Enhance Operational Efficiency with Custom IoT Solutions

Hedge funds operate in a highly competitive environment where operational efficiency significantly impacts profitability. Custom IoT software solutions allow investment groups to automate essential processes, such as data gathering and analysis, which typically require considerable time and resources. For instance, IoT devices can collect real-time information on market conditions, asset performance, and client interactions, allowing investment firms to make informed decisions swiftly.

According to a report by McKinsey, implementing IoT solutions can yield efficiency gains of 20-30%, particularly in areas like pricing and delivery times. This automation not only reduces operational expenses but also enhances the precision of financial modeling and risk evaluation – critical components for asset managers aiming to optimize their investment strategies.

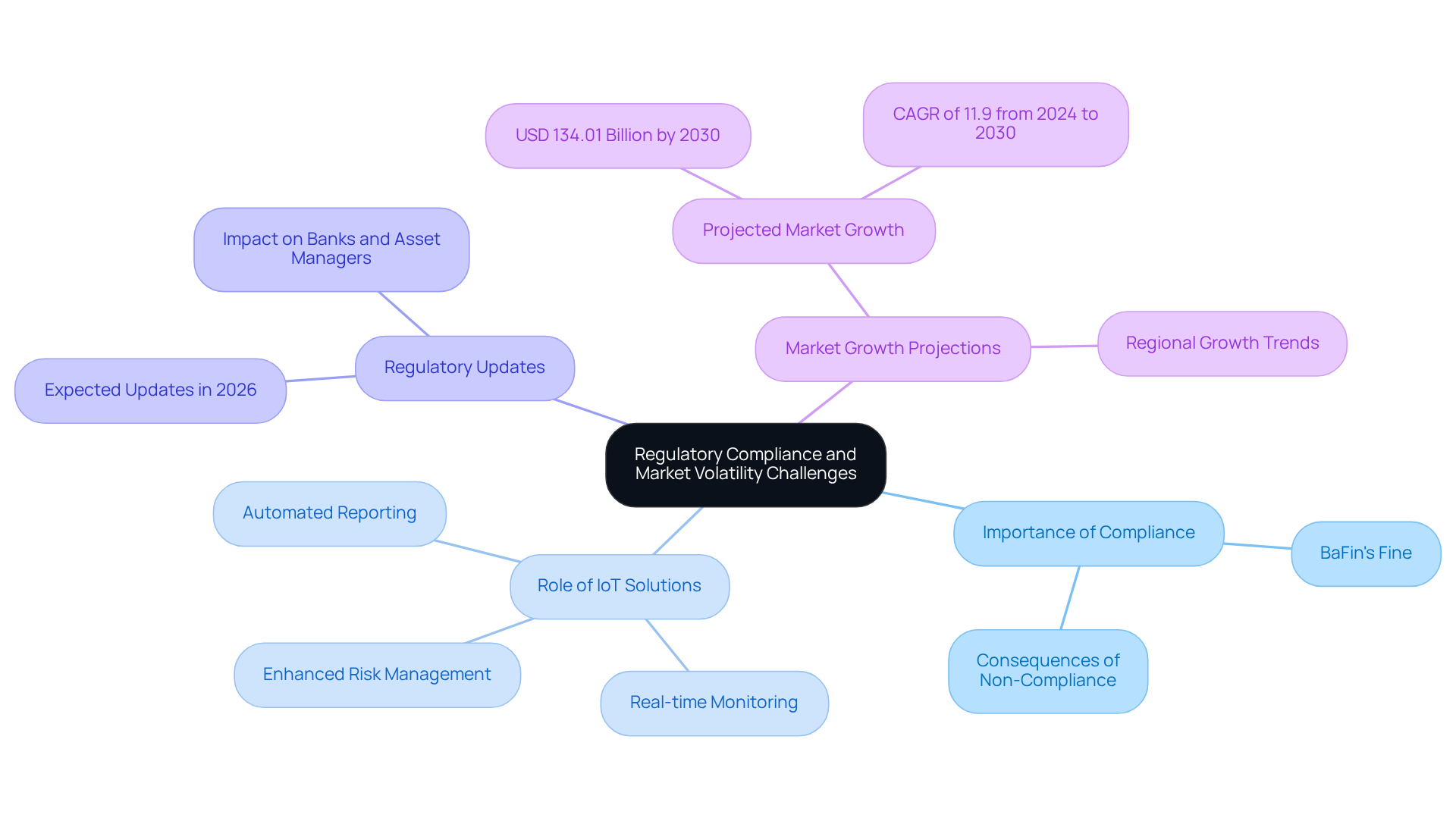

Address Regulatory Compliance and Market Volatility Challenges

Hedge investments are under growing examination from regulatory agencies, making strong compliance systems crucial. Recent enforcement actions, such as BaFin’s €600,000 fine for lapses in voting rights disclosure, underscore the consequences of non-compliance, reinforcing the importance of robust compliance mechanisms.

Custom IoT software solutions play a pivotal role in facilitating real-time monitoring and reporting, while ensuring adherence to stringent regulations. For example, IoT devices can automate transaction data collection, enabling investment firms to maintain accurate records and create necessary reports for regulatory authorities.

Additionally, significant regulatory updates expected in 2026 will impact banks and asset managers, highlighting the urgency for hedge funds to adopt custom IoT software solutions for compliance. IoT technology enables investment firms to react efficiently to fluctuations in the economy by providing prompt insights into trends and risks.

By utilizing IoT data, investment groups can enhance their risk management approaches, allowing them to maneuver through intricate regulatory environments while reducing vulnerability to price variations. In fact, the IoT in banking and financial services market is projected to grow significantly, reaching an estimated USD 134.01 billion by 2030, with a compound annual growth rate of 11.9% from 2024 to 2030, underscoring the increasing reliance on these technologies for compliance and operational efficiency.

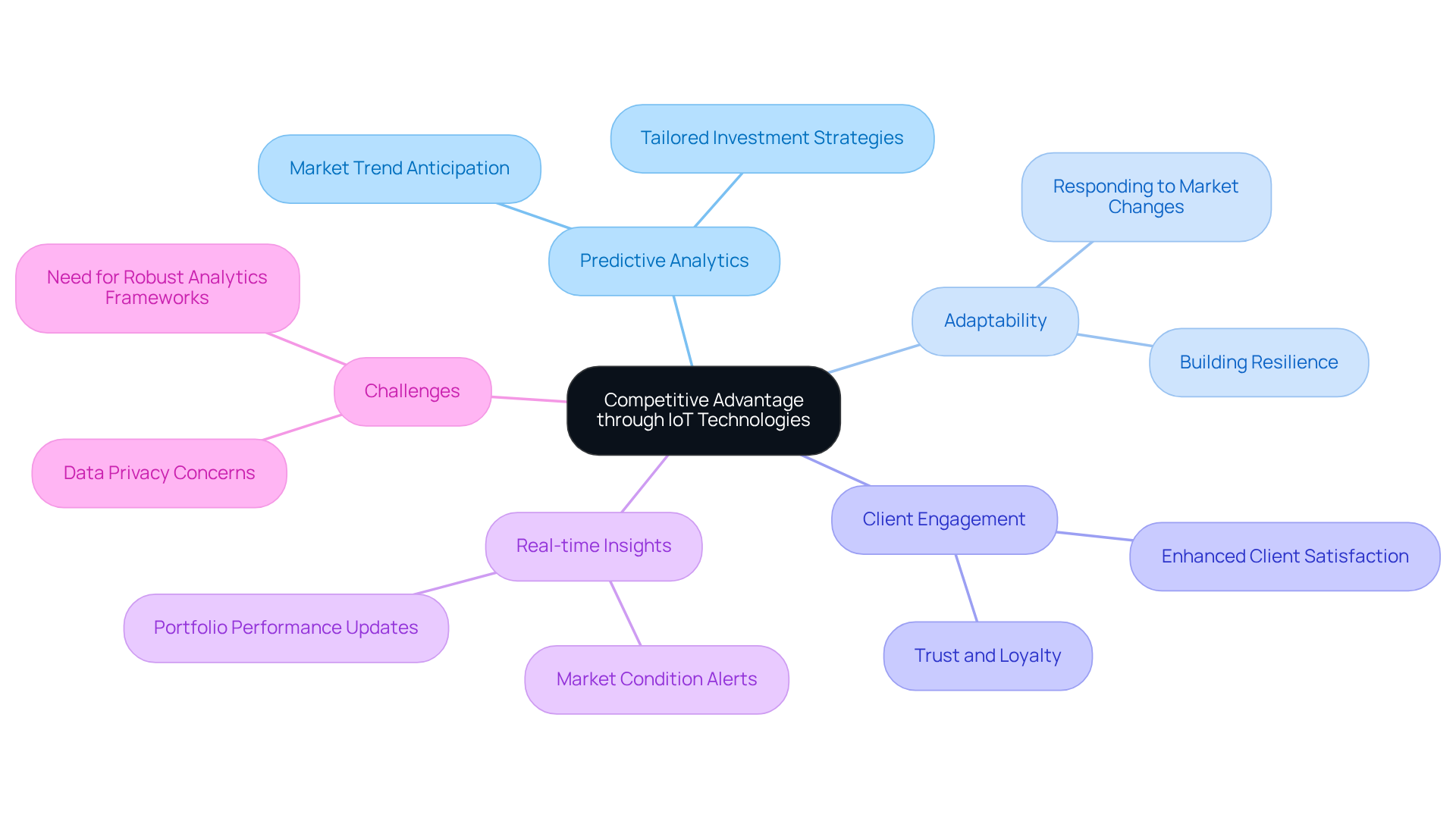

Gain Competitive Advantage through Tailored IoT Technologies

In the competitive landscape of hedge funds, achieving a competitive advantage is essential through the integration of custom IoT software solutions. These technologies enable predictive analytics, allowing hedge funds to anticipate market trends and adjust their strategies accordingly. As Seth Klarman articulates, “Accepting that we cannot predict the future is the first step to becoming less fragile and more adaptable,” underscoring the importance of adaptability in investment strategies.

By leveraging IoT data, hedge funds can create custom IoT software solutions to develop tailored investment strategies that resonate with clients, thereby enhancing engagement and satisfaction. For example, IoT-enabled devices provide real-time updates on market conditions, which empowers investment firms to swiftly modify their positions. Additionally, the ability to offer real-time insights into portfolio performance sets a hedge fund apart from its competitors, fostering trust and loyalty among clients.

Industry leaders assert that firms proficient in utilizing IoT can secure a significant competitive edge, positioning themselves as innovators within the financial sector. However, it is crucial to acknowledge potential challenges, including data privacy concerns and the necessity for robust analytics frameworks. In conclusion, custom IoT software solutions not only enhance operational efficiency but also play a vital role in establishing a hedge fund’s competitive edge.

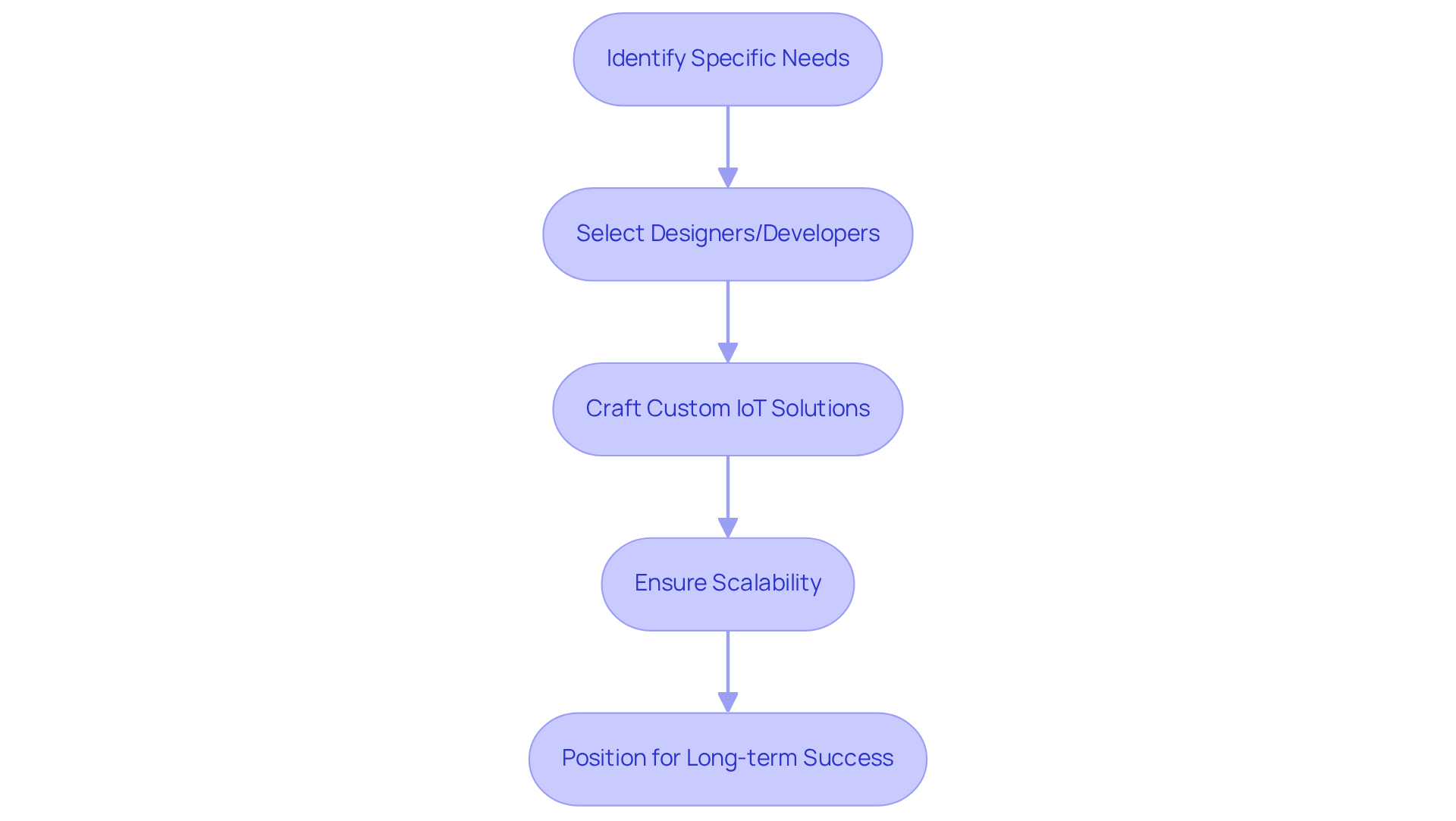

Ensure Long-term Success with Scalable IoT Solutions

As investment pools expand and their operational requirements evolve, the scalability of technological solutions becomes increasingly critical. At Neutech, we start by collaboratively identifying your specific needs. This process enables us to present a selection of candidate designers and developers capable of crafting custom IoT solutions tailored to your requirements.

These solutions are designed to scale seamlessly, accommodating the dynamic demands of your business. For example, as an investment group expands its portfolio or client base, IoT systems can be adjusted to handle increased data volumes and processing requirements without compromising performance. This adaptability is essential in an environment characterized by rapid changes and unpredictability.

Furthermore, the use of custom IoT software solutions facilitates the integration of new technologies and data sources, ensuring that hedge funds remain at the forefront of innovation. By investing in scalable IoT infrastructure, hedge funds position themselves for long-term success, allowing them to adapt to market shifts and client needs with agility.

Conclusion

Custom IoT software solutions have emerged as a pivotal factor for hedge funds, significantly enhancing operational efficiency, ensuring regulatory compliance, and providing a competitive advantage in a swiftly changing financial landscape. By automating essential processes and offering real-time insights, these bespoke technologies enable investment firms to make prompt, informed decisions that are vital for success in a fiercely competitive environment.

Key insights throughout the article demonstrate how custom IoT solutions drive efficiency gains, from automating data collection to maintaining adherence to regulatory standards. The capacity to utilize predictive analytics allows hedge funds to proactively adjust their strategies, while scalable IoT infrastructures guarantee that firms can expand and innovate seamlessly. These advancements not only optimize operations but also cultivate stronger client relationships through improved engagement and satisfaction.

The integration of custom IoT software is not merely a trend; it is a strategic imperative for hedge funds aspiring to achieve long-term success. As the financial sector continues to respond to market volatility and regulatory shifts, the adoption of IoT technologies will be essential. Investment firms that prioritize these solutions will not only navigate challenges more adeptly but also establish themselves as leaders in innovation and performance. Embracing custom IoT solutions is the pathway forward for hedge funds aiming to excel in an increasingly complex landscape.

Frequently Asked Questions

What is the main focus of custom IoT solutions for hedge funds?

Custom IoT solutions focus on enhancing operational efficiency by automating essential processes such as data gathering and analysis.

How do IoT devices benefit investment firms?

IoT devices benefit investment firms by collecting real-time information on market conditions, asset performance, and client interactions, which helps in making informed decisions quickly.

What efficiency gains can be expected from implementing IoT solutions according to McKinsey?

Implementing IoT solutions can yield efficiency gains of 20-30%, particularly in pricing and delivery times.

How do custom IoT solutions impact operational expenses for hedge funds?

Custom IoT solutions reduce operational expenses by automating processes that typically require significant time and resources.

What are the critical components enhanced by IoT solutions for asset managers?

IoT solutions enhance the precision of financial modeling and risk evaluation, which are critical for asset managers to optimize their investment strategies.