Understanding Software Performance Testing Services for Hedge Funds

Introduction

Understanding the complexities of software performance testing services is crucial for hedge funds operating within the dynamic financial landscape. These services not only ensure the efficient operation of trading platforms but also protect against costly operational failures that could threaten investment strategies. As the stakes continue to rise, hedge funds must consider how to effectively implement these testing methodologies to enhance software performance and ultimately increase profitability.

Define Software Performance Testing Services

Software performance testing services encompass a variety of methodologies designed to measure the speed, scalability, and stability of applications under diverse conditions. This testing is crucial for hedge funds, as software performance testing services can significantly impact the efficiency of trading platforms and financial applications, affecting investment strategies and overall profitability.

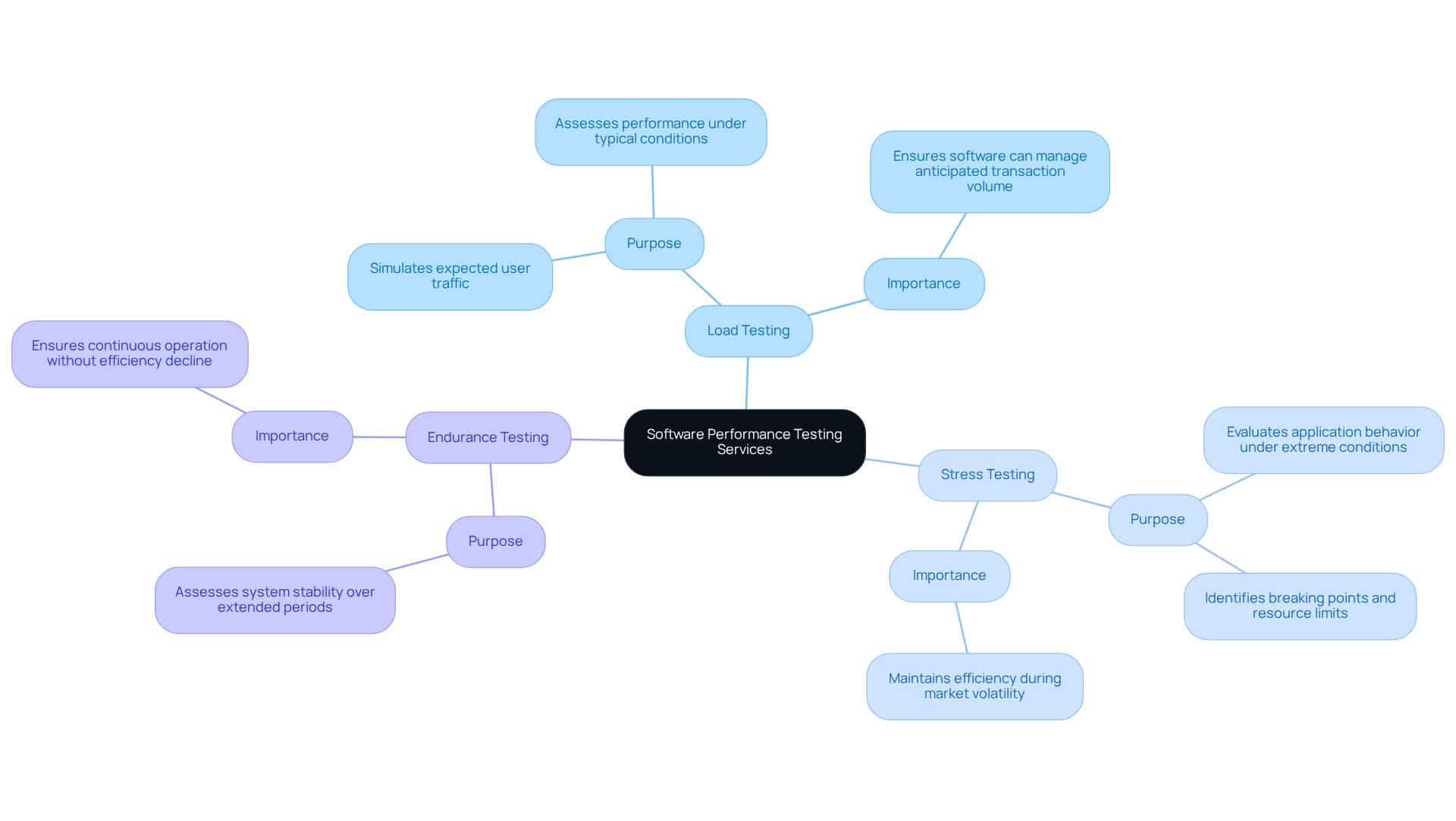

Key methodologies include:

- Load Testing: This simulates expected user traffic to assess how the software performs under typical conditions, ensuring it can manage the anticipated volume of transactions.

- Stress Testing: This evaluates the application’s behavior under extreme conditions, identifying breaking points and resource limits, which is essential for maintaining efficiency during market volatility.

- Endurance Testing: This assesses system stability over extended periods, ensuring that applications can operate continuously without a decline in efficiency.

By proactively identifying bottlenecks and efficiency issues before deployment, hedge funds can ensure their software performance testing services enable their software solutions to operate reliably in high-pressure environments. For instance, SESCO Enterprises, with over 20 years of experience in energy trading, employs advanced evaluation methods to refine their trading strategies, illustrating the tangible benefits of comprehensive assessment practices. Furthermore, expert insights indicate that a robust evaluation framework not only enhances user experience but also leads to higher conversion rates, making it a critical investment for financial services in 2026 and beyond. At Neutech, we emphasize intangibles-such as work ethic, communication, and leadership-to ensure our engineering talent is not only skilled but also adaptable to the evolving demands of the financial sector. Our plug-and-play model allows investment funds to quickly scale their engineering resources, whether they need a full-time frontend developer one month or a backend developer the next, providing the flexibility to respond to changing needs while maintaining high-quality standards.

Explain the Importance for Hedge Funds

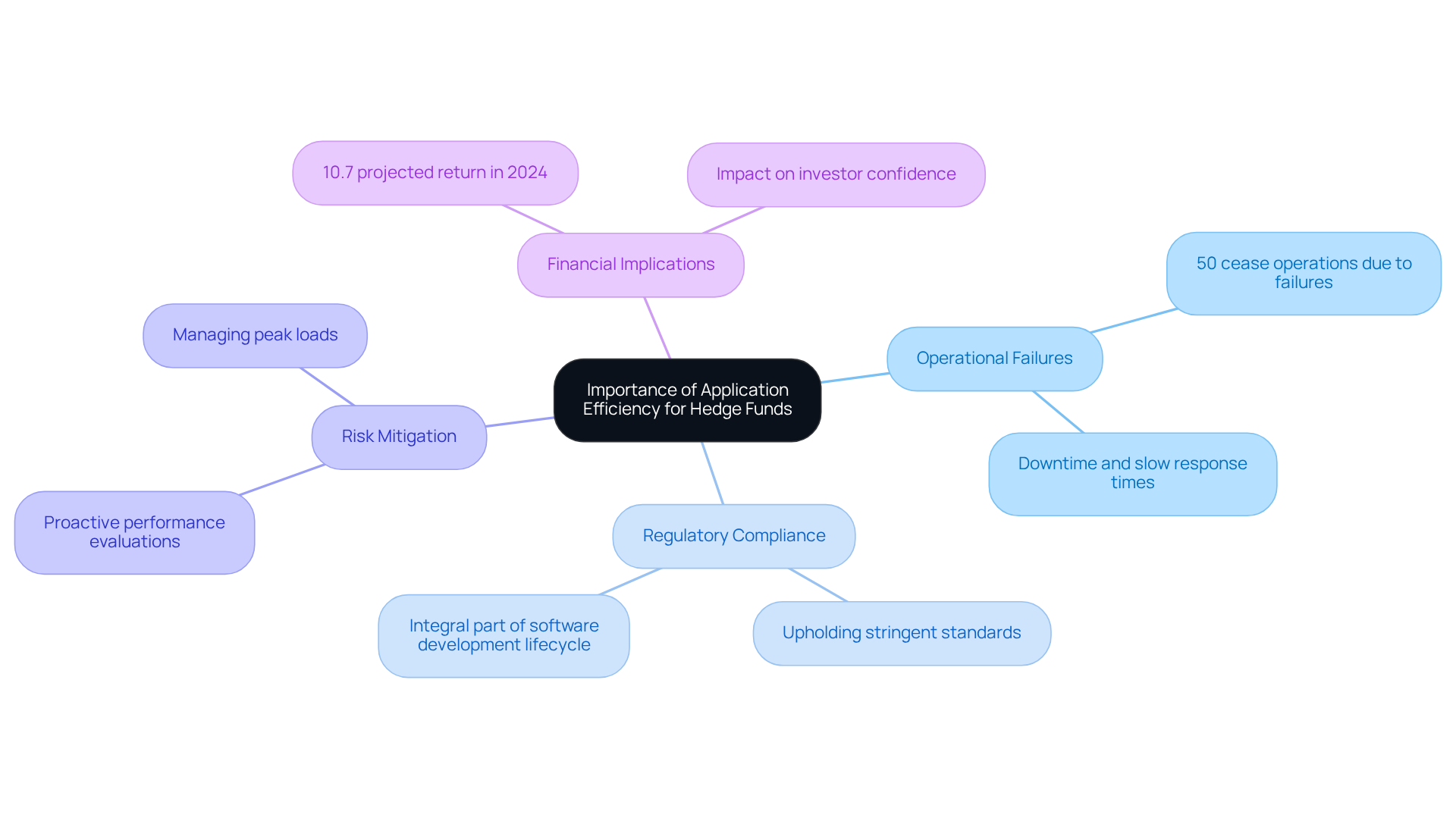

For investment funds, evaluating application efficiency is crucial. Operating in a highly competitive and regulated environment, where even milliseconds can influence trade outcomes, this evaluation serves as a vital safeguard against system failures. Issues such as downtime or slow response times can result in significant financial repercussions; indeed, a Capco study indicates that 50% of investment funds cease operations due to operational failures.

Moreover, regulatory compliance mandates that investment funds uphold stringent standards of operational integrity, making evaluations an integral part of their software development lifecycle. By ensuring that applications can manage peak loads and deliver consistent results, investment funds not only improve their operational efficiency but also bolster investor confidence.

This proactive approach to evaluating performance is essential for mitigating risks and ensuring that trading strategies remain robust and effective. Additionally, with investment funds projected to average a 10.7% return in 2024, the financial implications tied to application efficiency are significant, underscoring the necessity for thorough evaluation.

Outline Key Characteristics of Performance Testing Services

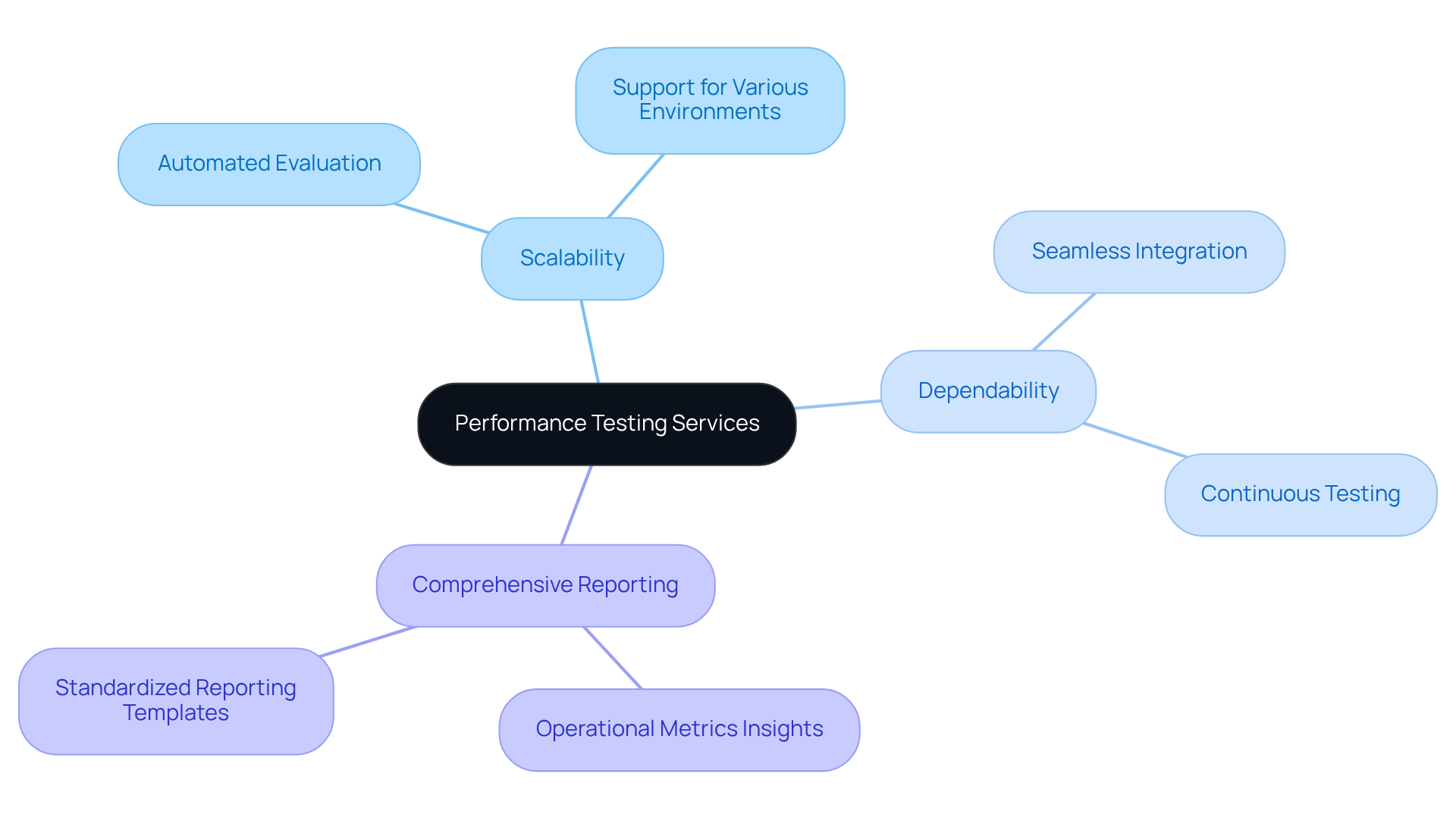

Efficient software performance testing services are characterized by scalability, dependability, and comprehensive reporting. Scalability is essential, enabling applications to accommodate increasing demands without a decline in efficiency – an important requirement for investment firms that may experience sudden spikes in user engagement. Reliability guarantees that programs consistently perform under diverse conditions, which is crucial for maintaining investor trust. Comprehensive reporting offers insights into operational metrics, empowering hedge funds to make informed decisions regarding software performance testing services for enhancements.

Additional critical features include:

- Automated evaluation capabilities, which uphold performance standards without the need for manual intervention

- Seamless integration with continuous deployment pipelines

- Support for various assessment environments

These elements are integral to a robust strategy for software performance testing services evaluation. For instance, companies like Amazon utilize load evaluation to optimize their infrastructure during peak shopping seasons, ensuring their systems can handle high volumes of concurrent users. Similarly, Netflix conducts load evaluations to guarantee uninterrupted streaming experiences, underscoring the importance of these attributes in maintaining service quality and user satisfaction.

Provide Examples of Tools and Methodologies

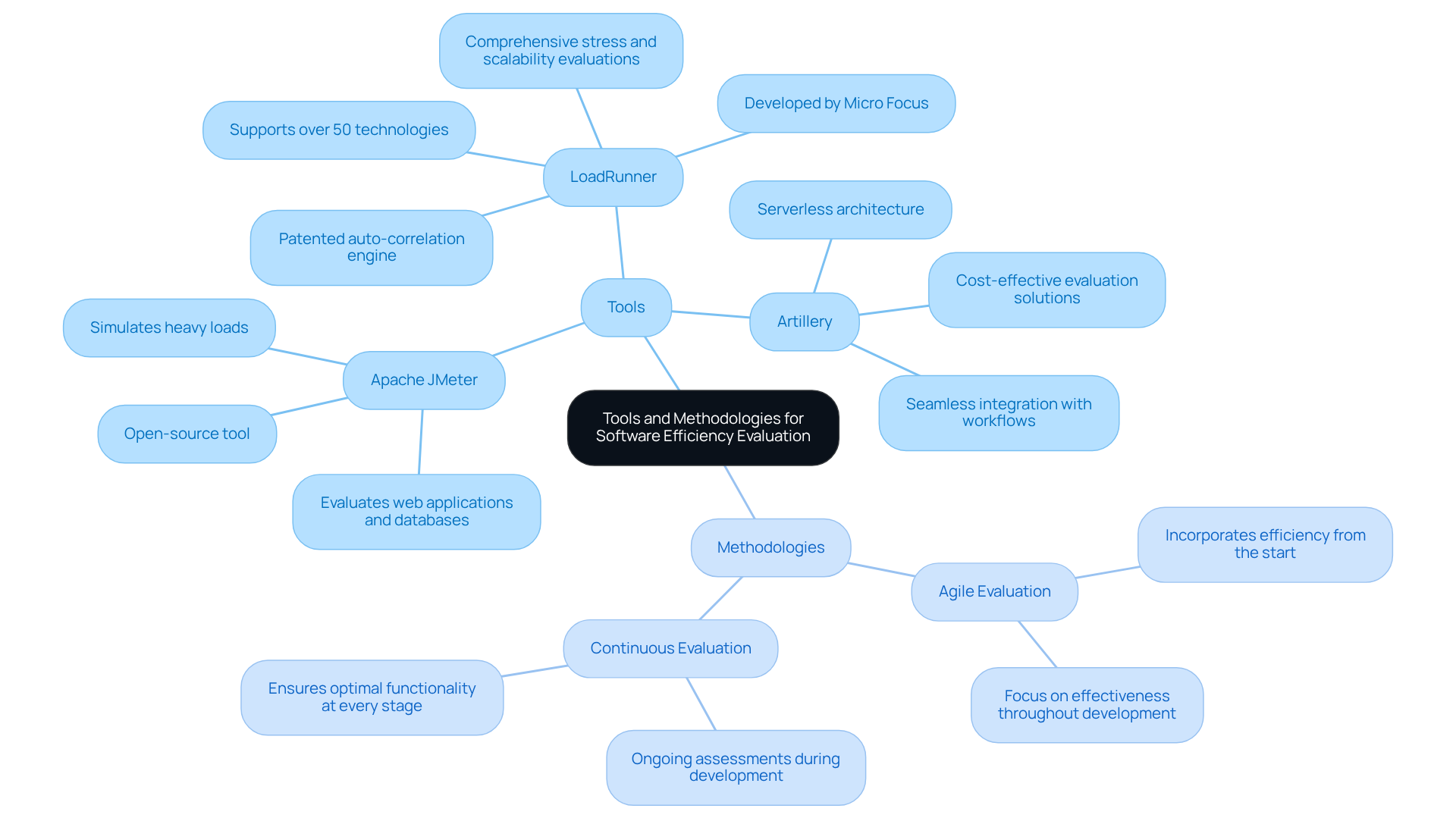

In the realm of software efficiency evaluation, several tools and methodologies stand out for their effectiveness in addressing the unique challenges faced by financial services, particularly hedge funds. Apache JMeter is a leading choice, recognized for its capability to simulate multiple users and assess application functionality under load. This open-source tool is particularly beneficial for evaluating web applications and databases, establishing itself as a fundamental resource in the financial sector where efficiency and reliability are paramount.

LoadRunner, developed by Micro Focus, builds upon JMeter’s capabilities with its extensive features, including stress and scalability evaluations. Supporting over 50 technologies, it enables financial institutions to conduct comprehensive assessments that replicate real-world user behavior. LoadRunner’s patented auto-correlation engine enhances evaluation efficiency, facilitating the swift identification of functionality bottlenecks.

Artillery is another noteworthy tool that offers cost-effective ongoing evaluation solutions, making it suitable for hedge funds aiming to sustain performance without incurring significant expenses. Its serverless architecture allows for seamless scalability and integration with existing workflows.

Methodologies such as Agile evaluation incorporate efficiency considerations into the development lifecycle from the outset. This approach ensures that effectiveness remains a primary focus throughout development. Continuous evaluation further enhances this by allowing for ongoing assessments as software is developed and deployed, guaranteeing optimal functionality at every stage.

Data security is also a critical aspect of evaluation within the financial sector. As investment funds manage sensitive information, it is essential to ensure that testing results do not compromise data integrity.

Real-world applications of these methodologies are evident in various financial institutions. For example, Apache JMeter has been effectively utilized to simulate heavy loads during peak transaction periods, assisting banks in identifying potential bottlenecks before they affect users. Similarly, LoadRunner has been employed to evaluate the scalability of banking applications, ensuring they can accommodate increased user loads during critical events, such as market fluctuations or product launches.

By leveraging these tools and methodologies, hedge funds and financial services can uphold high performance and reliability through software performance testing services, ultimately enhancing user satisfaction and operational efficiency.

Conclusion

Software performance testing services are essential for hedge funds, ensuring that trading platforms and financial applications function at optimal efficiency. By utilizing methodologies such as load, stress, and endurance testing, hedge funds can pinpoint potential issues before they escalate, thereby protecting their operations from costly failures. This proactive assessment of software performance not only improves user experience but also bolsters investor confidence, ultimately influencing profitability in a fiercely competitive market.

Key insights from the article underscore the vital role of software performance testing within the financial sector. Given the significant financial consequences that can arise from operational failures, hedge funds must prioritize thorough testing to uphold compliance and operational integrity. Tools like Apache JMeter and LoadRunner, alongside methodologies such as Agile evaluation, enable these institutions to provide reliable and efficient software solutions, ensuring resilience against market fluctuations.

In an environment where every millisecond is critical, the significance of software performance testing services cannot be overstated. Hedge funds are urged to adopt a comprehensive strategy for performance evaluation, leveraging advanced tools and methodologies to bolster their operational resilience. By doing so, they not only mitigate risks but also position themselves for sustained success, ultimately leading to enhanced returns and greater investor satisfaction.

Frequently Asked Questions

What are software performance testing services?

Software performance testing services are methodologies designed to measure the speed, scalability, and stability of applications under various conditions, which is crucial for hedge funds to ensure the efficiency of trading platforms and financial applications.

Why is software performance testing important for hedge funds?

It significantly impacts the efficiency of trading platforms and financial applications, affecting investment strategies and overall profitability.

What are the key methodologies used in software performance testing?

The key methodologies include Load Testing, Stress Testing, and Endurance Testing.

What is Load Testing?

Load Testing simulates expected user traffic to assess how the software performs under typical conditions, ensuring it can manage the anticipated volume of transactions.

What does Stress Testing evaluate?

Stress Testing evaluates the application’s behavior under extreme conditions, identifying breaking points and resource limits, which is essential during market volatility.

What is Endurance Testing?

Endurance Testing assesses system stability over extended periods to ensure that applications can operate continuously without a decline in efficiency.

How can performance testing benefit hedge funds?

By identifying bottlenecks and efficiency issues before deployment, hedge funds can ensure their software solutions operate reliably in high-pressure environments, ultimately enhancing user experience and conversion rates.

Can you provide an example of a company that utilizes software performance testing?

SESCO Enterprises, with over 20 years of experience in energy trading, employs advanced evaluation methods to refine their trading strategies, demonstrating the benefits of comprehensive assessment practices.

What additional factors does Neutech emphasize for their engineering talent?

Neutech emphasizes intangibles such as work ethic, communication, and leadership to ensure their engineering talent is skilled and adaptable to the evolving demands of the financial sector.

How does Neutech’s model support investment funds?

Neutech’s plug-and-play model allows investment funds to quickly scale their engineering resources according to changing needs while maintaining high-quality standards.