Master Composable Software Architecture for Financial Success

Introduction

Composable software architecture is transforming the financial services landscape by providing a modular framework that enables institutions to swiftly adapt to market changes and regulatory demands. This innovative approach not only improves agility and cost efficiency but also cultivates a culture of continuous improvement and innovation. However, as financial organizations embark on this transformative journey, they encounter significant challenges, including integration complexities and cultural resistance. Therefore, how can these institutions effectively navigate the transition to composable architecture while maximizing its benefits?

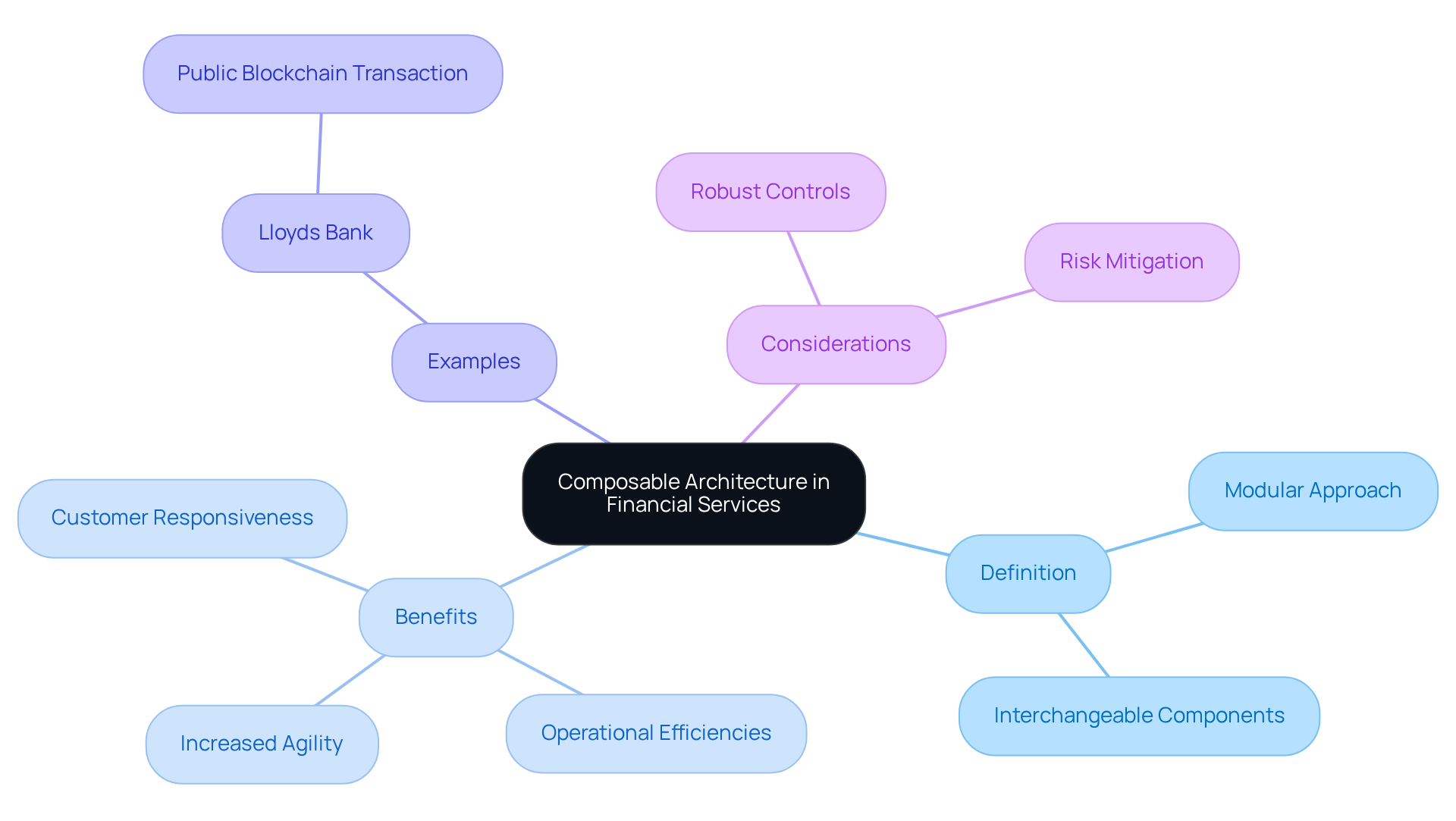

Define Composable Architecture and Its Relevance to Financial Services

Composable software architecture represents a modular approach to software design, wherein applications are built from interchangeable components that can be developed, deployed, and scaled independently. This structure is particularly vital for monetary organizations, enabling them to create flexible systems that swiftly adapt to evolving market demands and regulatory frameworks. By leveraging microservices and APIs, these organizations can integrate diverse functionalities seamlessly, thereby overcoming the constraints of traditional monolithic systems. This flexibility not only promotes innovation but also enhances responsiveness to customer needs, positioning financial institutions to excel in a competitive landscape.

As banks progressively adopt modular design by 2026, they will benefit from increased agility, facilitating rapid feature deployment and customized customer experiences. Statistics reveal that organizations employing modular systems can realize substantial operational efficiencies, with many reporting a decrease in time-to-market for new services. The shift to composable software architecture is essential for survival in the digital banking services sector, as highlighted by industry experts. Noteworthy examples include Lloyds Bank, which successfully executed a public blockchain transaction, illustrating the advantages of modular designs that allow for independent updates and the implementation of new features.

However, it is crucial for banks to establish robust controls when integrating low-code and no-code solutions to mitigate associated risks, ensuring they can adeptly navigate the complexities of contemporary economic landscapes.

Highlight Benefits of Composable Architecture for Financial Institutions

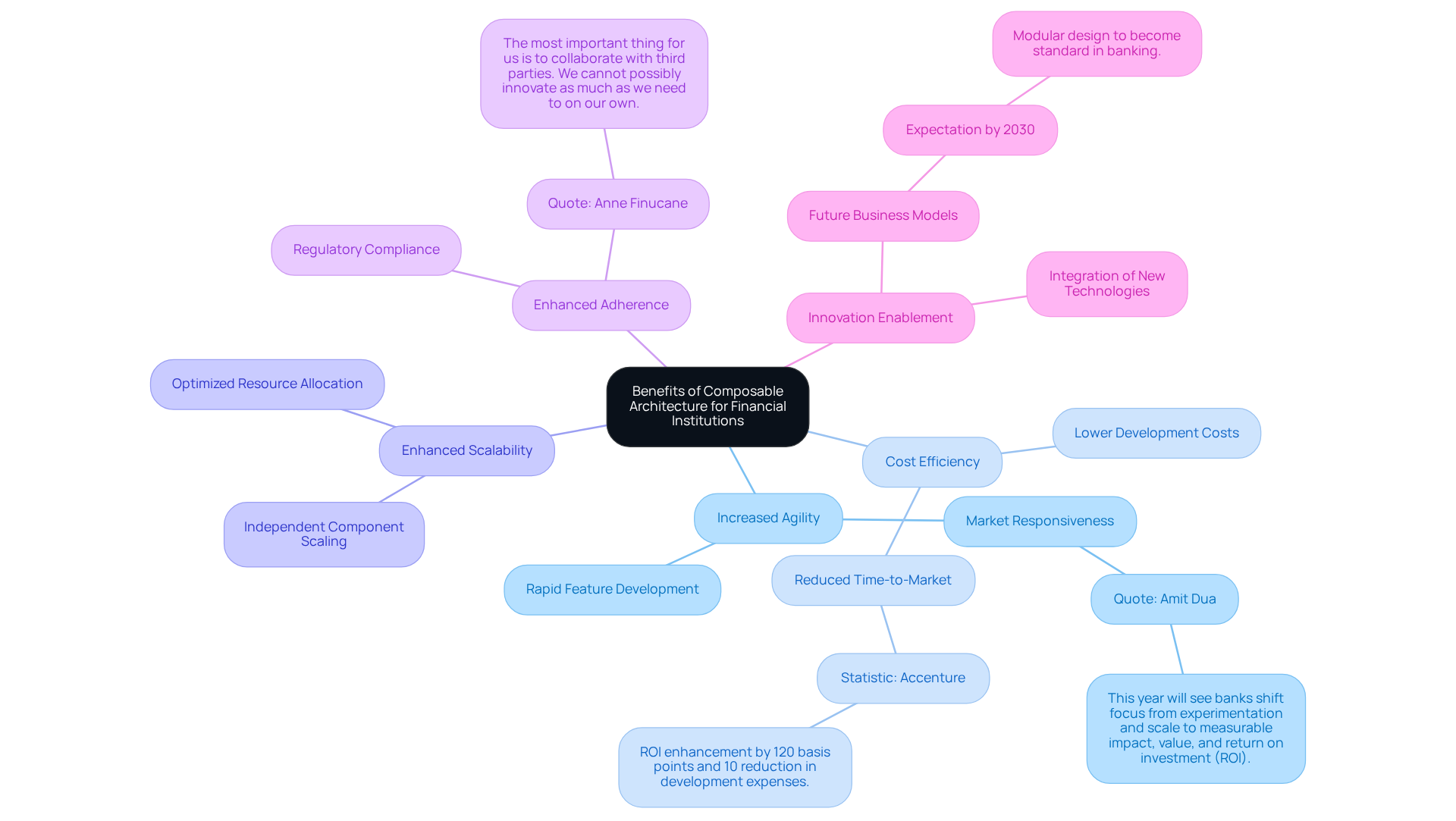

The adoption of composable architecture presents significant advantages for financial institutions, including:

-

Increased Agility: Financial organizations can swiftly develop and deploy new features, enabling them to respond promptly to market fluctuations and customer demands. As Amit Dua, President of SunTec Business Solutions, observes, “This year will see banks shift focus from experimentation and scale to measurable impact, value, and return on investment (ROI).”

-

Cost Efficiency: By leveraging modular components, organizations can lower development costs and reduce time-to-market, as they can repurpose existing functionalities instead of starting from scratch. Accenture reports that implementing a composable software architecture can enhance ROI by 120 basis points and decrease development expenses by 10%.

-

Enhanced scalability is achieved as composable software architecture allows organizations to scale specific components independently, ensuring efficient resource allocation based on demand. This targeted scalability optimizes infrastructure costs and sustains performance during peak periods, facilitating a more responsive approach to customer needs.

-

Enhanced Adherence: Modular systems can be designed to meet specific regulatory standards, aiding organizations in adapting to changing compliance landscapes. As Anne Finucane, retired vice chairman of Bank of America, emphasizes, “The most important thing for us is to collaborate with third parties. We cannot possibly innovate as much as we need to on our own.”

-

Innovation Enablement: With the capacity to integrate new technologies and services, banks can cultivate a culture of innovation, exploring new business models and revenue streams. By 2030, modular design is expected to become standard in the banking sector, providing a competitive advantage to forward-thinking organizations.

In conclusion, the transition to modular design not only enhances operational efficiency but also empowers organizations to thrive in a rapidly evolving market landscape.

Implement a Structured Approach to Adopting Composable Architecture

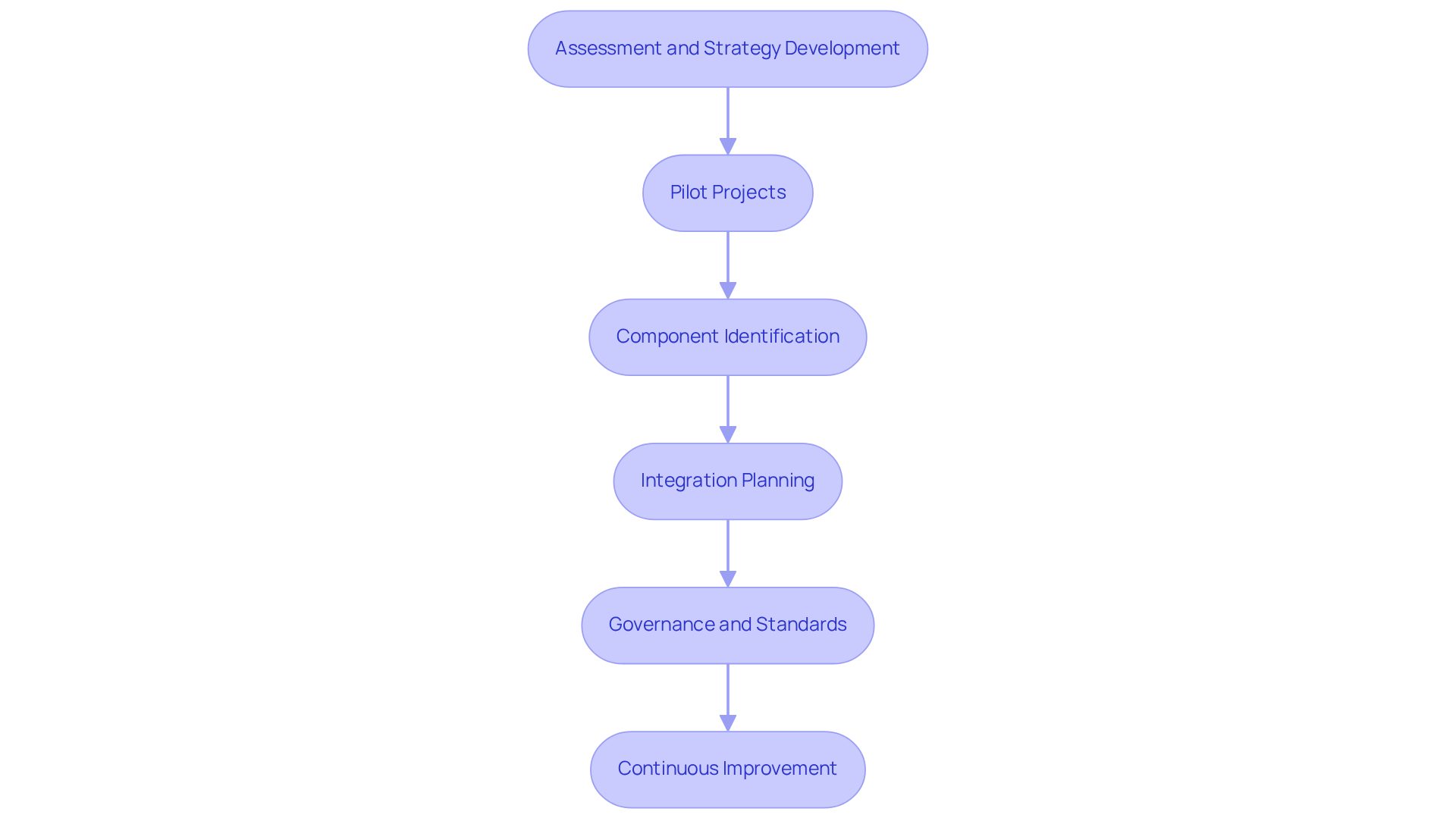

To successfully adopt composable architecture, financial institutions should follow a structured approach:

-

Assessment and Strategy Development: Begin by assessing current systems and identifying key capabilities that can be modularized. Develop a clear strategy that aligns with business goals and customer needs. As Sean Forward from ClearBank notes, institutional adoption of digital assets is expected to accelerate in 2026, making this assessment crucial for staying competitive.

-

Pilot Projects: Initiate small-scale pilot initiatives to evaluate the modular structure in a controlled setting. This approach allows for experimentation and learning without significant risk. J.P. Morgan’s transformation through composable software architecture exemplifies how pilot projects can lead to successful implementation.

-

Component Identification: Identify and define the modular components that will form the basis of the new architecture. Ensure these components are designed with interoperability in mind. Richard K. LaTulip from Recorded Future emphasizes that financial institutions are only as secure as the least-protected vendor in their ecosystem, underscoring the importance of well-defined components.

-

Integration Planning: Develop a comprehensive integration plan that outlines how new components will interact with existing systems. This includes establishing APIs and data exchange protocols. The incorporation of PayPal’s flexible ecosystem illustrates the practical benefits of effective integration planning.

-

Governance and Standards: Establish governance frameworks and standards for development, security, and compliance to ensure consistency and quality across all components. This is crucial as the sector shifts towards composable software architecture, which promotes modular and flexible designs to enhance agility and innovation.

-

Continuous Improvement: Implement a feedback loop to continuously monitor performance and gather insights for ongoing enhancement of the modular framework. With global spending on AI in banking projected to rise significantly, continuous improvement will be vital for leveraging new technologies effectively.

By adhering to these steps, organizations can manage the shift to modular design efficiently, positioning themselves for improved agility and innovation in a swiftly changing environment.

Address Challenges and Considerations in Transitioning to Composable Architecture

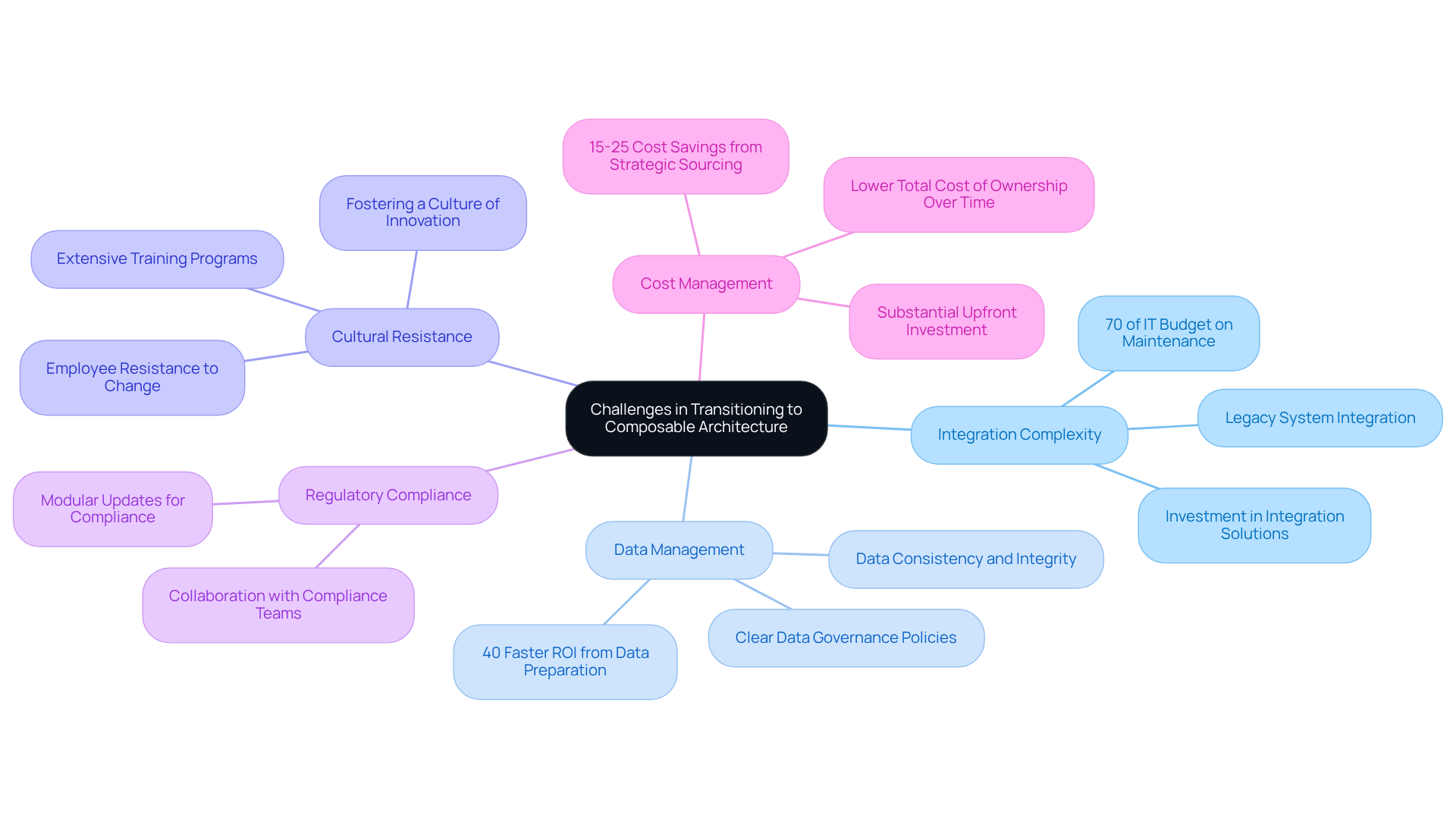

Transitioning to composable architecture presents several challenges that financial institutions must navigate:

-

Integration Complexity: The modular nature of composable architecture can lead to significant integration challenges, particularly when connecting legacy systems with new components. Institutions should prioritize investment in robust integration solutions and skilled personnel to effectively manage this complexity. Traditional banking systems often struggle with integration, resulting in lengthy development cycles and high maintenance costs, which can consume up to 70% of the IT budget. As noted by Accenture, these prohibitive maintenance costs can significantly hinder digital transformation efforts.

-

Data Management: Ensuring data consistency and integrity across modular components is crucial yet challenging. Institutions must establish clear data governance policies and utilize advanced data management tools to maintain quality. Organizations that prioritize data preparation can achieve 40% faster ROI from AI procurement investments, underscoring the importance of effective data management in modular economic systems.

-

Cultural Resistance: Employees may resist changes to established workflows and processes, which can hinder the transition. To address this, organizations should foster a culture of innovation and provide extensive training to assist staff in adjusting to new systems. Successful organizations emphasize the need for a progressive approach and adequate team training to facilitate smooth transitions, as highlighted in various case studies.

-

Regulatory Compliance: As financial institutions adopt new technologies, ensuring compliance with existing regulations becomes paramount. This necessitates ongoing collaboration with compliance teams to integrate regulatory considerations into the design framework. Composable software architecture enables specific modules to be modified without overhauling the entire system, thereby enhancing compliance efforts and reducing the risk of non-compliance.

-

Cost Management: While modular design can lead to long-term cost reductions, the upfront investment can be substantial. Institutions should carefully evaluate the long-term benefits against initial costs to justify the transition. Successful implementations have reported 15-25% cost savings through strategic sourcing initiatives, highlighting the potential economic benefits of adopting a modular approach. Furthermore, the Total Cost of Ownership (TCO) of a composable software architecture is lower over time despite higher initial costs, providing a more comprehensive view of the financial implications of transitioning to composable architecture.

Conclusion

Composable software architecture is transforming the financial services sector by offering a modular framework that enhances flexibility, innovation, and responsiveness. This approach enables financial institutions to construct applications using interchangeable components, allowing for swift adaptation to market changes and regulatory demands. As the industry shifts towards this modular design, organizations that adopt composable architecture position themselves for success in an increasingly competitive landscape.

The article outlines several key advantages of embracing composable architecture, including:

- Increased agility

- Cost efficiency

- Enhanced scalability

- Improved regulatory compliance

- Promotion of innovation

By utilizing modular components, financial institutions can rapidly deploy new features, lower development costs, and ensure adherence to evolving regulations. Furthermore, the structured approach to implementing composable architecture-encompassing assessment, pilot projects, integration planning, and governance-provides a clear roadmap for organizations to navigate their transition effectively.

Ultimately, the transition to composable architecture is not merely a trend; it represents a critical evolution for financial institutions striving to thrive in a dynamic environment. By recognizing and addressing the challenges associated with this transition, such as integration complexity and cultural resistance, organizations can achieve significant operational efficiencies and enhance customer experiences. Embracing composable architecture is essential for financial institutions to remain competitive, foster continuous innovation, and respond adeptly to the demands of the modern financial landscape.

Frequently Asked Questions

What is composable architecture?

Composable architecture is a modular approach to software design where applications are constructed from interchangeable components that can be developed, deployed, and scaled independently.

Why is composable architecture important for financial services?

It enables financial organizations to create flexible systems that quickly adapt to changing market demands and regulatory frameworks, enhancing innovation and responsiveness to customer needs.

How do microservices and APIs relate to composable architecture?

Microservices and APIs are leveraged within composable architecture to seamlessly integrate diverse functionalities, overcoming the limitations of traditional monolithic systems.

What benefits do banks gain by adopting modular design by 2026?

Banks can achieve increased agility, allowing for rapid feature deployment and customized customer experiences, as well as substantial operational efficiencies and reduced time-to-market for new services.

What is the significance of the shift to composable software architecture in the digital banking sector?

The shift is essential for survival in the digital banking services sector, as it allows institutions to remain competitive and responsive to market changes.

Can you provide an example of a bank that has successfully implemented composable architecture?

Lloyds Bank is an example, having executed a public blockchain transaction that demonstrates the advantages of modular designs, such as independent updates and the implementation of new features.

What precautions should banks take when integrating low-code and no-code solutions?

Banks should establish robust controls to mitigate risks associated with low-code and no-code solutions, ensuring they can effectively navigate the complexities of the contemporary economic landscape.